Florida Housing Market Faces Climate Challenges: A Deep Dive Into Resilience And Opportunity

Florida’s sunlit beaches, tax-friendly policies, and robust economy have long made it a dream destination for homebuyers and investors alike. From bustling metropolitan areas like Miami to tranquil inland towns such as Tallahassee, the state offers a diverse range of real estate opportunities. Yet, the increasing prevalence of hurricanes and flooding, coupled with surging insurance premiums, is creating a more complex housing market landscape. While Florida real estate continues to be a haven for those seeking both lifestyle and investment opportunities, these challenges demand a more nuanced approach. Buyers, sellers, and investors must carefully navigate the risks and rewards of this evolving market.

This article examines how climate risks, demographic shifts, and evolving market dynamics are reshaping Florida’s housing market, highlighting strategies to succeed in the face of these growing challenges.

A MARKET DEFINED BY CONTRASTS

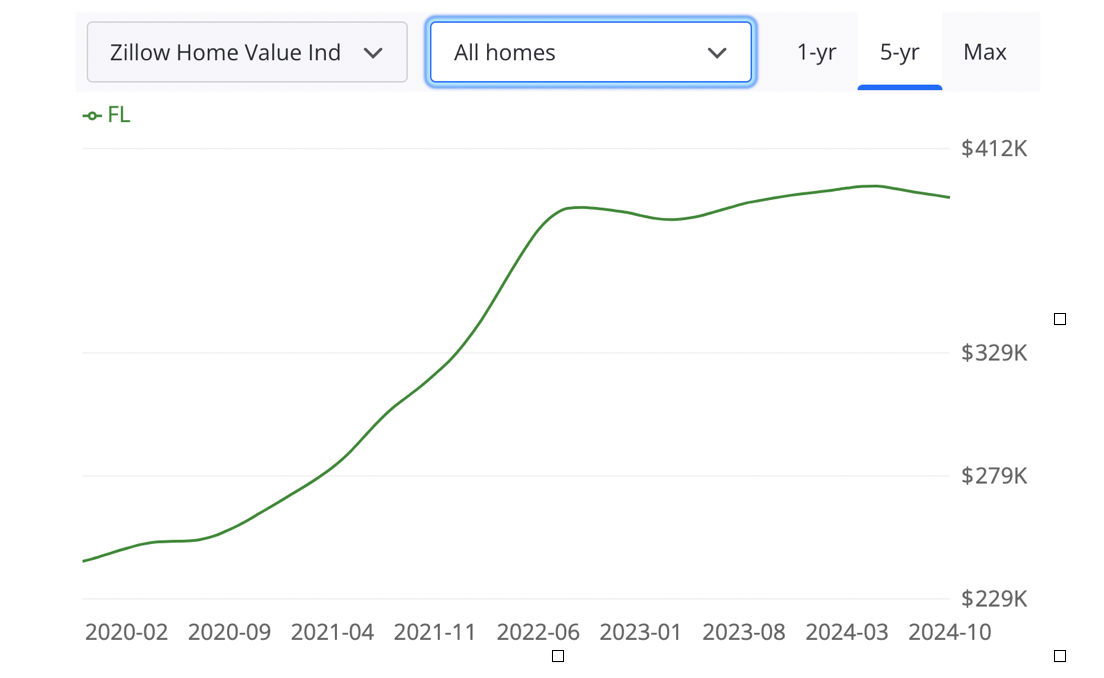

Florida’s housing market is remarkably resilient but not immune to the pressures of economic shifts and environmental changes. In 2024, the average home price in Florida stays stable year-over-year, reaching approximately $400,000. This steady indicator, despite the global context, reflects an existing demand for Florida real estate, even as concerns over rising interest rates and insurance costs grow.

However, sales volumes tell a different story. Transaction numbers have fallen by 11.8% year-over-year, signaling that buyers are exercising caution, and this hesitancy is amplified by mounting climate risks, particularly in hurricane-prone areas.

Inventory levels, meanwhile, show a significant increase of 27.8% over the previous year. This suggests that homes are staying on the market longer as buyers take more time to evaluate their options. For the Tampa housing market, properties average 64 days on the market, while Naples—an upscale coastal area—sees homes linger for 86 days. By contrast, inland cities such as Lakeland experience faster turnover, with homes selling in just 38 days on average, reflecting a growing interest in regions less impacted by hurricanes.

What’s more, the Florida housing market reflects a balance of local and out-of-state influences. Buyers from high-tax states like New York and California continue to migrate to Florida, drawn by its tax advantages and lower cost of living – but these new residents often prioritize homes in less flood-prone areas, creating heightened demand in inland cities like Tallahassee. This divergence underscores Florida’s dual identity as a state of opportunity and caution. While prime locations remain attractive, the complexities of climate risks and rising costs are forcing both buyers and sellers to reassess their strategies.

HURRICANES: A MARKET DISRUPTOR AND EQUALIZER

Property damage and recovery costs

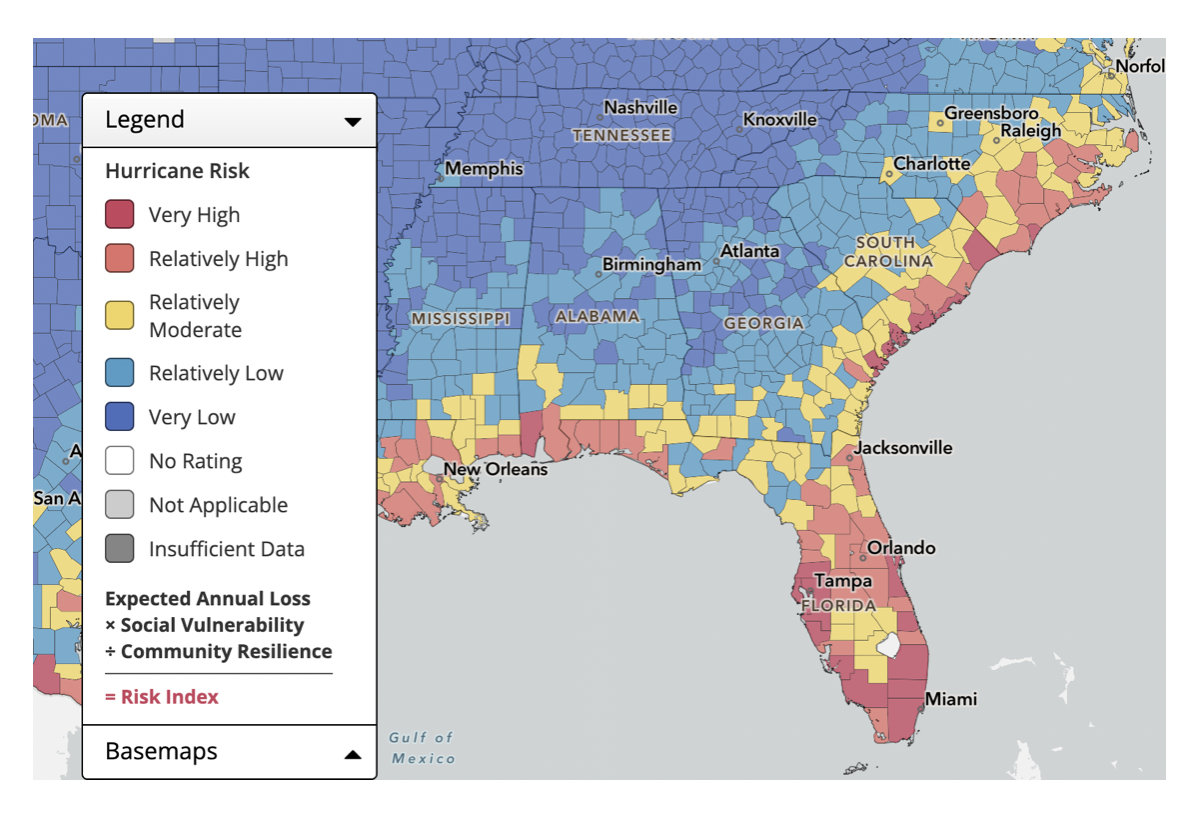

Florida’s vulnerability to hurricanes is unmatched in the United States. On average, the state experiences the brunt of at least three significant storms annually. Between 2000 and 2023, major hurricanes such as Michael (2018), Irma (2017), and Ian (2022) inflicted over $100 billion in damages. Hurricane Ian alone caused $36 billion in residential damage, with thousands of homes left uninhabitable. The financial toll for homeowners is staggering: replacing a roof can cost between $10,000 and $20,000, while repairing flood-damaged interiors often exceeds $100,000. For many, these costs are compounded by delays in insurance payouts, stretching the recovery process over months or even years.

Beyond the immediate destruction, hurricanes disrupt local real estate markets in unique ways. Affected areas often see a temporary reduction in available inventory, driving up home prices by 5% to 10% in the three years following the disaster. For example, after Hurricane Michael, the median home price in Bay County rose by 7%, reflecting the imbalance between supply and demand. These disruptions create challenges but also opportunities for investors and buyers willing to rebuild. Homes damaged by hurricanes can sell at discounts of 15% to 30%, presenting an entry point for those prepared to undertake repairs.

The insurance crisis

The rising cost of homeowners insurance is another significant factor reshaping Florida’s housing market. Floridians pay an average of $4,200 annually for insurance—nearly three times the national average—and premiums are climbing fast. Following Hurricane Helene in 2024, coastal homeowners reported increases of up to 25%. Compounding the issue, many major insurers have withdrawn from the Florida market, leaving homeowners reliant on Citizens Property Insurance, the state’s insurer of last resort. Citizens now insures over 1.5 million policies, a 50% increase since 2023, illustrating the severity of the private market’s retreat.

Insurance rates are particularly punishing for waterfront properties or homes located in FEMA-designated flood zones. For example, a home valued at $500,000 in a high-risk flood area may face annual insurance premiums exceeding $8,000, deterring potential buyers and complicating sales.

Demographic shifts and gentrification

Hurricanes don’t just damage properties; they transform communities. Wealthier buyers often move into hurricane-affected areas, purchasing discounted homes and rebuilding with resilience features. In contrast, lower-income residents are frequently displaced, unable to afford repairs or escalating insurance premiums. Research examining Florida’s housing market from 2000 to 2016 found that the average income of buyers in storm-hit areas rose by nearly 10% in the years following a disaster. This demographic shift is particularly evident in regions like Fort Myers and the Florida Panhandle, where gentrification has spurred economic growth but also reduced affordability.

Additionally, government programs such as disaster recovery grants tend to favor wealthier homeowners who have the resources to rebuild quickly, further accelerating this demographic shift.

BUYERS AND SELLERS: NAVIGATING THE NEW NORM

For buyers: calculated risks

Buying property in Florida now requires a comprehensive evaluation of risks and benefits. Flood zone designations, building codes, and insurance costs are key considerations. Properties equipped with resilience features—such as impact-resistant windows, reinforced roofs, and storm shutters—are increasingly sought after. These upgrades, though expensive, offer significant long-term savings by reducing repair costs and lowering insurance premiums.

For example, adding storm shutters can cost around $2,000 but may reduce annual insurance costs by 10% to 15%. Similarly, elevating a home to avoid flooding can increase construction costs by $10,000 to $30,000, yet it provides invaluable protection against water damage.

Inland cities such as Lakeland and Tallahassee are becoming popular alternatives for buyers seeking affordability and safety. These areas offer reduced hurricane risk and lower insurance premiums, making them attractive for families and retirees alike. Additionally, buying in inland markets often provides more square footage and larger lots at a fraction of the cost of coastal properties.

For sellers: competitive strategies

Sellers face mounting pressure to meet buyer expectations in an increasingly climate-conscious market. Homes lacking resilience features or located in high-risk areas are more difficult to sell, often requiring price reductions or significant investments in upgrades. Investing in features such as solar panels, hurricane-resistant windows, or energy-efficient appliances can increase a property’s marketability. High-quality photography, virtual tours, and detailed listings that emphasize resilience can also help attract attention.

Additionally, sellers must be prepared for extended negotiation periods as buyers scrutinize properties more thoroughly than in previous years. Also, working with real estate agents experienced in marketing homes in high-risk areas can help sellers navigate these challenges more effectively.

TRENDS SHAPING THE FUTURE

Stronger building codes and resilient design

Florida’s building codes, some of the strictest in the nation, have evolved significantly since Hurricane Andrew in 1992. Homes built under these regulations are more likely to withstand severe weather, featuring reinforced materials, wind-resistant roofing, and elevated designs. Developers are increasingly incorporating smart technologies, such as automated storm shutters and solar energy systems, to meet buyer demands for resilience and sustainability.

Inland migration gains momentum

The growing risks associated with coastal living are prompting a noticeable migration toward Florida’s inland cities. Tallahassee, Gainesville, and Lakeland have seen steady population growth, driven by their lower vulnerability to hurricanes and more affordable housing markets.

Population growth in inland Florida has outpaced coastal areas by 15% over the past decade. This trend is likely to accelerate as hurricanes grow more frequent and intense, reshaping long-term housing demand.

Investor opportunities in a changing landscape

While hurricanes present challenges, they also create opportunities for real estate investors. As we said, properties in need of repair post-storm often sell at significant discounts, offering strong potential for rehabilitation and resale.

The surge in rental demand following hurricanes is another opportunity. Displaced residents frequently seek temporary housing, creating lucrative short-term rental markets in affected areas. For investors with properties in these regions, the potential for high occupancy rates and premium rental prices is significant.

THE WAY FORWARD

Florida’s housing market is a microcosm of the broader global challenge of balancing opportunity with resilience. The state’s enduring appeal is tempered by the realities of rising insurance costs, climate risks, and shifting buyer preferences. For buyers, thorough research and prioritization of resilience features are essential. Sellers must adapt by investing in upgrades and crafting compelling marketing strategies, while investors should focus on balancing risks with long-term rewards.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.