Here’s How to Find Out if a House is in Foreclosure!

Here’s How to Find Out if a House is in Foreclosure!

Unraveling the puzzle of how to find out if a house is in foreclosure can be both intriguing and vital. In a world where property dynamics shift rapidly, understanding the signs and signals of foreclosure can be the key to unlocking golden opportunities or safeguarding cherished homes. Dive in, and let’s demystify the world of foreclosures together.

Key Takeaways

- Pre-foreclosure represents the initial phase in the foreclosure process, signaling that timely intervention can prevent a full foreclosure.

- Engaging with a foreclosure attorney can provide homeowners with clarity, direction, and potential solutions during the challenging foreclosure process.

- Online databases like Zillow, RealtyTrac, and Foreclosure.com have revolutionized the way individuals can identify and research foreclosed properties.

- Visiting the county courthouse offers a direct and reliable method to access public records related to foreclosure, providing a wealth of information for those willing to do the legwork.

- Real estate agents play a pivotal role in the foreclosure landscape, leveraging tools like the Multiple Listing Service (MLS) to pinpoint properties in various stages of foreclosure.

Understanding Foreclosure

At its core, foreclosure is a legal process initiated by a lender when a homeowner fails to make their mortgage payments. This process allows the lender to take possession of the property to recover the outstanding debt. Understanding the nuances of foreclosure is essential, especially if you’re trying to find out if a house is undergoing this process.

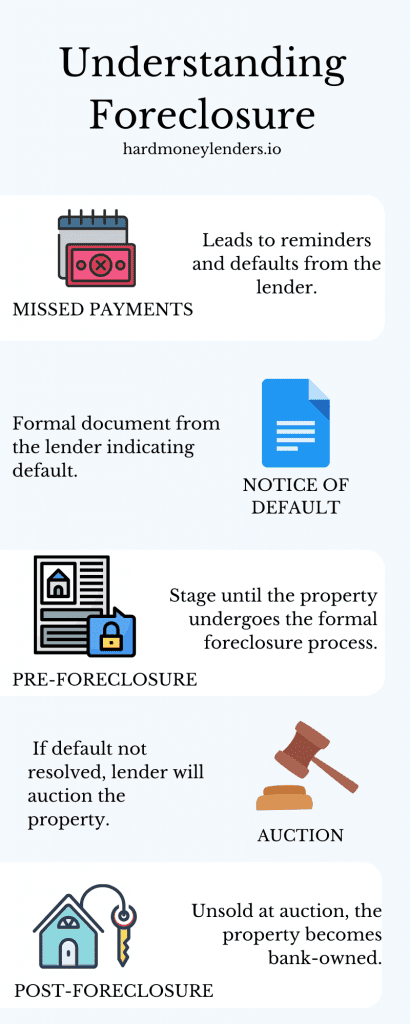

The foreclosure process can be broken down into several stages:

- Missed Payments: It all starts when a homeowner fails to make one or more mortgage payments. The lender will send a reminder, and if the payments continue to be missed, a notice of default is issued.

- Notice of Default: This is a formal document sent by the lender, indicating that the homeowner is in default.

- Pre-Foreclosure: This phase lasts until the property is officially foreclosed. During this time, the homeowner can take steps to stop foreclosure, such as…

- Negotiating with the lender

- Refinancing

- Selling the property.

- Auction: If the homeowner cannot resolve the default, the lender will attempt to sell the property at a public auction. The highest bidder will take ownership of the property.

- Post-Foreclosure: If the property doesn’t sell at auction, it becomes a bank-owned property or real estate owned (REO). The lender can then choose to sell the house on the open market.

Pre-Foreclosure: An Early Warning Sign

The term pre-foreclosure often evokes a sense of urgency and concern, and rightly so. It represents the initial phase in the foreclosure process, signaling that a homeowner is on the brink of facing more severe consequences if corrective actions aren’t taken. Understanding what pre-foreclosure entails and how to navigate it can be the difference between retaining a home and losing it.

What Does Pre-Foreclosure Mean?

Pre-foreclosure begins when a homeowner misses one or more mortgage payments and the lender issues a Notice of Default. This notice serves as a formal warning, indicating that the homeowner has defaulted on their mortgage agreement. While the property isn’t yet foreclosed during this stage, it’s a clear indication that the lender is gearing up to initiate the foreclosure proceedings if the default isn’t addressed.

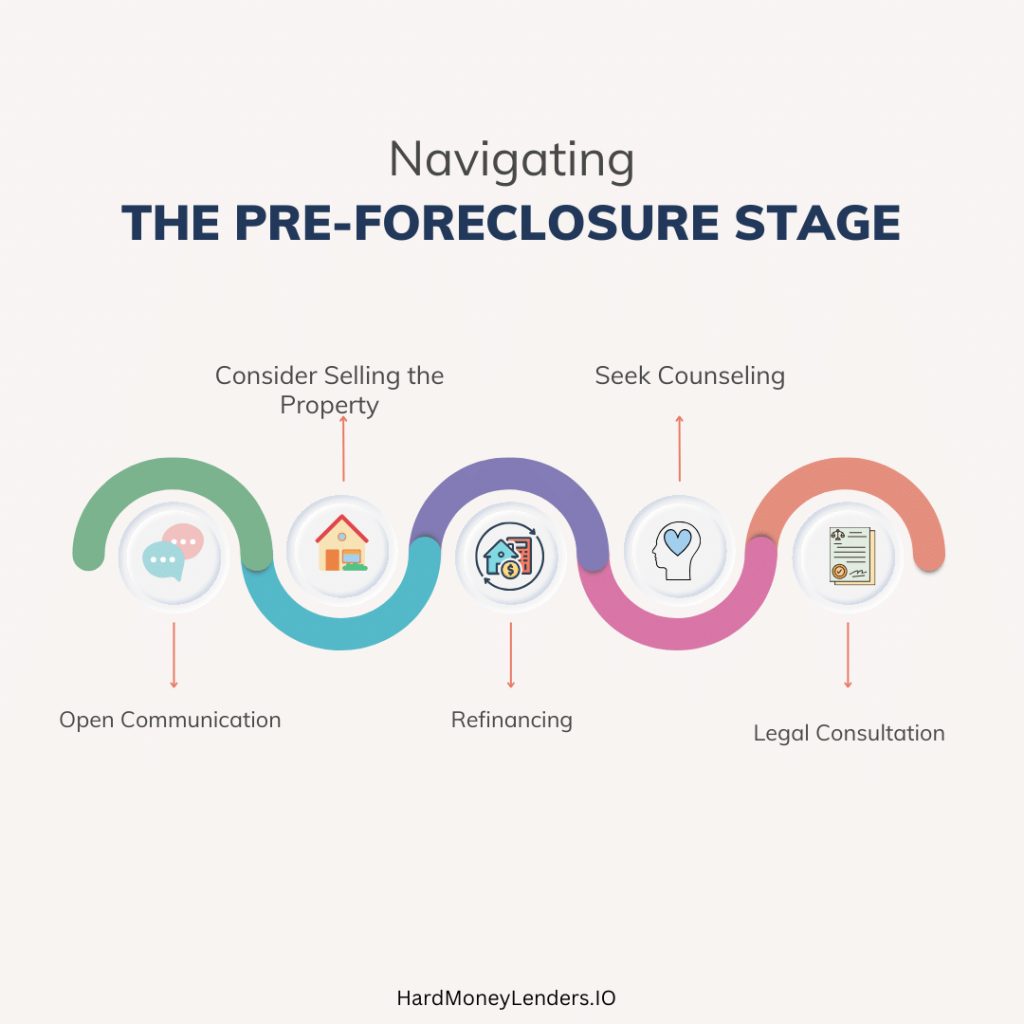

Navigating the Pre-Foreclosure Stage

For homeowners, the pre-foreclosure phase is a critical window of opportunity.

Here’s how they can act to potentially prevent full foreclosure:

1. Open Communication with the Lender

Ignoring calls or letters from the lender is a mistake. Instead, homeowners should communicate their financial difficulties and seek potential solutions. Lenders might offer loan modifications, repayment plans, or other alternatives.

2. Consider Selling the Property

If the financial strain is too significant, homeowners might choose to sell their property before it goes into foreclosure. This allows them to pay off the outstanding mortgage and possibly retain some equity.

3. Refinancing

If the homeowner’s credit is still in good standing, they might consider refinancing the mortgage to secure a lower interest rate or extended loan term, reducing monthly payments.

4. Seek Counseling

Non-profit organizations offer free housing counseling for homeowners facing foreclosure. These counselors can provide guidance on available options and resources.

5. Legal Consultation

Engaging with a foreclosure attorney can provide insights into legal rights and potential strategies to avoid foreclosure.

The Importance of Notices and Communication

The Notice of Default and other related notices are not just formalities; they are crucial communication tools. These notices provide detailed information about the amount owed, the deadline for payment, and the consequences of continued default. Understanding these notices is paramount. Homeowners should read them carefully, noting any deadlines and ensuring they respond appropriately.

Signs a House Is in Foreclosure

When a house is in foreclosure, there are several telltale signs that can alert homeowners, neighbors, and potential buyers. Recognizing these signs early can be crucial for homeowners to take proactive measures and potentially avoid foreclosure.

Notice of Default

The Notice of Default serves as a formal warning, indicating that the homeowner is in default of their loan agreement. It’s typically recorded with the county recorder’s office and becomes a public record, accessible to anyone who wishes to find out if a house is in the early stages of foreclosure.

Summons and Complaint

This legal document initiates the foreclosure proceedings. The summons informs the homeowner of the lawsuit, while the complaint outlines the lender’s grievances and the amount owed.

Homeowners should take this document seriously, as it indicates that the foreclosure process has formally begun. Consulting with a foreclosure attorney at this stage can provide valuable insights and potential solutions.

Warning Signs for Homeowners

Missed Payments

The most obvious sign is missing one or more mortgage payments. Lenders typically send reminders or late notices after the first missed payment.

Calls from the Bank

Frequent communication from the bank or the lender’s attorney regarding the outstanding mortgage can be a red flag.

Foreclosure Notices in Local Newspapers

Lenders are often required to publish foreclosure notices in local newspapers as part of the legal process. Regularly checking these publications can help homeowners stay informed.

Letters from Real Estate Investors

If your property is in foreclosure, you might receive unsolicited offers from real estate investors looking to purchase distressed properties.

A Notice on the Door

In some cases, a physical notice might be posted on the property, especially if the lender struggles to contact the homeowner directly.

Using Online Resources to Find a Foreclosure

In today’s digital age, the internet has become an invaluable tool for those looking to find out if a house is in foreclosure. With a plethora of online databases and platforms available, identifying a foreclosed property has never been easier. However, with the vast amount of information available, it’s essential to know where to look and how to interpret the data accurately.

Online Databases

Zillow

A popular real estate marketplace, Zillow provides comprehensive property listings, including those in pre-foreclosure and foreclosure. By using the filter options, users can narrow down their search to only view properties in these categories.

Zillow also offers a feature called “Zestimate,” which gives an estimated market value for homes, helping potential buyers gauge the property’s worth.

RealtyTrac

Specializing in foreclosure listings, RealtyTrac offers a vast database of properties in various stages of the foreclosure process. From Notice of Default to auction listings, users can access detailed information about each property, including the property’s address, auction date, and outstanding loan details.

Foreclosure.com

As the name suggests, this platform focuses solely on foreclosure homes. It provides a user-friendly interface to search for foreclosure listings by state, city, or zip code. Foreclosure.com also offers educational resources and tools for those new to the foreclosure market.

The Role of MLS in Identifying Foreclosures

The Multiple Listing Service (MLS) is a database used by real estate professionals to list and find properties. While it’s primarily used by real estate agents, the public can access some of its features through various platforms. MLS listings are comprehensive and often include properties not found on other online databases. For those serious about purchasing a foreclosed home, working with a real estate agent who has access to MLS can be beneficial.

Effectively Using Online Platforms

Filtering

Most platforms offer filtering options. Use these to narrow down your search to only view foreclosed or pre-foreclosure homes.

Stay Updated

Foreclosure listings can change rapidly. It’s essential to check these platforms regularly to stay updated on new listings or status changes.

Verify Information

While online databases are handy, always verify the information. Cross-referencing with the county recorder’s office or county assessor’s website can provide accurate and up-to-date details.

Engage with Professionals

If you’re serious about purchasing a foreclosed property, consider engaging with a foreclosure attorney or real estate agent. They can provide valuable insights, help interpret the data, and guide you through the buying process.

The Role of Real Estate Agents in Foreclosure

Navigating the world of foreclosures can be complex and daunting. However, with the right guidance, the process becomes more manageable and less intimidating. This is where real estate agents and attorneys play a pivotal role. Their expertise and insights can be invaluable for both homeowners and potential buyers.

Real Estate Agents and Foreclosed Properties

Real estate agents have access to a wealth of resources that can assist in identifying foreclosed properties.

Aside from the wealth of resources that a real estate agent can have, their experience can provide insights into the local housing market, helping buyers determine a property’s worth and potential return on investment. They can also guide buyers through the intricacies of purchasing a foreclosed home, ensuring all legal and procedural requirements are met.

Working with a Real Estate Attorney

While a real estate agent can guide you through the buying process, a real estate attorney specializes in the legal aspects of property transactions. When dealing with foreclosures, legal complexities often require expert attention.

For instance, a foreclosure attorney can:

- Review foreclosure notices and other related documents for accuracy and legality.

- Advise on potential risks associated with purchasing a specific foreclosed property.

- Represent buyers during negotiations with banks or lenders.

- Ensure that the property’s title is clear of any liens or encumbrances.

Selecting an Experienced Foreclosure Attorney

If you’re considering purchasing a foreclosed home or if you’re a homeowner facing foreclosure, it’s crucial to work with an attorney experienced in foreclosure cases. Here are some tips to help you choose the right one:

Research and Reviews

Look for attorneys with positive reviews and testimonials.

Free Consultation

Many attorneys offer a free consultation. Use this opportunity to gauge their expertise and determine if they’re a good fit for your needs.

Ask Questions

Don’t hesitate to ask about their experience with foreclosure cases, their approach, and their fees.

Trust Your Instincts

Ultimately, choose an attorney you feel comfortable with and trust to represent your best interests.

Visiting the Courthouse for Foreclosure Information

While online resources and professional assistance are invaluable in the quest to find out if a house is in foreclosure, sometimes the most direct and accurate information can be sourced from the courthouse. Courthouses maintain public records related to all property transactions, including foreclosures, making them a goldmine of information for those willing to do a bit of legwork.

Accessing Public Records

Every foreclosure initiates a trail of documentation, and these documents are filed with the county courthouse. These public records can be accessed by anyone, and they provide a detailed account of the foreclosure proceedings.

To access these records:

- Visit the county courthouse or the county recorder’s office where the property is located.

- You may need the property’s address or the property’s parcel number for a more refined search.

- Ask the clerk for assistance if you’re unsure about how to navigate the records.

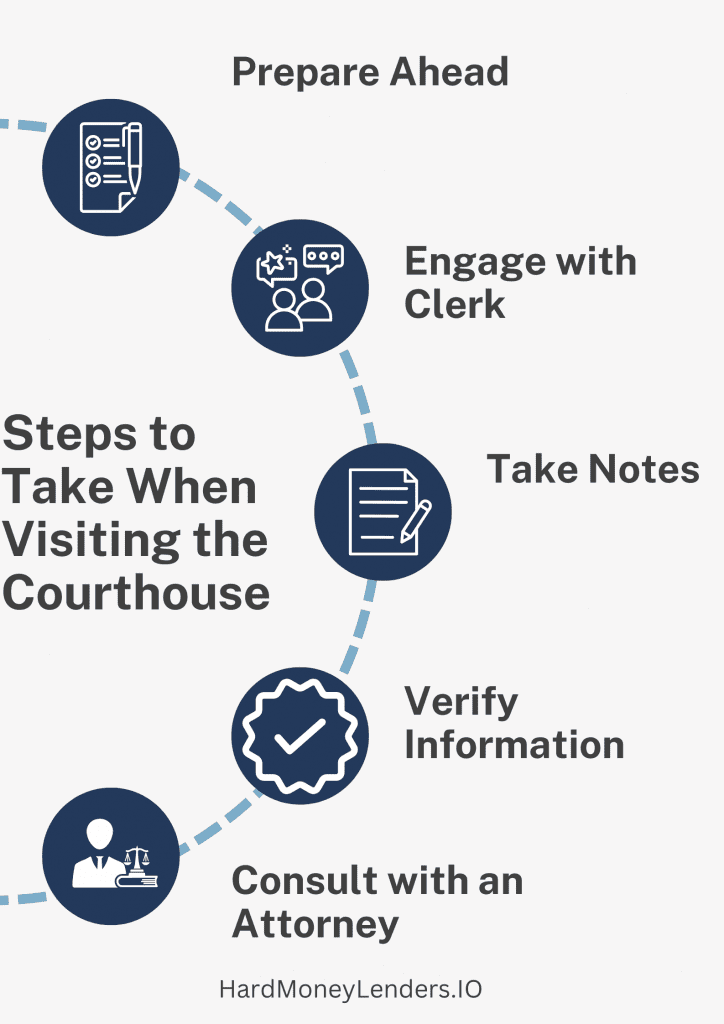

Steps to Take When Visiting the Courthouse

1. Prepare Ahead

Before heading to the courthouse, ensure you have all the necessary details like the property’s address or parcel number. This will make your search more efficient.

2. Engage with the Clerk

Courthouse clerks are knowledgeable and can guide you on how to access the records you need.

3. Take Notes

As you sift through the documents, take detailed notes. This will be helpful if you need to cross-reference information later.

4. Verify Information

While courthouse records are generally accurate, it’s always a good idea to verify any critical details, especially if you’re considering purchasing the property.

5. Consult with an Attorney

If you come across any documents or terms you’re unfamiliar with, consider consulting with a foreclosure attorney. They can provide clarity and guide you on the next steps.

Data-Backed Insights on Foreclosure Trends

Understanding the trends and data surrounding foreclosures can provide valuable insights into the broader economic landscape and the real estate market’s health.

Foreclosure Rates in Recent Years

According to the data from Statista, nationally, 0.26% of properties foreclosed in 2023. This includes bank-owned properties headed for auction and those in the pre-foreclosure stage.

Economic Factors Impacting Foreclosure Trends

Several economic factors can influence foreclosure rates:

Economic Downturns

Periods of economic recession or stagnation can lead to job losses and reduced incomes, making it challenging for homeowners to keep up with their mortgage payments.

Interest Rates

Fluctuations in interest rates can affect homeowners with adjustable-rate mortgages. A sudden spike in rates can increase monthly payments, leading to potential defaults.

Property Values

A decline in property values can result in homeowners owing more on their mortgage than their home’s worth, a situation termed ‘underwater‘. This can lead to increased foreclosure rates, especially if homeowners see no potential for property value recovery.

Conclusion

how to find out if a house is in foreclosure is filled with opportunities and challenges. Your journey to uncover the status of a property and make informed decisions is a valuable one. If you’re ready to further explore or have more questions in the future, reach out to us. Best of luck in your real estate endeavors, whether it’s safeguarding your home or seeking investment opportunities!

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.