Hard Money Loans vs DSCR Loans in Florida

Florida’s housing market is ripe with opportunities, and if you want to get in on the action—then you already know you’ll need capital. But where do you find the money to tap into Florida’s real estate market? Well, after all the years I’ve been in the industry, I’ve found that using other people’s money makes the most sense. That means finding the best loans for your real estate needs. Choosing the right type of financing can impact the success of your real estate investment. That being said, let’s take a look at the hard money loans vs DSCR loans in Florida, how to use Florida hard money loans to your advantage, and all about DSCR loans.

What You Need to Know About Florida Hard Money Loans

Typical Terms and Conditions

- Interest Rates: Hard money loans usually come with higher interest rates compared to traditional loans, typically ranging from 9% to 12%. These rates reflect the increased risk and short-term nature of the loans.

- Loan Durations: The duration of hard money loans is generally short, often between 6 months to 3 years. This aligns with the typical timelines of real estate investment projects, such as fix-and-flip or quick renovations.

- Loan-to-Value (LTV) Ratios: Hard money lenders often offer LTV ratios up to 75%, meaning you can borrow up to 75% of the property’s value.

Benefits of Hard Money Loans

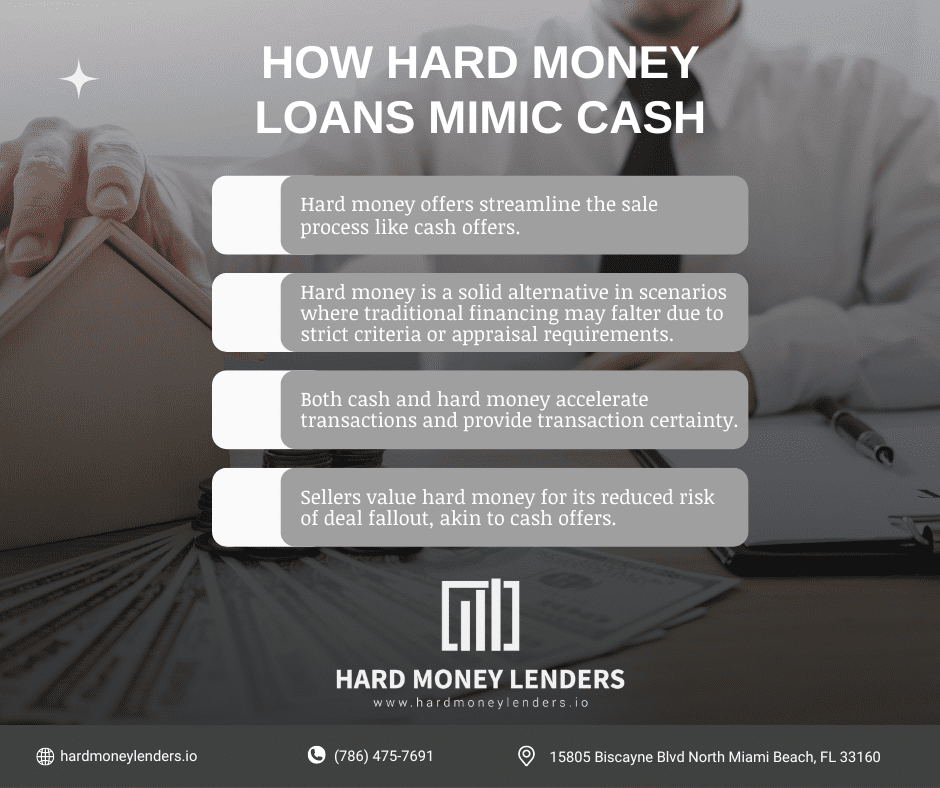

- Quick Approval and Funding: One of the main advantages of hard money loans is the speed of approval and funding. Investors can often secure financing within days, enabling them to act quickly on investment opportunities.

- Flexibility in Terms and Conditions: Hard money lenders are more flexible with their terms and conditions compared to traditional lenders. This flexibility can be beneficial in structuring deals that suit specific investment needs.

- Less Stringent Credit Requirements: Hard money loans focus more on the property’s value than the borrower’s credit score. This makes them accessible to investors with less-than-perfect credit.

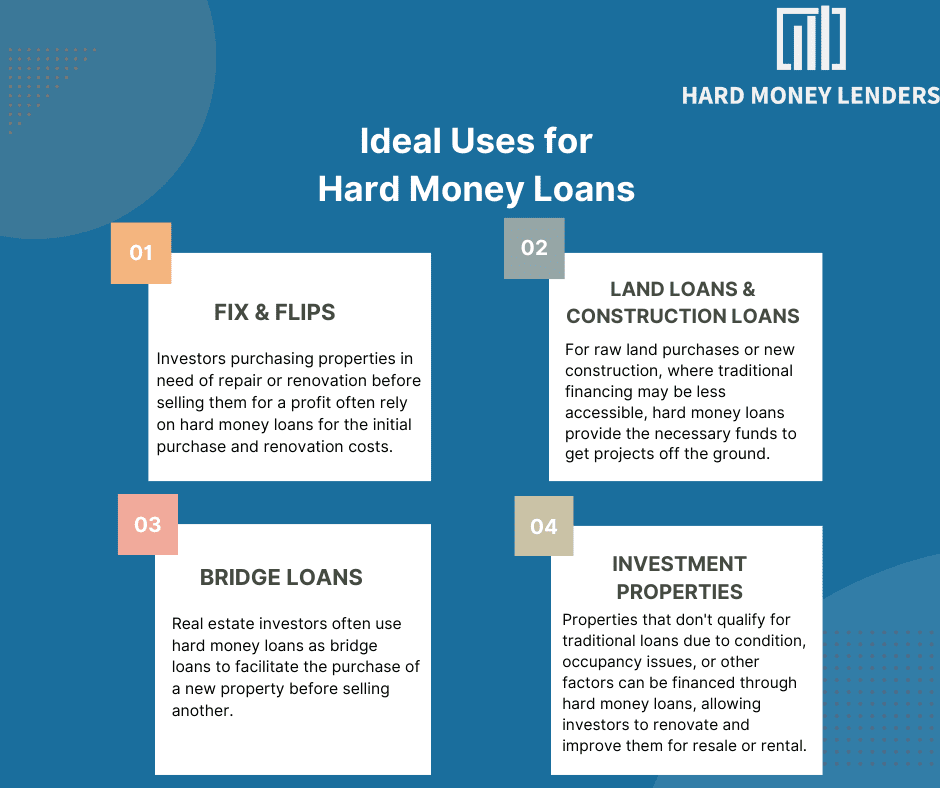

Use Cases for Hard Money Loans in Florida

- Fix-and-Flip Projects: Ideal for investors looking to purchase, renovate, and quickly resell properties.

- Short-Term Investments: Suitable for projects with a short turnaround time, such as bridging the gap between purchase and long-term financing.

- Situations Requiring Fast Access to Capital: Perfect for competitive real estate markets where quick decisions and access to funds are crucial.

What is a Florida DSCR Loan?

DSCR loans, or Debt Service Coverage Ratio loans, are a type of financing based on the income generated by the property rather than the borrower’s personal income. The DSCR measures the property’s ability to cover its debt obligations, making it a critical factor in the approval process for these loans.

Typical Terms and Conditions of DSCR Loans in Florida

- Interest Rates: DSCR loans generally offer lower interest rates compared to hard money loans. Current DSCR loan rates range from about 7.2% to 8.7% APR.

- Loan Durations: These loans are usually long-term, with durations extending from 10 to 30 years, aligning with the typical mortgage period.

- DSCR Requirements: To qualify for a DSCR loan, the property must generate enough income to cover the loan’s debt service. Lenders usually require a DSCR of 1.25 or higher, meaning the property’s income must be 25% greater than its debt obligations. DSCR will vary depending on the lender.

Benefits of DSCR Loans

- Focus on Property Income: DSCR loans emphasize the property’s income potential rather than the borrower’s personal credit, making them suitable for income-generating properties.

- Lower Interest Rates: These loans typically come with lower interest rates compared to hard money loans, reducing the overall cost of borrowing.

- Long-Term Stability: With longer loan durations, DSCR loans provide stability and predictability in monthly payments, which can be beneficial for long-term investors.

Use Cases for DSCR Loans in Florida

- Long-Term Rental Properties: Ideal for investors looking to finance rental properties that generate consistent income.

- Commercial Real Estate Investments: Suitable for commercial properties that have stable tenants and reliable income streams.

Hard Money Loans vs DSCR Loans in Florida

Interest Rate Comparison

- Hard Money Loans: Interest rates for hard money loans in Florida typically range from 9% to 12%. These higher rates reflect the increased risk and shorter loan durations associated with hard money lending.

- DSCR Loans: DSCR loans offer lower interest rates, currently ranging from 7.2% to 8.70% APR. These rates are more comparable to traditional mortgage rates due to the focus on income-generating properties and longer loan terms.

Loan Term Comparison

- Hard Money Loans: The duration of hard money loans is short-term, often between 6 months and 3 years. This short-term aligns with the typical timelines of real estate investment projects, such as fix-and-flip.

- DSCR Loans: DSCR loans are long-term, with durations ranging from 10 to 30 years. This provides long-term stability and lower monthly payments.

Repayment Schedules

- Hard Money Loans: Repayment schedules for hard money loans are often interest-only during the loan term, with the principal repaid at the end of the term. This structure can be beneficial for investors looking to minimize monthly payments during the project period.

- DSCR Loans: DSCR loans usually have standard amortization schedules, where both interest and principal are paid over the loan term. This results in higher monthly payments compared to interest-only loans but provides a clear path to full repayment over time.

Hard Money Loans vs DSCR Loans Florida

Application Process and Approval

When considering financing options for your real estate investments in Florida, understanding the application process and approval criteria for both hard money loans and DSCR loans is essential. Here’s a detailed comparison of the two:

Florida Hard Money Loan Application Process

- Pre-Qualification: The initial step involves providing basic financial information to the lender. HardMoneyLenders.io simplifies this with an online application that assesses your eligibility quickly.

- Application Submission: Submit a detailed application along with necessary documentation such as property plans, cost estimates, and project timelines. HardMoneyLenders.io typically requires fewer documents compared to traditional lenders, focusing more on the property value and potential.

- Credit and Financial Review: Although credit scores are considered, hard money lenders like HardMoneyLenders.io prioritize the property’s value and the investment’s potential. The approval process is often faster due to this focus, with decisions made within days.

- Property Appraisal: An independent appraisal ensures the property’s value aligns with the loan amount. This step confirms that the investment is sound and justifies the requested funding.

- Loan Approval: If the application is approved, you receive a loan commitment outlining terms and conditions. HardMoneyLenders.io offers flexible terms tailored to your project’s needs.

- Closing: Sign the loan agreement to secure the funding. HardMoneyLenders.io disburses funds quickly, adhering to an agreed draw schedule that aligns with your project milestones.

Florida DSCR Loan Application Process

- Pre-Qualification: This involves a thorough analysis of the property’s income-generating potential. Lenders require detailed financial records demonstrating consistent rental income or other revenue streams.

- Application Submission: Submit comprehensive documentation, including income statements, rental agreements, and detailed property performance reports. This documentation is more extensive than that required for hard money loans.

- Credit and Financial Review: Lenders evaluate the Debt Service Coverage Ratio (DSCR) to ensure the property generates sufficient income to cover the debt. A DSCR of 1.25 or higher is usually required, indicating the property’s income is 25% higher than its debt obligations. Some lenders will offer lower or higher requirements.

- Property Appraisal: Similar to hard money loans, an independent appraisal verifies the property’s value and income potential.

- Loan Approval: If the property meets the lender’s criteria, a loan commitment is issued. The approval process for DSCR loans can be more time-consuming due to the detailed financial scrutiny.

- Closing: Once the terms are agreed upon, sign the loan agreement. DSCR loans typically have a longer closing period compared to hard money loans due to the detailed financial evaluations.

Comparison of Ease of Approval

- Hard Money Loans: These loans are generally easier and faster to obtain. HardMoneyLenders.io, for instance, focuses more on the property’s value and less on the borrower’s credit score or detailed income verification. This makes them ideal for investors needing quick access to capital.

- DSCR Loans: Approval for DSCR loans is more stringent, with a heavy emphasis on the property’s income-generating ability. The detailed financial analysis required can slow down the approval process, making these loans more suitable for stable, long-term investments.

Florida Hard Money Loans Offer More Flexibility Than Florida DSCR Loans

Flexibility of Hard Money Loans

Hard money loans are known for their flexibility, making them a preferred choice for various real estate investment scenarios. Key benefits include:

- Customizable Terms: Lenders like HardMoneyLenders.io offer tailored loan terms that can be adjusted based on the specific needs of your project. This flexibility can include interest-only payments during the loan term or customized repayment schedules.

- Quick Adjustments: The terms of a hard money loan can be modified if the project’s circumstances change, allowing for adjustments in draw schedules, repayment terms, or even loan extensions.

- Varied Use Cases: Hard money loans can be used for a wide range of projects, including fix-and-flip ventures, short-term bridge financing, and construction of new spec homes. This versatility makes them an excellent tool for investors looking to capitalize on different opportunities.

Limitations of DSCR Loans

While DSCR loans offer stability and lower interest rates, they come with certain limitations:

- Stricter Requirements: DSCR loans require thorough income verification and higher DSCR ratios, which can limit accessibility for some investors.

- Focused Use Cases: These loans are best suited for income-generating properties, such as rental units or commercial properties, and may not be as flexible for other types of real estate investments.

- Longer Approval Process: The detailed financial scrutiny and requirement for a high DSCR can prolong the approval process, making it less suitable for investors needing quick access to capital.

Return Potential

- Hard Money Loans: These loans can offer high returns, especially in high-yield projects like fix-and-flip ventures. The ability to quickly acquire and improve properties can result in significant profit margins.

- DSCR Loans: With lower interest rates and long-term stability, DSCR loans are ideal for income-generating properties that provide steady, reliable returns over time.

Risks vs. Reward Potential of Hard Money Loans and DSCR Loans in Florida

Risk Factors Associated with Hard Money Loans

- Higher Interest Rates: Hard money loans come with higher interest rates, typically between 9% and 12%. While these rates reflect the higher risk taken by lenders, they also increase the cost of borrowing.

- Shorter Loan Durations: The short-term nature of hard money loans (6 months to 3 years) means investors need to ensure their projects are completed and sold within a tight timeframe to avoid refinancing or default risks.

- Market Dependence: The success of a hard money loan project often depends on favorable market conditions. Rapid market shifts can impact the resale value and profitability of the investment.

Risk Factors Associated with DSCR Loans

- Dependence on Property Income: DSCR loans rely heavily on the property’s ability to generate income. Any disruption in rental income or vacancy can impact the borrower’s ability to meet debt obligations.

- Stricter Eligibility Criteria: The need for a high DSCR ratio and thorough income verification can limit the accessibility of these loans, particularly for properties with inconsistent income streams.

- Market Conditions: While DSCR loans offer long-term stability, they are still subject to market conditions. Changes in rental demand or property values can affect the investment’s performance.

Examples of Successful Hard Money Funding in Florida

Spec Home Construction Loan in Naples

Quick Closing on a Home in Boca Raton

Second Position Mortgage in Jacksonville

Final Thoughts: Hard Money Loans are Better Than DSCR Loans

If you’re looking to capitalize on the thriving Florida real estate market, Hard Money Lenders IO can be your trusted partner. With a proven track record of successful funding for various projects, from spec home construction to quick closings on high-equity properties, Hard Money Lenders IO offers tailored financing solutions that align with your investment goals.

FAQs: Hard Money Loans vs DSCR Loans Florida

Who Should Use Hard Money Loans in Florida?

Hard money loans are ideal for investors who need quick access to capital and have a property with substantial value. They are particularly useful for:

- Fix-and-Flip Investors: Those looking to purchase, renovate, and quickly resell properties for a profit.

- Short-Term Investors: Projects with a short turnaround time, such as bridging the gap between purchase and long-term financing.

- Investors with Less-than-Perfect Credit: Hard money lenders prioritize the property’s value over the borrower’s credit score, making these loans accessible to those with poor credit history.

- Competitive Market Participants: Investors who need to act fast in competitive markets where traditional financing might be too slow.

Who Should Use DSCR Loans in Florida?

DSCR loans are suited for investors who own or are purchasing income-generating properties. They are best for:

- Long-Term Rental Property Investors: Ideal for those looking to finance rental properties that generate consistent income.

- Commercial Real Estate Investors: Suitable for commercial properties with stable tenants and reliable income streams.

- Investors with Strong Property Income: DSCR loans focus on the income generated by the property rather than the borrower’s personal credit, making them suitable for income-generating assets.

How Much Down Payment is Needed for a DSCR Loan in Florida?

The down payment required for a DSCR loan typically ranges from 20% to 30% of the property’s purchase price. This amount can vary based on the lender’s requirements, the borrower’s financial profile, and the specific property being financed.

Who is Eligible for a DSCR Loan?

Eligibility for a DSCR loan generally includes the following criteria:

- Property Income: The property must generate sufficient income to cover the loan’s debt service, usually requiring a DSCR of 1.25 or higher.

- Property Type: Both residential (multi-family units) and commercial properties are eligible, provided they generate reliable income.

- Financial Stability: While personal credit is less emphasized, lenders still look for financial stability and may require a review of the borrower’s financial statements and rental income history.

- Experience: Some lenders prefer borrowers with experience in managing rental properties or commercial real estate.

How Difficult is it to Get a DSCR Loan?

Obtaining a DSCR loan can be more challenging than other types of loans due to the specific requirements:

- Income Verification: The property must demonstrate sufficient income to meet the DSCR threshold, which can involve extensive documentation of rental income and expenses.

- Detailed Financial Review: Lenders conduct a thorough review of the property’s financial performance, including income statements, rental agreements, and occupancy rates.

- Property Appraisal: An independent appraisal is required to verify the property’s value and income potential.

- Stricter Underwriting: The detailed financial scrutiny and high DSCR ratio required can make the approval process more stringent and time-consuming compared to other loan types.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.