What Is The Average Hard Money Loan Interest Rate?

Hard money loans have a variety of advantages — they can be approved very quickly, and they are incredibly flexible. Compared to a traditional mortgage loan, hard money loans can be approved much faster, and in competitive seller’s markets, hard money loans make real estate investors instantly competitive. Of course, when it comes to getting a hard money loan, it’s important to know the average hard money loan interest rate. Below, you’ll learn what is a hard money loan, what is the average hard money loan interest rate, and how to find the best hard money loan rates.

What is the Average Hard Money Loan Interest Rate?

Currently, the average interest rates for hard money loans, typically ranging between 9% and 15%, are influenced by a number of factors that can cause significant fluctuations, such as the Federal Funds rate.

Here’s a look at the Federal Funds rate between 2014 and 2024.

| Year | Federal Funds Rate Range (%) |

|---|---|

| 2024 | 5.33 (as of January) |

| 2023 | 4.33 – 5.33 |

| 2022 | 0.08 – 4.10 |

| 2021 | 0.06 – 0.10 |

| 2020 | 0.05 – 1.58 |

| 2019 | 1.55 – 2.42 |

| 2018 | 1.41 – 2.27 |

| 2017 | 0.65 – 1.30 |

| 2016 | 0.34 – 0.54 |

| 2015 | 0.11 – 0.24 |

| 2014 | 0.07 – 0.12 |

Other Factors Can Affect Hard Money Loan Interest Rates

Other factors that can affect hard money loan interest rates include but are not limited to, the borrower’s credit score, real estate experience, the value and type of property being used as collateral, and the length of the loan term. The variability in rates reflects the diverse risk profiles of each loan, dictated by the specifics of the investment and the borrower’s financial standing.

Interest rates on hard money loans are markedly higher than those of traditional mortgages, which can often be found in the range of 3% to 6%, depending on market conditions. However, in rising interest rate environments, such as the one we’re currently in — mortgage rates have hovered around 7% and 8%.

This discrepancy is primarily due to the increased risk lenders undertake with real estate investments and the expedited funding they offer.

Hard money loans are often sought for projects that may not qualify for traditional financing, such as fix-and-flips, construction loans, and properties in need of immediate repair. The higher rates are a reflection of the lender’s increased exposure to risk in these ventures, as well as the convenience of quick, asset-based financing.

Understanding the dynamics of these rates is crucial for investors aiming to utilize hard money financing effectively. By comprehending how various factors influence interest rates, borrowers can better position themselves to secure favorable terms.

What is a Hard Money Loan?

Hard money loans represent a pivotal financing mechanism in the real estate sector, particularly for investors and developers who engage in projects requiring swift execution or those dealing with properties not meeting traditional lending criteria. These loans are typically provided by private lenders or investment companies and are characterized by their short duration, usually ranging from 6 months to a few years, and their reliance on the property as collateral rather than the borrower’s creditworthiness or financial history.

Key Features of Hard Money Loans

- Asset-based Lending: The cornerstone of hard money lending is its focus on the value of the property being financed, rather than the borrower’s credit score or income. Lenders assess the potential value of the property post-renovation or development to determine the loan amount, often referred to as the after-repair value (ARV).

- Speed of Funding: One of the most compelling advantages of hard money loans is the rapidity with which they can be funded. Due to the less bureaucratic process compared to traditional banking, hard money loans can be approved and disbursed within days or weeks. This speed is crucial for real estate investors competing in markets where quick property acquisitions can make or break a deal.

- Flexible Terms: Hard money lenders often offer more flexible terms compared to traditional loans. This flexibility can include negotiable interest rates, repayment schedules, and loan-to-value ratios. Lenders are typically more willing to tailor the loan terms to fit the specific needs of the project or the investor.

- Higher Interest Rates and Fees: The convenience and flexibility of hard money loans come at a cost, typically in the form of higher interest rates and additional fees. These rates are higher to compensate for the increased risk the lender takes by focusing on the collateral value rather than the borrower’s creditworthiness.

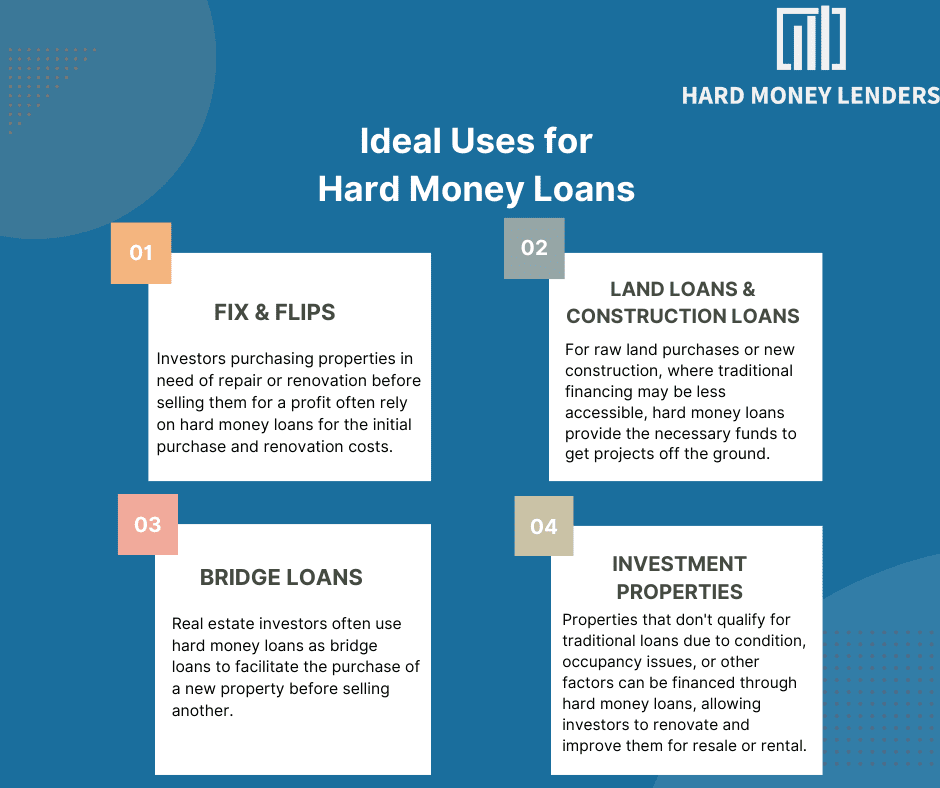

Ideal Uses for Hard Money Loans

Hard money loans are particularly suited for several types of real estate transactions:

- Fix-and-Flips: Investors purchasing properties in need of repair or renovation before selling them for a profit often rely on hard money loans for the initial purchase and renovation costs.

- Land Loans and Construction Loans: For raw land purchases or new construction, where traditional financing may be less accessible, hard money loans provide the necessary funds to get projects off the ground.

- Bridge Loans: These are used to bridge the gap between immediate financing needs and securing long-term financing. Real estate investors often use hard money loans as bridge loans to facilitate the purchase of a new property before selling another.

- Investment Properties: Properties that don’t qualify for traditional loans due to condition, occupancy issues, or other factors can be financed through hard money loans, allowing investors to renovate and improve them for resale or rental.

Risks and Considerations

While hard money loans offer significant advantages in terms of speed and flexibility, they also come with risks. The higher interest rates and fees can significantly impact the overall cost of the project. Additionally, since these loans are typically secured by the property, failing to repay the loan can result in foreclosure. Therefore, it’s crucial for borrowers to have a solid exit strategy in place, whether it’s selling the property at a profit or refinancing into a long-term, lower-interest loan.

Factors That Affect Hard Money Loan Interest Rates

Several factors can influence the interest rates on hard money loans, including:

- Loan-to-Value (LTV) Ratio: Lenders typically offer lower interest rates for loans with a lower LTV ratio, as they pose a reduced risk.

- Borrower’s Creditworthiness and Experience: While not as crucial as with traditional loans, a borrower’s credit history and experience in real estate can affect interest rates.

- Property Type and Location: The nature and location of the property can also impact rates, with prime locations often attracting more favorable terms.

- Term Length of the Loan: Shorter loan terms usually have higher interest rates due to the increased risk to lenders.

Here are some of the factors that matter for the interest rates of hard money loans.

The down payment of the borrower

Famously, hard money loans have lower loan-to-value (LTV) ratios than traditional mortgage loans. The average hard money loan has an LTV ratio between 60 to 80%, while most commercial mortgages from banks have rate of 80% or more. This means borrowers who use hard money loans have to put down bigger down payments.

Usually, the bigger the down payment, the better the interest rate of the loan. A bigger down payment means more of a commitment from the borrower, and also lessens the likelihood of a real estate investor defaulting on a hard money loan.

To hard money lenders, the down payment of the borrower is their investment. Also, lenders often require different down payments for different investments — they require a down payment of 10–20% for a residential property loan and 30–40% for a commercial property.

There are some hard money lenders who charge no down payment whatsoever — but there are often other costs. These costs include very high-interest rates and other fees, and unforgiving payment schedules.

Also, a good credit score proves the buyer might not default on their hard money loans. While a bad credit score may not deny you getting a hard money loan, it does impact your interest rate. In particular, new investors’ credit scores and financial histories are important — since many hard money lenders rely on the investment history of the borrower, other hard money lenders rely on credit score, money in the bank, and amount of debt for the amount of debt a borrower incurs.

While the popular convention is most hard money lenders don’t care about credit, the fact is new investors in particular have to be very conscientious about their credit scores.

The experience of the borrower

Another factor that impacts the rate of a hard money loan is the experience of a borrower. Typically, borrowers with track records of successful investments get better interest rates from lenders. The more experienced the borrower, the more reliable they are to pay off hard money loans (from a lender’s perspective).

The biggest factor for a hard money lender is the risk of default, and hard money lenders want to avoid defaulting at all costs. Many hard money lenders won’t even lend to new investors since they might only work with real estate investors with a couple of successful investments. There is just that much risk for a lender working with a new investor.

The location and type of the property

There are properties hard money lenders consider “low risk,” like a residential property. And there are also properties considered “high risk,” like farms. The location of a hard money loan matters and lenders might prioritize some investment properties over others.

Other factors that influence hard money loans include the amount of a requested loan. Typically, a hard money loan of $100,000 is going to be more than a hard money loan of $50,000 because the lender is taking on more risk.

The location of the property also matters depending on whether the lender is in a mortgage state or deed of trust state. A deed of trust state means a lender can foreclose in an auction-like sale. A mortgage state means hard money lenders have to go through the traditional foreclosure process if a borrower defaults, much like banks.

Interest rates are typically lower in deed of trust states than they are in mortgage states, which is not within the borrower’s control, but one factor to take into account.

How to Find the Best Hard Money Loan Rates

Securing favorable terms on a hard money loan requires a proactive and informed approach. Borrowers can enhance their chances of obtaining attractive rates and terms by:

- Negotiating: Engage in negotiations with lenders to improve the terms of the loan. Given the competitive nature of the lending market, many hard money lenders are willing to adjust their rates and fees for well-qualified borrowers or appealing investment opportunities.

- Comparing Offers: Diligently shop around and request quotes from multiple hard money lenders. This comparison should extend beyond just the interest rates to include points, fees, and other loan terms. Utilizing online platforms and networks can streamline this process, providing access to a broader range of lenders.

- Assessing the Full Cost: When evaluating loan offers, it’s essential to consider all associated costs, not just the headline interest rate. Calculate the total cost of the loan, including interest, points, fees, and any other charges, to determine the most economically viable option.

By adopting these strategies, borrowers can better navigate the hard money lending landscape, securing terms that align with their investment goals and financial capabilities. This comprehensive approach ensures that investors not only focus on the immediate benefits of quick financing but also on the long-term implications of their borrowing decisions, maximizing the potential for success in their real estate endeavors.

Questions People Also Ask About Hard Money Loans and Hard Money Loan Interest Rates

Here are some frequently asked questions (FAQs) that we’ve received from our community.

Can I Get a Hard Money Loan with Bad Credit?

Yes, obtaining a hard money loan with bad credit is feasible, primarily because these loans are secured by the property itself rather than the borrower’s credit history. Hard money lenders assess the value and potential of the real estate investment rather than focusing solely on the borrower’s credit score. However, it’s important to note that while credit requirements are less stringent, other factors come into play that can influence the loan’s terms and interest rates.

For borrowers with bad credit, lenders might impose higher interest rates or require a lower loan-to-value (LTV) ratio to mitigate their risk. Additionally, the borrower’s experience in real estate, the project’s potential profitability, and the strength of the exit strategy can also influence the lender’s decision. In essence, while bad credit does not disqualify you from getting a hard money loan, it may affect the loan terms. Therefore, presenting a strong, well-thought-out investment proposal can help offset the impact of a lower credit score.

How Fast Can I Get a Hard Money Loan?

The speed at which a hard money loan can be funded is one of its most appealing attributes, especially for investors who need to act quickly in competitive real estate markets. Typically, hard money loans can be funded within a few days to a couple of weeks after the initial application. This timeframe is significantly faster than traditional bank loans, which can take several weeks to months to process due to rigorous credit checks, income verification, and other regulatory requirements.

The exact timing for a hard money loan approval and funding can vary based on several factors, including the lender’s due diligence process, the complexity of the loan application, and the borrower’s promptness in providing required documentation. To expedite the process, borrowers should have all their financial information, property details, and a clear plan for the project ready before applying for the loan. Proactive communication with the lender and responsiveness to requests for information can further speed up the approval and funding process.

Are There Prepayment Penalties for Hard Money Loans?

The existence of prepayment penalties on hard money loans can vary significantly by lender and loan agreement. Some lenders impose prepayment penalties to ensure they earn a minimum amount of interest on the loan, especially if the loan is paid off much earlier than anticipated. These penalties can vary in structure, ranging from a fixed fee to a percentage of the remaining loan balance or the interest that would have been paid over a set period.

However, not all hard money lenders charge prepayment penalties, and for those who do, the terms can often be negotiated. If the ability to pay off the loan early is important for your investment strategy, it’s crucial to discuss this with the lender upfront and understand any potential penalties that could apply. Reviewing the loan agreement carefully and possibly consulting with a real estate attorney can help ensure you’re fully aware of the implications of prepayment on your hard money loan.

When considering a hard money loan, asking detailed questions about credit requirements, funding timelines, and prepayment penalties will help you better understand the terms and make an informed decision that aligns with your investment goals.

What Types of Properties Qualify for Hard Money Loans?

Hard money loans can be used for a wide range of property types, including residential, commercial, land, and industrial properties. The key factor for qualification often centers on the property’s potential value post-repair or development, rather than its current condition. This makes hard money loans particularly appealing for fix-and-flip projects, land development, construction projects, and properties that do not meet traditional lending standards due to disrepair or other issues. Each hard money lender may have specific preferences or expertise in certain types of properties, so it’s important to discuss your project in detail to ensure alignment.

How Do I Choose a Hard Money Lender?

Choosing a hard money lender involves evaluating several factors beyond just the interest rate. Consider the lender’s reputation, experience in your specific type of real estate project, flexibility in loan terms, and speed of funding. It’s also crucial to understand their fee structure, including points, origination fees, and any hidden costs. Seeking recommendations from other real estate investors or professionals in your network can also provide valuable insights. Ultimately, the best lender for your project is one that understands your investment goals and offers terms that align with your financial strategy.

How is the Interest Charged on Hard Money Loans?

Interest on hard money loans can be structured in several ways but is most commonly charged as simple interest, calculated on the principal balance of the loan. Some lenders may offer interest-only payment options for the term of the loan, with the principal due at maturity. This can be beneficial for projects where cash flow is a concern. It’s important to understand the interest structure of your loan, as this will impact your monthly payments and the total cost of borrowing.

Can I Refinance a Hard Money Loan with a Traditional Mortgage?

Yes, it’s possible to refinance a hard money loan with a traditional mortgage, assuming the property now qualifies under conventional lending standards. This is a common strategy for investors who use hard money loans for quick acquisitions or renovations and then seek to refinance into a longer-term, lower-interest loan once the property is stabilized or improved. Preparing for this transition involves ensuring that the property meets all requirements for traditional financing, including appraisal values, and that the borrower’s financials are in order.

How HardMoneyLenders.IO Can Help

There are some resources that can calculate the interest rate of a hard money loan based on various different factors. It’s important to note the interest rates of hard money loans are so high because they finance homes most a lot of financers won’t touch.

Here at Hard Money Lenders IO, we have a loan calculator where real estate investors can calculate payments on loans.

We’re all about educating real estate investors and providing them with useful tips on how to get funding and tap into the market to improve their profits.

Now, some actionable ways to reduce the interest rate of a hard money loan are to put down a bigger down payment, improve your credit score, or make more real estate investments. This can manifest itself by paying off existing debts and maintaining a habit of paying off bills on time or early.

Keep in mind, there are also other fees like origination fees, closing costs, underwriting fees, and processing fees.

It’s important to not get bogged down in too many junk fees, and these loan origination fees are often accompanied by third-party fees. Most hard money lenders charge 3 to 5 points on most loans, and in real estate, a point is one percent of the loan amount.

A real estate investor using hard money loans has to determine whether the risks and costs of a hard money loan justify the investment.

What Sets HardMoneyLenders.IO Apart From The Rest

Obviously, every real estate investor is in a different situation. At Hard Money Lenders IO, we offer a free consultation to answer questions for your particular investment goals or financial situation.

We offer different kinds of loans for different types of real estate transactions, and our broker program helps a hard money lender find the best possible loan with the best possible interest rate.

Of course, we are hard money lenders ourselves, but we also want the best for each investor, even if we are not the lender you choose. It is essential to find the lender who gives the best rates and terms for your goals, especially as a new investor. Not every hard money lender gives to new investors or foreign nationals, but we do.

The average interest rate for a hard money loan fluctuates, but there are actionable steps you can take to reduce that interest rate.

We’re here to help.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.