Florida ALF Financing 101: All About Assisted Living Facility Loans

Assisted living facility loans provide financial support for savvy investors and developers in Florida looking to enter the thriving market. These loans are specifically designed to fund the acquisition, construction, or renovation of assisted living facilities (ALFs). That said, ALF loans cater to the unique needs of this specialized sector. Whether you’re a seasoned investor or new to the industry, understanding the ins and outs of ALF financing is crucial for success.

What are Assisted Living Facility Loans?

Assisted Living Facility Loans are specialized financial products designed to help investors and developers finance assisted living facilities’ acquisition, construction, or renovation. These loans provide the capital to cover the high costs of establishing and operating a facility.

Now, ALF financing offers investors leverage by enabling them to acquire or repair assisted living facilities with a portion of their own capital while borrowing the remainder from a lender. Consequently, this can amplify returns on investment.

Assisted Living Facility Loans typically offer competitive interest rates and flexible repayment terms, making them a viable option for savvy investors looking to enter Florida’s thriving assisted living market. These loans can be obtained from conventional banks, credit unions, or through government-sponsored programs.

As the demand for senior housing in Florida continues to rise, Assisted Living Facility Loans provide a crucial financial solution for entrepreneurs seeking to capitalize on this growing market. By understanding the ins and outs of these loans, investors can confidently navigate the financing process and achieve success in the assisted living sector.

Here’s a look at some key statistics of assisted living and senior care facilities in Florida.

| Florida Assisted Living Facilities: Key Numbers for Investors (2024) | ||

| Insight | Stat | Source |

| 65+ residents in Florida (growing 1.8% annually) | 5.4M | Florida Health Care Administration |

| Licensed assisted living facilities | 2,821 | Agency for Health Care Administration |

| Total beds in Florida ALFs | 141,715 | Agency for Health Care Administration |

| Occupancy rate (strong demand!) | 87.10% | NIC MAP Data Service |

| Projected annual revenue growth (promising market) | 4.10% | ibisworld.com |

| Average net operating income per facility | $1.3M | NIC MAP Data Service |

| Average cap rate (attractive investment return) | 7.50% | Cushman & Wakefield |

| Barriers to entry (protects established investors) | High | Industry experts |

| Metro areas with the highest ALF concentration | Top 4: Miami, Tampa Bay, Orlando, Jacksonville | NIC MAP Data Service |

Importance of Understanding ALF Financing

Understanding ALF financing is crucial for savvy investors and developers in Florida who set their sights on the assisted living market. With the rising demand for high-quality assisted living facilities, having a solid grasp of ALF financing can make all the difference in securing the necessary funds for a successful venture.

By understanding ALF financing, investors can:

- Make Informed Decisions: Knowing the ins and outs of ALF loans allows investors to make well-informed decisions about the best financing options for their specific needs and goals.

- Maximize Profitability: With a clear understanding of ALF financing, investors can ensure they secure the most favorable loan terms, minimizing interest rates and maximizing profitability.

- Mitigate Risks: Understanding ALF loan eligibility and compliance requirements can help investors mitigate risks and avoid potential pitfalls.

- Access Additional Resources: By being well-versed in ALF financing, investors can access additional resources and support from local associations, financial advisors, and government programs.

Overall, understanding ALF financing is a key factor in the success of any assisted living facility venture in Florida.

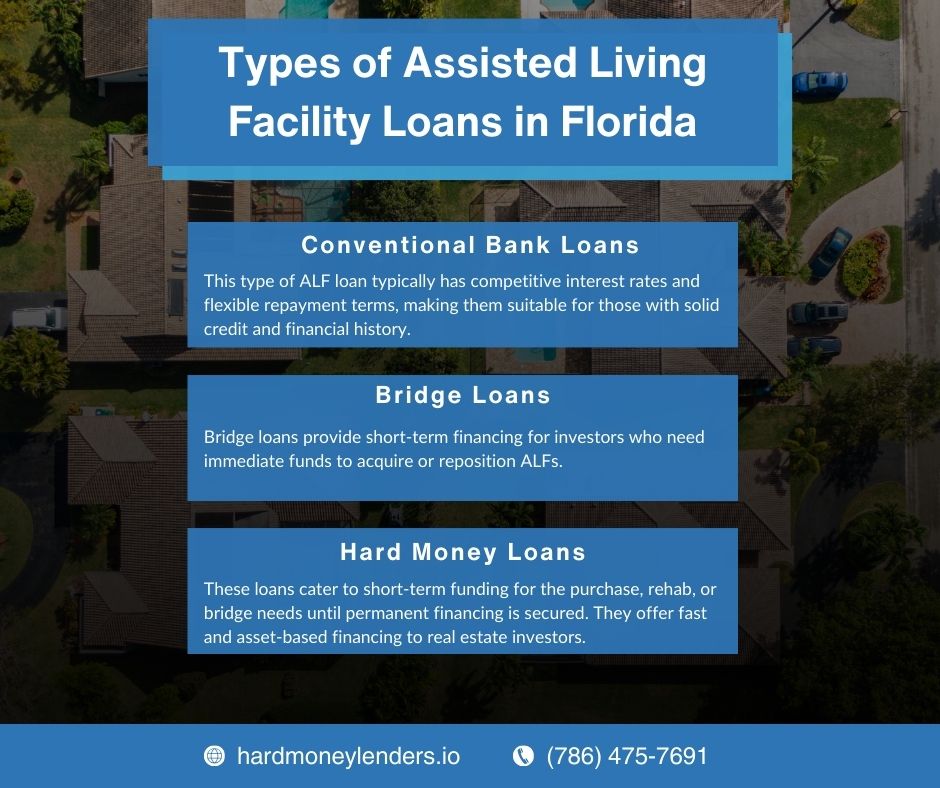

Types of Assisted Living Facility Loans in Florida

When financing assisted living facilities (ALFs) in Florida, various kinds of loans are available to savvy investors and developers. Now, these

- Conventional Bank Loans: Traditional bank loans are a popular option for ALF financing. This type of ALF loan typically has competitive interest rates and flexible repayment terms, making them suitable for those with solid credit and financial history.

- Government-Sponsored Loans: Government agencies like the Small Business Administration (SBA) offer loan programs tailored to ALFs. These loans often have favorable terms, such as lower interest rates and more extended repayment periods.

- Bridge Loans: Bridge loans provide short-term financing for investors who need immediate funds to acquire or reposition ALFs. These loans bridge the gap between the purchase or renovation and the long-term financing.

- Hard Money Loans: Hard Money loans offer fast, asset-based financing to real estate investors, focusing more on property value than borrower creditworthiness. These loans cater to short-term funding for the purchase, rehab, or bridge needs until permanent financing is secured.

By understanding the different types of ALF loans available in Florida, investors can confidently choose the option that best suits their needs and embark on their assisted living facility venture.

Conventional Bank Loans for ALFs

Conventional bank loans are a popular option for financing assisted living facilities (ALFs) in Florida. Traditional banks and financial institutions typically offer these loans. Conventional bank loans provide borrowers with a lump sum of money that can be used to fund various aspects of ALF development, including construction, renovations, and equipment purchases.

One of the main advantages of conventional bank loans is the competitive interest rates they offer. These rates are often lower than other financing options, making them a cost-effective choice for ALF developers. Additionally, conventional bank loans usually come with flexible repayment terms, allowing borrowers to customize their loan payment schedule based on their financial situation.

To qualify for a conventional bank loan, borrowers must meet specific criteria, such as a good credit score and a strong financial history. The bank will also assess the feasibility and profitability of the ALF project before approving the loan.

Government-Sponsored Loans for ALFs

Government-sponsored loans are another viable option for financing Florida assisted living facilities (ALFs). These loans are provided by government agencies such as the Small Business Administration (SBA), which offers programs specifically tailored for ALFs.

One of the main advantages of government-sponsored loans is the availability of loan guarantees, which reduce the risk for lenders and increase the likelihood of approval. These loans can be used for various purposes, including the acquisition or construction of ALFs, as well as for working capital or refinancing existing debt.

Government-sponsored loans offer a supportive and flexible financing option for ALFs and can be a valuable resource for savvy investors and developers seeking to enter the market.

Bridge Loans for Florida’s Assisted Living Facility Market

Bridge loans are a fundamental financing option for stakeholders looking to invest in Assisted Living Facilities (ALFs) within Florida’s dynamic real estate environment. They serve as a short-term financial solution designed to provide immediate cash flow, which is crucial for investors aiming to purchase, renovate, or reposition an ALF.

The main advantage of a bridge loan for ALF financing is its ability to fill the interim financing gap that arises between an initial investment and the arrangement of long-term financing. This characteristic is particularly valuable in the competitive and time-sensitive Florida ALF market, where the ability to act quickly can be paramount to the success of an investment venture.

Hard Money Loans: A Quick Alternative for Real Estate Investment

As an adjunct to bridge loans, hard money loans offer another expedient financing pathway for real estate investors in Florida. These asset-based loans are primarily anchored by the value of the real estate itself.

Hard money loans are favored for their simplicity and swift approval process, which positions them as an excellent choice for investors requiring prompt financial access to capitalize on investment opportunities.

The agility provided by hard money loans aligns well with Florida’s fast-paced ALF industry, allowing for decisive acquisition or renovation endeavors. It’s important to note that hard money loans typically come with higher interest rates and shorter repayment terms than those offered by traditional financial institutions, making them more suitable for short-duration financial strategies.

Eligibility and Requirements for Assisted Living Facility Loans

When seeking financing for an assisted living facility in Florida, there are certain eligibility criteria and requirements that investors and developers must meet.

One key factor is a strong credit score and financial history, which demonstrates the ability to manage and repay loans responsibly. Additionally, ALF licensing and compliance requirements play a crucial role in determining eligibility.

The facility must adhere to all state regulations and have the necessary certifications in order to qualify for a loan. Meeting these eligibility requirements is essential for lenders to assess the viability of the investment and ensure that the funds will be used appropriately.

By understanding and satisfying these criteria, investors can position themselves favorably when applying for assisted living facility loans in Florida.

Credit Score and Financial History

When it comes to securing assisted living facility loans in Florida, understanding the importance of your credit score and financial history is crucial. Lenders consider your credit score as a reflection of your financial responsibility and ability to repay the loan. A higher credit score increases your chances of qualifying for favorable interest rates and loan terms.

In addition to your credit score, lenders will also scrutinize your financial history, including your income, assets, and existing debts. They will assess your ability to generate sufficient cash flow to support the loan repayment and meet any additional financial obligations.

To strengthen your loan application, it’s essential to maintain a good credit score by paying bills on time, reducing debt, and resolving any financial issues. Taking proactive steps to improve your financial stability and demonstrating responsible financial management can greatly enhance your chances of securing the desired assisted living facility loan.

ALF Licensing and Compliance Requirements

ALF licensing and compliance requirements are crucial aspects of obtaining financing for assisted living facilities in Florida. To ensure the safety and well-being of residents, ALFs must comply with specific regulations set by the Agency for Health Care Administration (AHCA).

These requirements include obtaining a valid license from the AHCA and adhering to strict guidelines regarding staffing, safety protocols, health and sanitation practices, medication administration, and resident care standards.

Additionally, ALFs must undergo regular inspections and maintain compliance with all licensing and regulatory standards. In Florida, there are specific regulations for assisted living facilities and senior care facilities, so it’s important to make sure you’re current on them as well.

Lenders will typically require proof of compliance with these requirements before approving financing for an ALF, as they want to ensure that the facility meets the necessary quality standards to operate successfully.

Understand the Assisted Living Facility Loan Process

Once you have a solid understanding of the different types of assisted living facility loans available in Florida, it’s important to familiarize yourself with the loan process. This will help you navigate the application and approval process with confidence.

The first step in the assisted living facility loan process is to prepare a comprehensive business plan. This plan should outline your facility’s financial projections, market analysis, and operational strategies. It will serve as a roadmap for lenders to assess your potential for success.

Once your business plan is ready, you can begin the application process. This typically involves submitting financial documents, such as tax returns and balance sheets, and providing information about your facility’s licensing and compliance with state regulations.

After submitting your application, the lender will review your documents and assess your creditworthiness. They will also evaluate the feasibility of your business plan and the potential profitability of your facility. If your application meets their criteria, a loan offer will be presented for your consideration.

Upon accepting the loan offer, you will enter the approval process, which involves due diligence and underwriting. The lender will conduct a thorough analysis of your financial history, facility operations, and market conditions. This step ensures that both parties have a clear understanding of the risks and benefits associated with the loan.

Once the underwriting process is complete and all necessary documents are signed, the loan will be funded, and you can proceed with your assisted living facility project.

By understanding the assisted living facility loan process and being prepared with a solid business plan, you can increase your chances of a successful loan application and secure the financing you need to bring your assisted living facility to life.

Preparing your ALF Business Plan

When it comes to securing financing for your assisted living facility (ALF), one of the crucial steps is preparing a comprehensive and well-crafted business plan. This document will not only serve as a roadmap for your ALF venture but also demonstrate to lenders that you have done your due diligence and have a solid understanding of the industry.

In your ALF business plan, be sure to include vital information such as an executive summary, a description of your facility, market analysis, financial projections, and a marketing strategy. It is essential to showcase your expertise, highlight the unique aspects of your ALF, and outline how you plan to ensure its success.

Remember to make your business plan concise, clear, and compelling. Ensure that it aligns with your goals and showcases your commitment, expertise, and financial viability. A well-prepared business plan will not only help you secure financing but also guide you through the process of launching and operating your ALF successfully.

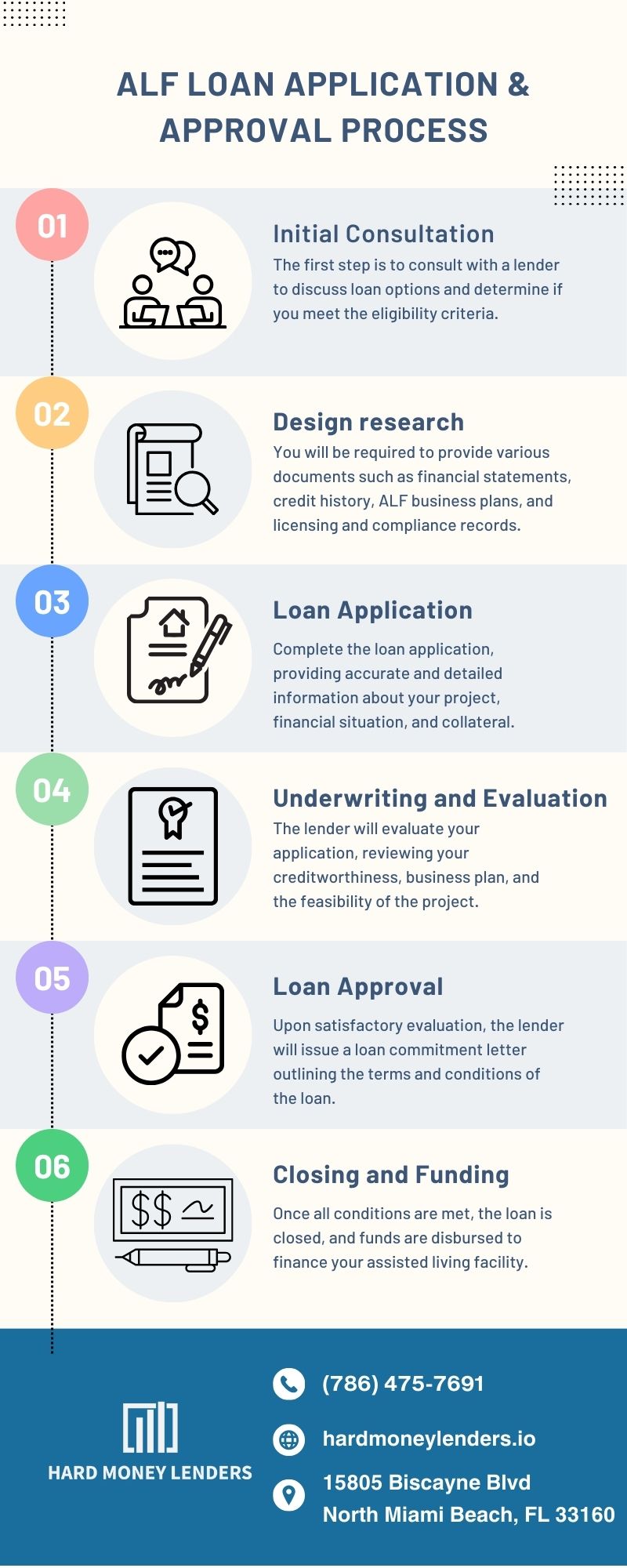

Application and Approval Process

The application and approval process for assisted living facility loans in Florida involves several steps to ensure the lender’s due diligence and the borrower’s eligibility.

- Initial Consultation. The first step is to consult with a lender to discuss loan options. Thereafter, the can determine if you meet the eligibility criteria.

- Gather Documentation. You will be required to provide various documents such as financial statements, credit history, ALF business plans, and licensing and compliance records.

- Loan Application. Complete the loan application, providing accurate and detailed information about your project, financial situation, and collateral.

- Underwriting and Evaluation. The lender will evaluate your application, reviewing your creditworthiness, business plan, and the feasibility of the project.

- Loan Approval. Upon satisfactory evaluation, the lender will issue a loan commitment letter outlining the terms and conditions of the loan.

- Closing and Funding. Once all conditions are met, the loan is closed, and funds are disbursed to finance your assisted living facility.

Working closely with the lender throughout the application and approval process is essential to ensure a smooth and seamless experience.

Comparing Assisted Living Facility Loan Providers in Florida

When it comes to financing an assisted living facility (ALF) in Florida, choosing the right loan provider is crucial for the success of your venture. There are various factors to consider when comparing loan providers in the market.

First and foremost, interest rates and loan terms should be carefully evaluated. Look for providers that offer competitive rates and flexible repayment options that align with your financial goals.

Additionally, consider the reputation and customer satisfaction of the loan provider. Read reviews, seek recommendations, and assess the level of support and expertise they provide throughout the loan process.

Lastly, take into account any additional resources and support that the loan provider offers. This could include educational resources, networking opportunities, and access to industry experts who can provide valuable insights and guidance.

By conducting thorough research and comparing the different loan providers in Florida, you can make an informed decision that suits your specific needs and helps you succeed in the assisted living market.

Interest Rates and Loan Terms

Interest rates and loan terms play a crucial role in determining the cost and feasibility of financing an assisted living facility in Florida.

When comparing different loan providers, it’s important for savvy investors and developers to consider these factors carefully. Interest rates can significantly impact the overall cost of borrowing, so it’s essential to seek competitive rates that align with your financial goals.

Additionally, understanding the loan terms, such as the repayment period and payment schedule, is vital for budgeting and financial planning. By carefully evaluating interest rates and loan terms, investors can make informed decisions and secure the most favorable financing options for their assisted living facility projects.

Reputation and Customer Satisfaction

When considering different assisted living facility loan providers in Florida, reputation and customer satisfaction should be key factors to evaluate.

A provider’s reputation speaks volumes about their ability to deliver quality services and fulfill customer needs. Savvy investors and developers should research customer reviews, testimonials, and ratings to gain insight into the provider’s track record and level of customer satisfaction. Positive reviews and high ratings are indications of a reliable and trustworthy lender who values their clients.

Additionally, it is beneficial to consider any industry awards or certifications the provider has received. By choosing a reputable loan provider with a proven history of customer satisfaction, investors can have peace of mind knowing they are working with a reliable partner for their assisted living facility financing needs.

Final Thoughts on Assisted Living Facility Financing in Florida and ALF Loans

Now, understanding the ins and outs of assisted living facility loans in Florida is crucial for savvy investors and developers. By exploring the different types of loans available, individuals can make informed decisions that align with their unique financial goals.

Eligibility requirements, including credit score and compliance with ALF licensing, must also be considered. Moreover, being well-versed in the loan process and comparing providers is key to securing favorable interest rates and loan terms.

To further support their journey, investors and developers can leverage resources and support from local and state assisted living associations, financial advisors, online communities and forums, and government agencies. By harnessing these resources, investors and developers are well-equipped to navigate the ALF financing landscape with confidence.

Questions People Also Ask About Assisted Living Facility Loans

When considering ALF financing in Florida, there may be some additional questions that come to mind. Here are a few common questions that people also ask when exploring assisted living facility loans in Florida.

Is ALF financing right for me?

ALF financing can be a suitable option for individuals or organizations looking to fund the purchase or development of an assisted living facility.

However, it’s important to assess your specific needs and financial situation to determine if ALF financing is the right choice for you.

Consider factors such as your budget, creditworthiness, and long-term goals. Evaluate the potential benefits and drawbacks of ALF financing and how it aligns with your overall business plan.

For example, ALF financing with Hard Money Lenders can provide the necessary funds to acquire or upgrade a facility. In turn, this can lead to increased revenue and a positive impact on the community.

Conversely, taking a loan can also mean additional financial obligations and risks.

Ultimately, it’s crucial to thoroughly research and consult with lenders who specialize in ALF financing. That way, you can gain a comprehensive understanding of the terms, interest rates, and repayment options available.

By carefully evaluating your circumstances and gaining a clear understanding of the loan process, you can confidently determine if ALF financing is the right fit for your needs.

How much can I borrow with ALF financing?

Now, the amount you can borrow will depend on various factors. For example, the size and value of the assisted living facility, creditworthiness, and specific terms and conditions of the loan. Generally, lenders for ALF financing can provide loans ranging from $500,000 to several million dollars or more.

It’s important to note that lenders typically consider the ability of the facility to generate sufficient income to meet loan repayment obligations. They may evaluate financial statements, cash flow projections, and occupancy rates to assess the loan amount that can be approved.

Additionally, the loan-to-value ratio (LTV) is a crucial factor in determining the borrowing amount. Typically, lenders offer up to 75% to 80% LTV. In other words, they may finance up to 75% to 80% of the appraised value of the property.

To get a clear understanding of the borrowing capacity for ALF financing, you can get a free consultation with Hard Money Lenders. Just give us a call at (786) 475-7691 or click here to learn more about our loan programs.

Our team can evaluate your unique situation and provide you with information on the amount you can qualify for.

Questions People Also Ask When Comparing ALF Loans in Florida

When comparing ALF loans in Florida, potential borrowers often have specific questions to help them make informed decisions. Here are some common questions people ask when comparing assisted living facility loans.

By addressing these questions, borrowers can compare ALF loans effectively and make well-informed decisions for their ALF financing in Florida.

What are the fees associated with ALF financing?

When considering ALF financing, it’s important to be aware of the fees that may be associated with it. While the specific fees can vary depending on the lender and loan terms, there are some common fees to look out for.

- Application Fees. Some lenders may charge an application fee to cover the costs of processing your loan application.

- Origination Fees. These fees are typically charged by the lender for originating the loan. This can be a percentage of the loan amount.

- Closing Costs. Similar to a traditional mortgage, ALF financing may involve closing costs, including fees for title searches, appraisals, and legal documentation.

- Interest Rates. Interest rates are the cost of borrowing the funds and are usually stated as an annual percentage. The rate can be fixed or adjustable, depending on the loan terms.

- Prepayment Penalties. Some lenders may charge a fee if you choose to pay off the loan early. This fee is meant to compensate for the interest the lender would have earned over the remaining loan term.

That said, you can make an informed decision about the affordability and suitability of the loan for your specific needs.

Is it better to get a fixed-rate or adjustable-rate ALF loan?

Deciding between a fixed-rate or adjustable-rate ALF loan ultimately depends on your individual financial situation and preferences. Here are some key factors to consider:

- Stability vs. flexibility. A fixed-rate loan offers stability because the interest rate remains the same throughout the loan term, providing predictable monthly payments. On the other hand, an adjustable-rate loan has an interest rate that can change. Consequently, this allows for potential savings if interest rates decrease.

- Risk tolerance. Adjustable-rate loans come with the risk of interest rate increases, which could lead to higher monthly payments. If you have a low-risk tolerance, a fixed-rate loan may be the safer choice.

- Current market conditions. Consider the current interest rate environment. If rates are historically low, a fixed-rate loan may be more attractive. Conversely, if rates are high and expected to decrease in the future, an adjustable-rate loan could provide initial savings.

It’s important to consult with a lender that specializes in ALF financing to fully understand the benefits and potential risks of each loan type. They can help you evaluate your financial goals and choose the option that aligns best with your needs.

Questions People Also Ask When They’re Ready to Apply for Assisted Living Facility Financing in Florida

When individuals are ready to apply for assisted living facility financing in Florida, they may have a few important questions. Here are some common concerns and their answers.

How can I apply for ALF financing?

To apply for ALF financing, individuals can follow a straightforward process. First, gather all the necessary documentation, including financial statements, business plans, tax information, and P&L statements. These documents provide lenders with a clear picture of your business’s financial health and potential for success.

Next, reach out to lenders who specialize in ALF financing. It’s essential to work with lenders who understand the unique needs and challenges of the assisted living facility industry. They can guide you through the application process and tailor loan options to meet your requirements.

Once you’ve identified suitable lenders, submit your application along with the required documentation. The lender will then review your application, assess your creditworthiness, and evaluate the viability of your business.

If approved, you can proceed with the loan agreement and receive the necessary funds to support your assisted living facility. Remember, working with experienced ALF financing specialists can greatly assist you in navigating the application process and increasing your chances of approval.

What is the best way to improve my chances of getting approved for ALF financing?

There are several steps to take to improve your chances of getting approved for ALF financing. First, it’s important to have a solid business plan in place.

Lenders want to see that you have a clear vision for your assisted living facility. Additionally, they want to see you have a sound strategy for success. Moreover, maintaining good credit is crucial.

Lenders will assess your creditworthiness, so pay bills on time, reduce existing debt, and monitor your credit report for errors. Building a strong financial profile by showcasing consistent cash flow, positive net income, and healthy financial ratios can also increase your chances of approval.

Furthermore, having collateral to secure the loan can provide added reassurance to lenders.

Finally, working with an experienced specialist can greatly enhance your chances of securing financing for your assisted living facility.

What can I do if I get denied ALF financing?

If you find yourself denied ALF financing, don’t despair. There are several options you can explore to improve your chances of securing the funding you need.

- Review the reasons for the denial. Carefully assess the reasons provided. This will help you understand what areas to address or improve upon.

- Strengthen your application. Take the time to gather additional supporting documentation, update financial statements, and improve your credit score. This may involve paying down existing debt or resolving any outstanding issues.

- Seek alternative financing. Consider exploring alternative sources of funding, such as private lenders, crowdfunding platforms, or partnerships with investors. These options may have different requirements and be more flexible in lending criteria.

- Consult with a financing specialist. An experienced ALF financing specialist can provide valuable insights and guidance. They can help you understand the reasons for denial and suggest strategies for improving your chances of approval.

Remember, a denial does not mean the end of your options. By seeking expert advice, you can increase your chances of securing the financing you need for your assisted living facility.

What happens if I can’t repay my assisted living facility loan?

If you find yourself unable to repay your assisted living facility loan, it’s important to understand the potential consequences.

Defaulting on your loan can have serious financial repercussions and may negatively impact your credit score.

Here are some possible outcomes if you can’t repay your assisted living facility loan:

- Collection efforts. The lender may employ collection agencies or take legal action to recover the unpaid amount. This may result in additional fees and may harm your credit history.

- Foreclosure or repossession. The lender may initiate foreclosure or repossession proceedings to recover their investment if your loan is backed by collateral.

- Damage to credit score. Failure to repay your loan can significantly harm your credit score. Consequently, this makes it difficult to secure future financing for other needs.

That said, it’s crucial to communicate with your lender if you anticipate difficulties in repaying your loan.

They may be willing to work out a repayment plan or explore other options to help you meet your obligations.

Are there any tax benefits to using ALF financing?

Using ALF financing may not provide direct tax benefits. The reason is that the interest payments on the loan are not typically tax deductible. However, potential indirect tax benefits can arise from using ALF financing.

When using ALF financing for a business purpose, you can deduct the interest payments as a business expense.

It’s important to consult with a tax advisor to understand your situation’s specific tax implications fully.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.