Want to Refinance Your Hard Money Loan? | Read This First!

Hard money loans are a lifeline for many real estate investors, offering the swift capital necessary for property purchases or renovations. However, due to their typically higher interest rates and shorter terms, many borrowers soon seek out refinancing options. Refinancing a hard money loan can provide more favorable loan terms, including lower interest rates and extended payment periods, leading to enhanced financial flexibility and stability. If you want to refinance your hard money loan, then you should keep reading.

Key Takeaways

- Hard money loans are short-term, property-secured loans favored by investors for their flexibility and speed.

- Refinancing hard money loans can offer project extensions, access to increased property equity, and potential interest savings.

- The underwriting process for refinancing focuses primarily on the property’s value and equity.

- Successful refinancing requires thorough preparation, including financial details, property appraisal, and a clear exit strategy.

- Transitioning to long-term refinancing options, like fixed-rate loans, provides stability, lower interest rates, and extended payment periods.

What is a Hard Money Loan?

A hard money loan is a type of short-term financing primarily used by real estate investors. Unlike conventional mortgage loans, which are based on the borrower’s creditworthiness and ability to repay, a hard money loan is secured by the value of the property being financed.

While both hard money loans and traditional mortgages can be used to finance properties, they cater to different needs and audiences. Hard money loans offer flexibility and speed, making them a preferred choice for real estate investors looking for quick financing without the stringent income requirements and process that requires traditional loan approval.

The Refinancing Process Explained

Refinancing a hard money loan entails obtaining a new loan to pay off an existing one. This process is sought by borrowers aiming to improve their financial stance through more favorable loan conditions. Specifically for hard money loan borrowers, who typically deal with higher interest rates and shorter repayment terms due to the nature of their loans, refinancing can offer a pathway to more sustainable financial management. The journey from a hard money loan to a traditional mortgage or a lower-interest loan can significantly impact a borrower’s financial health.

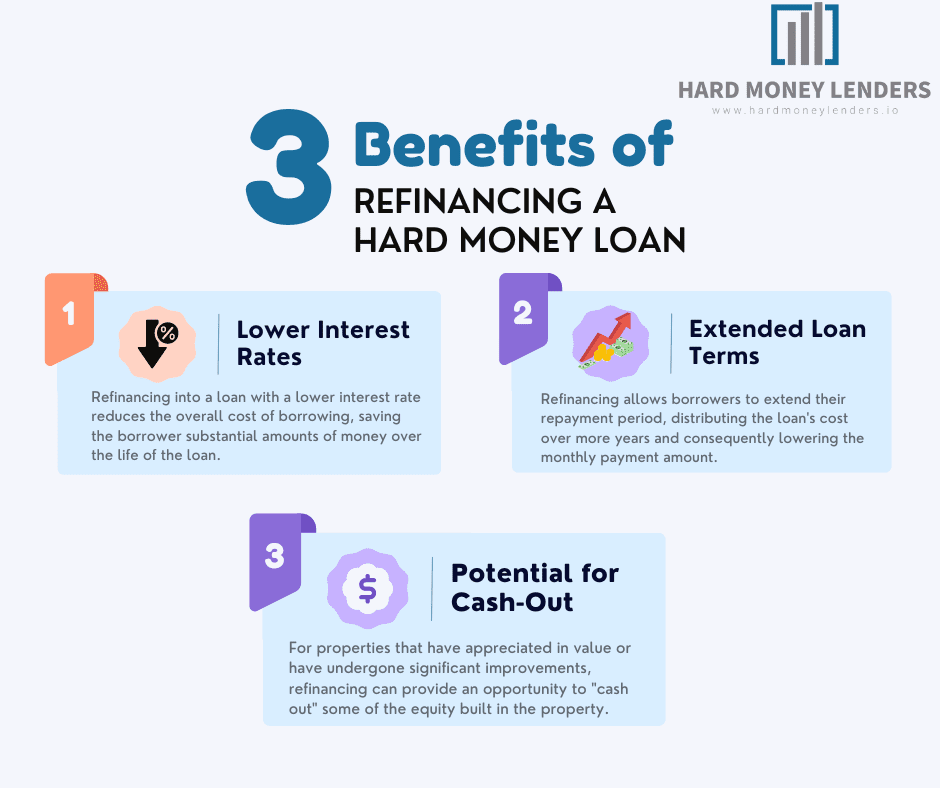

Key Benefits of Refinancing

- Lower Interest Rates: One of the most compelling reasons to refinance is the opportunity to secure a loan with a lower interest rate. Hard money loans are known for their relatively high rates, reflecting the higher risk assumed by the lender. Refinancing into a loan with a lower interest rate reduces the overall cost of borrowing, saving the borrower substantial amounts of money over the life of the loan.

- Extended Loan Terms: Hard money loans often come with short maturity periods, sometimes as brief as 12 months. Such timelines can pose significant pressure on borrowers to repay the loan quickly. Refinancing allows borrowers to extend their repayment period, distributing the loan’s cost over more years and consequently lowering the monthly payment amount. This extension provides breathing room for borrowers to manage their finances more comfortably and allocate funds to other investments or expenses.

- Potential for Cash-Out: For properties that have appreciated in value or have undergone significant improvements, refinancing can provide an opportunity to “cash out” some of the equity built in the property. This means borrowers can obtain a loan amount that’s greater than what they owe on their current mortgage, accessing cash that can be used for further investments, debt consolidation, or other financial needs.

Why Refinance a Hard Money Loan?

Refinancing a hard money loan is a strategic move that many real estate investors consider during their investment journey. But what drives this decision? Let’s delve into the primary reasons.

Time and Money

Time and money to complete renovations can be a significant factor. Hard money loans are inherently short-term, designed to be repaid quickly, often within a year. However, renovation projects, especially extensive ones, can sometimes face unforeseen delays.

Whether it’s a supply chain issue, unexpected structural problems, or even external factors like market downturns, these delays can push the project’s completion beyond the loan’s due date.

In such scenarios, refinancing the hard money loan provides the investor with the much-needed extension, allowing them more time to finish the project without the pressure of an impending loan payment deadline.

Maximize Profits

Another compelling reason to refinance is the potential to maximize profits. As the property undergoes renovations and improvements, its value can increase. By refinancing, an investor can tap into the increased equity of the property, securing a cash-out refinance loan.

This strategy not only provides additional funds to enhance the property further but also can be used to invest in other promising real estate investment properties. Essentially, refinancing can turn the existing equity into liquid capital, offering the investor greater financial flexibility.

Interest Rates

Interest rates play a pivotal role. Hard money loans typically come with higher interest rates due to their short-term nature and the associated risks. If an investor finds themselves in a position where they’d like to hold onto the property longer than initially planned, perhaps turning it into a rental or waiting for a more favorable market to sell, refinancing can be a wise choice.

Transitioning from a hard money loan with a higher interest rate to a conventional loan or another type of mortgage with a lower rate can result in significant savings over time.

Underwriting a Hard Money Loan Refinance

The decision to refinance a hard money loan is a significant one, and understanding the underwriting process can provide clarity and confidence to the borrower. Underwriting, in essence, is the method lenders use to assess the risk of lending money to a borrower.

Unlike conventional loans, where the loan application process can be lengthy and heavily reliant on the borrower’s credit score and financial history, a private money lender typically focuses on the value of the property in question. This expedited approach ensures that the real estate investor can secure the necessary funds quickly, allowing them to capitalize on time-sensitive opportunities.

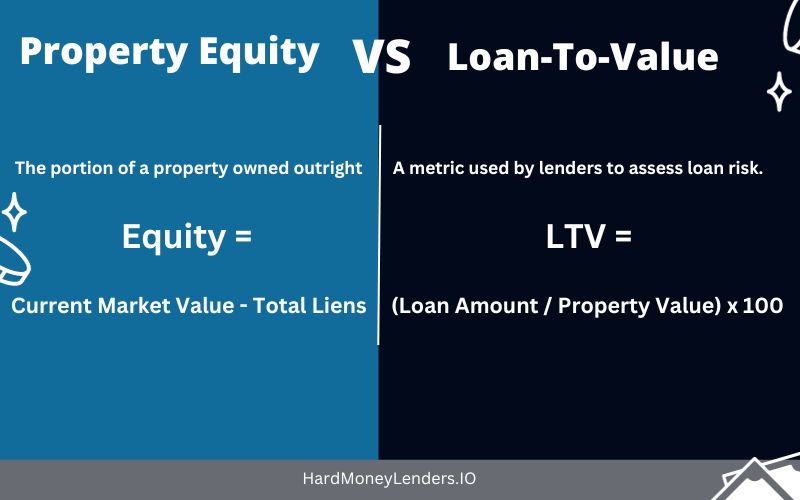

Property Equity

Property equity plays a pivotal role in the underwriting process for a hard money loan refinance. Equity refers to the difference between the property’s current market value and the remaining loan amount. The more equity a property has, the more attractive it becomes to hard money lenders.

In scenarios where the borrower might default on loan payments, the private lender can take possession of the property and sell it to recover their funds. Thus, a property with substantial equity presents a lower risk to the lender.

Loan-To-Value (LTV) Ratio

The loan-to-value (LTV) ratio is another crucial factor in the underwriting process. This ratio represents the relationship between the loan amount and the property’s appraised value. A lower LTV indicates that the borrower has a significant amount of their own money invested in the property, which, in turn, reduces the risk for the lender.

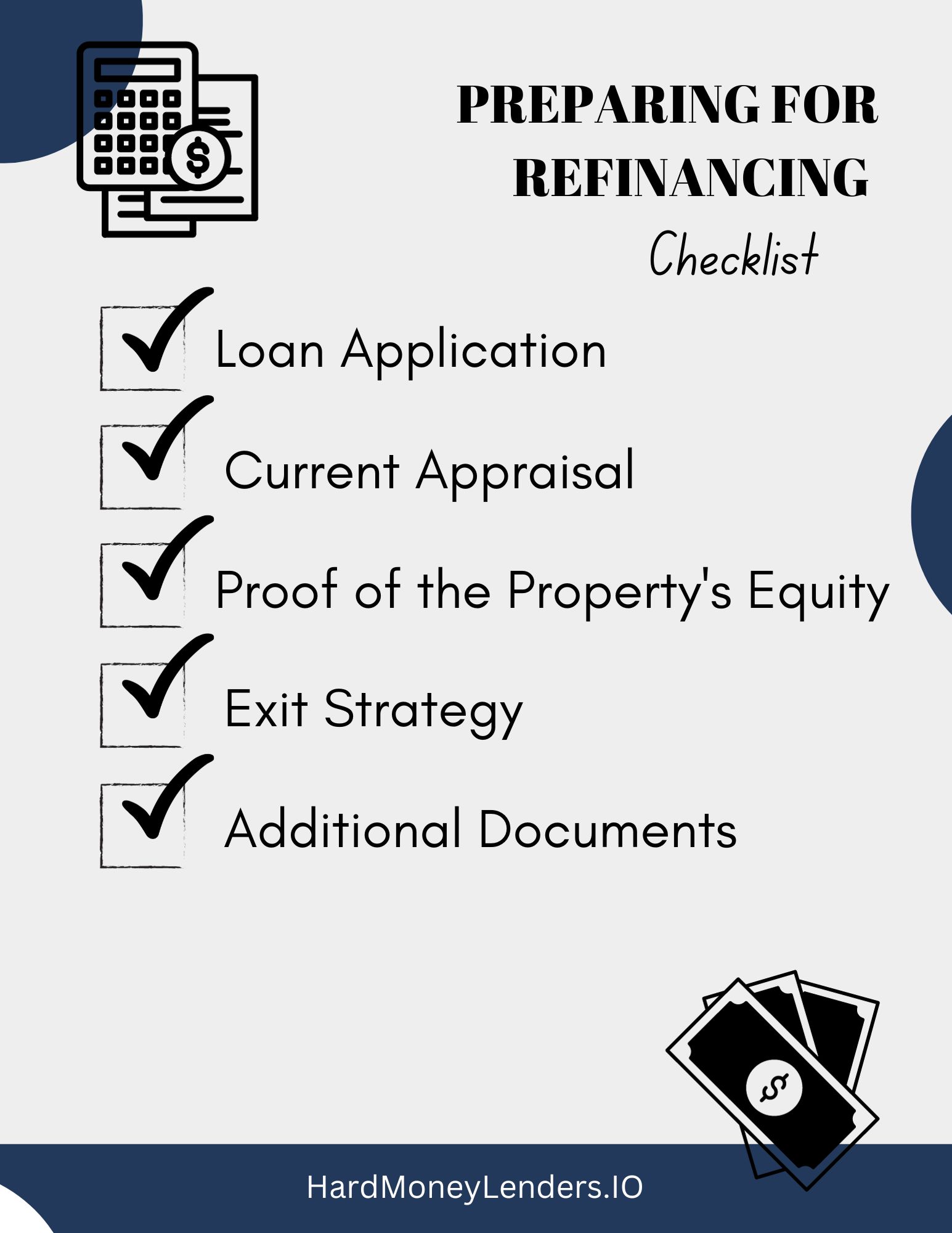

Preparing for Refinancing

The refinancing process, while offering numerous benefits, requires specific documentation and information to ensure a seamless transition. Being well-prepared not only expedites the process but also positions the borrower in a favorable light with potential lenders.

Loan Application

This application will ask for details about the borrower’s financial situation, the property in question, and the reasons for refinancing. While hard money lenders might not weigh the borrower’s credit score as heavily as conventional mortgage providers do, they still consider it, especially when determining interest rates and hard money loan terms.

Current Appraisal

This appraisal provides an updated value of the property, which is essential for determining the loan-to-value (LTV) ratio. As mentioned earlier, a favorable LTV can significantly influence the lender’s decision and the terms of the refinance.

Proof of the Property’s Equity

This can be in the form of previous loan payments receipts or bank statements showing consistent payments. Demonstrating that a significant portion of the original hard money loan has been paid off can be a persuasive argument for refinancing.

Exit Strategy

This strategy outlines the borrower’s plan for repaying the refinance loan, whether it’s through the sale of the property, acquiring a conventional loan, or another viable method. A well-thought-out exit strategy can instill confidence in the lender about the borrower’s commitment and ability to repay.

Additional Documents

Any additional documents that showcase the borrower’s financial stability can be beneficial. This might include bank statements, tax returns, or even references from previous lenders or business partners.

Five Common Reasons for Refinancing Your Current Hard Money

1. Loan Maturity and Default Rates

If the loan matures and the borrower cannot repay, they risk defaulting. Understanding the implications of a maturing loan is crucial.

A default can severely impact the borrower’s good credit score and their relationship with the lender. Moreover, hard money loans often come with higher interest rates, which can accumulate rapidly, increasing the financial burden.

Refinancing can provide a solution, allowing the borrower to secure better terms and avoid the pitfalls of high default rates.

2. Need for Additional Renovation Funds

Real estate projects, especially renovations, can sometimes exceed initial budget estimates. Whether it’s due to unforeseen structural issues or a decision to upgrade materials, additional funds might be required.

Refinancing allows investors to tap into the property’s equity, providing the necessary capital to complete the renovations. Moreover, efficient project management is vital. By ensuring that renovations are completed on time and within budget, investors can maximize the property’s value and potential returns.

3. Seizing New Business Opportunities

The real estate market is dynamic, with new investment opportunities arising frequently. For a real estate investor, liquidity is essential to capitalize on these opportunities.

Refinancing a hard money loan can provide the needed funds quickly. Additionally, there’s the concept of hard money bridge loans. These are short-term loans that offer quick financing, bridging the gap between the sale of one property and the purchase of another. Such loans can be invaluable for investors looking to expand their real estate portfolio.

4. Cash Purchases and the Need for Rehab Funds

Sometimes, investors might make cash purchases, buying properties outright without any financing. While this approach has its advantages, it can tie up significant amounts of capital. If the property requires rehabilitation, additional funds are needed.

In such scenarios, refinancing can be a strategic move. By leveraging hard money refinance loans, investors can access the capital needed for renovations, enhancing the property’s value.

5. Inherited Properties and Renovation

Inheriting a property can be both a blessing and a challenge. While the new owner gains a valuable asset, the property might be outdated or in need of repairs. Using hard money loans for renovations can be an effective strategy. It provides the necessary funds to modernize and enhance the property, increasing its market value.

Mistakes to Avoid When You Refinance Your Hard Money Loan

Payment Delinquencies

One of the most common pitfalls during the refinancing process is payment delinquencies on the existing hard money loan. Timely payments are not just about avoiding late fees; they demonstrate the borrower’s commitment and reliability.

Lenders, whether they’re hard money lenders or conventional mortgage providers, prioritize clients who have a history of punctuality. When considering refinancing, it’s crucial to ensure that all loan payments on the original hard money loan are up-to-date.

This not only improves the chances of securing favorable refinance terms but also protects the borrower’s credit score.

Communication with the Current Lender

Open and transparent communication with the current lender is often overlooked but is vital during the refinancing process. Before seeking a new loan or another type of mortgage, it’s beneficial to discuss potential refinancing options with the existing lender.

They might offer competitive terms or even provide guidance on the best course of action. Keeping the lender informed about the intention to refinance fosters trust and can lead to smoother transitions between loans.

Moreover, a good relationship with a lender can be invaluable for future real estate investments.

Maintaining Property Insurance

Property insurance is a safeguard against unforeseen damages or losses to the property, be it from natural disasters, theft, or other incidents. When looking to refinance, it’s essential to ensure that the property insurance is current and comprehensive.

An outdated or lapsed insurance policy can be a red flag for potential lenders. They want the assurance that their investment, the property in this case, is protected against potential risks.

Having up-to-date property insurance can expedite the loan application process and provide peace of mind to both the borrower and the lender.

Refinance Hard Money Loan: Long-Term Option

Hard money loans, while invaluable for short-term real estate projects, are not typically designed for long-term holding. As these loans approach their maturity, many borrowers seek more sustainable and cost-effective financing solutions. This is where long-term refinancing options come into play.

Transitioning from Hard Money Loans to Fixed-Rate Loans

One of the most popular long-term refinancing options is transitioning from a hard money loan to a fixed-rate conventional loan. There are several advantages to opting for long-term refinance loans:

Stability

Fixed-rate loans provide a stable interest rate, ensuring that monthly payments remain consistent. This stability is especially beneficial in an unpredictable economic environment.

Lower Interest Rates

Over the long term, the cumulative interest paid on a hard money loan can be substantial due to its higher interest rates. Transitioning to a conventional loan with a lower rate can result in thousands of dollars saved over the loan’s lifespan.

Extended Payment Period

Long-term loans provide borrowers with more time to repay, reducing the monthly financial burden. 30-year loans are especially beneficial for properties that generate a steady property’s cash flow, like rentals.

Building Credit

Timely payments on a long-term mortgage can positively impact a borrower’s credit score, enhancing their financial credibility and opening doors to more favorable loan terms in the future.

Equity Building

As borrowers make consistent payments on their long-term loan, they gradually build equity in the property. This equity can be leveraged in the future for other investments or financial needs.

Final Thoughts on Refinancing a Hard Money Loan

Refinancing your hard money loan can pave the way for substantial financial savings and more manageable loan terms. By thoroughly understanding the refinancing process and carefully evaluating your options, you can make an informed decision that supports your long-term financial health. Remember, preparation, research, and a clear understanding of your financial goals are key to successfully refinancing your hard money loan.

Ready to elevate your real estate game and maximize your returns? Don’t wait! Get in touch with one of our loans experts today and ensure your real estate ventures soar to new heights!

FAQs on Refinancing Your Hard Money Loan

What is Refinancing?

Refinancing is a financial strategy that involves securing a new loan to replace an existing one. The aim is to obtain more favorable terms than those of the original loan, which could mean securing a lower interest rate, altering the loan term to either shorten or extend the repayment period, or switching from a variable interest rate to a fixed one. This process can result in lower monthly payments, reduced total loan costs, or a quicker path to debt freedom, depending on the borrower’s goals. For investors and property owners with hard money loans, refinancing often serves as a means to transition from high-interest, short-term financing to more sustainable, long-term financial solutions.

Can I Refinance My Hard Money Loan into a Traditional Mortgage?

Absolutely. Many borrowers look to refinance their hard money loans into traditional mortgages to capitalize on the latter’s lower interest rates and longer repayment terms. This transition can lead to substantial savings over the life of the loan and provide more predictable, manageable monthly payments. However, eligibility for a traditional mortgage depends on meeting more stringent criteria, including a thorough credit assessment, stable income verification, and employment history, along with a property appraisal that meets the lender’s standards. Successfully moving from a hard money loan to a traditional mortgage requires careful preparation and timing to meet these qualifications.

What Are the Requirements for Refinancing a Hard Money Loan?

The specific requirements for refinancing a hard money loan can vary significantly between lenders but typically include:

- Credit Check: An evaluation of your credit history to determine creditworthiness.

- Proof of Income: Documentation such as pay stubs, tax returns, or bank statements to verify stable income.

- Employment History: A stable employment record to assure lenders of your ability to repay the loan.

- Property Appraisal: An assessment to determine the current market value of the property.

- Debt-to-Income Ratio: A calculation used by lenders to gauge your financial health and ability to take on new debt.

- Loan-to-Value (LTV) Ratio: An assessment to ensure the loan amount does not exceed a certain percentage of the property’s appraised value.

Meeting these criteria reassures lenders of your capability to handle the new loan terms.

How Can I Qualify for Refinancing a Hard Money Loan if I Have Bad Credit?

Refinancing with bad credit is challenging, but there are strategies to enhance your application:

- Show Strong Income: Solid proof of income can counterbalance bad credit by demonstrating your ability to cover monthly payments.

- Lower Your Debt-to-Income Ratio: Paying off debts can improve this crucial ratio, making you a more attractive candidate for refinancing.

- Offer Additional Collateral: Additional assets can provide lenders with more security, potentially offsetting the risk associated with your credit score.

- Find a Co-signer: A co-signer with better credit can significantly improve your chances of approval by offering additional assurance to the lender.

What Should You Consider Before You Refinance Your Hard Money Loan?

Before proceeding with refinancing, evaluate the new loan’s terms against your current situation and goals. Consider:

- Interest Rate Changes: Ensure the new rate offers a tangible benefit over your current rate.

- Repayment Term: Understand how the new term affects your payments and total interest paid.

- Fees and Penalties: Be aware of any costs associated with refinancing, including potential prepayment penalties on your hard money loan, and weigh these against the long-term savings.

How Do I Find the Best Refinancing Option for My Situation?

Finding the best refinancing option requires research and comparison:

- Explore Lender Options: Look at offerings from banks, credit unions, and specialized online lenders.

- Compare Loan Products: Evaluate the terms, rates, fees, and features of various refinancing options.

- Seek Professional Advice: A financial advisor or mortgage broker can offer insights and recommendations tailored to your specific needs and financial situation.

What Are the Costs Associated with Refinancing a Hard Money Loan?

The costs of refinancing can vary widely but generally include:

- Application Fees: Charges for processing your loan application.

- Origination Fees: Costs associated with creating the new loan.

- Appraisal Fees: Expenses for having the property professionally appraised.

- Prepayment Penalties: Fees that may apply for paying off your hard money loan early.

Understanding these costs is crucial to determining whether

refinancing will provide the financial benefits you’re seeking. Calculate the total expenses associated with the new loan and compare them to your current loan terms and future savings. Consider the break-even point—how long it will take for the monthly savings to surpass the upfront costs of refinancing. This calculation will help you make an informed decision about whether refinancing your hard money loan is a financially sound move for your specific circumstances and long-term goals.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.