Hard money loans emerge as a pivotal option in real estate investing and non-traditional financing. Unlike conventional loans obtained through banks, hard money loans offer a swift, asset-based lending route for investors and borrowers who require quick access to funds. Understanding hard money loans is essential for anyone looking to navigate the complexities of real estate transactions or in need of rapid financing solutions. If you’re still wondering, “What are hard money loans?” — keep on reading.

TL;DR

- Hard money loans are defined as short-term, asset-based loans provided by private lenders, where the purchased property acts as collateral.

- These loans are ideally used for real estate transactions, helping to speed up the financing process for buying and selling properties.

- Key features of hard money loans include shorter terms ranging from one to five years, higher interest rates between 8% and 15%, loan-to-value (LTV) ratios typically between 65% and 75%, and the significant advantage of speedy funding, often within days or weeks.

- The benefits of using hard money loans encompass flexibility in loan terms, rapid access to funds which is crucial for time-sensitive investments, and the provision of financing based on the property’s value, which allows those with credit issues to secure funding.

- Potential drawbacks involve higher costs due to elevated interest rates and additional fees, the necessity of a clear exit strategy due to short repayment periods, and the risk of losing the property if the loan is not repaid.

- Ideal candidates for hard money loans include real estate investors looking to quickly flip properties, individuals facing difficulties securing traditional financing due to credit issues, and property owners in need of short-term financing for renovations or as bridge loans.

- Finding a hard money lender requires thorough research and due diligence, focusing on the lender’s experience, reputation, and transparency about terms and fees, with networking and seeking recommendations being valuable strategies.

- The application and approval process for a hard money loan involves submitting a detailed proposal, undergoing property evaluation and strategy assessment, and benefits from a notably swift approval timeframe, enabling quick project initiation.

What are Hard Money Loans?

A hard money loan is a non-traditional loan given from a private lender in which the asset being purchased with the loan doubles as collateral for the loan. These loans are also sometimes called short-term bridge loans, as they “bridge” the gap between long-term financing and investment purchases.

Hard money loans are mainly used for real estate transactions and help speed up home financing, as they can help speed of the process between buying and selling a property. However, they do have a few other potential uses, and could be very helpful for providing funding, depending on your goals.

Although it can be easy to get approved for a hard money loan, most lenders will only offer low loan-to-value (LTV) ratios.

Typically, the LTV is between 65% and 75%, so you will still need some assets to qualify for a hard money loan. These conservative LTV ratios make lending money less risky for hard money lenders, as they will have an easier time making it back if something goes wrong.

It’s important to keep in mind that private money lenders must always be ready for the worst-case scenario, and so will likely never want to provide 100% loan financing. If you think you have an amazing opportunity and would still like to try and pursue 100% financing, you can do further reading here.

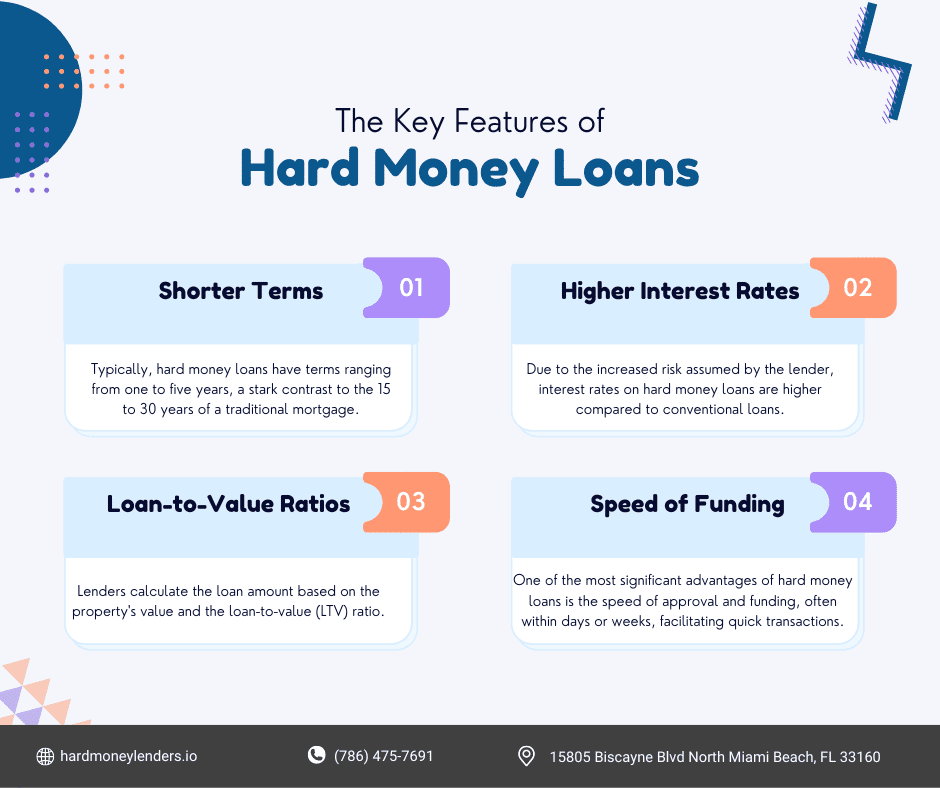

Key Features of Hard Money Loans

- Shorter Terms: Typically, hard money loans have terms ranging from one to five years, a stark contrast to the 15 to 30 years of a traditional mortgage.

- Higher Interest Rates: Due to the increased risk assumed by the lender, interest rates on hard money loans are higher compared to conventional loans, often ranging from 9% to 15%, sometimes higher.

- Loan-to-Value Ratios: Lenders calculate the loan amount based on the property’s value and the loan-to-value (LTV) ratio, usually capping at 65% to 75% of the property’s current market value.

- Speed of Funding: One of the most significant advantages of hard money loans is the speed of approval and funding, often within days or weeks, facilitating quick transactions.

The Benefits of Using Hard Money Loans

When it comes to hard money loans, there are a number of benefits. But here are the main reasons why you might want to consider them for your real estate financing needs.

Flexibility

One of the hallmark advantages of hard money loans is their inherent flexibility. Unlike traditional financial institutions, hard money lenders often provide a degree of adaptability in the loan terms that can significantly benefit the borrower.

This flexibility can manifest in various aspects of the loan agreement, including repayment schedules, interest rates, and the loan-to-value ratio.

For investors with unique project requirements or those seeking creative financing solutions, this level of personalization allows for a more tailored approach that can align closely with project timelines, cash flow projections, and overall investment strategy.

Rapid Access to Funds

In the fast-paced world of real estate investment, timing can be everything. Hard money loans offer a critical advantage by providing quick access to capital, often within days or weeks of the initial application.

This swift turnaround can be a game-changer for investors looking to capitalize on time-sensitive opportunities, such as auction properties or distressed sales, that require immediate action.

The ability to close deals quickly not only positions investors advantageously in competitive markets but also enables them to start on renovations sooner, potentially leading to faster returns on investment.

Asset-based Lending

Hard money loans are primarily secured by the property being purchased, which means that the lender focuses more on the value of the asset than on the borrower’s credit history or income. This approach offers a unique advantage for investors who may not qualify for traditional financing due to credit issues, irregular income, or other financial challenges.

By securing a loan based on the property’s potential after repair value (ARV), borrowers can access funding for projects that promise a good return on investment, opening up opportunities for rehabilitation projects, property flips, and other real estate ventures that might otherwise be out of reach.

Potential Drawbacks of Hard Money Loans

Of course, with benefits, there are also drawbacks to this type of financing.

Higher Costs

While hard money loans offer considerable advantages in terms of speed and flexibility, they also come at a higher cost. The convenience of quick funding and lenient qualification criteria is offset by higher interest rates, which can range significantly above those of conventional loans.

Additionally, borrowers may encounter various fees, including origination fees, processing fees, and closing costs, which can add to the total cost of the loan. These higher expenses are a reflection of the increased risk taken on by the lender and the premium placed on the speed and accessibility of the funds.

Short Repayment Periods

Hard money loans typically have shorter terms than traditional mortgages, often ranging from one to five years. This abbreviated timeframe necessitates a clear and viable exit strategy for repaying the loan, whether it’s through the sale of the property, refinancing with a more traditional loan, or another method.

The pressure of a short repayment period can be challenging, especially for projects that encounter unexpected delays or cost overruns. Investors need to carefully plan and manage their projects to ensure they can meet the repayment deadlines and avoid potential financial strain.

Risk of Property Loss

The asset-based nature of hard money lending means that the loan is secured by the property itself. If a borrower fails to repay the loan, the lender has the right to take possession of the property to recoup their investment.

This risk of property loss is a significant consideration for borrowers, underscoring the importance of having a solid plan in place for the project and the loan repayment. The potential loss of the property can be a daunting prospect, making it crucial for investors to evaluate their ability to meet the loan’s terms and conditions before proceeding.

Understanding both the benefits and drawbacks of hard money loans is essential for real estate investors considering this financing option. By carefully weighing the flexibility, speed, and accessibility against the costs, repayment demands, and risks, investors can make informed decisions that align with their investment strategies and financial goals.

Ideal Candidates for Hard Money Loans

Hard money loans cater to a diverse group of borrowers, each with unique needs and circumstances that make traditional financing less viable or desirable. Understanding whether you fit the profile of an ideal candidate can help you leverage hard money loans effectively.

Real Estate Investors Aiming to Flip Properties Quickly

For investors focused on buying, renovating, and selling properties in a short timeframe, hard money loans offer the speed and flexibility required to move quickly.

These loans can cover the purchase price and renovation costs, allowing investors to capitalize on market opportunities without the extensive paperwork and approval timelines associated with traditional loans.

The key here is the investor’s ability to accurately estimate the after-repair value (ARV) of the property and execute their renovation plans efficiently to ensure profitability.

Individuals Facing Challenges Securing Traditional Financing Due to Credit Issues

Borrowers with less-than-ideal credit histories may find hard money loans an accessible alternative. Since the property secures these loans, lenders may place less emphasis on credit scores and more on the collateral’s value and the borrower’s plan for the property.

This opens doors for individuals working on improving their financial standing but are ready to invest in real estate opportunities.

Property Owners in Need of Short-term Financing for Renovations or as Bridge Loans

Sometimes, property owners need immediate funds to upgrade a property before a sale or to bridge the gap between buying a new property and selling an existing one.

Hard money loans can provide the necessary capital for renovations that enhance a property’s value or ensure continuous investment activity without the wait times inherent to conventional banking processes.

How to Find a Hard Money Lender

Selecting the right hard money lender is critical to the success of your real estate venture. Here’s how to embark on this process.

- Research and Due Diligence: Start with thorough research. Online platforms, real estate forums, and industry publications can be invaluable resources for identifying lenders with expertise in your specific area of interest.

- Evaluate Lender’s Experience and Reputation: Consider the lender’s track record in the industry. Experience in funding similar projects to yours can be a strong indicator of their ability to understand and support your goals. Online reviews, testimonials, and Better Business Bureau (BBB) ratings can offer insights into their reputation and reliability.

- Transparency Regarding Terms and Fees: Transparency is key. A reputable lender should clearly outline the terms of the loan, including interest rates, upfront fees, loan-to-value ratios, and any additional costs. They should be willing to answer any questions you have, ensuring you fully understand the agreement before proceeding.

- Networking: Leverage your professional network. Recommendations from other real estate professionals, investors, or trusted advisors who have direct experience with hard money lenders can provide you with reliable options.

The Application and Approval Process

Navigating the application and approval process for a hard money loan involves several steps, designed to be much faster than traditional loan approvals:

- Detailed Application: The application process begins with submitting a comprehensive proposal, which includes your financial information, details about the property, and a clear plan outlining how you intend to use the loan. This plan should detail the purchase price, renovation costs, expected timeline, and projected after-repair value (ARV) of the property.

- Property Evaluation and Strategy Assessment: The lender will conduct a thorough evaluation of the property to assess its current value and potential. They will also review your strategy, focusing on the feasibility of your plans and your ability to execute them within the proposed timeline. This step often includes a physical inspection of the property and a review of market analyses and projections.

- Swift Approval Process: Hard money lenders are known for their ability to make quick decisions. If your proposal aligns with their lending criteria and they have confidence in the property’s potential and your plan, approval can be granted in a matter of days or weeks. This rapid process is one of the most significant advantages of hard money loans, enabling investors to act swiftly in competitive markets.

- Closing and Funding: Once approved, the closing process involves finalizing the loan terms and signing the agreement. The funding can then be provided, often within a short timeframe, allowing you to proceed with your real estate project without delay.

By understanding the ideal candidates for hard money loans, how to find a reliable lender, and what to expect during the application and approval process, borrowers can navigate the world of hard money lending with confidence. This knowledge enables you to make informed decisions and utilize hard money loans as a powerful tool in your real estate investment strategy.

Alternative Options to Hard Money Loans

There are some conventional loans, such as FHA loans, that you can still obtain without perfect credit. Thanks to assistance from the Federal Housing Administration, these loans have relatively low down payments while still maintaining much lower interest rates than hard money loans.

The FHA protects lenders and so can take more risk when deciding who to loan money too, which allows them to offer loans even to people with struggling credit or a history of bankruptcy. However, these options still have stringent requirements and other factors to investigate. These requirements and more can be found here.

Another possibility to look into for real estate financing is home equity loans. Equity refers to the gap between the value of your home and how much you still need to pay as part of your mortgage. These secondary mortgage loans let you take advantage of that equity and use it to pay back your loan with monthly payments.

Final Thoughts

Hard money loans are provided by private hard money lenders for investment in real estate. These loans have short terms, and provide reduced risk for the lender because the asset and the collateral are the same. Keep an eye out for high interest rates and pay attention to the LTV ratio offered by a lender. If you are looking for a short-term loan to finance your investment, or if you have struggled to gain traditional financing, hard money loans could be a great fit for you.

FAQs on Hard Money Loans

Why are hard money loans helpful?

While traditional mortgage lenders focus on your income and credit score to see if you can repay their debt, hard money lenders mainly care about your collateral and how valuable it is.

This helps people with low credit scores or variable income obtain a loan for a property. It also allows people to get money to buy a property very fast, which can be incredibly useful if you’re in a time crunch for a property.

Should I get a hard money loan?

If you’re looking to invest in real estate quickly but struggling to obtain traditional funding, you could consider a hard money lender.

This is a good option if you have a poor credit history. Since private hard money lenders don’t have as many factors to consider, they tend to move faster when providing funding, which helps you secure deals fast.

If you’re trying to buy real estate in a hot market and compete with other offers, a hard money loan could be for you. It can also help you get approved faster, since the property itself acts as collateral. This speedy approval is especially useful for investors looking to take advantage of hot real estate markets like Florida, for example.

Due to their speed, hard money loans can also come in handy when purchasing a house for personal use. If your house is at risk of foreclosure, consider using a hard money loan to try to turn that situation around.

Similarly, if you’re looking to buy a new house but haven’t sold your current house yet, you could think about using your current house as collateral for a loan from a hard money lender. This solution would put you on the fast track to buying a new home, as you will have the necessary funds to do so quickly.

Additionally, hard money loans can have more flexibility and room to negotiate than traditional loans, depending on your situation. For example, it can sometimes be possible to adjust repayment schedules. This can also be a more personalized experience than working with a typical mortgage lender, as you are working more directly with individuals than with major banks.

When can I use a hard money loan?

Due to high-interest rates, you only want hard money loans for short-term loans. If you are looking to fix and flip a property and make a profit fast, hard money loans could be an excellent way to speed up the process.

There are a lot of great ways to take advantage of hard money lenders, especially in hot markets. Hard money loans are generally preferable for people looking to invest in a property and sell it, rather than those who want to live in a property (due to their short-term nature and high rates).

If you feel you have an exceptional situation in which this doesn’t apply to you, contact a hard money lender for more personalized advice.

How can I get a hard money loan?

If you’re looking to get a hard money loan, reach out to institutions that specifically offer hard money services. Hard money lenders may not be as hard to find as you think, particularly if you look for them online. Reach out to lenders, real estate agents, and local investors to make connections and start funding your projects quickly and easily. Try negotiating with different lenders to see who has the best terms.

What’s the difference between a hard money loan from a traditional bank loan?

Hard money loans are specific types of asset-based loans wherein the loan is secured by the value of a property, often a real estate asset. Unlike traditional bank loans, which evaluate a borrower’s creditworthiness, income, and financial history, hard money loans prioritize the property’s value and potential profitability.

These loans are typically issued by private investors or companies and are known for their rapid funding times and flexible qualification criteria. This makes them ideal for real estate investors, individuals facing credit challenges, or anyone needing swift access to funds for property-related investments.

Why are interest rates on hard money loans higher, and how can they impact my project?

The interest rates on hard money loans are higher than those of traditional loans due to the increased risk assumed by the lender and the short-term nature of the loan. Rates can range between 9% to 15% or higher, depending on the project’s risk, the borrower’s experience, and the lending market conditions.

While these rates increase the cost of borrowing, the quick access to capital and the opportunity to invest in potentially lucrative real estate ventures can outweigh the cost for many investors. It’s crucial to incorporate these costs into your project’s financial analysis to ensure viability and profitability.

What types of projects are most suitable for hard money financing?

Hard money loans are particularly well-suited for short-term real estate projects that require quick funding decisions.

These include fix-and-flip ventures, where investors purchase, renovate, and sell a property within a short timeframe; land loans; new construction; and buy-and-hold strategies that involve purchasing rental properties to generate income.

Hard money loans can also serve as bridge loans, providing temporary financing to cover the gap between acquiring a new property and securing long-term financing or selling another property.

How do hard money lenders evaluate borrowers if not primarily based on credit?

While hard money lenders may consider credit scores, their primary focus is on the collateral’s value—the property being financed—and the borrower’s plan for the property. Lenders evaluate the property’s current market value, the proposed improvements or construction, and the projected after-repair value (ARV).

They also assess the borrower’s experience in similar real estate projects, the feasibility of the project timeline, and the borrower’s strategy for repaying the loan, whether through selling the property, refinancing, or other means.

What are common repayment terms for hard money loans, and how should I prepare?

Hard money loans typically have terms ranging from 6 months to 5 years, with interest-only payments and a balloon payment at the term’s end.

Borrowers should have a solid exit strategy in place before securing the loan, such as a plan for selling the property at a profit or obtaining long-term financing to pay off the hard money loan. Preparing involves thorough market research, realistic budgeting for renovations or construction, and contingency planning for unexpected delays or expenses.

What should I include in my loan application to increase the chances of approval?

To increase your chances of approval, provide a comprehensive and well-documented loan application, including:

- Detailed project plan: Outline your planned improvements, construction timeline, and expected outcomes.

- Financial analysis: Include a budget for the project, expected renovation or construction costs, and a comparative market analysis (CMA) to support your projected ARV.

- Personal and business financial statements: Show your financial stability and ability to manage the project and loan repayment.

- Experience: Detail your experience with similar projects to demonstrate your capability to complete the project and repay the loan successfully.

- Exit strategy: Clearly explain how you plan to repay the loan, whether through selling the property, refinancing, or another method.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.