How to Buy Foreclosed Homes in Florida

Florida is one of the best states in the country for real estate investing. Taxes are low, and many new residents want to rent properties, especially people looking to retire or buy vacation homes. One advantageous way of investing in real estate is buying foreclosed homes, especially in Florida. You can gain great equity on a quality home, especially after repairs and renovations. With so much demand for housing in Florida, it’s a fix and flipper’s dream if they can buy a foreclosed home and fix and flip it. Below, we’ll show you how to buy foreclosed homes in Florida and everything you need to know.

As a disclaimer, this article is not intended as financial or real estate advice. Please consult a real estate expert before making any major financial decisions.

Here’s a look a some key statistics about the Florida real estate market based on our analyst estimates.

| Statistic | Value |

| Current Foreclosure Rate | 0.05% |

| Median Purchase Price | $397,000 |

| Average Resale Price | $447,000 |

| Estimated Profit from Resale | $50,000 |

| Average Time to Foreclosure | 200-250 days |

Understanding the Foreclosure Process in Florida

Buying a foreclosed home is more difficult than you think.

It’s more time-consuming and rigorous to buy a foreclosed home than buying a non-foreclosed house. Foreclosed houses are often cheaper because banks are looking to recover their losses, and homeowners are looking to avoid massive hits to their credit and financial distress.

When a property owner does not pay their mortgage for a long period of time, the bank can force the sale of the property in a lengthy judicial process.

The process for forcing a foreclosure, in Florida, can take 200 days or more. Now, one of the primary ways to force a foreclosure is through the courts, through civil procedures. During the process of forcing a foreclosure, a lender is looking to regain the loss it incurred due to the borrower not paying their loan payments.

The process takes even longer if the borrower contests the foreclosure. It can also be lengthened if the borrower files bankruptcy. Included in the legal process are court filings, summons, and hearings.

It takes a judgment before a foreclosure date can be scheduled, and after a judgment, the foreclosed home is put on public auction. But foreclosures happen the quickest if borrowers don’t put up a defense.

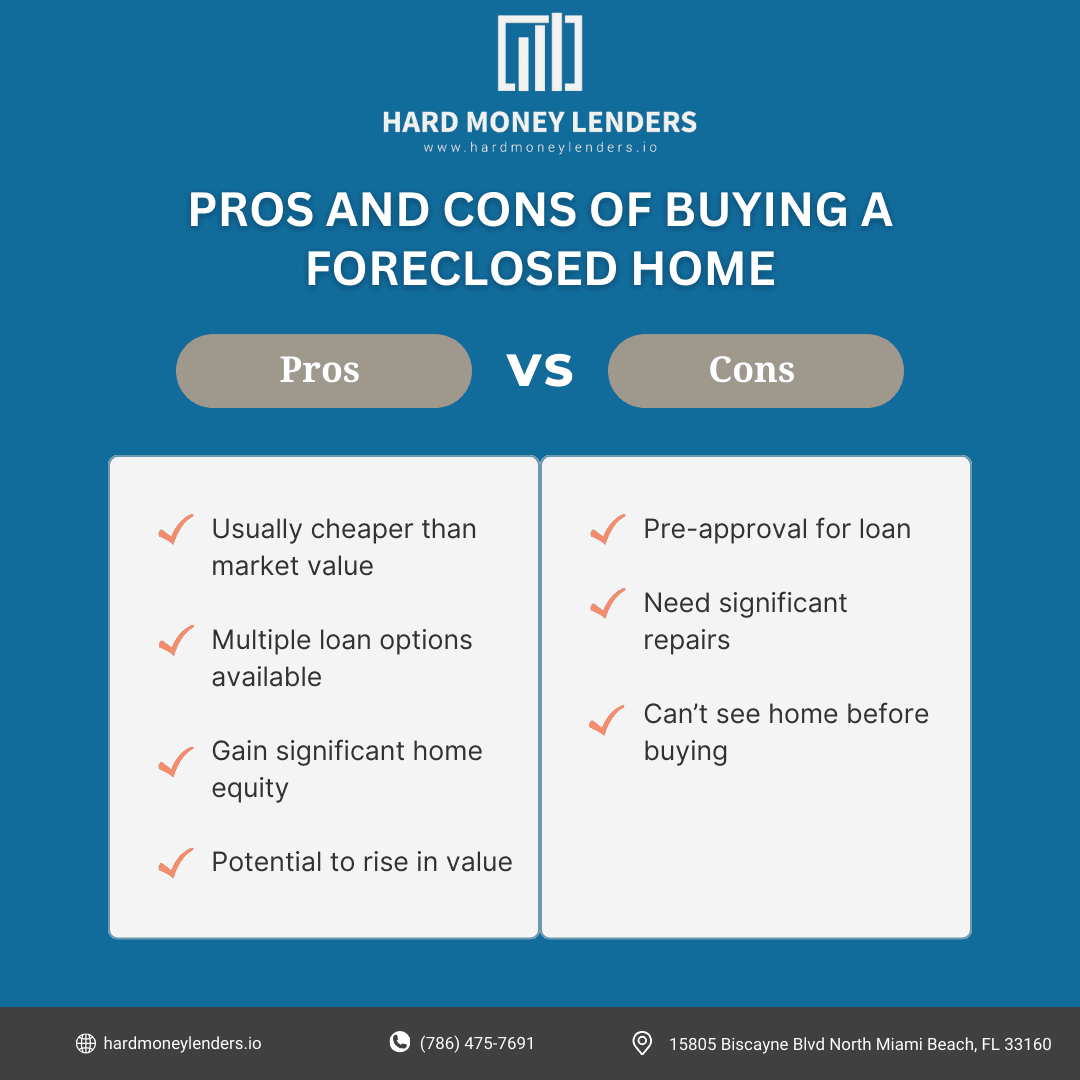

The Benefits of Buying a Foreclosed Home

For the borrower, a foreclosed home can be bought at less than market value. As long as the home is in a liveable condition, you can get a conventional loan or a government-backed loan to buy the house.

The government might also have other repair conditions to make it qualify as “liveable.” But foreclosed homes could also qualify for 203K loans, which are government FHA loans that help a borrower renovate and rehabilitate a home. Homeowners buying distressed homes can qualify for a loan package that helps them finance the home.

A real estate investor can also gain significant home equity on a foreclosed home. It might seem like common sense, but buying a house for cheap, under market value, and then having the value of the home increase with renovations and the shifting dynamics of a neighborhood is advantageous to your real estate portfolio.

A distressed property can also be in a desired neighborhood, which can make it a more desirable investment. After repairs and making the foreclosed home liveable, the home could be a “buy low, rent or sell high” prospect.

Lastly, one benefit is familiarity with the foreclosure market. Many real estate investors recommend sitting in on a foreclosure auction to see how the auction process works. Being familiar with the process allows you as an investor to be better prepared to buy a foreclosed property as an investment or rental property.

The Risks of Buying a Foreclosed Home

Most banks don’t let you see a home before buying a foreclosed home. And since you need to be pre-approved for a loan, you might not be able to get the money in time. Banks are often looking to unload properties as soon as possible because they want to avoid paying maintenance expenses associated with foreclosed homes.

Sometimes, buying a foreclosed home can be a mistake if the condition of the home does not meet your expectations. That’s why it’s important to contact the homeowner or seller’s representative.

Contacting the homeowner is sometimes the only way to really know the condition of the property and what is owed on it. A real estate agent could contact the borrower on your behalf, but otherwise, you may not have a reliable estimate of the status of the property.

You should also inspect the property, if the homeowner allows you to meet with them before the foreclosure.

Also, financing can be difficult to secure during the foreclosure process, so this means the financing process needs to be in place early. Making an offer that appeals to the homeowner can make sure you close the home quickly.

Where You Can Buy a Foreclosed Home in Florida

First, you can buy a foreclosed home during the pre-foreclosure process. Pre-foreclosure occurs when the homeowner is behind on the mortgage but the bank has not foreclosed on the home.

Now, the pre-foreclosure process can last anywhere from eight to 14 months from when the first payment is missed. Pre-foreclosure is the time period to view the property, talk to the homeowner, and buy directly from the homeowner without dealing with the bank.

As a general rule, homeowners are much more transparent about letting potential buyers see the home and give access to buyers than banks. After all, a homeowner in the pre-foreclosure process is often desperately trying to sell the home for their own benefit.

As a buyer, you would be responsible for paying outstanding balances or any kind of lien on the property if you buy the house during pre-foreclosure.

But the most common way foreclosed homes are sold is at auctions.

From the lender’s perspective, this will help them sell the property as soon as possible. Banks especially want to unload foreclosed real estate, and they can get all of their unpaid loans from a sale.

Most foreclosed property from banks get sent to a Sheriff’s Sale. Someone can find local auctions at the local government’s office, including online searches. In today’s digital age, there are also digital auctions online as more people become accustomed to big online purchases.

Once you find a property you’re interested in, you need to keep tracking the property until the day of the auction, and these dates can be canceled for bankruptcy filings relatively frequently.

If you buy a home at an auction, you are taking on all the risk. You need to pay cash during the sale and you are responsible for mishaps in the title, taxes or insurance. You may also be responsible for the condition of the home as-is, and you are not subject to any compensation.

Buying REO Properties in Florida

You can also buy a real estate-owned (REO) property. This means the property failed to sell at the auction, and the bank has taken the title to the property.

The bank will usually hire a real estate agent to sell the property. Banks are difficult to negotiate with since you can only negotiate with banks through a realtor.

The bank’s agent and your realtor will often try to negotiate the best deal for the bank as possible, and it is important to hire the best real estate attorney within your means to find the best deal for yourself.

Real estate attorneys will help you pay only what you’re meant to pay and receive an acceptable title for the home. Banks may hire title companies that try to shift legal responsibility to the buyer, so avoiding extraneous costs is critical when buying REO foreclosed properties.

It’s also important to secure financing and pre-approval. This will prevent you from being slowed down and not being considered a serious buyer. Many banks will not sell a property to a buyer without a pre-approval letter from a lender, due to the competitiveness of the REO market.

Securing Financing for Foreclosed Homes in Florida

Securing financing for foreclosed homes can be challenging but understanding the different options available can make the process smoother. Here’s a comprehensive guide on securing financing, focusing on both traditional and non-traditional financing options.

Traditional Financing Options

- Conventional Loans: These are mortgage loans not insured by the government and may have stringent qualification criteria. However, they often offer competitive interest rates.

- Government-Backed Loans: FHA, VA, and USDA loans can be used to purchase foreclosed homes. These loans often have lower down payment requirements and more flexible credit criteria.

Non-Traditional Financing Options

- Hard Money Loans: These are short-term loans from private lenders based on the property’s value rather than the borrower’s creditworthiness. Hard money loans are ideal for investors looking to renovate and flip properties because they provide quick access to capital. However, they come with higher interest rates and shorter repayment terms.

- Bridge Loans: These are short-term loans designed to bridge the gap between immediate financing needs and long-term solutions. They’re useful for buyers who need to act quickly on a foreclosure but may be waiting for another property to sell or a traditional loan to be approved. Bridge loans also carry higher interest rates and are intended for short-term use only.

- Home Equity Line of Credit (HELOC): If you already own a property, a HELOC allows you to borrow against the equity you have built up. This can be a flexible way to access funds for purchasing a foreclosed property, but it puts your current home at risk if you fail to make payments.

Approaching Lenders with a Strong Proposal

When approaching lenders, especially for non-traditional financing, presenting a strong proposal is key. Here are some tips:

- Detailed Business Plan: Outline your plan for the property, including any repairs or renovations needed and your strategy for selling or renting the home. Show how you will manage the costs and what your timeline looks like.

- Proof of Experience: If you have experience with real estate investments or renovations, provide details to your lenders. This experience can reassure lenders of your ability to manage and exit the investment profitably.

- Financial Overview: Include a detailed breakdown of your finances, including other investments, income, and expenses. A strong financial background can help in securing better terms.

- Exit Strategy: Clearly outline your exit strategy. Whether it’s refinancing with a traditional mortgage after renovating or selling the property at a profit, lenders want to know how you plan to pay off the loan.

- Property Valuation: Provide a current appraisal or a detailed analysis of the property’s potential value post-renovation. This will help in securing financing based on the property’s value.

Buying a Foreclosed Home in Florida with Hard Money

To secure the financing for a foreclosed property, and to secure it quickly, hard money loans are an option. A hard money loan is considered a short-term loan based on the value of a property — it usually has a higher interest rate and a shorter funding time frame than traditional mortgages.

A hard money loan is the best option if you don’t have enough cash to fund a foreclosure property purchase and don’t have investors to give the cash.

In particular, hard money loans can help a buyer buy a foreclosed property in the pre-foreclosure process to avoid trouble on all sides of the process. The hard money loan helps a potential buyer inspect the property earlier and assess repairs, avoid the costs of auctions, help homeowners in financial distress, and help banks avoid huge losses.

If hard money loans are used to help buy a property during the auction, hard money lenders can help get enough cash to purchase the property you want. Given how quickly hard money loans are secured, the cash will not be a barrier — the preparation to get funds in place and find the property you want is.

Having a proof of funds letter sets you apart from other buyers and shows you are serious about a home. Competing with other investors and buyers can be stressful, but finding a hard money loan can help you generate your proof of funds letter.

But it’s important to note buying a foreclosed property with a hard money loan doesn’t come without costs. High interest rates, origination fees, and low frame of repayment make the hard money loan difficult to repay if the foreclosed home does not generate an immediate product.

Looking For A Hard Money Loan?

We at Hard Money Lenders IO can provide the consultation as well as hard money loan necessary for you to buy the foreclosed home of your dreams. We can help you meet your real estate needs with our professionals who can calculate risk on a distressed property.

Of course, do your research and consult experts, but we have a variety of resources, including our hard money loan calculator, to help you secure the money you need to secure your foreclosed home at either an auction or in the pre-foreclosure process. Our professionals can help you find the best possible offers.

With real estate in Florida generally earning significant profit for homeowners and investors, finding undervalued properties and financing them is a terrific way to build your portfolio.

FAQs

What are the requirements to buy a foreclosed home in Florida?

To purchase a foreclosed home in Florida, you need to meet several criteria:

- Financial Preparedness: Obtain pre-approval for financing to demonstrate your readiness to purchase. This is crucial for participating effectively in foreclosure auctions.

- Legal Awareness: Familiarize yourself with Florida’s foreclosure laws. Understanding these laws is essential as they influence the entire buying process, including the notice periods and rights of the former homeowners.

- Cash Availability: Have sufficient funds available. Many foreclosure auctions require immediate payment or a significant deposit at the time of the auction.

- Research: Conduct thorough research or hire professionals to help identify potential properties. Regularly checking court filings, bank listings, and real estate websites can provide leads on foreclosed properties.

How to buy a pre-foreclosure in Florida?

Purchasing a property in pre-foreclosure involves several steps:

- Identify Potential Properties: Use online databases, foreclosure listings, and legal notices to find homes in pre-foreclosure.

- Direct Contact: Reach out to the homeowner directly to express your interest. This is sensitive and must be approached with respect and discretion.

- Negotiate Terms: If the homeowner is willing to sell, negotiate terms that are favorable but fair, considering their situation.

- Closing Process: Complete the transaction through normal real estate channels, which includes securing financing, conducting a home inspection, and closing the sale legally with all necessary documentation.

What happens after a foreclosure sale in Florida?

Post-foreclosure sale processes include:

- Title Transfer: The title is transferred to the highest bidder at the auction.

- No Redemption Period: Unlike some states, Florida does not offer a redemption period after the foreclosure sale where the original owner can reclaim the property.

- Eviction Proceedings: If the property is still occupied post-sale, the new owner might need to undertake legal proceedings to evict the previous homeowners or tenants.

How long can a tenant stay in a foreclosed property in Florida?

The duration a tenant can remain in a foreclosed property depends on several factors:

- Federal Protection: Under the “Protecting Tenants at Foreclosure Act,” tenants with a valid lease that was signed before the notice of foreclosure can remain until the lease expires. Month-to-month tenants must receive at least 90 days’ notice before eviction.

- Immediate Requirements: The new owner must issue proper notice if they intend to occupy the property as a primary residence and may not respect the term of the lease.

Can you sell a house in foreclosure in Florida?

Selling a home during the foreclosure process is possible:

- Short Sale: This option allows the homeowner to sell the home for less than the mortgage balance with the lender’s approval. It requires the lender’s agreement as it involves forgiving a portion of the debt.

- Regular Sale: If the homeowner has sufficient equity, they can sell the home outright, pay off the mortgage, and retain any excess funds.

- Lender Cooperation: Both scenarios require the lender’s cooperation and must be completed before the foreclosure auction date to prevent full foreclosure.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.