Buying a Property with Delinquent Taxes

When looking to diversify their portfolios, many investors choose to invest in tax-delinquent properties. After considering the current real estate market and interest rates, many look toward tax liens for the source of their next investment. While risky, buying tax liens and property with delinquent taxes is potentially profitable if done wisely.

What Are Delinquent Taxes?

Delinquent taxes are unpaid taxes owed to the IRS. Investopedia explains that with tax delinquency comes additional penalties and interest added to the debt. Filing or payment must be made within eight weeks of receiving a delinquent-tax notice. If you are unable to repay the balance in full, you can opt for an installment or partial payment plan. In extreme cases, the IRS can deem one “not currently collectible” and temporarily delay collection.

If the delinquent taxes are left unpaid, the IRS will issue a bill for the amount that is past due, including penalties and interest that has accrued since the original bill was issued. (The interest continues to compound daily.) The IRS will then pursue aggressive collection methods to ensure that the debt is paid. They can garnish wages or even place a tax lien on property and assets. It’s ideal to avoid this sort of situation whenever possible, as going down the road of wage garnishment can be extremely challenging to reverse if your finances don’t permit repayment of the taxes owed.

What Is a Tax Lien?

A tax lien is one method the government, whether it’s the IRS or the county, uses to recoup unpaid taxes. Investopedia says that a tax lien is a legal claim to a piece of property made when the owner fails to pay what is owed in property taxes. When a lien is placed on a property, creditors are notified, and the city or county in which the property is located issues a tax-lien certificate. The certificate covers the amount owed on the property and any additional interest or penalties. Tax liens can be issued by the county or state or federally by the IRS.

The IRS notes that a tax lien is not just limited to property and can apply to all assets and future assets acquired during the lien. They can also attach to business property, all rights to business property and accounts receivable. Once a lien is placed, the IRS notifies creditors by filing a notice of federal tax lien, which can negatively affect future credit attempts. Tax liens and notices can also persist after bankruptcy.

Owners with a tax lien on their property are left with a few options. The IRS explains that the best way to discharge a lien is to repay the delinquent taxes in full. Liens could also be discharged without the payment of delinquent taxes, but the property and situation must meet the Internal Revenue Code. Liens may also be eligible for subordination, in which the IRS lien is moved below other creditors in priority, or withdrawal, in which the IRS removes the public notice on the lien. The delinquent taxes still need to be repaid in full in both situations.

Types of Tax Liens

There are three types of tax liens: federal, state income and property. Issued by the IRS, PropLogix explains that these liens can remain on the property after foreclosure and still have to be repaid by the buyer as long as the IRS redeems the lien within 120 days of the recording of the new deed.

State income liens are filed when individual income taxes are left unpaid; the duration of these liens varies by state. PropLogix notes that, for example, state child support liens remain on the property until the payment is fulfilled. Property tax liens are issued by the county when property taxes go unpaid. If the delinquent taxes are not repaid within the set time frame, the property will be put up for auction in a tax-deed sale.

The sale does not transfer ownership of the property. If the original owner repays the delinquent taxes within a set time frame, the lien is removed, and the certificate holder is reimbursed in full plus interest. If the delinquent taxes are left unpaid, then the certificate holder can initiate a public auction that will discharge the lien and pay off the property tax debt that has accrued since the lien was issued.

Buying Tax Liens

Tax liens are auctioned off just like property, either online or in person, Investopedia explains. Investors looking to purchase tax-delinquent property can choose from residential, commercial or undeveloped land from a tax-lien properties list. Their level of return on the tax lien will depend on several variables, such as the price for which they purchased the lien, the location and type of property and other unforeseen circumstances.

Investors should research the property before the auction. Often, the market value of the property is less than the cost of the lien. Other liens could also exist on the property, which would prevent the investor from assuming ownership later. Potential investors can contact the county treasurer’s office for a tax-lien property list detailing scheduled auctions and whether they will be held in person or online. For information on a specific property, the office should supply more information on when that lien will appear on the schedule.

Once the lien is purchased, investors pay the delinquent taxes, interest and any additional accrued charges. Once the investor assumes ownership of the tax lien, the property owner must repay the debt to the investor, including interest, which typically ranges around 10 to 12 percent, according to Investopedia. If the investor bought the lien at a premium, the property owner must pay that as well. If the property owner cannot meet the payments, the investor can then foreclose on the property.

Buying Tax Deeds

Some tax-delinquent properties are sold through tax-deed property sales. Unlike tax-lien sales, buyers from a tax-deed sale receive ownership of the property upon purchase. Tax-deed sales operate the same as a foreclosure: The sale proceeds will pay off the lien. Tax-deed sales must be publicly advertised, and buyers must pay in cash within 24 hours of the winning bid. The property’s entry is forbidden, which is why these properties are often sold for significantly less than their neighbors since only the exterior can be viewed before purchase.

Since potential investors must purchase sight unseen, it is recommended that you assume that the property is in poor condition and will require remodeling. Keep this in mind when determining the property value. Potential investors should also check if any additional liens exist on the property, such as municipal fines and code violations. With all of this in mind, investors should determine their maximum bid.

Specific laws on tax liens and tax-deed sales vary by state; for instance, some states don’t allow auctions, while others don’t allow tax-deed sales. Before investing in tax-delinquent property, always perform ample research on the state’s laws and restrictions.

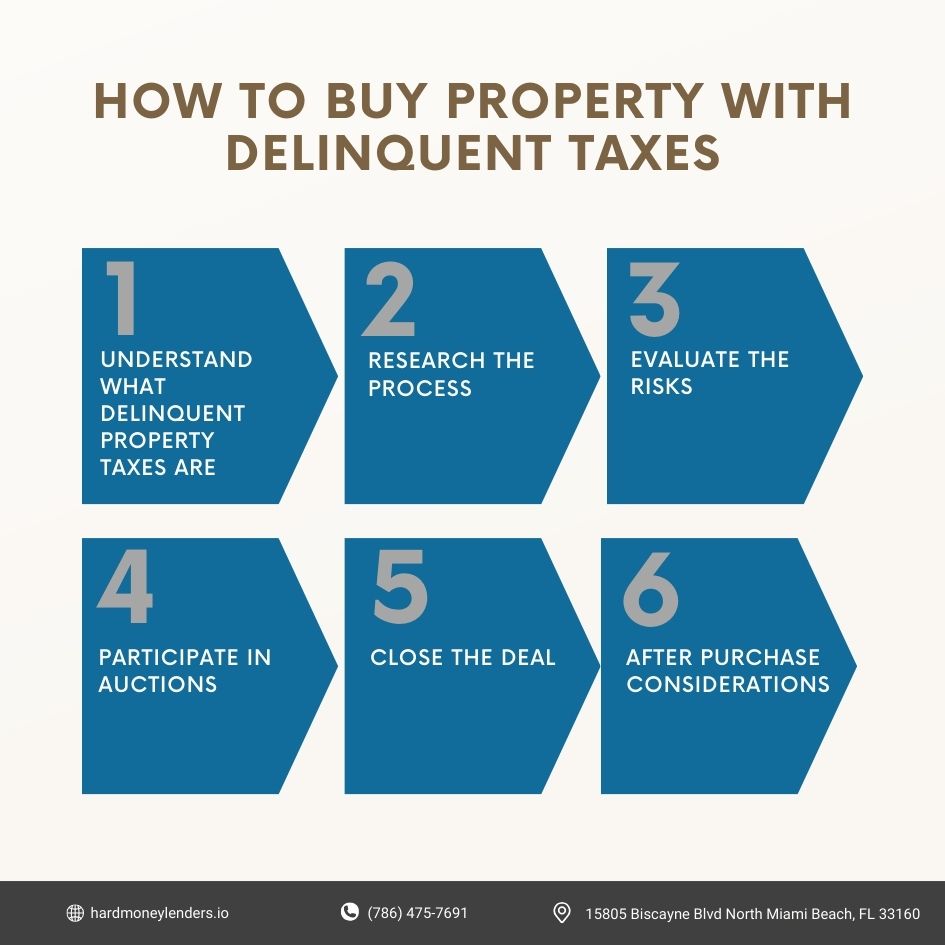

How to Buy Property with Delinquent Taxes

Buying property with delinquent taxes can be a lucrative investment strategy, offering the chance to acquire real estate at significantly lower prices than the market rate. However, this process involves specific steps that require careful consideration to ensure a profitable and smooth transaction. Whether you’re a seasoned investor or a beginner looking to enter the real estate market, understanding how to navigate the purchase of tax-delinquent properties is crucial. Here’s a comprehensive guide on how to buy property with delinquent taxes, designed to help you make informed decisions and maximize your investment.

Understand What Delinquent Property Taxes Are

Property taxes are annual financial charges that property owners owe to local government authorities. When these taxes are not paid, the property becomes tax-delinquent. Local governments may place a tax lien on the property, which is a legal claim against the assets for unpaid taxes. Buying properties with delinquent taxes often involves purchasing these tax liens or directly acquiring properties through tax sales.

Research the Process

- Local Laws and Procedures: Every state and county has different laws and procedures for handling delinquent taxes and tax sales. It’s essential to research and understand these local regulations. Some jurisdictions may offer tax lien certificates, allowing you to collect interest on the lien and potentially acquire the property if the owner fails to pay. Others may conduct tax deed sales, where the property itself is sold outright.

- Available Resources: Utilize resources such as county websites, local tax collector or treasurer offices, and real estate platforms that list tax-delinquent properties. These resources can provide valuable information on upcoming tax sales and the specifics of each property.

Evaluate the Risks

Investing in tax-delinquent properties comes with its own set of risks, including:

- Property Conditions: Often, properties available through tax sales are not open for inspection. You might be purchasing a property as-is, potentially with significant repair needs.

- Outstanding Liens: Other liens on the property may not be cleared by the tax sale, necessitating further financial outlay to clear these encumbrances.

- Competition: Popular or highly valuable properties might attract more bidders, driving up the price at auction.

Understanding these risks and preparing for them is crucial in making a successful investment.

Participate in Auctions

Tax-delinquent properties are typically sold at public auctions, which can be held in-person or online. Here’s how to prepare:

- Register for the Auction: Some jurisdictions require potential buyers to register before participating in a tax sale. This might involve submitting paperwork and paying a registration fee.

- Scout Properties: Do your homework on properties that interest you before the auction. Understand their market value, potential rental income, and renovation costs.

- Set a Budget: Based on your research, set a maximum bid for each property to ensure profitability.

Close the Deal

Once you win a bid at a tax sale, you’ll need to finalize the purchase. This typically involves:

- Paying the Winning Bid Amount: You’ll need to pay the auction price, often on the same day or within a short timeframe.

- Completing the Paperwork: Ensure all legal documents are completed correctly. It may be wise to work with a real estate attorney to navigate this process.

- Addressing Any Remaining Liens: Determine if there are other outstanding liens and manage them accordingly.

After Purchase Considerations

After acquiring a property, assess the next steps to maximize your investment, which might include:

- Renovating and Flipping the Property: If the property requires repairs, consider the costs of renovation against the potential increase in property value.

- Renting Out the Property: For long-term investment returns, renovating and renting out the property can provide steady rental income.

- Reselling the Property: Some investors may choose to clean up the title and resell the property quickly for a profit.

Buying property with delinquent taxes offers a unique opportunity to enter the real estate market at a lower cost, but it requires thorough preparation and understanding of the risks involved. By following this guide, you can navigate the complexities of tax-delinquent property investments and potentially unlock significant returns.

Risk Management in Tax Delinquent Investments

Comprehensive Due Diligence

Engaging in detailed due diligence is the cornerstone of mitigating risks in tax delinquent investments. Investors should perform a thorough investigation of the property’s history and status, including a search for any existing liens, judgments, or other encumbrances. This process involves accessing detailed property reports, examining county clerk records, and conducting physical site visits to evaluate the property’s condition. Understanding the full scope of the property’s liabilities ensures that investors are fully aware of any potential issues that could impact the investment’s profitability. Tools like property history reports and real estate databases are invaluable for gaining a comprehensive view of the property’s background.

Legal Safeguards

Consulting with a real estate attorney experienced in tax delinquent properties is essential. A specialized attorney can provide expert advice on navigating the complexities of tax lien laws and ensuring that all investments comply with regional legislation. This legal support is critical in avoiding potential lawsuits or legal disputes that could arise from unforeseen claims against the property. Attorneys can also assist in interpreting complex legal documents and advise on any procedural steps required by local or state laws, thereby safeguarding the investment from legal pitfalls.

Understanding Regulatory Compliance

Investors must have a thorough understanding of the specific regulations and laws that govern tax delinquent properties in different jurisdictions. These regulations can significantly affect the investment, particularly in terms of redemption rights and the potential for the original owners to reclaim their property. Keeping abreast of these laws through continuous learning and consultation with legal experts ensures compliance and helps investors navigate the regulatory landscape effectively. Local real estate forums, state websites, and tax authorities are critical resources for staying updated on these regulations.

Financial Risk Planning

Creating a well-defined financial strategy is crucial for managing potential risks associated with tax delinquent properties. This includes preparing a comprehensive budget that accounts for all potential costs—purchase prices, renovation expenses, legal fees, and a reserve for unforeseen expenses. Utilizing sophisticated financial planning tools can help investors maintain control over their finances and ensure that the project stays within budget. This financial preparedness is vital for avoiding liquidity issues and ensuring the sustainability of the investment.

Implementing Mitigation Strategies

To further mitigate risks, investors should consider strategies such as securing title insurance or obtaining a title opinion letter. These measures protect against potential title issues that were not disclosed during the initial due diligence phase. Title insurance, for instance, can provide financial protection against loss due to title defects, liens, or other matters. These risk mitigation tools are essential in providing peace of mind and financial security, allowing investors to focus on maximizing their return on investment.

Continuous Monitoring and Adaptation

The regulatory and economic environments surrounding tax delinquent properties are dynamic and can change. Therefore, continuous monitoring of legal and market developments is crucial. Regular consultations with legal advisors, attending real estate investment seminars, and subscribing to industry publications can help investors stay informed about new laws and market trends. This ongoing vigilance enables investors to adapt their strategies in response to environmental changes, ensuring long-term success in their investments.

Pros and Cons of Buying a Property with Delinquent Taxes

There are many positive aspects to buying a property with delinquent taxes. One positive aspect is that every real estate investor is looking for motivated sellers. Many chase foreclosures, probate homes, those late on their mortgages or with rundown homes with lots of deferred maintenance to find those motivated sellers. Some of these things may overlap with past-due property taxes, but not always. Everything else may be great. Seeking tax-delinquent properties could be a good method of connecting with owners who are serious about selling houses fast.

Whether you are buying a new residence, a second or vacation home or an investment property, having some leverage in negotiations is always a perk. Buying tax-delinquent properties isn’t just about looking for low prices, either. The experienced know that being able to negotiate more of the terms you want can be even more important. That includes closing dates, financing, inspections and repairs.

However, there are also negative aspects of buying a tax-delinquent property. One problem with properties with large past-due tax bills is that these liens can quickly eat up a lot of equity. We’ve begun to see more American properties slide back into negative equity or underwater positions. Just one year of delinquent annual property taxes can add over $10,000 to that problem. Some owe hundreds of thousands in back taxes. In some cases, you might find a “cheap” house deal that has more in delinquent taxes than the price of the house, or even the value of the house.

Often, past-due property taxes is just the tip of the iceberg of the problems — not always, but it’s quite likely. There may be many other past-due bills like utilities, mortgage payments, insurance and more. Or, the owners may have given up on the property due to other legal issues, code violations or rehab project roadblocks. Many of these can be overcome, but you’ve got to know what you are really dealing with before you get in and can assess it as a viable deal and at what price.

Wrapping Up: Buying a Property with Delinquent Taxes

Initially, buying a property with delinquent taxes may seem almost too good to be true. However, this form of investing requires a lot of capital upfront and comes with a multitude of risks.

Be sure to conduct research beforehand. It’s imperative that you make sure the property is in good condition before deciding to invest. In the long run, investing in tax liens give you the opportunity to diversify your portfolio like other investments can’t.

FAQs

What does it mean when a property has delinquent taxes?

When a property has delinquent taxes, it means the owner has failed to pay the required property taxes by the due date. As a consequence, the local government issues a tax lien against the property. This tax lien is a legal claim or hold on the property, serving as a method for the government to secure the amount owed in taxes. This lien must be resolved before the property can be sold or refinanced, as it gives the government a legal right to enforce payment, potentially through foreclosure if the taxes remain unpaid.

How can I find properties with delinquent taxes?

Locating properties with delinquent taxes involves several steps and resources, focusing on areas where tax liens are issued for unpaid taxes. Here’s how you can find such properties:

- County or Local Government Websites: Many local governments maintain online databases or lists of properties that have outstanding tax liens. These websites often provide search tools allowing you to filter properties by status, including those with delinquent taxes.

- Tax Collector’s Office: Visiting or contacting your local tax collector’s office can provide direct information and guidance on properties with tax delinquencies. These offices can also inform you about the procedures for tax sales or auctions.

- Specialized Online Platforms: There are several online platforms and services that specialize in listing properties with tax liens or other legal encumbrances. These services often offer detailed information on the status of the property, including the amount of unpaid taxes and upcoming tax lien sales.

What is a tax lien sale?

A tax lien sale is an auction process conducted by a municipal or county government to recover unpaid property taxes. Here’s a closer look at how it works:

- Issuance of Tax Lien: Once property taxes are deemed delinquent, the local government issues a tax lien against the property, which effectively makes the government a creditor.

- Sale of Tax Lien: The tax lien itself is sold at public auction. The starting bid is usually the amount of unpaid taxes plus any interest or penalties that have accrued.

- Rights of the Buyer: The investor who purchases the tax lien does not immediately own the property but obtains the right to collect the owed taxes plus interest from the original property owner.

- Foreclosure: If the homeowner does not pay the owed amount within a specified redemption period—this period varies by jurisdiction—the lienholder has the right to initiate foreclosure proceedings to take ownership of the property.

What is a tax deed sale?

A tax deed sale is a specific type of public auction where the property itself—not just the lien for unpaid taxes—is sold. This process is initiated by local governments to recover owed property taxes. Here’s what happens in a tax deed sale:

- Initiation: Once property taxes remain unpaid and become significantly delinquent, the local government schedules a tax deed sale to recover the owed amounts.

- Public Auction: The property is sold to the highest bidder at a public auction. The starting price typically covers the back taxes, penalties, and administrative costs associated with the sale.

- Transfer of Ownership: The winning bidder obtains the deed to the property, effectively becoming the new owner. However, this ownership is subject to any legal redemption period that may apply, allowing the previous owner a last opportunity to repay the owed taxes and reclaim the property.

Are there risks involved in buying property at a tax deed sale?

Investing in properties through tax deed sales can be highly rewarding but comes with notable risks:

- Property Condition: Many properties sold at tax deed sales require extensive repairs. Since physical access to the property might be restricted, assessing its true condition can be challenging.

- Outstanding Liens: The presence of other liens, such as mortgages or mechanics’ liens, might not be cleared by a tax deed sale. Buyers are responsible for resolving these liens, which can add to the total investment cost.

- Redemption Rights: Some jurisdictions allow the former owner a redemption period to repay the taxes and reclaim the property. During this period, the buyer’s control over the property is limited.

How do I prepare for a tax sale auction?

Preparing effectively for a tax sale auction is crucial for success and involves several key steps:

- Thorough Research: Investigate all available details about the property, including legal status, market value, and any encumbrances. Public records and online real estate databases can be invaluable resources.

- Property Inspection: Whenever possible, visit the property to assess its physical condition, location, and neighborhood. This can help you estimate potential renovation costs and evaluate the investment’s feasibility.

- Financial Planning: Set a clear budget for your maximum bid, factoring in estimated repair costs, potential liens, and other expenses such as property taxes and insurance.

- Auction Registration: Ensure you meet all the auction’s requirements, which may include pre-registration, deposit submissions, and presenting proof of funds.

What should I do after purchasing a property with delinquent taxes?

Once you successfully purchase a property at a tax deed sale, take the following steps to secure your investment:

- Title Review: Conduct a comprehensive title search to identify any unresolved issues or liens that could affect your ownership.

- Renovation Planning: Evaluate the property’s condition and plan any necessary renovations. This may involve hiring contractors, obtaining permits, and scheduling repairs to increase the property’s value.

- Investment Strategy: Decide on your long-term strategy for the property. Whether you plan to flip the house for a quick profit, rent it out for ongoing income, or hold it as part of a broader investment portfolio, having a clear strategy is essential for maximizing returns.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.