Buying Mortgage Bank Notes: Everything You Need to Know

Mortgage bank notes are a popular trend in real estate investing that gives income streams to real estate investors. By investing in real estate without becoming a landlord or having to buy or sell houses, the risk is lower for mortgage note investors than traditional real estate investors. There’s not much information online about mortgage notes, but this comprehensive guide should give you the details you need to know about buying mortgage bank notes.

As a disclaimer, this article is not financial advice, so please seek out the advice of a real estate or financial expert before making any major investing decisions.

What is a Mortgage Bank Note?

A mortgage bank note is a crucial document signed at the end of a home closing, formalizing an agreement between the borrower and the lender. This document outlines the borrower’s commitment to repay the loan and serves as collateral. Essentially, a mortgage note represents a promise to repay the debt incurred during the purchase of a property, including the interest accrued over time. Unlike traditional property investment, purchasing a mortgage note allows investors to earn passive income without the responsibilities of being a landlord.

A mortgage bank note is a crucial document signed at the end of a home closing, formalizing an agreement between the borrower and the lender. This document outlines the borrower’s commitment to repay the loan and serves as collateral. Essentially, a mortgage note represents a promise to repay the debt incurred during the purchase of a property, including the interest accrued over time. Unlike traditional property investment, purchasing a mortgage note allows investors to earn passive income without the responsibilities of being a landlord.

In essence, a mortgage note involves buying the debt associated with a property rather than the property itself. Investors who purchase mortgage notes assume the role of the lender, collecting payments from the borrower according to the terms specified in the note. These terms include the loan amount, down payment, repayment schedule (monthly or bi-monthly), and the interest rate. The mortgage note is a legally binding document, ensuring both parties adhere to the agreed-upon terms.

Investing in mortgage notes means the investor does not own the property but becomes the new creditor to the homeowner. These notes can be held until maturity, providing a steady stream of income, or resold in the secondary market. A mortgage note typically accompanies a promissory note, which details the repayment terms and conditions, including the interest rate and potential consequences if the borrower fails to repay the loan.

It is advisable to have an attorney review the mortgage note to ensure maximum protection for the lender. Understanding the lender’s perspective is also critical; lenders seek low-risk investments and reliable real estate investors. The primary risks associated with mortgage notes include borrower default and prepayment. Default occurs when a borrower fails to make payments, while prepayment means the borrower pays off the loan early, reducing the expected interest income.

To profit from note investing, identifying high-quality mortgage notes is essential. Investors should differentiate between performing and non-performing notes. Performing notes are those where the borrower makes regular payments, while non-performing notes involve borrowers who have defaulted on their payments.

Additionally, two other types of mortgage notes exist: sub-performing notes and non-conforming notes. A sub-performing note is one that has not been fully repaid but has not yet defaulted, indicating some risk. A non-conforming note, on the other hand, involves unconventional terms and is usually insured by a government program.

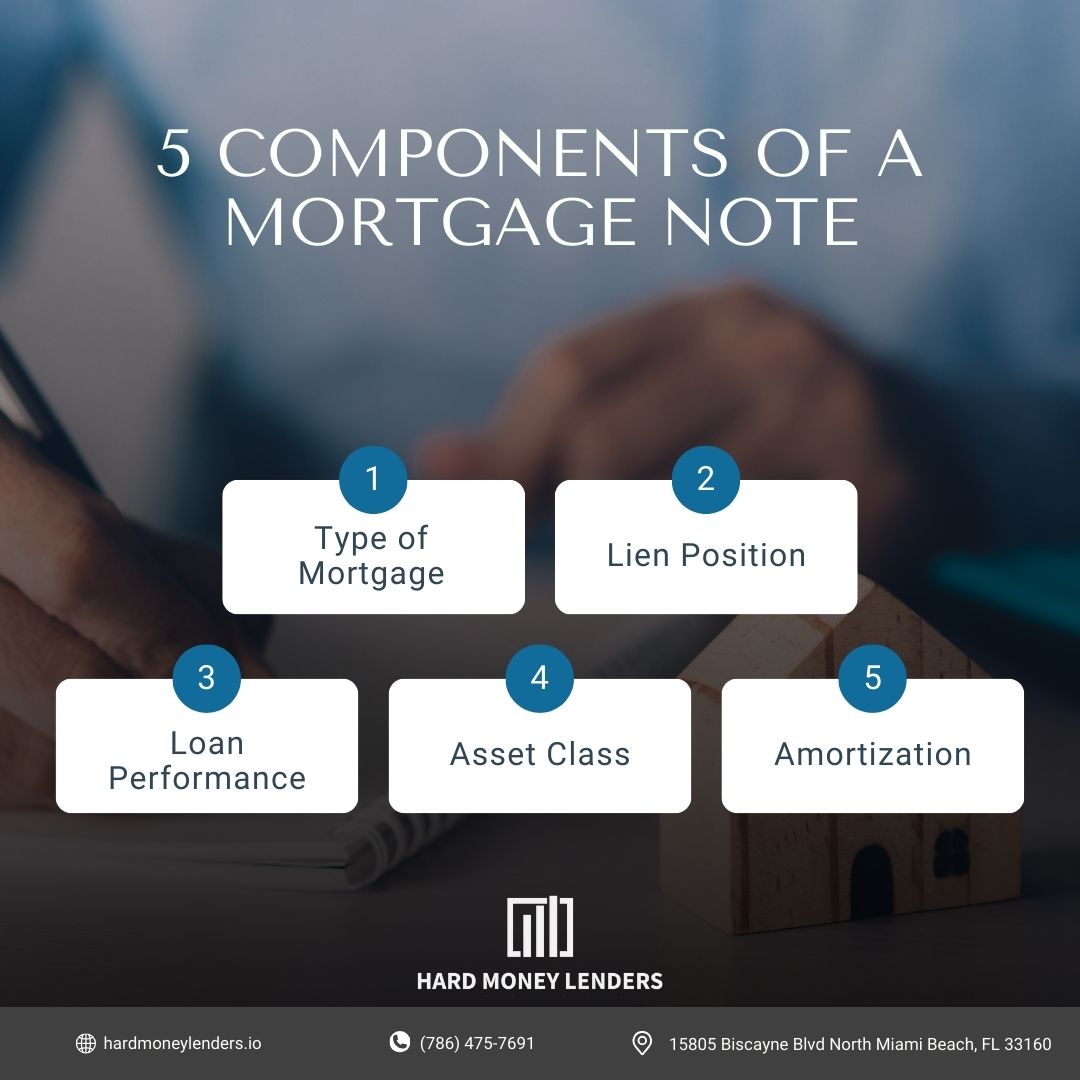

What Are the Components of a Mortgage Note?

A mortgage note is a comprehensive financial document that outlines the terms and conditions of a loan agreement between a borrower and a lender. Understanding the various components of a mortgage note is essential for both borrowers and investors. These components can be categorized by the type of mortgage loan, lien position, performance, and asset class.

A mortgage note is a comprehensive financial document that outlines the terms and conditions of a loan agreement between a borrower and a lender. Understanding the various components of a mortgage note is essential for both borrowers and investors. These components can be categorized by the type of mortgage loan, lien position, performance, and asset class.

Type of Mortgage Loan

Mortgage loans can be classified into various subcategories, such as private loans or institutional loans, and secured or unsecured loans. A secured loan is backed by an asset, typically the property itself. If the borrower defaults, the lender has the right to take ownership of the property. In contrast, an unsecured loan does not have any collateral tied to it, posing a higher risk to the lender. The distinction between institutional and private loans primarily lies in the regulatory oversight, with institutional loans being more heavily regulated.

Lien Position

A lien is a legal right or interest that a lender has in the borrower’s property, granted until the debt obligation is satisfied. Lien position determines the order in which creditors are paid off in the event of foreclosure. A first position lien has the highest priority and will be paid before any other claims on the property. Second or third position liens are subordinate and only receive payment after the first position lien is satisfied. However, certain involuntary liens, such as property tax liens or judgment liens, can take precedence over first position liens.

Loan Performance

Loan performance refers to the payment history of a mortgage note. A “performing” note indicates that the borrower has consistently made timely payments. Conversely, a “non-performing” note means that the borrower has failed to make payments for 90 days or more. Notes that are 30 to 60 days late are often classified as “sub-performing.” The performance of a note is a critical factor for investors, as it impacts the risk and potential return on investment.

Asset Class

The asset class of a mortgage note refers to the type of property securing the loan. This can include single-family homes, small multi-unit properties, apartment complexes, or townhouses. Mortgage notes are typically categorized into residential or commercial notes. The classification affects the note’s risk profile and potential returns, with residential notes often being less volatile than commercial ones.

Amortization

Amortization is the process of gradually paying off a loan through regular payments that cover both principal and interest. An amortized loan reduces the principal balance over time, decreasing the interest owed each month. This contrasts with interest-only loans, where only the interest is paid periodically, and the principal remains unchanged until the loan matures. Understanding amortization is crucial for calculating accurate returns on investment, as it affects the overall cost and income generated by the loan.

Banks’ Perspective

Banks often sell mortgage notes to free up capital and mitigate risks associated with non-performing loans. By selling these notes, banks can avoid foreclosure processes and associated legal costs. Non-performing notes can often be purchased at a discount, providing opportunities for investors to acquire properties below market value. While these notes come with higher risks, they also offer the potential for higher returns and greater control over the investment terms.

Risks and Benefits

Investing in non-performing notes is inherently riskier than performing notes, as it involves taking on loans where the borrower has defaulted. However, this also provides investors with more control over the investment, allowing them to renegotiate loan terms and potentially aid borrowers in recovering their financial standing. Despite the risks, non-performing notes can be a quick way to acquire real estate, which can then be converted into rental properties or sold for profit.

The Process of Buying a Mortgage Note

Understanding the process of buying a mortgage note is crucial for any investor. The decision to purchase a mortgage note hinges significantly on one’s risk tolerance and investment strategy. Investors must decide whether they plan to hold onto the note for steady income or flip it for a potential profit. There are various types of mortgage notes, each carrying different levels of risk and potential return.

Types of Mortgage Notes

Mortgage notes can be categorized by their risk level and return potential. Low-risk mortgage notes typically provide stable and predictable income. These are often performing mortgage notes with a first position lien, ensuring a higher priority in case of borrower default. High-risk mortgage notes, on the other hand, might be available at a significant discount but come with lower lien priority and greater uncertainty.

Investment Strategies

Investors seeking passive income should focus on performing mortgage notes, which have a track record of timely payments. Conversely, purchasing mortgage notes from banks can offer substantial returns but requires a flexible and strategic approach. Banks often sell mortgage notes to manage their loan portfolios and mitigate risks associated with non-performing loans.

Selecting the Right Mortgage Note

When considering where to buy a mortgage note, it’s essential to be selective. The mortgage note market is largely unregulated, leading to potential price inefficiencies. Buying in a secondary market from private sellers often creates a “seller’s market,” making it challenging to find favorable deals. Banks can be a good source of mortgage notes, often selling them to offload non-performing loans or to free up capital for new mortgages.

Reviewing Mortgage Note “Tapes”

A critical step in the buying process is reviewing the mortgage note “tape,” a detailed data sheet that provides essential information about each note’s investment value. This allows investors to make informed decisions. It’s also advisable to position oneself directly in front of decision-makers at banks or companies, demonstrating seriousness and preparedness with a solid real estate investment plan.

Determining a Bid Price

Determining a bid price is another crucial aspect. This price is typically a negotiation between the initial offer and the buyer’s bid, influenced by the borrower’s credit score, payment history, and the remaining number of payments. Institutional notes from banks often differ significantly from those sold by private companies.

Legal Considerations

Engaging a qualified attorney is vital when purchasing a mortgage note. An attorney can review the terms of the promissory note, including interest rates, monthly payments, loan terms, and various waiver clauses. They can also ensure compliance with state-specific real estate laws.

Borrower Vetting

Vetting the borrower is equally important. As a note buyer, conducting due diligence on the borrower’s credit score, credit history, income, and payment history is essential. Understanding the terms of the loan, including interest rates and repayment timelines, helps in assessing the investment’s viability.

Real estate advisors suggest that after two to three years of consistent mortgage payments, an investor can have a reliable gauge of the borrower’s payment history. This period is often ideal for purchasing a note, as many homeowners move every five to seven years, ensuring consistent payments for an additional three to five years.

Metrics for Note Investing

When investing in mortgage notes, understanding key metrics is crucial for making informed decisions. These metrics help investors assess the risk and potential return of a note, ensuring they make sound investments.

Seasoning

Seasoning refers to the length of time a borrower has been making payments on a note. A well-seasoned note is more attractive to investors due to its credible payment history. The longer the seasoning period, the lower the risk associated with the note, as it demonstrates the borrower’s ability to make consistent payments.

Evaluating Non-Performing Notes

Investing in non-performing notes requires careful evaluation. Investors need to vet the borrower thoroughly to determine if they can help the borrower resume payments or, if necessary, take control of the property through foreclosure. The potential to rehabilitate a non-performing note or gain control of the underlying property can offer significant returns, but it comes with increased risk.

Key Financial Ratios

Two critical metrics for note investors are the Loan to Value ratio (LTV) and the Investment to Value ratio (ITV).

- Loan to Value Ratio (LTV): LTV compares the face value of the loan to the property’s market value. A lower LTV indicates a lower risk, as there is more equity in the property relative to the loan amount. For example, if a property is valued at $200,000 and the outstanding loan balance is $100,000, the LTV is 50%.

- Investment to Value Ratio (ITV): ITV compares the purchase price of the mortgage note to the property’s market value. A lower ITV suggests a better investment. For instance, if the same $200,000 property has a mortgage note purchased for $75,000, the ITV is 37.5%. Keeping LTV and ITV ratios at 65% or lower helps mitigate risk, allowing investors to recover most of the loan if foreclosure occurs.

Mortgage Term and Maturity

The term of the mortgage refers to the length of time before the note’s balance is due. Shorter terms are generally preferable for investors, as they reduce the duration of risk exposure. A 15-year mortgage, for example, is more attractive than a 30-year mortgage due to the quicker return of principal and reduced uncertainty over time.

Borrower Quality

Assessing the quality of the borrower is vital for note investors. Key indicators include:

- Credit Score: A high credit score reflects the borrower’s ability to manage debt effectively.

- Debt to Income Ratio (DTI): This ratio indicates the borrower’s ability to repay the loan based on their income relative to their debt. A lower DTI suggests a more reliable borrower.

For rental properties, additional factors such as rental income and debt repayments are crucial. The Debt Service Coverage Ratio (DSCR) is used to evaluate the risk associated with rental properties. A higher DSCR implies higher risk, so investors should aim for properties with lower DSCRs to ensure a safer investment.

Buying Mortgage Notes from Banks

Purchasing mortgage notes from banks can be highly advantageous but challenging. It requires significant time and effort, especially when dealing with non-performing notes that banks are eager to unload.

Importance of Relationships

Building a strong relationship with the seller is crucial for securing mortgage notes from banks. This human connection helps in acquiring non-performing notes that are not listed online. Banks prefer to deal with knowledgeable buyers who understand the complexities involved. Establishing trust and demonstrating expertise can significantly enhance your chances of successfully purchasing these notes.

Compliance and Bulk Sales

Mortgage notes from banks must comply with the Dodd-Frank Act and Bureau of Consumer Financial Protection regulations. Banks often sell non-performing mortgage notes in bulk, requiring buyers to have substantial financial resources. Tools like BankProspector can be helpful, providing a database of over 5,000 banks and contact information for decision-makers. Additionally, understanding the regulatory landscape ensures that your investment is secure and compliant with all legal requirements.

Investors should also be aware that buying in bulk can offer opportunities for negotiating better terms and prices. While this approach requires a more significant initial investment, it can result in a diversified portfolio with varied risk profiles, potentially leading to higher overall returns.

The Process of Buying a Performing Mortgage Note

Cost and Negotiation

Performing notes are generally more expensive and not usually sold at a discount. They are often acquired through private investors rather than banks. The negotiation process focuses on the remaining balance of the mortgage, with performing notes providing regular, predictable payments. Investors must evaluate the current market conditions and the specific terms of each note to ensure they are making a sound investment.

Security and Reliability

Performing notes offer a secure and reliable income stream. Investors receive payments according to the schedule, term, and interest rate, making these notes a stable investment with minimal unpredictability. This type of investment is particularly appealing to those seeking a passive income stream, as it involves less active management compared to other real estate investments.

To maximize the benefits of performing notes, investors should conduct thorough due diligence. This includes reviewing the borrower’s payment history, credit score, and any potential risks associated with the property. By doing so, investors can ensure they are selecting notes that align with their financial goals and risk tolerance.

The Process of Buying a Non-Performing Mortgage Note

Shifting Strategies

Traditionally, banks would foreclose homes when borrowers defaulted. Now, they prefer to sell non-performing notes, allowing buyers to either fix and flip homes or hold them long-term. Buying these notes from banks is difficult because they often sell in bulk, but this can also present unique opportunities for savvy investors.

Private Lenders and Negotiation

Private lenders, hedge funds, and servicers offer a more accessible route for individual investors. These entities may sell non-performing loans individually, often at heavily discounted prices. Buying at a discount can yield a higher return compared to the normal interest rate of a note. Investors must be prepared to negotiate and thoroughly vet each opportunity to ensure they are getting the best possible deal.

Flexibility and Risk

Purchasing non-performing notes offers flexibility, allowing investors to work with homeowners to generate passive income. However, the property’s collateral value is critical. Investors should only buy notes if they would be comfortable owning the property itself. This involves assessing the potential for property appreciation, rental income, and any necessary repairs or renovations.

Additionally, working with distressed homeowners requires empathy and strategic planning. Investors can often restructure the loan to help borrowers get back on track, creating a win-win situation. This approach not only stabilizes the investment but can also build goodwill and a positive reputation in the market.

Key Considerations

Several factors must be evaluated when deciding to buy a non-performing note:

- Property Value: Assess the current condition and market value of the property. This will help determine the potential for recovery and profit if the property is foreclosed and sold.

- Lien Position: Identify any existing liens that could affect the investment. Understanding lien priority is crucial, as it impacts the order in which creditors are paid.

- Unpaid Taxes: Determine any outstanding taxes that need to be addressed. Unpaid taxes can become a significant liability and affect the overall profitability of the investment.

- Payment History: Review the borrower’s payment history on the note. This provides insight into their financial behavior and likelihood of resuming payments.

- Borrower’s Credit Score: Evaluate the borrower’s creditworthiness. A higher credit score indicates a lower risk of default, while a lower score may require additional scrutiny and risk mitigation strategies.

By carefully considering these factors, investors can make informed decisions, ensuring they understand the risks and potential rewards associated with non-performing mortgage notes. This comprehensive approach not only protects their investment but also positions them for long-term success in the mortgage note market.

Additional Insights and Strategies

Diversification

Diversifying your portfolio by investing in a mix of performing and non-performing notes can balance risk and reward. While performing notes provide steady income, non-performing notes offer the potential for higher returns through property acquisition and loan restructuring. This strategy helps mitigate risk and ensures a more stable investment portfolio.

Market Research

Staying informed about market trends and economic indicators is essential for successful note investing. Factors such as interest rates, housing market conditions, and regulatory changes can significantly impact the value and performance of mortgage notes. Regularly reviewing market reports and attending industry conferences can provide valuable insights and help you stay ahead of the curve.

Professional Advice

Consulting with real estate attorneys, financial advisors, and experienced note investors can provide additional guidance and expertise. These professionals can help navigate complex transactions, ensure compliance with legal requirements, and develop effective investment strategies. Building a network of trusted advisors can enhance your decision-making process and improve your overall investment outcomes.

How to Make Money with a Mortgage Note

Investing in mortgage notes can be a lucrative venture, providing a steady stream of passive income. However, while it may seem straightforward, making money from mortgage notes involves careful strategy and understanding of the different types of notes and their associated risks.

Understanding Performing vs. Non-Performing Notes

Making money with mortgage notes is relatively simple with a stable, performing note. These notes are those where the borrower makes regular payments as agreed. This provides a predictable monthly income and a high yield of return.

For non-performing notes, where the borrower has defaulted, the process is more complex but can also be profitable. Investors can modify the terms of the note to help the borrower get back on track. This could involve adjusting the interest rate or other loan factors to make payments more manageable for the borrower. By doing this, the lender can turn a non-performing note into a performing one, known as a re-performing note.

Foreclosure and Real Estate Sales

Another strategy for making money with non-performing notes is foreclosure. After buying the non-performing note at a significant discount, the lender can foreclose on the property and sell it. This can result in substantial profits, especially if the real estate market is favorable. The process of foreclosing and selling real estate requires a thorough understanding of the legal and market dynamics, but it can be a highly effective way to maximize returns.

Selling Payment Portions

Investors can also sell portions of the payment stream from a mortgage note to a third party. This allows the investor to recoup some of their initial investment while retaining some of the note’s benefits. This strategy can be particularly useful for managing cash flow and reducing risk.

Benefits and Risks

Investing in real estate notes is generally considered less risky than direct real estate investing. It provides a way to gain exposure to the real estate market without the complexities of property management. However, it is essential to conduct thorough due diligence. This includes evaluating the borrower’s creditworthiness, understanding the property’s value, and assessing the note’s terms and conditions.

Historical Context and Current Environment

Historically, times of financial crisis have proven profitable for note investors. During the 2008 financial crisis, many investors bought bad debt and made substantial profits from foreclosed real estate. The current economic environment, with low interest rates and federal stimulus dollars, has driven up housing prices, creating a favorable market for investing in real estate notes.

Strategies for Success

To succeed in making money with mortgage notes, consider the following strategies:

- Build Relationships: Establish strong relationships with banks and private lenders to gain access to quality notes.

- Conduct Due Diligence: Thoroughly vet the borrower and the property associated with the note. Assess credit scores, payment histories, and property values.

- Stay Informed: Keep up-to-date with market trends and economic indicators that can affect the value and performance of mortgage notes.

- Seek Professional Advice: Work with real estate attorneys, financial advisors, and experienced note investors to navigate complex transactions and develop effective strategies.

The Costs and Risks of Owning a Mortgage Note

Investing in mortgage notes can be a profitable venture, but it comes with its own set of costs and risks. Understanding these aspects is crucial for making informed decisions and mitigating potential downsides.

Types of Mortgage Notes and Their Risks

Certain types of mortgage notes are inherently riskier than others. Non-performing notes, where the borrower has defaulted, and notes with 2nd or 3rd position liens, which have lower priority in repayment, carry higher risks. However, mortgage notes are generally less risky and less expensive compared to rental properties, making them an attractive option for new investors.

Servicing Costs

One of the primary expenses associated with owning a mortgage note is the cost of servicing the loan. Most investors hire a third-party servicing company to handle loan administration, maintain payment records, and collect payments. These companies benefit both the borrower and the lender by providing detailed statements and ensuring accurate tracking of interest and principal.

Self-Servicing vs. Professional Servicing

Servicing a loan yourself in a heavily regulated market can be challenging and risky. Hiring a third-party servicing company is often recommended to avoid these complexities. Professional servicers can also manage late payments, which can be a significant hassle if handled personally.

Legal Fees and Non-Performing Notes

Non-performing notes come with additional costs, such as legal fees for regaining title and maintaining the property when a borrower defaults. These expenses can add up quickly and should be considered when evaluating the potential profitability of an investment.

Assessing Borrower Risk

The risk associated with mortgage notes is heavily contingent on the borrower’s financial stability, payment history, and credit history. Borrowers experiencing financial instability or with poor payment histories present a higher risk of default, which can affect the note’s profitability.

Property Condition and Valuation

Investors often cannot inspect the property or speak to the borrower before purchasing a note. It is advisable to assume the property is in poor condition to avoid unpleasant surprises. Negotiating significant discounts before buying a mortgage note can also help mitigate potential risks.

Foreclosure Risks

If a borrower defaults, the investor can initiate foreclosure proceedings. However, foreclosure involves legal costs and can negatively impact the borrower’s credit score. For investors holding a 2nd position lien, foreclosure is particularly risky as they may not recover any funds if the property is sold.

Prepayment and Refinancing

When a borrower pays off their mortgage in full or refinances, the note is closed, potentially leading to a loss of future interest income for the investor. Changes in note ownership can also affect the borrower, as the new note holder may alter the interest rate or other mortgage details.

Industry Regulation and Communication Challenges

The mortgage note industry is not highly regulated, which means notes can sometimes be sold without the borrower’s knowledge or permission. This can lead to confusion and poor communication between the borrower and the new note holder. It is essential to research thoroughly before purchasing a note to ensure proper communication and understanding of the borrower’s situation.

Due Diligence and Documentation

Conducting thorough due diligence is critical when buying mortgage notes. This includes verifying lien information, examining the title, and keeping copies of the original note with all amendments. Effective communication with the borrower and a clear understanding of their financial situation can help mitigate risks and ensure a smoother investment process.

Strategies of Mortgage Note Investing

Investing in mortgage notes offers a range of strategies, each with its unique advantages and challenges. Here, we explore several common strategies used by private investors to maximize their returns and manage risks effectively.

Flipping Notes

Flipping notes is a popular strategy among note brokers and hedge funds. This involves buying notes in bulk directly from lenders and then reselling them to individual investors for a profit. While this strategy can be highly profitable, it requires long-term relationships with sellers and extensive experience in the market. Note flipping is typically reserved for more seasoned investors who can navigate the complexities of bulk purchases and resale.

Rehabbing Notes

Rehabbing notes involves modifying the terms of a loan to transform a non-performing note into a re-performing note. This strategy not only helps borrowers get back on track with their payments but also increases the value of the note. Rehabbing notes can be rewarding but requires careful selection of notes and a thorough understanding of the borrower’s financial situation. It’s crucial to adhere to strict regulations surrounding loans and borrowers to avoid legal pitfalls.

Steps for Rehabbing Notes:

- Assess the Borrower: Understand their financial situation, payment history, and willingness to negotiate.

- Modify Loan Terms: Adjust interest rates, extend repayment periods, or change other loan terms to make payments more manageable.

- Negotiate: Work closely with the borrower to reach an agreement that benefits both parties.

- Resell or Hold: After rehabbing, decide whether to resell the note for a profit or hold it to build long-term passive income.

Owning Real Estate

If rehabbing a note isn’t feasible, another strategy is to foreclose and take ownership of the property. This can be an expensive and time-consuming process, especially in the United States. Alternative methods to gain property ownership include taking a Deed in Lieu or negotiating a sale with the borrower. Both options involve substantial investment but can be profitable if handled correctly.

Performing Notes

Buying performing notes is the safest and most straightforward strategy. Although these notes are more expensive and less discounted than non-performing notes, they provide stable, low-maintenance income. Performing notes can be sourced through various platforms, lenders, note brokers, and hedge funds. Research and expert consultation are essential to find high-quality performing notes.

Seller-Financed Loans

Seller-financed loans occur when an owner sells real estate and finances part of the sale to the buyer. This strategy allows buyers who might not qualify for traditional bank loans to become homeowners. The seller acts as a private lender, receiving monthly payments from the buyer. Seller-financed loans are beneficial for both parties and create a reliable income stream for the note holder.

Becoming a Private Lender

Creating your own mortgage notes and acting as a private lender is another viable strategy. This approach involves lending directly to borrowers and earning interest on the loans. It requires thorough vetting of borrowers to ensure they can repay the loan. This strategy is often used by veteran investors who have a deep understanding of the market and borrower behavior.

Key Considerations for Note Investing:

- Due Diligence: Research thoroughly before purchasing any note, especially non-performing ones. Verify the borrower’s financial status and the property’s condition.

- Legal Compliance: Ensure all transactions comply with relevant laws and regulations to avoid legal issues.

- Risk Management: Diversify your portfolio to spread risk and avoid significant losses from any single investment.

- Expert Advice: Consult with real estate professionals and legal advisors to make informed decisions.

Online platforms and lenders that give mortgage bank notes

If securing a mortgage note from a bank is not a current possibility, like it isn’t for most new investors, most have to look for mortgage notes for sale online from private lenders. New investors often have to pay retail prices for mortgage notes and buy individual notes.

Here is a list of online companies that offer mortgage notes:

Hard Money Lenders IO

Here at Hard Money Lenders IO, we offer mortgage notes for sale constantly for you to buy. Our mortgage notes are investment deals that we’re ready to help and willing to give you a pre-qualification on the very same day you submit your information.

Like other platforms, Hard Money Lenders IO allows the modern and digital buying and selling of mortgage notes in a fast-growing market place. We list both performing and non-performing mortgage notes, as well as notes of different loan priorities.

You can apply now to see our investing deals. If the investing deals are not a good fit for you, we also offer hard money loans to help you finance your note purchase. Hard money lenders are professionals who can give loans for renovations, but also for notes. Hard money investors like us can use our own capital and investor money to give you the money to secure a promising note.

Paperstac

Paperstac is a platform that allows modern buying and selling of mortgage notes online. It’s a fast-growing note marketplace that takes note trading in a fully digitized manner. The website allows the viewing of assets for sale,

It lists both performing and non-performing notes. It lists the lien priority and the price of the mortgage note. Paperstac allows any person to buy and sell mortgage notes and see mortgage notes listed. Listing a mortgage note for sale is free, and the platform makes money by charging 1% for successful sales.

Garnaco

Garnaco also has an investor portal that partners with private lenders who want to buy mortgage notes. All of Garnaco’s notes are performing notes, which makes the site incredibly appealing to first-time note investors.

The website also has a priority investor email list, where it sends out details of new lending opportunities and performing notes for sales. Each Thursday, potential investors will get a list of new mortgage notes to keep up to date with deals.

Crowdfunding websites

Crowdfunding is when several investors put in small amounts of capital for financial investment. In the case of note investing, crowdfunding is one way for many people who do not want to commit substantial time, effort, and money into mortgage notes to get one.

The Crowdfund Act in 2015, which allowed companies to use crowdfunding to issue securities, according to Garnaco, was a game-changer in the real estate industry. Crowdfunding websites allow an investor to give a small investment into real estate, and particularly real estate notes.

These note funds allow the experts and professionals to invest while you are removed from the process. A fund manager uses the money to invest in mortgage notes, and the process is much more hands-off than the work of buying your own mortgage notes. Mortgage note funds are often run by accredited investors, and it is essential to do your research on a fund before contributing to it.

Some crowdfunding websites include Peer Street, Patch of Land, and Fundrise.

Note brokers

A note broker is someone who buys mortgage notes from banks and other large institutions, then keeps some while selling other mortgage notes. Note brokers offer many different notes, including re-performing notes, or non-performing notes that have not worked out.

Some notable note brokers include Paper Assets Capital, Fusion Notes, and Noteology.

How to Get Started With Buying Mortgage Bank Notes

Mortgage note investing is often seen as more accessible than traditional real estate investing, but there is still a barrier of entry in terms of time, energy and resources. Investing with banks is difficult due to banks often selling their non-performing notes in bulk.

But for new and individual note buyers, there are other options like private lenders, note buyers, and online platforms. It’s important to assess your goals and your personal risk tolerance, and continue to educate yourself on note investing before making your first note investment. Mortgage notes may help you secure a reliable, consistent income stream, or they can help you secure real estate for cheap. Buying them is an accessible means of investing in real estate, but it’s important to consult with experts and do your research.

Consulting with a real estate expert here at Hard Money Lenders IO for a note you want to buy will get you started as a new investor in mortgage notes. Contact us now for a consultation or for a hard money loan to buy your first note.

FAQs on Buying Mortgage Bank Notes

What are the different types of mortgage notes?

Mortgage notes can be classified into several types:

- Performing Notes: These notes have borrowers who make regular, timely payments. They are considered low-risk and provide a steady income stream for investors.

- Non-Performing Notes: These involve borrowers who have defaulted on their payments, typically for 90 days or more. They carry higher risks but can be purchased at significant discounts.

- Sub-Performing Notes: These are notes where payments are late but not yet in default. They present moderate risk and can potentially be turned into performing notes.

- Non-Conforming Notes: These have unconventional terms and are usually insured by government programs. They can offer unique investment opportunities but require careful evaluation.

What factors should I consider when buying a mortgage note?

When buying a mortgage note, consider the following factors:

- Borrower’s Financial Status: Review the borrower’s credit score, payment history, and income stability to assess their ability to repay the loan.

- Property Value: Evaluate the current market value and condition of the property securing the note. This helps determine the potential for recovery in case of default.

- Lien Position: Understand the priority of the lien. A first position lien has the highest repayment priority, reducing investment risk.

- Loan-to-Value (LTV) Ratio: A lower LTV ratio indicates lower risk, as it means the loan amount is less than the property value.

- Investment-to-Value (ITV) Ratio: A lower ITV ratio suggests a better investment, as the purchase price of the note is lower relative to the property value.

- Legal and Regulatory Compliance: Ensure the note complies with relevant laws and regulations to avoid legal issues.

How do I make money from mortgage notes?

There are several strategies to profit from mortgage notes:

- Flipping Notes: Buy notes in bulk from lenders and resell them to individual investors at a profit. This requires strong relationships with sellers and market expertise.

- Rehabbing Notes: Modify the loan terms to help the borrower resume payments, turning non-performing notes into performing notes. This can increase the note’s value and provide steady income.

- Foreclosure: If the borrower defaults, you can foreclose on the property and sell it. This can be profitable but involves legal costs and effort.

- Selling Payment Portions: Sell portions of the payment stream to third parties to recoup part of your investment while retaining some benefits of the note.

- Holding Performing Notes: Maintain performing notes for steady, predictable income over time.

What are the risks associated with mortgage note investing?

Mortgage note investing comes with several risks:

- Borrower Default: If the borrower fails to make payments, the note can become non-performing, potentially leading to foreclosure and legal costs.

- Foreclosure Costs: Initiating foreclosure proceedings can be expensive and time-consuming.

- Prepayment Risk: If the borrower pays off the loan early, you may lose future interest income.

- Market and Economic Conditions: Changes in the real estate market and broader economy can affect property values and borrower stability.

- Regulatory Risks: Non-compliance with legal and regulatory requirements can lead to legal challenges and financial losses.

How do I evaluate non-performing notes?

Evaluating non-performing notes involves careful assessment:

- Borrower Evaluation: Thoroughly vet the borrower’s financial situation, credit history, and payment behavior to gauge their ability to resume payments.

- Property Assessment: Determine the current condition and market value of the property securing the note. This helps assess recovery potential if foreclosure is necessary.

- Lien Position and Existing Liens: Understand the lien’s priority and identify any other liens that could affect your investment.

- Legal and Maintenance Costs: Consider the potential legal fees and costs associated with maintaining the property if you need to foreclose.

What are the key financial ratios in note investing?

Two critical financial ratios for note investors are:

- Loan-to-Value (LTV) Ratio: This compares the loan amount to the property’s market value. A lower LTV indicates lower risk, as there is more equity in the property.

- Investment-to-Value (ITV) Ratio: This compares the purchase price of the mortgage note to the property’s market value. A lower ITV suggests a more favorable investment, as it indicates a better price relative to the property’s value.

How do I choose between performing and non-performing notes?

Choosing between performing and non-performing notes depends on your investment goals and risk tolerance:

- Performing Notes: These provide stable, predictable income with lower risk. They are ideal for investors seeking passive income and minimal management effort.

- Non-Performing Notes: These can be purchased at a discount and offer higher potential returns. However, they require active management, including possible loan modifications or foreclosure, and carry higher risks.

What role do servicing companies play in mortgage note investing?

Servicing companies manage the administrative aspects of mortgage notes, including:

- Payment Collection: They handle collecting payments from borrowers and tracking payment history.

- Record-Keeping: They maintain detailed records of interest, principal, and any late payments.

- Compliance: They ensure the loan servicing complies with regulatory requirements, reducing legal risks for the investor.

- Late Payment Management: They pursue late payments and manage communication with borrowers, alleviating the investor’s administrative burden.

How can I get started with mortgage note investing?

To start investing in mortgage notes, follow these steps:

- Educate Yourself: Learn about the mortgage note market, investment strategies, and risks involved. Consider taking courses or reading books on the subject.

- Assess Your Goals: Determine your financial goals and risk tolerance. Decide whether you prefer passive income from performing notes or higher returns from non-performing notes.

- Conduct Due Diligence: Research potential notes thoroughly, including the borrower’s financial status, property condition, and lien position.

- Build Relationships: Establish connections with banks, private lenders, and note brokers to access quality notes.

- Seek Professional Advice: Consult with real estate attorneys, financial advisors, and experienced note investors to guide your investment decisions.

- Start Small: Begin with a smaller investment to gain experience and gradually build your portfolio as you become more comfortable with the process.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.