Florida Short Sales: How Do Short Sales Work in Florida

Short sales in Florida offer a solution for homeowners facing financial hardship. In a short sale, the homeowner and mortgage company agree to sell the property for less than the amount owed on the mortgage. This provides an alternative to foreclosure and allows homeowners to avoid damaging their credit further. Short sales in Florida present an opportunity for potential buyers to purchase properties at discounted prices. However, it’s important to understand that the process can be complex and time-consuming. Patience and persistence are key when navigating a Florida short sale. With the right knowledge and guidance, both buyers and sellers can benefit from this real estate option.

What is a Short Sale in Real Estate?

A short sale is a real estate transaction where the homeowner, with the approval of their mortgage lender, sells the property for less than the amount owed on the mortgage. The purpose of a short sale is to provide an alternative to foreclosure for homeowners who are facing financial hardship and are unable to continue making their mortgage payments.

By agreeing to a short sale, the lender forgives the remaining balance on the loan, allowing the homeowner to avoid foreclosure and potentially minimize the damage to their credit. Short sales in Florida offer homeowners a chance to alleviate their financial burden while also providing potential buyers with an opportunity to purchase properties at a discounted price.

Benefits and drawbacks of pursuing a short sale in Florida

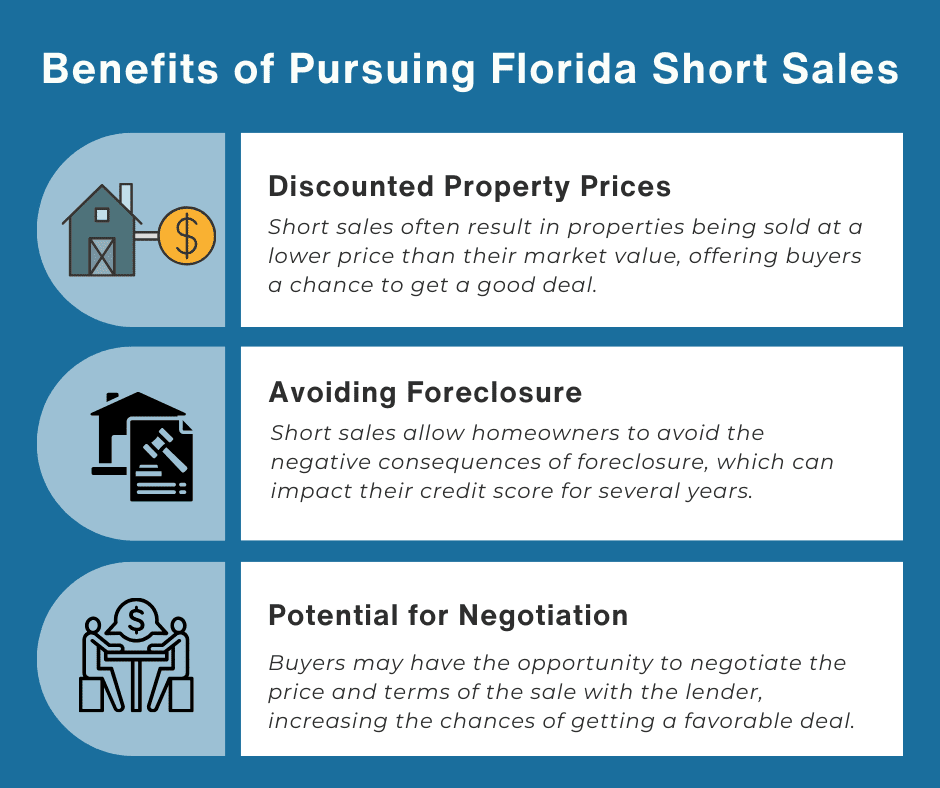

Pursuing a short sale in Florida can have several benefits and drawbacks. Some of the benefits include:

- Discounted prices: Short sales often result in properties being sold at a lower price than their market value, offering buyers a chance to get a good deal.

- Avoiding foreclosure: Short sales allow homeowners to avoid the negative consequences of foreclosure, which can impact their credit score for several years.

- Potential for negotiation: Buyers may have the opportunity to negotiate the price and terms of the sale with the lender, increasing the chances of getting a favorable deal.

However, there are also drawbacks to consider:

- Lengthy process. Short sales can take longer than traditional real estate transactions, as they involve negotiations with the lender and additional paperwork.

- Uncertainty. There is no guarantee that the lender will approve the short sale, which means buyers may invest time and resources into a property that may not be sold.

- Limited inventory. Short sales may have limited inventory in certain areas, making it more challenging for buyers to find suitable properties.

Overall, pursuing a short sale in Florida can be a viable option for buyers looking for discounted properties, but it requires patience and careful consideration of the potential risks involved.

The Short Sale Process in Florida

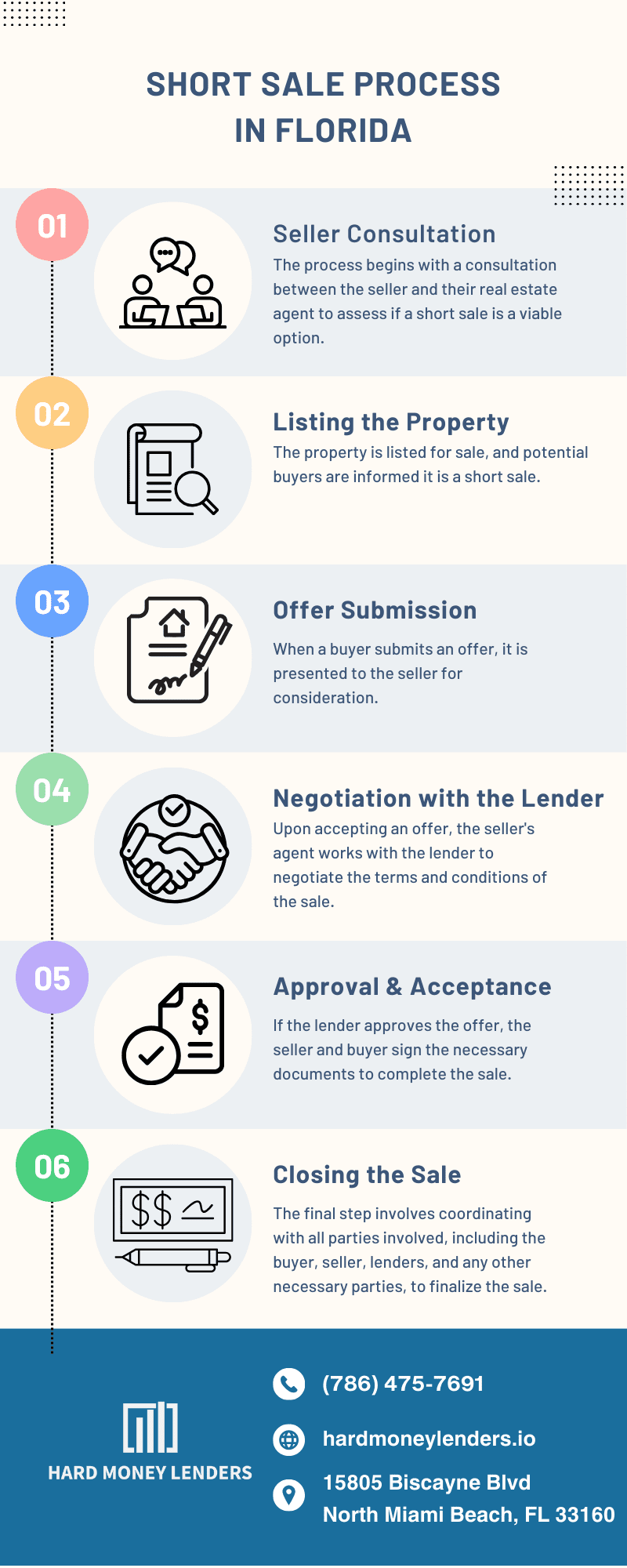

The short sale process in Florida involves several steps and can be complex. Here is a step-by-step guide to help you understand the process:

- Seller consultation. The process begins with a consultation between the seller and their real estate agent to assess if a short sale is a viable option.

- Listing the property. The property is listed for sale, and potential buyers are informed it is a short sale.

- Offer submission. When a buyer submits an offer, it is presented to the seller for consideration.

- Negotiation with the lender. Upon accepting an offer, the seller’s agent works with the lender to negotiate the terms and conditions of the sale.

- Approval and acceptance. If the lender approves the offer, the seller and buyer sign the necessary documents to complete the sale.

- Closing the sale. The final step involves coordinating with all parties involved, including the buyer, seller, lenders, and any other necessary parties, to finalize the sale.

It’s essential to note that the short sale process can vary depending on the lender and the specific circumstances of the sale. Working with an experienced real estate agent who specializes in short sales can help navigate through the process successfully.

Required documents and approvals for a short sale in Florida

When pursuing a short sale in Florida, there are several required documents and approvals that both the seller and the buyer must provide. For the seller, some of the essential documents include a hardship letter, financial statements, tax returns, bank statements, pay stubs, and a purchase contract. These documents help demonstrate the seller’s financial hardship and provide evidence of the buyer’s ability to purchase the property.

Additionally, the lender will also require an appraisal or a broker’s price opinion to determine the property’s value. It is crucial for both parties to carefully review and promptly submit all required documents to ensure a smooth and successful short-sale transaction.

Potential Challenges and Considerations in Florida Short Sales

- Lengthy and Uncertain Process. Short sales often involve multiple parties, including the seller, buyer, lender, and potentially other lien holders. This can lead to a lengthy and uncertain process, with negotiations and approvals taking months to finalize.

- Financial Implications. Sellers must demonstrate financial hardship to qualify for a short sale, which can impact their credit score and future borrowing abilities. Buyers may face challenges securing financing for a short-sale property, as lenders may have stricter requirements.

- Limited Inventory. Short sales can provide opportunities for buyers to purchase properties at a discounted price. However, the inventory of short-sale properties may be limited, making it important for buyers to act quickly when a desirable property becomes available.

- Potential for Counteroffers. Lenders may reject the initial offer or propose a counteroffer, creating additional negotiation and uncertainty in the short sale process.

- Property Condition. Florida short-sale properties may not have been well-maintained by sellers facing financial difficulties. Buyers should be prepared for potential repairs or maintenance issues.

- Complex Negotiations. Negotiating with lenders and other parties involved in a short sale can be complex and require expertise. It’s essential to work with a knowledgeable real estate agent or attorney to navigate the negotiation process effectively.

It’s important for both buyers and sellers to understand the potential challenges and considerations involved in Florida short sales. Consulting with professionals, conducting thorough due diligence, and being prepared for potential obstacles can help facilitate a successful short-sale transaction.

Ways to overcome common challenges in the Florida short sale process

To overcome common challenges in the Florida short sale process, there are several strategies that buyers and sellers can employ. Here are some ways to navigate these obstacles:

- Communication and Patience. Clear communication between all parties involved is crucial for a successful short sale. Patience is key, as the process can be lengthy and involve negotiations.

- Experienced Professionals. Working with experienced real estate agents and attorneys who specialize in short sales can make a significant difference in navigating the complexities of the process.

- Documentation and Preparation. Having all required documents and financial information readily available can streamline the process and prevent delays.

- Proactive Approach. Proactively addressing any issues or concerns can help resolve them more efficiently and prevent further complications.

- Flexibility. Being open to negotiation and compromise can increase the chances of a successful short sale.

By implementing these strategies, buyers and sellers can overcome challenges and increase the likelihood of a successful short-sale transaction in Florida.

Legal and Financial Implications of Florida Short Sales

When considering a short sale in Florida, it is crucial to be aware of the legal and financial implications involved. From a financial standpoint, sellers may face potential tax consequences and damage to their credit scores. It is advisable to consult with a tax professional and a financial advisor to understand the specific implications and potential risks.

Legally, Florida has specific laws and regulations regarding short sales, and it is essential to ensure compliance with these laws. Buyers and sellers should be aware of their rights and responsibilities during the transaction. Legal protections and disclosures, such as the requirement to disclose any material defects in the property, must be followed to avoid possible legal consequences.

Navigating the legal and financial aspects of a short sale in Florida requires careful consideration and professional guidance to protect both parties’ interests.

Tax and credit implications of a short sale in Florida

When considering a short sale in Florida, it is crucial to be aware of the potential tax and credit implications. From a tax perspective, sellers may be subject to potential tax consequences due to the cancellation of debt. The forgiven debt may be deemed as taxable income by the IRS.

It is advisable to consult with a tax professional to understand the specific tax implications and potential eligibility for tax exemptions or exclusions.

In terms of credit, a short sale can have a negative impact on the seller’s credit score. It may be reported as a “settled for less than the full amount” status on their credit report, which can lower their credit score. This can make it more challenging to obtain future credit or loans. However, the impact on credit is generally less severe compared to a foreclosure.

It is important for sellers to understand and weigh the potential tax and credit consequences before pursuing a short sale in Florida.

Legal protections and disclosures in a Florida short sale transaction

In a Florida short sale transaction, there are legal protections and disclosures in place to ensure transparency and fairness for all parties involved. Sellers must disclose any known defects or issues with the property to potential buyers.

This is typically done through a Seller’s Disclosure Statement, which outlines the condition and history of the property. Additionally, Florida law requires licensed real estate agents to provide a disclosure when advertising short-sale services.

This disclosure informs potential buyers that the seller’s lender may require the approval of the sale and that the seller may be responsible for any deficiencies after the sale. These legal protections and disclosures help to protect the interests of both buyers and sellers in a Florida short sale transaction.

Final Thoughts on Real Estate Short Sales in Florida

Now that you understand Florida’s short sales, you probably know they can be a viable option for both buyers and sellers in Florida. For potential buyers, short sales offer the opportunity to purchase a property at a discounted price. It allows them to get a good deal and potentially build equity in the long run. However, it is important to be aware of the potential challenges and risks involved, such as the lengthy process and potential financing obstacles.

For sellers facing financial hardship, a short sale can provide an alternative to foreclosure and help them avoid devastating credit consequences. Overall, it is crucial for both buyers and sellers to work with experienced real estate professionals who are knowledgeable in the niche market of Florida short sales.

For buyers, it can help to look for alternative lenders, as it can be easier to secure a loan to acquire Florida short sales.

Questions People Also Ask About Short Sales in Florida

Potential buyers, first-time homeowners, and risk-tolerant investors in Florida often have questions about short sales. Here are some frequently asked questions about short sales in Florida.

Knowing the answers to these questions can help individuals better navigate the short sale market in Florida and make informed decisions.

What are the red flags of a Florida short-sale scam?

Potential buyers and homeowners should be aware of the red flags that may indicate a short-sale scam. These red flags include:

- Unrealistic promises. Be cautious of any individual or company that guarantees a successful short sale or promises to eliminate all mortgage debt.

- Upfront fees. Legitimate short-sale transactions typically do not require upfront fees. If someone asks for payment before providing any services, it could be a scam.

- Pressure tactics. Scammers may pressure homeowners to quickly sign documents without carefully reviewing them or consulting with a professional.

- Unauthorized third parties. Be cautious of any third party who claims to be working on behalf of the lender without proper authorization.

- Lack of transparency. If the person or company involved in the short sale is evasive or unwilling to provide clear explanations about the process, it could be a sign of fraudulent activity.

To avoid falling victim to a short-sale scam, it is important to work with reputable real estate professionals, conduct thorough research, and seek guidance from a qualified professional.

How long does a short sale process typically take in Florida?

The duration of a short sale process in Florida can vary depending on various factors. On average, it can take a few months to longer than six months to complete a short sale. The timeline is influenced by factors such as the efficiency of the lender, the complexity of the mortgage situation, and the responsiveness of all parties involved, including the buyer, seller, and lender. It is important for both buyers and sellers to have patience and be prepared for a potentially lengthy process. It is also wise to have backup options in case the short sale does not work out as planned.

Can I qualify for a mortgage to buy a short-sale property?

Qualifying for a mortgage to buy a short-sale property in Florida is possible, but it can be challenging. Lenders may have stricter requirements for financing a short sale compared to a traditional sale.

Buyers will need to go through the usual mortgage application process, which includes providing financial documentation and meeting credit score criteria. It’s important to note that short-sale properties are typically sold “as-is,” meaning there may be repairs or maintenance needed.

Lenders may also require a higher down payment or have more stringent appraisal requirements. That being said, working with a knowledgeable real estate agent and mortgage lender who have experience with short sales can help navigate the process and increase the chances of mortgage approval.

If you’re looking for a loan to acquire a Florida short sale, call our team at Hard Money Lenders and they’ll let you know if you qualify. Click (786) 475-7691 to contact us.

What are the tax implications of buying or selling a short-sale property?

When buying or selling a short-sale property in Florida, there are important tax implications to consider. It would be wise if you consult with a tax professional for detailed guidance in your specific situation. Here are some general points to keep in mind:

- Potential Income Tax. If the lender forgives a portion of your mortgage debt in a short sale, the IRS may consider this as taxable income. This could result in you owing taxes on the forgiven amount.

- Mortgage Forgiveness Debt Relief Act. Under this act, certain homeowners may be exempt from paying taxes on forgiven mortgage debt related to a primary residence. Now, this includes short sale situations. However, this act has expired but may still apply to older debts.

- Consult a Tax Professional. Tax laws can be complex and subject to change. It’s advisable to seek professional assistance to understand the specific tax implications of buying or selling a short-sale property in Florida.

Remember, understanding the tax implications can help you make informed decisions and avoid any unexpected financial burdens.

What type of financing is available for Florida short sales?

When it comes to financing a Florida short sale, potential buyers have several options available. These include:

- Conventional Loans. Buyers can choose to finance their short-sale purchase through a conventional mortgage loan. This type of loan typically requires a higher credit score and a larger down payment.

- FHA Loans. The Federal Housing Administration (FHA) offers loans specifically designed for first-time homebuyers and those with lower credit scores. FHA loans can be an attractive option for buyers looking to finance a Florida short sale.

- Cash Buyers. Cash buyers have the advantage of not needing to secure financing. This can be appealing to sellers in a short-sale situation as it reduces the risk of financing falling through.

- Hard Money Lenders. This type of financing provides buyers with quick access to capital and may be appealing to those who want short-term financing.

It’s important for buyers to consult with a professional to explore their financing options and determine the best approach for their individual circumstances.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.