How to Finance a Yacht in Florida

Florida is arguably the best place to own a yacht. We’ve seen celebrities and CEOs like Steven Spielberg, Larry Ellison and Tom Brady with yachts in Florida. It’s a dream destination for many, and if you own a yacht in cities like Miami—that can open up the doors for business dealings. Owning a yacht in Florida opens up endless opportunities for luxury, relaxation, and adventure. However, purchasing a yacht in Florida is a significant financial commitment. That said, if you’ve ever thought about buying a yacht like many people, including myself, it’s important to learn how to finance a yacht in Florida.

Before we get into detail about the steps involved in financing a yacht in Florida, I’m going to go over a little bit about yacht financing and why to finance a yacht in Florida.

What is Yacht Financing?

Yacht financing is a tailored loan specifically designed to assist individuals in purchasing a yacht. Much like home or car financing, a yacht loan enables buyers to spread the cost of this substantial investment over time, making yacht ownership more feasible for a wider range of people. The process of obtaining a yacht loan involves several steps and considerations, which can differ based on your circumstances.

When applying for yacht financing, detailed financial information, including your credit score, income, and current debt, is typically required. Lenders use this data to evaluate your creditworthiness and determine your loan’s terms, such as the interest rate and repayment period. Yacht loans can feature either fixed or variable interest rates, with terms spanning from a few years to several decades.

A unique aspect of yacht financing is that the yacht itself often serves as collateral for the loan. This means that if the borrower defaults, the lender has the right to seize the yacht to recover the outstanding debt. Given that yachts are high-value assets, lenders may also require a marine survey to assess the vessel’s condition and value before approving the loan.

Yacht financing is applicable not only for new yachts but also for purchasing pre-owned vessels or refinancing existing yacht loans. Some lenders specialize in marine financing and offer customized loan products to meet yacht buyers’ specific needs. These specialized lenders often have more flexible lending criteria and can provide higher levels of customer service compared to traditional banks.

Furthermore, yacht financing can include various features such as interest-only periods, balloon payments, and flexible repayment options. These features can help manage cash flow and make yacht ownership more financially manageable.

Why Finance a Yacht in Florida?

Florida is a premier destination for yachting enthusiasts, offering an unmatched combination of natural beauty, favorable weather, and a vibrant maritime culture. Financing a yacht in Florida can significantly enhance your lifestyle, providing both leisure and investment opportunities that are hard to match elsewhere.

One of the main reasons to finance a yacht in Florida is the state’s extensive network of waterways. With over 1,350 miles of coastline, numerous rivers, lakes, and the famous Intracoastal Waterway, Florida is a paradise for boaters and yachting aficionados. These waterways offer endless opportunities for exploration, from tranquil fishing spots and secluded anchorages to bustling ports and vibrant waterfront cities.

Florida’s favorable climate is another compelling reason to finance a yacht in the Sunshine State. With warm temperatures and sunny skies, Florida offers year-round boating opportunities. Whether you enjoy leisurely weekend cruises, long-distance sailing, or high-speed adventures, the state’s climate means you can make the most of your yacht throughout the year.

Open Up A World of Social Opportunities

Financing a yacht in Florida also opens up a world of social and recreational opportunities. The state hosts numerous yachting events, regattas, and boat shows, attracting enthusiasts from around the world.

These outings offer excellent opportunities to connect with fellow yacht owners, participate in exciting competitions, and even make business deals.

Additionally, owning a yacht in Florida can offer significant investment potential. The state’s thriving tourism industry and growing demand for luxury charters mean your yacht can generate rental income when not in use. Many yacht owners in Florida choose to charter their vessels, leveraging the high demand for private yacht charters to offset ownership costs and even turn a profit.

Overall, financing a yacht in Florida is an investment in a lifestyle that offers unparalleled freedom, adventure, and luxury. With its ideal boating conditions, comprehensive maritime infrastructure, and vibrant yachting community, Florida is the perfect place to enjoy the many benefits of yacht ownership.

How to Finance a Yacht in Florida

Traditional Yacht Financing Options

Many banks and credit unions offer yacht loans, making traditional financing a viable option for many prospective yacht owners. Traditional yacht loans in Florida typically come with fixed interest rates and repayment terms that can range from a few years to a few decades, allowing borrowers to spread the cost over an extended period. For instance, interest rates on yacht loans from traditional banks might start at around 6.5% to 8%, but the exact rate can vary significantly based on the applicant’s creditworthiness and the loan amount.

Traditional lenders usually require a strong credit score and a stable financial history. They will assess the borrower’s income, debt-to-income ratio, and overall financial health. The application process can be detailed and lengthy, involving the submission of various financial documents, including tax returns, bank statements, and proof of income.

One of the advantages of traditional financing is the potential for lower interest rates, especially for borrowers with excellent credit scores. Additionally, established banks and credit unions often have customer loyalty programs that might offer better terms to existing customers. However, the stringent approval criteria can be a barrier for some borrowers.

For example, J.P. Morgan Chase offers competitive yacht loans with flexible terms, but they emphasize the need for good credit and a strong financial background.

Alternative Yacht Financing in Florida

Hard money lenders offer an excellent alternative for individuals who may not meet the stringent criteria of traditional banks or seek more flexible loan options. These lenders specialize in providing quick and adaptable financing solutions, recognizing the unique aspects of high-value purchases like yachts. Consequently, they can offer loan products that often better suit the specific needs of yacht buyers.

Hard money loans are typically asset-based, meaning the yacht itself serves as collateral. This can be particularly advantageous for buyers with less-than-perfect credit or those needing to secure financing rapidly. Hard money lenders generally have more lenient approval criteria compared to traditional banks, making yacht ownership more accessible than ever.

Now, Hard Money Lenders IO specializes in yacht financing in Florida, and unlike many other lenders— Hard Money Lenders IO offers personalized yacht loans. At Hard Money Lenders IO, we understand that every yacht enthusiast has unique needs, and we provide financing tailored to your situation.

Benefits of Financing a Yacht in Florida with HardMoneyLenders.io

Benefits of Financing a Yacht in Florida with HardMoneyLenders.io

Lower Upfront Costs

Enjoy the Florida waters without sinking your funds. Our financing options require minimal upfront payment, allowing you to allocate your resources more efficiently.

Preserve Your Investments

Instead of liquidating your assets, use our financing solutions to maintain your investment strategy while still acquiring your dream yacht. Keep your portfolio intact and grow your wealth.

Budget with Confidence

Fixed monthly payments help you plan your finances with certainty. We make sure there are no surprises, just smooth sailing as you navigate your financial commitments.

Yacht Loan Rates in Florida

Current Market Rates

As of 2024, yacht loan interest rates have been on a downward trend, with fixed rates starting around 7%. This decline can be attributed to recent economic trends and favorable lending conditions. Variable-rate loans may offer even lower initial rates, although they come with the risk of rate increases over time.

Factors Influencing Loan Rates

Several factors influence yacht loan rates, including your credit score, the desired loan amount for the yacht, loan term, and the prevailing economic climate. Additionally, the age and condition of the yacht, the down payment amount, and the lender’s specific policies play crucial roles. Generally, a higher credit score and a larger down payment result in lower interest rates. Understanding these factors can help prospective yacht buyers secure more favorable loan terms.

Luxury Yacht Loans in Florida

You’ve probably seen the massive yachts before. If you’ve been on one like I have—it’s awe-inspiring, and if you’re looking to get a “super yacht”, then look into luxury yacht loans.

High-net-worth individuals seeking to purchase luxury yachts have access to exclusive financing options tailored to their unique needs. These specialized loan products are crafted with affluent buyers in mind, offering personalized service, flexible terms, and bespoke loan structures not typically available through standard financing routes. High-end yacht loans often feature custom-tailored terms, variable interest rates, and concierge-level service to ensure a seamless and convenient financing experience.

Lenders offering these exclusive financing options understand the complexities and specific requirements associated with purchasing luxury yachts. Consequently, they provide highly individualized services, including dedicated lenders who work closely with clients to structure the loan to best suit their financial situation and objectives. This level of personalized service extends to every aspect of the loan process, from initial consultation to final disbursement of funds.

Loan Amounts and Terms

High-end yacht loans can cover substantial amounts, often exceeding $1 million and going up to $25 million or more, depending on the lender and the borrower’s needs. These loans are structured to accommodate the significant financial commitments involved in purchasing luxury yachts. For example, Hard Money Lenders offers yacht financing for boats ranging between $1,000,000 and $25,000,000, providing a broad spectrum of loan amounts to meet the diverse requirements of luxury yacht buyers.

Requirements to Finance a Yacht in Florida

Credit Score and Financial History

Yacht lenders typically require a good credit score, often above 700, coupled with a solid financial history to qualify for yacht loans. Lenders will scrutinize your credit report to assess your payment history and overall creditworthiness. This review helps lenders gauge the risk involved in lending to you and sets the stage for negotiating loan terms such as interest rates and repayment periods.

Income and Debt-to-Income Ratio

Lenders evaluate your ability to repay a boat loan by examining your income and debt-to-income ratio (DTI).

A lower DTI increases typically your chances of approval, with lenders generally preferring a DTI below 40%. As a rule of thumb, your total monthly debt payments shouldn’t exceed 40% of your gross monthly income. Lenders will also consider your overall financial stability, including your employment history and income consistency. A stable income and long-term employment can positively influence the lender’s decision.

Collateral and Down Payments

Yacht loans typically require a down payment, usually around 20% of the yacht’s value. The yacht itself often serves as collateral for the loan. For higher loan amounts, the down payment requirement might increase to 25% or even 30%. This collateral arrangement helps secure the loan and can sometimes result in more favorable interest rates. The yacht’s value and condition are crucial in determining the loan amount and the interest rate. A well-maintained yacht that retains its value can serve as strong collateral, reducing the lender’s risk and potentially leading to better loan terms.

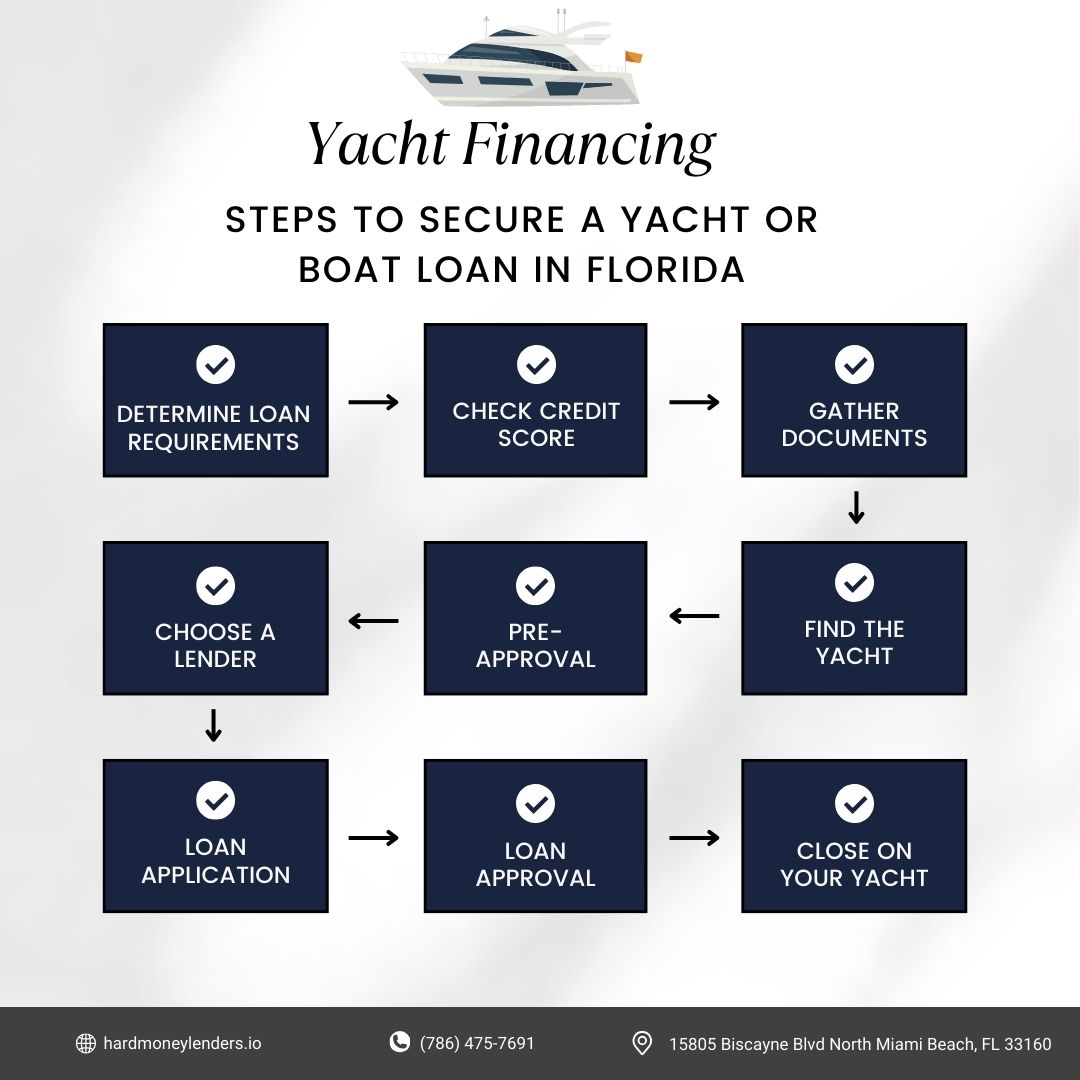

Steps to Secure a Yacht or Boat Loan in Florida

Securing a yacht or boat loan in Florida involves several steps to make sure both the borrower and lender are protected, and that the loan is structured to benefit both parties. Here’s a detailed guide to help you through the process:

Securing a yacht or boat loan in Florida involves several steps to make sure both the borrower and lender are protected, and that the loan is structured to benefit both parties. Here’s a detailed guide to help you through the process:

1. Determine Your Budget and Loan Requirements

Before you start the loan application process, it’s essential to have a clear understanding of your budget and loan requirements. Consider all costs associated with owning a yacht, including the purchase price, insurance, maintenance, docking fees, and other related expenses. Determine how much you can afford for a down payment and what loan amount and terms you are comfortable with.

2. Check Your Credit Score

Your credit score is a critical factor in securing a yacht loan. Yacht loan lenders use your credit score to assess your creditworthiness. Additionally, they’ll use it to determine the interest rates and terms of your loan. A higher credit score can help you secure better loan terms. Check your credit report for any inaccuracies and take steps to improve your score if necessary. Most lenders prefer a credit score of at least 700 for yacht loans.

3. Gather Financial Documentation

Lenders require detailed financial documentation to process your loan application. This typically includes:

- Income Verification: Pay stubs, tax returns, and proof of other income sources.

- Asset Statements: Bank statements, investment account statements, and proof of other significant assets.

- Debt Information: A list of current debts and obligations to assess your debt-to-income ratio.

4. Choose the Right Lender

Selecting the right lender is crucial. You can choose between traditional banks, credit unions, and specialized marine lenders. Traditional banks and credit unions offer competitive rates but may have stricter requirements. Specialized marine lenders, such as Hard Money Lenders, provide more flexible terms and personalized services tailored to yacht financing. Research various lenders and compare their loan products, interest rates, and terms to find the best fit for your needs.

5. Pre-Qualification and Pre-Approval

Getting pre-qualified or pre-approved for a loan can streamline the purchasing process. Pre-qualification gives you an estimate of the loan amount you might qualify for based on your financial information. Pre-approval is a more detailed process where the lender verifies your financial information and gives you a conditional commitment for a specific loan amount. Pre-approval can strengthen your position when negotiating with sellers, as it shows you are a serious and qualified buyer.

6. Find the Right Yacht

Once you have a clear budget and pre-approval, start looking for the yacht that meets your needs and preferences. Work with a yacht broker to explore available options and make sure the yacht is in good condition. A marine surveyor can inspect the vessel to assess its value and condition, which is often a requirement for securing a loan.

7. Submit the Loan Application

Submit a formal loan application to your chosen lender. This application will include detailed information about the yacht you intend to purchase, as well as your financial documentation. Be prepared to provide the yacht’s purchase agreement, a recent marine survey, and proof of insurance.

8. Loan Approval and Documentation

Once your application is submitted, the lender will review your financial documents and the yacht’s value and condition. If everything is in order, the lender will approve your loan and provide a loan agreement outlining the terms and conditions. Review the loan agreement carefully, and consult with a financial advisor or lawyer if necessary so you understand all the terms.

9. Closing the Loan

The final step is closing the loan, where you sign all necessary documents and finalize the purchase of the yacht. This process often involves paying closing costs, which can include loan origination fees, documentation fees, and registration costs. Once the loan is closed, the lender will disburse the funds to the seller, and you will take ownership of the yacht.

10. Post-Purchase Considerations

After securing your yacht, you should maintain proper insurance coverage and keep up with regular maintenance to protect your investment. Keep detailed records of all maintenance and repairs, as this can help preserve the value of your yacht and simplify any future resale or refinancing processes.

Thinking of Financing a Yacht in Florida?

Financing a yacht in Florida unlocks a world of opportunities for maritime adventures, allowing you to explore the state’s stunning waterways and vibrant boating culture. By understanding your financing options and partnering with specialized lenders like HardMoneyLenders.io, you can navigate the process smoothly and secure the yacht of your dreams. These lenders offer tailored loan products and personalized services, ensuring that your unique needs are met.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.