How to Get 100% Financing through Hard Money Loans

If you’re wondering how to get 100% financing for a real estate investment purchase, we’re here to help! Finding 100% real estate financing can be difficult, particularly because most private money lenders will avoid this level of risk. However, through using 100% hard money loans, we’ll explain possible ways to overcome this problem. This article deals with hard money loans from private lending companies in regard to real estate investments.

Understanding Hard Money Loans

Hard money loans stand apart in the world of finance as they offer a distinct approach to funding, particularly beneficial in the real estate sector. These loans are not sourced from traditional financial institutions like banks but rather come from private investors or specialized lending companies. The key characteristic that defines a hard money loan is its security basis, which is the value of the real estate property itself, rather than the borrower’s credit score or financial history.

This asset-based lending approach enables lenders to focus on the potential value and profitability of the investment property, rather than the borrower’s creditworthiness. As a result, hard money loans can be approved and disbursed much more quickly than traditional loans, often within days. This rapid turnaround is invaluable for real estate investors who need to act swiftly to clinch deals, bid at auctions, or capitalize on short-term market opportunities.

Not only that but because hard money lenders are primarily interested in the collateral value, they are often willing to overlook issues that would be red flags for traditional lenders, such as poor credit scores or unconventional income sources. This makes hard money loans an accessible financing option for a wider range of investors, including those who might be rehabbing properties or investing in real estate as a side business.

The Appeal of 100% Financing

Securing 100% financing through hard money loans carries several significant advantages for real estate investors, making these loans a sought-after tool for those looking to maximize their market impact without tying up personal capital.

- Cash Conservation: One of the primary benefits of 100% financing is the ability to conserve cash. By securing full financing for the purchase price and potentially some or all of the renovation costs, investors can keep their liquid assets free for other uses. This flexibility is crucial for investors who may need to cover unexpected expenses, invest in multiple properties simultaneously, or simply wish to maintain a buffer for personal financial security.

- Leverage: 100% financing effectively increases an investor’s leverage, enabling them to undertake larger or more numerous projects than they could if they were restricted by their available capital. This can significantly amplify potential returns, as investors can spread their risk across multiple properties or tackle more ambitious projects with higher profit margins.

- Speed: In real estate investment, opportunities can come and go quickly, making the ability to move fast a substantial advantage. With 100% financing from a hard money loan, investors can expedite the property acquisition process, outpacing competitors who may be reliant on slower, traditional financing methods. This speed can be the difference between securing a profitable investment property and missing out on a lucrative deal.

The combination of cash conservation, leverage, and speed makes 100% financing through hard money loans a potent strategy for real estate investors looking to maximize their market presence and profitability. However, it’s important for investors to approach these opportunities with a clear understanding of the terms and risks involved, ensuring that the benefits outweigh the costs and potential challenges.

How Can I Get 100% Real Estate Financing?

If you are trying to purchase an investment property that won’t be dramatically improved during the term of the loan, you need to use cross collateralization to get 100% financing for the property.

Essentially, instead of using cash to provide collateral, you must have another investment property with enough equity to offer as collateral. If you don’t have a mortgage on the property that you already own, you can purchase the new property with up to 70% of the first property’s value.

The lender will then take a 1st position on the new property, and a mortgage on the property you already owned. Most lenders will not accept a property that already has a mortgage as collateral, as they would have to take a 2nd position on the mortgage, but those that do tend to have higher pricing, such as interest rates ranging from 10% to 15%.

Unfortunately, not all private lenders offer this option, and those that do will often take longer to close on the deal. Since speed is such a large factor in today’s hot real estate market, Some could say that this method does not truly count as 100% real estate financing, considering that you need to have another investment property as collateral, but it allows you to buy a property despite not having a cash down payment regardless.

Securing 100% Financing: The Basics

Achieving 100% financing through hard money loans is a strategic process that demands careful planning and execution. While not every lender offers this option, positioning yourself as a low-risk, high-reward opportunity can open doors to comprehensive financing solutions. Here’s a deeper dive into how to bolster your chances:

Find the Right Lender: Focus your search on lenders known for their flexibility and openness to full financing deals. These entities are typically more responsive to innovative financing structures and understand the unique needs of real estate investors. Networking with other investors, attending real estate seminars, and participating in online forums can lead to recommendations for such lenders.

Present a Strong Proposal: A compelling loan proposal is your primary tool in securing 100% financing. This should be a meticulously crafted document or presentation that includes:

- A comprehensive overview of the property, highlighting its potential post-renovation.

- A detailed renovation plan with estimated costs and timelines.

- A market analysis showcasing comparable sales, market trends, and the target buyer or tenant demographic.

- A clear exit strategy, whether it’s selling at a profit or refinancing to hold as a rental property, illustrating how the loan will be repaid.

Quick Tips on Securing 100% Financing Through Hard Money Loans

Quick Tips on Securing 100% Financing Through Hard Money Loans

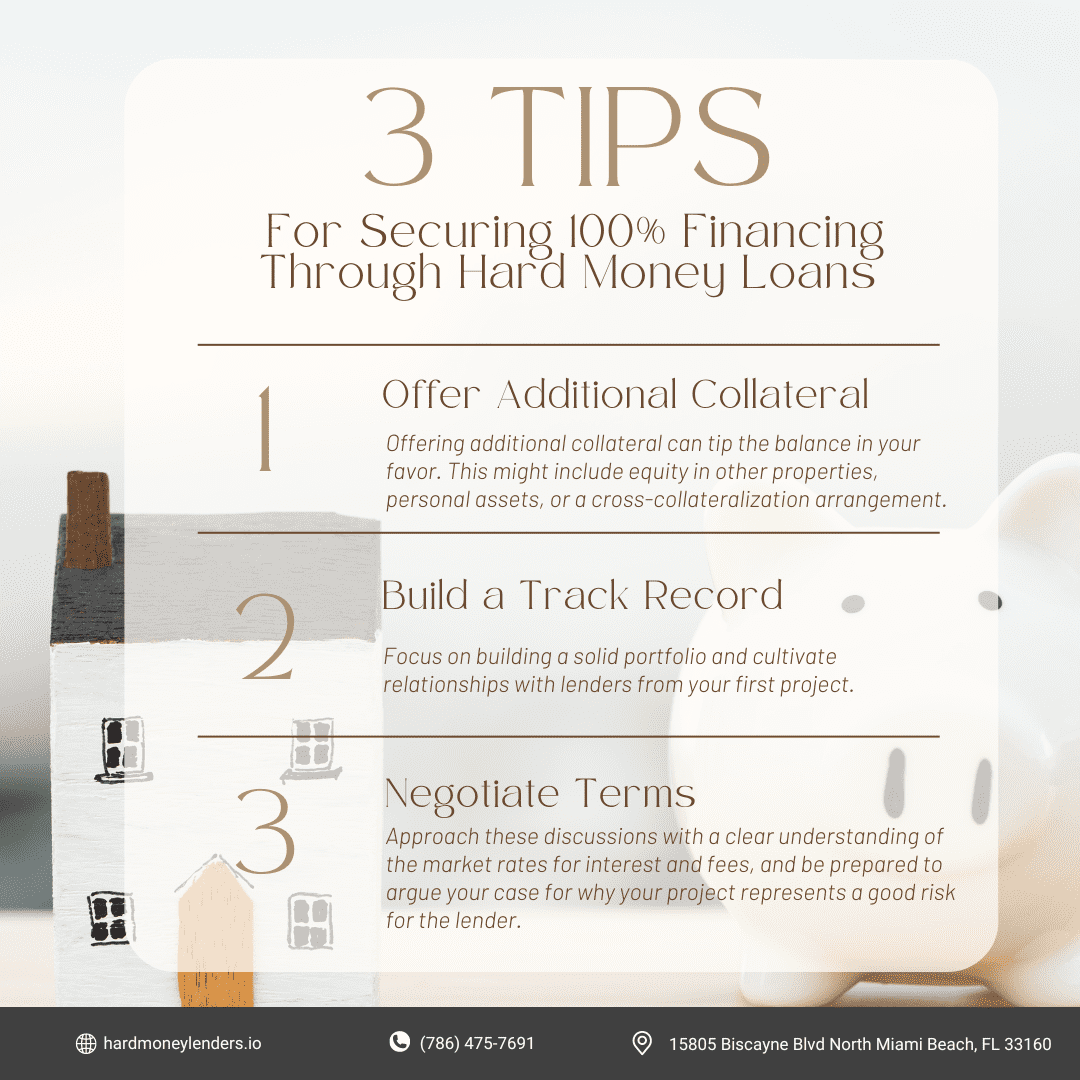

Offer Additional Collateral: If the deal itself doesn’t provide enough security for the lender, offering additional collateral can tip the balance in your favor. This might include equity in other properties, personal assets, or a cross-collateralization arrangement. The key is to provide the lender with enough confidence in your ability to repay the loan under any circumstances.

Build a Track Record: Lenders prefer to work with investors who have a history of successful flips or real estate investments. Focus on building a solid portfolio and cultivate relationships with lenders from your first project. Documenting your successes, through before-and-after photos, financials, and testimonials, can serve as persuasive evidence of your expertise.

Negotiate Terms: Effective negotiation can significantly impact the terms of your hard money loan. Approach these discussions with a clear understanding of the market rates for interest and fees, and be prepared to argue your case for why your project represents a good risk for the lender. Flexibility on points such as loan duration or interest payments can also facilitate an agreement.

Risks and Considerations

Venturing into 100% financing with hard money loans comes with its set of challenges and risks that investors must navigate carefully:

- Higher Costs: The convenience and accessibility of hard money loans come at a price, typically in the form of higher interest rates and additional fees. Investors need to factor these costs into their project budgets and ensure that the potential profit margins justify the expense.

- Shorter Repayment Terms: Hard money loans are designed as short-term financing solutions, often requiring repayment within 12 to 36 months. This compressed timeline necessitates efficient project management to ensure renovations are completed and the property is sold or refinanced within the loan period.

- Dependency on Property Performance: Since the loan is secured against the property, any complications during the renovation process or unexpected dips in the market value can jeopardize your ability to repay the loan. It’s crucial to conduct thorough due diligence before purchasing a property and to maintain a contingency fund for unforeseen expenses.

Navigating 100% financing through hard money loans requires a strategic approach, from selecting the right lender and crafting a compelling proposal to effectively managing project risks. By understanding the nuances of this financing option and preparing accordingly, investors can leverage hard money loans to their advantage, facilitating the growth and success of their real estate endeavors.

Alternatives to 100% Real Estate Financing

Alternatives to 100% Real Estate Financing

Another option is to use a seller carry-back to get higher leverage in purchase bridge loans. The seller uses a 2nd mortgage to cover the distance between the purchase price and the maximum LTV of the private lender. However, this option does not cover 100% financing because private lenders will only consider it if the borrower is contributing some of their own personal cash.

It may be possible to find a lender who can fund up to 70% of the purchase. The investor typically needs to contribute at least 10-15% of the purchase price, and the minimum hard money loan amount is usually one million dollars. Unfortunately, this will not work for purchasing residential properties.

Loan-to-Value Options

If you can’t get 100% real estate financing, you may be wondering what other maximum percentage LTV you can get. For short-term hard money loans, the maximum LTV is typically 70%, though some lenders will occasionally go up to 75%. The exact LTV may also vary depending on location, property type, or lender preference. For example, vacant land has a maximum 50% LTV.

However, private lending companies such as Hard Money Lenders will sometimes consider long-term financing of 5, 10, or even 30 years for residential properties. Depending on your credit score and the market, these long-term options can have a maximum LTP as high as 80%.

Conclusion

Although it is hard to get 100% real estate financing, through private money lenders and hard money loans, suitable alternatives can be found. If you have another investment property to act as collateral, particularly if there’s no mortgage on that property, then some private money lenders may consider this acceptable collateral rather than a cash down payment. An alternative to this process is to try using a seller carry-back, which is not quite 100% financing as the investor contributes 10% to 15% of the value, but still provides more leverage. Otherwise, you can use hard money loans to find a high LTV, often going up to 70% or 75% financing, though the precise LTV may vary depending on the private money lender or the property in question.

Frequently Asked Questions (FAQs) About Getting 100% Financing

What exactly is a hard money loan, and how does it differ from traditional financing?

A hard money loan is a type of short-term lending primarily used in real estate transactions, where the loan is secured by the property being purchased rather than the borrower’s creditworthiness. Unlike traditional financing options provided by banks or mortgage companies, which evaluate a borrower’s credit score, income, and other financial indicators, hard money loans focus on the value of the property itself. This approach allows for faster approval and funding times, making hard money loans particularly attractive for real estate investors looking to close deals quickly or compete in hot markets.

Can anyone get 100% financing through hard money loans, or are there specific qualifications?

Securing 100% financing through hard money loans is not guaranteed and typically requires the borrower to meet certain criteria that reduce the lender’s risk. While specific qualifications can vary between lenders, common factors that increase your chances include presenting a compelling and well-documented proposal, offering additional collateral, and having a proven track record of successful real estate investments. New investors may find it more challenging to obtain 100% financing but can improve their odds by demonstrating a clear understanding of the property’s potential and the real estate market.

Are there specific types of properties that are more suitable for 100% financing with hard money loans?

Yes, certain types of properties might be more appealing to lenders for 100% financing through hard money loans. Properties with high potential for quick value appreciation after renovations, located in desirable or up-and-coming neighborhoods, are particularly attractive. This is because they represent a lower risk for the lender, with a clear path to profitability that can ensure the borrower’s ability to repay the loan. Distressed properties that can be acquired below market value and have significant room for improvement through renovations often fit this bill.

How can I find reputable hard money lenders that offer 100% financing?

Finding reputable hard money lenders requires research and networking within the real estate investment community. Start by attending real estate investment meetings, seminars, and conferences, where you can connect with other investors and learn from their experiences. Online forums and real estate investment groups on social media platforms can also be valuable resources for recommendations. Always perform due diligence on potential lenders by checking their track record, reviewing borrower testimonials, and verifying their credentials with financial regulatory bodies

Why is 100% financing so hard to find?

100% real estate financing is rare and difficult to find because most private lending companies consider it far too risky. If you aren’t putting any of your own money into an investment, it’s very easy for you to back out of the deal and give up on a property at the first sign of trouble. Lenders don’t want to deal with the property themselves, and so the possibility that you will leave them stuck with the property is too risky for private money lenders to provide 100% financing. After all, there is a reason that private money lenders are not real estate investors themselves. They don’t want to look after properties and deal with the consequences of that investment; rather, they want to lend money and fund someone else’s investment. If a private money lender was willing to pay for the full price of the property, they might as well invest in the property themselves!

What if I’m getting a good deal on a property?

If you’re buying a property for below market value, it’s understandable to think that you may have an easier time getting 100% financing. After all, you found a great deal! Unfortunately, this is typically not how it works; even if you talked to every single lender in our hard money lender directory, you’d be hard-pressed to find one willing to loan 100% of a property’s purchase price. Private lenders typically consider the purchase price to be the value of the property, regardless of the real or perceived value.

It’s important to know the difference between LTV and LTP. Both ratios measure the risk a lender is taking on with a loan for a property.

LTV: Loan-to-Value

LTP: Loan-to-Purchase Price

If you don’t plan to add any value to the property you are purchasing during the term of the loan, private lenders will focus on the purchase price and measure their risk using LTP. A common mistake among real estate investors is focusing too much on LTV when the private money lender is considering LTP regarding hard money loans.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.