Is Buying Land a Good Investment?

You’ve probably heard that land is finite and that it’s one of the most sound investments one can make. Whether the purpose for the purchase is to build a home, start a business, or save it until the value increases, it’s generally a safe bet if you do the research and follow a few rules along the way. Consider the following information to help assist with purchases and ideas for making the most out of land purchases. This guide is a resource to help you learn more about the process and why this investment strategy works for many across the country, and then you’ll be able to decide for yourself if buying land is a good investment.

Buying Land

Buying land is a time-honored tradition globally and for a good reason. People with land have plenty of opportunities to build on it or hold on to it for investment purposes. There are, however, a few things to know about buying land before getting started.

As with any investment, buying land can pose some potential risks for losses or other issues. The best method to avoid these problems is to thoroughly research the land and the area and estimate value growth and potential. Keep in mind that zoning laws greatly affect the potential of the land and its future value.

Areas with commercial and residential zoning may offer the best investment because the use for the land is very flexible and can offer a suitable place for a home or a business. But always do your due diligence before you commit to buying a property.

Visit a property that interests you and inspect it carefully. In fact, it’s a good idea to hire a professional inspector. You’ll want to consider factors that may, for instance, prevent a homeowner from purchasing this type of land, such as the surrounding traffic and noise, or suboptimal access via dirt roads.

How to Buy Land

One of the first things to do when attempting to purchase land is to determine a budget. Be sure to also leave some room for fluctuations in the budget because there could be unanticipated costs along the way. Keep in mind that some costs you’ll face can include the following.

- Permits

- Closing fees

- Realtor fees

- Land purchase price fluctuations

Research how to buy land to ensure you get the most recent and helpful information in preparation for a purchase. It’s also beneficial to know how to buy vacant land and learn more about the process. You may even consider buying land with a credit card.

Types of Land Loans

When potential land buyers need to obtain a loan from a traditional lender such as a bank, they need to keep in mind a few things related to getting a loan. First, there are three types of land loans to pursue, and they include the following.

- Raw land loan

- Unimproved land loan

- Improved land loan

The raw land loan is for a blank slate piece of land with no electricity or improvements. Keep in mind that this type of land loan is notoriously difficult to acquire, so it might take some time to find the right one.

The unimproved land loan is for properties with a few amenities in place, such as water and electricity. Although not as difficult to obtain as a raw land loan, this loan may still prove tricky for land buyers.

An improved land loan is a plot of land with features such as a road, electricity, water, and other features. These loans are usually easiest to obtain but require a higher down payment due to the risky nature of land loans in general.

It’s recommended to purchase land with cash if possible; however, many people don’t have cash lying around. That’s why most will need to get a loan for buying land. This process is pretty much the same as getting a loan for a home; however, there can be a few differences.

Especially for commercial and agricultural properties, you’re typically looking at a fixed interest rate for only a few years, after which the rate becomes variable. This can lead to more financial exposure than you want if interest rates go up.

Buying Land Cheap

One of the best ways to buy land for cheap is to research foreclosures in the area. Banks and lenders don’t want to hold onto land, so they are often willing to part with it for a bargain if you have cash.

Also, it would be worth considering land in rural areas where there seems to be some urban spreading or potential for subdivisions and neighborhoods to pop up over time. There are places across America where land is extremely cheap and could make a sound investment for the future as populations increase and land is necessary for builds and homes.

But, do your due diligence. If you are buying a piece of property on the expectation that droves of people will be moving to the area or some big business or industry is poised to start operations there, be sure that it is a done deal. Environmental concerns, for instance, have derailed many promising developments and business projects that were not fully nailed down.

Another way some get a great deal may be through a process called land hacking, in which a portion of the land serves your personal use and the rest is rented out to help cover the land’s cost. Although it’s controversial, it may allow for a purchase that in effect is way below the property’s actual value.

What to Know Before Buying Land

You’ll need to have an adequate amount of money on hand for a down payment before you get started. If you buy in certain areas, there may be fees associated with the purchase, so research before buying. Next, you’ll need to know how the land is zoned to know what potential the land has for increasing in value.

Is Buying Land a Good Investment?

People want to know what a good land purchase entails and is buying land a good investment for their needs. The value of land varies greatly, and some may want to know whether or not it is a good investment when the answer isn’t simple. Some land has great value, while other parcels may not increase much over time. There are a few factors to consider.

- Area

- Purpose

- Size

- Zoning

For example, farmland may be very valuable, while undeveloped waterfront land may not be worth much because of frequent flooding.

How to Invest in Land

If you want to invest inland, you’ll first want to find some suitable land options in the area. You could work with a realtor to cut down on research and guesswork, but you’ll owe them a commission that may exceed the normal commission for a home purchase. Consider investing in the following.

- Invest in farmland

- Buy land to start a campground

- Land Flip

Learn more about investing in land by researching online and attending seminars from professionals with good insight. You may also want to consider how to start a campground for residual income over time. If you want to learn how to invest in land and make money, consider investing and reselling later or even have it available for multiple uses for a fee such as parking, camping, fishing, or shooting.

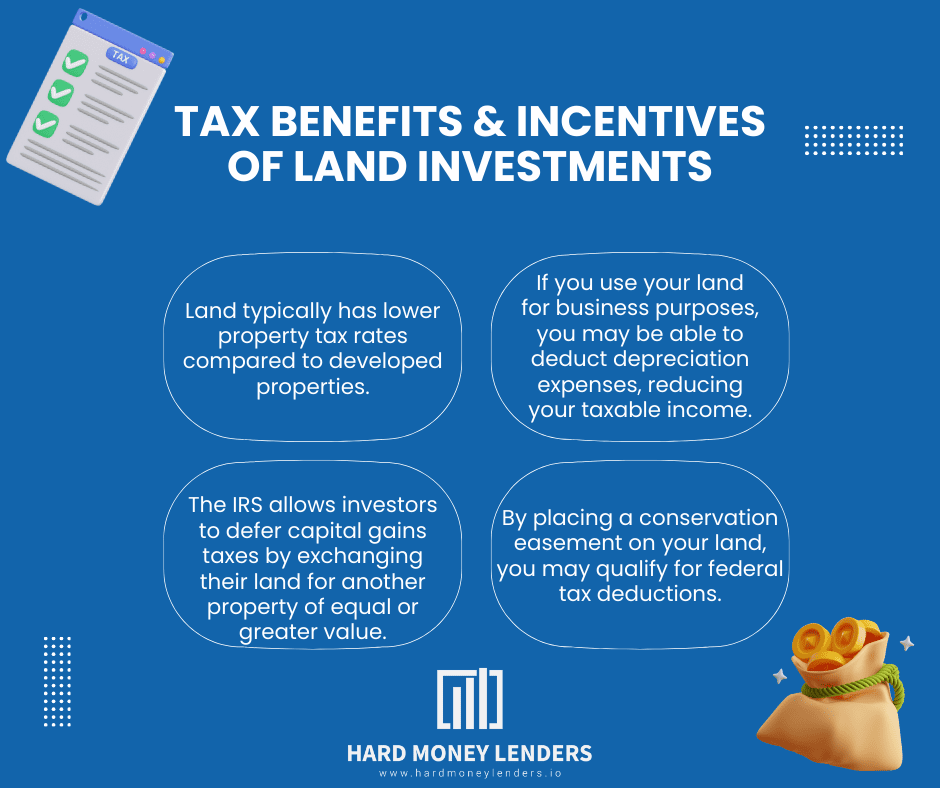

Tax Implications and Benefits

In-depth Tax Guide

Understanding the tax implications associated with different types of land ownership and investment strategies is crucial:

- Holding Land: Taxes on land held as an investment are typically based on capital gains at the time of sale. The tax rate varies depending on whether the asset was held for a short term (less than a year, taxed as ordinary income) or long term (more than a year, taxed at lower capital gains rates).

- Developing Land: If the land is developed and then sold, the profits are usually treated as ordinary income, which can be taxed at a higher rate. However, strategic structuring of the business entity can mitigate tax liabilities.

Tax Advantages

Leveraging tax benefits effectively can enhance the profitability of land investments:

- Deductions: Many costs incurred in the development and maintenance of land can be deducted. These include not only interest on development loans and property taxes but also expenses related to utilities setup, road construction, and professional fees for architects and lawyers.

- Depreciation: For land with structures, depreciation can offset income derived from the property, such as rental income. The depreciation of improvements (e.g., buildings) on the land provides a substantial tax shield, especially valuable for properties held and leased over a long period.

- 1031 Exchange: This tax strategy allows investors to defer paying capital gains taxes on the sale of investment land by reinvesting the proceeds into similar types of properties. To benefit, the replacement property must be identified within 45 days. Thereafter, the property must be acquired within 180 days of the sale of the original property.

By meticulously planning development projects and understanding the intricate tax implications, investors can maximize the financial outcomes of their land investments, ensuring both short-term gains and long-term sustainability.

Long-Term Investment Strategies

Land Development Plans

Developing land is not only about transforming a plot; it’s an opportunity to significantly increase its value. Here’s how to plan effectively:

- Permit Acquisition: The type of permits required will depend largely on the land’s location and the intended development. Common permits include zoning permits, building permits, and environmental permits. Engage with local planning offices early to understand all requirements and avoid legal complications.

- Timeline: Effective planning involves detailed timelines that accommodate everything from the initial design and permitting process to the actual construction and marketing of the property. Break down the project into phases, set realistic deadlines, and always include buffer time for unforeseen delays, such as weather impacts or regulatory changes.

- Potential Roadblocks: Anticipate and strategize around potential issues like zoning changes, which may require a reevaluation of your development plan, or funding shortages, which might necessitate seeking additional investors or loans. Contractor disputes can also arise, so ensure contracts are clear and include dispute resolution terms.

Exit Strategies

Strategic exit plans are essential for maximizing the return on your investment:

- Selling to Developers: This is often the quickest exit strategy if the land appreciates. Target developers who specialize in the type of development you’ve prepared the land for, whether residential, commercial, or mixed-use.

- Leasing: Leasing land for agricultural, commercial, or recreational use can provide a reliable income stream. Consider long-term leases to stabilize cash flow and reduce turnover costs.

- Long-Term Holding: Sometimes, the best strategy is to wait. Land in the path of urban expansion or near upcoming infrastructure projects can significantly increase in value over time. Monitor market trends and local development plans to decide the optimal time to sell.

Financing Land Purchases

Comparative Analysis of Loan Types

When purchasing land, the type of loan you choose can greatly affect both your upfront costs and long-term financial obligations. Here’s a deeper look into the types of land loans:

- Raw Land Loans: These are used for purchasing undeveloped land with no utilities or roads. Typically, raw land loans have higher interest rates and require a larger down payment—often 50% or more—due to the perceived risk by lenders.

- Unimproved Land Loans: This loan type is for land that may have some basic utilities but still lacks significant improvements like roads or structures. Unimproved land loans generally require down payments of about 35-45% and have slightly lower interest rates compared to raw land loans.

- Improved Land Loans: These loans are for land that has significant improvements already in place, such as roads, electricity, and water. Improved land is less risky for lenders, so these loans often have lower down payments (20-30%) and competitive interest rates.

Alternative Financing Solutions

For those unable or unwilling to secure traditional financing, alternative solutions exist:

- Seller Financing: In this arrangement, the seller acts as the lender. Terms can be flexible, negotiated between buyer and seller, and may not require a traditional loan application process.

- Land Lease Options: A land lease allows you to rent the land with an option to purchase at a later date. This can be a way to secure land without a large initial investment.

- Partnerships: Joining forces with a business partner or investor can spread out the financial risk and bring additional resources to a project. Partnerships should be formalized with clear agreements detailing each party’s contributions and shares.

- Hard Money Lending: Hard money loans are another viable option for land purchases, particularly for investors looking for quick access to capital without the stringent requirements of traditional banks. These loans typically come from private investors or companies and carry higher interest rates due to the increased risk. However, they can be advantageous for short-term financing with quicker approval times.

Conclusion

When you buy land, it comes with liabilities. Land is not like a toy that you can put in a closet and forget about. You’ll be paying taxes each year on any land that you own. Know what those taxes are and what they are likely to be down the road.

In regard to taxes, ag (agricultural) land is always the best, which is usually just a few dollars an acre. That same acre, if zoned for commercial or residential, can cost you many hundreds or even thousands of dollars annually. As a result, it can be great to buy a commercial property that gets treated for tax purposes as ag until it gets developed.

Besides keeping track of taxes, you will probably need some insurance to cover your exposure in case anybody goes on your land (even as a trespasser) and gets hurt.

Lastly, be advised of any environmental hazards associated with the land you may be considering buying. Someone may offer you a piece of land for what seems like a ridiculously low price. If you accept the price and buy the property, you may be faced with an environmental clean-up that you can’t offload to anyone else. (Compare buying a house with asbestos.)

So, always do your due diligence. Better to spend a bit more money at the start to make sure that you’re not taking on someone else’s headaches.

FAQ

Is it worth buying land as an investment?

Investing in land can be a solid choice, offering potential for appreciation in value over time, especially in areas poised for growth. Unlike other investments, land is a finite resource, making it inherently valuable as development expands. However, investors should be prepared for the long-term nature of this investment, as returns might not be immediate and selling the land can take time. Proper research into the location, market trends, and development plans is essential to ensure that the land purchased today holds potential for future growth.

What are the negatives of buying land?

Investing in land has several potential drawbacks:

- Liquidity: Land is a highly illiquid asset, which means it can take longer to sell compared to other types of investments.

- Maintenance and Upkeep: Depending on the location and nature of the land, you may face ongoing costs for maintenance, property management, and taxes.

- Regulatory and Developmental Risks: Land use regulations, environmental laws, and zoning restrictions can affect how you can use the land. These factors can change and potentially impact the value and usability of the property.

- Capital Intensive: The initial outlay for purchasing land can be substantial, with additional funds potentially needed for development or to comply with regulatory requirements.

Is land a better investment than stocks?

The comparison between land and stocks varies based on individual financial goals, risk tolerance, and investment timeline. Land tends to be less volatile than stocks and may offer better protection against inflation. However, it usually requires a longer time horizon to appreciate in value and lacks the liquidity that stocks offer. Stocks can provide dividends and quicker gains, but they are subject to market fluctuations and economic downturns.

Is it better to have land or cash?

Keeping cash offers flexibility and immediate access to funds for emergencies or other investment opportunities. However, cash can lose value over time due to inflation. Land, as a physical asset, generally appreciates over time and can offer a hedge against inflation, but it lacks the liquidity of cash. The choice between holding land or cash should align with your financial strategy, risk tolerance, and investment timeline.

Does owning land make you money?

Land ownership can generate income and financial gains through several methods:

- Rental Income: Leasing land for agricultural, commercial, or recreational use can provide steady income.

- Capital Appreciation: As the demand for land increases, its value can grow, offering the potential for substantial gains when sold.

- Development: By developing the land (e.g., building homes, commercial complexes), you can significantly increase its market value.

- Raw Material Extraction: If the land contains valuable natural resources, selling these can be highly profitable.

Is it smart to buy land and build later?

Purchasing land with the intent to build in the future can be advantageous, particularly in emerging markets where land prices are expected to rise. This strategy requires careful planning to mitigate risks, such as changes in zoning laws or market conditions. Investors should consider factors like future area development, infrastructure improvements, and community plans to assess the potential for appreciation in land value.

How to make money buying land?

Profitable strategies for land investment include:

- Speculative Buying: Purchase land in areas likely to experience growth or development, hold onto it, and sell at a profit as demand increases.

- Development for Resale: Develop the land to boost its value, then sell the improved property for a higher price.

- Land Leasing: Generate ongoing income by leasing land for various uses, from agricultural operations to solar farms, depending on the land’s characteristics and location.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.