Proof of Funds Letters: A Guide to Real Estate Transactions

Whether you’re thinking about buying an investment property or just curious about the process, one of the first things you need to know about is the importance of a Proof of Funds letter in real estate. Since we offer Proof of Funds Letters here at Hard Money Lenders, we’ve prepared this helpful guide to navigate the uncertainties surrounding your Proof of Funds letter.

What is a Proof of Funds Letter?

A Proof of Funds letter is a document from a bank or financial institution verifying that an individual or corporate entity has sufficient funds to complete a transaction. Unlike a pre-approval letter for a loan, a POF letter proves the availability of liquid assets, including cash in bank accounts, money market accounts, or other instruments readily convertible to cash.

Essential components of a standard POF letter include the account holder’s name, balance of available funds, date of the letter, and the bank’s contact information, ensuring transparency and legitimacy.

The Role of Proof of Funds Letters in Real Estate

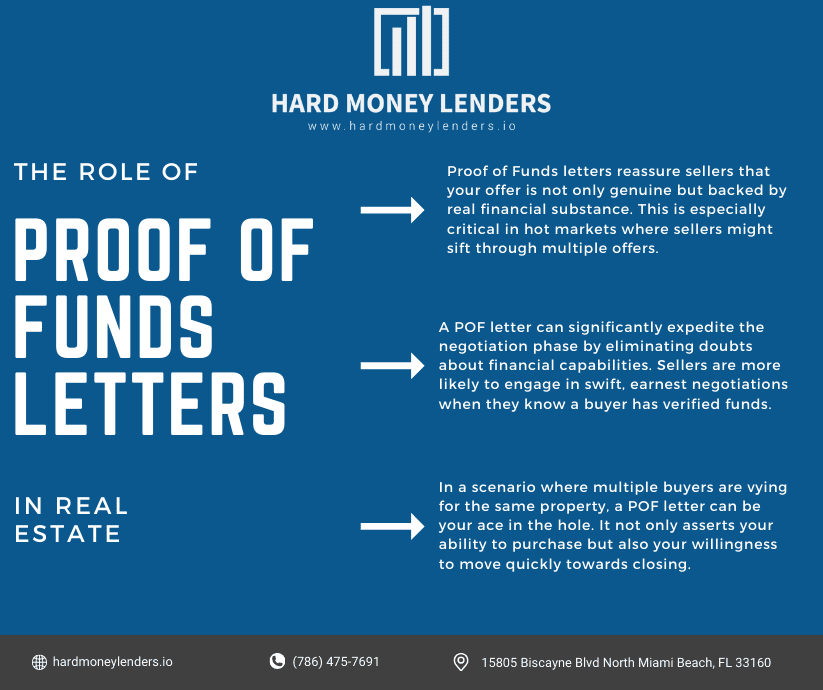

Proof of Funds (POF) letters are not just formalities; they are powerful tools in the real estate arena. These documents do more than show you have the necessary funds; they communicate your readiness and determination to make a deal happen. Here’s why they’re indispensable.

Building Trust with Sellers

A POF letter serves as a concrete demonstration of your financial ability to complete a purchase. It reassures sellers that your offer is not only genuine but backed by real financial substance. This is especially critical in hot markets where sellers might sift through multiple offers. A solid POF letter can elevate your bid from the pile, signaling that you are a serious contender who has done the homework and is not just window-shopping.

Accelerating the Transaction Process

In real estate, time is often of the essence. A POF letter can significantly expedite the negotiation phase by eliminating doubts about financial capabilities. Sellers are more likely to engage in swift, earnest negotiations when they know a buyer has verified funds. This efficiency can be crucial, especially when dealing with properties that attract a lot of attention. It streamlines the path to closing, cutting down on back-and-forth and reducing the time spent in limbo.

Enhancing Your Position in Competitive Scenarios

In a scenario where multiple buyers are vying for the same property, a POF letter can be your ace in the hole. It not only asserts your ability to purchase but also your willingness to move quickly towards closing. This readiness can be particularly compelling to sellers eager to conclude their sale without undue delay or uncertainty.

That being said, whether you’re looking to fix and flip a property or renovate and rent a property, you’ll want to provide Proof of Funds.

Of course, now you’re probably thinking, “How do I actually get a Proof of Funds Letter?”

How to Obtain a Proof of Funds Letter

Securing a Proof of Funds letter is a straightforward yet crucial step in your real estate journey. Following the detailed steps below can help ensure smooth sailing when you’re tapping into the real estate market.

Review Your Finances

First and foremost, take a thorough look at your financial landscape. Your funds need to be readily available and in a form that can be easily accessed for the purchase. This might mean moving funds around to ensure they are in liquid accounts or liquidating assets that are not immediately cashable. The goal is to present a clear, uncomplicated picture of your financial readiness to the institution providing your POF letter.

Contact Your Bank or Financial Institution

Once your funds are in order, reach out to your bank or another financial institution where your funds are held. It’s important to clearly state the purpose of the POF letter to make certain it meets the specific needs of your transaction. Financial institutions deal with these requests regularly and understand their role in facilitating real estate deals, so they can usually provide a POF letter promptly.

Verify Details for Accuracy

After receiving your POF letter, it’s crucial to verify all the details for accuracy. This includes ensuring the letter correctly reflects your available balance and that all personal information is current and accurately represented. Discrepancies or outdated information can lead to unnecessary hiccups in the transaction process. Also, be mindful of the letter’s issuance date; some sellers may require a letter that is recently dated to reflect your current financial standing accurately.

Taking these steps not only helps in obtaining a POF letter but also in reinforcing your position as a well-prepared and serious buyer in the real estate market.

A Note About Proof of Funds Letter from Hard Money Letters

Now, if you’re using a hard money letter, the lender should be able to give you a Proof of Funds letter. Use their email, phone number, or website to contact the lender.

They will most likely ask you to provide information such as the name of the person or entity making the purchase, the address and purchase price of the property, and your contact information.

At Hard Money Lenders, this is the exact process we use when issuing Proof of Funds letters.

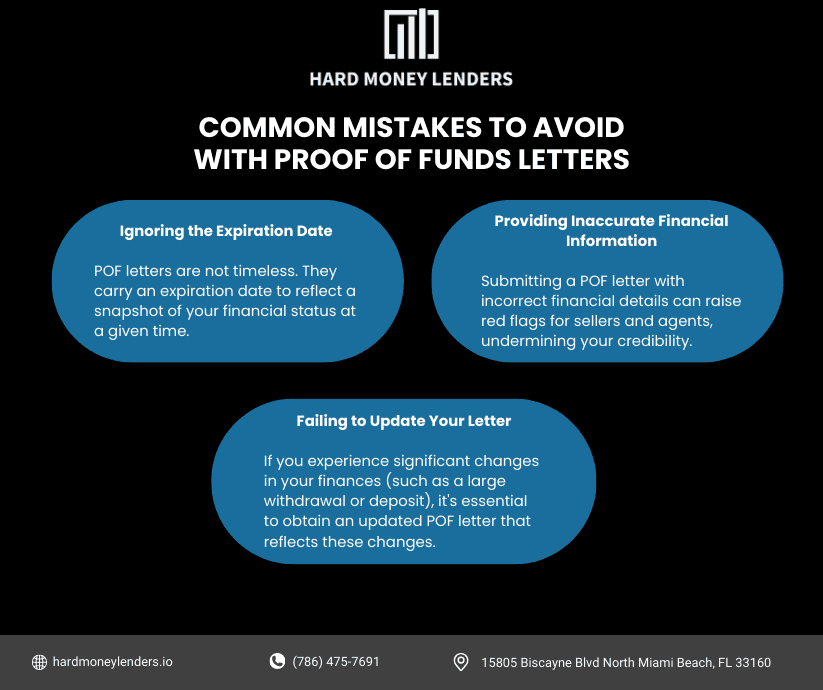

Common Mistakes to Avoid with Proof of Funds Letters

When it comes to utilizing Proof of Funds (POF) letters in real estate transactions, certain missteps can lead to unnecessary complications or even derail a deal. Here are some common pitfalls and how to steer clear of them.

Ignoring the Expiration Date

POF letters are not timeless. They carry an expiration date to reflect a snapshot of your financial status at a given time. Overlooking this date can result in presenting outdated proof to sellers, casting doubt on your current financial capabilities. To avoid this, regularly review and update your POF letter, especially if your transaction extends over a longer period than initially anticipated.

Providing Inaccurate Financial Information

Accuracy is paramount in all aspects of a real estate transaction, especially when it comes to financial documents. Submitting a POF letter with incorrect financial details can raise red flags for sellers and agents, undermining your credibility. Always double-check the information in your letter against your latest financial statements to ensure consistency and accuracy.

Failing to Update Your Letter

The real estate market can move quickly, and so can your financial situation. If you experience significant changes in your finances (such as a large withdrawal or deposit), it’s essential to obtain an updated POF letter that reflects these changes. This keeps all parties informed and maintains the integrity of your offer.

Best Practices for Using Proof of Funds Letters

Effectively leveraging a Proof of Funds letter requires more than just obtaining it. Here’s how to make sure your POF letter serves its purpose optimally.

Organize Your Financial Documents

A well-organized financial portfolio simplifies the process of obtaining and updating your POF letter. Keep all relevant documents, such as bank statements and asset valuations, in order and easily accessible. This not only aids in quickly generating POF letters but also helps you maintain a clear overview of your financial readiness for purchasing.

Verify Authenticity and Accuracy

Before submitting your POF letter with an offer, verify its authenticity and accuracy. This means checking that the letter correctly identifies your financial institution, includes correct contact information for verification, and accurately represents your available funds. Errors or omissions can lead to questions about the validity of your proof.

Communicate Clearly with Your Real Estate Agent

Your real estate agent is a crucial ally in the buying process. Make sure they are fully briefed on your financial situation and the details of your POF letter. Clear communication can prevent misunderstandings and enable your agent to advocate effectively on your behalf.

Last Thoughts

Proof of Funds letters are an important real estate document to have before offering any property. If done correctly, a Proof of Funds letter will show your commitment and trustworthiness as a buyer and ensure the seller gives your offer the consideration it deserves. If you need help with your Proof of Funds letter, contact Hard Money Lenders.

FAQs on Proof of Funds Letters

Why does a Proof of Funds letter matter?

A Proof of Funds letter gives you more credibility as a potential buyer. It shows sellers that your offer is serious and that they can trust you to pay the amount you say you will.

Buying an investment property is a huge commitment financially, and a Proof of Funds letter for real estate purchases can go a long way towards showing a seller that you are ready and able to make that commitment.

Proof of Funds letters are often a sign of trust that can help you build a positive relationship with a seller. Providing a Proof of Funds letter shows that you are prepared and reliable.

Do I need a Proof of Funds letter?

While some real estate agents will give potential buyers a short window of time to provide Proof of Funds, most prefer to have a Proof of Funds letter before they will even consider the offer. If you need a Proof of Funds letter quickly, we provide instant Proof of Funds letters through an application here.

There are a few circumstances where Proof of Funds may not be needed, such as if you are interested in buying from a homeowner that does not have a real estate agent, but most buyers will need a Proof of Funds letter for real estate purchases.

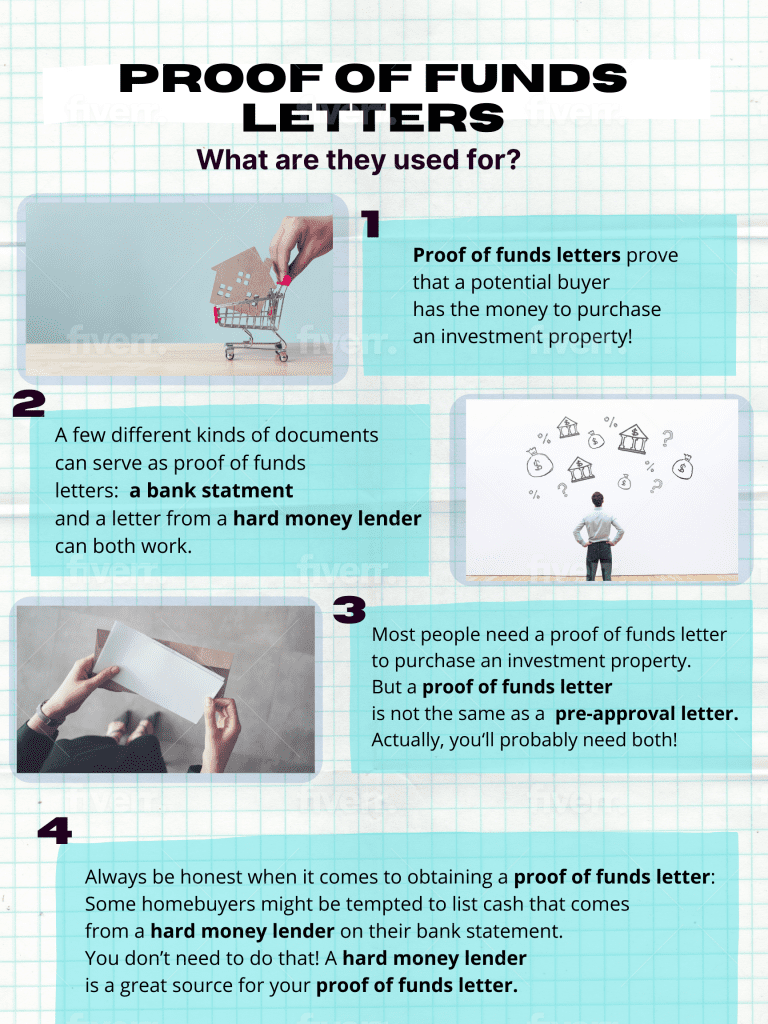

What kind of Proof of Funds letter should I get?

There are two best kinds of Proof of Funds letters for real estate, depending on how you plan to purchase the property. If you plan to use your own cash, you can use a bank statement to provide Proof of Funds. However, if you are working with a hard money lender instead of buying the property with your own cash, you should get a Proof of Funds letter directly from the hard money lender.

Both these options are valid and dependable. Some online companies offer Proof of Funds letters for real estate, but sellers typically do not like this form of Proof of Funds, as they seem unreliable and could potentially be a scam.

Therefore, we recommend you stay away from companies online when it comes to untrustworthy sources and obtain Proof of Funds letters from a bank or hard money lender like us instead.

Is a Proof of Funds letter the same as a pre-approval letter?

A pre-approval letter is very different from a Proof of Funds letter in real estate. While both can be important documents, they each do different things in the process of buying an investment property.

A Proof of Funds letter shows that a bank or lender already has the cash needed to purchase a property successfully. This typically marks the beginning of the underwriting and appraisal processes, but is not a legal commitment or agreement between any parties.

A pre-approval letter, on the other hand, is a legal commitment between a lender and a borrower. This letter says that a potential borrower has the necessary qualifications to receive a loan from the lender, though that loan may not be ready or available yet. If you want to learn more about pre-approval letters, you can read this article here.

What mistakes should I watch out for in my Proof of Funds letter?

The most important aspect of a Proof of Funds letter is simply to have one when you decide to make an offer on a property. Having a Proof of Funds letter in real estate helps demonstrate your commitment and trustworthiness to the seller.

Having a Proof of Funds letter on-hand prevents any slow-downs during the offer process; this is especially essential during today’s hot real estate market, especially in Florida. You can get a Proof of Funds letter from the bank or a lender quickly and easily, so make sure you provide Proof of Funds with your offers.

Beyond having a Proof of Funds letter, one mistake that buyers often make is trying to pretend that they are using their own cash to buy a property when they are actually using cash from a hard money lender.

However, cash deals are known to close the fastest, hard money loans close nearly as quickly, as they have minimal regulations and are flexible. Being dishonest about your Proof of Funds is never a good idea, and there is no need to hide the fact that you are using a hard money lender as long as they’re reputable one such as Hard Money Lenders. Make sure your Proof of Funds letter is accurate and honest about where the funds are coming from in order to build your credibility as a potential buyer.

Who issues Proof of Funds Letters?

Proof of Funds Letters can be issued by banks, credit unions, or other financial institutions where you hold your assets. It’s important to request this letter from an institution that can accurately reflect your liquid assets and financial standing.

What information is included in a Proof of Funds Letter?

A typical Proof of Funds Letter includes:

- The name of the account holder (the buyer).

- The balance of available funds.

- The date of the letter.

- The financial institution’s name and contact information.

- A statement that the funds are available and accessible.

What if my Proof of Funds Letter is rejected?

If your POF letter is rejected, first clarify the reasons for rejection. It might be due to outdated information, insufficient funds shown, or concerns about the authenticity of the document. Address these concerns by providing an updated letter, additional documentation, or obtaining a POF letter from a different institution if necessary.

Can I use a digital screenshot of my account balance as a Proof of Funds?

While a digital screenshot may show your current balance, it lacks the formal verification and details provided by a POF letter issued by a financial institution. Sellers and their agents typically require an official letter to verify the availability of funds, as it provides a higher level of assurance and legitimacy.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.