Tax Lien Investing: How Do Tax Liens Work in Florida

Tax lien investing in Florida can be a lucrative opportunity for real estate investors. Understanding how tax liens work in Florida is crucial for those interested in this investment strategy. When property owners fail to pay their property taxes, the local government places tax liens on the property. This lien gives the government the right to collect the overdue taxes by selling the lien at a public auction. Investors can purchase these liens and become lienholders, with the potential to earn interest on their investment.

However, tax lien investing involves certain risks and considerations that need to be carefully evaluated. Here at Hard Money Lenders, we aim to provide a comprehensive guide on tax lien investing in Florida below. You’ll discover the benefits, auction process, research strategies, bidding strategies, risks, potential returns, redemption period, and important tips. Investors can make informed decisions and maximize their investment opportunities by gaining a solid understanding of tax lien investing in Florida.

Understanding Tax Liens and Tax Lien Investing in Florida

Tax liens are legal claims against a property when the owner fails to pay their property taxes. In Florida, tax liens are sold at public auctions, providing an opportunity for investors to invest in these liens and potentially earn interest on their investments.

Tax lien investing in Florida is a unique investment strategy that offers several benefits and leverage.

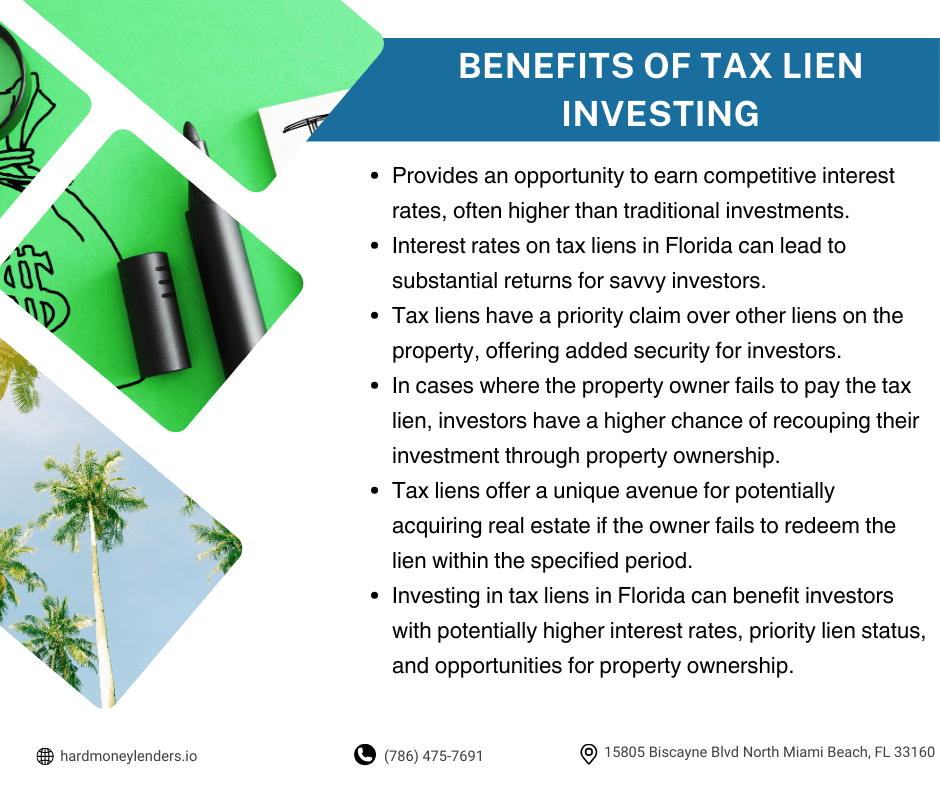

Firstly, it allows investors to earn competitive interest rates, often higher than traditional investments.

Additionally, tax liens have a priority claim over other liens on the property, which provides added security.

Furthermore, tax liens can lead to property ownership if the owner fails to redeem the lien within the redemption period.

To participate in tax lien auctions in Florida, investors need to conduct thorough research, evaluate potential properties, and develop effective bidding strategies. Considering the risks and potential returns associated with tax lien investing is important.

Understanding how tax liens work in Florida is crucial for real estate investors looking to diversify their portfolios and potentially earn passive income through tax lien investing.

Benefits of Investing in Tax Liens

Tax lien investing in Florida offers several benefits for real estate investors.

First and foremost, it provides an opportunity to earn competitive interest rates on their investment. The interest rates on tax liens in Florida can vary but are often higher than traditional investment options. This can lead to a substantial return on investment for savvy investors.

Now, tax liens have a priority claim over other liens on the property. If the property owner fails to pay the tax lien, the investor has a higher chance of recouping their investment through property ownership. This added security makes tax lien investing an attractive option for those looking to diversify their portfolio.

Furthermore, tax liens provide a unique avenue to acquire real estate potentially. If the property owner fails to redeem the lien within the specified redemption period, the investor may become the property’s new owner.

By investing in Florida’s tax liens, investors can benefit from potentially higher interest rates, priority lien status, and even property ownership opportunities.

Overview of the Tax Lien Auctions in Florida

Tax lien auctions in Florida are conducted at the county level, with each county holding its auction. These auctions allow investors to purchase tax liens on properties that are delinquent on their property taxes. The auctions are typically held once a year, although some counties may hold them more frequently.

During the auction, interested investors can bid on tax liens. The auction process varies by county, with some using traditional in-person auctions and others utilizing online platforms. Depending on their investment preferences, bidders can bid on individual liens or bundles of liens.

It’s important for investors to research and understand the specific rules and procedures for each county’s auction. This includes familiarizing themselves with the auction dates, registration requirements, bidding process, and any additional fees or costs associated with participating.

Overall, tax lien auctions in Florida provide a structured and regulated platform for investors to acquire tax liens and potentially earn attractive returns on their investments.

How to Participate in a Tax Lien Auction in Florida

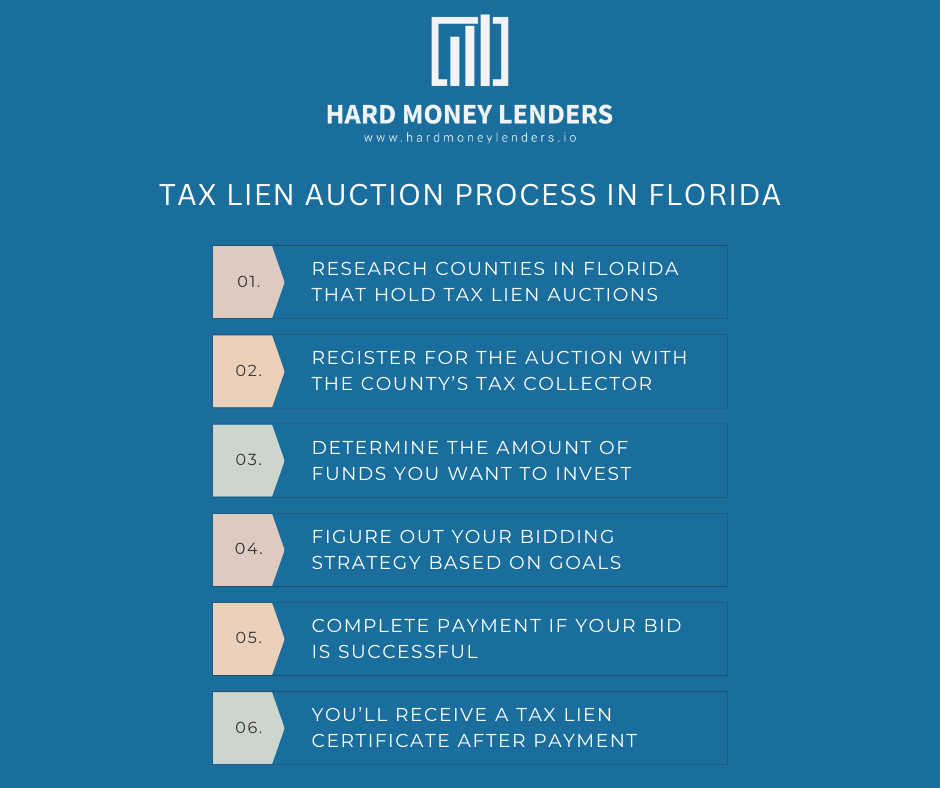

To participate in a tax lien auction in Florida, investors need to follow a few key steps.

- Research: Start by identifying the counties in Florida that hold tax lien auctions and reviewing their specific auction procedures. Each county may have different rules and requirements.

- Register: Once you have identified the auction you want to participate in, register with the county’s tax collector’s office. This typically involves providing your personal information and paying a registration fee.

- Funding: Determine the amount of funds you are willing to invest in tax liens. Make sure you have the necessary capital available to cover your bids.

- Bid: During the auction, either in person or online, carefully review the available tax liens and their associated properties. Determine your bidding strategy based on your investment goals and desired property types.

- Complete Payment: If your bid is successful, you will be required to complete payment for the tax lien within a specified timeframe. Failure to do so may result in the forfeiture of the lien.

- Ownership: After payment, you will receive a tax lien certificate, which establishes your ownership of the lien.

Remember, it is crucial to thoroughly understand the specific rules and procedures of each county’s tax lien auction before participating to ensure a successful and compliant investment.

How to Research Tax Liens in Florida

When it comes to researching tax liens in Florida, thorough due diligence is essential to making informed investment decisions. Here are some steps to help you research tax liens in Florida:

- Start by identifying the counties in Florida that hold tax lien auctions. Visit the official websites of these counties to access information about upcoming auctions and available tax lien properties.

- Utilize online resources and databases that provide comprehensive information about tax liens in Florida. These resources may include property details, tax lien certificates, redemption periods, and current bid information.

- Consider consulting with local real estate professionals or tax lien investing experts who are familiar with the Florida market. They can provide valuable insights, guidance, and recommendations based on their experience in the industry.

- Verify the authenticity and accuracy of the information you find by cross-referencing multiple sources. Ensure that the properties you are interested in have clear titles and do not have any outstanding liens or encumbrances.

- Perform a thorough analysis of the potential profitability of tax lien properties by considering factors such as property location, market conditions, historical redemption rates, and potential added value through improvements or development.

By following these steps and conducting comprehensive research, you can increase your chances of making successful tax lien investments in Florida. Remember to verify all facts and data to ensure accuracy, and always seek professional advice if needed.

Finding Tax Lien Properties in Florida

When it comes to finding tax lien properties in Florida, there are several avenues you can explore. Here are some methods to consider:

- County Websites: Visit the official websites of Florida counties holding tax lien auctions. Many counties provide online databases where you can search for available tax lien properties.

- Online Resources: Utilize online platforms and databases that specialize in tax lien investing. These resources often provide comprehensive information about tax lien properties, including property details, tax lien certificates, redemption periods, and current bid information.

- Real Estate Professionals: Consult with local real estate professionals familiar with the Florida market. They may have access to exclusive listings or insights on upcoming tax lien properties.

- Local Auctions: Attend local tax lien auctions in Florida. These auctions are typically advertised in newspapers, online, or through county websites. By attending these auctions, you can directly view and bid on tax lien properties.

Remember to verify the accuracy of the information you find and conduct thorough due diligence on any properties you are interested in.

Evaluating the Potential of Tax Lien Properties

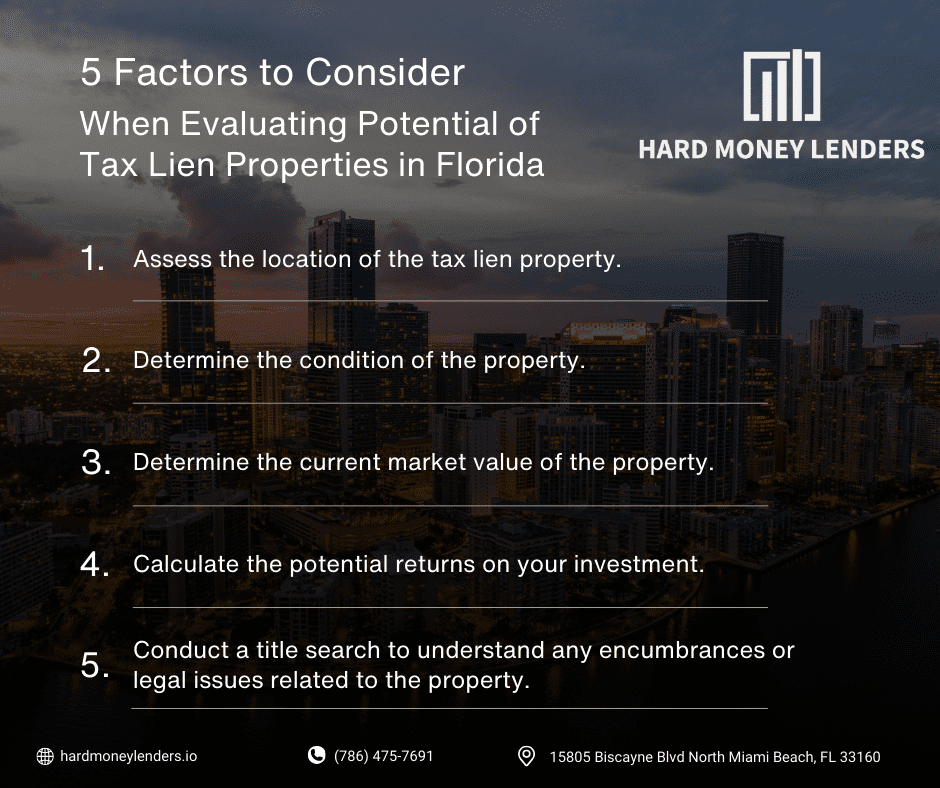

When evaluating the potential of tax lien properties in Florida, there are several factors to consider. Here are some key considerations for investors:

- Property Location: Assess the location of the tax lien property. Is it in a desirable area? Are there growth prospects or development plans in the vicinity?

- Property Condition: Determine the condition of the property. Conduct a thorough inspection or research to understand any potential repair or renovation costs.

- Market Value: Determine the current market value of the property. This can be done by researching comparable properties or consulting with real estate professionals.

- Potential Returns: Calculate the potential returns on your investment. Assess the interest rate and possible redemption amounts to understand the profitability of the tax lien.

- Title Research: Conduct a title search to understand any encumbrances or legal issues related to the property.

By considering these factors, investors can make informed decisions about the potential of tax lien properties in Florida. Remember to verify the information and seek professional advice when necessary.

Investing in Tax Liens in Florida

Investing in tax liens in Florida can be a lucrative opportunity for real estate investors. By purchasing a tax lien, investors have the potential to earn interest on the unpaid property taxes and, in some cases, even acquire the property itself.

To start investing in tax liens in Florida, investors should research tax lien auctions held by the county. These auctions typically occur online or in person and allow investors to bid on tax liens. Developing effective bidding strategies is important to maximize the chances of winning desirable tax liens.

However, it’s crucial to consider the risks associated with tax lien investing. The property owner may redeem the tax lien by paying off the outstanding taxes, resulting in a lower return on investment. Additionally, investors should be prepared for the potential need to foreclose on the property if the owner fails to redeem the tax lien.

Overall, investing in tax liens in Florida requires careful evaluation of properties, thorough research, and a solid understanding of the potential risks and returns. Investors can generate attractive profits through tax lien investments by applying a strategic approach.

Bidding Strategies for Tax Lien Auctions in Florida

When participating in tax lien auctions in Florida, it’s important for investors to plan their bidding strategies carefully. Here are some effective strategies to consider:

- Set a Budget: Before the auction, determine your maximum bid amount based on your available funds and desired return on investment.

- Conduct Research: Thoroughly research the properties and their potential value to identify those with the highest potential for profit.

- Focus on Desirable Properties: Concentrate your efforts on properties in desirable locations or with high market demand to increase the chances of a successful investment.

- Understand Interest Rates: Familiarize yourself with Florida’s tax lien interest rates, as they can vary county by county. This knowledge will help you determine each property’s potential return on investment.

- Start with Small Bids: Begin by bidding on lower-priced liens to gain experience and reduce the risk of overspending on unprofitable properties.

- Attend Multiple Auctions: Consider participating in auctions from different counties to diversify your portfolio and increase the chances of acquiring profitable tax liens.

- Be Patient: Avoid getting caught up in bidding wars and remain patient. Remember, there will always be other opportunities to invest in tax liens.

By utilizing these bidding strategies, investors can increase their chances of securing profitable tax liens in Florida and maximize their potential returns.

Risks and Considerations of Tax Lien Investing

While tax lien investing in Florida can be lucrative, it’s important for investors to be aware of the risks and considerations involved.

Here are some key points to keep in mind.

- Property Condition: Tax lien properties may require extensive repairs or renovations, which can eat into your potential profits. It’s crucial to thoroughly inspect the property and estimate any additional costs before investing.

- Competition: Tax lien auctions can be highly competitive, with experienced investors vying for the same properties. This can drive up the bidding price and reduce the potential returns. It’s important to stay informed, set realistic expectations, and be prepared to walk away if the numbers don’t add up.

- Redemption Rate: While Florida has a relatively low redemption rate compared to other states, there’s still a possibility that the property owner will redeem the tax lien, resulting in the return of their property and the loss of your investment. Analyze the property and the owner’s financial situation before investing.

- Title Issues: Some tax lien properties may have title issues or other legal complications. Conduct a thorough title search and consult a real estate attorney to ensure a clear title before purchasing a tax lien.

- Lack of Control: As a tax lien investor, you don’t have control over the property until the redemption period expires and you can initiate foreclosure proceedings. This lack of control means you rely on the property owner to redeem the lien or for the foreclosure process to succeed.

- Limited Information: Due diligence can be challenging as the information provided for tax lien properties may be limited. It’s important to rely on various sources of information and consult with professionals to make informed decisions.

By understanding and carefully considering these risks and considerations, investors can navigate the tax lien market in Florida successfully and minimize potential losses. Remember to consult with financial and legal professionals to ensure you are making the best possible investment decisions.

Redemption Period and Potential Returns

Redemption Period and Potential Returns

A crucial aspect of tax lien investing in Florida is understanding the redemption period and its impact on potential returns. In Florida, the redemption period is two years from the issuance of the tax lien certificate. During this period, the property owner has the opportunity to redeem the lien by paying the outstanding taxes plus any accrued interest and penalties.

If the property owner does not redeem the lien within the redemption period, the tax lien holder can initiate foreclosure proceedings and potentially gain ownership of the property.

The potential returns on tax liens in Florida can vary. If the property owner redeems the tax lien, the investor will receive the initial investment amount plus any accrued interest. However, if the property goes into foreclosure and the investor obtains ownership, the potential returns can be significantly higher.

It’s important to carefully analyze the property’s value, condition, and potential for resale or rental income to determine the potential returns on investment. Additionally, keeping an eye on market trends and property values can help maximize potential returns.

Understanding the Redemption Period for Tax Liens in Florida

The redemption period is a critical aspect to understand when it comes to tax lien investing in Florida. In Florida, the redemption period lasts for two years from the issuance of the tax lien certificate. During this period, the property owner has the opportunity to redeem the lien by paying the outstanding taxes, along with any accrued interest and penalties.

If the property owner successfully redeems the tax lien, the investor will receive the initial investment amount, as well as any accrued interest. However, if the property owner fails to redeem the lien within the redemption period, the tax lien holder can initiate foreclosure proceedings. This means that the investor may have the opportunity to gain ownership of the property.

It’s important for tax lien investors to consider the redemption period and its potential impact on their returns. In some cases, the property owner may redeem the lien early, resulting in a lower return on investment. On the other hand, if the investor gains ownership of the property through foreclosure, the potential returns can be significantly higher.

Calculating Potential Returns on Tax Liens

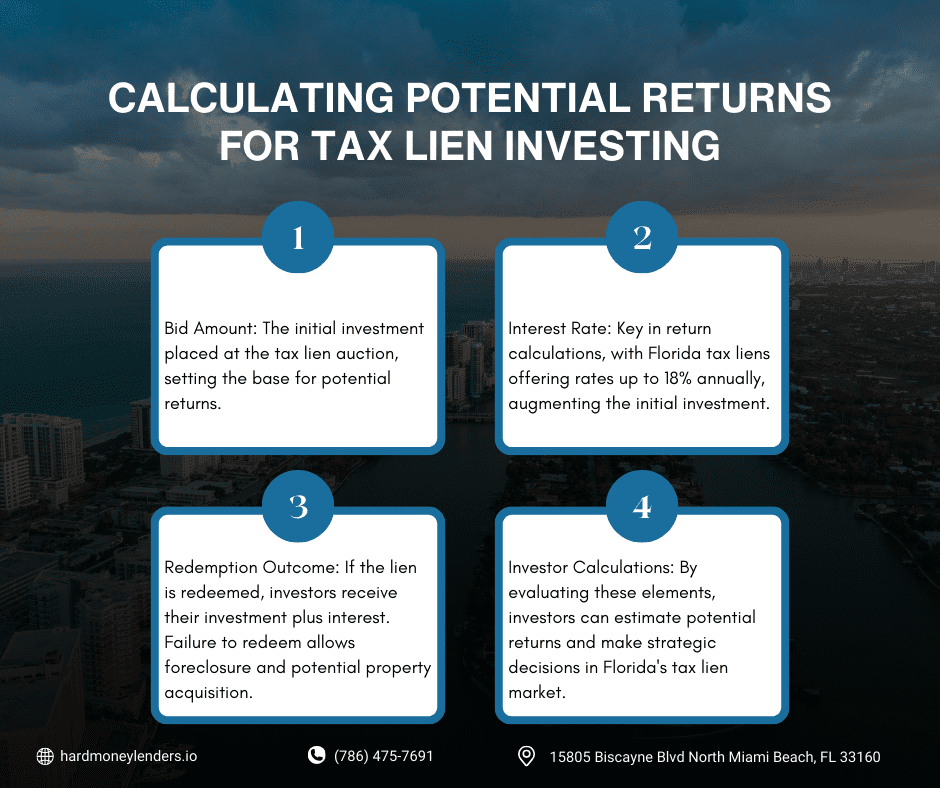

To calculate potential returns on tax liens in Florida, investors need to consider the bid amount, interest rate, and redemption outcome.

First, the bid amount is the initial investment made at the tax lien auction. This amount will determine the starting point for potential returns.

Second, the interest rate is an essential factor in calculating returns. In Florida, tax liens can have an interest rate of up to 18%. The interest is typically calculated annually and is added to the initial investment amount.

Lastly, the redemption outcome plays a significant role in determining the final returns. If the property owner redeems the tax lien within the redemption period, the investor will receive the initial investment amount and any accrued interest. However, if the property owner fails to redeem the lien, the investor may proceed with foreclosure and potentially gain ownership of the property.

By considering these factors, investors can calculate potential returns and make informed decisions when investing in tax liens in Florida.

Tips for Successful Tax Lien Investing in Florida

When it comes to successful tax lien investing in Florida, there are a few tips that can help investors maximize their returns and minimize risks. Here are some essential tips to keep in mind:

- Thoroughly research the properties: Before bidding on a tax lien property, conduct a thorough investigation of the property’s condition, market value, and potential for redemption. This research will help you make informed decisions and avoid investing in properties with little to no value.

- Diversify your investments: To mitigate risks, it is advisable to diversify your investments across different properties and tax lien auctions. This strategy can help you spread out your risk and increase your chances of earning higher returns.

- Set a budget: Determine your investment budget before participating in tax lien auctions. This will help you avoid overbidding or investing more than you can afford.

- Attend tax lien auctions: Attending tax lien auctions in person can provide valuable insights and opportunities to interact with other experienced investors. It also allows you to make decisions based on real-time market conditions.

- Stay updated on tax laws and regulations: Keep yourself informed about any changes in tax laws and regulations in Florida. This can help you navigate the tax lien investment process more effectively and avoid any legal pitfalls.

- Consult with professionals: Consider seeking the guidance of legal and real estate professionals proficient in tax lien investing. They can provide valuable advice and ensure you comply with all legal requirements.

By following these tips, investors can enhance their chances of success in tax lien investing in Florida. It is essential to remain diligent, well-informed, and cautious throughout the process to achieve optimal results.

Questions People Also Ask About Tax Lien Investing in Florida

Who is eligible to participate in tax lien auctions in Florida?

To participate in tax lien auctions in Florida, individuals must meet certain eligibility requirements. In Florida, tax lien auctions are open to the general public, allowing both individuals and corporations to participate. There are no residency requirements, meaning investors from out of state can also participate and bid on tax liens in Florida.

However, it is essential to note that bidders must register with the county’s tax collector’s office before the auction. This registration process often requires providing personal information and paying a registration fee.

Whether you are a seasoned investor or new to tax lien investing, as long as you fulfill the registration requirements, you are eligible to participate in tax lien auctions in Florida. It provides an opportunity for a diverse range of investors to explore and capitalize on tax lien investment opportunities in the state.

What are the different types of tax liens available in Florida?

In Florida, there are two main types of tax liens that investors can acquire: County-held tax liens and Municipal-held tax liens.

- County-Held Tax Liens: These are tax liens issued on properties with unpaid property taxes. County-held tax liens are usually sold through auctions, where investors can bid on the liens. If the property owner fails to pay the outstanding taxes, the investor who holds the tax lien can eventually foreclose on the property.

- Municipal-Held Tax Liens: Municipal-held tax liens are issued by cities or towns for unpaid municipal fees, such as water bills or code violations. These liens are also sold to investors through auctions, and investors can earn interest or penalties on the liens until they are repaid.

Both types of tax liens can offer investment opportunities, but it is important to carefully research and assess the potential risks and rewards associated with each type before participating in tax lien auctions in Florida.

What are the minimum investment amounts for tax lien auctions in Florida?

The minimum investment amounts for tax lien auctions in Florida can vary depending on the county or municipality. Each auction may have its own set minimum bid requirements. In some cases, the minimum bid could be as low as the amount of the outstanding taxes owed on the property.

However, it is important to note that bidding at the minimum amount may not guarantee a successful purchase of the tax lien. Other bidders may offer higher bids, so it is advisable to have a budget in mind that allows for competitive bidding.

Additionally, investors should be prepared for potential additional costs and fees associated with participating in tax lien auctions, such as recording fees or auctioneer fees. It is recommended to thoroughly research the specific requirements and costs for each auction before participating.

What are some advanced strategies for successful tax lien investing in Florida?

When it comes to tax lien investing in Florida, there are several advanced strategies that can increase your chances of success. Here are a few tactics to consider:

- Focus on properties in desirable locations: Look for tax lien properties in areas with high demand and potential for appreciation. Locations near popular tourist destinations or thriving cities often offer better chances of finding valuable properties.

- Conduct thorough due diligence: Before bidding on a tax lien, research the property’s history, condition, and potential market value. This will help you assess its profitability and determine a suitable bid amount.

- Diversify your investment portfolio: Spread your investments across multiple tax liens to minimize risk. By diversifying, you can offset any potential losses with the gains from successful investments.

- Attend multiple auctions: Participate in multiple tax lien auctions to increase your chances of securing profitable properties. By exploring different auctions, you can access a wider range of opportunities and potentially find undervalued properties.

- Network with industry professionals: Connect with real estate agents, attorneys, and experienced tax lien investors in Florida. Their insights and advice can help you make informed decisions and identify lucrative investment opportunities.

Remember, advanced strategies come with their own risks and complexities. It’s essential to thoroughly understand the tax lien process and seek professional guidance when needed.

What are the potential returns on investment for tax lien investing in Florida?

Tax lien investing in Florida has the potential for lucrative returns. When a property owner fails to pay their taxes, the county government places a tax lien on the property. Investors can then purchase these liens at auction. If the property owner redeems the lien by paying the owed taxes within the redemption period, the investor receives the full amount of their investment plus interest.

In Florida, the interest rates can vary, but they are often quite high, as much as 18%. This provides an opportunity for significant returns on investment. However, it’s important to note that not all liens are redeemed, and there is a risk of losing your investment if the property owner does not pay.

Conduct thorough research and due diligence to identify properties with a higher likelihood of redemption and maximize your potential returns.

Are there any additional fees or costs associated with participating in tax lien auctions?

When participating in tax lien auctions in Florida, there may be additional fees and costs that investors need to consider. These expenses can vary depending on the county and auction platform used. Some common fees associated with tax lien auctions include:

- Registration Fee: Investors are typically required to pay a registration fee to participate in the auction. This fee covers administrative costs and ensures that only serious investors are participating.

- Auction Platform Fee: If the auction is conducted through an online platform, the platform may charge a fee for providing the auction services.

- Redemption Fee: In the event that the property owner redeems the tax lien, the investor may be responsible for paying the redemption fee. This fee is usually a percentage of the redeemed amount and covers the administrative costs associated with processing the redemption.

It is important for investors to carefully review the auction terms and conditions to understand the specific fees and costs associated with a particular tax lien auction in Florida. By considering these additional expenses, investors can accurately assess the overall investment potential and determine the profitability of participating in tax lien auctions.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.