Gap Funding In Real Estate Investing

Whether you’re new to real estate investing, or have been doing it for some time now, it’s likely you’ve encountered the phrase “gap funding” in real estate. Gap funding in real estate is simply a temporary loan that is used to provide cash influx to an investor while they work towards securing a long-term loan, or if they’re working with multiple properties simultaneously.

What is Gap Funding in Real Estate Investing?

Gap funding is often referred to as a bridge loan in real estate investing because it “bridges the gap” between the primary sale of the first property and the purchase of a second property.

This way, the buyer is able to leverage the equity of the first property when buying the second property, then securing a loan while the first property is still on the market. You may also hear this kind of loan referred to as a swing loan, gap financing, or interim financing.

Gap funding can prove to be extremely beneficial to investors who need access to money immediately while their long-term financing is pending. If you need capital to help cover expenses while you’re still awaiting your permanent loan, gap funding may be the right option for you.

The Role of Gap Funding In Real Estate

Many real estate investors utilize private money or a hard money loan for investing purposes. However, often times, these lenders only cover 70% to 80% of the purchase price of a property.

This means that the real estate investor is left to come up with the remaining 20% to 30% as a down payment, in addition to closing costs. For that reason, the majority of borrowers will need to secure additional money to cover these costs, which is exactly where gap funding comes in.

Gap funding can help bridge the gap between the hard money loan and the remaining costs associated with your investment. That means that the additional funding can assist in covering the remaining acquisition costs, as well as the expenses sustained from remodeling, advertising, then selling the property.

When considering a gap loan for your investment project, it is important to bear in mind that the rates are typically more expensive than a private or hard money loan. Gap loans are considered “second position loans”, meaning they’re subordinate to the primary original loan you have acquired. The lender will compensate for the added risk of the secondary loan with more expensive rates.

Sometimes, gap funding lenders may also require the borrower to pay a percentage of the profit they make from the impending deal once it’s complete. Gap funding has provided opportunity to many investors that may have not have been able to secure a deal otherwise, but it must be used cautiously.

Pros of Gap Funding

There are many positive aspects of gap funding, and it could serve as a great way to assist you along your real estate investing journey financially.

One positive aspect of gap funding is that it is perfectly suited for high-volume house flippers, specifically those looking to tackle multiple projects simultaneously.

Gap funding can help alleviate the risks an investor could encounter from a slow sale after flipping a house, or any situation that could unexpectedly decelerate the fix-and-flip process.

When utilizing gap funding, you can also increase the number and scope of your real estate deals, since it allows you to avoid being tied up in capital constraints that you would otherwise normally encounter. In the long run, this can increase your revenues and profits, allowing you to grow your business at an even faster rate.

Another pro of gap funding for real estate investors is that gap funding can cover the difference between hard money loans and the remaining costs of your investment property. Because of this, gap funding makes it possible for many investors to secure deals they otherwise couldn’t have.

Gap funding can also help investors with other steps in the fix-and-flip process besides purchasing the property. The additional money can allow you to advertise the home properly to ensure that you find the deal you’re looking for and cover any closing costs when you sell the house.

One last positive associated with gap funding is that it allows for financial freedom. In theory, with gap funding, you can fix and flip an investment property with no capital whatsoever. While this is not normally the case, gap funding allows you to use your money for personal finances instead of having it tied up in your real estate investment.

Cons of Gap Funding

While there are many positive sides to gap funding, there are also negative aspects that you should be aware of when considering whether or not it is right for you.

Gap funding’s short-term nature makes it more beneficial for investors juggling multiple projects at once and less ideal for those who are attempting a single fix-and-flip. The additional costs are generally meant to meet the needs of those who intend to flip a large number of properties simultaneously. In most cases, the cost of a gap loan probably isn’t worth taking on if you only plan on flipping one property at a time.

Another negative to gap funding is reward-sharing. While the lender is incurring additional risk by taking you on as a borrower, the reward for them is high in the fact that there’s a chance that you may have to forfeit up to half of your profit in return for a zero-cash deal.

If the deal benefits you financially even after sharing the profit, then you may want to consider saving your capital and taking an alternative route.

Gap funding also consists of increased rates. Because of the increased risk put on lenders, borrowers are expected to pay more interest. Usually, the rate is much higher than your average private or hard money loan.

When Should You Use Gap Funding?

Real estate gap funding has been known to be incredibly beneficial for many investors, particularly those who are starting with very little capital, or investors who have multiple properties on the market at one time. However, there is a time and a place for gap funding, and it is not necessary for every deal. Because of the high risks connected with it, it should be used sparingly, and you should weigh the pros and cons to determine whether or not it’s right for you.

Gap funding may be beneficial for you if:

- You can’t afford the down payment without equity from the first property.

- Larger projects have the ability to yield larger returns.

- You expect to sell the first property within the next few months, and are ready to purchase another property now.

- Local sellers aren’t willing to accept offers based on contingencies.

- You don’t have enough capital to secure a deal.

- Capital is needed to complete any rehabbing projects on the investment property.

- Interest payments are increasing because a deal is taking longer to complete.

However, gap funding isn’t always a good idea. You should also consider some circumstances in which gap funding may not work out for you, such as if:

- You don’t know how long it will take to sell the first property, or if it will sell at all.

- You don’t need the funding to make a down payment on the second property.

- You can secure financing in your area without gap funding.

- You aren’t certain you could afford two mortgages at once.

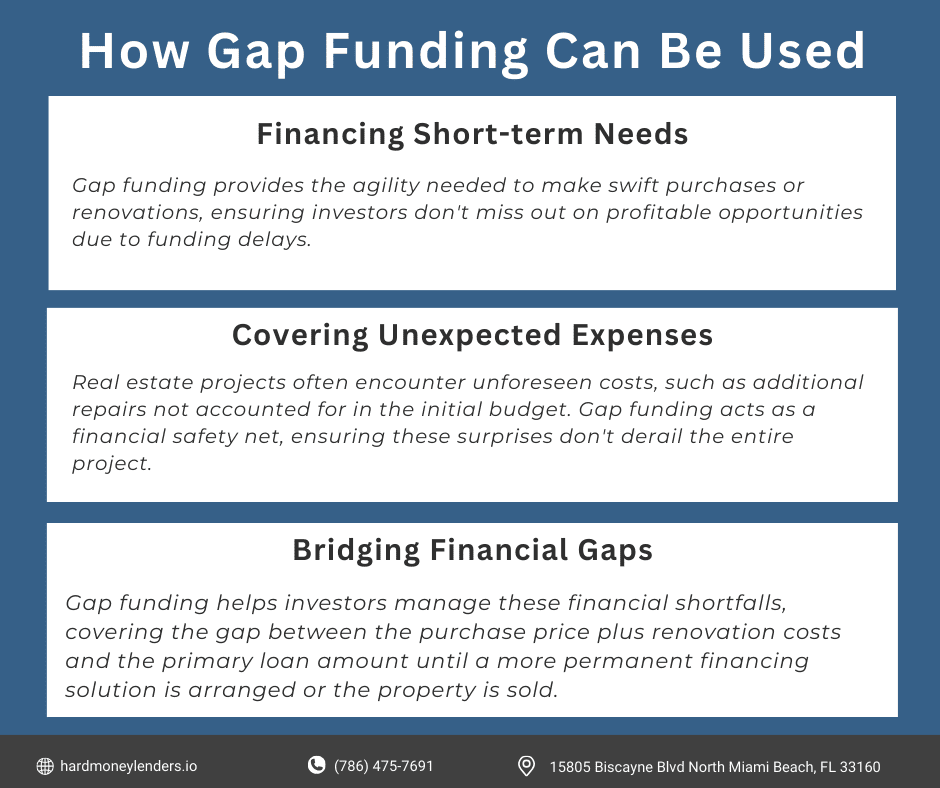

Gap Funding is a Versatile Tool

In short, gap funding is a versatile financial tool in real estate investment, playing a pivotal role in various scenarios:

- Financing Short-term Needs: Many real estate projects, particularly fix-and-flips, operate on tight schedules where traditional financing timelines can be prohibitive. Gap funding provides the agility needed to make swift purchases or renovations, ensuring investors don’t miss out on profitable opportunities due to funding delays.

- Covering Unexpected Expenses: Real estate projects often encounter unforeseen costs, such as additional repairs not accounted for in the initial budget. Gap funding acts as a financial safety net, ensuring these surprises don’t derail the entire project.

- Bridging Financial Gaps: The initial acquisition and subsequent renovation of a property can require more capital than initially projected. Gap funding helps investors manage these financial shortfalls, covering the gap between the purchase price plus renovation costs and the primary loan amount until a more permanent financing solution is arranged or the property is sold.

How and Where To Get Gap Funding

If you want to look into acquiring gap funding for your real estate investment, you must first decide whether you want to buy traditionally from a bank, or privately from a lender.

If you’re looking to acquire a gap loan from a bank, you will need to apply for it, similar to a traditional loan.

If you want to use a private lending resource, you will need to find the right private money lender.

Since gap lending is riskier than a hard money or private loan, investors must convince the gap lenders that their real estate investment would be worthwhile.

Remember that often times, the higher the chance of success the deal has of landing, the more likely the private lender is to provide you with a gap loan.

Typical Parties That Offer Gap Funding

- Private Investors: Typically individuals or investment groups with a keen interest in real estate ventures, private investors are a common source of gap funding. They may seek higher returns on their investments and can offer more personalized terms. Building strong relationships with these investors can lead to more flexible and accessible funding options.

- Hard Money Lenders: Specializing in short-term loans secured by real estate, hard money lenders are often more willing to take on projects traditional banks shy away from. Their interest rates are generally higher, reflecting the increased risk and the value they place on the property’s collateral over the borrower’s credit history.

- Crowdfunding Platforms: These platforms democratize the investment process, allowing individual investors to contribute smaller amounts of capital towards larger real estate projects. Crowdfunding can be a valuable source of gap funding, especially for projects with strong community appeal or innovative concepts.

- Personal Networks: Friends and family members may offer more lenient terms and a willingness to invest based on personal trust and relationships. However, mixing business with personal relationships requires clear communication and legal agreements to prevent misunderstandings.

Strategies to Secure Gap Funding

Securing gap funding requires a multifaceted approach, combining a compelling case for the investment with strategic networking and proof of financial reliability. Here’s how real estate investors can enhance their strategy to attract gap funding successfully:

Develop a Compelling Investment Proposal

- Market Analysis: Incorporate a comprehensive analysis of the current market trends, property values in the area, and the demand for real estate within the project’s locale. This should include comparative market analysis (CMA) to demonstrate the project’s potential market value post-completion.

- Project Specifics: Detail the project timeline, from acquisition through to completion, including all stages of renovation or construction. Provide architectural drawings, renovation plans, and any permits to show preparedness and compliance with local regulations.

- Financial Projections: Offer a detailed budget that covers all costs, including purchase price, renovation expenses, holding costs, and the anticipated gap funding amount. Supplement this with projected financial outcomes, such as sale price or rental income, to illustrate potential returns on investment.

- Exit Strategy: Clearly define your exit strategy, whether it’s selling the property post-renovation, refinancing to a long-term loan, or holding the property for rental income. This shows lenders your plan for loan repayment and the project’s endgame.

Leverage Networks

- Real Estate Investment Associations (REIAs): Regularly attending REIA meetings can connect you with a community of lenders and investors who have a vested interest in gap funding opportunities. These associations often host speakers and panels on financing strategies, including gap funding.

- Online Real Estate Platforms: Engage actively on platforms like BiggerPockets and LinkedIn. Share insights, participate in discussions, and showcase your previous projects. These platforms can also be valuable for identifying potential investors who are actively looking for opportunities to fund.

- Partnerships: Consider forming partnerships with other investors for larger projects. This not only increases your investment capacity but also spreads the risk, making the proposal more attractive to gap funders.

Demonstrate Repayment Capability

- Financial Documentation: Prepare to show comprehensive financial documents, including personal and business tax returns, current income statements, and balance sheets. For projects already underway, provide an accounting of expenditures to date and proof of project progress.

- Portfolio of Past Projects: Compile a portfolio showcasing successful past projects, especially those similar in scope to the current proposal. Include before-and-after photos, budget outlines, and actual returns. This tangible proof of your expertise and success can significantly bolster confidence in your ability to execute and profit.

- Clear Communication: Throughout the process, maintain clear and open communication with potential lenders. Be ready to answer questions about your proposal, adjust terms as necessary, and demonstrate your commitment to the project’s success.

- Legal and Professional Advice: Engage with legal and financial advisors to ensure that your investment proposal and any agreements are professionally prepared and that they protect all parties’ interests. This level of professionalism further reassures lenders of the seriousness and potential of your venture.

Hard Money Lenders IO Gap Funding

If you need to perform complex financing options, such as gap funding in Florida, then Hard Money Lenders IO is here to assist you every step of the way.

We provide gap funding to those in need of cash for great investment deals. Hard Money Lenders IO offers quick approval, reasonable rates, and access to the funds you need to make deals happen.

We look forward to helping you develop your portfolio by providing gap funding that increases your ability to invest in great deals hitting the market – even if your equity is currently tied up in another property.

Conclusion

In summary, gap funding can prove to be extremely beneficial to investors who need access to immediate cash while their long-term financing is pending. If you need capital to help cover expenses while you’re still awaiting your permanent loan, gap funding may be the right option for you. It’s also very helpful for investors who are taking on multiple real estate investment projects simultaneously.

However, while gap funding has assisted numerous investors in closing deals that they might not have otherwise, it is not without it’s faults. Like many things in the real estate industry, gap funding comes with its pros and cons, and should be used situationally on a case-by-case basis. Be sure to conduct proper research so that you can make an informed decision on whether or not gap funding can assist you in your real estate ventures.

FAQs About Gap Funding

How Does Gap Funding Work?

Gap funding acts as a crucial bridge in real estate financing, serving to fill the shortfall between the investor’s available capital (including primary loans) and the total funds required to successfully complete a project.

This type of funding is secured by the real estate asset itself, offering lenders a tangible security against the loan. The repayment of gap funding is typically structured to align with major project milestones—most commonly, the sale of the property or the securing of long-term, more traditional financing.

This setup allows investors to proceed with confidence, knowing they have the necessary resources to see the project through to completion or to a point where conventional financing becomes viable.

Who Can Benefit from Gap Funding?

Gap funding is particularly advantageous for a wide array of real estate investors, especially those involved in short-term, high-intensity projects like fix-and-flips, where the turnaround time from purchase to sale is relatively quick.

It also benefits developers working on new constructions or extensive renovations that require a substantial upfront investment to get off the ground. Additionally, investors looking to purchase properties at auction, where quick access to funds is essential, can leverage gap funding to secure winning bids.

This flexible financing solution is tailored to meet the needs of investors who encounter funding gaps that cannot be bridged by traditional means alone.

What Are the Typical Terms for Gap Funding?

The terms for gap funding are designed to accommodate the inherently higher risk and short-term nature of these loans. Interest rates are generally higher than those found in conventional real estate loans, reflecting the increased risk profile and the expedited underwriting and funding processes.

Loan durations are also shorter, typically ranging from a few months up to two years, providing just enough time for the investor to execute their project plan and transition to more stable financing or sell the property for a profit. Specific terms can vary greatly depending on the lender’s policies and the specifics of the project, so it’s crucial for investors to negotiate terms that align with their project timelines and financial strategies.

How Do I Find Gap Funding Sources?

Identifying sources for gap funding requires a multifaceted approach. Begin with thorough online research to discover private investors and hard money lenders who explicitly offer gap funding for real estate projects. Crowdfunding platforms can also be a viable source, offering the opportunity to pitch your project to a wider audience of potential investors.

Additionally, tapping into your personal and professional networks can uncover funding opportunities that might not be publicly advertised. Attending real estate investment conferences, local meetups, and forums can facilitate connections with like-minded individuals and potential lenders who are open to gap funding arrangements.

What Are the Risks Involved with Gap Funding?

While gap funding provides essential capital, it comes with its own set of risks. The foremost concern is the higher cost of borrowing, which can impact the overall profitability of your project.

Short repayment periods necessitate having a robust exit strategy in place to ensure timely repayment without jeopardizing the project’s success. Failure to repay the gap funding as agreed can result in severe consequences, including the loss of the property and legal action, which in turn could harm your reputation and creditworthiness in the investment community.

Can Gap Funding Affect My Credit Score?

Direct impact on your credit score from gap funding is unlikely if the funding comes from non-institutional sources that typically do not report to credit bureaus. However, should there be a default on the loan that leads to legal action or a lien against the property, this could negatively affect your credit history.

It’s imperative to understand the terms and conditions of your gap funding agreement and to plan meticulously to avoid any negative repercussions that could arise from failure to meet your repayment obligations.

What Does “Second Position” Mean in Gap Funding?

In the context of gap funding, “second position” refers to the order of repayment priority in the event of a default or when the property is sold or refinanced. Typically, loans are arranged in a hierarchy based on when they were secured by the property, determining which lenders get paid first out of the proceeds from a sale or refinancing.

When a gap loan is in second position, it means there is another loan, often referred to as the first or senior lien, that has priority over the gap loan. This senior lien is usually the primary mortgage or loan used to purchase the property. Should the property be sold or go into foreclosure, the lender in the first position is paid back their due amount before any funds are allocated to repay the gap loan in second position.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.