When it comes to real estate investing, securing flexible and timely financing is a cornerstone of success. Asset-based lending is one pivotal strategy for investors looking to leverage their assets for quick funding. Among the most potent forms of asset-based financing is the hard money loan—a tool that can turbocharge investment opportunities. That said, let’s take a look at the role of asset based lending for real estate investors. Below, we’ll provide real estate investors with the knowledge to harness these financial vehicles effectively.

What is Asset-Based Lending for Real Estate Investors?

Asset-based lending is when a real estate investor can acquire financing for a property, based on the assets of the borrower.

Asset-based lending is when a real estate investor can acquire financing for a property, based on the assets of the borrower.

In asset-based lending, liquid assets are assets that can be converted to cash in a very short amount of time, including cash or marketable securities. In particular, liquid assets refer to assets that can be quickly converted to cash. Liquid assets include your personal income, cash, stocks, mutual funds, and bonds.

However, asset-based lending usually does not refer to liquid assets. It usually refers to the property as the asset. In short, there has to be some kind of collateral for asset-based loans, and asset-based loans are mostly used for fix and flips, repairs of distressed properties, or long-term rentals. By definition, asset-based loans are almost always for business purposes rather than traditional homeownership.

Another name for asset-based lending is equity-based lending.

But one big advantage of asset-based lending is it is much faster than dealing with banks and traditional lending. It also requires less stringent requirements and banks, so asset-based lending has the advantage of faster financing and faster speed of approval.

An asset-based loan can be approved within a couple of days if not a week.

Sometimes, an asset-based lender is the best possible alternative for someone who does not qualify for traditional financing.

When Should a Real Estate Investor Use Asset-Based Financing?

People with bad credit or a foreclosure can consider asset-based loans for real estate investments.

Unlike traditional loans, which consider the borrower’s creditworthiness as a primary criterion, asset-based loans focus on the value of the collateral. This approach offers flexibility and accessibility to investors, making it an ideal solution for those needing fast funding to capitalize on timely opportunities.

If someone has had trouble getting approved in financing from a traditional bank, asset-based lending might be the answer. Lenders usually look at the investment properties themselves, and asset-based lending is prevalent for investors who are looking for fast financing.

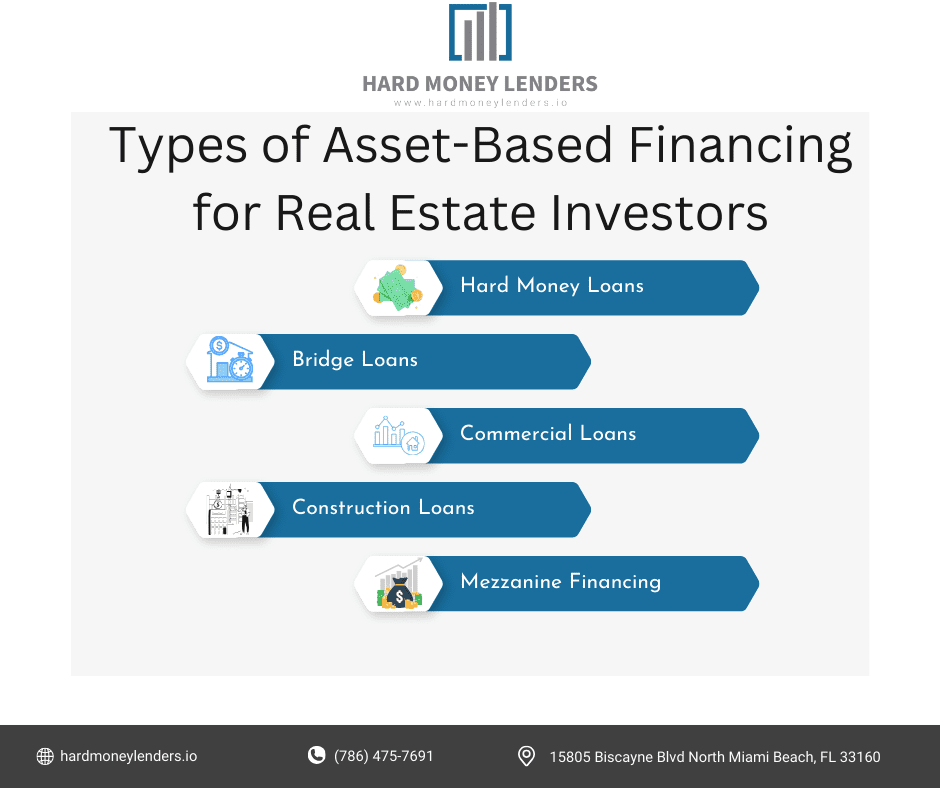

Different Types of Asset-Based Financing for Real Estate Investors

Below, you’ll find the diverse types of asset-based lending available to real estate investors, each catering to different needs and strategies within the realm of property investment.

Below, you’ll find the diverse types of asset-based lending available to real estate investors, each catering to different needs and strategies within the realm of property investment.

Hard Money Loans

As a pivotal form of asset-based lending, hard money loans are favored for their rapid approval and funding processes. Issued by private lenders, these loans are ideal for investors looking to finance projects requiring immediate action, such as fix-and-flips, auction purchases, or properties needing significant rehabilitation.

The interest rates are typically higher, reflecting the short-term nature and risk involved, but the focus on property value over borrower credit history makes this an accessible option for many investors.

Bridge Loans

Bridge loans serve as a temporary financing solution, enabling investors to bridge the gap between acquiring a new property and selling an existing one. These short-term loans help investors manage timing discrepancies between transactions, providing the necessary capital to move forward with a purchase before securing long-term financing or completing a sale. Like hard money loans, bridge loans are secured by real estate assets and offer quick access to funds, though they usually involve lower LTV ratios to mitigate lender risk.

Commercial Loans

Specifically designed for commercial real estate investments, commercial hard money loans offer short to medium-term financing for properties like office buildings, retail spaces, or multifamily units. Investors may use these loans to enhance a property’s value through renovations or to stabilize occupancy rates before refinancing to a more permanent loan solution. The terms can vary widely based on the project’s scale and complexity, with the underlying property serving as collateral.

Construction Loans

For investors aiming to develop raw land or undertake significant construction projects, construction loans provide tailored financing that supports the project from ground-breaking to completion. These loans are disbursed in stages, corresponding to specific milestones in the construction process, and are converted into traditional mortgages upon project completion. Given the higher risk associated with construction projects, these loans demand detailed planning and budgeting, with loan amounts based on the projected value of the completed property.

Blanket Loans

Blanket loans are a strategic financing tool for investors with multiple properties, allowing them to consolidate several mortgages into one loan. This approach simplifies the management of multiple properties by offering a single payment and uniform terms. Blanket loans are particularly useful for portfolio investors looking to leverage equity across several assets, expand their holdings, or streamline refinancing efforts. However, they typically require substantial equity and a strong investment track record to qualify.

Mezzanine Financing

Mezzanine financing is a hybrid form of asset-based lending that blends debt and equity financing. It provides capital to investors for large-scale projects or acquisitions, secured by the borrower’s equity in the property rather than the property itself. This financing type is more complex and often involves higher interest rates, but it offers flexibility for investors to undertake significant ventures without diluting ownership.

Now that you know the different types of asset-based lending for real estate investors, you should know the benefits and drawbacks.

The Advantages and Disadvantages of Asset-Based Lending

There are many benefits to asset-based lending and some drawbacks. It’s important you understand them in detail before securing asset-based financing.

Advantages of Asset-Based Lending for Real Estate Investors

The first is a fast speed of approval, which can help a real estate investor compete with other buyers, especially in competitive seller’s markets where demand outpaces supply.

Other advantages include fewer guidelines and more flexibility with the loan money. Also, asset-based lending provides a short-term cash flow for mid and small-sized businesses.

Asset-based loans can be used for real estate investors with a not ideal credit score or history. Usually, a lender performs a cash flow analysis on a property to see how good it is as an asset. If the property is a long-term rental, the lender tries to see the net cash flow of the property.

Another important advantage of an asset-based loan is that many sellers count it as cash when they sell a cash-only property. In real estate, cash-only obviously means the buyer can only pay in cash, but it is a term with deeper implications because the home did not qualify for traditional financing and a mortgage if it is cash only. This usually means the property is in a severe state of disrepair, to the point where a bank does not even want to touch the property.

Normally, a big barrier to buying a cash only property is not having enough cash, but many sellers count asset-based loans and hard money loans as cash because they are not backed by traditional financing. Asset-based loans are, in some ways, designed for just the purpose of rehabilitating a distressed property and flipping it into an attractive real estate property, which is why many sellers agree to take hard money or asset-based loan money as cash.

That said, asset-based loans help real estate investors compete and enter the market for a very select pool of properties and real estate investments. They give fast money for investors who might not want to wait for the lengthy process of traditional financing with banks.

Drawbacks of Asset-Based Lending

Likewise, it’s important to also talk about the disadvantages of asset-based lending. Asset-based loans are more expensive for a variety of reasons.

They have higher interest rates than traditional financing, and if a hard money loan is being used for an asset-based loan, this means a borrower is taking on interest rates of 8–15%.

Also, asset-based loans tend to be shorter in their repayment periods. They need to repaid very quickly compared to traditional mortgage loans, which need to be repaid within 15 to 30 years.

The asset-based loan also has a lower LTV ratio than a traditional loan, which means the buyer has to put down a greater down payment on average.

The Role of Hard Money Loans in Real Estate Investments

Hard money loans serve as a crucial financing tool within the real estate sector, particularly appealing to investors facing fast-paced market conditions or those with unique financial situations. These loans are provided by private investors or companies rather than traditional banking institutions, distinguishing them notably from standard mortgage options. The essence of hard money lending lies in its asset-based approach, where the loan’s security is directly tied to the real estate property being financed.

The short-term nature of these loans, typically ranging from six months to a few years, combined with higher interest rates, reflects the elevated risk profile and the expedited underwriting process. Yet, it’s precisely these characteristics that render hard money loans invaluable to real estate investors. They facilitate funding for projects that might not fit within the rigid criteria of traditional financing, such as properties requiring significant rehabilitation, or situations demanding rapid financial closure that conventional lenders simply cannot accommodate.

Advantages of Hard Money Loans for Real Estate Investors

- Speed of Approval: The streamlined approval process is a hallmark of hard money lending, with decisions and funding possible within mere days. This efficiency is grounded in the lender’s focus on the property’s value and potential rather than the borrower’s credit history, enabling swift project initiation.

- Flexibility in Terms: Unlike the one-size-fits-all approach typical of conventional loans, hard money lenders offer a level of flexibility unmatched in the financial world. Terms can be tailored to align with the investor’s project timeline, cash flow needs, and overall strategy, including customizable interest-only payment periods or balloon payments at loan maturity.

- Opportunity Leverage: For real estate investors, timing can be everything. Hard money loans empower investors to act decisively when opportunities arise, providing the necessary capital to secure auction properties, capitalize on short sales, or invest in time-sensitive deals that would be unfeasible with slower, traditional financing methods.

Navigating the Hard Money Loan Process

- Property Evaluation: The initial step in the hard money loan process involves a detailed analysis of the property in question. Lenders assess its value, the equity it represents, and the potential returns on investment it offers. This assessment not only determines loan eligibility but also influences the terms of the loan.

- Loan Application: Successful loan applications hinge on the presentation of a comprehensive and compelling investment proposal. This includes detailed renovation plans, cost estimates, projected timelines, and a market analysis to justify the project’s viability and profitability.

- Repayment Strategy: Crafting a viable exit strategy is paramount for securing a hard money loan. Whether planning to sell the property post-renovation at a profit or transitioning to traditional financing through refinancing, a clear, executable repayment plan reassures lenders of the borrower’s commitment and financial acumen.

Best Practices for Real Estate Investors Using Hard Money Loans

- Conduct Due Diligence: The importance of vetting potential lenders cannot be overstated. Investigate their lending history, financial stability, and borrower testimonials to ensure a partnership that aligns with your investment goals and ethical standards.

- Understand the Costs: Familiarize yourself with all associated costs of the loan, from interest rates to processing fees and potential penalties. An accurate understanding of these figures is critical for effective financial planning and project budgeting.

- Prepare for Appraisal: Maximizing the property’s appraisal value is crucial for securing favorable loan terms. This may involve preliminary property improvements or simply ensuring the property is presented in its best light, highlighting its potential and value to the lender.

By adhering to these detailed insights and practices, real estate investors can effectively navigate the world of hard money loans, leveraging their unique benefits to achieve investment success.

Final Thoughts on Asset-Based Lending for Real Estate Investors

Asset-based lending and hard money loans open a realm of possibilities for real estate investors, offering a fast, flexible, and effective way to finance properties. By leveraging these financial instruments wisely, investors can navigate the market’s challenges and capitalize on its opportunities.

FAQs About Asset-Based Lending for Real Estate Investments

What is Asset-Based Lending in Real Estate?

Asset-based lending in real estate is a financing method where loans are provided based on the value of the collateral, typically the property itself, rather than the borrower’s creditworthiness. This type of lending focuses on the asset’s potential to generate income or be sold at a profit, making it a popular choice for investors who need quick funding for property acquisitions, renovations, or development projects.

How Does Asset-Based Lending Differ from Traditional Loans?

The key difference between asset-based lending and traditional loans lies in the underwriting process. While traditional loans evaluate a borrower’s credit score, income, and debt-to-income ratio, asset-based lending primarily assesses the value and potential of the property being used as collateral. This approach allows for faster approval times and provides access to financing for borrowers who might not qualify for conventional loans due to credit issues or the unconventional nature of their investment projects.

What Types of Properties Qualify for Asset-Based Lending?

Asset-based lending can cover a wide range of property types, including residential, commercial, industrial, and land. Specific types of financing, like hard money loans, bridge loans, or construction loans, cater to different investment strategies, such as fix-and-flips, property development, or buying and holding. The qualifying factor is typically the property’s value and the feasibility of the proposed investment plan.

Can I Use Asset-Based Lending for Property Development?

Yes, asset-based lending is particularly well-suited for property development projects, including ground-up construction and major renovations. Construction loans are a form of asset-based lending designed to fund development projects, providing capital in stages as the project progresses. These loans are based on the projected value of the property upon completion, allowing developers to finance projects that might not be eligible for traditional funding.

What Are the Interest Rates for Asset-Based Loans?

Interest rates for asset-based loans are generally higher than those for traditional mortgages, reflecting the higher risk assumed by the lender and the short-term nature of the loan. Rates can vary widely depending on the lender, the type of loan, the value of the collateral, and the borrower’s financial situation. Hard money loans, for example, often have interest rates in the double digits.

What Are the Requirements for Obtaining an Asset-Based Loan?

While requirements can vary by lender and loan type, common criteria for asset-based loans include a professional appraisal of the property, a clear and feasible investment plan, and sometimes a minimum equity or down payment. Borrowers may also need to demonstrate their ability to manage and execute the project effectively, though the emphasis is less on personal financial history and more on the property’s potential.

How Long Does It Take to Secure an Asset-Based Loan?

One of the advantages of asset-based lending is the speed of the funding process. Loans can often be approved and funded within a few weeks, and sometimes even days, depending on the lender’s requirements and the complexity of the deal. This quick turnaround is crucial for investors who need to act fast to secure properties or take advantage of time-sensitive opportunities.

Are There Any Drawbacks to Asset-Based Lending?

The primary drawbacks of asset-based lending are the higher interest rates and shorter loan terms compared to traditional financing, which can result in higher monthly payments and a more significant burden to refinance or pay off the loan quickly. Additionally, the loan amount is based on the property’s value, which may limit the total funding available if the property does not appraise at a high enough value.

Can Asset-Based Loans Be Refinanced?

Yes, asset-based loans can be refinanced, typically into a traditional mortgage or a longer-term loan with lower interest rates. Refinancing can provide more manageable repayment terms and reduce the cost of borrowing over time. Investors often use refinancing as a strategy to exit short-term asset-based loans once a property has been developed or its value has increased.

About HardMoneyLenders.IO

We at Hard Money Lenders IO are a hard money lender based in Miami, Florida. We give asset-based loans for real estate investors that can be approved within a couple of days, which gives all the advantages of hard money loans.

Not only that, but we give other resources as well, including a loan calculator, fix and flip calculator, and private lenders directory for hard money loans (in case we’re not the best hard money lender for your situation). Our directory pairs you with the most reputable and experienced hard money lenders in your area, covering all 50 states and major cities and suburbs within those states. Since lenders are often very localized, this directory is very helpful for finding hard money lenders in your area.

We offer loans to people who typically have a very hard time getting an asset-based loan, including foreign nationals and new investors. Foreign nationals have major barriers with having sufficient documentation to qualify for financing, while new investors may immediately not qualify because most lenders require successful track records of investments.

We also provide diverse kinds of loans like distressed property loans, residential rehabilitation, fix and flip funding, and commercial bridge loans. In terms of asset-based lending, the loans help small and mid sized businesses expand, and real estate investors gain profit.

We also have brokers who can help a real estate investor find the best possible hard money loan and lender for their situation and real estate investment goals.

Our experienced experts help you figure out which loan is best for you and which kind of asset-based loan can best assist you in your real estate journey.

Disclaimer: this article is for educational and informational purposes. It is not financial advice. Please seek the advice of a financial or real estate consultant prior to making any major real estate decisions.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.