Best Insurance For House Flippers

House flippers deal with significant risks, and house flipping is a very complex process that isn’t wrapped up very quickly. Because of these risks, insurance for house flippers is essential whenever a real estate investment goes wrong. In general, getting insured as a house flipper can be a complicated process, but there is one simple rule for real estate investors, both experienced and inexperienced. No house flipper should not have insurance.

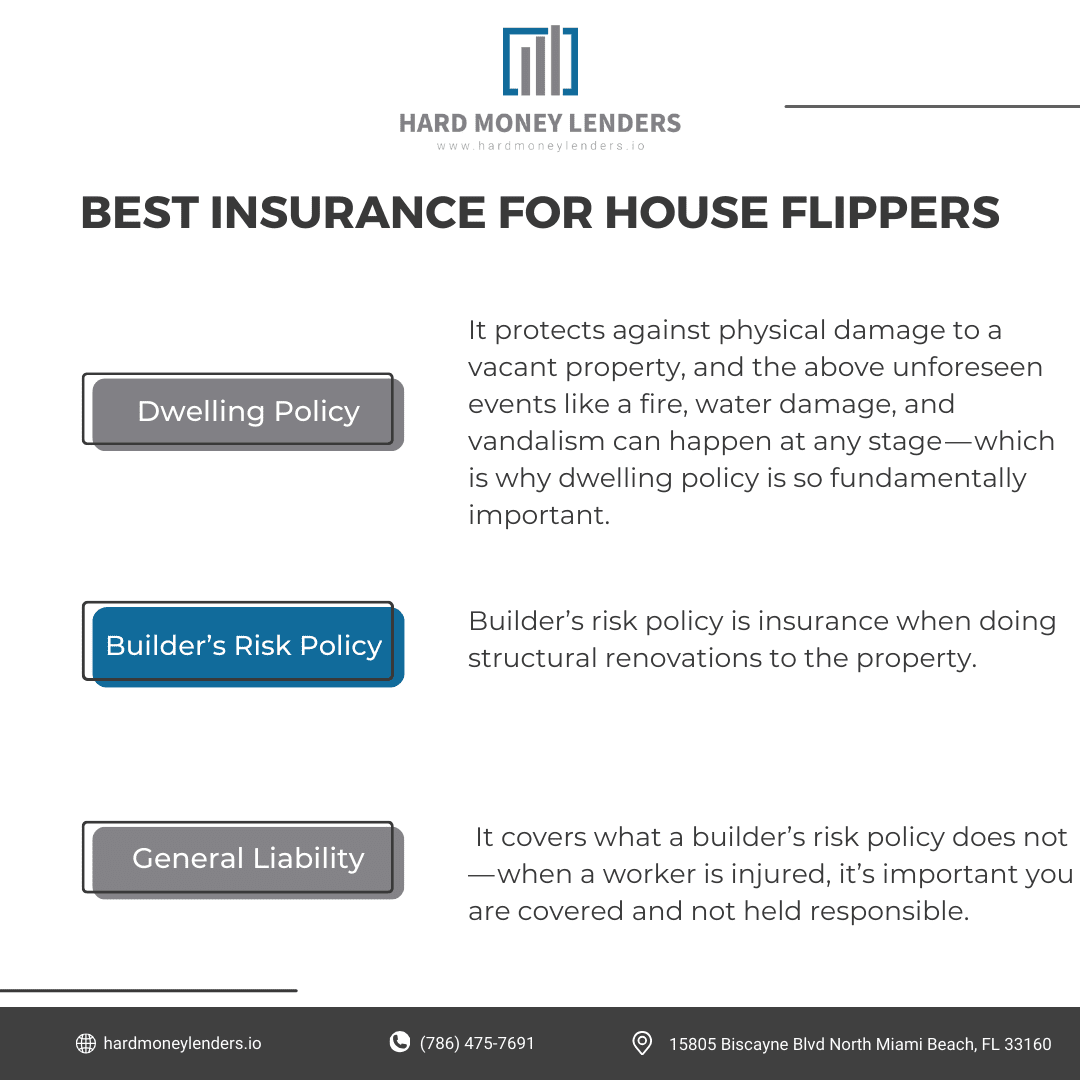

Now, you need to remember there are things that can go wrong with a house flip. A house can get burned down, a contractor can get hurt, and the property can be vandalized. Building material can also be stolen during the building process. Also, house flipping requires a special type of insurance that auto and personal home insurers do not cover. In particular, there are three kinds of insurance every house flipper should have: a dwelling policy, a builder’s risk policy, and a general liability umbrella.

Here’s what each policy is, and why it’s important to have for a house flipper.

Best Insurance for House Flippers

Dwelling policy

Dwelling policy

Dwelling policy is a necessary insurance policy needed for house flippers. It protects against physical damage to a vacant property, and the above unforeseen events like a fire, water damage, and vandalism can happen at any stage — which is why dwelling policy is so fundamentally important. You also want dwelling coverage in case the home is destroyed by a natural disaster or another hazard.

Dwelling insurance is part of a homeowner’s insurance policy to rebuild a home if it burns down. As a rule of thumb, it should be enough to cover the cost of rebuilding a home. It does not cover any belongings within the home, but just covers the amount necessary to rebuild the home itself.

Dwelling insurance policy is usually around 0.5% to 1% of the property value of the home per month. The riskier the property (vacant properties and those being renovated are higher risk), the higher the policy.

Builder’s risk policy

Builder’s risk policy is insurance when doing structural renovations to the property. Flipper Force notes it applies when there is “direct, physical damage to a property during the construction process.” This type of insurance covers building materials and equipment of the property and this equipment has to be owned by the insured.

An insurance policy must have a “Builder’s Risk rider” to consider. The builder’s risk policy covers both soft costs and more direct costs of the construction project. Now, a builder’s risk policy is the most affordable type of insurance for house flippers and great for beginning investors, since it is used in case of any structural renovations like new walls or roofs. If the repairs are more cosmetic (like new paint), like needing new paint and appliances, only a regular vacant policy is necessary.

Builder’s risk policy also does not cover liability issues like injuries, medical costs associated with injuries, and more.

General liability umbrella

A general liability umbrella is a different kind of insurance and is not the same as a builder’s risk policy. It covers what a builder’s risk policy does not — when a worker is injured, it’s important you are covered and not held responsible. General liability insurance can be purchased with the policy or can be purchased separately.

It is the policy that protects people from injuries and legal fees. It is necessary for any renovations that require structural changes. This policy contributes to legal fees and medical treatment.

This is an absolute essential if any renovation is required. Damage to workers or contractors is covered by the policy, but not damage to the property itself.

How Much Does Insurance Cost?

Insurance for house flipping is always much more expensive than regular homeowner’s insurance. Fix and flip homes are usually vacant, which leads to their being open to theft. There are also usually two options for insurance coverage,w which include basic form coverage and special form coverage.

Basic form coverage is coverage for damage listed in a policy, but nothing else. It does not cover theft and water damage, and basic form coverage often saves real estate investors a significant amount of time.

Special form coverage is coverage for all damages, except damages explicitly excluded in the policy. It means an insurance carrier has to prove a loss was caused by a lapse in coverage.

The cost is also determined by the value of the property, geographical location, and the amount of coverage a real estate investor wants to get.

Comparison of Insurance Providers for House Flippers

Choosing the right insurance provider is crucial for house flippers due to the high-risk nature of their investments. Here’s a more detailed comparison of different insurance providers focusing on their offerings, advantages, and limitations:

Customizable Policy Providers

- NREIG (National Real Estate Insurance Group): Specializes in insurance for real estate investors, including house flippers. NREIG is known for offering highly customizable policies that can be tailored to the specific stages of a flip—from vacant properties awaiting renovation to fully renovated ones on the market. This customization can include various types of coverage such as liability, builders risk, and vandalism, all under one policy, simplifying the management and potentially reducing the cost of insurance.

- National Real Estate Insurance Group: Similar to NREIG, this provider offers a comprehensive range of coverages that can be customized and combined depending on the specific needs of the project. Their ability to cover multiple properties under one policy makes them a go-to for investors with several ongoing projects, reducing paperwork and streamlining insurance processes.

Traditional Insurance Companies

- State Farm: Known for its strong customer service and nationwide availability, State Farm offers basic insurance coverage that suits the needs of most residential property investors. However, their offerings for house flippers are typically less flexible compared to those specialized in real estate investment. State Farm’s policies might cover the basics such as fire, theft, and liability but might not offer as much customization for renovation-specific risks.

- Allstate: Provides a range of property insurance products that can be useful for house flippers, including standard homeowners policies that cover major perils and liability. While Allstate is a reliable choice with robust customer support, its products might lack the specificity and flexibility that flippers need, particularly in terms of builder’s risk and vacant property insurance.

Factors to Consider When Choosing a Provider

- Coverage Options: Look for providers that offer flexible and extensive coverage options that can be tailored to the unique phases of house flipping, from acquisition and renovation to sale.

- Premium Costs: Compare the cost-effectiveness of different policies. Providers specializing in real estate investment might offer more competitive rates for bundled coverages.

- Claim Process: Evaluate the efficiency and ease of the claim process. A provider with a straightforward and quick claim process can be crucial during emergencies.

- Customer Service: Consider the provider’s reputation for customer service. Quick, reliable support can be vital for addressing issues during the flipping process.

- Experience in Real Estate: Providers with a focus on real estate investments are likely to understand the intricacies of house flipping better and offer relevant products and advice.

Risk Assessment for House Flippers

Conducting a thorough risk assessment is a critical step for house flippers to minimize potential losses and ensure the profitability of their investment. Here’s how to deepen your approach:

- Structural Integrity Evaluation:

- Assessment of Building Condition: Hire a professional inspector to evaluate the property’s foundation, roofing, plumbing, electrical systems, and overall structural health.

- Historical Maintenance Review: Look into the property’s maintenance records to understand past issues and repairs.

- Neighborhood Safety and Marketability:

- Crime Rates and Safety: Check local crime statistics and talk to neighbors to get a sense of the area’s safety.

- Local Market Trends: Analyze real estate market trends in the neighborhood, including average property prices, time on the market, and future development plans.

- Zoning Laws and Regulatory Compliance:

- Local Zoning Information: Research local zoning laws to understand what the property can be used for and any future changes that may affect your plans.

- Compliance Requirements: Ensure the property meets all local building codes and regulations, which might affect renovation plans or intended property use.

- Legal Considerations:

- Title Search: Conduct a title search to check for liens, easements, or other encumbrances that might impact your ownership.

- Boundary Disputes: Review property boundaries and any existing disputes or potential issues with neighboring properties.

- Natural Disaster Risk:

- Geographic Vulnerabilities: Evaluate the risk of natural disasters like floods, earthquakes, or wildfires, depending on the location.

- Insurance Requirements: Determine the type and amount of additional insurance needed to cover these risks adequately.

This comprehensive risk assessment will help you make more informed decisions, align investments with realistic expectations, and prepare adequately for potential challenges.

Insurance Considerations for Different Types of Properties

Residential Properties

For residential flipping projects, insurance coverage needs to be comprehensive and tailored to the specific risks involved:

- Basic Coverage: This typically includes a dwelling policy, which covers the physical structure against damage from fires, storms, and other perils. Builder’s risk insurance is crucial during renovations as it covers materials, fixtures, and equipment on-site that are intended for installation. General liability insurance is also essential to protect against claims of bodily injury or property damage caused by the renovation activities.

- Extended Coverage: In high-risk areas, consider additional protections such as vandalism or theft coverage. These policies are particularly important in neighborhoods with higher crime rates or when the property will remain vacant for extended periods. These additions help mitigate the financial impact of these common risks.

Commercial Properties

Commercial real estate investments carry unique risks, requiring specialized insurance solutions:

- Business Interruption Insurance: Essential for covering the loss of income when rental properties are uninhabitable due to ongoing construction or post-incident repairs. This insurance helps maintain cash flow, crucial for the financial stability of the project.

- Higher Liability Limits: Commercial properties typically see more public traffic and can involve activities that carry greater risk. Higher liability limits help ensure that any claims related to bodily injuries or property damage do not financially cripple the investment.

Urban vs. Rural Properties

The location of your property significantly influences the types of risks it may face:

- Urban Property Risks: Properties in urban areas may require additional coverage for acts of vandalism or theft. Civil disruption coverage can also be important in areas prone to protests or other forms of civil unrest.

- Rural Property Risks: These properties might face challenges related to environmental hazards like floods or wildfires. Accessibility issues due to less developed infrastructure can also necessitate specific coverages, such as road access or utility service interruptions.

Specialty Properties

Certain types of properties require specialized insurance due to their unique characteristics:

- Historic Properties: Insurance for historic properties often includes coverage for the architectural elements that are irreplaceable. Restoration work on these buildings needs to comply with local regulations regarding historical preservation, which can increase costs and complexities.

- Vacation Rentals: These properties often need additional liability coverage due to the increased risk of accidents, especially if the property includes recreational facilities like pools, hot tubs, or watercraft.

Each type of property and its associated risks should be carefully evaluated to ensure that the insurance coverage is adequate to protect against potential financial losses. Consulting with an insurance professional who has experience in real estate investing can provide valuable insights into crafting a policy that meets the specific needs of your investment strategy.

What Insurance Should I Get?

Every real estate investor should of course do their research, but in particular, new investors should talk to an insurance agent, and determine what coverage you should get.

Your homeowners or auto insurance should have insight into what insurance you need for a renovation or fix and flip.

You should never not have insurance for your renovation, unless in the rare cases where you’re living on the property while it’s being renovated. The insurance you get is as important as when you get insurance — it’s essential to get insurance early in the process.

Many insurance providers specialize in flipping houses, and it’s essential to seek out an ideal partner. Most likely, you can expect an insurance policy to cost about 1% to 4% of the home.

Hard money loans

Hard money loans are one of the most common ways house flippers secure financing to invest in real estate. Hard money loans are otherwise known as last resort loans, but they help real estate investors get fast funds for homes.

Hard money loans have a very distinct advantage: they can be approved very quickly. They can be approved in a couple of days, which is significantly faster than the approval rate for traditional mortgage loans.

In real estate investing, time is often money. Hard money loans can be approved so fast because they use the property as collateral and the asset. If a borrower defaults on the property, the hard money lender owns the property, which is a significantly faster process than a foreclosure.

However, this is a significantly riskier process than traditional mortgage financing. Hard money loans have high interest rates of 8–15%, short repayment periods of more or less a year, and lower LTV ratios. This is tremendously higher than the just higher than 4% interest rate of traditional mortgage financing, as well as the repayment periods of 15 to 30 years.

This means house flippers need to have significant funds for higher down payments, lest they risk higher interest rates. For many, the speed of the loan and its approval may justify the higher costs of hard money loans. They are essential for bidding for competitive properties.

Hard Money Lenders IO

Hard Money Lenders IO

At Hard Money Lenders IO, we can help you find an ideal insurance partner for your real estate transaction. We are a Florida-based private lending company that gives loans to real estate investors. We also provide free consultations and pair real estate investors with brokers.

We also would not give a hard money loan without referring a real estate investor to insurers that will partner with them.

We are a hard money lender, and for hard money loans, there may be even more insurance you need. You might need title insurance to secure a hard money loan and earning the trust of a lender. Most hard money lenders also require a dwelling policy to protect against the most common of damages.

It’s important to note different hard money lenders have different requirements. We are a hard money lender that clearly communicates about insurance requirements in our terms. We also communicate about what coverage is best for your situation, and how much you may need to pay for that coverage. We are a reputable and established lender who will make sure you have the most ideal coverage possible.

Again, never try to flip a house uninsured, because in case something happens to a home, contractor, or worker during renovations, you want to get your money back. We can link you to an insurance agent to get you the coverage you need.

As a disclaimer, this article is not financial advice. It is purely written for educational purposes.

FAQs

What kind of insurance do house flippers need?

House flippers typically need several types of insurance to cover various risks associated with real estate investments:

- Dwelling Policy: Covers damage to the property itself from risks like fire, storm damage, and vandalism.

- Builder’s Risk Insurance: Provides coverage for materials and equipment on-site during the renovation period.

- General Liability Insurance: Protects against claims of bodily injury or property damage that might occur on the property during the renovation.

- Vacant Property Insurance: Useful when the property remains unoccupied for extended periods, offering protection against risks like theft or fire.

How do you insure a home you are going to flip?

To insure a home you are planning to flip, follow these steps:

- Assess the Property’s Needs: Determine what types of risks are associated with the property based on its condition and location.

- Consult with Insurance Professionals: Speak with an agent who understands real estate investment and can guide you in selecting the right types of policies.

- Choose Appropriate Coverage: Select policies that cover all phases of your project, from acquisition through renovation, to sale.

- Regularly Review and Adjust Coverage: As the renovation progresses, reassess your coverage needs to ensure all new risks are adequately covered.

Is it more expensive to insure a flip house?

Yes, insuring a house intended for flipping is typically more expensive than insuring a standard residential home. This increase in cost is largely due to the higher risk associated with renovation projects. Houses under renovation are often targets for theft and vandalism, especially if they are left vacant for extended periods.

Additionally, the presence of construction equipment and ongoing work increases the likelihood of fire and accident-related claims. Insurers price these risks into the premiums, making policies for flip houses more costly. It is crucial for investors to communicate the exact nature of their projects to insurance providers to ensure that all potential risks are adequately covered and that they are not paying for unnecessary coverage.

Can I get insurance for a short-term property investment?

Yes, insurance for short-term property investments, commonly known as renovation or builder’s risk insurance, is specifically designed to cover properties from the start of renovations until they are sold.

This type of insurance is tailored to protect against the unique risks present during the remodeling phase, such as damage from work-related accidents, materials theft, and other liabilities that typical home insurance does not cover.

Builder’s risk policies are customizable to the duration of the project, whether it lasts a few months up to a year, providing flexibility to match the investment timeline. These policies are essential for managing financial risk and protecting investment returns during the renovation period.

What happens if I don’t insure my flip property?

Choosing not to insure a flip property can lead to severe financial repercussions. Without proper insurance, you as the property owner are directly liable for any damages or losses that occur on the site, whether from natural disasters, theft, or accidents during construction.

If someone were to be injured on the property, you could also face substantial legal costs and compensation payouts, which could jeopardize your financial stability and potentially lead to bankruptcy. The absence of insurance exposes you to significant risks that could turn a potentially profitable flip into a major financial burden.

Do I need workers’ compensation insurance for a house flip?

If you employ anyone to work on your property, whether they are casual laborers, contractors, or permanent employees, you are generally required to provide workers’ compensation insurance. This type of insurance is crucial as it covers medical costs, rehabilitation, and lost wages for workers who are injured on the job.

The requirement for workers’ compensation insurance varies by state and also depends on how workers are classified under local labor laws. Ensuring compliance with these regulations not only protects your workers but also shields you from legal issues and fines that can arise from non-compliance.

Should you get vacant home insurance?

Sometimes, a fix and flip home needs to be insured even when renovations have not begun. Vacant home insurance protects the property in case there’s damage to the property before starting renovations.

Even the best homeowner’s insurance does not cover an empty home. An empty home should be insured as well, so vacant home insurance covers empty homes for certain time periods.

Not only is vacant home insurance helpful before the renovations start, but it’s also helpful after renovations are complete when a home sits on the market.

Vacant home insurance covers the empty home during cases of water damage or extreme weather, but it might also cover a home for vandalism and theft. Policies differ, and it’s important to check carefully to make sure the policy covers cases of injury and theft.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.