What are Points on a Hard Money Loan & How Do They Work?

If you’ve ever been interested in acquiring a hard money loan for an investment property, you’ve likely come across the term “points”. So, what exactly are points when it comes to hard money loans? Now, before we go over what are points on hard money loans, you’ll need to understand a bit about hard money loans first.

What Is a Hard Money Loan?

A hard money loan is a financial tool provided by private lenders, offering a departure from traditional lending channels. It utilizes the property being acquired as collateral, making it an attractive option for real estate investors. These loans, often referred to as short-term bridge loans, serve as a bridge between the initial investment phase and long-term financing arrangements.

Primarily used for real estate transactions, hard money loans expedite the financing process, facilitating quicker property acquisitions and sales. However, they also find applications in various other scenarios, depending on the borrower’s financial objectives.

Unlike traditional bank loans, hard money loans derive their funds directly from private investors. The property being purchased acts as security, providing reassurance to lenders. In the event of default, lenders have the option to sell the property to recover their investment.

Hard money loans typically feature shorter terms compared to traditional mortgages, with durations ranging from one to three years. They serve as an alternative financing avenue, particularly suitable for ventures perceived as risky, such as house flipping projects.

What Are Points On a Hard Money Loan?

Points, in the context of hard money loans, represent a mechanism for adjusting interest rates. They involve paying a percentage of the loan amount upfront to secure a lower interest rate throughout the loan term.

Each point corresponds to one percent of the total loan amount. For example, if a lender offers a loan with five points, it means the borrower must pay an upfront fee equivalent to five percent of the loan amount.

Thus, on a $50,000 loan with five points, the fee would amount to $2,500.

Different Types of Points On a Hard Money Loan

There are two different types of points involved when considering using a hard money loan for purchasing a property.

Discount points are like prepaid interest on your loan that you are getting for your new home. The number of points that you choose to buy will depend on how much you want to reduce your interest rate. Under certain conditions, buying mortgage points are tax-deductible.

For every discount point you buy, your interest rate will be reduced by a certain percentage. The per-point discount you’ll receive in return varies from lender to lender, but you can generally expect to get a 0.125% to 0.25% interest rate reduction for every point that you buy. Almost all lenders put a limit on the number of points you can buy, and most of them allow you to purchase a fraction of a point.

Origination points can be charged by the lender to pay for the costs of making the loan. They are tax deductible only if the points were utilized to get the home mortgage and not to pay other closing expenses.

The Benefits of Hard Money Loan Points

Embracing points in hard money loans offers several benefits:

- Long-Term Savings: While the upfront cost of points may appear substantial, the potential for long-term savings through reduced interest rates is significant. By paying points upfront, borrowers can secure lower interest rates, resulting in considerable savings over the loan term.

- Lower Monthly Payments: Points contribute to lower monthly payments, enhancing the borrower’s cash flow and financial flexibility.

- Tax Advantages: Depending on the borrower’s tax situation, purchasing points may offer tax benefits. Discount points, if deductible, can result in tax savings, further enhancing the financial appeal of this strategy.

When Should I Buy Points On a Hard Money Loan?

The decision to purchase points depends on various factors:

- Long-Term Investment Plans: Points are most beneficial for borrowers planning to hold the property for an extended period. The accrued savings from lower interest rates over time can offset the initial upfront cost of points.

- Breakeven Analysis: Conducting a breakeven analysis helps borrowers determine whether purchasing points is financially advantageous. By calculating the point at which the savings from reduced interest rates equal the upfront cost of points, borrowers can make informed decisions.

When Should I NOT Buy Points On a Hard Money Loan?

There are instances when purchasing points may not be advisable:

- Short-Term Ownership Plans: If the borrower intends to sell or refinance the property within a short period, the benefits of purchasing points may be limited. In such cases, the upfront cost of points may outweigh the potential savings from reduced interest rates.

- Financial Constraints: For borrowers with limited financial resources, allocating funds to purchase points may not be feasible or advisable. In such situations, prioritizing essential expenses and maintaining liquidity may take precedence over purchasing points.

Final Thoughts: Points on Hard Money Loans

It is imperative for real estate investors to have a firm grasp of points in the context of hard money loans. Points, which are essentially upfront fees paid to the lender, can have a significant impact on the cost and terms of the loan. However, paying these points can lead to lower interest rates, resulting in substantial savings over the life of the loan, especially for long-term projects.

To make the best decision, investors must thoroughly analyze their financial situation, investment strategy, and future plans. While points offer tax benefits and potential long-term savings, they may not be the best choice for everyone, particularly those with short-term investment horizons or limited financial flexibility. Ultimately, a well-informed decision based on a comprehensive analysis will help maximize the benefits of a hard money loan in achieving investment objectives.

FAQs

FAQs

What is a Point in Hard Money Lending?

In hard money lending, a point refers to a unit of prepaid interest that allows you to secure a lower interest rate on the overall loan. Each point typically represents one percent of the total loan amount.

Example Calculation:

Imagine you’re taking out a hard money loan for $100,000. The lender offers you a two-point option, meaning you can pay 2% of the loan amount upfront to reduce the interest rate.

- Two points = 2% of $100,000 = $2,000 upfront cost.

By paying this $2,000 upfront, you’ll secure a lower interest rate throughout the loan term. This can potentially save you thousands of dollars in interest payments over the life of the loan.

Who Typically Uses Hard Money Loans?

Hard money loans are commonly used by real estate investors, particularly those involved in house flipping projects or other time-sensitive scenarios. They are suitable for situations where traditional bank loans might not be readily available due to factors like tight timelines, unconventional property types, or the borrower’s credit profile.

What are the Interest Rates and Fees Associated with Hard Money Loans?

Interest rates on hard money loans are typically higher compared to traditional bank loans due to the inherent risks involved for the lender. Additionally, there might be origination fees, points (explained above), and other closing costs associated with hard money loans.

Are points paid on hard money loans tax-deductible?

The ability to deduct points paid on a hard money loan from your taxes depends on the type of points and the purpose they serve. Here’s a more detailed explanation:

- Discount Points: These are essentially pre-paid interest. The IRS allows borrowers to deduct mortgage interest from their taxes, which includes discount points under specific conditions. For these points to be deductible, they must be paid as part of a deal to secure a loan for the property and not for any other purpose such as covering other closing costs. The deduction can be taken immediately if it pertains to the purchase or improvement of a primary residence. However, if the loan is for a property that is not a primary residence, such as an investment property, the deduction for these points must be spread out over the life of the loan.

- Origination Points: These are fees paid to the lender to cover the costs of processing the loan. Origination points are not generally deductible as interest. However, if they are used solely for the purpose of obtaining the mortgage—not for paying other closing costs—they can sometimes be deducted. The rules here can be complex, depending on the specifics of the loan and its use.

Given the complexity and the potential for significant tax benefits, consulting with a tax professional is highly recommended to ensure you are applying these rules correctly in your specific situation. A tax advisor can provide guidance on how to properly deduct these points and help maximize your tax return benefits based on current IRS rules and regulations.

How do I determine if buying points is the right decision for me?

Deciding to buy points on a hard money loan involves a careful financial analysis and understanding of your long-term investment goals. Here’s a more thorough approach:

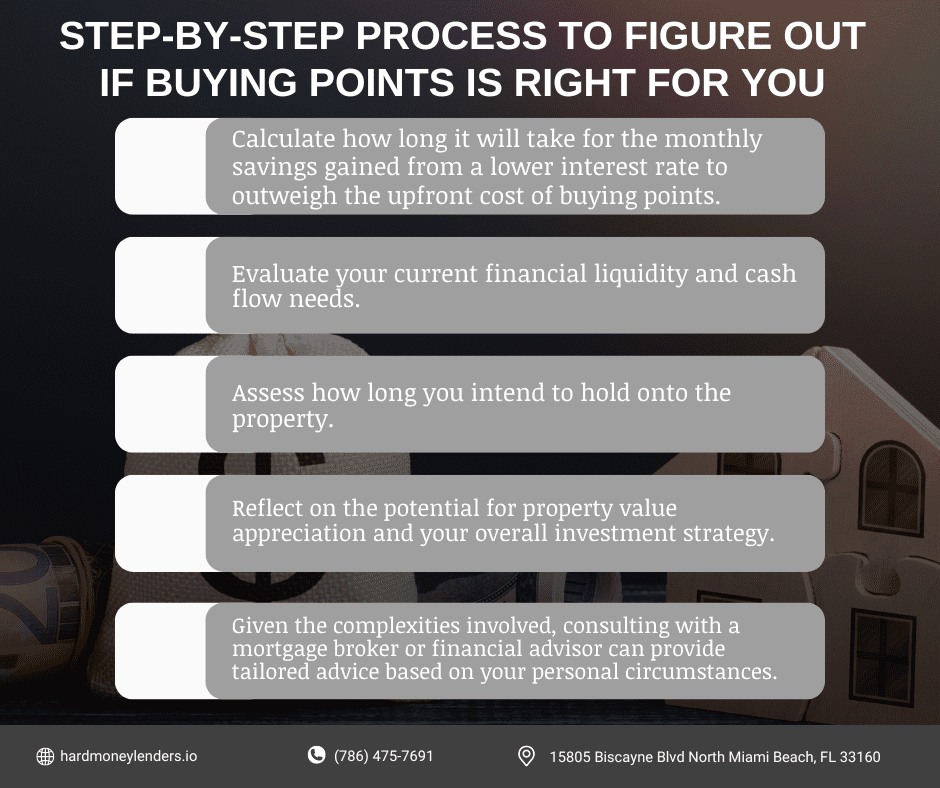

- Breakeven Analysis: This is the starting point. Calculate how long it will take for the monthly savings gained from a lower interest rate to outweigh the upfront cost of buying points. This period is your breakeven point. If you plan to own the property past this point, buying points might be cost-effective.

- Cash Flow Considerations: Evaluate your current financial liquidity and cash flow needs. Buying points requires upfront cash expenditure, so ensure this does not impede your ability to manage other expenses or investments. It’s important to maintain a balance where you can comfortably cover all your financial obligations.

- Property Holding Period: Assess how long you intend to hold onto the property. If you plan to sell or refinance quickly, the upfront investment in points may not have enough time to yield savings. Points generally favor longer holding periods where the accumulated interest savings can be more significant.

- Market and Investment Strategy: Reflect on the potential for property value appreciation and your overall investment strategy. In a rising market, the cost of points could be justified by the overall growth in property value. Additionally, consider how this purchase fits into your broader investment portfolio and goals.

- Consultation with Professionals: Given the complexities involved, consulting with a mortgage broker or financial advisor can provide tailored advice based on your personal circumstances. These professionals can help analyze the potential returns on buying points versus other investment opportunities, helping you make a decision that aligns with your financial goals and market conditions.

By considering these detailed factors, you can make a more informed decision on whether buying points on your hard money loan aligns with your financial strategy and goals

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.