Can an LLC get a mortgage? – Real Estate Investor Guide

There are several things to know before you apply for an LLC Mortgage. Learn what LLCs need to qualify for a mortgage and how to transfer a mortgage to an LLC. Also, learn how to establish a real estate LLC to avoid any possible legal pitfalls. And, of course, remember that an LLC is not the same as a corporation!

LLC Mortgages

An LLC is a business entity that is separate from a person. This arrangement offers several advantages to landlords and potential property owners looking to obtain a mortgage through an LLC. They are a popular choice among experienced investors. That’s why many first-time and experienced investors are turning toward buying properties through an LLC. In addition to its advantages, LLCs are also less expensive than corporations.

LLCs are typically able to obtain a mortgage if they are well financed. They can do this by securing a loan with collateral. Collateral can come in different forms depending on what the bank or private lender offers. Most lenders will order appraisals and may even ask to view updated property inspections. This screening process is similar to that required for a personal mortgage.

The downside of LLCs is that the interest rates may be higher than for individuals. The company must have members who guarantee the loan. The down payment for an LLC may be significantly higher than for an individual. Additionally, LLCs are not eligible for all types of residential loans. They can’t qualify for Fannie Mae or Freddie Mac loans.

Benefits of Getting a Mortgage Under an LLC

Lenders are cautious when financing loans without personal guarantees. Having an LLC as collateral may protect lenders from liability if the borrower fails to make payments. That’s why these types of mortgages are an attractive option for first-time investors, but more experienced investors may want to consider other options. Fortunately, most lenders are more willing to consider LLC mortgages because the extra costs are small, and the tax benefits may offset the costs.

Lenders are cautious when financing loans without personal guarantees. Having an LLC as collateral may protect lenders from liability if the borrower fails to make payments. That’s why these types of mortgages are an attractive option for first-time investors, but more experienced investors may want to consider other options. Fortunately, most lenders are more willing to consider LLC mortgages because the extra costs are small, and the tax benefits may offset the costs.

Using an LLC as a vehicle to purchase a home can also shield owners from liability. That makes them a great choice for landlords who want to avoid any possible liabilities in the future. It’s important to note that the members of an LLC should hold title to the property.

Another reason to use an LLC is to protect yourself from personal liability. Owning an apartment building can be very expensive and can be a major source of income. However, it can also be a source of liability for the owner. An injury to a tenant or negligence on your part could result in a lawsuit against you. The limited liability structure protects you from this risk and ensures that you can keep your property.

Lenders consider how stable the LLC’s income is and determine how much of the business’s cash flow is provided by its owners. The lender also reviews its balance sheet and bank statements to verify that the business’ capital is adequate. This may affect the approval of the loan. The life and balance of the business will determine the overall process of obtaining the loan from the bank or private lender.

Challenges in Securing Financing as an LLC

Higher Interest Rates and Down Payment Requirements

- Interest Rates: Due to the perceived higher risk of lending to LLCs, interest rates for LLC mortgages are often higher than those for personal mortgages. It is common for these rates to exceed personal rates by several percentage points.

- Down Payments: LLCs are frequently required to make larger down payments, often 20% or more. This requirement reflects the lender’s need for a higher security buffer due to the additional risks associated with business entities.

Lender Perceptions and Loan Terms Variability

- Lender Perceptions: Financial institutions often view LLCs as higher-risk borrowers. The limited liability protection LLCs offer their members can pose challenges for lenders in recovering losses if the LLC defaults on the loan.

- Loan Terms Variability: Loan conditions can vary widely between lenders. While some might offer favorable terms based on established relationships or the financial health of the LLC, others might impose more stringent conditions. This variability makes it essential for LLCs to thoroughly research and compare offers before committing to a loan.

Process of Applying for an LLC Mortgage

Step-by-Step Guide

Step-by-Step Guide

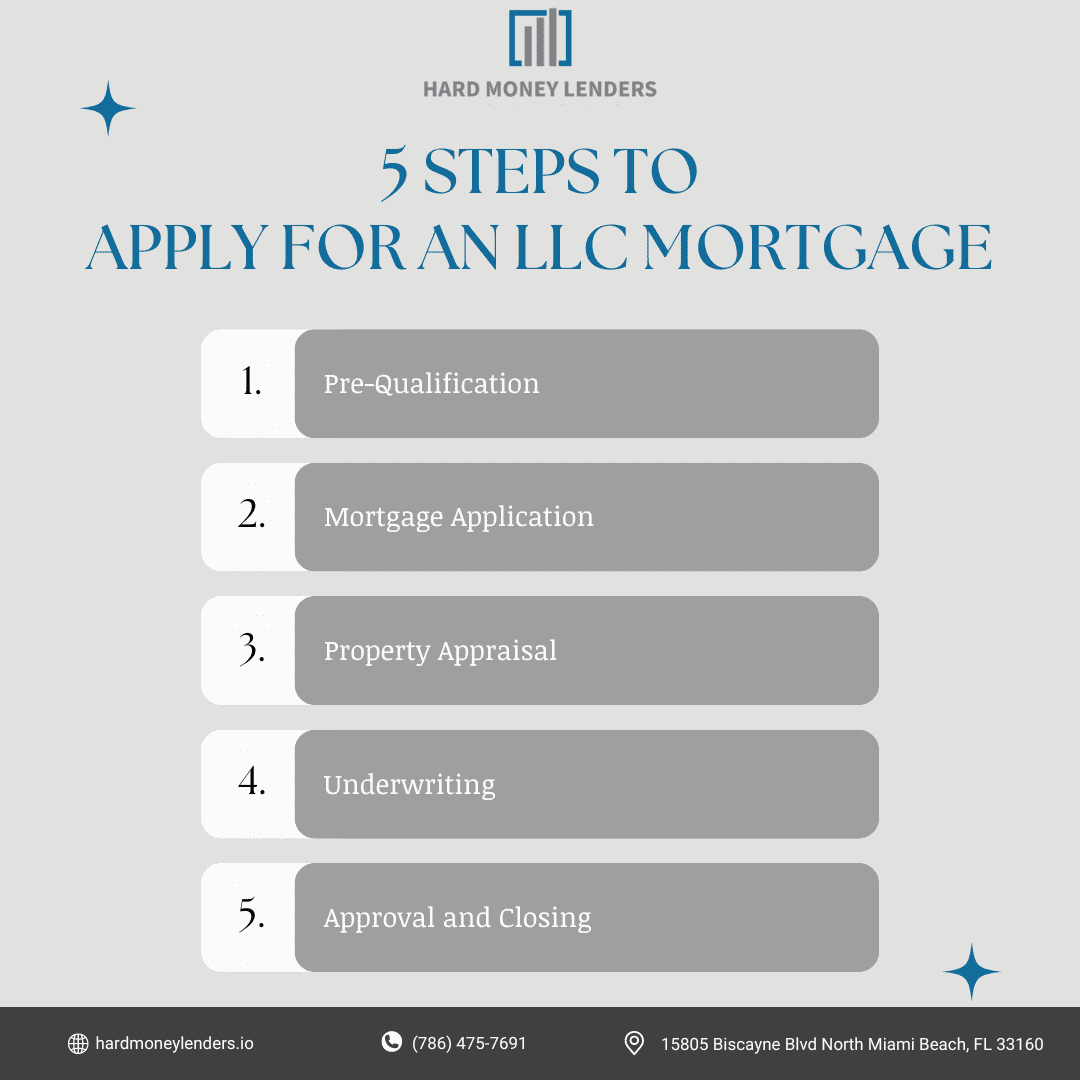

- Pre-Qualification: This initial step involves a financial review to estimate how much the LLC can borrow based on its financial stability, creditworthiness, and income streams. This helps set realistic expectations for the mortgage process.

- Mortgage Application: At this stage, the LLC must submit all necessary documentation, including financial statements, bank statements, articles of organization, and the operating agreement. Additionally, formal application forms provided by the lender need to be completed accurately to avoid delays.

- Property Appraisal: The lender will arrange for a professional appraisal to determine the property’s market value. This appraisal assesses the property’s condition, location, and other factors to ensure it meets the loan amount requested.

- Underwriting: During underwriting, the lender thoroughly reviews all submitted information to assess the risk associated with granting the mortgage. This includes verification of financial documents and evaluation of the property appraisal.

- Approval and Closing: If the loan application is approved, the final step is the closing process, where all parties sign the necessary documents to finalize the loan. The LLC then receives the funds to purchase the property.

Roles of Various Professionals

- Mortgage Broker: Assists the LLC in navigating the mortgage landscape to find the best rates and products suited to its needs. A broker can significantly simplify the application process by acting as an intermediary with lenders.

- Real Estate Attorney: Vital for ensuring all legal aspects of the mortgage process are correctly handled, including the transfer of property titles and the interpretation of contracts. An attorney helps mitigate legal risks during property acquisition.

- Accountant: Provides crucial support in preparing and reviewing financial documents. An accountant also advises on the tax implications of the mortgage, helping the LLC make informed financial decisions.

Property Appraiser: Engaged by the lender, this professional determines the fair market value of the property to ensure the loan amount is appropriate and justified.

What does an LLC need to get a mortgage?

There are several requirements you will need to meet before an LLC can apply for a mortgage. First, you must form the company and register it with the state’s Corporation Commission. In addition, you must have an operating agreement and obtain an employer identification number (EIN) from the IRS. Your business should also have a business bank account and a debit card to help establish credibility to obtain the loan.

A mortgage is usually secured by the property you’re buying, and an LLC can help protect it. The LLC will then act in the capacity to pay off expenses and collect rent. This will help it avoid potential defaults on its loan. You may need to discuss the mortgage with your mortgage lender before transferring the ownership of a property to an LLC.

Getting a Mortgage for an LLC Takes Time

Getting a mortgage for an LLC takes some time and work. It’s important to identify rental properties to secure the loan and shop around for the best interest rates. Small community banks and savings and loans are excellent options for financing an LLC mortgage. Alternatively, consider using a mortgage broker. This will speed up the process and allow you to use free rental property financial management software.

Lenders want to see that you have enough revenue to pay off the loan. In addition, you should provide a current balance sheet, as well as bank statements. Most lenders will want to see the cash flow of your business. If it’s decreasing, you may not qualify for a mortgage.

A private lender might be the best option for obtaining a mortgage if the LLC is not a business with many assets. These lenders often offer financing for rental properties and can provide short-term financing. While private lenders may require collateral, they may be more flexible and innovative when it comes to structuring an LLC mortgage. Some even offer non-recourse loans, which are ideal for investors who need a large amount of cash in a short period.

As previously stated, you will also need to have an EIN to open up business accounts. An EIN is important because it establishes business credit, which is important when applying for a mortgage. An LLC may also qualify for significant tax benefits if you hold rental properties under its umbrella. However, you should ensure that the owners of the property don’t own the property outright.

Eligibility and Requirements for an LLC to Obtain a Mortgage

Creditworthiness and Financial Health

To secure a mortgage, an LLC must demonstrate robust financial health and creditworthiness through several key indicators:

- Credit History of Members: Although an LLC as an entity does not have a personal credit score, lenders often evaluate the credit histories of its members. This assessment is particularly critical when personal guarantees are part of the loan agreement. A strong credit background supports the LLC’s application by showing financial responsibility and reliability in managing credit.

- Income Stability: Lenders place a premium on consistent and predictable income streams when assessing an LLC’s mortgage application. This stability can be evidenced through historical financial statements and revenue forecasts. For real estate investments, rental income is a critical component, with lenders typically looking for a history of occupancy and rent collection that supports the property’s operating expenses and mortgage obligations.

- Debt-to-Income Ratio (DTI): This metric is crucial as it compares the LLC’s monthly debt obligations to its income. A low DTI indicates that the LLC has sufficient income to cover existing debts plus any new obligations from a mortgage. Lenders usually prefer a DTI ratio that falls within their stipulated limits to minimize the risk of default.

- Capital Reserves: Having substantial capital reserves is essential, especially for covering the initial costs associated with purchasing property, such as down payments and closing costs. Moreover, lenders may require the LLC to maintain reserve funds that cover several months’ worth of mortgage payments to safeguard against potential financial difficulties.

Required Documentation

To apply for a mortgage, an LLC needs to provide comprehensive documentation that supports its application:

- Articles of Organization: This document proves the legal existence of the LLC and outlines its structure. It is filed with the state and is fundamental to establishing the business entity.

- Operating Agreement: While not mandatory in all states, this document is critical as it details the operational procedures and financial arrangements among members. It helps lenders understand the governance of the LLC and the allocation of income and liabilities.

- Financial Statements: Balance sheets, income statements, and cash flow statements for recent fiscal years are necessary to demonstrate the financial health of the LLC. These documents provide lenders with a clear picture of assets, liabilities, income, and expenditures.

- Bank Statements: Recent bank statements are required to verify the cash flow and operational liquidity of the LLC. They also help lenders assess the regularity of income and the management of expenditures.

- Property Appraisal and Inspection Reports: Before a mortgage is approved, the lender will require a professional appraisal of the property to determine its market value. Inspection reports may also be needed to assess the condition of the property and identify any potential issues that could affect its value.

- Personal Guarantee Documents: If the mortgage requires personal guarantees from the LLC members, relevant documentation will need to be provided. These guarantees tie the personal assets of the members to the financial obligations of the LLC, reducing the perceived risk for lenders.

- Employer Identification Number (EIN): Issued by the IRS, the EIN is necessary for tax purposes and is used to identify the business entity. It is also used when opening business bank accounts and applying for business loans.

How do I transfer a Mortgage to an LLC?

Transferring a mortgage to an LLC is a simple process that allows a homeowner to transfer a mortgage from an individual to a company. This process typically involves recording a deed that identifies the LLC as the new title holder. However, some important considerations should be made before transferring a mortgage to an LLC. First, it’s important to understand that transferring a mortgage to an LLC could trigger an acceleration clause in the mortgage agreement. This clause would make all payments due on the sale, and thus, the mortgage holder might balk at the transfer.

Another consideration is the liability issue. Most people purchase property in their name, which creates potential liabilities. Although transferring a mortgage to an LLC is a relatively easy process, it’s essential to contact the mortgage company and obtain their consent. If the transfer is not approved, the mortgage company may be able to foreclose on the lien.

An LLC should be in good standing with the Comptroller’s Office. If the company is in bad standing, the property cannot be transferred. In addition, the owners of an LLC should show proof of being an authorized signer. The authorized signer is generally the managing member or manager of the LLC.

There are a few other steps to take before transferring the mortgage to an LLC. First, make sure that you have adequate funds. After moving the mortgage, notify your lender and tenants of the new ownership. You should also update any leases. Also, consider refinancing your property in the LLC’s name.

The lender must approve the transfer before it can take effect. This process is extremely complicated and should only be attempted by a licensed attorney. In addition, other stakeholders may need legal advice.

LLCs for real estate

If you’re in the market for a mortgage, you might be wondering if LLCs for real estate can get a loan. The good news is that they can. Establishing a business’s credibility is the first step in getting any loan with an LLC. A good way to do this is to set up a business checking account at a community bank or online lender. In addition, lenders may ask to see a copy of your LLC’s operating agreement. This document doesn’t need to be complicated, but it should have information such as the names of the LLC owners and their percentage of ownership. It can be easily created online with free templates.

Many Real estate investors often structure their investments as an LLC. This legal structure protects their assets and provides greater legal protection. If you’re planning to invest in real estate using an LLC, it’s important to learn how LLCs can get a mortgage loan. Depending on your state, you may be able to get a mortgage if you structure your investments in this manner.

An LLC can also qualify for a lower interest rate than a standard bank mortgage. Mortgage lenders tend to be more willing to offer lower interest rates on loans for an investment property because they recognize that you’re more experienced in real estate and less risky as a borrower. An LLC may be a good choice if you have a lot of rental properties to finance.

Alternatives to Traditional Financing for LLCs

Private Lenders and Bridge Loans

Private lenders and bridge loans serve as valuable financing alternatives for LLCs, especially when traditional mortgage options are not feasible.

- Private Lenders: These lenders typically offer more flexible terms compared to traditional banks, which can be advantageous for LLCs with unique situations or needs. Private loans are often faster to secure, which helps in competitive real estate markets where a quick purchase is necessary. However, they usually come with higher interest rates and fees due to the increased risk perceived by the lender.

- Bridge Loans: These are short-term loans used to “bridge” the gap between immediate financing needs and the eventual securing of long-term financing. They are particularly useful when an LLC needs to act quickly to acquire a property before selling another. Bridge loans have higher interest rates and are meant to be repaid in a short period—usually within 12 months or upon the sale of the property.

Creative Financing Options

Creative financing can provide flexible acquisition strategies that are not tied to traditional loan structures. These include:

- Seller Financing: In this arrangement, the property seller acts as the lender. The buyer, or LLC, makes payments directly to the seller instead of a bank. This can be beneficial when an LLC does not qualify for a traditional loan or wants to avoid cumbersome bank regulations. Seller financing agreements can be flexible, tailored to both the buyer’s and seller’s needs.

- Leasing with an Option to Buy: This method allows the LLC to lease a property with the option to purchase at a later date. This can be an excellent strategy for an LLC that might not immediately qualify for a mortgage or needs time to arrange financing. The terms generally include a portion of the lease payments going towards the down payment or purchase price.

Hard Money Loans

- Hard Money Loans: These are another alternative lending form where financing is secured by the property itself. Hard money lenders focus on the property’s value rather than the borrower’s creditworthiness, making it easier for LLCs that might not meet traditional lending criteria to still obtain financing. These loans are typically short-term and have higher interest rates and fees, but they can be arranged quickly, which is advantageous for investors looking to move swiftly on a property purchase.

These alternative financing methods offer unique benefits and risks. They are particularly suitable for LLCs facing challenges with traditional lending routes due to stricter borrowing requirements or needing more flexible or rapid funding solutions. By considering these alternatives, LLCs can find innovative ways to finance their real estate investments, aligning with their specific business strategies and market conditions.

These alternative financing methods offer unique benefits and risks. They are particularly suitable for LLCs facing challenges with traditional lending routes due to stricter borrowing requirements or needing more flexible or rapid funding solutions. By considering these alternatives, LLCs can find innovative ways to finance their real estate investments, aligning with their specific business strategies and market conditions.

Final Thoughts

While getting a mortgage for an LLC is more complex than a traditional mortgage, it offers more protection and flexibility. However, it’s also more time-consuming and requires more paperwork than a traditional mortgage. In conclusion, using an LLC to get a mortgage is a great idea if you know what you are doing and have the experience behind you to help you in the process.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.