Florida Hotel Financing Options: A Comprehensive Guide

When it comes to financing a hotel in Florida, there are various options available to potential hotel owners. Knowing the different financing options and processes is essential to make informed decisions. At Hard Money Lenders, we’re all about educating people on unique ways to secure financing options. That said, keep reading if you’re looking for Florida hotel financing options or hotel loans and discover why hotel financing is crucial for hotel owners.

Overview of Florida Hotel Financing Options & Hotel Loans

Florida hotel financing options include traditional bank loans, Small Business Administration (SBA) loans, private funds, hard money loans, and crowdfunding. Each option has pros and cons regarding interest rates, repayment terms, and ease of qualifying.

Traditional bank loans can offer low-interest rates and extended repayment terms, making them an attractive option for hotel owners with good credit scores and substantial assets.

SBA loans have lower down payments and longer repayment terms than traditional bank loans but have more rigid eligibility requirements.

Private funds, hard money loans, and crowdfunding provide quick access to funds, but they have higher interest rates than traditional bank loans or SBA loans.

Crowdfunding has emerged as a popular financing option that has gained momentum over the years, offering an innovative way for hotel owners to raise capital.

Why Hotel Financing is Important for Hotel Owners

Financing is crucial for hotel owners as hotels require significant capital investments, including equipment, staffing, property maintenance, and renovation costs. Financing enables hotel owners to acquire the necessary funds to start their businesses and keep them running smoothly.

Financing can also help hotel owners leverage their assets to build wealth and expand their businesses. Moreover, if a hotel owner needs to sell a business or property, financial statements illustrating responsible borrowing can increase its value.

Consequently, knowing your options and the benefits of financing can put you in a better position as a Florida hotel owner. Consider working with financial advisors or lenders familiar with the hospitality industry when selecting a financing option that best fits your needs.

Commercial Real Estate Loans for Hotels

When seeking financing for a hotel in Florida, there are multiple options available. It’s essential for hotel owners to have an understanding of the different types of Florida hotel financing options and the qualifying processes to make informed decisions that would best fit their needs. One of the most common options is commercial real estate loans.

Types of Commercial Real Estate Loans Available for Hotel Financing

Commercial real estate loans are available in various forms, from traditional bank loans to hard money loans, with each option having its pros and cons. The most common types include:

- Traditional bank loans typically have low-interest rates and extended repayment terms.

- Small Business Administration (SBA) loans have a lower down payment and longer repayment terms than traditional bank loans.

- Private funds, hard money loans, and crowdfunding provide quick access to funds but have higher interest rates than traditional bank or SBA loans.

Each type of loan has qualifying criteria that must be met before approval can be granted.

How to Qualify for a Commercial Real Estate Hotel Loan

In most cases, lenders will assess the borrower’s credit score, debt-to-income ratio, loan-to-value ratio, cash reserves, and business plan before approving a commercial real estate loan, including one for a hotel.

To have the best chance of qualifying, hotel owners must have a solid business plan that shows profitability, good credit history, well-managed finances, and substantial collateral or assets.

Financing is an integral part of hotel ownership, making it vital for hotel owners to consider their options carefully and work with experienced financial advisors or lenders specialized in hospitality industry financing.

Small Business Administration (SBA) Loans for Hotels

Hotel owners in Florida looking for financing options have several choices available, including small business administration (SBA) loans. To make informed decisions, it’s vital for them to understand the different financing options available and the qualifying processes.

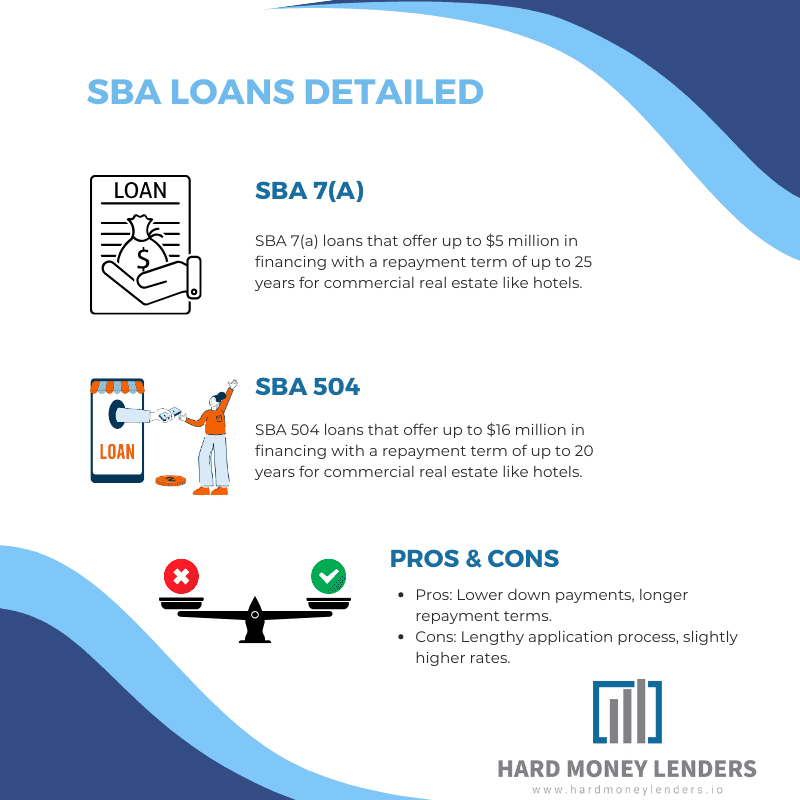

Types of SBA Loans Available for Hotel Financing

SBA loans are government-backed loans that offer benefits like lower down payments and longer repayment terms compared to traditional bank loans. The most common types of SBA loans include:

- SBA 7(a) loans that offer up to $5 million in financing with a repayment term of up to 25 years for commercial real estate like hotels.

- SBA 504 loans that offer up to $16 million in financing with a repayment term of up to 20 years for commercial real estate like hotels.

Pros and Cons of SBA Loans for Hotels

Like any loan option, SBA loans have both pros and cons. Some possible pros of SBA loans include:

- Lower down payment requirements compared to traditional bank loans.

- Longer repayment terms of up to 25 years, giving hotel owners more time to pay back the loan.

However, there are also cons hotel owners should consider, such as:

- The application process can be lengthy and complicated, requiring significant time investment.

- The rates may be a bit higher than traditional bank loans.

SBA loans for hotels can be a useful tool for potential hotel owners, but they are not the only option available. Working with experienced financial advisors or lenders who specialize in hotel financing can help hotel owners evaluate all their options and make informed financing decisions that best meet their needs.

How Private Equity and Venture Capital Can Be Used for Hotel Financing

Aside from SBA hotel loans, hotel owners may also consider private equity and venture capital as sources of financing. Private equity firms provide funding in exchange for ownership stakes in a company, while venture capital firms invest in high-risk startups with the potential for high returns. Both types of firms can offer larger amounts of funding with more flexible terms than traditional lenders.

The role of investors in hotel ownership and management

Investors who provide funding to hotel owners through private equity or venture capital can also play a significant role in hotel ownership and management. In some cases, they may take an active role in decision-making processes or require certain conditions to be met in exchange for funding. It is important for hotel owners to carefully consider the terms of any funding agreements before accepting funding from investors.

Working with experienced financial advisors or lenders who specialize in hotel financing can help hotel owners evaluate all their options and make informed financing decisions that best meet their needs.

Crowdfunding as a Florida Hotel Financing Option

Florida hotel owners seeking financing options may also consider crowdfunding as a potential option. Crowdfunding is a relatively new concept where individuals can fund projects through online platforms. In the context of hotel financing, hotel owners can pitch their projects online, and investors can contribute as little or as much as they want towards the project.

Overview of crowdfunding as a hotel financing option

Crowdfunding can be an attractive option for hotel owners who may have trouble securing traditional bank hotel loans or other types of funding. Crowdfunding can offer smaller-scale funding with fewer restrictions, making it accessible to a wider pool of investors. Additionally, crowdfunding platforms can provide valuable exposure to potential customers, which can help with marketing efforts.

Benefits and drawbacks of crowdfunding for hotel financing

As with any financing option, crowdfunding has both benefits and drawbacks that hotel owners should consider. Some benefits of crowdfunding can include:

- Lower barriers to entry: Crowdfunding can provide access to smaller amounts of funding compared to traditional bank loans.

- Diversified investor base: Crowdfunding platforms can attract a wide range of investors who are looking for new and innovative projects to fund.

- Marketing opportunities: Crowdfunding campaigns can provide marketing exposure and potentially attract new customers.

However, there are also some drawbacks to consider when considering crowdfunding, such as:

- Limited funding: Crowdfunding campaigns may not be able to raise enough money to fully finance a hotel project.

- Public scrutiny: Crowdfunding campaigns are publicly visible and subject to public scrutiny, which could harm a hotel’s reputation if the campaign does not succeed.

- Time commitment: Running a successful crowdfunding campaign requires a significant investment of time and effort.

Now, crowdfunding can be a viable option for Florida hotel owners seeking financing. It is important for hotel owners to carefully evaluate their options and consider working with experienced financial advisors or lenders specializing in hotel financing to make informed decisions that suit their needs.

Florida Hotel Construction Loans

Constructing a hotel in Florida is a significant investment that requires a substantial amount of funding. One way of acquiring this funding is through hotel construction loans.

Pros & Cons of Hotel Construction Loans

One of the benefits of hotel construction loans is that they offer a high amount of capital. The lenders know the profitability of the hospitality industry, and most of them offer substantial financing. With a stable source of financing, the construction company can buy materials, hire labor, and oversee the entire project without worrying about potential financing issues.

Furthermore, most lenders offer extended repayment periods, which can be as long as 25 years, giving the hotel enough time to generate income to pay back the loan.

On the downside, hotel construction loans come with strict terms and conditions, which can be disadvantageous to both long and short-term plans. For example, construction companies have to agree to a fixed interest rate, which can lead to difficult financial situations if payments are not made on time.

Additionally, lenders often require collateral in the form of the hotel property itself, which can lead to significant financial consequences if the hotel fails to generate the expected revenue.

Another disadvantage of hotel construction loans is that they can take a long time to process. While most hotels require immediate investment to take advantage of the peak tourism season, lenders require a lengthy application process and extensive documentation.

This delay can hurt the construction company since they might miss the opportunity to meet their prime market. It’s essential to consider that the appraisal value of the hotel can change if the market changes rapidly or if the economy adapts to new developments that affect tourism drastically.

Hotel Mortgage Brokerage Services

Florida hotel owners who are in need of financing for their projects may find it challenging to secure traditional bank loans. In such cases, alternatives such as crowdfunding or mezzanine financing may be considered. Another option is hotel mortgage brokerage services, which can help hotel owners find suitable financing solutions.

What Hotel Mortgage Brokers can do for Those Seeking Hotel Loans

Hotel mortgage brokers can assist hotel owners in finding suitable financing solutions. They can match hotel owners’ specific financing needs with the available lenders and loan programs.

They will work with hotel owners throughout the process, from initial qualification to closing the loan. Hotel mortgage brokers can also provide an understanding of the current market, enabling hotel owners to make informed decisions about financing.

How to Choose a Hotel Mortgage Broker

Hotel owners seeking hotel loans should carefully choose a hotel mortgage broker with experience in the hospitality industry. Hotel mortgage brokers should be able to provide a comprehensive understanding of the specific challenges and opportunities of hotel financing. Hotel owners should also look for brokers who have established relationships with a network of lenders and loan programs. This can facilitate the process of finding suitable financing solutions.

Hotel mortgage brokerage services can be an advantageous option for Florida hotel owners seeking financing for their projects. Hotel mortgage brokers can help hotel owners navigate the complex financing landscape by matching their specific needs with available lenders and loan programs. When choosing a hotel mortgage broker, experience in the hospitality industry and established lender relationships should be considered.

Mezzanine Florida Hotel Loans

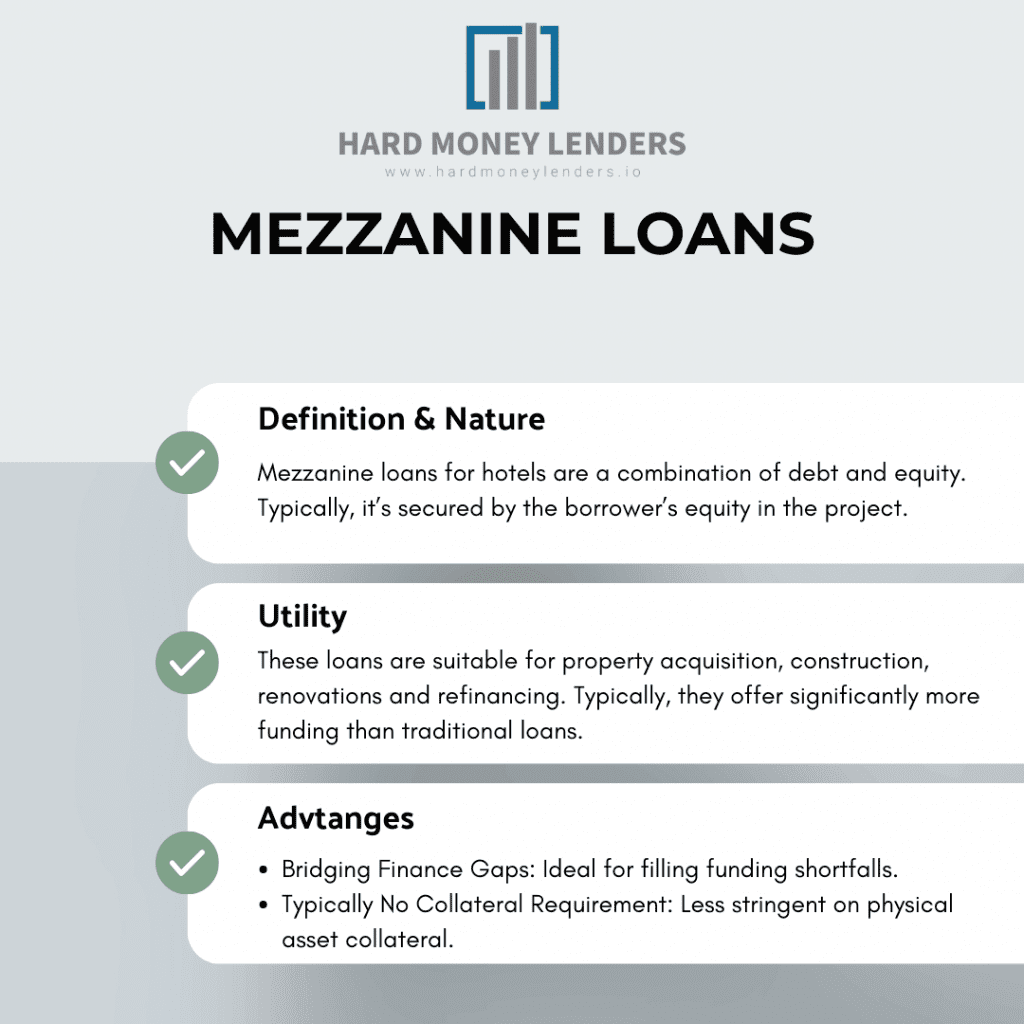

What Mezzanine Loans Are and How They Differ from Traditional Loans

Mezzanine loans are a hybrid of debt and equity financing that can be used to bridge the gap between traditional loans and equity. They differ from traditional loans as they are not secured by collateral but by the borrower’s equity in the project. Mezzanine lenders are paid only after the senior debt has been serviced, and the borrower’s equity has been paid off if there is any extra cash flow remaining.

How Mezzanine Financing Can be Used for Hotel Development

Mezzanine financing can be used for multiple purposes in hotel development, including property acquisition, construction, renovations, and refinancing. It provides an attractive form of debt for borrowers who may have trouble securing traditional bank loans or funding. Mezzanine lenders provide higher loan amounts than traditional lenders, thereby enabling hotel owners to achieve their development objectives.

Unique Financing Options

One unique financing option for hotels is the EB-5 financing program. This program allows foreign investors to obtain permanent residency in the U.S. by investing in qualifying commercial projects, such as hotels. Another option is sale-leaseback financing, where the property owner sells the property to an investor and then leases it back from them. This provides immediate cash flow for the hotel and can benefit those who cannot obtain traditional financing.

Benefits and Drawbacks of Unique Financing Options for Hotels

While alternative financing options may seem attractive, they also come with benefits and drawbacks. For instance, EB-5 financing can provide a reliable source of capital for hotel projects, but it can also be a time-consuming process that requires strict compliance with government regulations. On the other hand, sale-leaseback financing can provide immediate cash flow for the hotel but may result in a loss of future equity.

Florida hotel owners seeking financing for their projects have several unique options to consider besides traditional bank hotel loans. Hotel owners should work with experienced professionals who understand the specific challenges and opportunities of hotel financing to make informed decisions about the best option for their needs.

Factors to Consider When Selecting a Financing Option

Florida hotel owners should consider a few factors when selecting a financing option, including the project’s size and scope, the cost of financing, the terms of the loan, and the time required to secure financing. Work with experienced professionals who understand the specific challenges and opportunities of hotel financing to make informed decisions about which option is best suited for your needs.

Final Thoughts on Florida Hotel Financing Options

Florida hotel owners seeking financing for their projects have several unique options to consider in addition to traditional bank loans. It is essential to weigh the benefits and drawbacks of the different financing options and factor in the specific circumstances of the hotel project before making a final decision. Working with experienced financing professionals can also help hotel owners identify the right financing solution for their situation.

Now, if you’re dead set on getting a Florida hotel loan, but don’t know where to start — we have a team of experts at Hard Money Lenders that can help. Just call (786) 475-7691 or click here for our loan options.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.