Hard Money Loans For Mobile Homes

Mobile homes have many of the advantages of regular homes, but at a significantly lower price. However, it can be difficult to find a loan for a mobile home. A mobile home loan is especially difficult to secure because a mobile home can be moved. It is important to note a mobile home is considered personal property, not real estate property, and must be financed using a personal loan or a chattel loan.

A chattel loan is used for movable property, and the process closes faster than a conventional mortgage loan. Repayment periods are usually from 15 to 20 years. Monthly payments often exceed payments on a normal home. The personal loan can also be used to cover the expenses of a mobile home purchase, but the personal loan has higher interest rates than traditional mortgage loans.

Personal property loans need decent credit and interest rates will usually be higher than a mortgage.

However, a hard money loan can also be used. The hard money loan is particularly advantageous for a homebuyer with bad credit. Banks do not offer hard money loans — they are usually issued by individuals or companies. The hard money loan does not take into account a buyer’s previous financial history, mainly only the asset value of the home.

What Qualifies as a Mobile Home or Manufactured Home?

A mobile home is also known as a “manufactured home” — made at a factory and then often wheeled to a destination. The only difference between the terms is when the mobile home is made versus the manufactured home. The mobile home is manufactured before June 15, 1976, while the manufactured home is built after the date, and subject to U.S. Department of Housing and Urban Development’s Home Construction and Safety Standards, according to Casey Bond at US News.

Financing a mobile home will be more difficult, but is still possible. If the home is not on a permanent foundation, it does not qualify as real property and must use a personal or chattel loan.

For the purposes of this article, we will focus on mobile homes built before June 15, 1976, that don’t qualify for FHA loans. However, the FHA insures mobile home loans that are popular with first time home buyers for manufactured homes, and these loans are usually insured against loss if the borrower defaults.

Why Invest in a Mobile Home?

For some investors, mobile homes might be a terrific source of cash flow. Recently, mobile home parks have been a significant form of income to some investors, and individual mobile homes and mobile home parks remain under the radar investments in the current housing markets.

Mobile homes clearly serve residential purposes, and can serve as rental properties. Because mobile homes are considered personal property over real estate, this prevents mobile homes from receiving traditional loans from the bank. However, the land a mobile home sits on also counts as property and is subject to property task.

The IRS considers mobile homes as real real property if they are used as rentals. They depreciate like other rental properties.

Real estate investors who want to focus on mobile homes have multiple options. They can put a mobile home on land and rent the whole home to a tenant. They also have the option of owning a mobile home in a mobile home park and charging a tenant rent to the land and the home. Whether the tenant pays rent for the land or lot depends on whether the investor owns the land.

Mobile homes have a benefit of a low cost of entry. Mobile homes can be sold for very cheap prices, and some are willing to sell mobile homes for less than $1,000 to no longer pay lot rent. The low cost helps those starting to invest in real estate.

Mobile homes also give high returns on investment (ROI) due to a low initial investment. They are cheaper to operate and maintain than a building.

But there are downsides to renting mobile homes to invest as well. Mobile homes don’t appreciate in value over time. They depreciate as soon as they are bought, and depreciate more the more they are used.

Renting mobile homes gives cash flow, not a return on the original investment.

Mobile homes also can be difficult to maintain to meet Department of Housing and Urban Development (HUD) requirements. Inspections often reveal water damage, mold, and other structural issues that must be dealt with in frequent upkeep. Lot rent is also an expense mobile homes have that traditional homes do not. Because of the often cheaper price of mobile homes compared to traditional homes, they can be difficult to finance.

Eligibility Criteria for Hard Money Loans

For hard money loans, there are specific eligibility criteria and here’s a brief overview of what those are.

Specific Requirements

- Credit Scores: While hard money lenders place more emphasis on the property’s value rather than the borrower’s credit score, a minimal score is usually required to assess financial responsibility. Although these scores can vary widely, many hard money lenders look for scores starting around 600, though some may not have a strict minimum.

- Property Criteria: The investment property must demonstrate potential for quick resale or profitability. Lenders typically favor properties in regions where the real estate market is active, ensuring faster sales or high rental demand. This includes areas experiencing economic growth, development, or increasing property values.

- Investor Experience: Experience can play a crucial role, especially for larger or more complex loans. Some lenders might require borrowers to demonstrate a successful track record in real estate investments or renovations to assure the feasibility of their proposed projects.

Typical Obstacles and Solutions

- Insufficient Equity or Down Payment: Hard money loans usually require a substantial down payment or significant equity in the property, often ranging from 25% to 30% of the property’s value. To overcome this hurdle, investors might consider pooling resources with partners or seeking additional investors to provide the necessary capital.

- Property Does Not Meet Criteria: If a property is extensively damaged or located in a less desirable area, it may not meet the lender’s criteria. Investors should perform thorough due diligence to select properties that align with lenders’ preferences, focusing on those that require minimal to moderate renovations and are situated in promising neighborhoods.

- Regulatory Hurdles: Dealing with local regulations and zoning laws can be challenging. To navigate these potential obstacles, it’s advisable to consult with real estate attorneys or local experts who understand the specific regulatory landscape. This can prevent costly delays or rejections based on non-compliance with local real estate development standards.

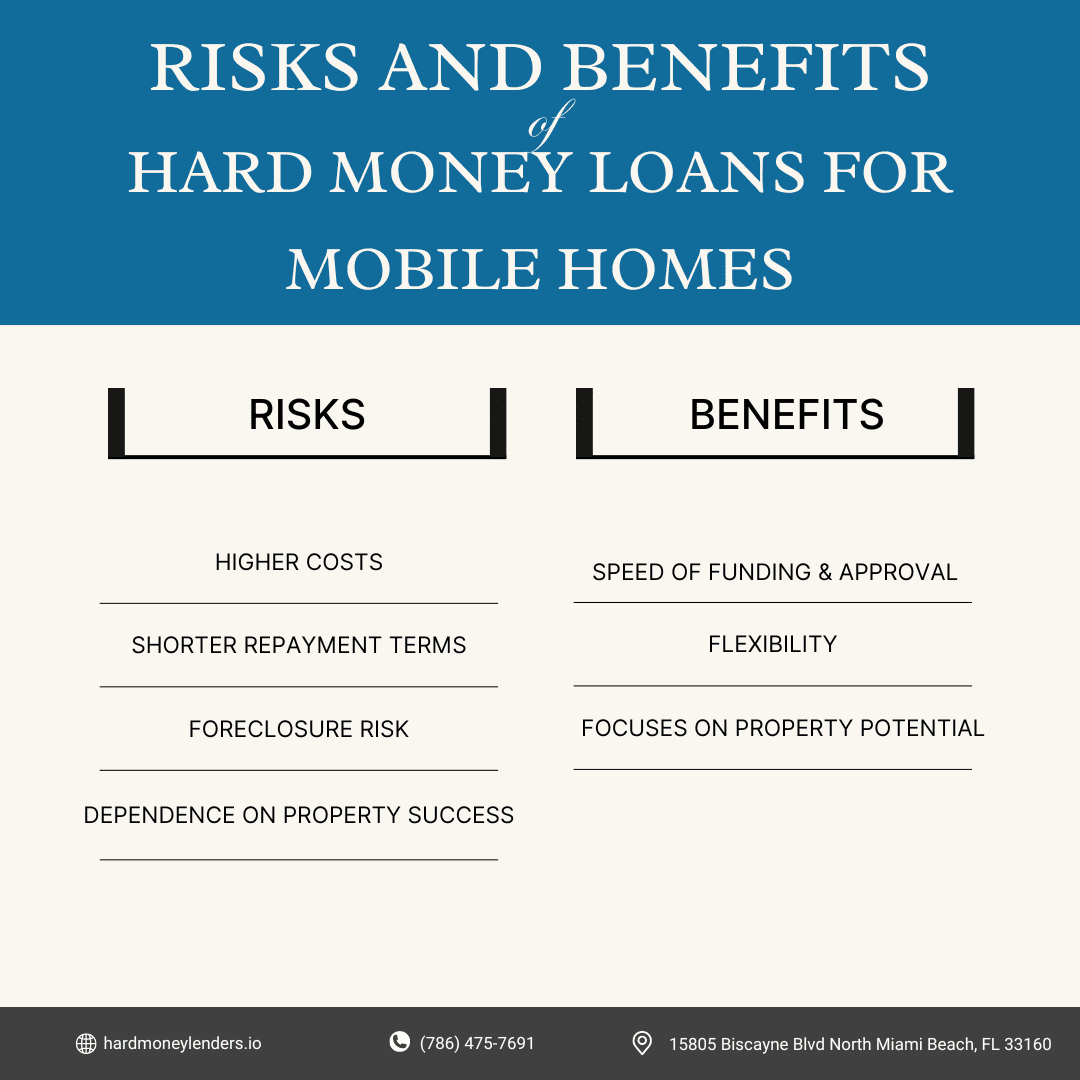

The Risks and Benefits of Hard Money Loans

Hard money loans are a distinctive form of financing in the real estate industry, commonly used by investors looking to quickly purchase and renovate properties. Here are the key risks and benefits associated with these loans:

Benefits of Hard Money Loans

- Speed of Approval and Funding: One of the most significant advantages of hard money loans is their quick processing times. Unlike traditional loans, which can take weeks or months to close, hard money loans can be approved and funded in a matter of days. This speed allows investors to seize opportunities swiftly and potentially outbid competitors who rely on slower, conventional financing.

- Flexibility: Hard money lenders are often more flexible than traditional banks. Because the loan is secured by the property itself, lenders can work with borrowers who might not meet the strict credit or income requirements of conventional lenders. This flexibility extends to the structuring of the loan terms, which can be tailored to suit the specific needs of the project.

- Focus on Property Potential: Hard money lenders evaluate loans primarily based on the value of the property and its after-repair value (ARV), not the borrower’s credit history. This focus is particularly advantageous for investors who deal with properties in need of renovation or those looking to flip homes for a profit.

Risks of Hard Money Loans

- Higher Costs: The convenience and accessibility of hard money come at a price. These loans typically have higher interest rates than traditional mortgages, sometimes double or triple the rates of conventional loans. Additionally, they may include upfront points (pre-paid interest), fees, and possibly higher penalties for late payments.

- Shorter Repayment Terms: Hard money loans are usually issued with shorter terms than traditional loans — often ranging from one to five years. This short timeframe can be a double-edged sword; it allows investors to move quickly but also requires them to either sell the property or refinance into a longer-term loan relatively quickly. This pressure can be challenging if the property does not sell as quickly as anticipated or if market conditions change unfavorably.

- Foreclosure Risk: Because these loans are secured by the property, failure to repay can lead to a faster foreclosure process compared to traditional mortgages. Hard money lenders are quick to recoup their investment by taking control of the property and selling it if the borrower defaults.

- Dependence on Property Success: The loan’s reliance on property value means that a poor investment decision or unforeseen complications in renovation can jeopardize the entire project. If the ARV is overestimated, or if renovation costs spiral, it might not be possible to sell the property for enough to cover the loan and make a profit.

Navigating the Challenges

To mitigate the risks associated with hard money loans, investors should:

- Conduct thorough due diligence on the property to ensure a realistic assessment of its potential and the cost of necessary renovations.

- Develop a clear exit strategy before taking out the loan, considering both best-case and worst-case scenarios.

- Build a cushion into the budget for unexpected expenses and delays to avoid financial strain if the project doesn’t proceed as planned.

Who Does Hard Money Mobile Home Loans?

Often, private real estate lenders will give hard money mobile home loans in several days, instead of waiting for a bank that can take months to give a loan.

Mobile home loans can have a complicated application process.

But we simplify the hard money lending process, particularly for mobile homes. We offer fix and flip loans and a group of professionals that will help you with your investment, all in the matter of a couple days, especially in Florida.

We have minimal requirements and make loan programs that are asset-based. We focus mainly on the level of risk of a property deal, especially that of a rental property. We will help guide you towards growth in your investment goals. For our Florida rental property loans, we require a minimum credit score of 600, and an interest rate between 9% to 12%. The loan term can be anywhere from 6 months to three years.

To get a clearer picture of your numbers, use our hard money loan calculator to determine the amount that can be loaned. Once we have necessary documentation, we can give you the money and close in three to four days. Both U.S. citizens and foreign nationals can get hard money loans for mobile homes.

What are the Elements of a Hard Money Loan?

At Hard Money Lenders IO, our loan calculator takes into account the amount of the home, the down payment, interest rate, and mortgage term. These can all be set to personal circumstances and a personal financial situation.

Set to one or two years, the calculator will give monthly payment amounts, principal, interest, and remaining balance.

Negotiating a hard money loan requires understanding several real estate terms, including the Loan to Value (LTV) ratio. This is the amount of money someone can get from a hard money lender compared to the total value of the property.

Loan to Cost (LTC) ratio stands for the total cost of the project that hard money lenders think about to make a decision on how much money to lend. The After Repair Value (ARV) is the value of the property after renovations have been made, particularly for fix and flip hard money loans.

Our mobile home loans give options and flexibility other lenders do not. Foreign nationals, beginning investors, a bad credit score, and a property being in poor conditions often lead to traditional bank loans giving rejections.

The best option for fix and flip loans is a hard money loan that gives fast closing and flexible terms. Even if we are not the best company for your hard money loan, we have a private lenders directory to help you find the right loan for your location, and hope to provide the best possible resources for financing your mobile home investment.

Step-by-Step Guide to Applying for a Hard Money Loan

Applying for a hard money loan involves several critical steps from finding a lender to closing the deal. Here’s a detailed guide to navigating the process:

Finding a Lender

- Research: Start by searching online for lenders that specialize in hard money loans for real estate. Use platforms like BiggerPockets or local real estate investor meetups to get recommendations.

- Reputation and Feedback: Check the lender’s reputation through reviews on platforms like Trustpilot or Google Reviews. Request references or case studies from the lender that demonstrate their experience and reliability in providing hard money loans.

Application Process

- Initial Consultation: Contact potential lenders to discuss your project in detail. This conversation should confirm whether your project meets their lending criteria.

- Formal Application: Submit a formal loan application. The application should include all necessary documentation such as your financial details, an appraisal of the property, and your business plan for its development.

- Property Evaluation: The lender will conduct an appraisal and possibly other inspections to ensure the property is a viable investment that meets their criteria.

- Loan Offer: If the lender decides to proceed, they will extend a loan offer with detailed terms and conditions.

Negotiating Loan Terms

- Understanding the Terms: Thoroughly review the proposed loan terms, focusing on interest rates, loan duration, points, fees, and the repayment schedule. Identify any terms that might be negotiable.

- Negotiation: Engage in negotiations over the terms. Areas often negotiable include interest rates and points. Make sure the draw schedule (the timeline and conditions under which loan funds are released) aligns with your project’s timeline.

Documentation Required

- Project Documentation: Include a detailed project plan and budget, which outlines the expected costs and timeline for the property development.

- Financial Records: Provide recent tax returns and bank statements to demonstrate your financial stability.

- Property Details: Submit property title information and recent appraisals. If applicable, include builder or contractor quotes and detailed construction plans.

Closing the Deal

- Review of Documents: Carefully review all closing documents. Consider hiring a real estate attorney to review the agreements, especially if the deal is complex or involves substantial amounts.

- Finalizing the Loan: Once all parties agree on the terms and the paperwork is in order, sign the loan documents. Upon signing, the funds will be disbursed according to the agreed schedule, allowing you to start or continue your property project.

Final Words on Mobile Homes and Manufactured Loans

Mobile homes can be an excellent investment opportunity for those looking to enter the real estate market with a low cost of entry. While financing a mobile home can be challenging, options such as personal loans, chattel loans, and hard money loans are available. Investors should consider the potential cash flow and high ROI but also be aware of the risks such as depreciation, maintenance costs, and lot rent expenses. With careful consideration and due diligence, mobile homes can be a profitable investment for those willing to put in the effort.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.