How to Find Rental Arbitrage Properties in Florida: VRBO & Airbnb Arbitrage

In Florida, rental arbitrage has the potential to be highly lucrative due to the state’s thriving tourism and real estate markets. With its sunny weather, beautiful beaches, and popular tourist attractions, Florida attracts millions of visitors each year. This creates a high demand for short-term rentals, making it an ideal market for rental arbitrage. Investors can capitalize on this opportunity by finding and managing rental properties that cater to the growing number of travelers visiting Florida. That said, it can be lucrative if you understand the nuances of VRBO and Airbnb arbitrage. Moreover, it’s crucial to know how to find properties for rental arbitrage, which we’ll go over in detail.

Before we dive in, there is another way to tap into the Florida rental market: by securing short-term rental loans and owning a short-term rental property.

What is Rental Arbitrage?

Rental arbitrage is an expert technique in the real estate industry where investors sublease a property they have rented for the sole purpose of listing it on platforms like Airbnb or VRBO for short-term rentals.

This allows them to profit by charging higher rates than their rental expenses. It involves finding properties in high-demand areas, managing bookings and guest relations, and ensuring the property meets the standards of vacation rentals. Rental arbitrage offers a unique opportunity to maximize returns on rental properties in popular tourist destinations like Florida.

The Potential of Rental Arbitrage in Florida

Florida offers immense potential for rental arbitrage due to its thriving tourist industry and high demand for short-term accommodations. With its year-round warm weather, beautiful beaches, and popular attractions like Disney World and the Everglades, Florida is a top destination for vacationers.

This creates a consistent demand for vacation rentals, making it an ideal market for rental arbitrage investors. By strategically finding properties in high-demand areas and effectively managing their listings, investors can generate substantial profits through rental arbitrage in Florida.

| Metric | Statistics |

| Average monthly revenue | $4,200 – $4,800 |

| Average market rent | $2,500 |

| Number of STR listings | Over 50,000 |

| Occupancy rate | 70% – 80% |

| Short-term rental premium | 100% – 200% |

| Top performing cities | Panama City Beach, Fort Lauderdale, Orlando, Miami, Jacksonville |

Source: AirDNA, Zillow, AIrbtics

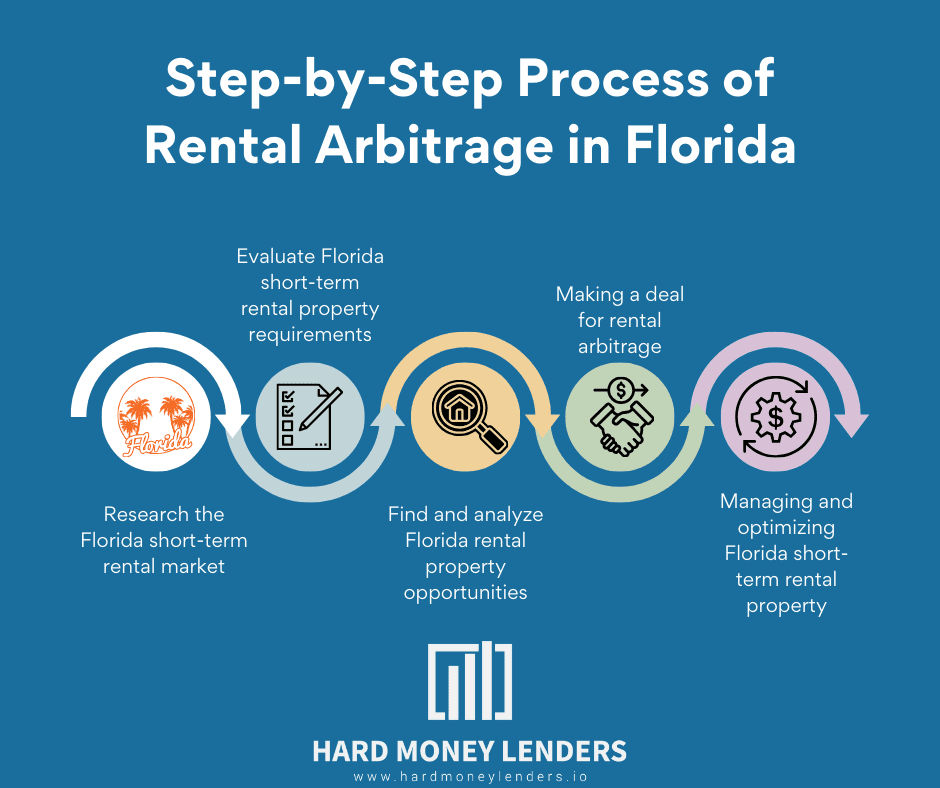

Researching the Florida Rental Market

To successfully engage in rental arbitrage in Florida, it is crucial for real estate investors to research the rental market in the state thoroughly. This involves exploring the demand for vacation rentals in popular areas such as Orlando, Miami, and Tampa.

By analyzing market trends, occupancy rates, and average rental prices on platforms like VRBO and Airbnb, investors can identify profitable rental areas. Additionally, understanding the local regulations and legal considerations is essential to ensure compliance and avoid any potential issues. Conducting thorough market research will help investors make informed decisions and maximize their rental arbitrage opportunities in Florida.

Exploring VRBO and Airbnb in Florida

When it comes to finding rental properties in Florida for arbitrage opportunities, two popular platforms to explore are VRBO and Airbnb. VRBO, which stands for Vacation Rentals By Owner, is known for its large inventory of vacation homes and rental properties. Airbnb, on the other hand, offers a wide range of accommodation types, including private rooms, shared rooms, and entire homes.

Both platforms have a strong presence in Florida, with a variety of listings in popular vacation destinations like Orlando, Miami, and Tampa. Real estate investors can use these platforms to search for properties, view photos, read reviews, and compare prices to find the best rental opportunities in the state.

Identifying Profitable Rental Areas in Florida

Identifying profitable rental areas in Florida is crucial for real estate investors looking to succeed in rental arbitrage. To determine the best locations, investors should consider factors such as high tourist demand, proximity to popular attractions, and rental market trends.

Areas like Orlando, Miami, and Tampa are known for their strong tourism industry and offer a steady stream of potential renters. Additionally, coastal cities like Destin and Fort Lauderdale attract vacationers year-round. Conducting thorough market research and analyzing occupancy rates and rental prices will help pinpoint the most profitable areas for rental arbitrage in Florida.

Evaluating Property Requirements and Regulations

When it comes to rental arbitrage in Florida, it’s essential to understand the property requirements and regulations involved. Real estate investors need to ensure their properties meet certain criteria before listing them on VRBO or Airbnb. These requirements may include things like having a valid license, meeting safety regulations and obtaining the necessary permits.

That being said, investors must also familiarize themselves with local regulations, such as zoning laws and homeowner association rules, to ensure compliance. By evaluating and meeting these property requirements and regulations, investors can operate their rental arbitrage businesses legally and successfully.

Property Requirements for VRBO and Airbnb Arbitrage

When it comes to rental arbitrage in Florida, real estate investors need to ensure their properties meet certain requirements set by VRBO and Airbnb. These requirements include having a valid license to operate as a short-term rental, meeting safety regulations, and obtaining necessary permits.

Additionally, investors must comply with local regulations, such as zoning laws and homeowner association rules. By fulfilling these property requirements, investors can confidently list their properties on VRBO and Airbnb platforms and attract potential guests.

Understanding Regulations and Legal Considerations in Florida

When engaging in rental arbitrage in Florida, it is crucial to understand the regulations and legal considerations that govern this practice. While rental arbitrage is not explicitly illegal in the state, it is subject to various rules and regulations.

Local jurisdictions may have specific zoning laws, permitting requirements, and registration processes that investors must comply with. Moreover, investors must be aware of any restrictions imposed by homeowner associations or rental agreements. It is essential to thoroughly research and understand these regulations to operate within the legal framework and avoid any potential penalties or disputes.

Finding Rental Properties in Florida

When it comes to finding rental properties in Florida for rental arbitrage, there are a few strategies that real estate investors can employ. One approach is to search for rental properties on vacation rental platforms like VRBO and Airbnb.

These platforms allow users to filter their search based on location, property type, and availability. Another method is to network with local landlords and property owners to find potential rental opportunities. Real estate agents and property management companies can also assist in finding suitable properties for rental arbitrage in Florida.

Searching for Rental Properties on VRBO

When finding rental properties for rental arbitrage on VRBO, real estate investors can utilize the platform’s search and filter features. By selecting the desired location in Florida, investors can browse through a range of available properties for short-term rental.

The search results can be further refined based on specific property requirements such as size, amenities, and rental rates. It is important to carefully review and assess the properties’ photos, descriptions, and reviews to ensure they meet the standards and preferences of potential guests.

That said, reaching out to property owners directly for negotiation and partnership opportunities can also be beneficial in finding suitable rental properties on VRBO.

Finding Rental Opportunities on Airbnb

When it comes to finding rental opportunities on Airbnb, real estate investors can employ several strategies. One approach is to search for properties on the Airbnb platform using filters such as location, property type, and rental rates.

Another option is to network and establish connections with existing Airbnb hosts who may be open to partnership opportunities or willing to share insights on acquiring rental properties. Additionally, attending local real estate investor meetings and speaking to real estate agents can provide valuable leads on potential Airbnb rental properties.

Analyzing Rental Property Opportunities

When it comes to rental property opportunities, real estate investors must conduct a thorough analysis to ensure profitability. This involves assessing factors such as occupancy rates, rental income potential, and property expenses.

By analyzing historical data and market trends, investors can determine the viability of a rental property. They can also calculate important metrics such as cash flow, return on investment (ROI), and cap rate. This analysis provides valuable insights into the potential financial returns of a rental property, allowing investors to make informed decisions and maximize their profits.

Assessing Profitability and Occupancy Rates

In order to determine the profitability of rental property opportunities in Florida, real estate investors must assess two key factors: occupancy rates and potential rental income. By analyzing historical data and market trends, investors can estimate the likelihood of high occupancy rates and calculate potential rental earnings.

They should also consider factors such as seasonality, local events, and competition in the area. Moreover, evaluating property expenses such as maintenance costs, property management fees, and taxes is crucial for accurately assessing profitability. By conducting a thorough analysis, investors can make informed decisions and maximize their returns on rental arbitrage properties in Florida.

Calculating Expenses and Potential Revenue

When assessing the profitability of rental arbitrage properties in Florida, real estate investors must carefully calculate the expenses and potential revenue. This includes considering expenses such as property taxes, maintenance costs, rental fees, and utilities.

Now, investors should estimate the potential rental income by analyzing market trends, historical data, and comparable rental rates in the area. By accurately calculating these expenses and potential revenue, investors can make informed decisions about the profitability of their rental arbitrage properties in Florida.

Managing and Optimizing VRBO & Airbnb Rentals

When it comes to managing and optimizing VRBO and Airbnb rentals, real estate investors must focus on effective property management practices and strategies to maximize rental profitability. This includes ensuring prompt and professional communication with guests, providing exceptional customer service, and maintaining the property in top condition.

Consequently, investors should implement strategies to enhance the rental experience, such as offering amenities and unique touches that will attract and impress guests. By prioritizing the satisfaction of guests and continuously improving the rental property, investors can maximize their returns and achieve long-term success in the rental arbitrage market.

Effective Property Management Practices

Effective property management practices are crucial for success in the rental arbitrage market. Real estate investors must prioritize prompt and professional communication with guests to ensure their satisfaction. Providing exceptional customer service and addressing any issues or concerns promptly is key.

It is also important to maintain the rental property in top condition, ensuring cleanliness and regular maintenance. By implementing these practices, investors can enhance the guest experience and maximize rental profitability. That said, using property management software can streamline operations and increase efficiency.

Implementing Strategies to Maximize Rental Profitability

Real estate investors can maximize the profitability of their rental properties by implementing various strategies. One effective strategy is to optimize pricing by conducting market research and adjusting rental rates accordingly.

Investors can also improve their property’s visibility by utilizing professional photography, writing compelling property descriptions, and optimizing their listings for search engines. Additionally, providing exceptional customer service, maintaining the property in top condition, and leveraging positive guest reviews can attract more bookings and increase rental profitability. Investors should also consider implementing dynamic pricing strategies to capitalize on high-demand periods and maximize rental revenue.

Questions People Also Ask About Airbnb Arbitrage and Rental Arbitrage

Is rental arbitrage legal in Florida?

Rental arbitrage is generally legal in Florida, as long as it complies with local laws, regulations, and ordinances. However, it is important for real estate investors to thoroughly research and understand the specific regulations in the city or county they plan to operate in. Some areas may have restrictions on short-term rentals or require permits and licenses. Investors should consult with local authorities or seek legal advice to ensure they are in compliance with all applicable laws.

What are the best cities in Florida for rental arbitrage?

When it comes to rental arbitrage in Florida, there are several cities that offer great potential for success. The best cities for rental arbitrage in Florida include Orlando, Miami, Tampa, Fort Lauderdale, Jacksonville, and Kissimmee.

These cities are known for their strong tourism industries and high demand for short-term rentals. Additionally, they have a favorable regulatory environment and a large number of tourists and business travelers, making them ideal for rental arbitrage investors. Keep in mind that each city may have its own specific regulations and market conditions, so it’s important to conduct thorough research before deciding on a location.

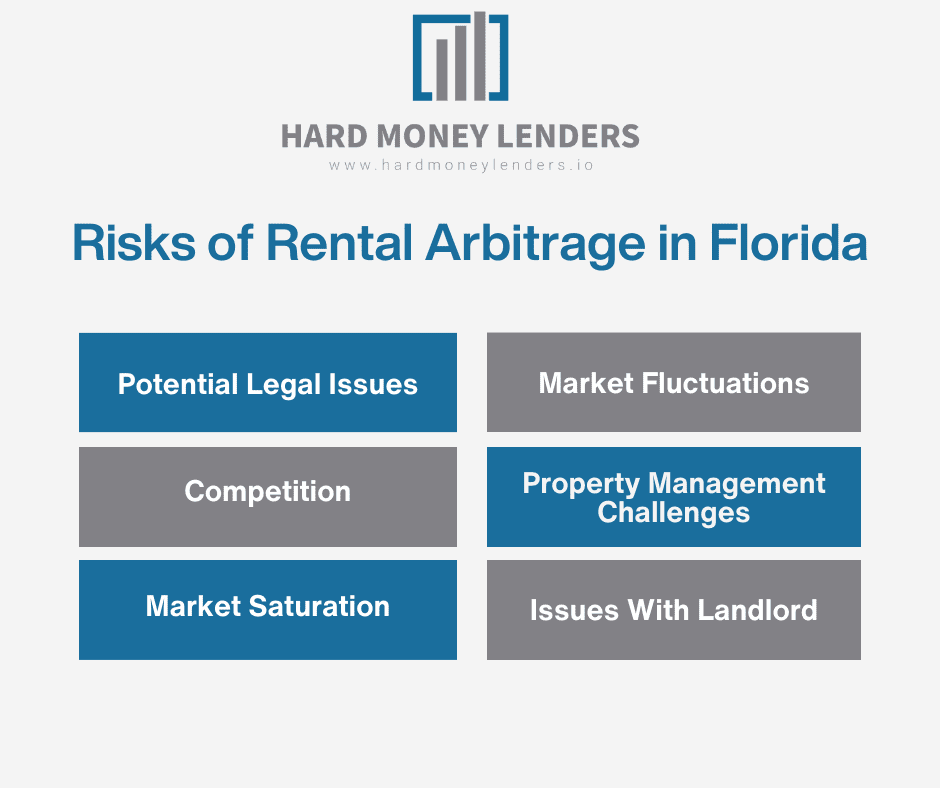

What are the risks of rental arbitrage in Florida?

Investing in rental arbitrage in Florida comes with its fair share of risks that investors should be aware of. Some of the key risks include:

- Legal Issues: Rental arbitrage operates in a legal gray area, and local regulations can change rapidly. Investors may face fines or even legal action if they violate zoning laws or licensing requirements.

- Market Fluctuations: The tourism industry, which drives demand for short-term rentals, is susceptible to fluctuations. Changes in travel patterns or economic downturns can affect occupancy rates and rental prices, impacting the profitability of rental arbitrage properties.

- Competition: Florida is a popular destination for rental arbitrage, leading to increased competition. Investors need to stay competitive by offering unique and attractive rental properties and maintaining high occupancy rates.

- Property Management Challenges: Managing a rental arbitrage property requires time, effort, and attention to detail. Dealing with maintenance issues, guest inquiries, and turnovers can be demanding, especially for new investors.

- Market Saturation: With the increasing popularity of rental arbitrage, some areas in Florida may become saturated with short-term rental properties. This could lead to lower demand, decreased rental rates, and decreased profits for investors.

To mitigate these risks, investors should conduct thorough research, stay updated on regulations, diversify their property portfolio, and implement effective property management strategies to ensure long-term success in the rental arbitrage market.

What are the startup costs for rental arbitrage in Florida?

The startup costs for rental arbitrage in Florida can vary depending on various factors. Some of the common startup costs include:

- Property Rental Costs: Investors need to consider the costs of long-term rental and managing short-term rentals, and any fees associated with rental arbitrage.

- Furnishing and Decor: Fully furnishing the rental property to provide a comfortable and attractive experience for guests.

- Marketing and Advertising: Promoting the rental property through various channels to attract potential guests.

- Utilities and Maintenance: Setting up utilities and amenities in the property, as well as ongoing maintenance and repairs.

- Licensing and Permits: Acquiring any necessary licenses and permits required for short-term rentals.

- Property Management Services: Engaging the services of a property management company to handle bookings, guest communication, and property maintenance.

It is essential for investors to carefully consider these startup costs to ensure they have sufficient capital to enter the rental arbitrage market in Florida successfully.

How do I find landlords who allow rental arbitrage in Florida?

When looking for landlords who allow rental arbitrage in Florida, there are a few strategies you can use.

- Reach out to local real estate agents: Agents often have connections with property owners and can help you find landlords who are open to rental arbitrage arrangements.

- Utilize online platforms: Websites like Airbnb and VRBO allow property owners to list their properties for short-term rentals. Reach out to these owners and inquire if they would be interested in a rental arbitrage partnership.

- Attend networking events: Join real estate investor groups or attend local real estate meetups. These events provide opportunities to network with other investors and potentially find landlords who are open to rental arbitrage.

Remember, it’s important to clearly communicate your intentions and ensure that both you and the landlord have a mutual understanding of the terms and conditions of the rental arbitrage agreement.

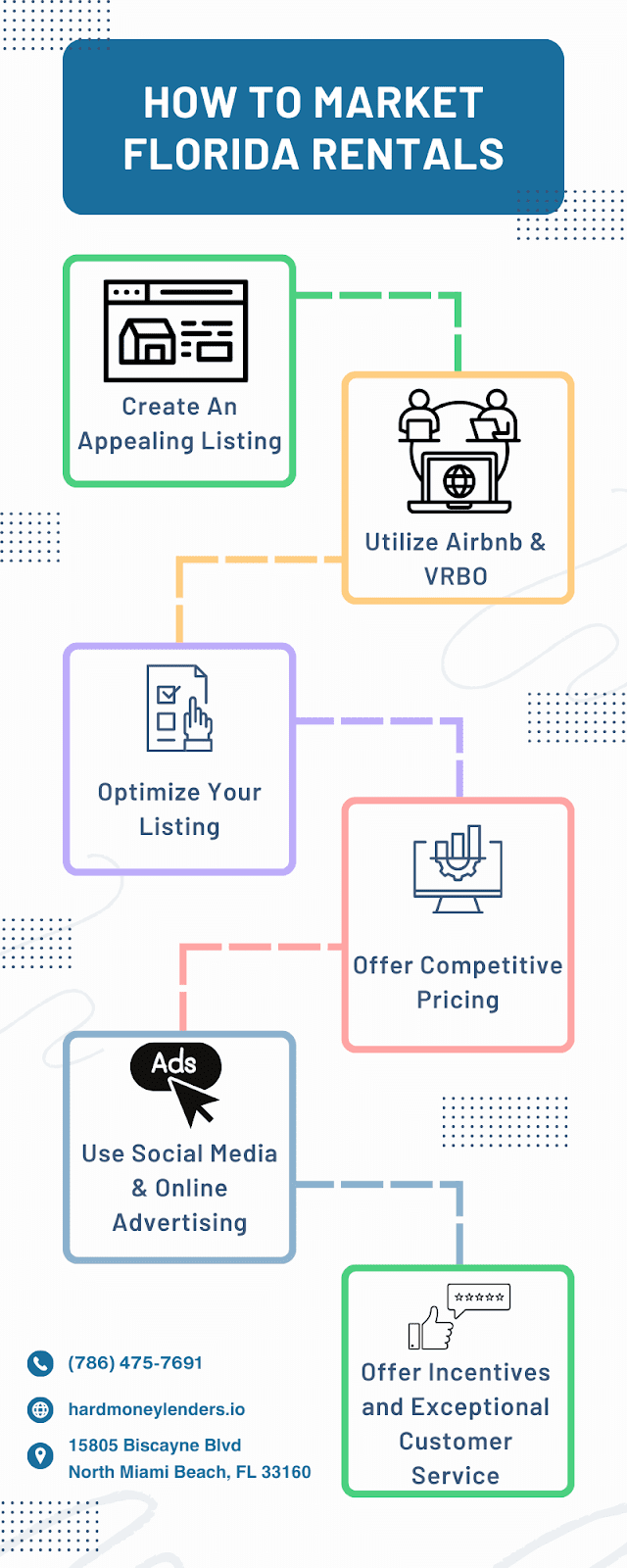

How do I market my rental arbitrage properties in Florida?

To market your rental arbitrage properties in Florida, there are several strategies you can employ.

- Create an appealing listing: Take high-quality photos, write a compelling description, and highlight the unique features of your property.

- Utilize online platforms: Use popular rental platforms like Airbnb, VRBO, and Booking.com to list your property and attract potential guests.

- Optimize your listing: Use keywords and descriptive titles to improve visibility in search results. Also, provide accurate information about amenities, location, and nearby attractions.

- Offer competitive pricing: Research similar properties in your area to determine competitive rates that will attract guests while still ensuring profitability.

- Use social media and online advertising: Promote your property on social media platforms, create targeted ads, and collaborate with influencers to reach a wider audience.

- Offer incentives and discounts: Provide promotional offers, discounts for longer stays, or packages that include additional services to entice guests.

- Provide exceptional guest experiences: Encourage positive reviews from guests by offering excellent customer service, maintaining cleanliness, and promptly addressing any issues.

Remember, marketing your rental arbitrage properties effectively is crucial for attracting guests and maximizing your profits.

How do I manage my rental arbitrage properties in Florida?

Managing rental arbitrage properties in Florida requires effective property management practices to ensure smooth operations and maximize profitability. Here are some tips:

- Regular Maintenance: Schedule regular inspections and maintenance to keep the property in good condition and address any issues promptly.

- Professional Cleaning: Hire professional cleaning services to maintain cleanliness and create a positive guest experience.

- Automated Bookings: Utilize property management software to streamline the booking process and manage reservations efficiently.

- Communication: Maintain regular communication with guests, addressing their inquiries and concerns promptly.

- Pricing Optimization: Continuously analyze market trends and adjust pricing to maximize occupancy rates and rental income.

- Guest Reviews: Encourage guests to leave reviews and address any negative feedback to maintain a positive online reputation.

- Compliance with Laws and Regulations: Stay updated on local regulations and ensure compliance with all legal requirements.

- Consider Hiring a Property Manager: If managing multiple properties becomes overwhelming, consider hiring a property manager to handle day-to-day operations.

By implementing these management strategies, you can successfully run your rental arbitrage properties in Florida and provide a great experience for your guests.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.