Last Updated on January 29, 2024

Short-term rental properties have become a popular investment option in Florida, attracting experienced real estate investors and newcomers to the industry. These properties offer the potential for high returns and flexibility in terms of occupancy. However, securing financing for a short-term rental property can be a hurdle for many aspiring investors. This step-by-step guide — by our team at Hard Money Lenders — aims to provide a clear roadmap for obtaining short-term rental loans in Florida. From understanding the basics of these loans to finding the right lender and completing the application process, this guide covers all the essential steps. Additionally, it offers tips for maximizing ROI and protecting your investment, ensuring a successful venture into the thriving short-term rental market in Florida.

Why Consider Short-Term Rental Properties in Florida

Investing in short-term rental properties in Florida can be a lucrative opportunity for several reasons. Firstly, Florida has a thriving tourism industry, attracting millions of visitors each year. This means a consistent demand for vacation rentals throughout the year and the potential for high occupancy rates. Secondly, short-term rental properties often generate higher rental income compared to traditional long-term rentals. Given Florida’s thriving tourism industry, you might want to consider a potentially lucrative opportunity with condotels in Florida, and you can learn about condotel financing and loans here.

This can result in greater cash flow and a quicker return on investment. Additionally, with the right property management strategies, investors can maximize their rental income and achieve a high return on investment. Lastly, Florida’s favorable tax climate and regulations for short-term rentals make it an attractive location for property investors. By securing a short-term rental loan, investors can tap into this market and capitalize on these benefits.

Understanding Short-Term Rental Loans

Short-term rental loans are designed for individuals looking to purchase or refinance a property for the purpose of short-term rentals. These loans are tailored to meet the unique needs of vacation rental property owners, Airbnb hosts, and condotel operators in the thriving Florida market.

In essence, short-term rental loans provide borrowers with the necessary funds to acquire or leverage their property, allowing them to generate higher rental income compared to long-term rentals. These loans offer flexible repayment options, allowing borrowers to maximize their return on investment.

To qualify for a short-term rental loan, borrowers must meet certain eligibility criteria, including a strong credit profile, sufficient rental income potential, and a solid financial history. By understanding the intricacies of short-term rental loans and working with a reputable lender, investors can unlock the potential of their vacation property and achieve financial success in the Florida rental market.

Benefits of Securing Short-Term Rental Loans

Securing a short-term rental loan for your vacation property in Florida offers several benefits. Here are some key advantages:

- Higher Rental Income: Short-term rentals often generate higher rental income compared to long-term rentals, providing you with greater cash flow and the potential for a quick return on investment.

- Capitalize on Demand: Florida’s thriving tourism industry ensures a consistent demand for vacation rentals throughout the year. This translates into high occupancy rates and maximizes your rental income potential.

- Favorable Tax Climate: Florida’s tax climate and regulations for short-term rentals are investor-friendly, allowing you to take advantage of tax incentives and deductions to optimize your investment returns.

- Flexibility and Control: With short-term rental properties, you have the flexibility to manage and control your property, allowing you to implement effective strategies to maximize rental income and occupancy rates.

By securing a short-term rental loan, you can capitalize on these benefits and unlock the potential for a successful investment in the booming Florida rental market.

Qualifications and Eligibility Criteria for Short-Term Rental Loans

Qualifying for a short-term rental loan in Florida typically requires meeting certain eligibility criteria. Lenders may consider factors such as credit score, income, and rental property experience. Here are some common qualifications:

- Credit Score: Borrowers should have a good credit score, typically above 680, to demonstrate their financial responsibility.

- Income and Debt-to-Income Ratio: Lenders assess the borrower’s income and debt-to-income ratio to ensure they have the means to handle loan payments.

- Rental Property Experience: Previous experience owning or managing rental properties, especially short-term rentals, can strengthen a borrower’s application.

- Property Cash Flow: Lenders may evaluate the potential rental income of the property to ensure it can generate adequate cash flow to cover loan payments.

- Loan-to-Value Ratio: Borrowers may be required to have a down payment or equity in the property to meet the lender’s loan-to-value ratio requirements.

Meeting these qualifications can increase the likelihood of approval for a short-term rental loan and help borrowers secure financing for their investment property.

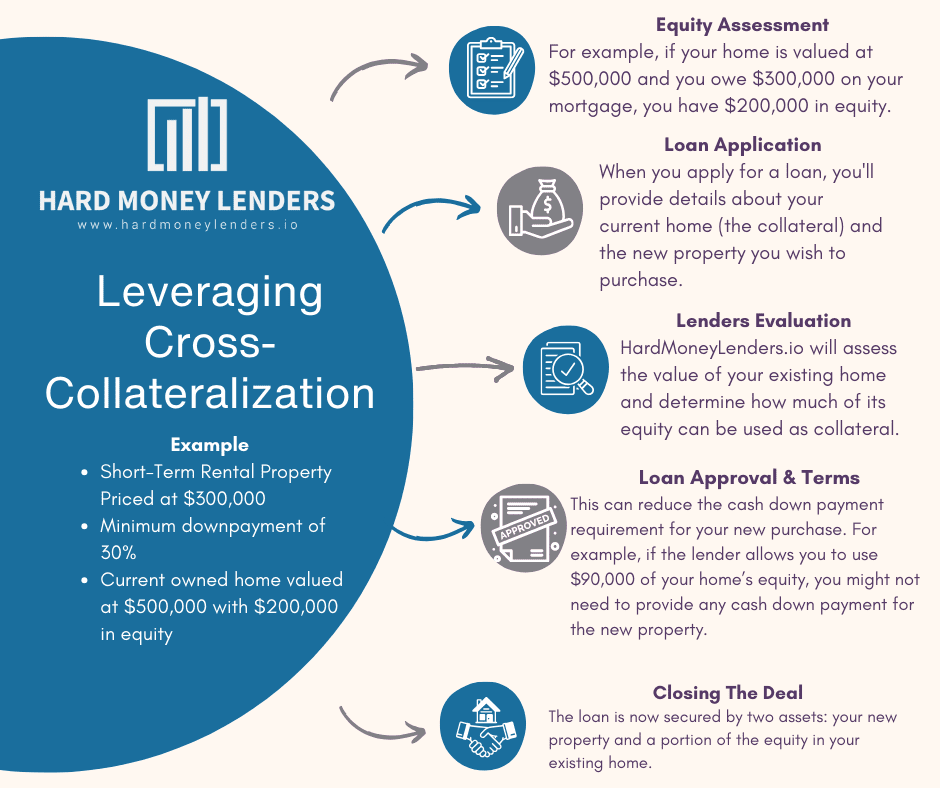

How Cross-Collateralization Can Be Used For Rental Properties

Cross collateralization is a powerful financial strategy for real estate investors, especially those looking to expand their portfolio with short-term rental properties. It involves using the equity in an existing property (like a home you own) as collateral for a loan to purchase a new property. This approach can be particularly useful for investors who may not have the cash required for a large down payment on a new investment property. It’s a useful tool if you want to leverage your existing equity in your home.

A Quick Example of How Cross-Collateralization Works

For instance, imagine you’re an investor interested in purchasing a short-term rental property priced at $300,000. Let’s say the minimum down payment is 30%, which in this case would be $90,000. However, if you don’t have $90,000 in liquid cash but own a home with substantial equity, you can leverage this asset through cross-collateralization.

Here’s how cross-collateralization would work in this example:

- Equity Assessment: First, determine the amount of equity in your existing home. Equity is the difference between the current market value of your home and the amount you owe on your mortgage. For example, if your home is valued at $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity.

- Loan Application: When you apply for a loan, you’ll provide details about your current home (the collateral) and the new property you wish to purchase. Make sure to ask about cross-collateralization, especially if you choose Hard Money Lenders as your lender.

- Lender’s Evaluation: HardMoneyLenders.io will assess the value of your existing home and determine how much of its equity can be used as collateral. They’ll factor in various aspects, including the home’s condition, location, and market trends.

- Loan Approval and Terms: If the lender approves your application, they’ll use your home as additional security for the loan. This can reduce the cash down payment requirement for your new purchase. For example, if the lender allows you to use $90,000 of your home’s equity, you might not need to provide any cash down payment for the new property.

- Closing the Deal: With the loan secured, you can proceed to purchase the short-term rental property. The loan is now secured by two assets: your new property and a portion of the equity in your existing home.

Cross-Collateralization Can Be A Powerful Tool…

It’s important to remember that while cross-collateralization can be a powerful tool, it also comes with risks. If you fail to repay the loan, you risk losing not only the new investment property but also the home you used as collateral. Therefore, it’s crucial to have a solid investment plan and a clear understanding of the risks involved.

HardMoneyLenders.io understands the intricacies of real estate investment and offers tailored solutions like cross-collateralization to help investors achieve their goals. With expert guidance and flexible loan options, investors can navigate the world of real estate investment more confidently and effectively.

Now that you’ve learned a unique way to unlock value, let’s take a look at one of the most crucial steps in securing a short-term rental loan in Florida.

Finding the Right Lender

When it comes to securing a short-term rental loan in Florida, finding the right lender is crucial. It’s important to thoroughly research and compare different lenders to ensure you choose the best option for your needs.

Start by gathering information on various lenders and their loan programs. Look for lenders who specialize in short-term rental financing and have experience in the Florida market.

Next, evaluate the terms and interest rates offered by each lender. Compare factors such as loan terms, down payment requirements, and closing costs.

Consider reaching out to a Florida real estate advisor for guidance and assistance in finding reputable lenders. They can help you navigate the process and make informed decisions.

Remember, choosing the right lender can greatly impact the success of your short-term rental investment.

Researching and comparing lenders

One of the key steps in securing a short-term rental loan in Florida is to research and compare different lenders thoroughly. By doing so, borrowers can ensure they choose the best option that suits their needs.

To begin, aspiring borrowers should gather information on various lenders and their loan programs. It is essential to look for lenders with specialized experience in short-term rental financing in the Florida market.

Next, evaluate the terms and interest rates offered by each lender. Factors such as loan terms, down payment requirements, and closing costs should be carefully considered and compared. Speaking with a real estate advisor who specializes in Florida properties can offer guidance and assistance in finding reputable lenders.

By conducting comprehensive research and comparing lenders, borrowers can make an informed decision on the right lender for their short-term rental loan.

Evaluating Terms and Interest Rates

When considering short-term rental loans in Florida, it is crucial to evaluate the terms and interest rates offered by different lenders. The terms of the loan include factors such as the loan duration, repayment structure, and any applicable fees or penalties. It is essential to understand these terms to ensure they align with your financial goals and rental property plans.

Additionally, borrowers should carefully analyze the interest rates offered by lenders. A lower interest rate can significantly impact the overall cost of the loan and your monthly payments. Take the time to compare interest rates from multiple lenders to find the most favorable option.

By evaluating the terms and interest rates, borrowers can make an informed decision and select a lender that best meets their needs and financial objectives.

Applying for a Short-Term Rental Loan

When applying for a short-term rental loan, there are certain steps and requirements that borrowers must follow. Firstly, gather all the necessary documentation, which typically includes personal identification, financial statements, and information about the rental property. This documentation will be used to assess your eligibility and the potential profitability of the rental property.

Next, find a reputable lender who specializes in short-term rental loans. It’s important to research and compare lenders to ensure you find the best terms and interest rates for your loan.

Once you’ve selected a lender, the loan application process typically involves completing an application form, providing the required documentation, and undergoing a thorough credit and income evaluation.

By carefully following the loan application process and providing all the necessary information, you can increase your chances of securing a short-term rental loan and kickstarting your rental property investment.

Required Documentation for Loan Application

To apply for a short-term rental loan, borrowers must provide certain documentation. While the specific requirements may vary among lenders, there are common documents typically requested.

These include personal identification such as a driver’s license or passport, proof of income such as pay stubs or tax returns, bank statements to verify assets and cash flow, and proof of address such as utility bills.

Additionally, lenders may require documentation related to the rental property, such as lease agreements, property tax records, and insurance coverage. Providing all the necessary documentation is crucial for lenders to assess your eligibility and the potential profitability of the rental property.

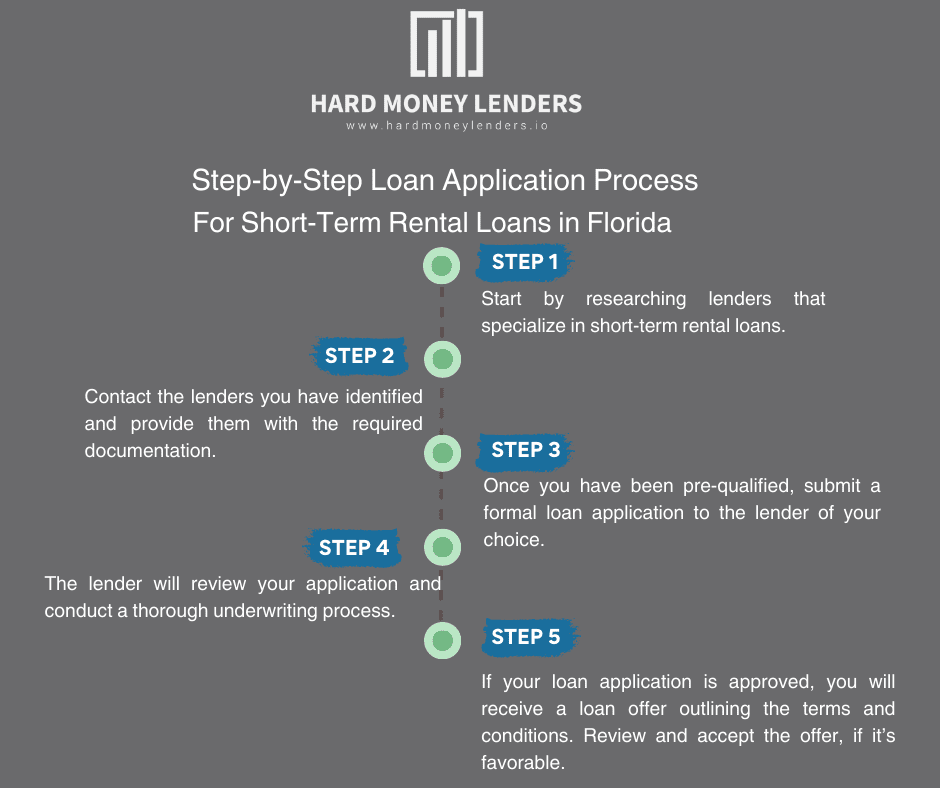

Step-by-Step Loan Application Process

The loan application process for a short-term rental loan in Florida typically involves the following steps:

- Research and gather documentation: Start by researching lenders that specialize in short-term rental loans and gather all the necessary documentation, including proof of income, bank statements, and property-related documents.

- Pre-qualification: Contact the lenders you have identified and provide them with the required documentation. They will evaluate your financial situation and determine if you pre-qualify for a loan.

- Loan application: Once you have been pre-qualified, submit a formal loan application to the lender of your choice. This application will include detailed information about the property, your financials, and your income.

- Loan underwriting: The lender will review your application and conduct a thorough underwriting process to assess your eligibility and the profitability of the rental property.

- Approval and closing: If your loan application is approved, you will receive a loan offer outlining the terms and conditions. After reviewing and accepting the offer, you can proceed with the closing process, including signing the necessary legal documents and paying any associated fees.

By following these steps and providing all the required documentation promptly, you can streamline the loan application process and increase your chances of securing a short-term rental loan in Florida.

Securing Your Investment

When it comes to securing your investment in a short-term rental property in Florida, there are a few key considerations to keep in mind. First, maximize your return on investment (ROI) by carefully analyzing the rental market and setting competitive rental rates. Researching the demand and pricing trends in your area can help you attract tenants and achieve optimal occupancy rates.

Secondly, protect your investment by ensuring you have proper insurance coverage. Short-term rental properties can be subject to unique risks, such as guest damage or liability claims. Consult with an insurance professional to understand the coverage options available to you and select policies that adequately protect your property.

Lastly, consider the strategy of cross-collateralization. This involves using the equity from one rental property to secure financing for another property. By leveraging your existing assets, you can expand your rental portfolio and increase your potential income.

By following these tips and considering the specific needs of your short-term rental investment, you can increase your chances of success in the Florida market.

Tips for Maximizing ROI on Your Short-Term Rental Property

To maximize return on investment (ROI) on your short-term rental property in Florida, there are several key tips to keep in mind.

Firstly, carefully analyze the rental market and set competitive rental rates by researching demand and pricing trends in your area. This will help attract tenants and achieve optimal occupancy rates.

Secondly, focus on providing exceptional guest experiences by ensuring your property is clean, well-maintained, and equipped with amenities.

Positive reviews and guest satisfaction will increase rental rates and bookings. Additionally, consider implementing a dynamic pricing strategy based on seasonality and local events to maximize rental income.

Finally, consider implementing cost-saving measures such as energy-efficient appliances and smart home technology to reduce expenses. By following these tips, you can optimize your ROI on your short-term rental property in Florida.

Protecting Your Investment Through Proper Insurance Coverage

Protecting your investment through proper insurance coverage is essential when it comes to short-term rental properties. With the unique nature of these properties and the risks they face, having the right insurance policy is crucial for safeguarding your investment.

A comprehensive insurance policy specifically designed for short-term rentals will provide coverage for property damage, liability claims, and loss of rental income. This means you can have peace of mind knowing that you are protected financially in the event of an unforeseen incident or accident.

When choosing an insurance provider, make sure to carefully review the policy details, including coverage limits, exclusions, and deductibles. Additionally, consider the reputation and customer service of the insurance company to ensure they will be responsive and supportive in the event of a claim. With the proper insurance coverage in place, you can protect your investment and mitigate potential financial risks.

Final Thoughts on Securing Short-Term Rental Loans in Florida

Securing short-term rental loans in Florida can be a lucrative venture for property investors. By carefully considering the benefits and qualifications of these loans, investors can maximize their returns and expand their rental property portfolio. When looking for the right lender, thorough research and a comparison of terms and interest rates are crucial. Additionally, ensuring all required documentation is in order and following the step-by-step loan application process will increase the chances of approval.

Once the loan is secured, investors should focus on maximizing their ROI by implementing effective rental strategies and obtaining proper insurance coverage. Overall, with the right approach and thorough planning, securing short-term rental loans can be a profitable endeavor in the Florida market.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.