How to Get a Hard Money Loan with Bad Credit | All You Need

Are you wondering how to get a hard money loan with bad credit? Well, you’re not alone. Imagine being able to unlock financial opportunities without the shackles of a low credit score holding you back.

This comprehensive guide will be your map, leading you through the labyrinth of hard money loans, credit scores, interest rates, and so much more.

Key Takeaways

- Hard Money Loans Defined: Short-term loans secured by real estate, offered by private lenders, ideal for investment properties.

- Benefits: They offer flexibility with no strict credit score requirements, but may have higher interest rates.

- Target Audience: Beneficial for real estate investors, house flippers, those with poor credit, and those needing quick financing.

- Challenges: Include higher interest rates and shorter loan terms. Solutions involve shopping around, being transparent, and seeking expert advice.

- Credit Importance: A better credit score can lead to favorable loan terms. Improve by timely payments, managing debt, and diversifying credit types.

What is a Hard Money Loan?

In the financial landscape, a hard money loan stands as a unique monument, a testament to the adaptability and innovation of private money lenders. Unlike a traditional loan from banks and credit unions, a hard money loan is a short-term loan primarily secured by real estate.

Definition and Use Cases

Definition and Use Cases

A hard money loan is a type of loan that is often used for investment properties, be it residential or commercial. These loans are provided by private money lenders, not traditional financial institutions.

The loan amount is determined by the property’s value that’s being offered as collateral, not by the borrower’s credit score or financial history. This makes hard money loans an attractive loan option for those with poor credit or low credit scores.

Why Choose a Hard Money Loan?

The allure of a hard money loan lies in its flexibility. Lenders may not require a minimum credit score requirement or even a credit check in some cases. This is a stark contrast to traditional lenders, who often have stringent credit score requirements and may not approve borrowers with low credit or a spotty credit report.

However, this flexibility often comes at a cost—higher interest rates. But for many, the ability to close your loan quickly and with fewer hoops to jump through outweighs the cost. It’s the financial fast lane, the fast money solution for urgent needs.

Who Can Benefit?

Hard money loans are typically used in real estate transactions and can benefit various individuals and entities, including:

- Real Estate Investors

- Fix-and-flip investors.

- Buy-and-hold investors.

- Rental property investors.

- Commercial property investors.

- House Flippers

- Those who buy distressed properties, renovate them, and sell them quickly for a profit.

- Developers

- Real estate developers looking to finance construction projects or land acquisition.

- Property Investors with Poor Credit

- Individuals or businesses with a low credit score or poor credit history who struggle to secure traditional bank loans.

- Individuals Needing Fast Financing

- Borrowers in need of quick funding, as hard money loans often have shorter approval and funding timelines compared to traditional mortgages.

- Short-Term Borrowers

- Individuals in search of short-term financial options might consider hard money loans, which usually come with brief loan durations, spanning from several months to a couple of years.

- Those with Unique Property Scenarios

- Borrowers with unconventional or non-standard properties, such as vacant land, distressed buildings, or properties in need of extensive repairs.

- Business Owners

- Entrepreneurs using real estate as collateral to secure capital for their business operations.

- Borrowers Unable to Qualify for Conventional Loans

- Individuals or businesses with irregular income, complex financial situations, or a lack of traditional loan qualifications.

- Individuals Facing Foreclosure or Bankruptcy

- Borrowers facing financial difficulties or foreclosure who need a quick infusion of capital to resolve their financial issues.

- Investors Looking for Flexible Terms

- Those who prefer flexible loan terms, including interest-only payments and the ability to negotiate terms directly with private lenders.

- Bridge Loan Seekers

- Borrowers looking for a bridge loan to cover the gap between the purchase of a new property and the sale of an existing one.

- Real Estate Professionals

- Real estate agents, brokers, or professionals who require financing for investment opportunities or to facilitate real estate transactions.

- Entrepreneurs Seeking Real Estate Investments

- Business owners and entrepreneurs looking to diversify their investment portfolios with real estate assets.

Why Credit Score Matters

In the realm of financial opportunities, your credit score serves as your passport, your ticket to a world of possibilities. But what happens when this score falls short of the minimum credit score requirement? That’s where hard money lending comes into play.

The Role of Credit Scores in Loan Approval

Traditional lenders use this score as a yardstick to measure your ability to repay the loan. A high score opens doors to lower interest rates and better loan options, while a low credit score can slam those doors shut.

In contrast, hard money lenders often don’t put as much weight on your credit score. While some may still conduct a credit check, the credit requirement is generally more lenient. This is particularly beneficial for those with poor credit or a low credit score, who might find themselves ineligible for loans from traditional lenders.

The Catch: Higher Interest Rates

While hard money lending offers a lifeline to those with poor credit, it’s important to note that this flexibility often comes with a higher interest rate. It’s the price you pay for the convenience and speed that hard money loans offer. Think of it as express shipping; you get what you need quickly, but it comes at a premium.

The Anatomy of a Credit Score

Imagine your credit score as a complex piece of art, a mosaic where each tile represents a different aspect of your financial behavior. It’s a masterpiece that’s continually evolving, shaped by your actions and decisions. Let’s dissect this artwork to understand the factors affecting your credit score.

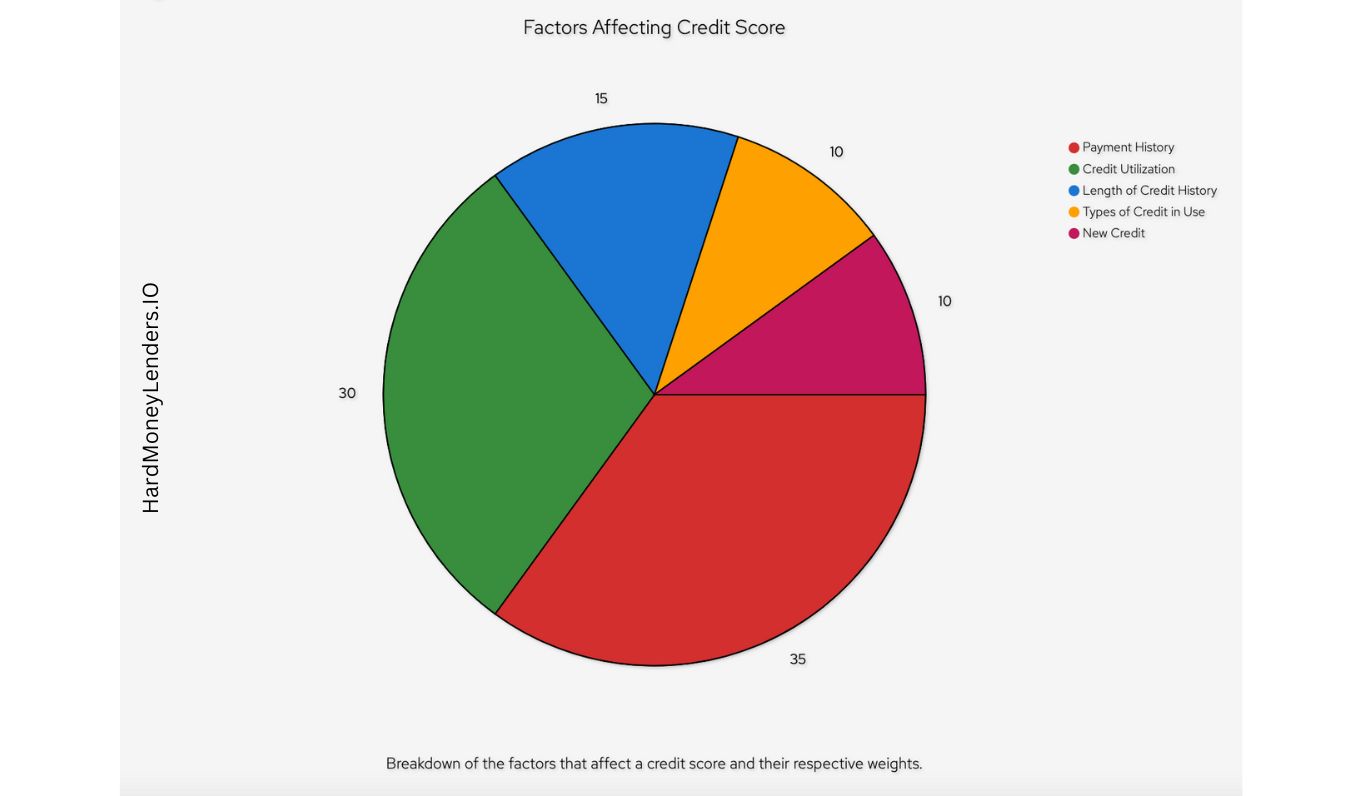

Factors Affecting Your Credit Score

Payment History (35%)

This is the cornerstone of your credit report. Just like a reliable car that starts every morning, consistent on-time payments add credibility to your financial profile.

Credit Utilization (30%)

Think of this as your financial bandwidth. It’s the ratio of your current credit line usage to your credit limit. The lower the utilization, the better your score.

Length of Credit History (15%)

This is the vintage wine factor—the older your accounts, the more they can positively impact your score.

Types of Credit in Use (10%)

Diversity is key here. A mix of credit cards, mortgage lenders, and other loan lenders adds depth to your credit profile.

New Credit (10%)

Opening too many new accounts in a short period can be a red flag, signaling financial desperation or instability.

Why It Matters in Hard Money Lending

While hard money lenders may not place as much emphasis on your credit score, understanding these factors can help you negotiate better terms. For instance, if you have a strong payment history but a low credit score due to high credit utilization, you might be able to secure a hard money loan with a slightly lower interest rate.

The FICO Score: The Industry Standard

The FICO score is often considered the gold standard in credit scoring. It uses a similar but proprietary blend of factors to calculate your score. While hard money lenders may not always require a FICO score, having a good one can be an added feather in your cap.

Why Bad Credit Isn’t a Deal-Breaker for Hard Money Lenders

Hard money lenders assess risk differently than traditional financial institutions. Their primary concern isn’t the borrower’s credit score but the Loan-to-Value (LTV) ratio. The LTV ratio is a critical metric that compares the requested loan amount against the appraised value of the property being used as collateral. An LTV ratio that falls within the lender’s comfort zone—typically around 60% to 75%—significantly reduces the perceived risk. This is because, in the event of a default, the lender is more likely to recoup their investment through the sale of the property.

Moreover, hard money lenders are investment-driven, focusing on the potential for the property to generate a return rather than on the borrower’s past financial mishaps.

This approach to lending ensures that opportunities are available to individuals with less-than-perfect credit scores, provided they have a promising investment proposition. It’s this asset-based lending model that makes hard money loans a viable option for real estate investors facing credit challenges.

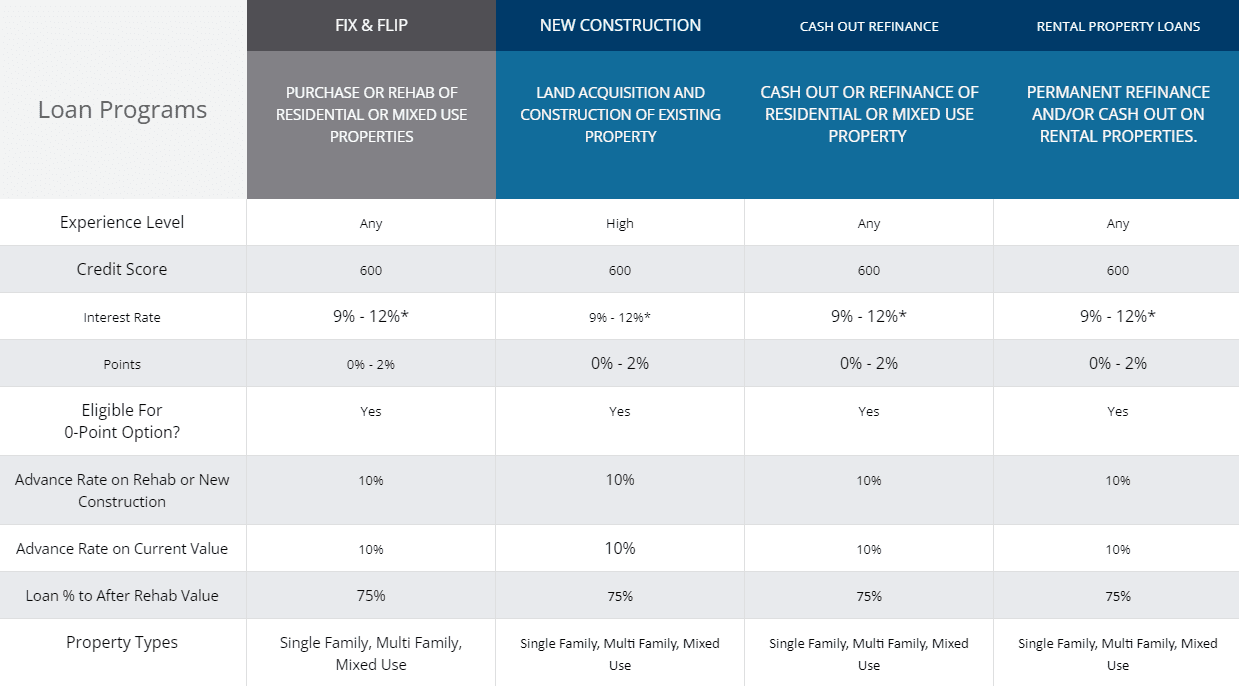

Here at HardMoneyLenders.IO, the minimum credit score requirement to secure a hard money loan is just 600.

Challenges of Getting a Hard Money Loan with Bad Credit

Challenges of Getting a Hard Money Loan with Bad Credit

While hard money loans offer a lifeline, they come with their own set of challenges, especially for those with poor credit or a blemished credit history.

Real-World Scenarios and Obstacles

Higher Interest Rates

One of the most glaring challenges is the higher interest rate that hard money lenders often charge.

Shorter Loan Terms

Hard money loans are typically short-term loans, meaning you’ll have less time to repay the loan.

Loan-to-Value Ratio

Hard money loans are often determined by the loan to value of the property you’re using to secure the loan. If the property’s value is low, you may find it challenging to get the amount you need.

Upfront Costs

These loans often come with upfront fees or points.

Property Risks

Since hard money loans are secured by real estate, failing to repay the loan could result in losing the property.

Lender Scrutiny

While they may not focus on your credit score, hard money lenders will still evaluate other aspects like your credit history and investment properties. They’re not just handing out money; they’re investing in you.

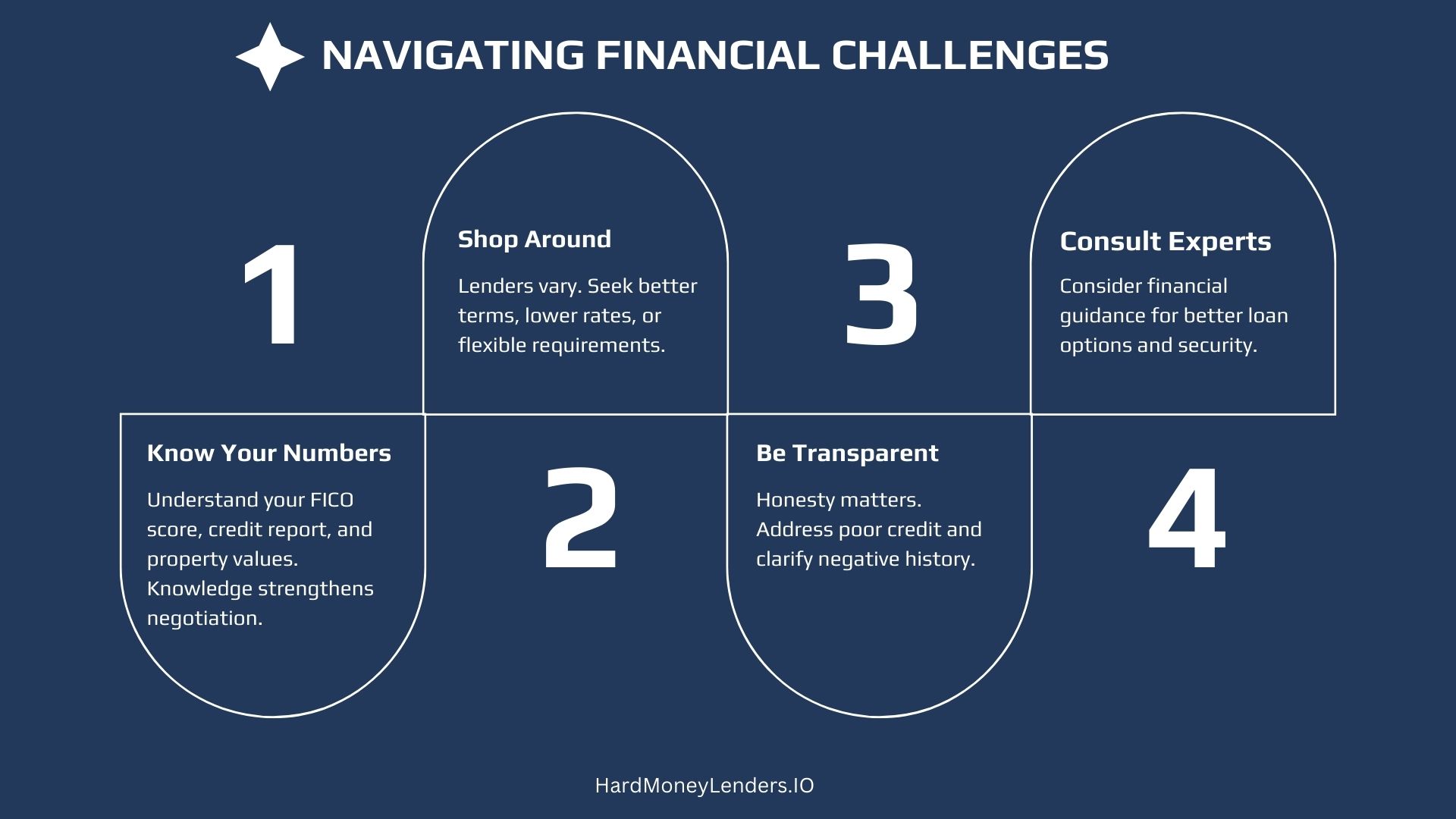

How to Navigate These Challenges

1. Know Your Numbers

Be aware of your FICO score, credit report, and the value of your investment properties. Knowledge is your best negotiating tool.

2. Shop Around

Not all hard money lenders are created equal. Some may offer better terms, lower interest rates, or more flexible credit requirements.

3. Be Transparent

Honesty is key. If you have poor credit, be upfront about it and explain any negative marks on your credit history.

4. Consult Experts

Sometimes, it’s wise to bring in a financial navigator. Consult experts who can guide you through the loan options and help you secure a hard money loan.

How Lenders Evaluate You

Hard money lenders are keen to see if you’re worth the investment. Unlike traditional lenders, who often act like stern critics focused solely on your credit score, hard money lenders adopt a more holistic approach.

Criteria Used by Hard Money Lenders

Collateral

The star of the show in hard money lending is the collateral, usually real estate. Lenders evaluate the property’s value, condition, and potential returns. It’s the safety net that allows them to take risks on borrowers with low credit scores.

Equity Stake

Lenders look at your equity in the property to gauge your commitment. The higher your stake, the more aligned your interests are with the lender.

Exit Strategy

This is your game plan for repaying the loan. Whether it’s selling the property, refinancing, or another avenue, lenders want to see a clear path to getting their hard cash back.

Financial Health

While your credit score may not be the focal point, lenders still assess your overall financial health. This could include cash reserves, debt-to-income ratio, and even your credit history.

Experience

Particularly in the realm of investment properties, experience can be a valuable asset. Lenders are more likely to trust borrowers who have successfully navigated similar deals in the past.

Legal Requirements

Lenders must adhere to both federal and state laws, which may include property inspections, permits, and other legalities. Compliance is non-negotiable.

Steps to Get a Hard Money Loan with Bad Credit

Embarking on the journey to secure a hard money loan with bad credit is akin to navigating a maze. Here’s your step-by-step guide to conquering this labyrinth.

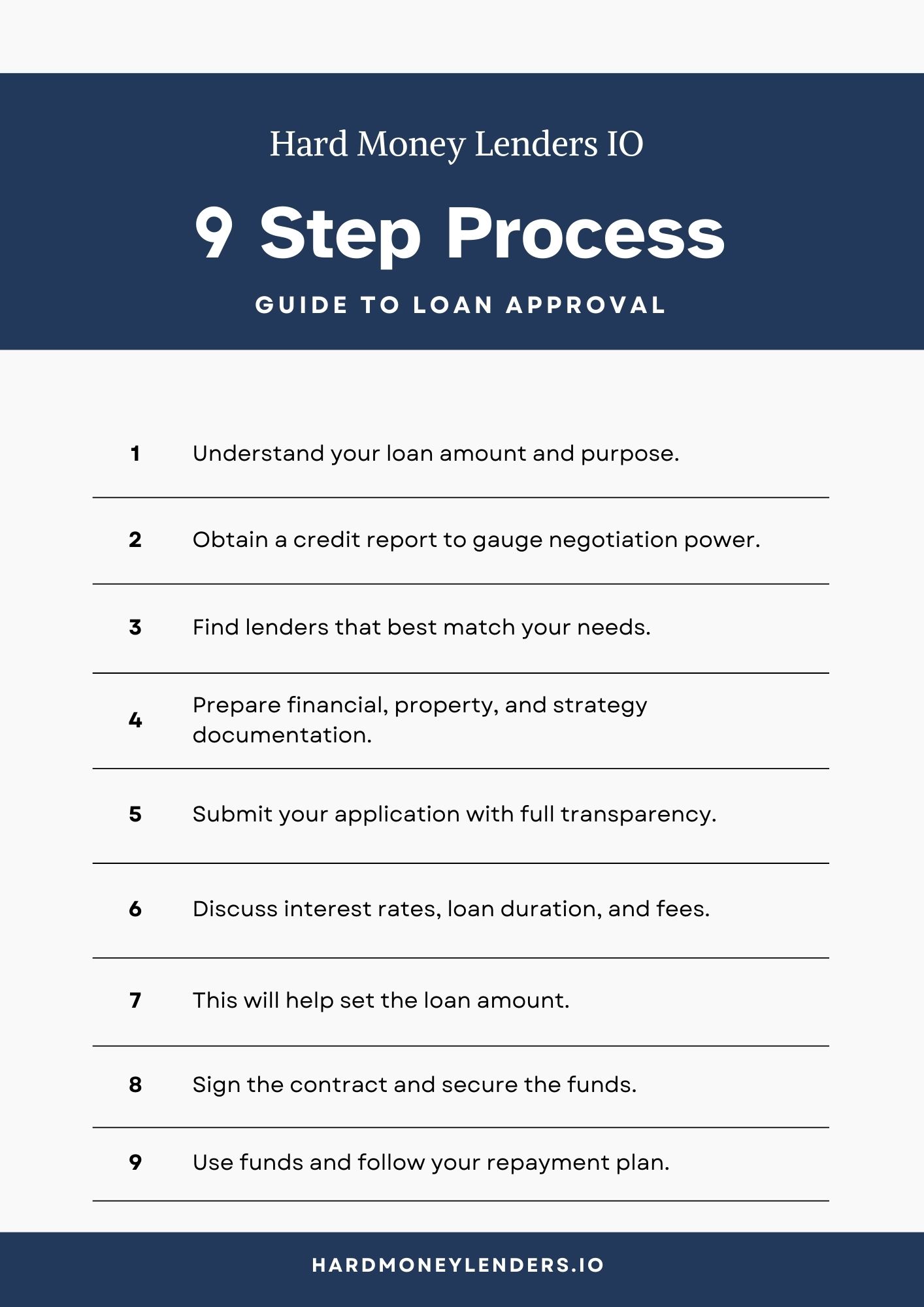

A Step-by-Step Guide to Loan Approval

1. Assess Your Needs

Before you even start looking for hard money lenders, know exactly how much you need a loan for and what you’ll use it for. This is your mission statement, your “why,” and it will guide your entire journey.

2. Check Your Credit

Even though hard money lenders are more lenient, knowing your credit score and credit history can give you a negotiating edge. Obtain a credit report to know where you stand.

3. Research Lenders

Not all hard money lenders are created equal. Some specialize in residential hard money loans, others in commercial. Some might offer loans with lower interest rates for borrowers with low credit scores.

4. Prepare Documentation

Lenders must see proof of your financial standing, the property details, and your exit strategy. Gather all necessary documents to speed up the loan approval process.

5. Apply

Once you’ve chosen a lender that aligns with your needs, submit your application. Be transparent and provide all requested information.

6. Negotiate Terms

If you’re approved for a loan, the next step is to negotiate the terms. This includes the interest rate, loan term, and any fees. Remember, everything is negotiable.

7. Property Appraisal

Hard money loans are secured by real estate. An appraisal will be conducted to determine the loan to value ratio, which will influence the loan amount.

8. Finalize the Deal

Once terms are agreed upon, you’ll sign the contract and receive the funds. Congratulations, you’ve successfully navigated the maze!

9. Execute Your Exit Strategy

Now that you have the funds, it’s time to implement your exit strategy to repay the loan. Whether it’s flipping the property or refinancing, stick to your plan.

Loan Amount and Loan Term

In the context of hard money loans, the loan amount and loan term are pivotal factors that vary with credit scores and significantly impact the borrowing experience. Let’s examine these variations and what they entail.

How These Factors Vary with Credit Scores

Loan Amount

Though, hard money lenders are more focused on the value of the collateral than your credit score, a low credit score could still impact the loan amount. The lower the score, the more cautious the lender may be in extending a large sum.

Loan Term

Hard money loans are inherently short-term loans. The term can range from a few months to a couple of years. A poor credit score may further shorten this window, requiring you to repay the loan in a more compressed timeframe.

The Balancing Act: Amount vs. Term

It’s a delicate balance between how much you can borrow (loan amount) and how long you have to pay it back (loan term). If you’re borrowing a large amount, be prepared for a shorter term or higher interest rates.

The Role of Collateral

The collateral, usually real estate, plays a pivotal role in determining both the loan amount and loan term. The loan is based on the loan to value ratio of the property. The higher the value, the more you can potentially borrow, and the more flexible the term may be.

The Fine Print: Fees and Penalties

Always read the fine print. Some hard money loans come with prepayment penalties or extension fees. Knowing these details upfront can save you from unpleasant surprises down the line.

Interest Rates

Interest rates can entice borrowers with the prospect of quick funds, yet they can also pose a significant financial threat if mishandled. This discussion will delve into the impact of bad credit on these rates and potential strategies to mitigate adverse effects.

How Bad Credit Affects Interest Rates

A low credit score often leads to higher interest rates. Lenders use this approach to offset the perceived risk when lending to individuals with less-than-ideal credit records.

The Cost of Convenience

Hard money loans are known for their speed and convenience, especially when you need a loan urgently. This convenience often comes at a cost. Hard money lenders typically charge higher rates than traditional lenders, and if you have bad credit, those rates can soar even higher.

Strategies to Mitigate High Interest Rates

Negotiation

Never underestimate the power of a good negotiation. If you have assets or a strong business plan, use them as leverage.

Down Payment

A larger down payment can sometimes offset the higher interest rate, acting as a show of good faith to the lender.

Co-Signers

Bringing in a co-signer with a better credit score can help you secure a lower rate.

Shorter Loan Term

Opting for a short-term loan can sometimes reduce the interest rate, but be sure you can repay the loan within the stipulated time.

How to Improve Your Credit Score

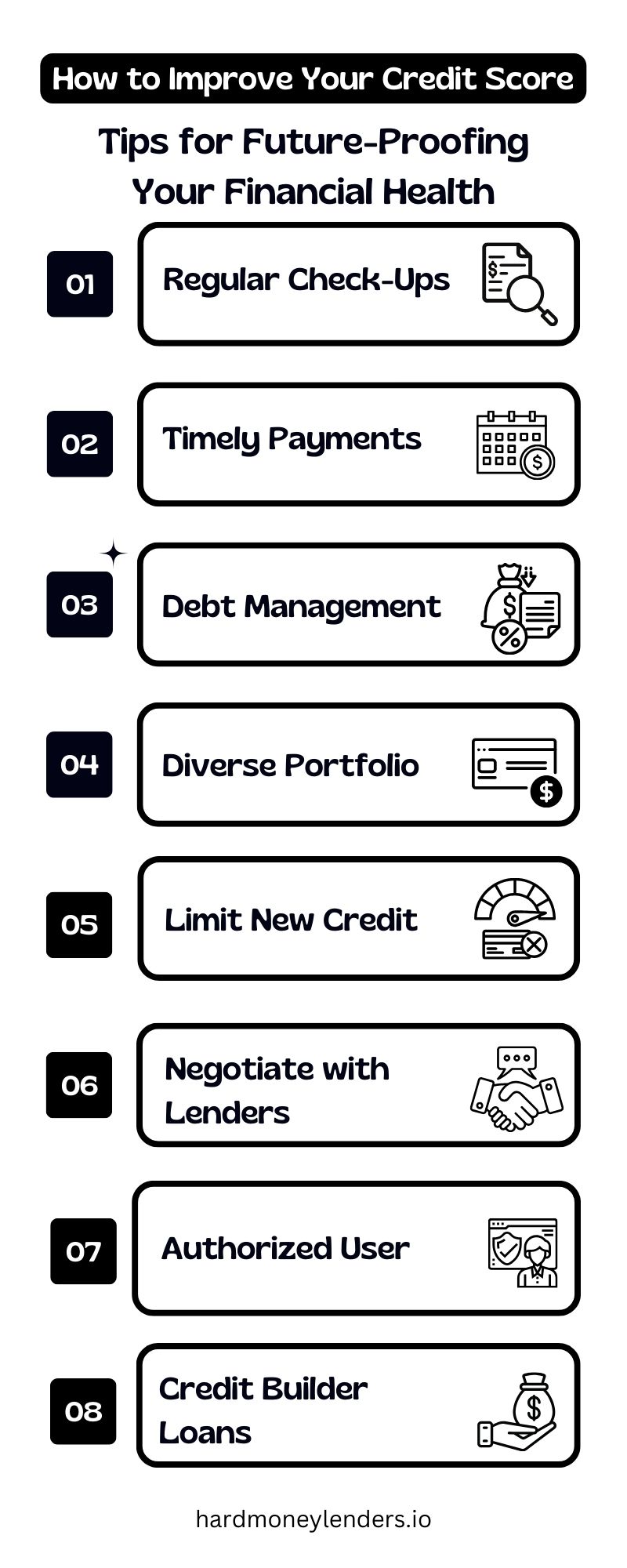

While there may not be a magical formula, there are certainly actionable steps you can take to improve your score, thereby enhancing your standing in the eyes of lenders. Consider this your treasure map to a more golden financial future.

Future-Proofing Your Financial Health

Regular Check-Ups

Just like you’d visit a doctor for a physical, regularly checking your credit report can help you catch errors or inconsistencies that could be dragging down your score.

Timely Payments

Consistency is key. Making payments on time, whether it’s for a credit card, mortgage, or any other type of debt, positively impacts your credit history.

Debt Management

Strive to maintain your credit utilization ratio, which is the proportion of credit you’re using relative to your credit limit – under 30%.

Diverse Portfolio

Having a mix of credit types, such as credit cards, a line of credit, and installment loans, can actually benefit your score.

Limit New Credit

Each time you apply for new credit, a credit check is performed, which can slightly lower your score. Be selective and strategic about opening new accounts.

Negotiate with Lenders

If you’ve missed a payment, it’s not the end of the world. Many lenders may be willing to remove the late payment from your record if you have a generally good payment history.

Authorized User

Being added as an authorized user on someone else’s credit card can help boost your score, but make sure it’s someone with a good credit history.

Credit Builder Loans

These are small loans specifically designed to help people build or rebuild credit.

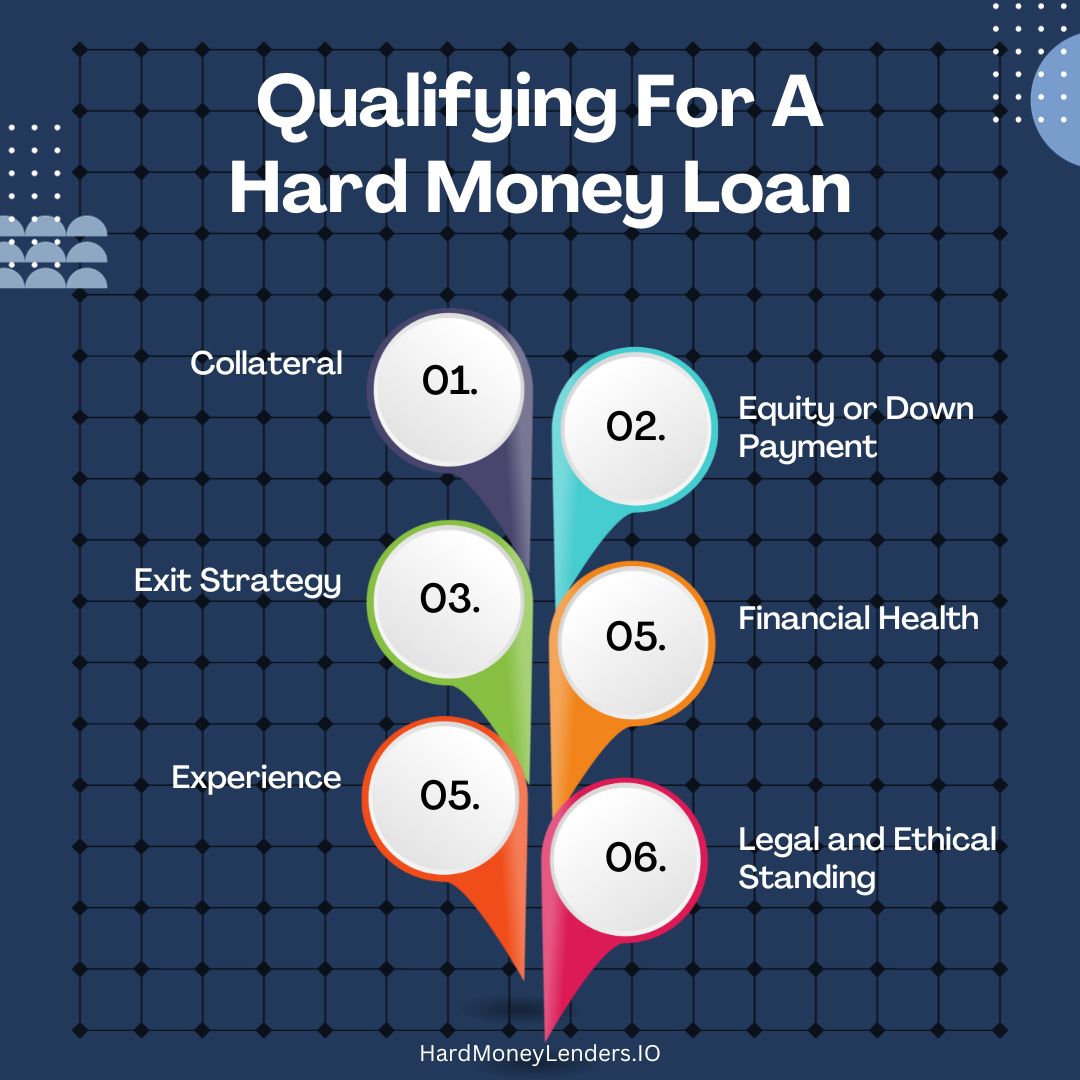

Qualifying for a Hard Money Loan

Qualifying for a hard money loan can be complex, but with the right information, it becomes manageable. This section serves as your guide through the process, making it easier to navigate.

Eligibility Criteria

Collateral

The cornerstone of hard money loans, collateral—often real estate—is your golden ticket. The property’s value and condition are scrutinized to secure the loan.

Equity or Down Payment

The more equity you have in the property, the better. This makes you a less risky bet for lenders, especially if you have a low credit score.

Exit Strategy

Lenders don’t just want to know how you’ll use the money; they’re keen to understand how you plan to repay the loan. A well-thought-out exit strategy can be your ace in the hole.

Financial Health

Proof of income, cash reserves, and other financial indicators are can help securing a loan.

Experience

If you’re seeking a hard money loan for real estate investment, experience can be a significant factor. A track record of successful investments can tip the scales in your favor.

Legal and Ethical Standing

Background checks and due diligence are standard procedures to ensure you’re above board legally and ethically.

Strategies to Secure a Hard Money Loan With Bad Credit

Now, there are ways to secure a hard money loan even with a credit score that’s below 650. Here are some ways to do just that.

Larger Down Payment

Offering a larger down payment is a strategic move to counterbalance the negative impact of bad credit when applying for a hard money loan. By significantly increasing the amount of money you’re willing to pay upfront, you effectively lower the Loan-to-Value (LTV) ratio. The LTV ratio is a critical measure for lenders to evaluate the risk associated with the loan. A lower LTV ratio provides the lender with a higher level of security, as it increases the equity in the property and reduces the lender’s exposure to potential loss.

For instance, if the property you’re interested in is valued at $200,000 and you offer a down payment of 40% instead of the standard 20%, you’re not only demonstrating a strong commitment to the project but also significantly decreasing the loan amount needed. This can sway hard money lenders to view your loan application more favorably, despite any credit issues, because it minimizes their risk and shows your financial investment in the project’s success.

Collateral

Expanding the range of collateral beyond just the investment property can significantly strengthen your hard money loan application. Collateral serves as a security net for lenders, ensuring that they have a recourse to recover the loan amount in case of default. By offering additional assets as collateral, such as personal real estate, vehicles, or other valuable possessions, you provide the lender with more assurance and reduce the perceived risk associated with lending to someone with bad credit.

This strategy involves legally pledging other assets you own as a backup in case the loan cannot be repaid from the profits of the property being financed. It’s crucial to carefully consider which assets to offer as collateral, evaluating their current market value and any emotional or practical importance they hold. Including these additional assets in your loan negotiation demonstrates a deeper level of commitment and can make your proposal more appealing to lenders.

Cross-Collateralization

Cross-collateralization is an advanced strategy that involves using the equity in multiple properties to secure a single loan. This method is particularly advantageous for borrowers with an existing real estate portfolio, as it allows them to leverage the accumulated equity in their properties without having to liquidate assets. By offering several properties as collateral, you essentially spread the risk across multiple assets, offering the lender multiple avenues for recouping the loan amount if necessary.

This approach requires a detailed and well-documented presentation of the properties involved, including their values, existing mortgages, and the equity available in each.

Cross-collateralization can be a powerful tool in negotiations, as it showcases not only the tangible assets backing the loan but also your comprehensive involvement in real estate investment. It’s essential, however, to understand the implications fully, as defaulting on the loan could put multiple properties at risk. Proper legal counsel should be sought to structure these arrangements in a way that aligns with your investment strategy and risk tolerance.

Get the Cash You Need: Quick Tips

In the fast-paced world of hard money lending, time is often of the essence. Whether you’re flipping a property or covering an unexpected expense, getting the cash you need quickly can be a game-changer. Think of this section as your quick-start guide, a cheat sheet if you will, to accelerate your financial gains.

Fast Solutions for Urgent Needs

Pre-Approval

Some hard money lenders offer pre-approval processes that can give you a head start.

Digital Platforms

Leveraging online platforms can expedite the application and approval process.

Streamlined Documentation

Have all your documents—financial statements, credit reports, property details—ready and in digital format. This can significantly speed up the review process.

Direct Communication

Maintain open lines of communication with your lender. Quick responses to queries or requests for additional information can shave days off the approval process.

Flexible Lenders

Look for lenders who offer more flexible terms or specialized products like bridge loans or line of credit options. These can often be processed more quickly.

Use a Broker

If you’re new to the world of hard money loans, a broker can guide you to the best hard money lenders for your needs, saving you valuable research time.

Emergency Funds

While not a loan, having an emergency fund can act as a buffer, giving you more time to secure the best loan terms. Think of it as your financial airbag, cushioning any sudden impacts.

Alternatives to Hard Money Loans

While hard money loans can be a viable option for many, especially those with bad credit, it’s essential to be aware of other financing alternatives. Depending on your financial situation and needs, one of the following options might be more suitable for you:

Personal Loans

These are unsecured loans offered by banks, credit unions, and private lenders. They can be used for a variety of purposes, and the interest rates might be lower than hard money loans, especially if you have a decent credit score.

Home Equity Loans

If you have built up equity in your home, you can borrow against it. These loans typically come with lower interest rates than hard money loans and can provide a significant amount of money.

3Peer-to-Peer (P2P) Lending

Platforms like LendingClub or Prosper allow to bypass traditional financial institutions. Interest rates can vary, but this can be a flexible option for many.

Credit Unions

Credit unions often offer more favorable loan terms than banks, especially for members with less-than-perfect credit. They might be more willing to work with you and understand your financial situation.

Crowdfunding

Websites like Kickstarter or GoFundMe allow individuals or businesses to raise money for specific projects or needs. This can be an option if you have a compelling story or business idea.

Business Lines of Credit

If you’re an entrepreneur or business owner, you might qualify for a line of credit. This gives you flexible access to funds as and when you need them.

Family and Friends

Sometimes, borrowing from someone you know can be the simplest and most straightforward option. However, it’s crucial to have clear terms and a written agreement to avoid any misunderstandings or strained relationships.

Government and Non-Profit Programs

Depending on your situation, you might qualify for loans or grants from government agencies or non-profit organizations. These can offer favorable terms and might be designed specifically for individuals in your situation.

Credit Card Cash Advances

While not the most cost-effective option due to high interest rates, it’s a quick way to access funds in an emergency.

Sell Assets

If you have valuable assets, like a second car, jewelry, or other items, consider selling them to raise the funds you need.

Final Thoughts on How to Get a Hard Money Loan With Bad Credit

Securing a hard money loan with bad credit is undeniably challenging but far from impossible. With the right preparation, a strong understanding of the hard money lending process, and effective negotiation, investors can access the funds needed to bring their real estate visions to life. Remember, the key lies in the value of your investment and your strategy, not just your credit score.

FAQs About Securing a Hard Money Loan With Bad Credit

Can I Get a Hard Money Loan If I Have a Foreclosure in My History?

Yes, securing a hard money loan with a foreclosure in your history is indeed possible. Hard money lenders prioritize the current investment opportunity over past financial setbacks. Key to this is demonstrating a strong investment plan that showcases the potential profitability and viability of the property in question. It’s crucial to provide a comprehensive plan that outlines your strategy for the property, backed by a thorough market analysis and a clear exit strategy. This approach can effectively mitigate lenders’ concerns about your foreclosure history by focusing on the present and future potential of your investment.

How Important Is My Income When Applying for a Hard Money Loan?

Your income, while not the primary criterion, plays a significant role in the hard money loan approval process. Lenders evaluate your income or cash reserves as part of their overall risk assessment, aiming to ensure that you can handle the loan’s interest payments, any unforeseen expenses related to the property, and the cost of potential renovations. Demonstrating reliable income sources or substantial reserves can significantly bolster your application, showing that you have the financial stability to support your investment endeavors despite any credit issues.

What Are the Typical Interest Rates for Hard Money Loans?

Interest rates for hard money loans are generally higher than those offered by traditional banks, reflecting the greater risk taken on by the lender and the convenience of quick funding. Rates can vary significantly based on the lender’s assessment of the deal’s risk, the borrower’s financial situation, and the property itself. Typically, hard money loan interest rates range from the high single digits to the mid-teens or even higher, depending on the specifics of the deal. Currently, the typical interest rates for hard money loans range from 9% and 15%.

How Quickly Can I Get a Hard Money Loan?

The speed of funding is a significant advantage of hard money loans, with the ability to close deals much faster than traditional financing allows. Depending on various factors, including the lender’s processes and the complexity of the transaction, hard money loans can be funded in as little as a few days to a couple of weeks. This expedited process enables investors to capitalize on opportunities swiftly and compete more effectively in hot markets.

Do I Need a Down Payment for a Hard Money Loan?

A down payment is typically required for a hard money loan, with the amount varying by lender and specific deal circumstances. Generally, lenders require a down payment of 20% to 30% of the purchase price or loan amount. A higher down payment can serve as a strong compensatory factor for borrowers with bad credit, lowering the loan-to-value ratio and thereby reducing the lender’s risk.

Can I Use a Hard Money Loan for a Property I Plan to Live In?

Hard money loans are primarily designed for investment properties, and regulatory guidelines often limit their use for owner-occupied residential properties. However, certain lenders might be willing to extend hard money loans for owner-occupied properties under specific conditions. It’s crucial to communicate your intentions with the lender upfront and verify that the loan terms align with legal and regulatory standards for owner-occupied financing.

What Can I Use as Collateral for a Hard Money Loan?

For a hard money loan, the primary collateral is typically the real estate property you are financing. However, lenders may consider additional assets as collateral to strengthen your loan application, especially if your credit history is less than ideal or if the loan’s Loan-to-Value (LTV) ratio is higher than preferred. These additional assets can include:

- Other Real Estate Properties: Whether residential or commercial, additional real estate holdings can be pledged as collateral.

- Personal Assets: High-value assets such as vehicles, boats, or expensive machinery could potentially be used as additional security for the loan.

- Investment Portfolios: Stocks, bonds, or other investment accounts might also be considered, though these are less commonly accepted due to their fluctuating value.

It’s essential to discuss with your lender what assets are acceptable as collateral and understand the implications of pledging additional assets, including the risk of loss if you’re unable to repay the loan.

Do Hard Money Loans Show Up on Credit?

Hard money loans may or may not show up on your credit report, depending on the lender’s reporting practices. Many hard money lenders do not report to credit bureaus because they operate outside of traditional banking systems. However, if a hard money loan goes into default and the lender takes legal action, or if the lender chooses to report to credit bureaus, the loan and any related judgments could appear on your credit report. It’s a good idea to ask the lender about their credit reporting practices before finalizing the loan to fully understand the potential impact on your credit history.

How Do Payments on Hard Money Loans Work?

Payments on hard money loans typically consist of interest and principal, just like traditional loans, but the structure can vary significantly. Many hard money loans are interest-only for the term of the loan, with a balloon payment of the principal due at the end. This arrangement allows borrowers to keep monthly payments low while they rehab and sell the property or secure longer-term financing. Payment schedules, interest rates, and whether the loan has a balloon payment should be clearly outlined in the loan agreement. Understanding the payment terms is crucial for managing your financial obligations and ensuring the project remains profitable.

What Is the Minimum Credit Score for a Hard Money Loan?

Unlike traditional financing, there’s often no strict minimum credit score requirement for hard money loans. Since hard money lenders primarily focus on the value of the collateral (the property being financed) and the strength of the borrower’s investment

plan, a low credit score can be offset by a strong project proposal and significant equity in the property. However, some hard money lenders might have preferred credit score ranges as part of their overall risk assessment. Borrowers with higher credit scores might secure more favorable terms, but having a lower score doesn’t automatically disqualify you from obtaining a hard money loan. It’s essential to communicate openly with potential lenders about your credit situation and discuss how other aspects of your loan application can compensate for any concerns related to your credit score.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.