Loan to Cost (LTC) Ratio Definition

When it comes to financing a real estate project, the Loan to Cost Ratio (LTC) is an important factor to consider. As a real estate investor, you’ll need to understand what this ratio is and how it relates to your loan, as it will affect the amount of money you need to borrow. In this article, we’ll be go over the loan-to-cost (LTC) ratio definition, what the LTC ratio is, and how it’s calculated so that you can make informed decisions about your investing needs… and much more.

What is the Loan-To-Cost Ratio (LTC)?

So what does loan to cost mean? The Loan-To-Cost Ratio (LTC) is a financial metric used in real estate investing. It measures the amount of money borrowed for a real estate investing project against the total cost of that project. The LTC ratio can vary from lender to lender but typically ranges from 75% – 85%.

So what does loan to cost mean? The Loan-To-Cost Ratio (LTC) is a financial metric used in real estate investing. It measures the amount of money borrowed for a real estate investing project against the total cost of that project. The LTC ratio can vary from lender to lender but typically ranges from 75% – 85%.

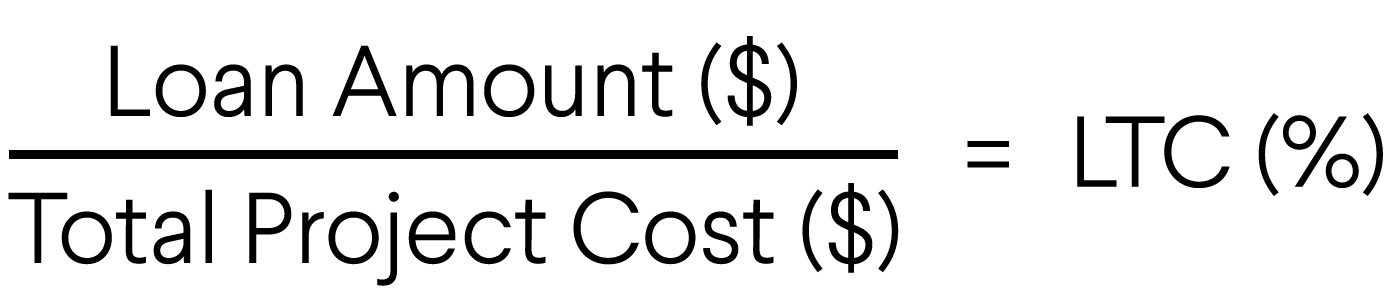

The Formula for LTC

The loan to cost real estate equation breaks down into two parts, total costs of the real estate project and total loan amount requested. To calculate the LTC ratio you divide the loan amount by the total cost of the project. This will give you your percentage value for LTC ex a Loan-To-Cost Ratio value of 75% means that 75% of your projects costs are covered by borrowing and 25% comes from equity.

What Does the Loan-To-Cost Ratio Tell You?

A crucial question that can’t be left unanswered is “What does LTC mean in real estate?” This ratio tells you how much of the total cost of a project is funded by debt financing versus equity financing. It’s important to note that this doesn’t take into account any closing costs associated with obtaining the loan. Those need to be factored in separately. Knowing this can help you make sure that your investment remains on track and profitable.

Why Does the LTC Ratio Matter?

The loan-to-cost (LTC) ratio is more than a mere calculation; it’s a comprehensive measure that impacts several facets of the real estate financing ecosystem.

The loan-to-cost (LTC) ratio is more than a mere calculation; it’s a comprehensive measure that impacts several facets of the real estate financing ecosystem.

LTC Ratio Helps With Risk Assessment

The LTC ratio acts as a barometer for financial risk, giving lenders a quick yet effective measure to gauge the level of exposure they face by funding a project. A higher LTC ratio, often exceeding 80%, flags a project as potentially riskier since it implies the borrower is putting up a smaller fraction of the project’s total cost as equity.

This limited skin in the game increases the likelihood of default, as borrowers have less to lose should the project not pan out as planned. Conversely, a lower LTC ratio signifies a more considerable equity contribution from the borrower, suggesting a more robust commitment to the project’s success and, by extension, a lower risk to lenders.

Investment Decision-Making with LTC Ratio

For investors, the LTC ratio serves as a critical indicator of a project’s financial health and potential return on investment (ROI). It helps in assessing the leverage level of a project and determining the balance between debt financing and equity.

By analyzing the LTC ratio, investors can identify projects that are optimally leveraged, offering a higher potential ROI without undue risk, thereby informing more strategic investment decisions.

Loan Approval Processes

Banks and other financial institutions leverage the LTC ratio as a cornerstone of their loan underwriting processes. A project with a high LTC ratio may face stricter scrutiny, higher interest rates, or outright rejection, as it signals a greater risk of non-completion or financial insolvency.

In contrast, projects demonstrating a lower LTC ratio are often viewed as safer bets, potentially qualifying for more favorable loan terms. This metric enables lenders to maintain a balanced portfolio, mitigating risk while fostering a healthy lending environment.

Factors Influencing the LTC Ratio

The LTC ratio is subject to a variety of influences, each playing a crucial role in its determination and interpretation. Below are three factors that can influence LTC ratios.

Project Type

The nature of the project significantly impacts the acceptable LTC ratio. For instance, commercial projects might be viewed as having higher risk due to market volatility, leading to lower acceptable LTC ratios to mitigate lender risk. Residential projects, particularly those in well-established areas with high demand, may afford slightly higher LTC ratios given their consistent market appeal and relatively stable value.

Market Conditions

The overarching economic environment and specific real estate market trends are critical in shaping the LTC ratio landscape. In a booming market with rising property values and high demand, lenders may be more inclined to accept higher LTC ratios, buoyed by the anticipation of strong project viability and profitability.

Conversely, in downturns or markets with oversupply, lower LTC ratios become the norm, reflecting the increased caution of lenders wary of declining property values and potential project failures.

Borrower’s Creditworthiness

A borrower’s financial health and credit history are integral to determining the terms of a loan, including the LTC ratio. Borrowers with strong credit profiles, substantial assets, and a history of successful projects typically qualify for loans with higher LTC ratios, as lenders have more confidence in their ability to manage and complete the project successfully.

In contrast, borrowers with less impressive financial credentials might face lower LTC ratio ceilings, reflecting the lender’s need to mitigate potential risks associated with their financial instability or lack of project management experience.

Example of How to Use LTC

To illustrate, let’s look at a loan to cost example in practice. Suppose you’re looking at investing in a new apartment complex construction project with an estimated total cost of $10 million. To fund this project, you take out a loan for $7 million and invest $3 million of your own capital into the deal. In this case, your Loan-to-Cost Ratio is 70% ($7M/$10M). This means that 70% of the funding for this project comes from debt and 30% from equity.

What is the Difference Between LTV and LTC?

Loan To Value (LTV) and Loan To Cost (LTC) are two common terms used in real estate, but what is the difference between them? Knowing how they work can help you make an informed decision when it comes to investing in a property. LTV is a ratio that compares the loan amount to the estimated value of a property. It’s typically expressed as a percentage and represents how much of a mortgage loan you can get on your property. For example, if your property is valued at $300,000 and your loan amount is $280,000, then your LTV would be 93%. On the other hand, LTC is also a ratio that compares your loan amount to costs incurred while acquiring or renovating an investment property.

Whether to Use loan to cost (LTC) or loan to value (LTV)?

When evaluating a loan, lenders consider both the Loan to Cost (LTC) ratio and the Loan to Value (LTV) ratio. While both are important metrics in assessing risk, they measure different aspects of a loan.

The LTC ratio is used to determine how much of a loan will be required for a project. It takes into account all costs related to completing the project, such as land purchase, construction costs and closing costs, and calculates what percentage of those costs need to be covered by a loan. The higher the LTC ratio is, the greater amount of financing needed for the project.

On the other hand, the LTV ratio measures how much value an asset has compared to its outstanding loan balance. This metric is often used by mortgage lenders in order to assess risk associated with lending against an asset’s value.

Best Practices for Managing Your LTC Ratio

Optimizing the Loan to Cost (LTC) ratio is crucial for real estate investors aiming to secure favorable loan terms and achieve superior investment outcomes. A well-managed LTC ratio not only enhances the likelihood of loan approval but also positions a project for financial success. Here are strategic tips and practices for maintaining a favorable LTC ratio throughout the lifecycle of your real estate project.

Initial Planning and Budgeting

- Accurate Cost Estimation: Start with a thorough and realistic estimation of the total project costs, including land acquisition, construction, permits, and unforeseen contingencies. Underestimating costs can lead to a higher LTC ratio as the project progresses, potentially compromising financing options.

- Equity Capital Maximization: Increase your equity contribution where possible. A higher equity investment reduces the need for debt financing, leading to a lower LTC ratio. Consider pooling resources with partners or seeking out investors to boost the project’s equity base.

- Seek Competitive Loan Offers: Don’t settle for the first loan offer. Shop around and negotiate with multiple lenders to find the best terms and the lowest possible interest rates. Sometimes, even a slight reduction in the interest rate can significantly impact the project’s financial viability and LTC ratio.

During Project Execution

- Efficient Project Management: Keep the project on schedule and within budget. Delays and cost overruns can inflate the total project cost, adversely affecting the LTC ratio. Implementing tight project management controls and contingency plans can mitigate these risks.

- Phase Financing Strategy: Consider phasing the project financing. By breaking the project into phases and securing financing for each phase as needed, you can potentially reduce the overall loan amount at any given time, managing the LTC ratio more effectively.

- Regular Financial Reviews: Conduct regular reviews of your project’s financial health, including the LTC ratio. This ongoing analysis can help identify trends, enabling adjustments to financing or project scope to maintain a favorable LTC ratio.

Long-term Strategies

- Refinancing Opportunities: Look for opportunities to refinance the project at a lower interest rate or better terms as the project progresses and risk decreases. Refinancing can lower your loan amount relative to the project cost, thus improving your LTC ratio.

- Maintain a Strong Credit Profile: A robust credit history and financial standing can improve your negotiating power with lenders, leading to better loan terms and potentially lower required equity contributions. Consistently manage your financial obligations wisely across all ventures.

- Leverage Equity from Other Assets: If available, consider leveraging equity from other assets to increase your equity contribution to the project. This strategy can lower the LTC ratio and demonstrate to lenders your substantial commitment to the project’s success.

By adopting these best practices, real estate investors can effectively manage their LTC ratio, enhancing their project’s financial structure and appeal to lenders. A favorable LTC ratio not only facilitates better loan terms but also positions a real estate project for higher profitability and long-term success.

Conclusion

That being said, the LTC ratio is an important metric to keep in mind when financing a new project. Having too high of an LTC ratio can reduce the amount of money you can borrow, and it can require you to have more equity invested in the project than you originally planned. Taking the time to understand your LTC ratio and what it means for your business will help you make informed decisions about your lending needs, and that’s always a good thing.

Get some insight on real estate investing, by checking out our Tips On Getting A Loan article.

Frequently Asked Questions (FAQs) About LTC Ratio

How Can I Improve My Project’s LTC Ratio?

Optimizing your project’s Loan to Cost (LTC) ratio is critical for securing favorable financing terms and reducing financial risk. Here are comprehensive strategies to improve this key metric:

- Increase Equity Contributions: By injecting more of your own funds or securing additional equity from investors, you decrease the loan amount needed, thereby improving the LTC ratio. This demonstrates to lenders your commitment to the project, potentially leading to better loan terms.

- Find Strategic Partners: Collaborating with business partners or finding investors who are willing to contribute capital can significantly enhance your project’s financial structure. Equity partnerships not only improve the LTC ratio but also distribute the risk.

- Accurate Cost Forecasting: Ensuring your project’s cost estimation is as precise as possible prevents surprises that could unfavorably affect your LTC ratio. Overestimations can inflate the LTC ratio unnecessarily, while underestimations might lead to additional financing needs later, worsening the ratio.

- Reevaluate Project Scope: If feasible, consider scaling back the project or finding cost-saving measures that can reduce the total project cost without compromising the project’s integrity or value. This approach can improve the LTC ratio by narrowing the gap between the loan amount and project cost.

Does the LTC Ratio Affect My Loan’s Interest Rate?

The LTC ratio plays a significant role in determining the interest rate on your loan. Here’s how:

- Risk-Based Pricing: Lenders use the LTC ratio as a measure of risk. A lower ratio means less risk for the lender, often resulting in lower interest rates for the borrower. Conversely, a high LTC ratio, indicating higher leverage and risk, may lead to higher interest rates as lenders seek compensation for the increased risk.

- Negotiation Leverage: A strong LTC ratio can serve as a negotiation tool when discussing terms with lenders. Demonstrating a lower risk through a favorable LTC ratio can help you secure more competitive interest rates.

Is There a Maximum Acceptable LTC Ratio for Lenders?

The ceiling for an acceptable LTC ratio is not set in stone and can vary widely depending on several key factors:

- Lender Policies and Project Type: Each lender has its own risk tolerance and policies regarding LTC ratios. Generally, residential projects may enjoy higher acceptable LTC ratios (70-90%) due to their perceived lower risk compared to commercial projects, which may have caps as low as 50%.

- Borrower’s Financial Health: Lenders consider the borrower’s credit history, financial stability, and track record of project completion. A strong financial profile might result in a lender being more flexible with the LTC ratio.

How Does the LTC Ratio Differ From the Loan to Value (LTV) Ratio?

Understanding the distinction between the LTC and LTV ratios is crucial for navigating real estate financing:

- Basis of Comparison: While the LTC ratio compares the loan amount to the total cost of the project, the LTV ratio measures the loan against the property’s appraised value upon completion. Essentially, LTC is a forward-looking metric focused on project costs, while LTV assesses the finished project’s value.

- Application and Implications: The LTC ratio is often used in the initial stages of financing, particularly for construction and development projects, reflecting the project’s budget and financial structure. The LTV ratio, however, is more prevalent in mortgage lending and refinancing, focusing on the property’s market value as security against the loan.

Can the LTC Ratio Change During a Project?

The dynamic nature of real estate projects means that the LTC ratio can fluctuate:

- Cost Variations: Changes in material costs, labor, or unforeseen challenges can affect the total project cost, impacting the LTC ratio.

- Additional Financing: Securing more equity or additional loans during the project can alter the financial structure, necessitating recalculations of the LTC ratio.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.