Last Updated on May 20, 2024

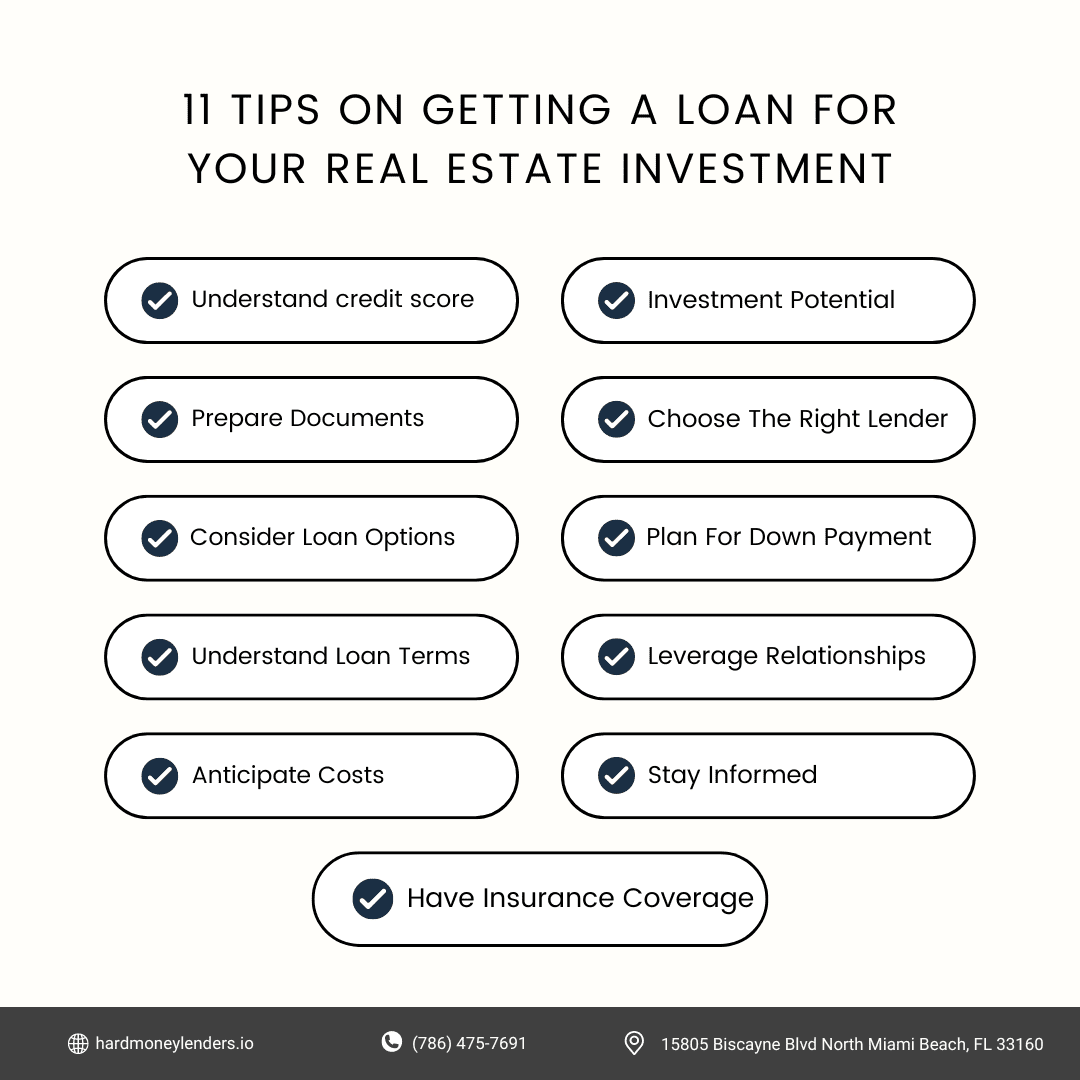

Real estate is one of the most significant investments one can go for. If you want to make a huge profit and wealth, going for real estate investment could be a good deal. However, the financing needed to start may be too high for you. Well, not everyone has wealthy relatives or friends to lend them huge sums of money for the business. Lacking finances to fund the business shouldn’t be a reason for you not to invest in real estate. There are many ways to financing a real estate investment. One of the ways is taking out a loan for real estate investment. It may not always require much money as you think, but with the help of a loan, you can grow your wealth with the investment. Here are a 11 tips that will help you when getting a loan for your real estate investment.

Tip #1: Understand Your Credit Score

A strong credit score is somewhat important in securing favorable loan terms, as it reflects your financial reliability to lenders. To prepare:

- Check Your Credit Score Regularly: Utilize free services provided by credit bureaus or your financial institution to check your score. This is the first step to understanding your financial standing from a lender’s perspective.

- Analyze Your Credit Report: Obtain a free annual credit report from major credit bureaus like Equifax, Experian, and TransUnion. Scrutinize it for any errors or discrepancies that could negatively impact your score, such as incorrect account details or fraudulent activities.

- Improve Your Credit Habits: Enhance your score by paying bills on time, reducing debt levels, and avoiding new credit inquiries in the months leading up to your loan application. Consistently managing these factors can significantly boost your creditworthiness.

- Consult Financial Advisors: If necessary, consult with a financial advisor who can provide personalized strategies to improve your credit score based on your financial situation.

Tip #2: Evaluate the Real Estate Investment’s Potential

To ensure the viability of your real estate investment, thorough analysis is required:

- Conduct Market Research: Analyze local real estate trends, including the average time on the market, recent sales prices, and the economic growth of the area. Tools like Zillow, Trulia, or local property databases can offer valuable insights.

- Calculate Potential Returns: Use real estate investment calculators to estimate the return on investment (ROI), cash flow, and total profit. Consider both best-case and worst-case scenarios in your calculations.

- Assess Rentability: If planning to rent out the property, research local rental markets to ensure your projected rental income will cover mortgage payments, maintenance, and other expenses.

- Get Professional Appraisals: Before finalizing the purchase, hire a professional appraiser to evaluate the property’s market value and potential after improvements. This will further validate your investment decision.

Tip #3: Prepare Your Documentation

Many people are locked out by many lenders for failing to have the proper documentation.

Well-organized documentation is key to a smooth loan application process:

- Financial Statements: Compile recent bank statements, investment accounts, and any other assets that demonstrate your financial stability.

- Proof of Income: Gather your recent pay stubs, tax returns for the past two years, and W-2 or 1099 forms. If self-employed, additional documentation like profit and loss statements might be required.

- Property Documentation: Include the real estate listing, proposed contract, and plans for the property. If renovations are planned, detailed project proposals and quotes from contractors will be necessary.

- Legal and Identity Documents: Ensure you have government-issued ID ready, along with any other legal documents pertinent to the real estate transaction or loan application.

- Consult With Lending Professionals: Engage with loan officers early in the process to understand specific documentation requirements for your chosen lender. They can provide checklists and guidance to ensure you gather all necessary paperwork.

It’s always good to find out how to get a loan for real estate from professionals as they might even help with the documentation. This might be a headache to some, but it minimizes the stress during the process.

Tip #4: Choose the Right Lender

Selecting the right lender is extremely important for securing financing that aligns with your real estate investment goals. Here’s how you can approach this:

- Research Extensively: Start by listing potential lenders, including banks, credit unions, and private lenders that specialize in real estate investments. Use online platforms and financial comparison sites to gather initial information.

- Compare Loan Offerings: Look at the specific real estate loan products each lender offers. Some might offer more favorable terms for certain types of investments like residential rentals or commercial properties.

- Evaluate Interest Rates and Terms: Compare the interest rates, loan terms, and additional fees (such as origination fees and prepayment penalties) of different lenders. Lower interest rates and fewer fees can significantly reduce the cost of borrowing.

- Read Customer Reviews: Check reviews and testimonials from other investors to gauge the lender’s reputation, reliability, and customer service quality. This can provide insights into how the lender handles loan servicing and dispute resolution.

- Expertise in Real Estate: Prefer lenders with experience in real estate investments. They can offer valuable insights and guidance, as well as more tailored products and services.

There are several different real estate investment lenders in South Florida, and you will need to choose the right one. Lenders will have different terms and different loan types.

Getting the right loan lender will be the beginning of your success. Talk to professionals as well as find materials online on everything you need to know about loan investment types. Before you approach a lender, understand their options available and how their terms work.

Before applying for a real estate investment loan, make sure it will work for you. Just because it worked for your friend, it might not be the case for you. Finding the best loan lender might be the beginning of your success on the real estate investment.

Tip #5: Consider Various Loan Options

Understanding different types of loans can help you choose the best financing option for your project:

- Conventional Mortgages: Typically used for purchasing residential properties, these loans often offer the best interest rates and terms but require good credit scores and significant down payments.

- Bridge Loans: Useful for investors needing short-term financing to bridge the gap between buying a new property and selling another. These are particularly helpful for quick acquisitions or when immediate action is needed before long-term financing can be secured.

- Hard Money Loans: These loans come from private lenders and are usually easier to qualify for but come with higher interest rates. They are a good option for fix-and-flip projects or situations where the borrower needs quick funding.

- Government-Backed Loans: Such as FHA or VA loans, which can offer lower down payments and are accessible to a broader range of borrowers. However, they come with specific criteria and limits, particularly around the type of property you can purchase.

Tip #6: Plan for a Down Payment

Tip #6: Plan for a Down Payment

The down payment is a critical component of securing a real estate loan, serving as your initial equity in the property:

- Assess Financial Capability: Review your financial health to determine how much you can realistically afford without jeopardizing other financial obligations.

- Down Payment Size: The typical down payment for real estate loans ranges from 20% to 30%. However, some loan programs, especially those aimed at first-time homebuyers or specific investment properties, may allow lower down payments.

- Impact on Loan Terms: A larger down payment often results in better loan terms, including lower interest rates and reduced mortgage insurance costs. It also lowers the loan-to-value ratio, which is favorable from a lender’s perspective.

- Saving Strategies: Consider various saving strategies and possibly tapping into investment funds or retirement accounts if applicable and prudent. Some investors might also consider partnership investments to meet down payment requirements.

Tip #7: Understand the Loan Terms

Understanding the specific terms of your loan agreement is critical to managing your financial obligations and avoiding surprises:

- Interest Rate Clarity: Clarify whether the interest rate offered is fixed or variable. A fixed rate offers stability over the loan period, while a variable rate may increase or decrease based on market conditions, affecting your monthly payments.

- Repayment Schedule Insight: Familiarize yourself with the number of payments required annually, the total duration of the loan, and how these payments are applied to interest and principal. This knowledge will help you plan for cash flow and assess the feasibility of early repayment.

- Details on Penalties: Investigate not just penalties for early repayment but also penalties for late payments, which can affect your credit score and increase the cost of the loan.

- Understanding Escrow: In some cases, loans might include an escrow account for taxes and insurance. Understand how this affects your monthly payments and responsibilities.

- Read the Fine Print: Be sure to read and understand all the terms and conditions outlined in the loan agreement. Consult with a financial advisor or attorney if anything is unclear.

Tip #8: Leverage Professional Relationships

Strong professional relationships can significantly ease the process of securing and managing a real estate loan:

- Establish Trusted Partnerships: Build relationships with professionals who can offer not just services but also strategic advice based on experience. These might include real estate agents familiar with property valuations and market trends, or mortgage brokers with access to multiple lending sources.

- Use Expert Insights for Negotiation: Leverage the expertise of financial advisors and mortgage brokers to negotiate better terms on loan agreements. Their understanding of the intricacies of real estate financing can provide you with a competitive edge.

- Continuous Learning: Engage regularly with these professionals to stay updated on new lending practices, changes in real estate laws, and economic factors that affect real estate investments.

Tip #9: Anticipate Additional Costs

Successful real estate investing involves planning for all potential costs:

- Reserve Funds: Beyond the initial investment, maintain a reserve fund for unforeseen expenses that arise during property ownership, such as emergency repairs or market downturns.

- Long-Term Planning: Calculate long-term costs like property maintenance, potential property tax increases, and the impact of possible interest rate rises on adjustable-rate loans.

- Investment in Property Upkeep: Budget for regular property maintenance and updates to sustain property value and appeal in the competitive real estate market.

Tip #10: Stay Informed About Market Conditions

Staying informed enables proactive management of your investment:

- Utilize Economic Forecasts: Use economic forecasts to anticipate market shifts that could affect property values and investment viability. Tools like the Federal Reserve Economic Data (FRED) can provide valuable insights into economic trends.

- Engage with Local Real Estate Groups: Local real estate investment groups and online forums can provide grassroots insights and firsthand accounts of the real estate climate in specific areas.

- Professional Development: Continually educate yourself on real estate investment through courses, seminars, and certifications to enhance your understanding and adapt to market changes.

Tip #11: Make Sure You Have Adequate Insurance Coverage

Before securing a loan for your real estate investment, it’s important to make sure you have adequate insurance coverage:

- Risk Management: Comprehensive insurance policies can protect your investment from unforeseen damages and liabilities. These policies might include property insurance, liability insurance, and, in some cases, builder’s risk insurance during construction phases.

- Lender Requirements: Most lenders will require proof of insurance before closing on a loan. This ensures that their collateral (your property) is protected against loss.

- Cost-Benefit Analysis: Evaluate the costs of insurance premiums against the potential risks to determine the right level of coverage. Over-insuring can unnecessarily increase your expenses, while under-insuring could leave you vulnerable to significant financial losses.

- Consult with Insurance Brokers: Engage with insurance professionals to get tailored advice based on the specific risks associated with your property type and location. They can help you navigate the complex world of insurance products and find a policy that fits your needs without overspending.

Final Thoughts: Getting A Loan For Your Real Estate Investment

Getting a loan for your real estate investment can be a good way to grow your wealth and achieve financial stability. However, it requires careful planning, thorough research, and proper documentation. By understanding your credit score, evaluating the investment potential, preparing your documentation, and choosing the right lender, you can increase your chances of securing favorable loan terms and achieving your real estate investment goals. Remember, it’s always best to consult with lending professionals to get personalized guidance and support throughout the loan application process.

FAQs

What type of loan is best for investment property?

Choosing the right type of loan depends largely on your investment strategy and financial situation:

- Hard Money Loans: Best for short-term investments like house flips or major renovations. These loans provide quick funding, which is helpful for closing deals swiftly. They typically have higher interest rates and shorter repayment terms but can be easier to qualify for if the property has good investment potential.

- Conventional Mortgages: These are more suitable for long-term investments. If you’re planning to acquire a property that will generate rental income over the years, a conventional mortgage might be the way to go. These loans offer lower interest rates and longer repayment terms, which can make monthly cash flow more manageable.

Can an FHA loan be used for investment property?

Yes, an FHA loan can indeed be used for purchasing investment properties, but with specific conditions focusing on owner-occupancy and multi-unit dwellings. Here’s a more detailed look at how you can utilize an FHA loan for investment purposes:

FHA Loan Basics

FHA loans are government-backed mortgages designed to help lower-income borrowers purchase homes with lower down payments and more accessible credit requirements. Typically, these loans are intended for primary residences, not for investment properties.

Using FHA Loans for Multifamily Properties

However, investors can use FHA loans to buy multifamily properties (up to four units), under the condition that they occupy one of those units as their primary residence. This setup offers several benefits:

- Lower Down Payment: FHA loans can require as little as 3.5% down, which is significantly lower than many conventional loan requirements. This lower barrier to entry makes it easier to purchase larger properties that can generate income.

- Favorable Interest Rates: FHA loans are known for their competitive interest rates, which can increase the affordability of a property, reduce the overall cost of the mortgage, and potentially increase cash flow from rental income.

- Rental Income Potential: By living in one unit and renting out the additional units, you can generate income that may cover your mortgage payments and operational costs. This setup can be an effective way to build equity while having others help pay down your mortgage.

Considerations and Restrictions

- Mortgage Insurance: FHA loans require mortgage insurance premiums (MIP) for the life of the loan if you make a down payment less than 10%, which can add to the monthly costs.

- Loan Limits: FHA loans have limits on how much you can borrow, which vary by location and the number of units in the property. It’s important to check the limits in your specific area to ensure they align with your investment goals.

- Owner Occupancy Requirement: You must move into the property within 60 days of closing and live there for at least one year. Failing to comply can lead to violations of the loan agreement.

- Property Approval: The property must meet certain standards and pass an FHA appraisal. Some properties may require significant repairs before they qualify, potentially increasing upfront costs.

How do I borrow against stocks to buy real estate?

Borrowing against stocks involves taking a securities-based loan (SBL), where your stock investments serve as collateral. This financing method is particularly useful for real estate investors who need immediate liquidity without selling their investments.

Steps to Consider

- Assessment and Eligibility: Your brokerage or a financial institution assesses the value of your securities to determine how much you can borrow. Generally, you can borrow up to 50-95% of your portfolio’s value depending on the marketability and volatility of your holdings.

- Understanding Risks: Be aware that if the market value of the collateral securities falls below a certain threshold, you’ll be subject to a margin call, requiring you to add more securities or repay part of the loan urgently.

- Interest Rates and Fees: Interest rates on SBLs are typically lower than personal loans because they are secured. However, they vary based on the lender and your portfolio value.

- Application Process: You’ll need to apply with a lender who offers SBLs, providing documentation about your portfolio and agreeing to terms that outline how the loan will be managed in different market conditions.

What credit score do you need for an investment property?

To finance an investment property, your credit score can greatly influence the loan terms you receive:

- Conventional Loans: Generally require a credit score of 620 or higher. Higher scores often translate into lower interest rates and better loan terms.

- Hard Money Loans: These loans are primarily asset-based, focusing more on the property’s potential value and project feasibility rather than your credit score. They are ideal for projects that require quick funding and for borrowers whose credit scores do not meet traditional lending criteria.

How does buying rental property affect your credit?

Purchasing a rental property impacts your credit in several distinct ways:

- Increased Total Debt: Initially, taking out a mortgage increases your total debt load, which could lower your credit score temporarily.

- Credit Utilization: Regularly making mortgage payments can improve your credit score over time as it shows lenders that you are a reliable borrower.

- Effect of Multiple Properties: Owning multiple properties and managing several mortgages simultaneously can either positively or negatively impact your credit based on how effectively you manage these loans.

Does investment property show up on credit report?

Yes, your investment property and its associated mortgage appear on your credit report, impacting your financial profile:

- Loan Details: The mortgage will be listed as a debt, including the principal amount, your payment history, and the lender’s name.

- Impact on Credit Score: Timely payments can enhance your credit score, while missed payments can cause significant damage. Managing this debt responsibly is crucial to maintaining a healthy credit profile.

- Leverage: Successfully managing mortgage debt can demonstrate to future lenders your ability to handle substantial financial obligations, potentially easing the way for future borrowing.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.