Discover the Tax Benefits of an LLC for Rental Properties!

Did you know that unlocking the tax benefits of LLC for rental property can be a game-changer if you’re a property owner? Every year, many landlords lose out on these possible savings.

Imagine having the flexibility that LLCs provide while lowering your taxable income, preserving your assets, and utilizing certain deductions. It’s essential to handle your money wisely in addition to protection.

Make the most of your perks this tax season by not letting another one pass. Explore in-depth with us to see how an LLC can maximize the taxes on your rental property right now!

Key Takeaways

- LLCs offer rental properties asset protection and tax perks.

- Separate finances are key to an LLC’s effectiveness.

- Different LLC structures impact tax reporting.

- LLCs have setup costs but safeguard personal assets.

- Tax experts optimize and ensure LLC compliance.

The Basics of Rental Income and Taxation

Every property owner knows that renting isn’t just collecting rent checks. It comes with many responsibilities, and one of the most daunting can be understanding the intricacies of taxation.

Whether you’re a seasoned rental property owner or just starting out, it’s essential to grasp how rental income is taxed and the advantages certain business structures, like an LLC, can offer.

Rental Income: How It’s Typically Taxed

Revenue from the rental of real estate is regarded as taxable income. You must include all rental income as a property owner on your tax return. But it’s more complex than merely declaring the rent checks you get. Certain costs associated with the upkeep and management of the rental property are deductible by the IRS for property owners. These can include depreciation, repair expenditures, property taxes, and mortgage interest.

But this is when things get a little complicated. Although these costs are deductible, you must still pay taxes on the remaining net rental revenue. This is where a lot of owners of rental properties get into issues.

Even though they may be making a sizable income from their rentals, the taxable amount may be significantly less after all the deductions. From the perspective of taxes, this is advantageous, but it can only be understood with the right assistance.

Pass-Through Taxation and Its Significance

If you’ve ever considered operating as an LLC or have heard the terms “LLC tax” or “LLC for a rental property,” you’ve likely come across this term. An LLC is a pass-through entity, which means that it doesn’t pay taxes at the corporate level. Instead, all profits and losses pass through to the members of the LLC, who then report them on their tax returns.

This is a significant advantage for several reasons. Firstly, it avoids the dreaded “double taxation” scenario where a corporation has to pay taxes on its profits. Then, shareholders also have to pay taxes on the dividends they receive. With pass-through taxation, the income is only taxed once, at the personal tax rate of the LLC’s members.

Tax Benefits of Forming an LLC for Rental Properties

Many property owners need help navigating the tax system. On the other hand, creating an LLC (Limited Liability Company) can provide several tax advantages that have a big effect on landlords’ profits. Now, let’s explore the tax benefits associated with rental property use of an LLC.

Rental Income Taxed Differently: The Power of Pass-Through Taxation

At its core, an LLC is a business structure that offers a unique taxation system known as pass-through taxation. Unlike traditional corporations that pay corporate taxes, an LLC does not pay taxes at the business level. Instead, all profits and losses are “passed through” to the individual members of the LLC. These members then report their share of the profits or losses on their individual tax return.

For rental property owners, this means that the rental income generated by the property owned by the LLC is not subject to corporate tax rates. Instead, it’s taxed at the individual member’s tax rate. This can lead to significant tax savings, especially if the LLC’s members are in a lower tax bracket.

Deductions and Depreciations: Maximizing Your Tax Savings

The ability to deduct a variety of expenses is one of an LLC’s most notable tax advantages. Owners of rental properties that conduct business as an LLC are eligible to write off various expenses, including interest paid on their mortgage, property taxes, maintenance charges, and even property management-related professional fees.

In addition, the IRS permits rental property depreciation, which can result in significant tax savings. Through the process of depreciation, property owners can lower their taxable income and, consequently, their tax liability by deducting a percentage of the property’s cost over several years.

Avoiding Double Taxation: Keeping More of Your Money

Double taxation is a scenario many corporations face, where the company’s profits are taxed, and then shareholders are taxed again on their dividends. However, one of the primary tax advantages of an LLC for a rental property is avoiding this double taxation. Since the LLC is a pass-through entity, profits are only taxed once at the individual member’s rate. This ensures that more money stays in the pockets of the rental property owner.

Data-Backed Claims: The Numbers Don’t Lie

According to TaxPolicyCenter.org, the pass-through taxation system is designed to promote small businesses and investments. Statistics have shown that LLCs, especially those in the real estate sector, have seen substantial tax savings due to this structure.

How to Set Up an LLC for Your Rental Property Business

An LLC can seem like a big undertaking for your rental property, especially with all the paperwork and legalese required. Nevertheless, the process can be shortened if the processes are clearly understood. In this section, we’ll cover all you need to know to create an LLC for your rental property business.

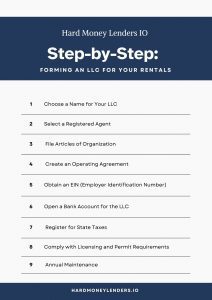

Steps to Form an LLC for Your Rental Property

-

Step 1. Choose a Name for Your LLC

The name of an LLC should be unique and not in use by another business in your state. Typically, it must end with “Limited Liability Company” or abbreviations like “LLC” or “L.L.C.”

-

Step 2 Select a Registered Agent

This is an individual or business entity responsible for receiving legal documents on behalf of the LLC. They must have a physical address in the state where the LLC is formed.

-

Step 3 File Articles of Organization

This is the primary document required to form your LLC officially. It’s submitted to the state’s Secretary of State office, along with a filing fee, which varies by state.

-

Step 4 Create an Operating Agreement

While only sometimes mandatory, it’s highly recommended. This document outlines the management structure of the LLC and the rights and responsibilities of its members.

-

Step 5 Obtain an EIN (Employer Identification Number)

This is like a Social Security number for your LLC, required for tax purposes. It’s obtainable for free from the IRS.

-

Step 6 Open a Bank Account for the LLC

It’s crucial to keep your LLC’s finances separate from personal finances. This step solidifies the LLC’s status as a separate entity and aids in asset protection.

-

Step 7 Register for State Taxes

Depending on your state and the nature of your business, you might need to register for certain state taxes.

-

Step 8 Comply with Licensing and Permit Requirements

Ensure you have all necessary licenses and permits to operate your rental property business legally.

-

Step 9 Annual Maintenance

Some states require annual LLC tax filings or reports. Stay updated on these to maintain your LLC’s good standing.

Rental Business Management with an LLC

Managing a rental property is no small feat. From tenant relations to property maintenance, the responsibilities are vast. However, operating your rental business under the umbrella of an LLC can offer distinct advantages that streamline management and enhance the overall business image. Let’s delve into how an LLC can elevate your rental business management.

Professional Appearance and Credibility with an LLC

First impressions matter, especially in the competitive world of real estate rentals. When potential tenants or partners see that you’re operating as an LLC, it immediately conveys a sense of professionalism. Here’s why:

-

Business Identity

Operating under an LLC is a business structure that distinguishes your rental operations from individual landlords. This separation can make your business appear more established and trustworthy.

-

Enhanced Credibility

The mere act of taking the time to form your LLC and adhere to its requirements showcases your commitment to the business. It can instill confidence in tenants, vendors, and partners, knowing they’re dealing with a serious and professional entity.

-

Clear Branding

With the name of an LLC, you have the opportunity to create a brand around your rental business. This can aid in marketing efforts and set you apart from competitors.

Transferring Ownership and Adding New Members Made Simple

One of the standout features of an LLC is its flexibility in management and ownership:

-

Ease of Transfer

If you ever decide to sell your rental property or bring in a partner, transferring ownership is straightforward with an LLC. Unlike other business structures, there’s no need for complex stock transfers or adjustments.

-

Adding or Removing Members

Whether you’re expanding your rental business and bringing in partners or a member decides to exit, the LLC allows for easy changes in membership. This is typically outlined in the Operating Agreement, ensuring all members are on the same page.

-

Continuity

One of the benefits of creating an LLC is its continuity. Even if a member exits or changes ownership, the LLC can continue to operate without disruption. This stability can be crucial for maintaining tenant relations and business operations.

Do You Need an LLC for Every Rental Property?

The strategic choice to create an LLC for rental properties is frequently motivated by the need to preserve assets and receive tax advantages.

However, many rental property owners face a typical dilemma: whether to form a different LLC for each property or combine several properties under one LLC.

Let’s examine each strategy’s benefits and drawbacks and some data-supported assertions that emphasize how crucial this choice is.

Separate LLCs for Each Property: A Layered Defense

-

Enhanced Asset Protection

The primary advantage of having a separate LLC for each property is its added protection layer. If a legal issue arises with one property, only the assets of that specific LLC are at risk. The other properties, shielded under their respective LLCs, remain untouched.

-

Simplified Accounting

With each property operating under its own LLC, tracking income and expenses becomes more straightforward. There’s no need to allocate costs or revenues among multiple properties, ensuring cleaner financial records.

-

Tailored Management

Different properties might have varying management needs. With separate LLCs, you can customize the management approach for each property without affecting the others.

One LLC for All Properties: A Unified Approach

-

Cost-Effective

Forming an LLC involves state filing fees and potential annual fees. By consolidating properties under one LLC, you can save on these costs.

-

Unified Management

A single LLC means a unified approach to property management. This can be beneficial if you have a consistent strategy for all your properties.

-

Simplified Reporting

With one LLC, there’s only one set of books to maintain and one tax return to file, simplifying the administrative aspect of the business.

Data-Backed Claims: The Legal Perspective

Several legal cases underscore the importance of the decision between separate LLCs and a single LLC. In the case of Turner v. Wilson, a property dispute led to a lawsuit. The property in question was one of several under a single LLC. Due to the consolidated nature of the LLC, assets from all properties were vulnerable in the lawsuit.

How Rental Income is Taxed in an LLC

Rental income taxation within an LLC framework can be a bit intricate, especially when considering the different structures of LLCs. Whether you’re a solo landlord operating as a single-member LLC or part of a group in a multi-member LLC, understanding how rental income is taxed is crucial.

Let’s break down the nuances of taxation based on the type of LLC and explore the process of reporting rental income on a tax return.

Single-Member LLCs: Simplicity in Taxation

A single-member LLC is essentially an LLC with only one member or owner. Here’s how rental income is taxed for this type of LLC:

-

Disregarded Entity

For tax purposes, the IRS typically views a single-member LLC as a “disregarded entity.” This means that, in the eyes of the IRS, the LLC and its owner are the same.

-

Personal Tax Return

Rental income earned by the LLC is reported directly on the owner’s tax return using Schedule E. This form is used to report supplemental income, including rental income.

-

Self-Employment Tax

One thing to note is that rental income from a single-member LLC is generally not subject to self-employment tax. However, if the owner is actively involved in the rental business, some portions of the income might be classified as “business income” and could be subject to this tax.

Multi-Member LLCs: A Partnership in Taxation

Multi-member LLCs have more than one member or owner. Their taxation is slightly different:

-

Treated as a Partnership

By default, the IRS treats multi-member LLCs as partnerships for tax purposes. This means the LLC itself does not pay taxes. Instead, each member’s share of the rental income is taxed.

-

Reporting Income

Each member reports their share of the rental income on their tax return. The LLC provides each member with a Schedule K-1, which details their share of the income and deductions. Members then use this information to complete their tax returns.

-

Self-Employment Tax

Like single-member LLCs, rental income in a multi-member LLC is typically not subject to self-employment tax. However, active involvement by members in the rental business can change this classification.

Reporting Rental Income on a Tax Return

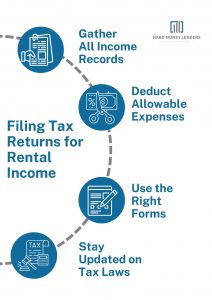

Regardless of the type of LLC, reporting rental income accurately is crucial. Here’s a step-by-step guide:

-

Step 1 Gather All Income Records

This includes rent checks, security deposit deductions, and any other form of income related to the property.

-

Step 2 Deduct Allowable Expenses

Deduct expenses like mortgage interest, property taxes, maintenance costs, and other allowable deductions. This will give you the net rental income.

-

Step 3 Use the Right Forms

For single-member LLCs, use Schedule E of Form 1040. Multi-member LLC members should use the information from Schedule K-1 to complete their tax returns.

-

Step 4 Stay Updated on Tax Laws

Tax laws and regulations can change. It’s essential to stay updated or consult with a tax professional to ensure compliance.

Benefits of an LLC Beyond Taxation

While the tax advantages of forming an LLC for rental properties are often the primary draw for many property owners, the benefits of an LLC extend far beyond just taxation.

From safeguarding personal assets to simplifying the inheritance process, an LLC offers many advantages that can be instrumental in ensuring the smooth operation and longevity of your rental business.

Let’s delve into these benefits in more detail.

Asset Protection and Liability Shielding

-

Personal Asset Safeguard

One of the most significant benefits of creating an LLC for your rental property is the protection of your assets. In the unfortunate event of a lawsuit or claim against your rental property, only the assets of the LLC are at risk. Your assets, such as your home, personal bank accounts, and other properties, remain protected from potential liabilities.

-

Clear Distinction

Operating under an LLC creates a clear distinction between your finances and the finances of the rental property. This separation not only aids in asset protection but also ensures cleaner financial records and easier accounting.

-

Reduced Personal Liability

Suppose a tenant or any third party were to sue over an incident related to the property. In that case, the LLC acts as a barrier, ensuring that members of the LLC are not held personally liable. This can be especially crucial in significant damages or accidents on the property.

Easier Estate Planning and Inheritance Processes

-

Streamlined Inheritance

An LLC can simplify the process of passing on property to heirs. Instead of transferring the actual property, you can transfer the ownership shares of the LLC. This can often bypass the lengthy probate process, ensuring a smoother transition.

-

Flexible Ownership Structures

With an LLC, you can structure ownership to align with your estate planning goals. For instance, you can allocate different ownership percentages to various heirs or set up a trust as a member of the LLC.

-

Continuity of Operation

Even in the event of an owner’s death, an LLC can continue to operate without disruption. This continuity ensures that the rental income stream remains uninterrupted, providing financial stability for heirs.

-

Tax Benefits in Inheritance

While the primary focus of this section is beyond taxation, it’s worth noting that inheriting shares of an LLC can come with tax benefits. Heirs often receive a “step-up” in basis, which can reduce capital gains taxes if they decide to sell the property.

Potential Drawbacks of Creating an LLC for Rental

While forming an LLC for rental properties offers many benefits, it’s essential to approach the decision with a balanced perspective. Like any business decision, there are potential drawbacks and challenges associated with creating and operating an LLC.

Let’s explore some of these potential pitfalls to provide a comprehensive understanding.

Costs Associated with Setting Up and Maintaining an LLC

-

Initial Setup Fees

Establishing an LLC involves filing fees, varying significantly from state to state. While some states have relatively low fees, others can be quite costly. Researching and investing in these costs is essential when considering forming an LLC.

-

Annual Fees and Reporting

Many states require LLCs to pay annual LLC tax or franchise fees. Additionally, some states mandate periodic reporting, which might come with associated fees. Over time, these costs can increase, especially for property owners with multiple LLCs.

-

Potential for Increased Accounting Costs

Operating as an LLC might necessitate more intricate bookkeeping and accounting practices, especially if the LLC has multiple members. This complexity could lead to higher accounting fees if you hire a professional.

Possible Complications with Mortgage Lenders

-

Refinancing Challenges

If you’ve purchased a property under your name and later transfer it to an LLC, refinancing that property can become challenging. Many lenders are hesitant to refinance properties owned by LLCs due to perceived increased risks.

-

Mortgage “Due on Sale” Clauses

Some mortgage agreements contain a “due on sale” clause, which states that if the property is sold or its ownership is transferred, the full loan amount becomes due immediately. Transferring a property to an LLC could potentially trigger this clause, leading to financial complications.

-

Higher Interest Rates

Even if a lender agrees to finance or refinance a property owned by an LLC, they might offer less favorable terms or higher interest rates compared to individual borrowers.

-

Insurance Implications

Switching property ownership from an individual to an LLC might affect the property’s insurance policy. Some insurance providers might increase premiums, while others might require a commercial policy, which can be more expensive than a personal one.

LLCs for Rental Properties: Best Practices

Let’s examine a few of these recommended practices to help you run your LLC more efficiently.

Keeping Personal and Business Finances Separate

-

Dedicated Bank Account

One of the fundamental steps after forming your LLC is to open a separate bank account for the LLC. All income from the rental property should be deposited into this account, and all property-related expenses should be paid. This clear separation solidifies the LLC’s status as a distinct entity and aids in asset protection.

-

Separate Credit Cards

If you use credit cards for business-related expenses, consider getting a card exclusively for the LLC. This ensures that personal and business transactions don’t mix, making accounting and tax filing more straightforward.

-

Document Everything

Maintain meticulous records of all transactions related to the property. This not only aids in accurate tax reporting but also strengthens the LLC’s standing as a separate entity, which can be crucial in legal disputes.

Regularly Consulting with a Tax Professional

-

Maximizing Tax Benefits

While the tax benefits of an LLC are significant, they can be complex. Regular consultations with a tax professional can ensure you’re taking advantage of all available deductions and credits, optimizing your tax savings.

-

Staying Updated

Tax laws and regulations are continually evolving. A tax professional can keep you informed about any changes that might affect your rental business, ensuring you remain compliant and avoid potential penalties.

-

Strategic Planning

Beyond annual tax filing, a tax professional can offer strategic advice tailored to your situation. Expert guidance can be invaluable, Whether deciding between a single-member or multi-member LLC, considering additional real estate investments, or planning for the future.

-

Estate and Succession Planning

If you’re considering passing on your rental properties to heirs or selling them, a tax professional can provide insights into the tax implications and offer strategies to minimize tax burdens.

Conclusion

We’ve studied in-depth the intricate financial details of rental homes. One thing is still very evident:

An LLC is more than just a company structure for property owners—it’s a game-changer. The benefits are difficult to ignore, including significant tax savings, deductions, and an improved barrier against liabilities.

Consider the possible savings, the stability of your finances, and the comfort that comes from knowing you’re using every resource available to make your rental property successful.

Take your time with the approaching tax season. Seize the initiative immediately, speak with a tax expert, and investigate how creating an LLC can improve the financial picture of your rental property.

As always, when you’re ready to buy your next rental property, we are just a phone call away to get you the money you need to get you started.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.