How To Find Out If Taxes Are Owed On A Property

You’ve probably heard the saying, “In life, there are only two certainties: death and taxes.” If you don’t already know, taxes are certain when it comes to real estate. Whether you’re eyeing a new investment, considering a property purchase, or simply keeping up with your obligations as a homeowner — it’s important to know how to find out if taxes are owed on a property. Here at Hard Money Lenders, we’ve crafted a simple guide to walk you through the process. That way, you’re well-informed — regardless of the type of real estate participant you are.

Before we dive in, let’s make sure you have an understanding of property taxes and how property taxes work.

What are Property Taxes?

Property taxes are not just another bill to pay; they’re a vital contribution that keeps the wheels of local governance turning. Serving as a significant income stream for municipalities, property taxes fund the services and infrastructure we often take for granted. From the maintenance of local parks and public libraries to ensuring that the fire department and public schools are well-equipped, property taxes play a central role in enhancing our quality of life.

How Property Taxes Work

Annually calculated, property taxes hinge on the assessed value of your tangible property. This includes not just the piece of land you own but also any structures on it—be it the family home, a detached shed, or the garage where you park your car. Even less obvious fixtures, like built-in swimming pools or custom-made outdoor patios, factor into this equation. The idea is to capture the full spectrum of your property’s worth, ensuring that everyone pays their fair share towards community upkeep and development.

The Intricacies of Property Tax Assessment

The Role of the Assessor

The journey of your property tax bill starts with an assessment carried out by an appointed local government official, typically known as the assessor. This isn’t a random appraisal; instead, it’s a meticulous process where the assessor evaluates your property against a set of specific criteria. These include:

- Size: How large is your property? This isn’t limited to the land area; the size of the structures built on the land is also considered.

- Location: Where your property is located can significantly impact its value. Properties in bustling urban centers or serene waterfronts tend to have higher valuations than those in more isolated areas.

- Improvements: Any enhancements made to the property, such as adding a new room, upgrading the kitchen, or landscaping the garden, can increase its overall value. The assessor takes stock of these improvements to ensure the property’s valuation reflects its current state accurately.

Determining the Fair Market Value

The goal of the assessment is to establish the property’s fair market value—essentially, what it would likely sell for under normal conditions in the current market. This valuation forms the basis for calculating your property tax.

Applying the Tax Rate

Once your property’s value is pinned down, the next step involves applying the local property tax rate, often expressed as a millage rate (the amount of tax payable per thousand dollars of a property’s value) or a straightforward percentage. This rate is where local governance shines through; it’s determined by the collective budgetary needs of the community you live in. Whether it’s funding a new public swimming pool, upgrading the local high school, or expanding emergency services, the tax rate reflects what your community decides is necessary for its growth and well-being.

It’s worth noting that this rate isn’t static; it can fluctuate based on the community’s evolving needs and priorities. Moreover, because these needs can differ greatly from one municipality to another, you’ll find that tax rates can vary widely across different regions.

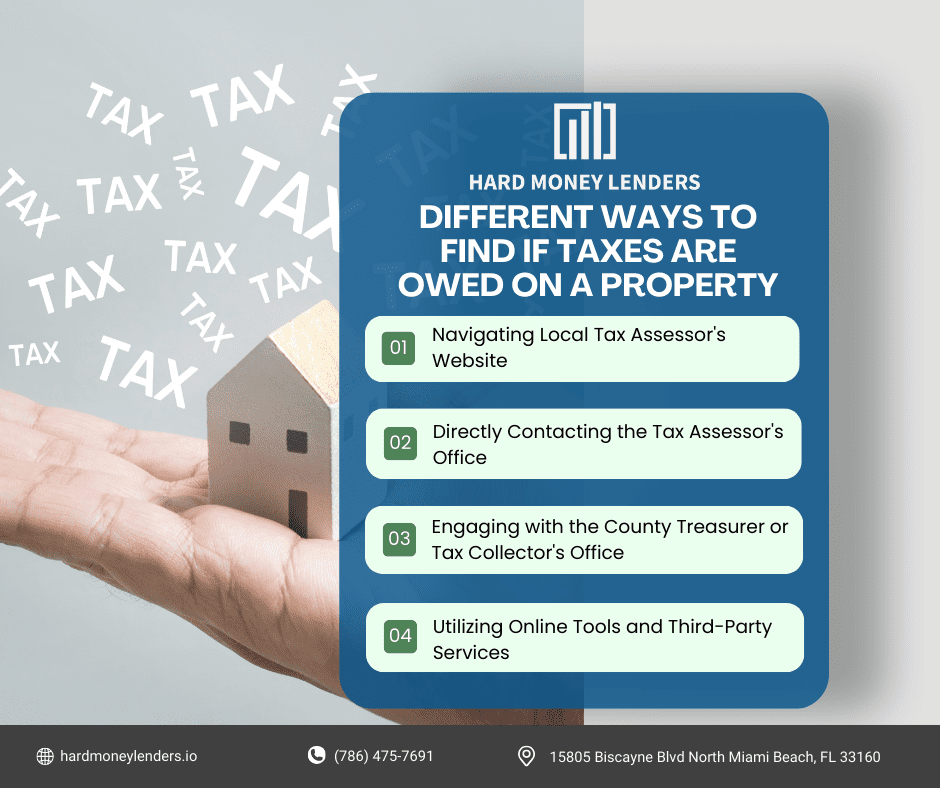

Different Ways to Find if Taxes Are Owed on a Property

Navigating Local Tax Assessor’s Website

The local tax assessor’s website serves as your primary digital tool for accessing comprehensive tax records. Here’s how to make the most of it:

- Search Functionality: Utilize the website’s search feature to find property tax records. You can typically search by the property address or the owner’s name. This flexibility helps in quickly locating the specific information you need.

- Understanding the Data: Once you access the records, you’ll find details about the property’s assessed value, the current and past years’ tax rates, and whether those taxes have been paid or if any amount remains outstanding.

- Navigating Through Historical Data: Many assessor websites also allow you to view historical tax records. This feature can be particularly useful for understanding how the property’s tax obligations have changed over time.

Directly Contacting the Tax Assessor’s Office

Sometimes, the information available online might not be comprehensive enough, or you may have specific questions that require clarification. In these cases, reaching out directly to the tax assessor’s office is advisable.

- Prepare Your Questions and Information: Before making a call or visiting, compile a list of questions you have and gather any relevant information about the property, such as the address or parcel number. This preparation will help make the interaction as efficient as possible.

- Inquire About Payment Plans and Discrepancies: Use this opportunity to ask about options for resolving any outstanding taxes, including payment plans or disputing discrepancies if the recorded details seem inaccurate.

Engaging with the County Treasurer or Tax Collector’s Office

While the assessor’s office provides the valuation, the treasurer or tax collector’s office handles the financial transactions. Here’s what they can offer:

- Payment Records and Status: They can provide a detailed account of all payments made towards the property’s taxes, as well as any amounts that are currently due.

- Dealing with Delinquencies: If taxes are overdue, this office can outline the consequences and options available to the property owner, including payment plans or steps to avoid further penalties.

- Comprehensive Financial Overview: Besides current and outstanding tax amounts, you can also learn about any tax liens against the property, which could indicate serious delinquencies.

Utilizing Online Tools and Third-Party Services

For a broader perspective or when facing challenges in accessing local office data, third-party websites and services come into play.

- Comprehensive Property Reports: Many of these services compile detailed property reports, which can include tax status, historical tax records, and even comparative tax information from similar properties.

- Verifying Accuracy: While third-party tools can provide valuable insights, it’s crucial to cross-reference this information with official records from the local tax assessor’s or collector’s office to ensure its accuracy.

- User-Friendly Interfaces and Additional Insights: These platforms often offer user-friendly interfaces and additional insights, such as property value estimations and neighborhood tax comparisons, which can be beneficial for broader research or investment analysis.

By employing these detailed methods, individuals interested in a property can gain a comprehensive understanding of its tax obligations.

Advantages of Buying a Property with Back Taxes

There are many positive aspects to buying a property with back taxes. One positive aspect is that every real estate investor is looking for motivated sellers. Many chase foreclosures, probate homes, those late on their mortgages or with rundown homes with lots of deferred maintenance to find those motivated sellers. Some of these things may overlap with past-due property taxes, but not always. Everything else may be great. Seeking tax-delinquent properties could be a good method of connecting with owners who are serious about selling houses fast.

Whether you are buying a new residence, a second or vacation home or an investment property, having some leverage in negotiations is always a perk. Buying tax-delinquent properties isn’t just about looking for low prices, either. The experienced know that being able to negotiate more of the terms you want can be even more important. That includes closing dates, financing, inspections and repairs.

Drawbacks of Buy a Property with Back Taxes

However, there are also negative aspects of buying a property with back taxes. One problem with properties with large past-due tax bills is that these liens can quickly eat up a lot of equity. We’ve begun to see more American properties slide back into negative equity or underwater positions. Just one year of delinquent annual property taxes can add over $10,000 to that problem. Some owe hundreds of thousands in back taxes. In some cases, you might find a “cheap” house deal that has more in delinquent taxes than the price of the house, or even the value of the house.

Often, past-due property taxes is just the tip of the iceberg of the problems — not always, but it’s quite likely. There may be many other past-due bills like utilities, mortgage payments, insurance and more. Or, the owners may have given up on the property due to other legal issues, code violations or rehab project roadblocks. Many of these can be overcome, but you’ve got to know what you are really dealing with before you get in and can assess it as a viable deal and at what price.

If you’re looking to invest in tax liens, keep reading.

Diversifying Real Estate Portfolios With Tax Lien Investing

When looking to diversify their portfolios, many real estate investors choose to invest in tax-delinquent properties. After considering the current real estate market and interest rates, many look toward tax liens as the source of their next investment.

While risky, buying tax liens and property with delinquent taxes is potentially profitable if done wisely. But, how exactly does one determine whether or not taxes are owed on a property?

Two important pieces of information are needed to find out if taxes are owed on a property; the county the property is located in and the property’s parcel number.

Once you acquire this information, visit the county treasurer’s website, enter the information into the database, and it should display the listing for the requested parcel. An array of details will appear, including the property address, owner name(s), as well as whether or not the property taxes are behind or up-to-date.

What is a Tax Lien?

A tax lien is a legal claim or hold placed on a property as a result of unpaid property taxes. This mechanism is used by local governments to compel property owners to pay overdue taxes. For property owners, a tax lien means that the sale of the property cannot proceed without clearing the outstanding tax debts first. For potential buyers, it signals that purchasing such a property comes with the added responsibility of settling these debts to obtain a clear title.

The implications of a tax lien are significant. For the property owner, it can lead to increased financial strain due to accumulating interest and penalties on top of the original tax debt. In extreme cases, it can even result in the property being foreclosed and sold at auction. For potential buyers, due diligence is required to ensure they’re not inheriting a problematic financial situation.

Once a lien is placed, the IRS notifies creditors by filing a notice of federal tax lien, which can negatively affect future credit attempts. Tax liens and notices can also persist after bankruptcy.

Owners with a tax lien on their property are left with a few options. The IRS explains that the best way to discharge a lien is to repay the delinquent taxes in full. Liens could also be discharged without the payment of delinquent taxes, but the property and situation must meet the Internal Revenue Code.

Liens may also be eligible for subordination, in which the IRS lien is moved below other creditors in priority, or withdrawal, in which the IRS removes the public notice on the lien. In both situations, the delinquent taxes still need to be repaid in full.

Types of Tax Liens

There are three types of tax liens: federal, state income, and property.

Issued by the IRS, PropLogix explains that these liens can remain on the property after foreclosure and still have to be repaid by the buyer as long as the IRS redeems the lien within 120 days of the recording of the new deed.

State income liens are filed when individual income taxes are left unpaid; the duration of these liens varies by state.

PropLogix notes that, for example, state child support liens remain on the property until the payment is fulfilled. Property tax liens are issued by the county when property taxes go unpaid. If the delinquent taxes are not repaid within the set time frame, the property will be put up for auction in a tax-deed sale.

The sale does not transfer ownership of the property. If the original owner repays the delinquent taxes within a set time frame, the lien is removed, and the certificate holder is reimbursed in full plus interest.

If the delinquent taxes are left unpaid, then the certificate holder can initiate a public auction that will discharge the lien and pay off the property tax debt that has accrued since the lien was issued.

Getting Started with Tax Lien Investing

Preparations for Tax Lien Sales

Before diving into tax lien investing, thorough preparation is key:

- Research Local Laws and Processes: Tax lien laws vary by jurisdiction, so understand the rules and timelines in the areas where you plan to invest.

- Attend Auctions: Many jurisdictions conduct tax lien sales through auctions, either online or in person. Attend a few without bidding to get a feel for the process.

- Due Diligence on Properties: Before bidding on a lien, research the property to assess its value and potential risks. Consider factors like location, condition, and market trends.

Tips for Success and Pitfalls to Avoid

- Start Small: Begin with smaller investments to understand the process and manage risk.

- Stay Informed: Keep abreast of tax laws and market conditions in your chosen investment area.

- Be Prepared for Redemption: Most tax liens are redeemed by the property owner. Have a plan for quickly reinvesting the returned capital.

- Avoid Overbidding: Remember, your return decreases as your investment cost increases. Stick to your calculated maximum bid to ensure profitability.

Buying Tax Liens

Tax liens are auctioned off just like property, either online or in person, Investopedia explains. Investors looking to purchase tax-delinquent property can choose from residential, commercial or undeveloped land from a tax-lien properties list.

Their level of return on the tax lien will depend on several variables, such as the price for which they purchased the lien, the location and type of property and other unforeseen circumstances.

Investors should research the property before the auction. Often, the market value of the property is less than the cost of the lien. Other liens could also exist on the property, which would prevent the investor from assuming ownership later.

Potential investors can contact the county treasurer’s office for a tax-lien property list detailing scheduled auctions and whether they will be held in person or online. For information on a specific property, the office should supply more information on when that lien will appear on the schedule.

Once the lien is purchased, investors pay the delinquent taxes, interest and any additional accrued charges. Once the investor assumes ownership of the tax lien, the property owner must repay the debt to the investor, including interest, which typically ranges around 10 to 12 percent, according to Investopedia.

If the investor bought the lien at a premium, the property owner must pay that as well. If the property owner cannot meet the payments, the investor can then foreclose on the property.

What Are Delinquent Taxes?

Delinquent taxes are unpaid taxes owed to the IRS. Investopedia explains that with tax delinquency comes additional penalties and interest added to the debt. Filing or payment must be made within eight weeks of receiving a delinquent-tax notice.

If you are unable to repay the balance in full, you can opt for an installment or partial payment plan. In extreme cases, the IRS can deem one “not currently collectible” and temporarily delay collection.

If the delinquent taxes are left unpaid, the IRS will issue a bill for the amount that is past due, including penalties and interest that has accrued since the original bill was issued. (The interest continues to compound daily.)

The IRS will then pursue aggressive collection methods to ensure that the debt is paid. They can garnish wages or even place a tax lien on property and assets. It’s ideal to avoid this sort of situation whenever possible, as going down the road of wage garnishment can be extremely challenging to reverse if your finances don’t permit repayment of the taxes owed.

Buying Tax Deeds

Some tax-delinquent properties are sold through tax-deed property sales. Unlike tax-lien sales, buyers from a tax-deed sale receive ownership of the property upon purchase.

Tax-deed sales operate the same as a foreclosure: The sale proceeds will pay off the lien. Tax-deed sales must be publicly advertised, and buyers must pay in cash within 24 hours of the winning bid. The property’s entry is forbidden, which is why these properties are often sold for significantly less than their neighbors since only the exterior can be viewed before purchase.

Since potential investors must purchase sight unseen, it is recommended that you assume that the property is in poor condition and will require remodeling. Keep this in mind when determining the property value.

Potential investors should also check if any additional liens exist on the property, such as municipal fines and code violations. With all of this in mind, investors should determine their maximum bid.

Specific laws on tax liens and tax-deed sales vary by state; for instance, some states don’t allow auctions, while others don’t allow tax-deed sales. Before investing in tax-delinquent property, always perform ample research on the state’s laws and restrictions.

Conclusion

You should always find out whether or not taxes are owed on a property before committing to buying it. Thankfully, this information is usually available for free online if you know where to look.

When searching for an investment opportunity, be sure to conduct research beforehand. It’s imperative that you make sure the property is in good condition before deciding to invest. In the long run, investing in tax liens may give you the opportunity to diversify your portfolio like other investments can’t.

Related Article: The Beginner’s Guide to House Flipping and Taxes

FAQs on Property Taxes and Tax Lien Investing

How often are property values reassessed for tax purposes?

The schedule for property reassessment can widely vary depending on the jurisdiction. Some areas reassess property values every year to reflect changes in the market, while others might do so less frequently, such as every three, five, or even ten years.

The reassessment process involves evaluating the market value of the property based on recent sales of comparable properties, improvements or renovations made to the property, and other factors that might affect its value. Property owners should check with their local tax assessor’s office to understand the reassessment schedule and process in their area, as this directly impacts their property tax obligations.

What is the difference between a tax lien and a tax deed?

The primary difference lies in what is being purchased at the sale. In a tax lien sale, an investor buys the right to collect unpaid property taxes plus interest from the property owner. The lienholder does not immediately acquire ownership of the property but may have the right to foreclose if the taxes remain unpaid after a certain period, known as the redemption period.

Conversely, a tax deed sale results in the outright purchase of the property itself, transferring ownership from the delinquent taxpayer to the highest bidder at the sale. Tax deed sales are typically the final step in the process after the expiration of the redemption period following a tax lien sale, where the property owner has failed to repay the owed taxes.

How can I participate in a tax lien or tax deed sale?

Participation usually involves several steps, starting with identifying when and where the sale will take place. This information is often available on the website of the county or municipal tax collector or treasurer’s office. Potential participants may need to register in advance, which could include submitting a registration form and paying a fee.

Some jurisdictions also require bidders to deposit funds upfront. On the day of the sale, auctions can be held in person or online, with the auction format varying widely by jurisdiction. Preparation is key, so potential investors should familiarize themselves with the specific rules and procedures of their target jurisdiction well before the auction date.

Are there any redemption periods for property owners after a tax lien sale?

Yes, nearly all jurisdictions provide a redemption period for property owners. This is a specific timeframe after the sale of a tax lien during which the property owner can repay the owed taxes plus interest and any additional fees to redeem their property and remove the lien.

Redemption periods vary significantly by jurisdiction, ranging from a few months to several years. During this period, the property owner retains possession of the property, and the lienholder cannot take steps to foreclose on the property unless the redemption period expires without the taxes being paid.

Can I inspect a property before a tax deed sale?

Policies regarding property inspections before a tax deed sale vary. In many cases, potential buyers are not allowed to enter the property for an interior inspection and must rely on external observations and public records to assess the property’s condition.

However, some jurisdictions may provide limited access or opportunities to view properties before the sale. It’s critical to check with the entity conducting the sale for their specific policies. Regardless, investors should proceed with caution and factor the potential for unseen issues and repair costs into their bidding strategy.

What happens if a property is not sold at a tax deed sale?

If a property does not sell at a tax deed sale, it may be retained by the government and potentially offered at a subsequent auction, sometimes at a reduced price. In some jurisdictions, unsold properties might become government property and could be sold directly to interested buyers outside of the auction process. Alternatively, the property may be offered to adjacent property owners or put to public use.

How can I find upcoming tax lien or tax deed sales in my area?

Local government offices, such as the county tax collector or treasurer, typically provide information on upcoming tax lien or tax deed sales. This information may be posted on their official websites, in local newspapers, or through direct mailings. Interested investors should regularly check these sources and may also sign up for notifications if the service is offered. Additionally, engaging with local investment groups or forums can provide insights and reminders about upcoming sales.

What are some strategies for successful tax lien or tax deed investing?

Successful investing in tax liens or tax deeds requires diligent research, a clear understanding of local laws and procedures, and prudent financial management.

Strategies include thoroughly researching properties and their locations, understanding the potential for additional liens or encumbrances, accurately assessing property values and repair costs, and setting strict budget limits to avoid overbidding. Networking with experienced investors and possibly consulting with real estate professionals or attorneys specializing in tax delinquent properties can also provide valuable insights and guidance.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.