What is asset-based lending?

When it comes to real estate, finding flexible and efficient financing solutions is key to seizing opportunities and driving success. Asset-based lending offers a unique approach to securing capital. Unlike traditional lending methods that focus heavily on credit scores and financial history, asset-based lending in real estate leverages the inherent value of properties themselves. That said, let’s take a look at what is asset-based lending in real estate and everything you need to know about this form of financing.

Understanding Asset-Based Lending in Real Estate

Asset-based lending (ABL) is a powerful financing strategy, particularly beneficial in the real estate sector. This type of lending allows borrowers to secure loans by using tangible real estate properties as collateral, instead of solely depending on traditional credit evaluation criteria like credit scores or debt-to-income ratios. Asset-based lending is particularly advantageous for real estate investors, developers, and businesses that require flexible financing options to cover operational costs, fund new projects, or facilitate the expansion of existing operations.

Real estate asset-based lending is not only about leveraging properties to raise funds; it also offers a strategic advantage in fast-paced markets where quick access to capital can make all the difference between seizing and missing a valuable investment opportunity. It provides a pathway for investors to make use of the locked equity within their properties, thereby optimizing their asset utilization and enhancing their ability to respond to market opportunities. With asset-based lending, real estate investors can take their ventures to the next level and turn their dreams into reality.

How Does Asset-Based Lending Work in Real Estate?

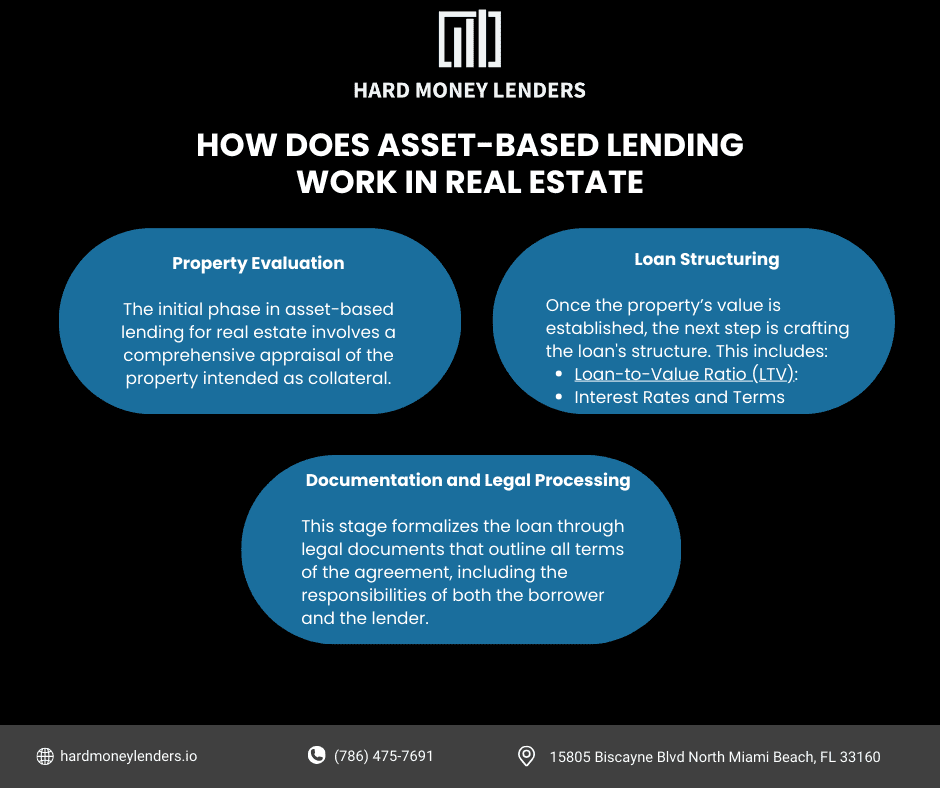

Property Evaluation

The initial phase in asset-based lending for real estate involves a comprehensive appraisal of the property intended as collateral. This assessment is critical as it determines the lending value of the property, which in turn influences the amount of the loan. The evaluation process considers several factors:

- Location: The geographical area of the property affects its market value and investment potential. Properties in prime locations or in rapidly developing areas generally have higher valuations.

- Property Type: Whether the property is residential, commercial, or industrial, each type has different market values and risks associated with it.

- Market Trends: Current and projected real estate market trends help in estimating the property’s future value.

- Income Generation Potential: For rental properties, the current and potential future income streams are also assessed. This includes looking at occupancy rates, rental yields, and the financial stability of tenants.

Loan Structuring

Once the property’s value is established, the next step is crafting the loan’s structure. This includes:

- Loan-to-Value Ratio (LTV): Typically, real estate asset-based loans offer an LTV ratio between 60% and 75%. This ratio is a measure of the loan amount relative to the value of the property, indicating the level of risk the lender is willing to accept.

- Interest Rates and Terms: The interest rates can be higher than traditional loans, reflecting the higher risk associated with asset-based lending. Loan terms, including the repayment schedule and any special conditions, are also established based on the risk assessment and borrower’s needs.

Documentation and Legal Processing

This stage formalizes the loan through legal documents that outline all terms of the agreement, including the responsibilities of both the borrower and the lender. This legal framework is crucial for protecting the interests of both parties, ensuring clarity on the rights to seize and sell the collateral if the borrower defaults.

Funding and Utilization

After the loan agreement is signed and all parties agree to the terms, the funds are disbursed. The borrower can then use these funds for the intended purposes such as purchasing new property, renovating existing properties, or refinancing other loans.

Ongoing Monitoring and Repayment

Throughout the loan term, the borrower must adhere to the repayment schedule agreed upon. The lender, on the other hand, may conduct periodic reviews of the property to ensure it maintains its value and to assess any changes that could affect the property’s market value or the terms of the loan. This ongoing monitoring is a vital aspect of asset-based lending as it helps manage the risk associated with fluctuating property values and market conditions.

Types of Real Estate for Asset-Based Lending

The diversity of property types eligible for asset-based lending provides tremendous flexibility and opens up numerous strategic opportunities for investors:

Residential Properties

- Scope: This category includes single-family homes, condominiums, duplexes, and multi-family units.

- Applications: Residential properties are highly popular among investors looking to purchase, renovate, and sell homes at a profit (commonly known as flipping). They are also favored by landlords interested in expanding rental portfolios. The value in residential real estate comes from its ability to generate consistent rental income and its potential for value appreciation.

- Considerations: The market for residential properties can be volatile, influenced by economic factors and changes in local housing regulations. Therefore, understanding local market trends is crucial for using these properties as collateral effectively.

Commercial Real Estate

- Scope: This broad category encompasses office buildings, retail spaces, shopping centers, warehouses, and light industrial facilities.

- Applications: Commercial properties are often used by businesses that require space for operations or by investors looking for income through leasing. The appeal of commercial real estate in asset-based lending lies in its higher potential rental yields and the stability of long-term leases.

- Considerations: The valuation of commercial properties can be complex, requiring a thorough understanding of commercial lease structures, tenant creditworthiness, and market conditions. The success of loans secured against commercial real estate heavily depends on the economic health of the business sector they serve.

Land

- Scope: Includes both undeveloped plots and land earmarked for development.

- Applications: Land can be a highly strategic asset for collateral, particularly for development projects that will significantly enhance its value. This includes residential subdivisions, commercial complexes, and industrial parks.

- Considerations: Lending against land involves a higher risk compared to developed property due to its lack of cash flow generation and greater susceptibility to market fluctuations. Lenders typically offer lower LTV ratios for land to mitigate their risk.

Specialty Real Estate

- Scope: Encompasses properties like hotels, resorts, hospitals, and mixed-use buildings that combine residential and commercial spaces.

- Applications: These properties often have specialized uses and are valued for their unique positioning in the market. They can be attractive for asset-based lending due to their potential for high revenue generation.

- Considerations: The complex nature of managing and valuing such properties requires lenders and borrowers to have specialized knowledge. The performance of these properties can be highly cyclical and sensitive to economic changes.

Benefits of Asset-Based Lending in Real Estate

- Flexibility in Funding: Asset-based lending offers a flexible funding solution that adapts to the specific needs of real estate investors, accommodating a wide range of investment strategies and property types.

- Quick Access to Capital: The ability to secure loans quickly based on property value (rather than exhaustive credit checks) speeds up the financing process, enabling investors to capitalize on timely market opportunities.

- Opportunity for Leveraging: Real estate investors can leverage properties that might not be immediately liquid into usable capital, facilitating further investments and portfolio diversification.

Considerations for Asset-Based Lending in Real Estate

- Risk of Property Seizure: The primary risk in asset-based lending is the potential loss of the property if the borrower defaults. This risk necessitates careful financial planning and management by the borrower.

- Market Volatility: Real estate markets are subject to fluctuations influenced by economic conditions, interest rates, and regulatory changes. A downturn in the market can reduce property values and affect the terms or viability of existing loans.

- Costs: The costs associated with asset-based real estate loans can be substantial, including higher interest rates, appraisal fees, legal fees, and other closing costs. These should be carefully weighed against the benefits of obtaining such loans.

Final Thoughts on Asset-Based Lending for Real Estate

Asset-based lending is a powerful tool for real estate professionals that provides a practical solution to finance property investments. By gaining a comprehensive understanding of how asset-based loans work, the types of properties that qualify for such financing, and the associated benefits and risks, real estate investors can confidently leverage their assets to support and expand their business ventures.

Frequently Asked Questions about Asset-Based Lending in Real Estate

How does asset-based lending differ from traditional lending?

Unlike traditional lending, which often relies on credit scores and financial history, asset-based lending primarily considers the value of the physical assets (real estate) being pledged as collateral. This focus on collateral allows for quicker loan approval processes and access to capital for those who might not meet conventional credit criteria.

What are the typical terms of an asset-based real estate loan?

The terms can vary widely but typically include:

- Loan-to-Value (LTV) ratios ranging from 60% to 75%

- Shorter loan terms, often between 1 to 3 years

- Higher interest rates compared to traditional bank loans

- Specific conditions related to the use and management of the property

What risks are associated with asset-based lending?

Risks include:

- Potential for property seizure in cases of default

- Exposure to real estate market volatility, which can impact the value of the collateral and the terms of the loan

- Generally higher costs associated with these loans, such as higher interest rates and additional fees (appraisal, legal, closing)

How do I prepare for an asset-based loan application?

Preparation steps include:

- Conducting a thorough assessment of the property to ensure it meets the criteria for collateral

- Gathering detailed documentation on the property, including appraisals, ownership details, and financial records related to income generation (if applicable)

- Reviewing your financial strategy to ensure alignment with the terms and repayment schedules of asset-based loans

Can asset-based loans be refinanced?

Yes, asset-based loans can be refinanced, often to secure a lower interest rate or better terms as the borrower’s financial situation or the value of the collateral changes. However, refinancing options depend on the current market conditions and the specific terms of the original loan.

Are there tax implications with asset-based lending?

Yes, there can be tax implications, such as the potential to deduct interest paid on the loan. It’s important to consult with a tax advisor to understand how these implications affect your specific financial situation.

Who qualifies for asset-based lending?

Asset-based lending is generally accessible to a wide range of borrowers, particularly those who have tangible assets but may not qualify for traditional loans due to insufficient credit scores or unstable financial histories. Here’s who typically qualifies:

- Businesses: Especially those with considerable tangible assets like real estate, equipment, or inventory. Asset-based loans are a common solution for businesses needing capital for expansion, operational costs, or bridging cash flow gaps.

- Real Estate Investors: Individuals or companies investing in residential or commercial properties often use asset-based lending to finance purchases, renovations, or refinancing of existing properties.

- Developers: Those involved in property development who need funding for projects but prefer not to or cannot secure traditional financing.

- Startups and SMEs: Small to medium enterprises, including startups that may not yet have robust financial records but possess valuable physical assets.

Is asset-based lending structured finance?

Yes, asset-based lending can be considered a form of structured finance. Structured finance involves complex financial instruments offered to borrowers with unique and sophisticated needs, typically involving the pooling of assets and selling the cash flows derived from these assets to third-party investors. Asset-based lending fits within this category because it involves using assets as collateral to secure loans, and the terms of these loans are often tailored to the specific needs and risks associated with the borrower’s assets and business operations.

Do banks do asset-based lending?

Yes, some banks offer asset-based lending services alongside non-bank financial institutions. However, the approach and terms can vary significantly between banks and alternative lenders:

- Banks: Typically have more stringent requirements regarding the creditworthiness of the borrower and the quality of assets. They may offer lower interest rates but require a more comprehensive evaluation process.

- Non-bank Lenders: Often provide more flexible terms and are more willing to accept higher-risk borrowers, but usually at higher interest rates. They might also offer quicker approval processes and less stringent credit requirements.

Asset-based lending by banks is usually part of a broader commercial banking service aimed at businesses rather than individual consumers. Businesses seeking asset-based loans may find that exploring options with both banks and non-bank lenders will provide a comprehensive view of the available terms and conditions, helping them find the most suitable financing solution.

If you need a private hard money loan and are wondering what that could mean for you, use our loan calculator or reach out to us here.

Hard Money Lenders IO is a Private Lending Company located in Miami, Florida providing loans to real estate investors and entrepreneurs. We specialize in offering loans to professional real estate investors for their non-owner occupied real estate investments. We operate throughout the state of Florida & have a network of investors nationwide.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.