If you’re looking into flipping a house, you’re probably wondering how to make sure your investment turns out to be profitable. There are a wide variety of approaches to answering that question, and we would recommend performing a house flip market analysis in any case. You can never be too thorough when making a major financial decision. However, one principle underlies all house-flipping scenarios, and it’s incredibly simple: the 70% rule. Below, you’ll discover what is the 70% rule of house flipping and how to apply it to your advantage.

What is the “70% Rule” of House Flipping?

The 70% Rule is a guideline that suggests an investor should not pay more than 70% of the after-repair value (ARV) of a property minus the costs of repairs and renovations needed. This rule is designed to help investors maintain a safe margin when flipping houses. By adhering to this rule, investors aim to minimize their risk and ensure a profitable return on their investment.

The 70% Rule is a guideline that suggests an investor should not pay more than 70% of the after-repair value (ARV) of a property minus the costs of repairs and renovations needed. This rule is designed to help investors maintain a safe margin when flipping houses. By adhering to this rule, investors aim to minimize their risk and ensure a profitable return on their investment.

With the 70% rule, your anticipated profit margin should be at least 30% of the final sales price.

The ARV, short for After Repair Value, is the estimate of a given property’s value after all repairs and upgrades are completed. It is used to determine the margin between a home’s current value and the value it will have after renovations.

We call this a “rule”, but it isn’t a totally rigid one. It should serve as the basis for a thorough market analysis, but it can be a very powerful tool in your decision-making process.

There’s an important caveat, though…

A 30% anticipated profit margin does not necessarily mean you walk away with exactly 30% in profit, as some may imagine.

Part of the reasoning behind the 70% rule is that you need a cushion to cover any expenses left at the end of the day; these could include agent commissions, title inspections, lender fees, and any other miscellaneous expenses included in closing.

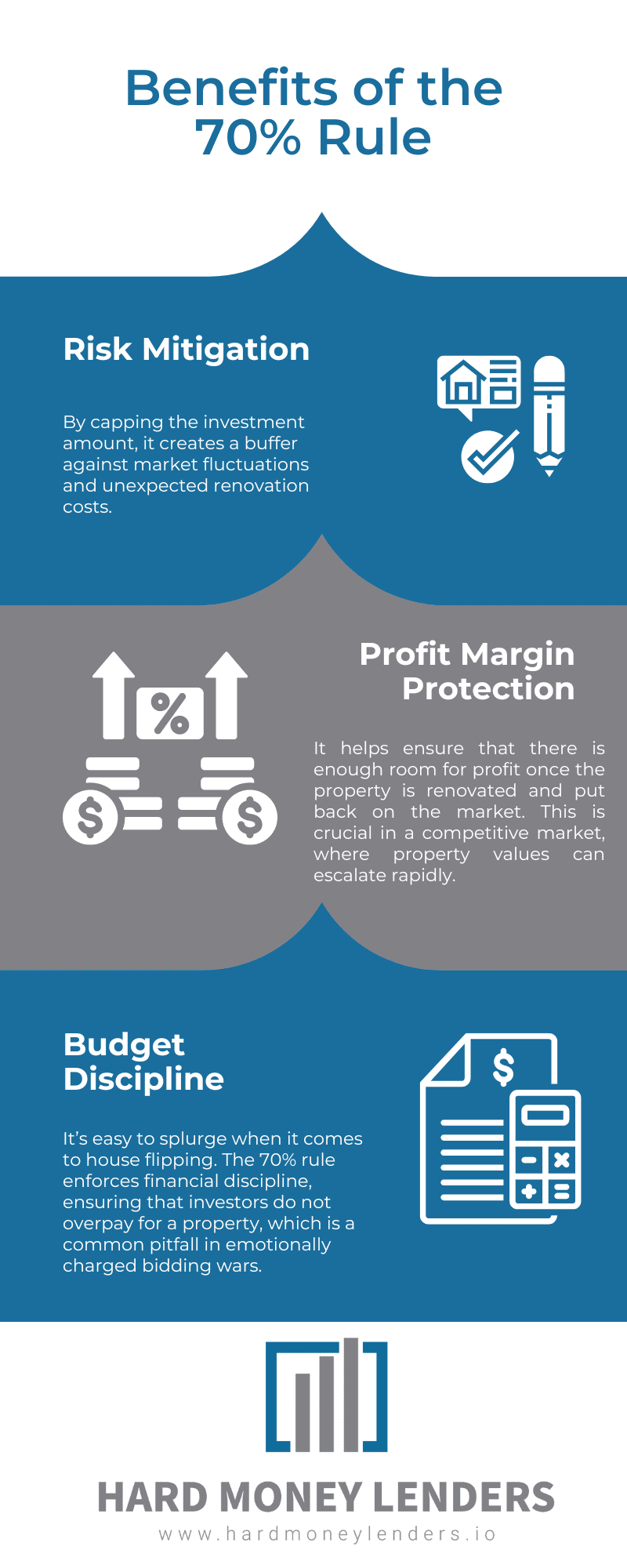

The 70% Rule Serves Multiple Critical Functions in the House Flipping Process

The 70% Rule Serves Multiple Critical Functions in the House Flipping Process

- Risk Management: It provides a buffer for unexpected expenses, market fluctuations, and potential overestimations of the ARV.

- Profit Assurance: By keeping the purchase and renovation costs within 70% of the ARV, investors are more likely to achieve a desirable profit margin.

- Simplified Decision Making: The rule offers a straightforward formula that investors can quickly apply to assess the viability of a property.

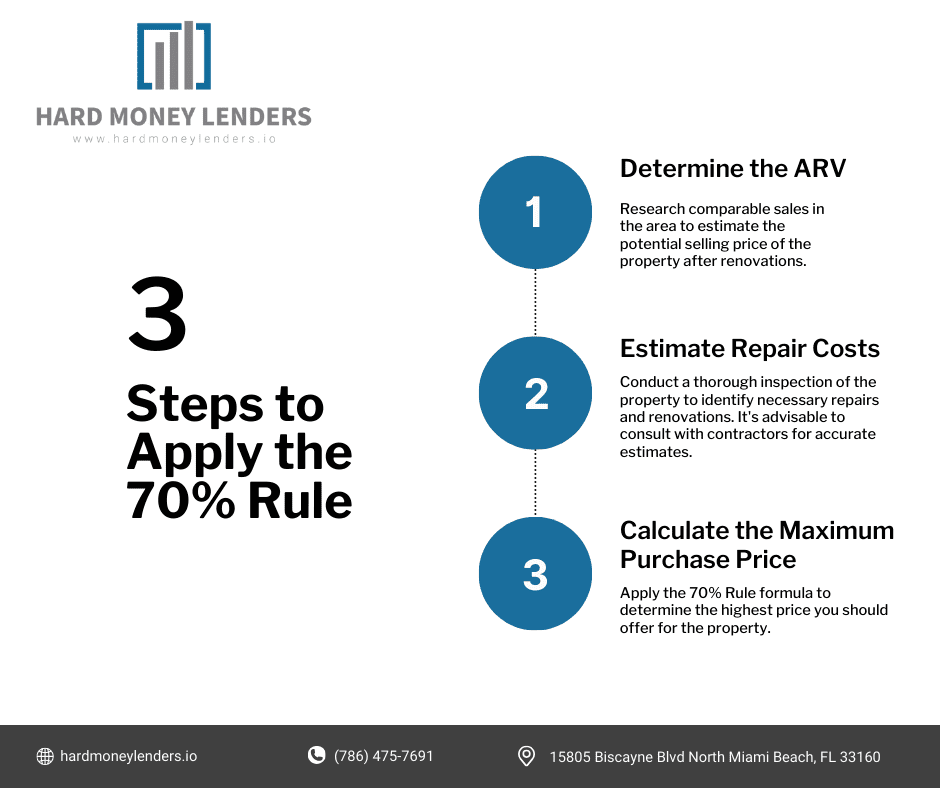

Applying the 70% Rule: A Step-by-Step Guide

- Determine the ARV: Research comparable sales in the area to estimate the potential selling price of the property after renovations.

- Estimate Repair Costs: Conduct a thorough inspection of the property to identify necessary repairs and renovations. It’s advisable to consult with contractors for accurate estimates.

- Calculate the Maximum Purchase Price: Apply the 70% Rule formula to determine the highest price you should offer for the property.

An Example: The 70% Rule in Practice

An Example: The 70% Rule in Practice

The 70% rule is really quite simple, no matter how intimidating it may seem. You just need to multiply the property’s ARV by 0.7 to determine the price ceiling for that property.

Take, for instance, a property which you anticipate to be worth $200,000 after repairs. You should pay a maximum of $140,000 right? Well, keep in mind that repairs are a significant expense too. You always want to be conservative with your estimates, accounting for further expenses than may appear on the surface.

Let’s assume the expense of repairs comes out to about $30,000. You’ll need to subtract that from the previous value, which in turn means that you shouldn’t buy for more than $110,000. Here’s a quick formula for those of us who like to see it in mathematical terms:

|

((ARV of property) x 0.7) – Cost of repairs = Maximum amount you should pay for the property |

Simple enough, right?

Why Use the 70% Rule in House Flipping?

Buying a property, especially a house to flip, is never easy. There are always many different factors to keep in mind when making your decision. It goes without saying that how much you’ll pay is the number one factor among them.

When you’re planning on investing more in the interest of making a property more viable on the market— that is, renovating and flipping the property— you’re always going to need to account for the costs incurred by repairs and upgrades.

Your profits all rest on the relationship between your expenses and the final sale price, and the 70% rule serves as a simple way to determine how much you’re willing to invest, and whether those investments will be worth it.

The Genius of the 70% Rule

The 70% rule works so well because it is so simple: there’s very little to complicate your calculations. It forces you to consider the two most important numbers in house flipping, those being the ARV and the repair costs.

None of this is to discount the significance of other numbers, such as the soft costs you may face during the renovation process. However, you really do need to keep the ARV and your repair costs in mind every step of the way, even before you embark on a more thorough analysis.

If anything, the 70% rule can be thought of as the first preliminary step of that analysis, a simple way to determine whether investing your time and money is likely to pay off in a given case.

70% Rule Versus Market Analysis

Applying the 70% rule is an important step, but it does not make for a complete market analysis in itself. For an accurate house flip market analysis, you’ll want to be thoroughly familiar with expenses beyond just purchase and repairs. Make sure to keep in mind that the 70% rule on its own does not account for the following:

- Settlement costs

- Carrying costs

- Financing costs

- Any other unforeseen expenses you need to budget for

So, although the 70% rule is a simple, versatile way to quickly assess a property, you shouldn’t base your decision on the rule alone.

When Should You Use the 70% Rule?

Being that the 70% rule is a useful tool, but not a comprehensive solution, there are always cases where its use makes more sense than others. It may make sense to offer only 65% of the ARV. Now, it could also be that 80% is justifiable in some scenarios. It is designed to be applicable in a broad context, but no tool is ever perfect.

Below, we’ll discuss a few factors to keep in mind. This list is by no means comprehensive, but it should offer some basic insight into the different kinds of decisions you could be making as a real estate investor looking to flip a home.

Making Your Exit

The 70% rule is most useful when flipping houses, which is likely your intent in reading all this. However, keep in mind that if your plans are subject to change, the 70% rule may not be a perfect match for your needs. If you’re holding onto the property over the long term, such as in the case of a rental, you should consider annual yield and income rather than just ARV.

Likewise, if you already have a buyer who you know will pay a certain amount, ARV may be insignificant. In that case, you’ll want to base all your decisions on the predetermined buyer’s intentions.

Market Price Point

Some markets are more difficult to work in than others, especially lower-income property markets. Your renovations could be seriously disrupted by trespassers, vandals, thieves, or even con artists.

In some areas, the underlying process of renovation can also vary significantly in terms of price. Labor could be much cheaper in an area with an abundance of workers in relevant trades and relatively few jobs available in those areas, but such an area may not be a very profitable market to operate in. The costs of doing business in general can also vary from state to state, city to city, or even neighborhood to neighborhood.

Keep in mind, as well, that settlement costs are fixed and do not vary based on the purchase (or sales) price. Lenders can charge a minimum fee. For that matter, your title-related fees are also likely to be fixed, rather than responsive to sales price. In a less profitable environment, these expenses could really add up.

On the other hand, higher end markets take more capital to approach, but also tend to make for more reliable investments with fewer headaches. Choose your markets carefully!

Target Profits and Labor

One deal may take more work on your end than another, and some investors expect more profit per deal than others.

A deal that requires minimal work and offers a quick turnaround with a buyer already in place may justify a lower profit margin than the 70% rule would suggest, not that such deals are easy to come by.

Always keep in mind, as well, that your repair costs and ARV estimates should be conservative. These are the numbers that divide loss from profit, and you really don’t want to take any unnecessary risks. Overestimating your expenses could leave you with more money left over, at the end of the day; underestimating could leave you facing a serious loss, or even in debt.

Closing Remarks of the 70% Rule of House Flipping

Closing Remarks of the 70% Rule of House Flipping

The 70% rule is perhaps less of a rule than a guideline, but it can be an incredibly valuable guideline. If you need a quick calculation to provide a rough ceiling figure, it’s hard to go wrong with the 70% rule.

However, you shouldn’t let it dictate your decision entirely. You’ll want to look into a potential flip in more detail before making any purchases.

Perhaps the most important thing to keep in mind when using the 70% rule is to be very cautious with your repair cost and ARV estimates. It can be very dangerous to be too optimistic in these regards; always account for some overhead.

If your access to the property is limited, so you can’t inspect it in detail, always use worst-case scenario numbers. These properties can be especially risky.

Remember: you always need to protect your resources, both time and money. Be precise, be conservative, and don’t be afraid to perform a more detailed follow up analysis when using the 70% rule in real estate.

FAQs About the 70% Rule

How Do I Accurately Determine the ARV for a Property?

Determining the After Repair Value (ARV) of a property requires a comprehensive market analysis. This involves comparing the property to similar, recently sold properties in the same area, adjusting for differences such as size, condition, and features. Real estate agents, appraisers, and online real estate platforms can provide valuable data for this assessment. Accuracy in estimating the ARV is crucial, as overestimation can lead to reduced profit margins or even losses.

What If My Repair Cost Estimates Are Wrong?

Underestimating repair costs is a common challenge in house flipping that can erode your profit margin. To mitigate this risk, it’s advisable to add a contingency buffer to your repair cost estimates, typically around 10-20%, depending on the project’s complexity and the condition of the property. Additionally, getting multiple quotes from contractors and conducting a thorough property inspection can help ensure your estimates are as accurate as possible.

Can the 70% Rule Be Adjusted for Competitive Markets?

Yes, in highly competitive markets where properties receive multiple offers, sticking rigidly to the 70% Rule may not always be feasible. Some investors adjust the rule to 75% or 80% to make their offers more competitive. However, it’s important to carefully assess whether the reduced profit margin aligns with your investment goals and risk tolerance. Adjusting the rule should be done cautiously and with a clear understanding of the potential impact on profitability.

How Does Financing Affect the Application of the 70% Rule?

Financing costs, including interest rates and loan fees, should be factored into your overall investment strategy but are not typically included in the 70% Rule calculation. The rule focuses on the purchase price and repair costs relative to the ARV. However, investors should calculate potential financing costs separately to ensure the investment remains profitable after accounting for these expenses.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.