Florida Foreclosures: How to Buy Foreclosed Homes in Florida

Buying a foreclosed home in Florida can be a lucrative endeavor for savvy real estate investors. With opportunities to purchase properties at a lower cost, the potential for profit is high. However, navigating the process of buying foreclosed homes requires understanding the intricacies of the foreclosure procedure and having access to valuable resources. Here at Hard Money Lenders, we’re all about educating people on the real estate market and loans. That said, let’s explore Florida foreclosures and how to buy foreclosed homes in Florida effectively, including tips for finding listings, assessing properties, securing financing, and successfully completing the purchase process.

Overview of Florida Foreclosures

Florida has a high number of foreclosures due to its size and population density. The state has a lengthy foreclosure process, with the lender required to file a lawsuit and obtain a court judgment before selling the property at auction.

This provides opportunities for buyers looking for discounted properties, but it also requires patience and knowledge of the legal procedures involved. Understanding the overview of Florida foreclosures is essential for anyone interested in buying foreclosed homes in the state. Keep in mind that foreclosures are different from Florida short sales, and you should understand the nuances.

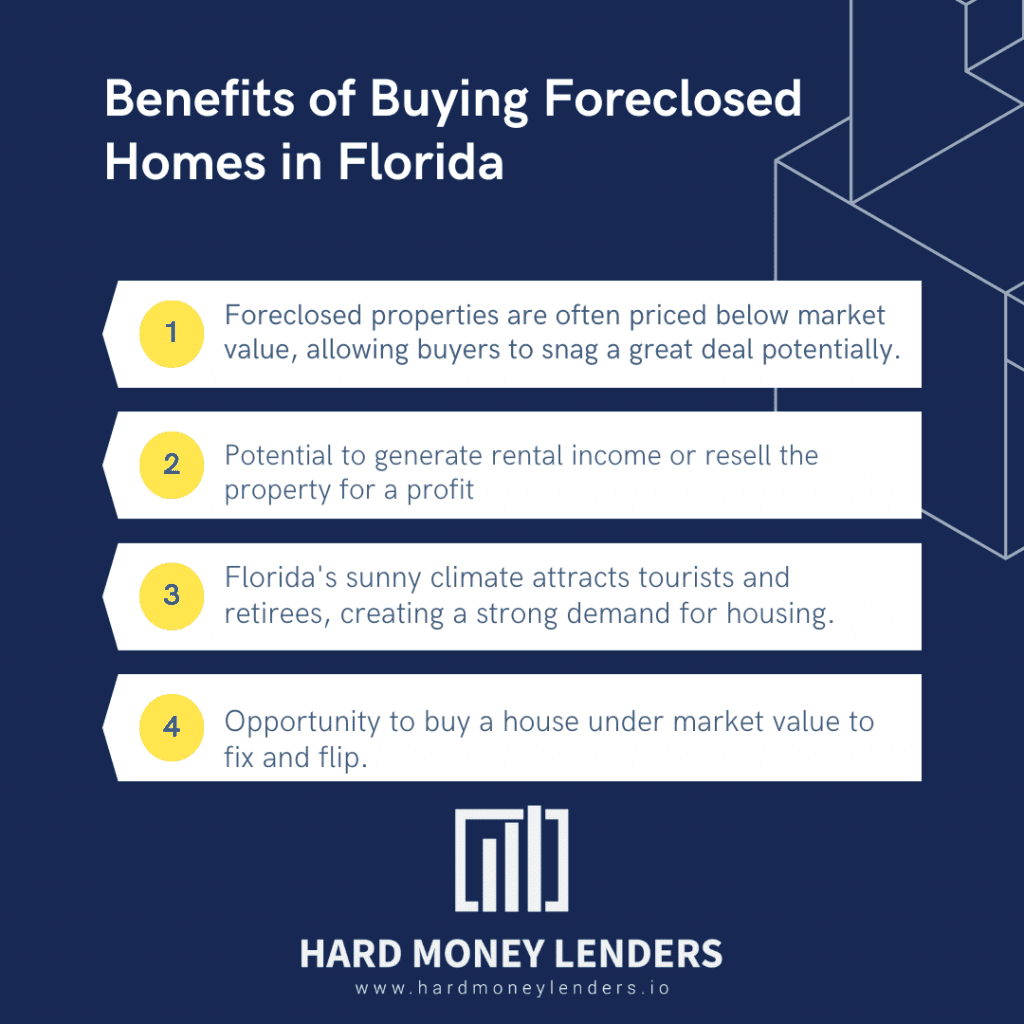

Benefits of Buying Foreclosed Homes in Florida

Florida offers several benefits for buyers interested in purchasing foreclosed homes. Firstly, these properties are often priced below market value, allowing buyers to snag a great deal potentially. Consequently, foreclosed homes may be a great opportunity as a fix-and-flip house.

That said, there may be opportunities for investors to generate rental income or resell the property for a profit. Lastly, Florida’s sunny climate attracts tourists and retirees, creating a strong demand for housing and potential long-term appreciation in property values. Overall, buying foreclosed homes in Florida presents an opportunity for financial gain and future growth potential.

Understanding Florida Foreclosures

Florida foreclosures are a legal process by which a lender takes possession of a property after the borrower defaults on their mortgage payments. The state of Florida follows a judicial foreclosure process, meaning that the foreclosure must go through the court system.

There are several types of foreclosures in Florida, including judicial sales, non-judicial sales, and tax deed sales. It is important for potential buyers to understand the different types of foreclosures and the legalities involved before pursuing a purchase.

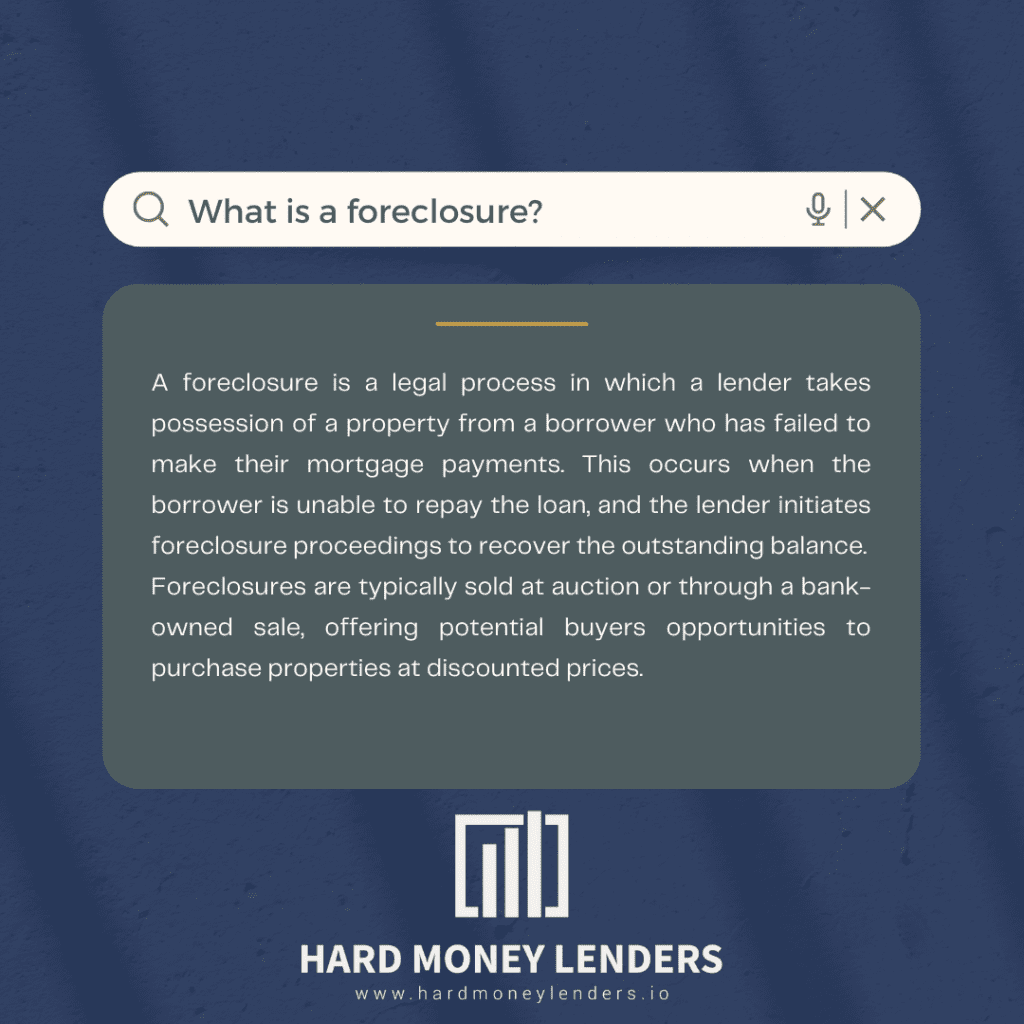

What is a Foreclosure?

A foreclosure is a legal process in which a lender takes possession of a property from a borrower who has failed to make their mortgage payments. This occurs when the borrower is unable to repay the loan, and the lender initiates foreclosure proceedings to recover the outstanding balance.

Foreclosures are typically sold at auction or through a bank-owned sale, offering potential buyers opportunities to purchase properties at discounted prices.

It’s important to understand the foreclosure process and its implications before considering buying a foreclosed home in Florida.

Finding Florida Foreclosures

When it comes to finding foreclosed homes in Florida, there are several methods you can utilize. One option is to work with a real estate agent who specializes in foreclosures.

They can help you navigate the market and find properties that meet your criteria. Moreover, you can search online platforms and websites that list foreclosure properties in Florida.

These resources often provide detailed information about the properties, including their location, price, and condition. By exploring these avenues, you can increase your chances of finding the perfect foreclosed home in Florida.

How to Find Foreclosed Homes in Florida

If you’re looking for foreclosed homes in Florida, potential buyers can utilize a variety of methods. One option is to search online real estate listing platforms that specialize in foreclosure properties. These websites provide comprehensive databases of available foreclosures in Florida, allowing buyers to refine their search based on location, price range, and other criteria.

Furthermore, contacting local real estate agents who have experience with foreclosures can be a valuable resource for finding these types of properties. Conducting thorough research and utilizing various avenues will increase the chances of locating suitable foreclosed homes in Florida.

Websites and resources for finding foreclosure listings

There are several websites and resources that can help you find foreclosure listings in Florida. Some popular options include RealtyTrac, Zillow, Foreclosure.com, and the Florida Department of Financial Services website.

These platforms provide comprehensive listings of foreclosed properties, allowing you to browse through available options and find potential investment opportunities.

In addition, local real estate agents who specialize in foreclosures can provide valuable insights and access to exclusive listings in your desired area.

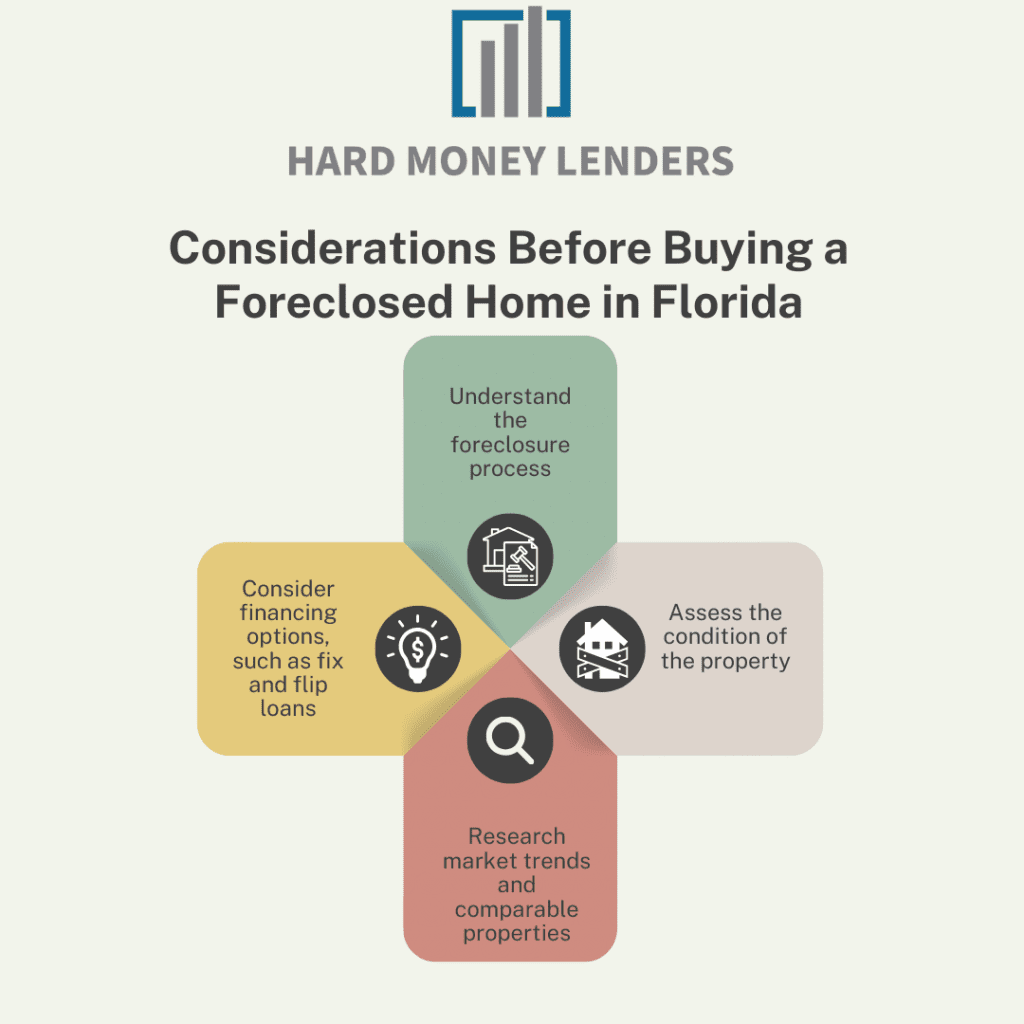

Assessing the Property

When buying a foreclosed home in Florida, it is crucial to assess the property before making a purchase. This includes conducting a comprehensive visual inspection, checking for structural damage, assessing the condition of the plumbing and electrical systems, and examining the overall integrity of the property.

It is also advisable to hire a professional home inspector who can provide a detailed report highlighting any hidden issues that may not be immediately apparent to the untrained eye. By conducting a thorough inspection, prospective buyers can make informed decisions and budget accordingly for any necessary repairs or renovations.

On top of that, researching local market trends and comparable properties can help determine if the asking price is reasonable. These steps will ensure that you make an informed decision when buying a foreclosed home in Florida.

Financing Options for Foreclosed Homes in Florida

When it comes to financing options for foreclosed homes in Florida, there are a few routes you can take. One option is to secure traditional financing through a mortgage lender.

However, it’s important to keep in mind that some lenders may be hesitant to provide loans for foreclosed properties.

Another option is to consider purchasing the property with cash, which can help streamline the buying process and potentially result in a better deal.

There are also specialized programs and loans available specifically for purchasing foreclosed homes. Exploring all of these financing options can help you choose the best approach for your situation and budget.

When it comes to loans, there are various options available. For example, let’s say you’re looking to buy a foreclosed home in Florida that you’re looking to rehab. You can opt to get a fix and flip loan.

Additionally, rental property, fix and flip, and second mortgage loans can be useful financing options to purchase foreclosed homes in Florida.

The foreclosure auction process and financing

During the foreclosure auction process in Florida, properties that have gone through the judicial foreclosure process are sold to the highest bidder. It’s important to note that auction purchases require immediate payment in cash or a certified check.

Financing options are generally not available during auctions, so buyers should come prepared with enough funds to cover the purchase price. It’s crucial to thoroughly research and understand the auction process before participating to ensure a successful purchase.

Tips for Buying a Foreclosed Home in Florida

When buying a foreclosed home in Florida, there are a few tips to keep in mind. Firstly, do your research and understand the foreclosure process in Florida.

It’s also important to have your finances in order, whether paying in cash or arranging financing.

Additionally, consider hiring a professional real estate agent who specializes in foreclosures to guide you through the process. Lastly, be prepared for bidding wars and negotiate wisely to ensure you get the best deal possible.

The bidding process and tips for winning the bid

Once you have identified a foreclosed home in Florida that you are interested in, the next step is participating in the bidding process. Bidding on a foreclosed home can be competitive, so it’s important to come prepared.

Start by setting a maximum bid that you are willing to go up to and stick to it. Conduct research on the property’s market value and consider any potential repairs or renovations needed.

During the auction, stay focused and confident, placing your bids strategically. Remember to keep an eye on other bidders and adjust your strategy accordingly. Persistence and patience are key when it comes to winning the bid on a foreclosed home in Florida.

Negotiating with the bank or lender

When buying a foreclosed home in Florida, negotiating with the bank or lender is an important step in the process.

After winning the bid or entering into a purchase agreement, you may have the opportunity to negotiate the terms of the sale, such as the purchase price or repair credits. It’s essential to work closely with your real estate agent or attorney to navigate these negotiations and ensure you get the best deal possible.

Closing on a Foreclosed Home in Florida

During the closing process for foreclosed homes in Florida, the buyer and seller will need to complete several important steps. This typically includes submitting all necessary paperwork, obtaining title insurance, and completing the final purchase agreement.

Additionally, the buyer may be responsible for paying any outstanding liens or taxes on the property. Once all necessary documents are signed and funds are transferred, ownership of the foreclosed home is officially transferred to the buyer.

It’s important to work closely with a real estate agent or attorney during this process to ensure a smooth and successful closing.

Title insurance and closing costs

When closing on a foreclosed home in Florida, it is important to consider the costs associated with title insurance and closing. Title insurance protects the buyer from any defects or liens on the property’s title, ensuring a clear ownership.

The cost of title insurance may vary depending on the purchase price of the home. Additionally, there are closing costs involved, which typically include fees for appraisals, inspections, and legal documentation. These costs can add up and should be taken into account when budgeting for a foreclosed home purchase in Florida.

Maintaining and Renovating a Foreclosed Home in Florida

Maintaining and renovating a foreclosed home in Florida is an important aspect of the buying process. These homes may have been neglected or vacant for some time, requiring repairs and updates to bring them back to their full potential.

It’s crucial to conduct a thorough inspection and identify any issues that need attention, such as plumbing or electrical problems. Hiring professionals who specialize in rehabilitating foreclosed properties can help ensure that the necessary repairs are done correctly and efficiently. Moreover, investing in renovations and upgrades can significantly increase the value of the property, making it a more profitable investment in the long run.

Maintaining foreclosed homes in Florida

Maintaining foreclosed homes in Florida is crucial for preserving and increasing the property’s value. Since these homes may have been vacant for a while, regular maintenance is necessary to prevent further deterioration.

This includes tasks such as cleaning, landscaping, and addressing any repairs or structural issues. Hiring a professional property management company can help ensure that the property is well-maintained and ready for potential buyers or tenants. Regular inspections and prompt maintenance are key to keeping foreclosed homes in Florida in good condition.

Renovating and improving foreclosed homes

Renovating and improving foreclosed homes is a common practice among buyers looking to maximize their investment. These properties, often neglected or in disrepair, offer opportunities for renovation projects that can significantly increase their value.

From cosmetic updates like painting and flooring to more extensive renovations such as kitchen and bathroom remodels, the possibilities are endless.

However, it’s essential to carefully assess the property’s condition before embarking on any renovations and budget accordingly to ensure a profitable outcome. Working with experienced contractors and obtaining necessary permits is crucial to ensure the renovations meet building codes and regulations.

Final Thoughts on How to Buy Foreclosed Homes in Florida

Now, buying foreclosed homes in Florida can be a lucrative opportunity for savvy real estate investors. With the potential for purchasing properties at a lower price, there is the possibility of making a profit through renovations or resale. However, it is important to be aware of the foreclosure process and its associated risks. Researching and understanding the local market, as well as conducting thorough property assessments, will contribute to a successful venture into buying foreclosed homes in Florida.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.