Florida Real Estate Leverage: How to Use Leverage in Real Estate

Leverage is a powerful tool that can significantly impact real estate investments. It allows investors to increase purchasing power, generate higher returns, and optimize cash flow. However, using leverage in real estate comes with risks and challenges that need to be carefully managed. At Hard Money Lenders, we want everyone to make well-informed decisions. That said, let’s explore what leverage is, its potential benefits and drawbacks, how to use leverage in real estate, and strategies for effectively managing leverage in the Florida market.

What is Leverage in Real Estate?

Leverage in real estate refers to the strategic use of borrowed capital to amplify potential returns on investment. It involves using debt, such as a mortgage, along with a small portion of your own money as a down payment to purchase properties.

Leverage allows investors to control assets that are worth more than their initial investment, giving them the opportunity for greater profits. By utilizing leverage strategically, investors can maximize their purchasing power and achieve higher returns on their real estate investments.

By leveraging other people’s money (OPM), you can control assets worth more than your initial investment. This opens up opportunities for greater profits and long-term financial growth. Leverage truly unlocks the power of real estate investing!

Different Types of Leverage in Real Estate Investments

Real estate investment offers multiple avenues for leveraging your funds.

One common type of leverage is utilizing a traditional mortgage, where you secure a loan based on the value of the property. For Florida, with its thriving assisted living facility market, some investors use assisted living facility loans to get leverage.

Another option is partnership leverage, partnering with other investors to pool resources and share the risks and rewards of a real estate venture.

Additionally, using home equity loans or lines of credit on existing properties can provide additional funds for purchasing new assets. These various types of leverage allow investors to maximize their potential returns and expand their real estate portfolios exponentially.

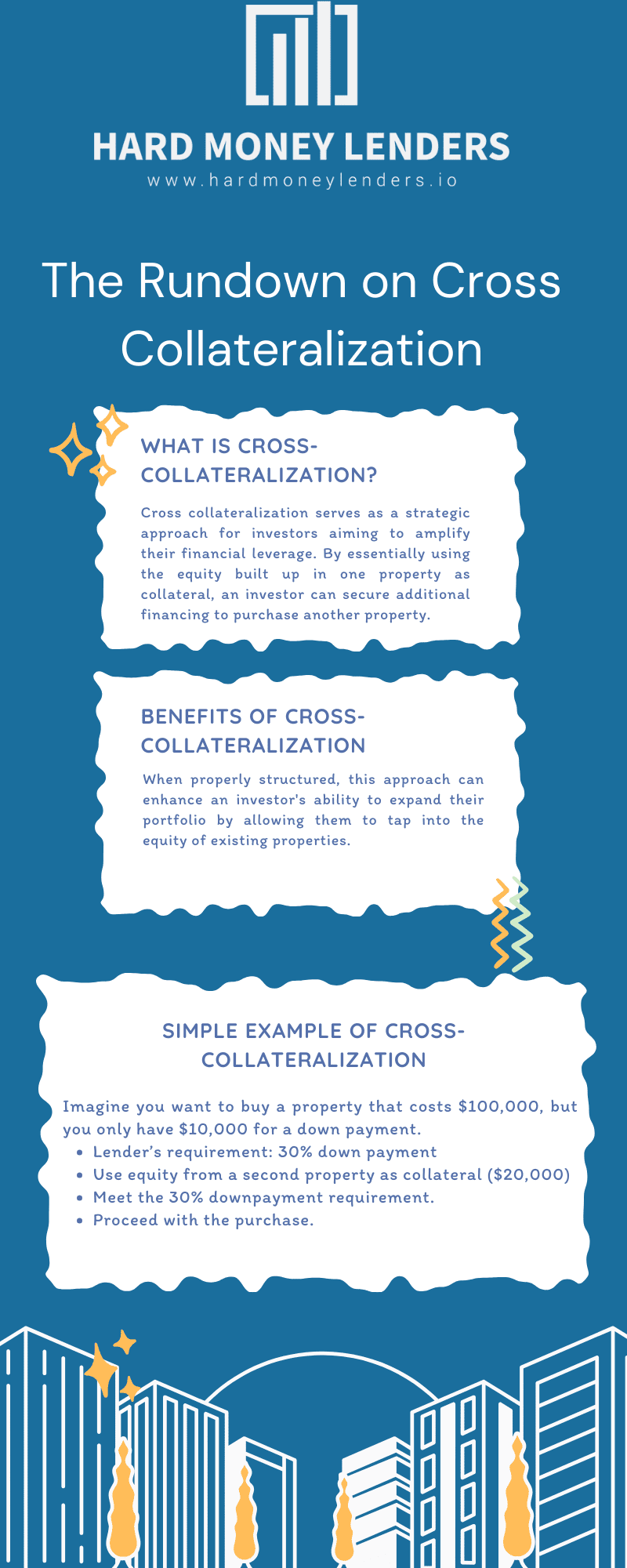

Unlocking Leverage with Cross-Collateralization

Cross collateralization serves as a strategic approach for investors aiming to amplify their financial leverage. By using the equity built up in one property as collateral, an investor can secure additional financing to purchase another property.

This process reduces the immediate cash capital required, unlocking further investment opportunities. It’s particularly attractive to those who may not have a large reserve of liquid assets but hold significant equity in their existing properties.

Why Cross-Collateralization is so Appealing

Lenders often find cross-collateralization appealing due to the added security it provides. However, investors must proceed with caution and consider the risks, such as the potential of defaulting and the consequent seizing of collateral assets. With careful planning and risk assessment, cross-collateralization can be an effective tool to grow an investment portfolio.

When properly structured, this approach can enhance an investor’s ability to expand their portfolio by allowing them to tap into the equity of existing properties.

However, it is imperative to understand that cross-collateralization also means that if a default occurs, all properties linked as collateral are at risk.

Consultation with a real estate attorney or financial advisor experienced in Florida’s legal landscape is strongly recommended to navigate the complexities of such financial agreements.

Cross-Collateralization in Real Estate Example

Imagine you want to buy a property that costs $100,000, but you only have $10,000 for a down payment. The lender requires a 30% down payment, which would be $30,000. To meet the lender’s down payment requirement without having the full amount in cash, you could use cross-collateralization.

Here’s how it would work: You have another property or asset that has equity in it. Let’s say you own a second property that has $20,000 in equity. The lender agrees to take a second mortgage on this other property, using the $20,000 in equity as additional collateral.

This allows you to leverage the equity in your second property to meet the 30% down payment requirement on the new property purchase.

So, with your $10,000 cash and the $20,000 in equity from your second property, you manage to satisfy the lender’s 30% down payment condition through cross-collateralization. Now, you can proceed with buying the $100,000 property.

Cross-collateralization is great for those who already have a home and are looking to find a fix and flip home to generate cash flow or sell for a profit.

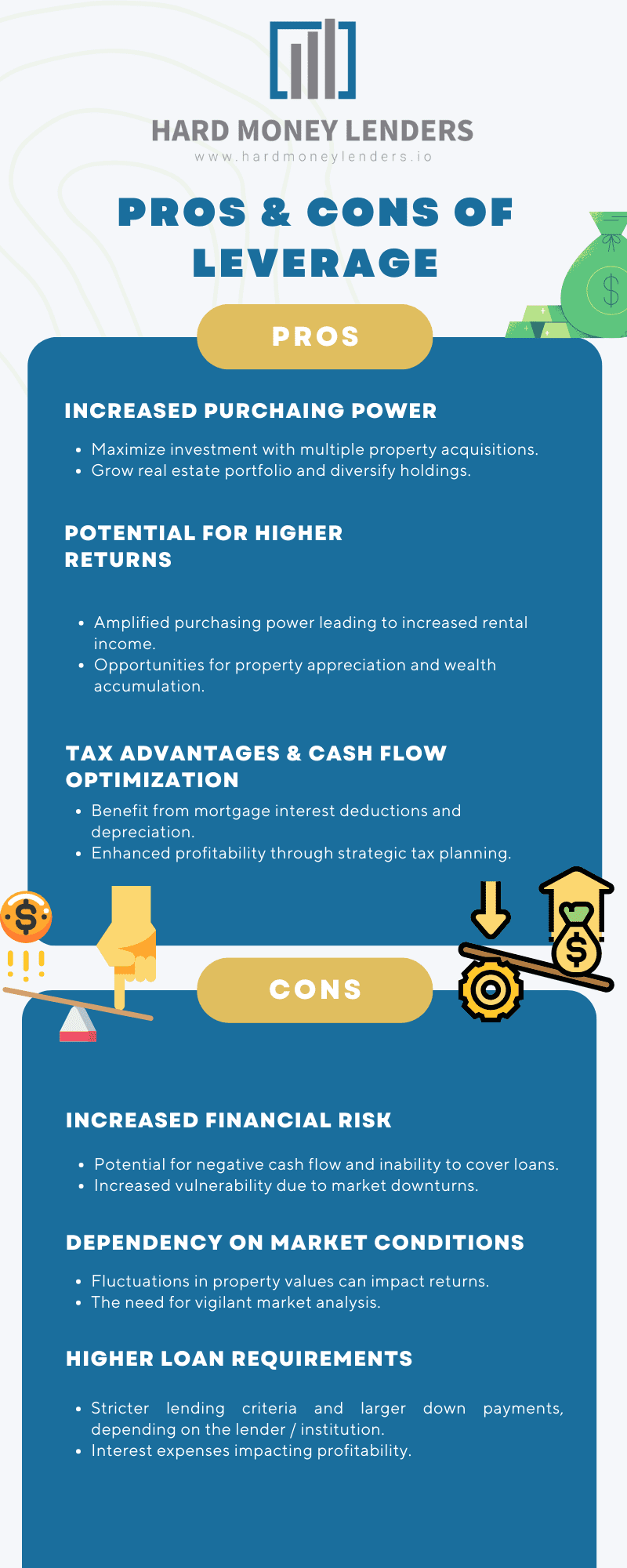

Pros of Using Leverage in Real Estate

Using leverage in real estate has numerous benefits that can help investors maximize their potential returns and build wealth.

The key pros of using leverage include increased purchasing power, allowing investors to acquire multiple properties, and diversify their portfolios.

Additionally, leveraging can provide tax advantages and optimize cash flow by utilizing borrowed funds for property acquisition. With the right strategies and market conditions, leverage can be a powerful tool in real estate investing.

Increased Purchasing Power and Ability to Acquire Multiple Properties

Using leverage in real estate opens up exciting opportunities for investors.

By utilizing borrowed funds, they can significantly increase their purchasing power and venture into a world of multiple property acquisitions.

Imagine being able to buy not just one but several properties with the same amount of initial investment! Leverage amplifies an investor’s ability to grow their real estate portfolio and diversify their holdings, ultimately paving the way for greater wealth accumulation and financial success.

It’s an incredible advantage that savvy investors eagerly embrace to maximize their potential returns.

Potential for Higher Returns on Investment

When it comes to using leverage in real estate, one of the most exciting benefits is the potential for higher returns on investment.

By leveraging borrowed funds, investors can amplify their purchasing power and acquire multiple properties. This opens up a world of opportunity for increased rental income and property appreciation.

With the right investment strategy and market conditions, leverage can lead to significant wealth accumulation and financial success. It’s an exhilarating prospect that makes real estate investing even more enticing.

Tax Advantages and Cash Flow Optimization

One of the key benefits of using leverage in real estate is the potential for tax advantages and cash flow optimization.

By utilizing debt to finance property acquisitions, investors can take advantage of various tax deductions and incentives, such as mortgage interest deductions and depreciation allowances.

These tax advantages can help lower expenses and increase cash flow, ultimately maximizing the profitability of the investment. Additionally, leveraging allows investors to allocate their own capital towards other investments or use it for personal purposes, further optimizing their cash flow.

With strategic planning and smart decision-making, leverage can become a powerful tool for achieving financial success in real estate.

Cons of Using Leverage

Using leverage in real estate investments also comes with its own set of cons. The primary drawback is the increased financial risk and potential for negative cash flow. If property values decrease or rental income is not sufficient to cover loan payments, investors may find themselves in a vulnerable position.

Additionally, leverage exposes investors to market conditions, as fluctuations can impact property values and the ability to sell or refinance. Moreover, leveraging requires higher loan requirements and interest expenses, which can eat into profits.

Increased financial risk and potential for negative cash flow

Using leverage in real estate investments comes with an increased financial risk and the potential for negative cash flow. While leveraging allows investors to acquire properties with less of their own capital, it also exposes them to the possibility of property value decreases or rental income is insufficient to cover loan payments.

This can result in a vulnerable position where investors may experience negative cash flow and struggle to meet their financial obligations. It’s essential for investors to carefully consider these risks before utilizing leverage in their real estate ventures.

Dependency on market conditions and property values

When utilizing leverage in real estate investments, one must be aware of the dependency on market conditions and property values. The success of leveraging is heavily influenced by the state of the real estate market and the fluctuations in property values.

If the market experiences a downturn or if property values decline, investors may face challenges in generating positive returns or even covering their loan payments.

It’s crucial for investors to closely monitor market conditions and thoroughly analyze potential risks before diving into leveraged real estate investments.

Higher loan requirements and interest expenses

Investors must consider the potential drawbacks of using leverage in real estate, including higher loan requirements and interest expenses.

Banks often have stricter lending criteria for investment properties, requiring larger down payments and proof of steady income. This can limit the number of properties an investor can acquire and make it more difficult to secure financing.

Additionally, leveraging comes with interest expenses, which can significantly impact cash flow and reduce overall profitability. It’s crucial for investors to carefully evaluate these factors before leveraging their real estate investments.

How to Use Leverage in Real Estate

Using leverage to purchase real estate is a game-changer for investors looking to maximize their buying power and capitalize on opportunities.

By utilizing a combination of your own funds and borrowed capital, you can acquire properties that may have been out of reach otherwise.

This allows you to build a diversified portfolio and potentially generate higher returns on your investments. With the right financing options and lenders, leveraging can open doors to exciting real estate prospects and help you achieve your wealth-building goals. For example, there are real estate investors out there who use condotel financing to tap into Florida’s condotel industry.

Steps to take when using leverage to buy property

When utilizing leverage to buy property, there are several important steps to take. First, it’s crucial to determine your budget and financial goals. Next, research and identify potential properties that align with your investment strategy.

Once you’ve found a property, secure pre-approval for a loan, and compare financing options to ensure favorable terms, conduct a thorough analysis of the property’s potential value appreciation and rental income.

Finally, negotiate the purchase price and terms with the seller, ensuring you have a solid contract. By following these steps, you can maximize your leverage and pave the way for a successful real estate investment.

Finding the right financing options and lenders

When utilizing leverage to purchase real estate, finding the right financing options and lenders is essential.

Investors should research and compare different loan products from various financial institutions. It’s crucial to consider factors such as interest rates, loan terms, and down payment requirements.

Additionally, working with reputable lenders who specialize in real estate investment loans can provide valuable guidance and support throughout the process.

By carefully selecting the right financing options and lenders, investors can maximize their leverage and set themselves up for success in their real estate endeavors.

Evaluating Risk and Return with Leverage

Evaluating the risk and return associated with leverage is a critical step in real estate investment. By carefully assessing the potential risks and rewards, investors can make informed decisions and maximize their returns.

This involves evaluating factors such as market conditions, property values, interest rates, and cash flow projections. It’s important to strike a balance between taking on enough leverage to enhance returns while also managing the risks involved.

Through thorough analysis and prudent decision-making, investors can navigate the complexities of leveraging in real estate and achieve profitable outcomes.

Assessing risk exposure and determining acceptable levels

Assessing risk exposure and determining acceptable levels of leverage is crucial when investing in real estate. It involves evaluating factors such as market conditions, property values, interest rates, and cash flow projections.

By thoroughly analyzing these elements, investors can determine their risk tolerance and set boundaries for leverage usage. This helps in finding the right balance between maximizing returns and managing potential risks.

Setting acceptable levels of leverage ensures that investors make informed decisions and safeguard their investments, ultimately leading to successful outcomes.

Analyzing potential returns and investment performance with leverage

When it comes to real estate investments, analyzing potential returns and investment performance is critical, especially when utilizing leverage.

Leverage allows investors to amplify their buying power and potentially generate higher returns on their investment. By carefully evaluating market conditions, property values, and cash flow projections, investors can determine the feasibility of leveraging their investments.

This analysis helps them make informed decisions about leveraging ratios and evaluate the potential risks and rewards of using leverage in real estate. With a thorough assessment, investors can maximize their returns and achieve greater success in their real estate ventures.

Diversifying and Managing Real Estate Leverage

Diversifying and managing real estate leverage is essential for investors looking to minimize risk and maximize potential returns. One strategy is to spread risk through diversification by investing in different types of properties or locations.

This helps protect against fluctuations in the market. Additionally, implementing effective management strategies, such as regular property inspections and proactive maintenance, can help ensure that the investment performs well.

By carefully managing leverage and diversifying investments, investors can navigate market variability and achieve long-term success in real estate.

Implementing strategies to manage leverage effectively

Implementing effective strategies to manage leverage is crucial in real estate investments. One key strategy is to maintain a conservative loan-to-value ratio (LTV) by ensuring that the amount borrowed is not excessive compared to the property’s value. This helps mitigate the risk of negative equity and potential foreclosure.

Final Thoughts on Using Real Estate Leverage in the Florida Market

That said, understanding how to use leverage in real estate investments effectively can be a game-changer for investors. By leveraging their capital and using debt strategically, investors can increase their purchasing power and potentially achieve higher returns on their investments.

However, it is essential to carefully manage the risks associated with leverage and maintain a conservative loan-to-value ratio. By implementing sound strategies and continuously monitoring market trends, investors can harness the power of leverage while minimizing potential risks. With the right approach, leveraging real estate can be a powerful tool for building wealth and achieving financial success.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.