Last Updated on January 29, 2024

Welcome to our comprehensive guide on condotel financing in Florida. Given Florida’s booming tourism industry and sunny beaches make it an ideal location for condotel investments, Hard Money Lenders created this extensive guide — covering everything from what condotels are and their characteristics to the pros and cons of investing in them. Additionally, we’ll discuss various financing options for condotels in Florida, including traditional mortgage loans and hard money condotel loans in Florida. By the end, you’ll have a thorough understanding of condotel financing in Florida, empowering you to make informed decisions and navigate the market with confidence. So, let’s get started on this exciting real estate adventure in the Sunshine State!

Dive into the Sunshine State’s Unique Investment Opportunity: Condotels in Florida

Florida is known not only for its beautiful beaches and vibrant tourism industry but also for its unique investment opportunity: condotels. These hybrid properties offer the perfect blend of personal enjoyment and financial gain.

By owning a condotel in Florida, investors can enjoy their own slice of paradise while also generating rental income when they’re not using the property themselves.

The thriving tourism industry ensures a steady stream of visitors, making condotels a lucrative investment option.

Whether you’re a seasoned investor or someone looking to dip their toes into real estate, condotels in Florida provide a unique opportunity to maximize both lifestyle and financial returns.

Of course, we have stats on Florida condotels — that way, you can make an informed decision before you consider investing in condotels and go searching for condotel financing in Florida.

|

Florida Condotel Statistics |

||

| Metric | Data (Verified) | Source |

| Number of Condotels | 1,127 | Florida Department of Financial Services (2022 Report) |

| Median Sales Price | $235,000 | Florida Realtors® (Q3 2023 Report) |

| Sales Volume | $5.2 billion | Florida Realtors® (2023 YTD Report) |

| Rental Income | $32,400 (annual average) | AirDNA (Miami Beach 1-bedroom, Dec 2023) |

| Vacancy Rate | 7.20% | STR Global (Florida, Q3 2023 Report) |

| Occupancy Rate | 92.80% | STR Global (Florida, Q3 2023 Report) |

| Growth Rate (Sales Price) | 4.80% | Florida Realtors® (Q2-Q3 2023 Comparison) |

| Growth Rate (Rental Income) | 10.20% | AirDNA (Miami Beach year-over-year) |

| Capitalization Rate | 4.7% – 6.3% (estimated range for Florida condotels) | National Association of Realtors® (2023 Investment Report) |

What is a Condotel?

A condotel, also known as a condominium-hotel or condo hotel, is a unique type of property that combines the benefits of owning a vacation home with the convenience of hotel amenities and rental options.

Essentially, it is a condominium unit within a hotel or resort complex. Owners of condotels can enjoy their unit for personal use whenever they desire while also having the option to rent it out to guests when they are not occupying it.

Condotels typically offer features and services such as housekeeping, concierge services, and access to common areas such as pools, spas, and restaurants. It’s like having a vacation getaway with the added bonus of potential rental income.

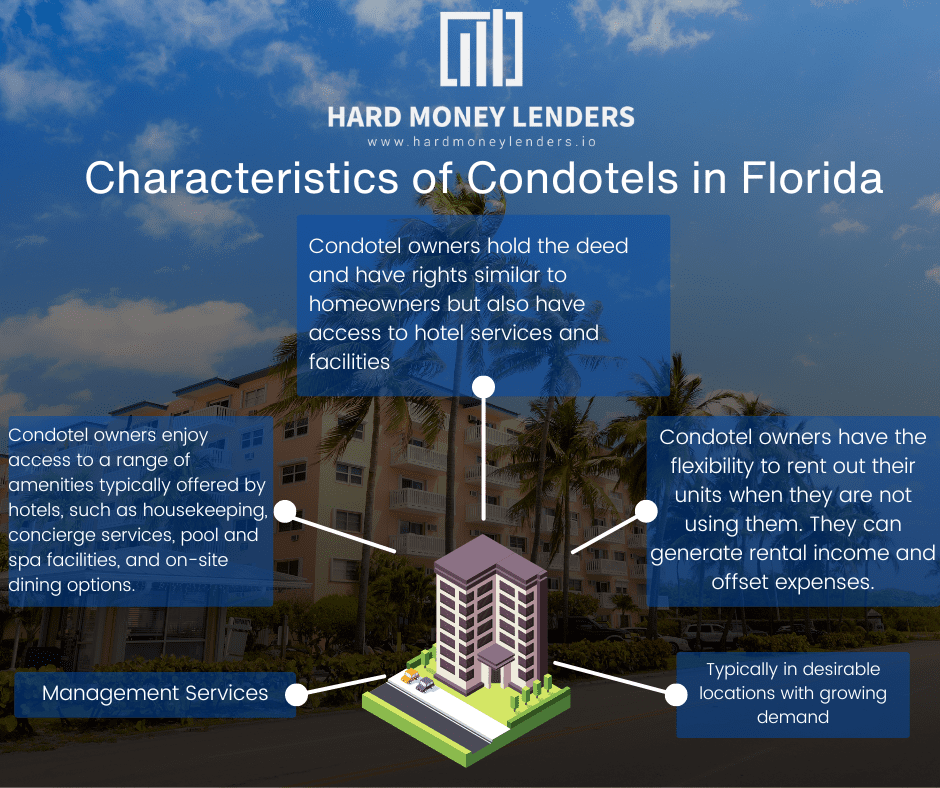

Characteristics of a Condotel

- Ownership Structure: Condotel owners hold the deed to their individual units and have rights similar to traditional homeowners. However, they also have access to hotel services and facilities.

- Rental Options: Condotel owners have the flexibility to rent out their units when they are not using them. This provides an opportunity to generate rental income and offset expenses.

- Hotel Amenities: Condotel owners enjoy access to a range of amenities typically offered by hotels, such as housekeeping, concierge services, pool and spa facilities, and on-site dining options.

- Management Services: The hotel management usually handles the day-to-day operations of the condotel, including guest bookings, maintenance, and marketing. This relieves owners of the burden of managing their units.

- Location: Many condotels are located in desirable vacation destinations, offering owners a prime location for their personal use and attracting tourists seeking accommodation.

Overall, condotels provide an attractive combination of ownership and hotel services, making them an appealing investment for individuals looking to enjoy both a vacation home and potential income opportunities.

Pros and Cons of Investing in a Condotel in Florida

Investing in a condotel can offer several advantages.

Firstly, condotels provide a fantastic opportunity to own a vacation home in a desirable location without the high costs associated with a traditional standalone property. With access to hotel amenities and services, owners can enjoy the convenience of a resort experience.

Additionally, condotels offer the potential for rental income, allowing owners to offset expenses and even generate profit.

However, there are also certain drawbacks to consider. Maintaining a condotel can be costly, with owners often responsible for fees, maintenance, and management costs.

Furthermore, rental income can fluctuate depending on market conditions and occupancy rates. It’s crucial to weigh the pros and cons carefully to make an informed investment decision.

Owning a Slice of Paradise: Different Approaches to Florida Condotel Ownership

When it comes to owning a slice of paradise in Florida, there are different approaches to condotel ownership. Each approach offers its own benefits and considerations, allowing individuals to tailor their investment to their specific needs.

One approach is to fully embrace the resort lifestyle and maximize personal enjoyment by using the condotel as a vacation home. This allows owners to indulge in the luxury amenities and services offered by the property, creating unforgettable memories in their own piece of paradise.

Another approach is to strike a balance between personal use and investment potential. Owners can choose to rent out their condotel unit when they’re not using it, generating rental income that helps offset expenses and potentially even turn a profit. This approach offers both the joy of ownership and the opportunity for a return on investment.

Lastly, some individuals may opt for a purely investment-focused approach. They purchase a condotel unit solely with the intent of generating rental income and capital appreciation. This approach requires careful consideration of market conditions, occupancy rates, and rental management options to ensure a successful investment.

Ultimately, the choice of approach to condotel ownership depends on one’s personal preferences, financial goals, and lifestyle. Whether seeking a dream vacation home or a savvy investment opportunity, owning a condotel in Florida opens up a world of possibilities for enjoying the sunshine state’s vibrant real estate market.

Florida Condotel Financing Options

When it comes to financing a condotel in Florida, there are various options to consider. Traditional mortgage loans are available for condotels, although they may have stricter requirements compared to regular residential mortgages.

It’s important to research and find lenders who specialize in condotel financing to increase your chances of approval.

| Options | Key Features | Benefits | Ideal For |

| Conventional Loan | Familiar terms, potentially lower rates | Widely available, good credit rewarded | Investors with strong credit & income |

| Hard Money Loan | Fast funding, minimal documentation | Quick access to capital for urgent needs | Investors with a credit score of 600 or more and want fast funding |

| Portfolio Loan | Flexible terms, consider non-traditional uses | Tailored options, may suit unique needs | Experienced investors comfortable with flexibility |

| Condotel-Specific Loan | Streamlined process, understand condotel risks | Niche expertise, faster closing potential | Investors focused on condotels, accepting higher costs |

Factors to Consider When Selecting a Condotel Loan

When selecting a condotel loan, several factors should be taken into consideration.

Firstly, it’s crucial to assess your financial stability and determine your borrowing capacity. Consider your credit score, income stability, and debt-to-income ratio to understand what loan options you qualify for and can comfortably afford.

Secondly, examine the interest rates and loan terms offered by different lenders. Compare rates, fees, and repayment options to find the most favorable terms.

Additionally, consider the lender’s experience and expertise in condotel financing. Working with a lender who understands the unique challenges and intricacies of condotel loans can streamline the process and ensure a successful investment. Lastly, evaluate the loan structures and flexibility.

Some loans may offer adjustable rates or balloon payments, which may or may not align with your long-term financial goals. By carefully considering these factors, you can select a condotel loan that meets your needs and supports your investment objectives.

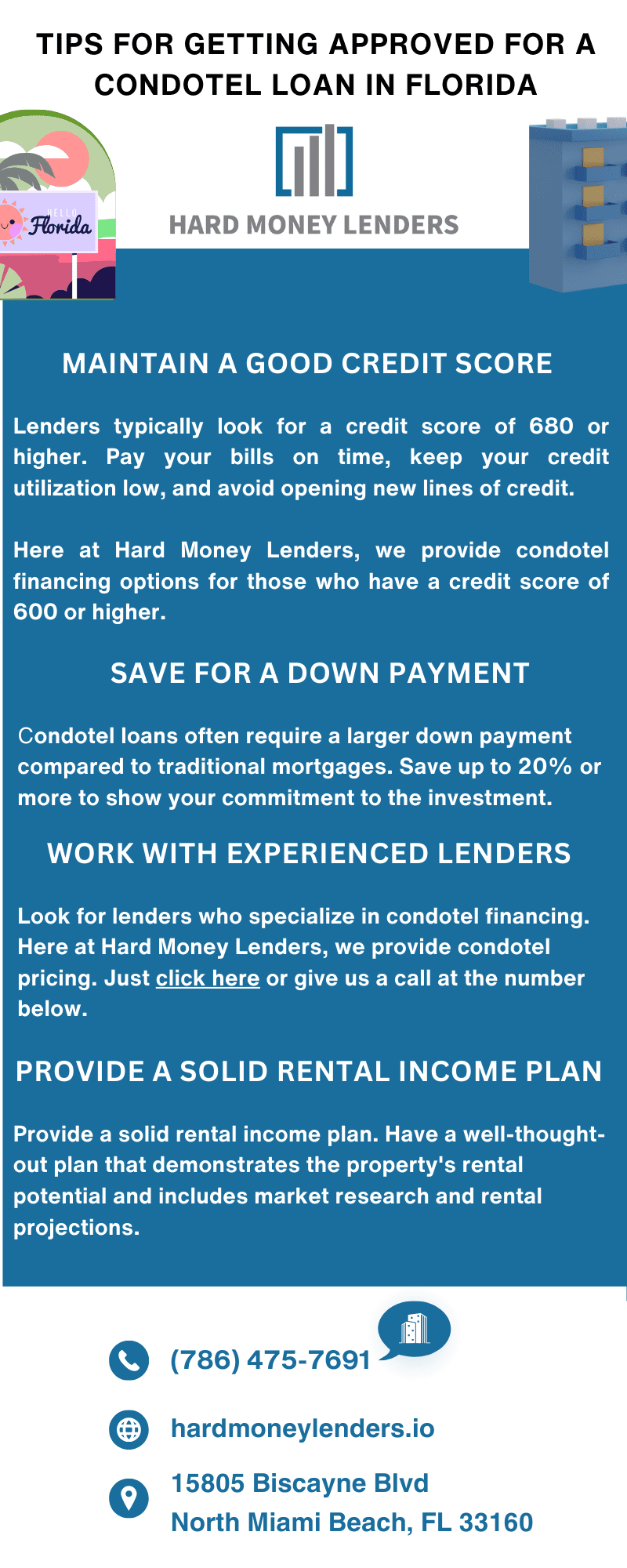

Tips for Getting Approved for a Condotel Loan in Florida

Here are some tips to increase your chances of getting approved for a condotel loan:

- Maintain a good credit score: Lenders typically look for a credit score of 680 or higher. Pay your bills on time, keep your credit utilization low, and avoid opening new lines of credit. However, here at Hard Money Lenders, we provide condotel financing options for those who have a credit score of 600 or higher.

- Have a stable income: Typically, lenders want assurance that you can afford the mortgage payments. Make sure you have a steady income and provide necessary documentation such as pay stubs and tax returns.

- Save for a down payment: Condotel loans often require a larger down payment compared to traditional mortgages. Save up to 20% or more to show your commitment to the investment.

- Work with experienced lenders: Look for lenders who specialize in condotel financing. They will have a better understanding of the unique aspects of the loan and can guide you through the process.

- Provide a solid rental income plan: Have a well-thought-out plan that demonstrates the property’s rental potential and includes market research and rental projections.

By following these tips, you can increase your chances of getting approved for a condotel loan and secure financing for your investment.

Managing Your Florida Condotel Investment:

Once you’ve secured your condotel investment in Florida, it’s important to manage it effectively to ensure its success. Here are some tips to help you manage your Florida condotel investment:

- Hiring a Professional Management Company: Consider working with a reputable management company that specializes in condotel properties. They can handle the day-to-day operations, including maintenance, housekeeping, and guest services, freeing up your time and ensuring a seamless experience for guests.

- Maintaining the Property: Regular upkeep and maintenance are essential to keep your condotel in top condition. Schedule routine inspections, address any repairs promptly, and keep the property clean and inviting to attract guests.

- Navigating Occupancy Rates and Rental Income: Keep a close eye on occupancy rates and rental income to gauge the performance of your investment. Analyze market trends, adjust pricing strategies, and explore marketing opportunities to maximize occupancy and revenue.

- Providing Excellent Guest Experiences: Positive guest experiences are key to attracting repeat customers and positive reviews. Ensure that your condotel offers a comfortable and enjoyable stay by providing quality furnishings, amenities, and responsive customer service.

- Stay Informed About Local Regulations: Familiarize yourself with local regulations and guidelines for condotel rentals in Florida. Stay up to date on any changes or updates to ensure compliance and avoid any potential legal issues.

By effectively managing your Florida condotel investment, you can optimize the returns and make the most out of your property. It’s essential to stay proactive, informed, and committed to providing an exceptional experience for guests.

Florida Condotel Exit Strategies

As a condotel owner, it’s important to have a clear exit strategy in mind for when you’re ready to sell or transition your investment. Here are two common Florida condotel exit strategies to consider:

- Selling your condotel investment: When the time comes, you can list your condotel on the market and sell it like any other property. Working with a reputable real estate agent who specializes in condotels can help you attract potential buyers and negotiate a favorable sale price.

- Converting your condotel into a regular condominium: If you’re looking for a more long-term investment approach, you may choose to convert your condotel into a regular condominium. This process involves removing any rental restrictions and transforming the property into a traditional residential unit. However, it’s important to consider local regulations and consult with professionals familiar with this process.

Regardless of the exit strategy you choose, it’s crucial to research market conditions, consult with professionals, and understand any legal and financial implications. Planning ahead will help you make an informed decision and maximize your investment returns.

Final Thoughts on Florida Condotels and Financing Options

Condotel financing in Florida presents a unique investment opportunity for individuals interested in owning a slice of paradise. Before diving into this market, it is essential to understand the characteristics of condotels and weigh the pros and cons.

Remember to carefully evaluate factors such as interest rates, loan terms, and eligibility requirements. Successful management of your condotel investment involves staying informed about occupancy rates and rental income trends. Lastly, consider your exit strategy, whether selling your condotel or converting it into a regular condominium. With careful research and planning, condotel ownership in Florida can be a rewarding and profitable venture.

Questions People Also Ask About Condotels & Condotel Financing in Florida

When considering condotel financing in Florida, you might have specific questions and concerns. Here are answers to some commonly asked questions about condotels and condotel loans in Florida.

Are condotels a good investment in Florida?

When it comes to Florida condotel investments, every person’s situation is different. However, Florida condotels may provide attractive investment opportunities. When considering them and looking for Florida condotel loans, here are some key points to focus on:

- Location: Condotels in prime tourist destinations like Miami, Orlando, or the Keys may have higher occupancy rates due to their appeal to vacationers.

- Management: Effective management is crucial as it can impact the profitability of the investment through successful marketing, maintenance, and customer service.

- Rental Revenue: Investors can potentially earn income from the rental pool when they are not using the unit. However, the income must be balanced against management fees and other expenses.

- Market Trends: The real estate market is subject to cycles. The right timing in the market cycle could make a condotel a better investment.

- Maintenance and Upkeep: Since the units are part of a hotel, there can be higher standards for furnishings and maintenance, which can lead to additional expenses.

- Financing: Obtaining financing for a condotel can be more challenging than for a traditional condominium, making the initial investment potentially more onerous.

- Liquidity: In times of economic downturn, condotels might be harder to sell compared to traditional real estate due to their specialized nature.

Can I use a mortgage loan to finance a condotel?

Yes, you can use a mortgage loan to finance a condotel, similar to financing a traditional home purchase. However, it’s important to research Florida regulations on short-term rentals as they can impact your potential rental income.

Is it easier to get a hard money loan than a traditional loan for a condotel?

Generally, obtaining a hard money loan can be easier than securing a traditional loan for a condotel since hard money lenders focus on the value of the physical property rather than the borrower’s creditworthiness. Traditional lenders might be hesitant to finance condotels due to their mixed-use nature, higher risk profile, and the challenges in reselling them in case of default.

Hard money loans offer several benefits for condotel financing in Florida. They often provide quicker approval times, as these lenders typically have less stringent underwriting processes. Moreover, hard money loans can be more flexible in terms of repayment schedules and collateral requirements.

What are the closing costs associated with condotel loans in Florida?

Closing costs associated with condotel loans in Florida typically include fees for the loan origination, title search, title insurance, appraisals, and possibly higher lender fees due to the unique nature of condotel financing. There may also be state-specific fees and taxes. It’s important to consult with a real estate professional and a lender who has experience with condotels to get an accurate estimate of the closing costs for your specific transaction.

What factors affect my eligibility for a condotel loan in Florida?

Eligibility for a condotel loan in Florida is influenced by the borrower’s credit score, down payment size, debt-to-income ratio, and the financial health and occupancy rates of the condotel development.

Is it a good investment to buy a condotel in Florida with financing?

Whether it’s a good investment depends on market conditions, location, management effectiveness, and rental demand. Financing adds to the cost, so potential returns must be weighed against interest rates and loan terms.

What are the differences between condotel financing and traditional mortgage options?

Condotel financing typically involves higher interest rates, larger down payments, shorter loan terms, and stricter eligibility criteria compared to traditional mortgages due to the higher perceived risks.

At Hard Money Lenders, we provide a number of loan options that may help with your Florida condotel financing needs. Check them out here.

What are the long-term financial implications of financing a condotel investment in Florida?

Long-term implications include the potential for positive cash flow from rental income, appreciation in property value, ongoing maintenance costs, and the impact of loan repayments on financial liquidity.

What are the typical maintenance and operating costs associated with owning a financed condotel in Florida?

Typical costs include homeowners’ association (HOA) fees, property management fees, insurance, property taxes, repairs, and utilities, which may fluctuate based on the property’s usage and rental occupancy.

What is the minimum credit score requirement for condotel loans in Florida?

The minimum credit score typically varies by lender but generally ranges from 620 to 680. Some lenders may require higher scores for condotel loans. However, at Hard Money Lenders, our minimum credit score for condotel loans in Florida is only 600.

Do I need a larger down payment for a condotel compared to a regular condo in Florida?

Yes, down payments for condotels are usually larger, often ranging from 20% to 50%, compared to conventional condos due to the higher risk associated with condotels as investment properties. It all depends on your lender, you can give our team at Hard Money Lenders a call at (786) 475-7691.

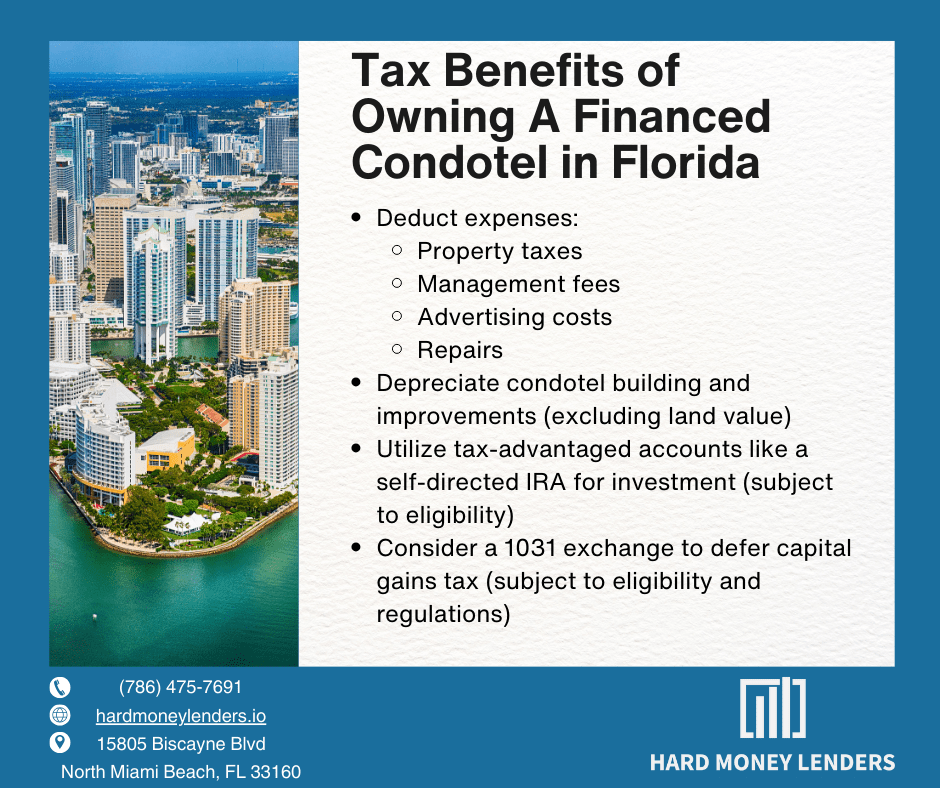

What are the tax benefits of owning a financed condotel in Florida?

Tax benefits may include deducting mortgage interest, property taxes, operational expenses, depreciation, and other related expenses against rental income. Consult a tax advisor for specific benefits.

What are the key factors to consider when evaluating a condotel property for investment potential and financing?

Key factors include location, developer reputation, rental income history, occupancy rates, association fees, property condition, market trends, and the terms of the loan being considered.

Can I get a condotel loan with bad credit in Florida?

It may be possible, but it’s challenging with most lenders. Borrowers with bad credit may face higher interest rates and larger down payments or may need to consider alternative financing options or cosigners. With Hard Money Lenders, our minimum credit score requirement for condotel loans in Florida is only 600.

What are the financing options available for pre-construction condotels in Florida?

Financing options may include developer financing, hard money loans, portfolio loans, or seeking investors. Traditional lenders are generally less likely to finance pre-construction condotels.

How can I finance a condotel purchase as a first-time investor in Florida?

First-time investors can consider portfolio lenders, credit unions, or regional banks that offer condotel loans or possibly developer financing but should expect stricter loan requirements. You can also consider hard money loans, which typically have more lenient loan requirements.

What are some strategies to manage the risk of fluctuating rental income from a condotel?

To mitigate the risk of fluctuating rental income from a condotel, consider these strategies:

- Diversification: Invest in multiple condotels or properties to spread risk.

- Reserve Funds: Maintain a reserve fund to cover periods of low occupancy or unexpected expenses.

- Fixed Costs: Lock in fixed mortgage rates to stabilize monthly expenses.

- Active Marketing: Employ strategic marketing efforts to increase visibility and attract renters.

- Professional Management: Hire a professional property management company to optimize rental income and maintain high service standards.

- Rental Pools: Participate in a rental pool program to even out income among condotel owners.

Can I refinance a condotel loan in Florida, and what are the benefits?

Yes, it is possible to refinance a condotel loan in Florida, although options are more limited compared to traditional mortgages due to the unique nature of condotels. Refinancing a condotel loan can potentially lower your interest rate, reduce your monthly payment, adjust your loan term, or allow you to tap into the property’s equity.

The benefits of refinancing could also include the possibility of transitioning from an adjustable-rate to a fixed-rate loan for more predictable payments.

What are the best Florida cities or areas for condotel investment?

When considering a condotel investment in Florida, potential buyers often look at cities with high tourism rates, desirable weather, and strong rental markets. Cities like Miami, Orlando, Fort Lauderdale, and Tampa are popular due to their consistent flow of tourists and business travelers.

Beachfront properties in locations such as Miami Beach, Daytona Beach, and the Florida Keys also show promising returns due to their appeal to vacationers.

However, investors should consider local regulations, seasonal property demand, and area-specific market trends when selecting an investment location.

What amenities and features are most desirable in a Florida condotel for rental purposes?

Desirable amenities and features in a Florida condotel for rental purposes typically include close proximity to beaches, tourist attractions, and business centers. Facilities such as swimming pools, fitness centers, full-service spas, on-site restaurants, and concierge services enhance the attractiveness for vacationers.

Additionally, units that offer modern conveniences, such as full kitchens, in-unit washers and dryers, spacious balconies, and high-speed internet access, are likely to be in higher demand. It is crucial for condotels to maintain a competitive edge by offering the amenities that travelers expect from a luxury hotel experience.

What are some tax-saving strategies for condotel ownership in Florida?

Tax-saving strategies for condotel ownership in Florida might include deducting expenses such as property taxes, management fees, advertising costs, and repairs from the rental income.

Additionally, depreciation can be claimed on the condotel building and improvements, excluding the land value. It’s important for owners to keep thorough records and possibly consult with a tax advisor who is experienced in real estate and knowledgeable about specific Florida tax regulations.

Utilizing tax-advantaged accounts like a self-directed IRA for investment or considering a 1031 exchange to defer capital gains tax might also be beneficial, subject to specific eligibility criteria and regulations.

Can I use a condotel for personal use alongside generating rental income?

Yes, you can use a condotel for personal use while also generating rental income. Many condotel owners enjoy the flexibility of using their unit as a vacation home and renting it out when it’s not in use.

However, the number of days the owner can occupy the unit may be limited by the hotel management company or governed by IRS rules for tax deductions related to rental properties. It’s important for owners to understand and comply with these regulations and with any rental program agreements that may stipulate owner usage restrictions.

How do condotel returns compare to investment options like rental properties or stocks?

Condotels may offer the potential for rental income and property appreciation, but they often come with higher management fees and less personal use flexibility. Traditional rental properties may provide more control over the asset, but they require more active management.

Stocks typically offer liquidity and ease of diversification but do not include the tangible asset value or potential rental income of real estate investments. Each investment type has unique benefits and risks, making it important to consider personal financial goals, risk tolerance, and market conditions when making an investment decision.

How can I use leverage for condotel loans in Florida?

Using leverage for condotel loans refers to the practice of using borrowed capital to increase the potential return of an investment. In Florida, obtaining a condotel loan can be challenging due to the unique nature of condotel financing. Traditional mortgage lenders often view these properties as riskier investments.

To employ leverage for a condotel loan, you would typically need to find a lender that specializes in condotel financing and understands the market in Florida. These lenders often require a higher down payment compared to traditional properties, around 20-30% of the purchase price, and may charge higher interest rates to offset the increased risk.

By using a condotel loan, you’re leveraging your investment by controlling the property with a smaller amount of your own capital, while the loan covers the majority. This can enhance your return on investment if the condotel’s value appreciates or it generates significant rental income. However, potential investors should remain cautious, as this approach also amplifies the risk if the investment underperforms.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.