Last Updated on May 7, 2024

With real estate being more competitive than ever in the investing realm, people may find themselves taking unique avenues to find their next deal. Looking in the right places can net a fantastic deal on a property that other investors may not know about, and probate properties are a great example! Probate properties, if you find yourself in the right place at the right time, can be a great investment opportunity. Of course, with greater potential returns, there’s greater risk… so you need to make sure you have a medium to high risk tolerance. Now, navigating the probate process to acquire these properties can be complex. Here at Hard Money Lenders IO, we’ve created A Guide to Buying Probate Properties — read on to learn more.

What is a Probate Property?

Probate assets are assets left by a deceased person who failed to specify an heir for their property. In the case of a probate home, this would mean the owner of the home passed away and did not specify an heir or next of kin to take over the property. In this case, the property is seized by the state and the closest living relatives are appointed to handle the sale of the property.

Are Probate Properties Good Investments?

The answer to this question is relative to your risk tolerance, the research you do, and the condition of the property. Probate properties are often sold by the closest living relatives for much lower than fair market value because they don’t want to deal with the hassle of getting the home in great shape for a sale. Because of this, probate properties can often be picked up on the cheap if you come across someone looking to move on from the property in a hurry!

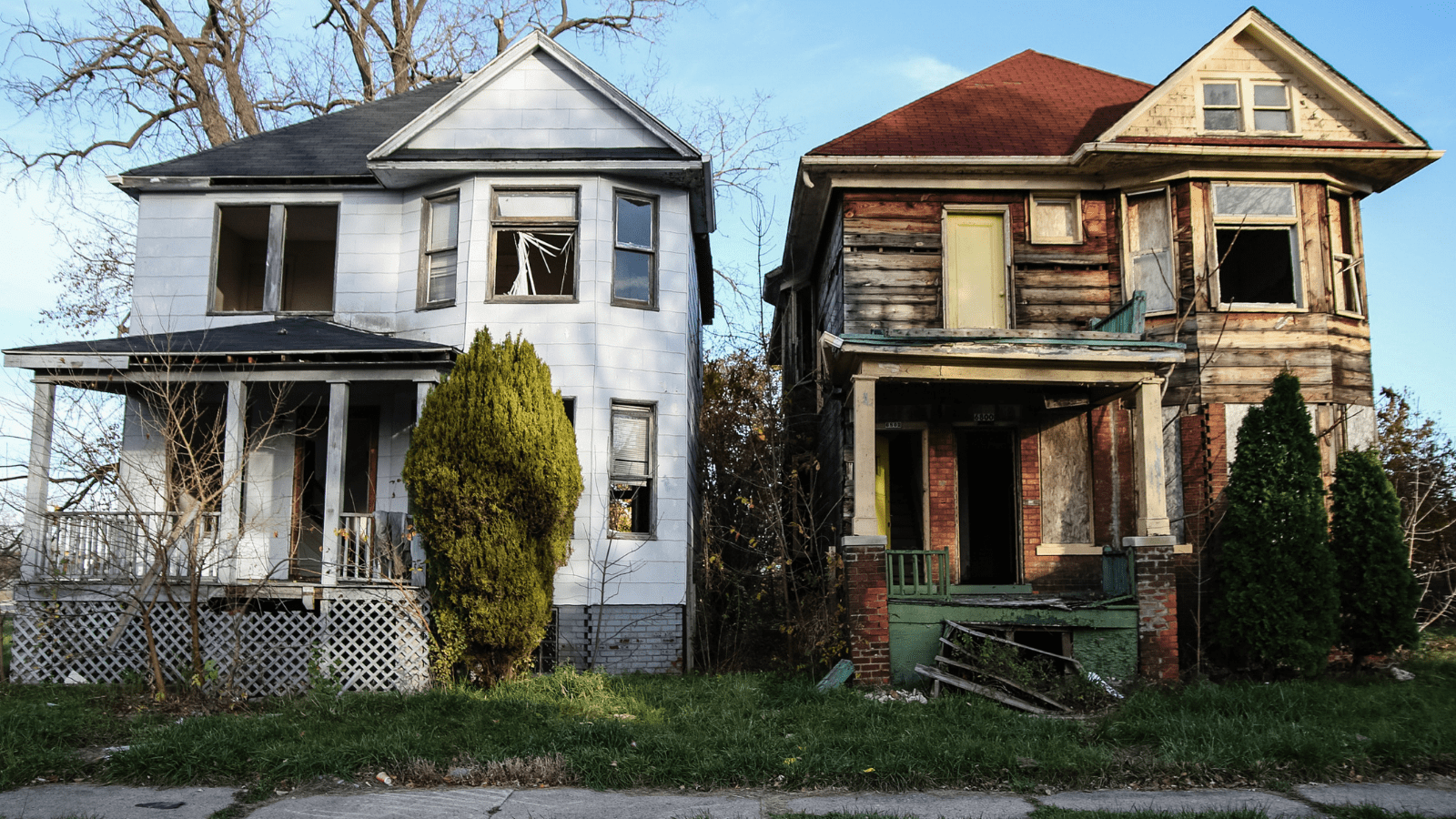

That being said, probate properties come with some pitfalls and additional risk. For one thing, probate properties can be in poor condition if neglected long enough. It’s more likely than not that a probate property will be in need of some kind of repairs, so be prepared to put in some work once ownership is transferred to you.

Additionally, probate properties come with an impressive set of hoops to jump through. Since the state is involved, be prepared for paperwork and drawn-out wait times. Probate properties can take anywhere from 18-36 months to close on compared to the 60 days it takes to close on a traditional property.

If you’re willing to wait out this process, you can secure yourself a potentially great deal on a property! Or, after all that, you may find that the home isn’t as profitable as it once was because of changing market conditions, newfound repair issues, and more — a lot can happen in 1 to 3 years!

Pro Tip: The probate property purchase process can take anywhere from 18 to 36 months to conclude. If you don’t want your money tied up that long, look for investments elsewhere!

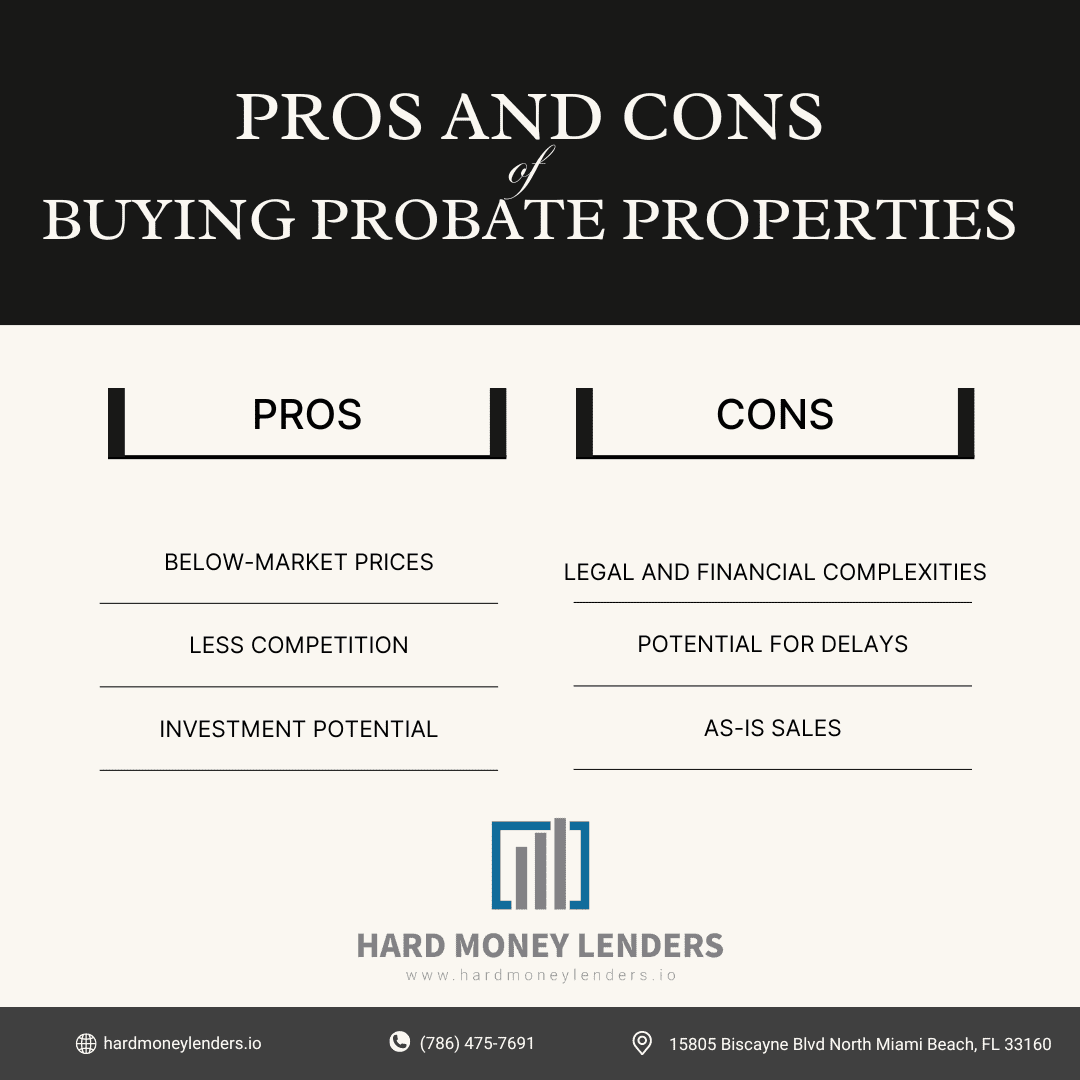

The Pros and Cons of Buying Probate Properties

Investing in probate properties can be an attractive strategy for real estate investors, offering opportunities for significant returns. However, it’s essential to weigh the potential benefits against the challenges involved in these transactions.

Pros of Buying Probate Properties

- Below-Market Prices: One of the most appealing aspects of probate properties is their pricing. These properties are often listed at lower prices compared to similar listings in the area. The reason is simple: estates are usually keen to close the sale quickly to distribute assets among heirs, which often results in below-market pricing to attract immediate interest.

- Less Competition: The unique nature of probate sales, combined with the requirement to navigate legal processes and potentially longer transaction times, tends to deter casual buyers and investors looking for straightforward deals. This reduced competition can be a significant advantage for those willing to engage with the probate process, providing more negotiation power and the opportunity to secure properties at even lower prices.

- Investment Potential: Many probate properties require renovations or updates, which can be off-putting for some buyers but presents a golden opportunity for investors. The chance to refurbish and modernize these properties can lead to substantial increases in value, offering lucrative returns on the investment once the property is resold or rented out.

Cons of Buying Probate Properties

- Legal and Financial Complexities: The process of buying a probate property is markedly different from standard real estate transactions, involving court procedures and the potential for legal challenges from heirs or creditors of the estate. These complexities require a good understanding of probate laws and may necessitate legal counsel, adding to the overall cost and effort involved in the purchase.

- Potential for Delays: The timeline for closing a probate sale can be unpredictable and is generally longer than that of a non-probate sale. The need for court approvals and the possibility of claims against the estate can introduce delays, sometimes extending the process to a year or more. This can be a significant drawback for investors seeking quick turnovers.

- As-Is Sales: Probate properties are typically sold in their current condition, with no warranties or guarantees from the seller. This “as-is” nature means that buyers assume all risks related to the condition of the property. Extensive and potentially expensive repairs may be needed, requiring investors to carefully evaluate the property’s condition and renovation costs before making an offer.

Navigating the pros and cons of buying probate properties requires due diligence, patience, and sometimes a tolerance for risk. However, for those prepared to deal with the complexities, probate real estate offers a pathway to considerable investment opportunities.

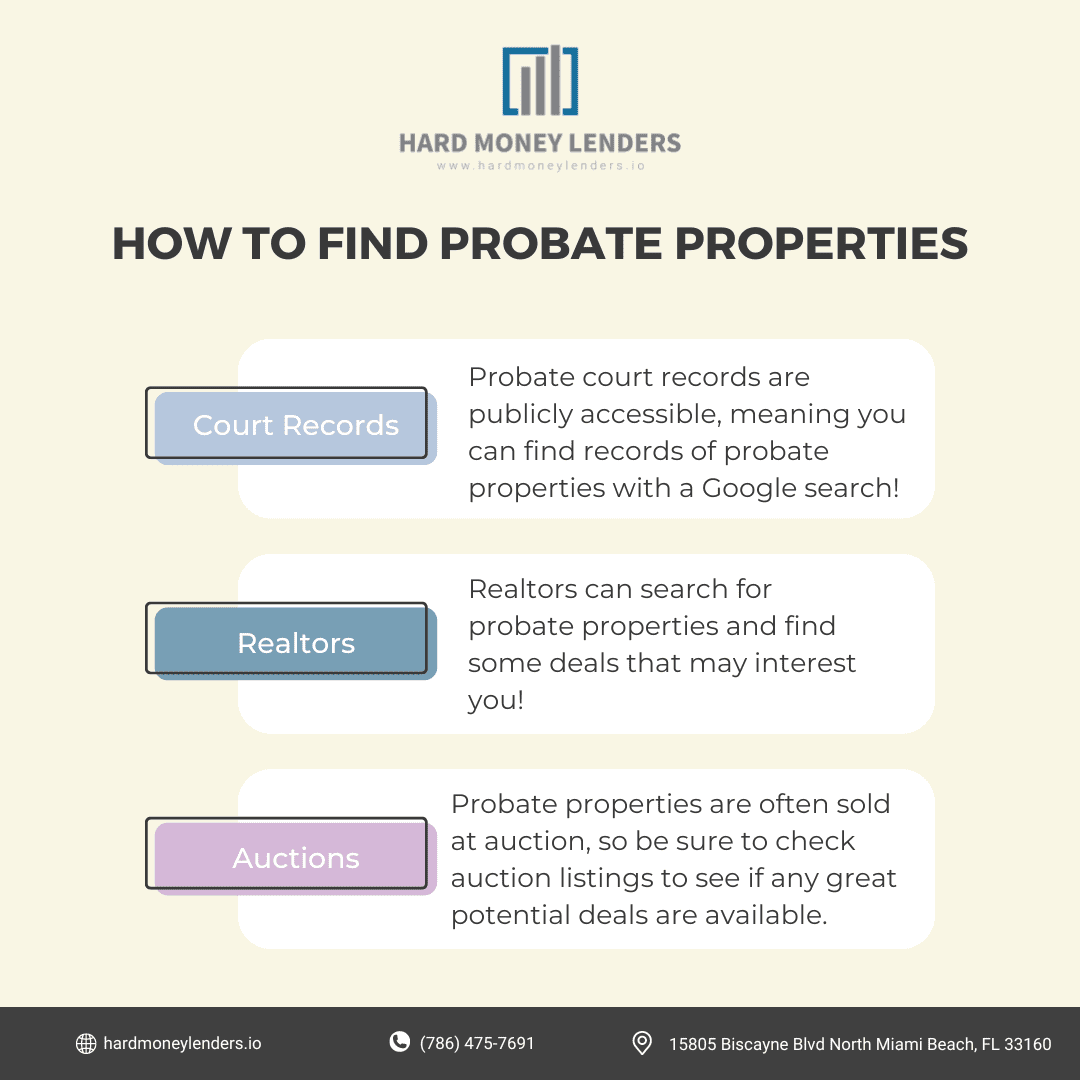

How to Find Probate Properties

Find Probate Properties Through Court Records

Find Probate Properties Through Court Records

Probate court records are publicly accessible, meaning you can find records of probate properties with a Google search! Search your county’s court records online with terms like, “probate list in [x] county,” “probate property list [x] county,” and the like. You should be able to find a list of probate properties that are active, and from there you can continue your investigative work! A great online resource to start doing your research can be found here.

Afterwards, you’ll want to contact the closest living relatives that have been assigned the property rights. If they’re friendly and responsive to your Facebook invite, phone call, or however you choose to contact them, that’s the time to strike up a conversation about putting some money in their pocket and ridding them of this probate property hassle!

Ask Your Realtor ABout Any Probate Property Listings

Having a great relationship with a realtor can make a world of difference in your investments. If your realtor knows you’re serious, they may undertake some of the leg work or have a list of probate properties ready to go for you! Realtors have access to the MLS, a system filled with information on all properties in their area. They can search for probate properties and find some deals that may interest you!

Some realtors that deal with multiple investors may have probate lists ready to access for you and other potential investors. It may be best to seek out a realtor that consistently works with probate property buyers, as the entire process is lengthy and complex. Even if you find a new and eager realtor willing to take on your requests, it might be a better idea to find an experienced realtor who has gone through the probate process multiple times. In the end, it’s down to your personal preference and comfort level with uncertainty.

Research Probate Property Auctions

Probate properties are often sold at auction, so be sure to check auction listings to see if any great potential deals are available. Many investors shy away from bidding on probate properties because of involvement with the probate court and process, but patience may lead to great returns!

Many experienced investors will be at probate auctions hoping to snap up a deal way under fair market value. By joining a crowd of experienced investors bidding on the same probate property, you’ll need to take a risk, do extensive research to know more about the property than others, or outbid others and pay more than anyone else is willing to with the information available.

No matter what, you’ll need to either take a deal that other experienced investors shy away from, or know something that other people in the crowd don’t. Keep this in mind when buying probate properties at auction – what seems like an excellent deal at first might not always be, especially when probate properties tie up your money for years at a time!

How to Buy a Probate Property

Navigating the acquisition of a probate property is a unique journey that requires understanding the nuanced steps involved. The process often unfolds as follows:

- Identification and Research: Initially, identifying a probate property of interest involves research through public records, probate court filings, or real estate agents specializing in such sales. Once a property catches your eye, it’s imperative to conduct a preliminary investigation regarding the estate details and any outstanding liens or claims against the property.

- Making an Initial Offer: After pinpointing a potential property, the next step is to make an offer. This offer is typically directed to the estate’s executor or the attorney handling the probate proceedings. It’s important to note that this initial offer is just the beginning of the negotiation process.

- Court Involvement: Unlike traditional real estate transactions, the purchase of a probate property often requires court approval. This step ensures that the sale price is fair and in the best interest of the estate and its beneficiaries. The court may mandate the property to be listed for sale publicly, often through an auction, to guarantee a transparent transaction that yields fair market value.

- Auction Process: If the court orders a public auction, the property is offered to all interested parties, including the initial offeror. This process ensures a level playing field, allowing any interested buyer to submit bids. The highest bid is then subject to court approval.

- Final Court Approval: The final step involves securing court approval for the sale. This stage formalizes the transaction, granting the buyer the right to proceed with the purchase under the terms agreed upon at auction or through the initial offer process.

Pro Tip: Use tools such as our Fix and Flip Calculator to get an idea of the financials you’ll have to hit to make the project profitable based on estimates.

Making an Offer on a Probate Property

Crafting an offer on a probate property is a delicate balance of competitiveness and financial prudence. Here’s how to approach it:

- Due Diligence: Conducting a thorough due diligence process is critical. This involves evaluating the property’s condition, estimating repair and renovation costs, and understanding any legal encumbrances that might affect the property. This assessment forms the basis of your offer and prepares you for any necessary work post-purchase.

- Offer Strategy: Your offer should reflect both the property’s current state and its potential value. While it’s tempting to lowball in hopes of a great deal, remember that probate sales aim for fair market value to benefit the estate’s heirs. Therefore, your offer must be competitive but also account for the renovation costs and any other unforeseen expenses.

- Flexibility and Patience: The probate sale timeline can be unpredictable, often requiring buyers to wait for court hearings and approvals. Your ability to remain flexible and patient during this period can be a significant advantage. Additionally, be prepared for the possibility of a public auction, which could pit you against other interested buyers.

- Court Approval: Understand that your offer, while accepted by the executor or attorney, ultimately needs court approval. This step can introduce a waiting period into the transaction, during which the court reviews the offer’s fairness and adequacy in representing the estate’s best interests.

Financing Probate Property Purchases

Financing a probate property does indeed present unique challenges, but with the right strategy, it’s entirely manageable. Here are detailed approaches to secure financing:

- Pre-Approval and Proof of Funds: Before diving into the probate market, obtaining pre-approval for a loan demonstrates to the estate’s executor and the court that you are a serious buyer with the means to complete the purchase. Similarly, if you’re buying with cash, having proof of funds ready can expedite the process.

- Exploring Alternative Financing: Given that many traditional lenders may balk at financing probate properties, especially those in disrepair, looking into alternative financing sources is prudent. Hard money loans, which are short-term, high-interest loans from private investors, can be a viable option. These loans are often more flexible regarding the property’s condition and can be disbursed quickly.

- Partnering with Investors: For those without immediate access to large sums of cash or hesitant to take on high-interest loans, partnering with real estate investors can provide the necessary capital. This approach requires a clear agreement on the investment terms and profit sharing.

- Renovation Loans: If the property requires extensive repairs, a renovation loan might be appropriate. These loans consider the property’s potential value after improvements, providing funds for the purchase and the renovation.

Closing the Deal

Closing the Deal

The closing process for a probate property does require additional steps and considerations:

- Court Approval: One of the most significant differences in closing a probate sale is the need for court approval. This legal oversight aims to protect the interests of the estate and its beneficiaries, ensuring the sale is conducted fairly and transparently.

- Addressing Claims: Part of closing a probate sale may involve resolving claims against the estate, whether from heirs, creditors, or other parties. A real estate attorney with experience in probate sales can be invaluable in navigating these issues, ensuring that the sale proceeds without legal entanglements.

- Understanding the Timeline: The probate sale timeline can be longer and more unpredictable than traditional real estate transactions, primarily due to the court involvement and the need to address any claims. Patience and flexibility are crucial during this phase.

Closing Thoughts

Buying a probate property is a difficult process. Whether it be finding active probate properties, bidding against others at an auction, bidding again against others in probate court, or finalizing the purchase process with an agent, it’s a headache from start to end.

The property is not able to be inspected before putting down a 10% down payment, and you cannot back out of the purchase without losing your 10% in the process. You won’t be able to make any contingencies on your offer, either, and it’s a “take it as it is” situation. Worst of all, your money can be tied up for 18 to 36 months while finalizing your purchase — an investor’s worst nightmare!

All that being said, why on earth would someone be interested in a probate property? Well, probate properties are often sold extremely cheap — it’s not unheard of to get a property at only 40% of fair market value at a probate auction. For those with the patience, diligence, and high appetite for risk, probate properties can have a huge potential payoff.

Questions People Also Asked About Buying Probate Properties

What makes financing probate property purchases more challenging than standard real estate transactions?

Financing probate properties can be particularly challenging due to the condition of the property and the intricacies involved in the probate process. Many lenders are cautious about financing these purchases because probate properties often require substantial renovation, which can add risk to the loan.

Now, the legal process surrounding probate sales can introduce uncertainties that lenders are typically not equipped to manage. To mitigate these challenges, obtaining pre-approval for financing and being able to demonstrate proof of funds are crucial steps in strengthening your offer.

Exploring alternative financing options, such as hard money loans, can also be beneficial. These loans are more flexible regarding property condition and can be disbursed quickly, making them a suitable option for properties needing significant work.

What additional steps are involved in closing a deal on a probate property?

Closing a deal on a probate property includes several additional steps not usually found in standard real estate transactions. One of the primary differences is the requirement for court approval, which can add time and complexity to the closing process. Additionally, there may be claims from heirs or creditors associated with the estate that need to be addressed before the sale can proceed.

Working with a real estate attorney who has experience with probate sales is invaluable in navigating these challenges. An attorney can help ensure that all legal requirements are met, assist in resolving any claims against the estate, and guide you through the court approval process.

How can I increase my chances of success when buying probate properties?

Success in purchasing probate properties often hinges on three key factors: due diligence, education, and networking. Thoroughly understanding the legal and financial aspects of probate sales is essential. This knowledge can be gained through dedicated research, attending seminars on real estate investment, and seeking out educational resources specific to probate properties.

Building a strong network of professionals, including real estate agents who specialize in probate sales, attorneys, and contractors, can provide invaluable support and insight throughout the buying process. Being well-informed and connected allows you to act quickly and decisively when opportunities arise, significantly increasing your chances of successfully purchasing and profiting from probate properties.

What are the risks involved in buying a probate property?

Investing in probate properties, while potentially lucrative, comes with its unique set of challenges and risks. One significant risk is the legal and financial complexities inherent in the probate process, including potential disputes among heirs or claims against the estate that could impact the sale or future ownership of the property.

Since probate sales are typically conducted “as-is,” buyers assume all risks related to the property’s condition, which may require extensive and costly repairs. This aspect can be particularly daunting if there are hidden defects or structural problems not immediately apparent during initial inspections. Another notable risk is the duration of the probate process itself, which can be lengthy and unpredictable, often extending for months or even years.

This extended timeframe can lead to prolonged periods where your capital is tied up in the property, delaying your ability to realize any return on your investment. Lastly, navigating the probate court’s requirements and securing approval for the sale can introduce additional delays and complications, requiring investors to be patient and flexible throughout the process.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.

Find Probate Properties Through Court Records

Find Probate Properties Through Court Records