Average Net Profit for Flipping a House in 2024

The ultimate goal of house flipping is to purchase a property for below-market value, renovate it, then sell it for a profit. As we move through 2024, understanding the nuances of net profit in house flipping becomes increasingly crucial, especially given the unpredictability of market conditions. Flipping a house can be, and has been, extremely profitable for many investors over the years if done correctly. But, what exactly is the average net profit from flipping a house? Below, we’ll explore the average net profit from flipping a house in 2024 and what you can expect.

| Metric | Q3 2023 Data [1] | 2024 Projections |

| Total Flips | 72,543 | 75,000 (Estimate) |

| Flipping Rate | 7.2% | 7.5% (Estimate) |

| Previous Quarter Flipping Rate | 7.9% | 8.1% (Estimate) |

| Year-over-Year Flipping Rate | 7.7% | 7.9% (Estimate) |

| Profit Margin | 29.8% | 30.5% (Estimate) |

| Average Raw Profit | $70,000 | $75,000 (Estimate) |

| Median Resale Price | $305,000 | $320,000 (Estimate) |

| Median Purchase Price | $235,000 | $245,000 (Estimate) |

Net Profit Margin

The net profit margin measures how much net income or profit is generated as a percentage of revenue. This includes the profit you make after you sell the house once all expenses associated with the flipping process have been accounted for.

The net profit margin measures how much net income or profit is generated as a percentage of revenue. This includes the profit you make after you sell the house once all expenses associated with the flipping process have been accounted for.

Each house flipper’s net profit margin will differ based on their individual circumstances.

Suppose the investment property you’re interested in is listed well below-market value and won’t cost a significant amount of money to renovate. In that case, you’re likely to turn a pretty good profit on it.

Conversely, if the property is overpriced and will still require significant upgrades, there’s a good chance that you end up losing money in the transaction.

Understanding Net Profit in House Flipping

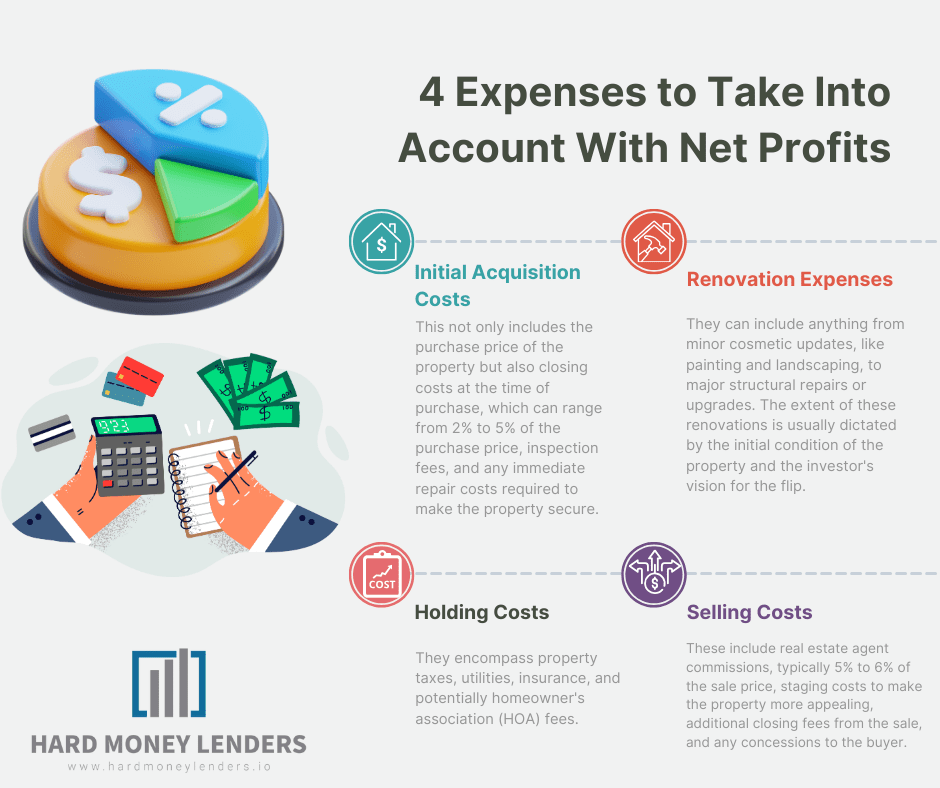

Net profit in house flipping is a critical metric that encapsulates the financial success of flipping endeavors. It is the final figure an investor is left with after all the expenses related to the flip are settled. To dive deeper, let’s categorize and examine these expenses.

- Initial Acquisition Costs: This not only includes the purchase price of the property but also closing costs at the time of purchase, which can range from 2% to 5% of the purchase price, inspection fees, and any immediate repair costs required to make the property secure.

- Renovation Expenses: These are often the most variable and significant costs in flipping. They can include anything from minor cosmetic updates, like painting and landscaping, to major structural repairs or upgrades. The extent of these renovations is usually dictated by the initial condition of the property and the investor’s vision for the flip. Successful flippers often work with a trusted contractor to get accurate estimates and manage renovations efficiently.

- Holding Costs: These are the costs incurred from owning the property during the flip. They encompass property taxes, utilities, insurance, and potentially homeowner’s association (HOA) fees. The longer the flip takes, the higher these costs accumulate, impacting the net profit.

- Selling Costs: Once the property is ready to be sold, selling costs come into play. These include real estate agent commissions, typically 5% to 6% of the sale price, staging costs to make the property more appealing, additional closing fees from the sale, and any concessions to the buyer.

Understanding and meticulously planning for these expenses is paramount for flipping success. Investors often use a buffer in their budget for unexpected costs, ensuring the net profit remains positive even when surprises arise.

Calculating Net Profit for House Flipping

To ensure a profitable flip, investors must accurately calculate the potential net profit before committing to a project. This calculation involves several steps:

- Assessing the Purchase Price: This is the foundation of the flip’s financials. Investors use various strategies to find below-market-value properties, including foreclosures, short sales, or properties in need of significant repair.

- Estimating Renovation and Repair Costs: Based on a detailed inspection and assessment, investors should list all required renovations and repairs, categorizing them into must-haves and nice-to-haves. Working with experienced contractors for accurate estimates and timelines is crucial here.

- Calculating Holding Costs: Using the expected duration of the flip, investors calculate all associated holding costs. This requires knowing local tax rates, average utility costs, insurance premiums, and any HOA fees, then projecting these over the holding period.

- Anticipating Selling Costs: By understanding local real estate market norms, investors can forecast selling costs, including agent commissions, staging expenses, and any expected concessions to the buyer.

- Adding a Contingency Buffer: Experienced flippers typically add a contingency buffer of 10% to 20% of the total estimated costs to safeguard against unexpected expenses.

By subtracting the total expenses (including the purchase price, renovation costs, holding costs, selling costs, and contingency buffer) from the anticipated selling price, investors can estimate the net profit. This comprehensive approach allows for informed decision-making, ensuring that each flip has the best chance of being profitable in the ever-changing 2024 market landscape.

The 2024 Real Estate Market Overview

The real estate market in 2024 is navigating through a period of unprecedented volatility, making the house flipping landscape both challenging and potentially rewarding. This volatility is influenced by several macroeconomic factors.

- Economic Policies: Changes in government housing policies, tax laws, and investment incentives directly affect the real estate market’s dynamics. Flippers need to stay abreast of these changes to adapt their strategies accordingly.

- Interest Rates: The Federal Reserve’s stance on interest rates significantly impacts borrowing costs. Lower rates can stimulate buying activity, making it an ideal time for flippers to sell. Conversely, higher rates may cool down the market, affecting selling prices and times.

- Regional Developments: Local factors such as new employment opportunities, infrastructure projects, or changes in zoning laws can dramatically affect property values in specific areas. Savvy investors monitor these developments closely, targeting areas poised for growth or recovery.

- Market Phases: Different regions can be in different phases of the real estate cycle, from burgeoning buyer’s markets with ample inventory and lower prices to seller’s markets where high demand pushes prices up. Understanding these phases allows investors to tailor their purchasing and selling strategies to maximize profit.

Navigating this landscape requires a keen understanding of both national trends and local market conditions, making thorough research and flexibility key components of a successful flipping strategy.

How much should I pay for an investment property?

Unfortunately, there is no set amount that you should look to pay for an investment property. Every situation is different and is dependent on your own personal circumstances. However, there are some general guidelines that you should follow when determining the right price to pay for a house.

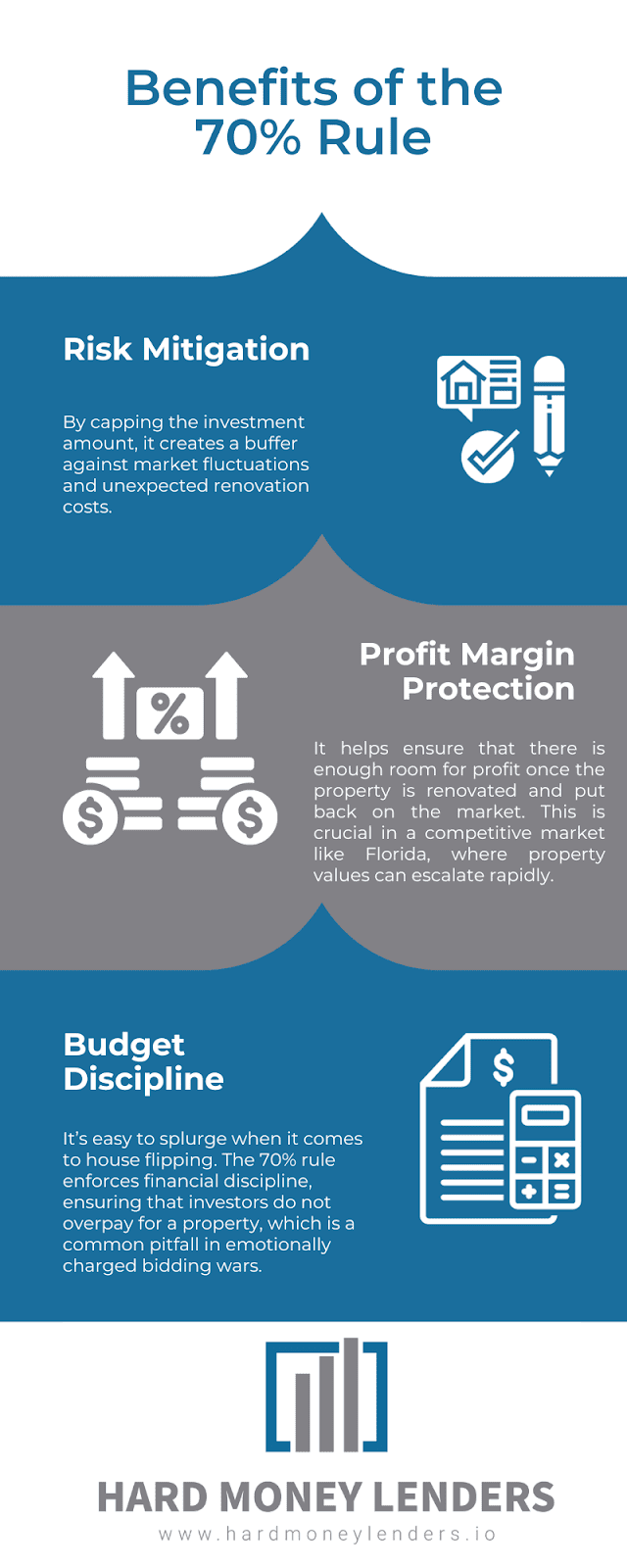

Using the 70% Rule to Maximize Net Profit When Flipping a House

Ideally, you should spend no more than 70% of the property’s ARV (After Repair Value) on the property. In other words, your anticipated profit margin should be at least 30% of the final sales price.

The ARV, short for After Repair Value, is the estimate of a given property’s value after all repairs and upgrades are completed. It is used to determine the margin between a home’s current value, and the value it will have after renovations. We call this a “rule”, but it isn’t a totally rigid one. It should serve as the basis for a thorough market analysis, but it can be a very powerful tool in your decision making process.

However, there is an important caveat to consider. A 30% anticipated profit margin does not necessarily mean you walk away with exactly 30% in profit, as some may imagine. Part of the reasoning behind the 70% rule is that you need a cushion to cover any expenses left at the end of the day; these could include agent commissions, title inspections, lender fees, and any other miscellaneous expenses included in closing.

Buying a property, especially a house to flip, is never easy. There are always many different factors to keep in mind when making your decision. It goes without saying that how much you’ll pay is the number one factor among them.

When you’re planning on investing more in the interest of making a property more viable on the market— that is, renovating and flipping the property— you’re always going to need to account for the costs incurred by repairs and upgrades.

The 70% Rule for House Flipping is Simple, But Powerful

Your profits all rest on the relationship between your expenses and the final sale price, and the 70% rule serves as a simple way to determine how much you’re willing to invest, and whether those investments will be worth it. The 70% rule works so well because it is so simple: there’s very little to complicate your calculations. It forces you to consider the two most important numbers in house flipping, those being the ARV and the repair costs.

None of this is to discount the significance of other numbers, such as the soft costs you may face during the renovation process.

However, you really do need to keep the ARV and your repair costs in mind every step of the way, even before you embark on a more thorough analysis.

If anything, the 70% rule can be thought of as the first preliminary step of that analysis, a simple way to determine whether investing your time and money is likely to pay off in a given case.

Factors to consider when determining average net profit

How much money or capital do you have to work with?

One of the most obvious factors that will impact the amount of houses you are able to flip in one year is the amount of money, or capital, that you have to work with. Even though you are able to fund up to 90% of the investment property with a hard money loan, you will still be required to invest some of your own personal money.

As you can probably imagine, capital plays a huge role in the amount of houses you’re able to flip consecutively and simultaneously. For example, if you have an abundance of capital at your disposal, it may be possible for you to flip multiple houses at one time. On the other hand, if you’re working with a limited amount of money, you may only be able to take on one house flipping project at a time, requiring you to work in a linear fashion, as opposed to simultaneously.

The amount of money, or capital, that you have to work with when flipping houses will vary from person to person, and it’s important to remember to strategize what will work best for you financially, and to not overextend yourself and take on more than you can handle.

You can check out our hard money loan calculator and our fix and flip calculator to help you determine the potential expenses and profit margins associated with flipping a house.

Locating properties

Your ability to locate undervalued properties can also affect the amount of houses you’re able to flip realistically. This is one of the most difficult steps in the house flipping process, and if you can find a way to quickly and efficiently find homes that have the potential to be flipped, you can maximize your average net profit.

There are a number of ways to locate houses for below-market prices in your area. The first thing you should consider doing is using your network. While it is not always a 100% guarantee that you will find a house to flip this way, there’s always a chance that you may find a lead or two by communicating with others in your community. Believe it or not, word of mouth is still important, and if you know the right people, there’s a possibility you can find out about deals as they are hitting the market.

An excellent way to connect with other real estate investors and realtors who have access to valuable information is to join a community real estate group. The chance of locating a great property alone makes it worth joining, and it can also serve as a fun and informative way to network with others in the industry.

How much time do you have to work with?

Time can be an enormous constraint when it comes to determining your average net profit from house flipping.

First off, you need time to find undervalued properties to purchase. Having a real estate agent assist you can speed up the process, but at the end of the day, finding the right property takes time.

Next, you’ll need time to renovate and repair the property. This can take anywhere from two to six months, depending on the condition of the house and the severity of the renovations needed.

Lastly, factor in your own availability. Are you a full-time house flipper, or do you use it as a side hustle? As a full-time flipper, you may be capable of committing almost all of your time into your business, enabling you to flip upwards of seven houses in a single year. If you only flip houses on the side, you may only be able to fix and flip one to three houses in a single year, depending on the time commitment required by each project.

Housing Market Conditions

Another important factor to consider when trying to determine your average net profit from flipping a house is the current conditions of the housing market. Unfortunately, this is something that you as a flipper will have little to no control over.

In a hot housing market, a house flipper may be capable of reselling a property within just a couple of days after putting it on the market for sale. However, they might struggle to find houses to flip because there is so much competition for houses in that market.

Alternatively, in a cold housing market, a house flipper might be able to find plenty of houses to purchase, but their flips have the potential to sit on the market for months while waiting for a buyer.

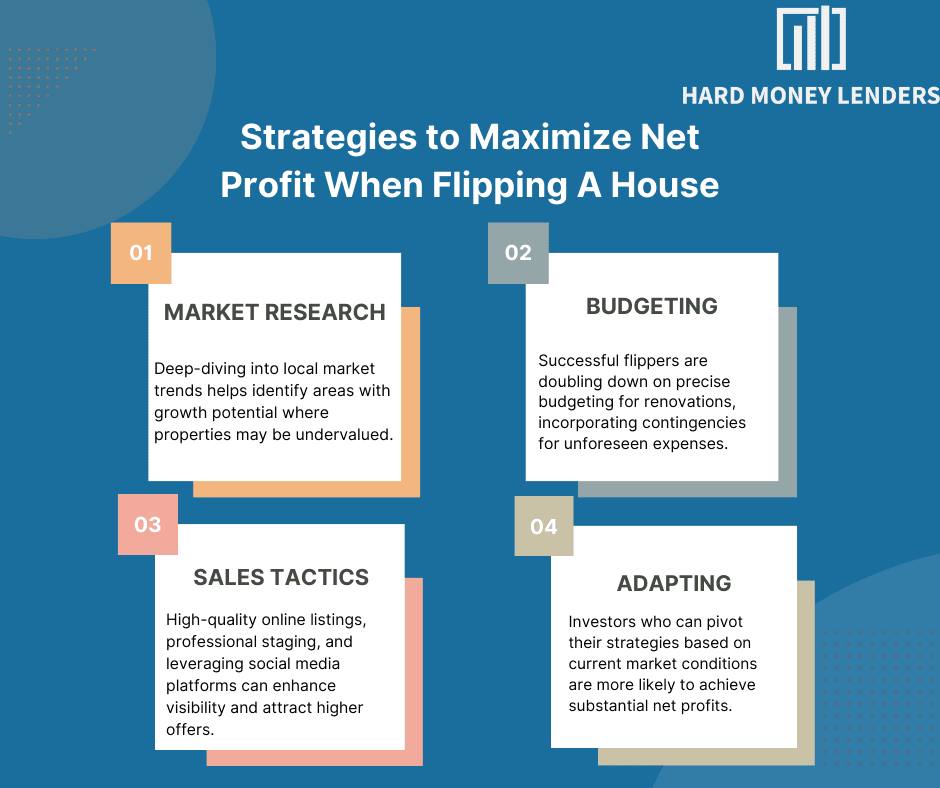

Strategies to Maximize Net Profit When Flipping A House

To maximize net profit in the fluctuating market of 2024, investors are employing strategic approaches:

- Market Research for Undervalued Properties: Deep-diving into local market trends helps identify areas with growth potential where properties may be undervalued. Utilizing data analytics tools and maintaining strong networks with real estate professionals can uncover hidden gems.

- Meticulous Budgeting and Cost Management: Successful flippers are doubling down on precise budgeting for renovations, incorporating contingencies for unforeseen expenses. Negotiating better rates with contractors, purchasing materials in bulk, and choosing renovations that offer the best return on investment are key strategies.

- Innovative Marketing and Sales Tactics: In a crowded market, effectively marketing flipped properties can make a significant difference. High-quality online listings, professional staging, and leveraging social media platforms can enhance visibility and attract higher offers. Additionally, timing the sale to coincide with peak market activity in the region can maximize selling prices.

- Adapting to Market Conditions: Flexibility and adaptability are crucial in 2024’s dynamic market. Investors who can pivot their strategies based on current market conditions—whether it means holding onto a property longer than anticipated or adjusting renovation plans to meet buyer demands—are more likely to achieve substantial net profits.

Final Thoughts on the Average Net Profit For Flipping A House in 2024

The average net profit from flipping a house will vary amongst investors. Each investment opportunity comes with its own individual circumstances. The price of the house, renovation costs, and market conditions are all factors that could affect the net profit from flipping a house.

If you play your cards the right way, you can make anywhere from $30,000 to $60,000 in net profit from flipping a house (potentially more, depending on the market environment). There are a multitude of factors involved, but with the right tools and team around you, you may have the opportunity to be even more successful than you imagined in the house flipping business.

FAQs About Net Profit For Flipping A House in 2024

What is the gross profit of a house flipper?

In 2024, the typical gross profit can be north of $70,000 — depending on the region. Now, gross profit for a house flipper is the financial gain obtained from the sale of a flipped property before deducting any expenses related to the purchase, renovation, and sale of the property. This figure is crucial for understanding the initial success of a flip but doesn’t reflect the net profit after all costs are considered.

Is flipping houses really profitable?

Flipping houses can indeed be profitable, but it significantly depends on the flipper’s ability to navigate the real estate market, manage renovation costs effectively, and sell for a higher price. The profitability also hinges on market conditions, the property’s location, and the economic landscape at the time of both purchase and sale.

Is flipping houses still profitable in 2024?

The profitability of flipping houses in 2024 is expected to continue, influenced by ongoing and emerging real estate market trends, economic conditions, and the strategic decisions of investors. While market dynamics and economic factors can change, informed and adaptable investors can find opportunities for profit in house flipping.

How much does the average house flipper make a year?

Annual earnings from house flipping vary greatly among investors, influenced by the number of flips completed, profit margins per flip, and operational efficiencies. Some flippers may earn significant amounts, particularly if they successfully complete multiple flips with good returns, while others may see lower earnings due to various challenges and market conditions. According to our 2024 projections, the average house flipper can make up to $70,000 per deal.

How do you calculate net profit when flipping a house?

Calculating the net profit from flipping a house is a crucial step for real estate investors, providing clear insight into the financial success of their venture. To ensure accuracy and a comprehensive understanding, it’s essential to meticulously account for every cost incurred from acquisition to sale. Here’s an expanded guide on how to calculate net profit when flipping a house:

Step 1: Determine the Final Sale Price

The final sale price is the amount the property is sold for, not including any concessions or credits given to the buyer. This figure is the gross revenue from the flip and serves as the starting point for calculating net profit.

Step 2: Calculate the Purchase Price of the Property

This is the initial acquisition cost of the property. It includes the price paid to purchase the property but should also factor in any upfront fees, such as auction fees if applicable, and closing costs on the buying side.

Step 3: Account for the Cost of Renovations and Repairs

Renovation and repair costs form a significant portion of the expenses in a house flip. This includes labor and materials for structural updates, cosmetic improvements, major systems repairs (HVAC, electrical, plumbing), landscaping, and any permits or inspection fees required. Keeping detailed records of all renovation expenses is crucial for an accurate profit calculation.

Step 4: Include Holding Costs

Holding costs are the expenses associated with owning the property during the renovation and sale process. Key components include:

- Property Taxes: Prorated based on the duration the property was held.

- Insurance: Liability and property insurance costs during the holding period.

- Utility Bills: Electricity, water, gas, and any other utilities required to maintain the property.

- Financing Costs: Interest payments on any loans or mortgages taken out to finance the purchase and renovation of the property. This could also include origination fees or points paid upfront.

Step 5: Factor in Selling Costs

Selling costs encompass all expenses related to marketing and transferring the property to the new owner. This includes:

- Agent Commissions: Typically a percentage of the sale price, if you use a real estate agent.

- Closing Fees: Costs for closing the sale, which can include attorney fees, title search, title insurance, transfer taxes, and any other administrative fees.

- Staging Costs: If the property was staged for sale, include the rental cost of furniture and decorations.

- Marketing Expenses: Costs for listing the property, professional photography, and any other marketing materials.

Calculating Net Profit When Flipping A House

With all the costs detailed, calculating net profit is straightforward but critical. Subtract the total expenses (purchase price, renovation and repair costs, holding costs, and selling costs) from the final sale price of the property.

Net Profit=Sale Price−(Purchase Price+Renovation Costs+Holding Costs+Selling Costs)

Net Profit=Sale Price−(Purchase Price+Renovation Costs+Holding Costs+Selling Costs)

Additional Considerations

- Unexpected Costs: Always include a buffer for unexpected costs or overruns in renovations. These can impact the net profit significantly if not anticipated.

- Tax Implications: Consult with a tax professional to understand the tax implications of your profit, as this can affect your net gain.

- Time Factor: Consider the value of your time invested in the project. While not directly included in the calculation, it’s important for evaluating the overall profitability and efficiency of the flip.

By following these detailed steps and considerations, real estate investors can gain a comprehensive view of their net profit from flipping a house, allowing for informed decisions and strategic planning for future projects.

Are there any tax implications that can affect net profit when flipping a house?

Understanding the tax implications associated with house flipping is crucial for accurately calculating your net profit and for strategic planning. The way your profits are taxed can significantly affect the overall financial outcome of your flip. Here’s an expanded look at the tax considerations to keep in mind:

Ordinary Income vs. Capital Gains

- Ordinary Income Tax: If flipping houses is considered your business or trade, the IRS may classify profits as ordinary income. This classification applies when you frequently buy and sell properties with the intention of making a profit. The rate at which you’re taxed depends on your total taxable income for the year. Ordinary income tax rates can be significantly higher than capital gains rates, impacting your net profit.

- Capital Gains Tax: If you’re involved in a one-time flip or infrequently deal with real estate sales, your profit might be considered a capital gain. Capital gains are categorized as short-term or long-term, depending on how long you’ve held the property.

- Short-term Capital Gains are applicable if you hold a property for less than a year. These gains are taxed at the same rate as ordinary income, which can be higher.

- Long-term Capital Gains apply to properties held for more than a year. These gains benefit from lower tax rates, typically ranging from 0% to 20%, depending on your income level.

Additional Tax Considerations

- Self-Employment Taxes: If flipping houses is your primary business, you might also be subject to self-employment taxes. This is in addition to the income taxes on your profits.

- Depreciation Recapture: For flippers who rent out their property while attempting to sell it, depreciation claimed during the rental period can be subject to recapture at the time of sale. Depreciation recapture is taxed as ordinary income. Now, the maximum rate for this is 25%.

- State and Local Taxes: Besides federal taxes, you must consider state and local taxes, which can vary widely. Now, some states have high income tax rates, while others have none at all.

- 1031 Exchange: Although not typically used in flipping due to its nature, a 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting the proceeds from a sale into a new property. Consequently, this strategy is more applicable to investment properties held for rental income rather than properties flipped for a quick profit.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.