Last Updated on March 14, 2024

Commercial real estate lending is one of the most critical aspects of real estate development. It is essential for anyone looking to finance an investment property or refinance an existing loan to understand how it works and how to take advantage of it for success. Below, we’ll examine what commercial real estate lending entails, including when you should consider it, how it works, and how it benefits your real estate business. Not only that, but we’ll also provide tips on finding the right lender and getting the best terms possible. When you’re done reading, you should have a better understanding of the basics of commercial real estate lending.

Understanding the Basics Of Commercial Real Estate Lending

Commercial real estate lending plays a pivotal role in the real estate sector, enabling the acquisition, development, and refinancing of properties that serve as business ventures. This type of lending is distinct from residential lending, which primarily supports individual homeowners. Commercial loans are tailored for income-generating properties, encompassing a wide array of real estate categories including office buildings, retail centers, industrial warehouses, and multifamily residential complexes.

Key Details

- Purpose: Designed to support properties that generate income or are used for business purposes.

- Borrowers: Typically investors, corporations, developers, or small business owners rather than individual homebuyers.

- Property Types: Includes a broad spectrum from shopping malls to apartment complexes and everything in between.

How Commercial Real Estate Loans Work

The intricacies of commercial loans set them apart from their residential counterparts. When a lender considers a commercial loan application, the focus extends beyond the borrower’s credit score. Lenders meticulously evaluate the property’s market value, its capacity to generate income, and the borrower’s business acumen.

Loan Terms and Conditions for Commercial Real Estate Loans

- Amortization and Term: Commercial loans may have shorter amortization periods than residential loans, with terms often ranging from 5 to 20 years, culminating in a balloon payment if the loan doesn’t fully amortize over its term.

- Interest Rates: The rates can vary widely, influenced by the borrower’s creditworthiness, the property in question, and prevailing market conditions.

- Loan-to-Value (LTV) Ratios: This ratio is critical in commercial lending, influencing the lender’s decision on the loan amount. A typical LTV ratio for commercial loans falls between 65% and 85%, dictating the proportion of the property’s value that the loan will cover.

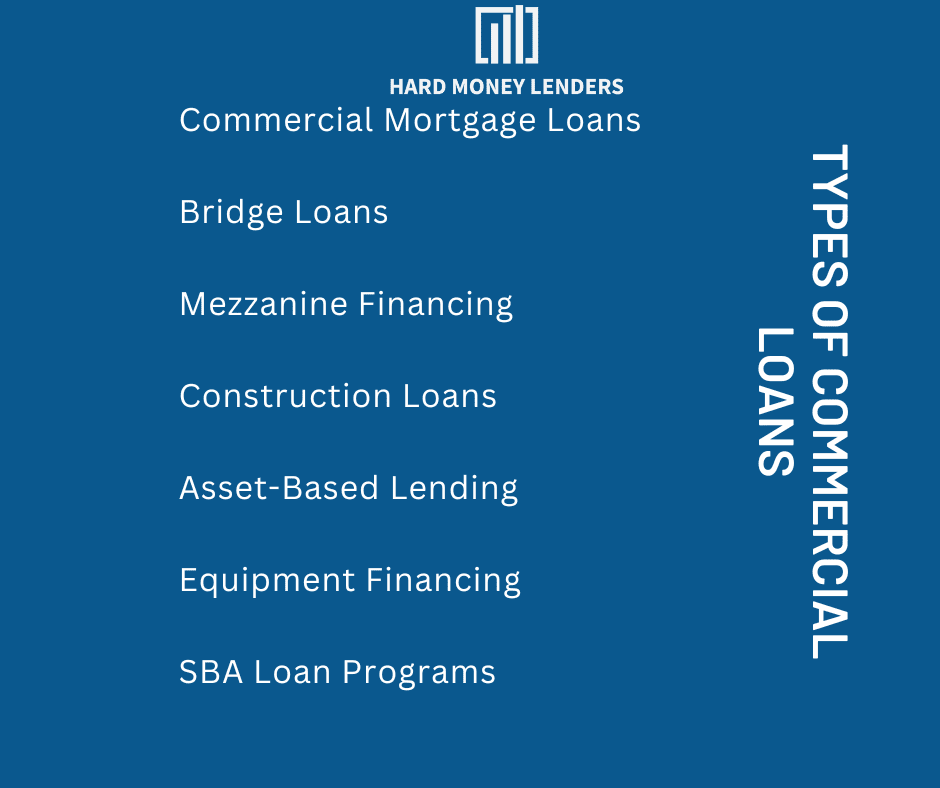

7 Types of Commercial Loans for Your Business

7 Types of Commercial Loans for Your Business

Commercial lending isn’t a one-size-fits-all deal. Businesses have various loan options that suit their needs and objectives. Here are seven types of commercial loans companies should consider when it comes to real estate investment.

Commercial Mortgage Loans

These are typically used for long-term financing of commercial property purchases, such as an office building or shopping center. The lender will require collateral from the purchased property, and repayment terms can range from 5 – 30 years.

Bridge Loans

Bridge loans provide immediate capital for those looking to purchase a new piece of land before they’ve sold their existing asset or to cover expenses during construction projects. They usually come with higher interest rates than other forms of credit but don’t require prepayment penalties if paid early. Commercial real estate bridge lending is a short-term financing option for real estate developers or investors.

Mezzanine Financing

This commercial real estate line of credit is secured by the equity in the company rather than by specific assets like buildings or machinery. It’s often used along with traditional bank financing since mezzanine lenders look at more than just cash flow and credit scores; they also evaluate market conditions and prospects for success on future investments.

Construction Loans

Designed for developers undertaking large-scale projects requiring significant upfront funding, these loans allow you access to money while work is underway. They can help you avoid closing down operations due to a lack of funds. Repayments may be split into two parts—the first after completion and the second once occupancy has been achieved.

Asset-Based Lending

ABLs offer flexibility when a business needs quick access to capital but doesn’t meet the requirements for traditional bank borrowing because its credit score isn’t high enough or it lacks sufficient collateral. Assets such as accounts receivable, inventory, equipment, and intellectual property can all be considered eligible collateral under an Asset Based Lending loan agreement.

Equipment Financing

Companies needing assistance acquiring specialized machinery or vehicles to operate their business may turn to equipment financing agreements. Such agreements use leased equipment as collateral or structure payments based on actual usage over time (pay per use).

SBA Loan Programs

Smaller businesses who might otherwise struggle to secure conventional financing qualify for government-backed programs through the US Small Business Administration, including Microloans (up to $50K), CDC/504 Loans ($5M+), and Disaster Assistance Loans ($2500-$25k).

How Commercial Loans Work: A Comprehensive Overview

Commercial loans are specialized financing instruments designed to meet the needs of businesses and investors in acquiring, developing, or refinancing commercial properties. These loans are distinct from residential loans in several key aspects, reflecting the unique challenges and opportunities in the commercial real estate sector.

Understanding the Terms & Conditions

It’s important to understand the terms and conditions when it comes to commercial real estate loans or any loans.

Amortization and Term

Unlike residential loans, which typically extend up to 30 years with a possibility of full amortization, commercial loans often feature shorter terms—ranging from 5 to 20 years. A unique aspect of many commercial loans is the balloon payment at the end of the term, where the remaining balance is due, assuming the loan doesn’t fully amortize over its duration. This structure requires borrowers to have a strategic plan for refinancing or selling the property as the loan maturity approaches.

Interest Rates

The interest rates on commercial loans are more variable and can be significantly influenced by the borrower’s credit history, financial stability, and the specific characteristics of the property being financed. Rates can fluctuate based on market trends, the lender’s assessment of risk, and the economic environment, often resulting in higher costs compared to residential mortgages.

Loan-to-Value (LTV) Ratios

LTV ratio is a critical metric in commercial lending, determining the maximum loan amount relative to the property’s appraised value. Lenders typically offer LTV ratios between 65% and 85%, requiring borrowers to contribute a substantial down payment. The exact LTV ratio offered can vary depending on the property type, income generation potential, and borrower’s financial standing.

The Application Process: Navigating the Steps

Securing a commercial loan is a multifaceted endeavor, necessitating a well-prepared approach to satisfy lenders’ requirements and achieve favorable financing terms.

Steps to Application:

- Financial Documentation: Assembling a comprehensive financial dossier is paramount. This includes detailed income statements, balance sheets, and cash flow projections that paint a clear picture of the borrower’s financial health. This step is crucial for lenders to assess the borrower’s ability to service the loan.

- Business Plan: Crafting a detailed and compelling business plan is essential. This document should outline the property’s potential for profitability, including a thorough market analysis, projected revenue streams, and a strategic plan for property utilization. The business plan helps lenders understand the investment’s viability and the borrower’s vision.

- Property Appraisal: Obtaining a professional appraisal is a critical step in the application process. This appraisal provides an objective valuation of the property, which is instrumental in determining the loan amount and ensuring the investment’s soundness.

- Loan Proposal: The culmination of the application process is the submission of a loan proposal. This comprehensive package should include the borrower’s financial documentation, business plan, and property appraisal. A strong proposal convincingly demonstrates the project’s feasibility and the borrower’s commitment and capability to repay the loan.

Success Factors

- Market Understanding: Demonstrating a thorough understanding of the commercial real estate market and the specific segment the property occupies is vital.

- Robust Business Plan: A well-researched and realistic business plan that convincingly showcases the property’s income-generating potential can significantly enhance the loan application.

- Financial Strength: Presenting strong personal and business financial statements is key to proving creditworthiness and the ability to withstand potential financial challenges.

Tips for Securing a Commercial Real Estate Loan

Securing a commercial real estate loan is a nuanced process that requires strategic preparation. Here are detailed strategies to enhance your chances of loan approval.

Improve Your Credit Score

Begin by obtaining your credit report from major credit bureaus and review it for any inaccuracies. Paying off high-interest debts and maintaining a history of timely payments can boost your score. A higher credit score not only increases your chances of approval but can also secure you more favorable loan terms.

Now, some lenders offer hard money loans even to those with low credit scores. Here’s how to get a hard money loan with bad credit.

Offer a Substantial Down Payment

The more equity you have in the property from the start, the lower the risk for the lender. A down payment of 20% or more can significantly impact your loan’s interest rate and terms. Start saving early, and consider liquidating non-essential assets to increase your down payment, if necessary.

Prepare Detailed Financial Projections

Your ability to repay the loan is paramount. Prepare a comprehensive business plan that includes detailed revenue forecasts, expense estimates, and cash flow projections. Use realistic market data to support your projections. Lenders need to see a well-thought-out strategy for how the property will generate income and cover the loan payments.

Demonstrate Industry Experience

If you have prior experience in managing or investing in commercial properties, highlight this in your application. Experience in the specific type of commercial property you’re financing (e.g., retail, office, industrial) can be particularly persuasive.

Understand and Leverage the Property’s Value

Be prepared to discuss how you will enhance the property’s value or profitability. Whether through renovation, rebranding, or changing the property’s use, showing a clear plan for increasing value can make your loan application more attractive.

Potential Challenges in Commercial Real Estate Lending

Navigating the commercial real estate lending landscape comes with its set of challenges. Awareness and preparation for these potential hurdles can position you for a smoother lending experience:

- Higher Interest Rates: Commercial loans typically come with higher interest rates than residential loans. This reflects the higher risk associated with commercial properties. Comparing rates from different lenders and negotiating terms can help mitigate this challenge.

- Rigorous Financial Scrutiny: Lenders conduct thorough due diligence on borrowers’ financial health, including credit history, cash flow, and collateral value. Ensure your financial records are in order, and be ready to explain any anomalies or issues.

- Significant Down Payments: Commercial lenders often require larger down payments compared to residential lenders. This could range from 20% to 30% of the purchase price, depending on the loan type and property. Start financial planning early to meet this requirement.

- Appraisal and Approval Process: The commercial loan appraisal process can be complex, evaluating not just the property value but its income-generating potential. Having detailed financial projections and a solid business plan can help support the property’s appraised value.

- Loan-to-Value (LTV) Ratios: LTV ratios for commercial loans are generally stricter. If the appraisal doesn’t support the desired loan amount, you may need to renegotiate the purchase price, increase your down payment, or find additional financing sources.

Conclusion

Commercial real estate lending is an essential part of the economy and a great way to finance business investments. It’s beneficial for businesses because it provides access to capital that can be used in different ways, such as purchasing or renovating the property. The terms of these loans are also typically longer than traditional loans which means borrowers have more time to pay them back. Knowing the differences between conventional and commercial loans will help you make informed decisions when selecting the right option for your business.

Frequently Asked Questions (FAQs)

What Is the Term For Commercial Real Estate Loan?

Commercial real estate loans are typically offered at a fixed or variable rate, with terms that range from short-term bridge loans to long-term permanent financing. The amount of money lent in this type of loan depends on the project’s cost, size, scope, and the borrower’s financial standing.

The commercial real estate lending rate varies depending on factors such as economic conditions, supply/demand dynamics in local markets, location and quality of the property being financed, the creditworthiness of the borrower, and other market conditions.

To qualify for a commercial real estate loan (CREL), borrowers must have acceptable credit scores, sufficient equity reserves, collateral including cash reserves, business assets, or personal properties, liquidity to cover monthly payments, and experience managing investments or similar businesses. Additionally, they must provide tax returns as evidence of income stability. Lenders usually approve CREL applications within 2-4 weeks after submission if all criteria are met.

Why Is Commercial Lending Important?

Commercial real estate lending allows investors to finance the purchase or refinancing of a property, such as office buildings, retail stores, and warehouses. Commercial lending also provides access to capital for business owners who may not have other options.

Having this type of financing accessible is critical for businesses looking to expand their operations or invest in new properties.

Commercial real estate lending allows companies to borrow money at lower rates than traditional loans because tangible assets like land or buildings back them. Additionally, these loans offer more flexible terms than other types of financing since they are secured against collateral that can be used if needed.

In Miami, there has been an increased demand for commercial real estate lending due to its thriving economy and growing population.

This influx of people creates opportunities for business owners who want to capitalize on it by investing in properties that generate long-term revenue streams using commercial real estate lending Miami. With access to low-cost financing options, entrepreneurs can make investments that pay off significantly over time.

What Is A Commercial Loan Example?

One example of a commercial loan is an equipment-based loan. This loan can be used to purchase necessary business items, such as machinery, computers, or vehicles.

The lender may require the borrower to provide collateral or an asset, such as real estate, that can be seized if the borrower fails to pay back the money owed.

Another typical commercial loan example is an SBA loan. These government-backed loans offer favorable terms and interest rates for small businesses operating in specific industries that meet certain criteria set forth by the Small Business Administration (SBA).

Related Article: Loan To Cost (LTC) Definition

What Is the Difference Between A Regular Loan and A Commercial Loan

Commercial loans are typically larger than regular ones because they are used for business-related activities. That could mean purchasing inventory or equipment, expanding operations, or refinancing debt.

The amount loaned from banks, private lenders, and other financial institutions is usually higher because of this focus on commercial projects.

In contrast to commercial loans, regular loans may offer lower interest rates but come with shorter repayment terms. They’re often used for personal needs like home purchases or car purchases. While these types of loans tend to be smaller amounts than those offered by commercial lenders, it doesn’t necessarily mean that one kind of loan is better than the other. Choosing which option makes more sense depends on the borrower’s situation and goals.

Related Article: Difference Between Hard Money Loans & Soft Money Loans

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.