Buying Abandoned Properties: What You Need to Know

Abandoned properties crop up everywhere: whether it be a long-foreclosed property, a community being turned around, or a one-off property in an established community, there is great opportunity to be had. While buying abandoned properties can create amazing returns, they also come with inherent risk. At Hard Money Lenders, we’re all about educating real estate investors before they pull the trigger. That said, below, you’ll find everything you need to know before buying abandoned properties.

Why Choose an Abandoned Property?

To the right investor with a keen eye, abandoned properties can produce an excellent return on investment. The allure of abandoned properties extends beyond their potential for high returns; it encompasses the opportunity to transform a neglected space into something valuable and vibrant.

These properties are often priced significantly below market value due to their condition, lack of maintenance, and sometimes, the urgency of the selling party to divest. This under-valuation presents a unique opportunity for investors and homebuyers with the vision and resources to rehabilitate the property. The process of renovation and improvement not only has the potential to yield considerable profits upon resale or rental but also offers personal satisfaction from restoring and repurposing dormant spaces. Furthermore, revitalizing abandoned properties can contribute positively to the community by enhancing neighborhood aesthetics, increasing property values, and reducing crime and vandalism associated with vacant buildings.

On the other hand, picking the wrong abandoned property can be a complete bust — unforeseen repairs, structural integrity issues, title disputes and more can all be commonplace. For these reasons, only those looking to take on extra risk in return for a higher potential return should seek out abandoned properties.

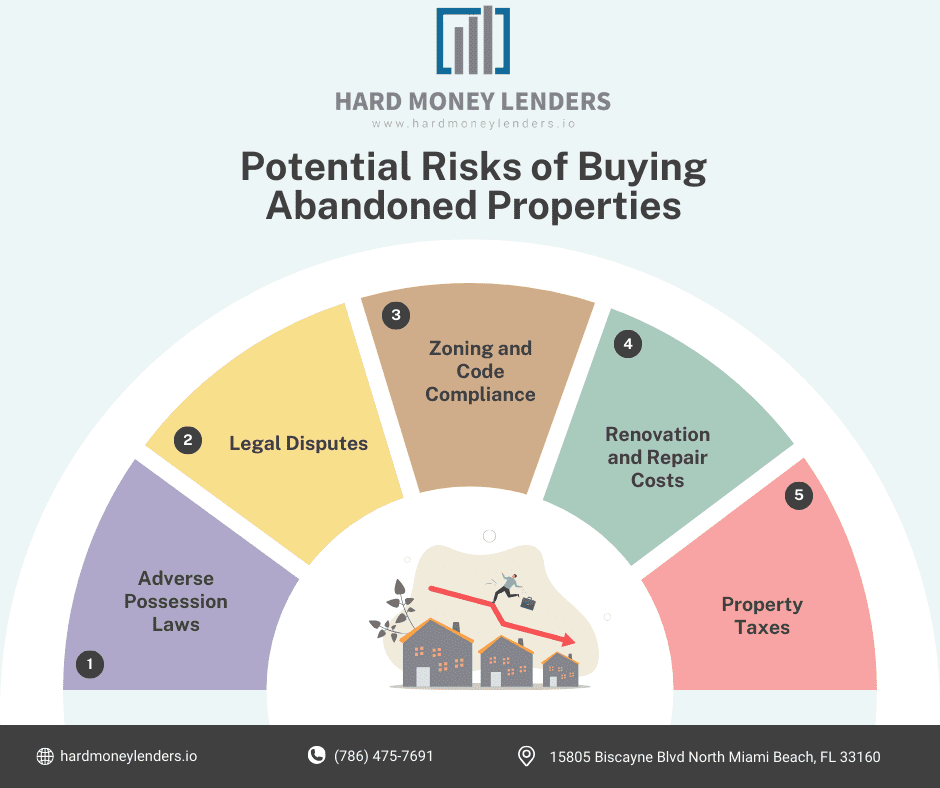

Closer Look at Potential Risks

There are potential risks when looking to invest in abandoned properties. Here are some that our team here at HardMoneyLenders.IO believes are of the utmost importance.

Legal Considerations and Challenges

When it comes to buying abandoned properties, there are legal considerations and challenges to consider.

Title Search and Ownership Verification

The first step in navigating the purchase of an abandoned property involves a comprehensive title search to verify ownership and ensure the title is free from liens, encumbrances, or legal disputes. This process is critical, as unresolved issues can jeopardize the transaction and future ownership. Engaging a reputable title company or legal professional to conduct this search can uncover hidden problems, such as unpaid taxes, judgments against the previous owner, or claims by heirs or creditors.

Adverse Possession Laws

Adverse possession, sometimes known as “squatter’s rights,” is a legal principle that allows a person to claim ownership of an abandoned property under certain conditions, such as open and notorious possession for a specific period, which varies by jurisdiction. Understanding these laws is crucial for both potential possessors and buyers looking to acquire title to abandoned properties. It’s essential to consult with a legal expert to navigate the complexities of adverse possession and ensure compliance with all legal requirements.

Zoning and Code Compliance

Abandoned properties may not meet current zoning regulations or building codes, posing significant challenges to rehabilitation efforts. Buyers must investigate the property’s zoning classification and ensure that their intended use complies with local ordinances. Additionally, properties that have fallen into disrepair may require extensive updates to meet safety and building codes, necessitating a thorough inspection and assessment of renovation needs. This process often involves engaging architects, contractors, and code enforcement officials to determine the scope of work and associated costs.

Financial Implications

Now that you know the legal considerations, it’s important to understand the financial implications when buying abandoned properties.

Renovation and Repair Costs

Investing in an abandoned property typically entails significant renovation and repair costs to make the space habitable or marketable. The extent of these renovations can vary widely, from cosmetic updates to complete structural overhauls. Buyers should conduct a detailed property inspection with a qualified professional to identify necessary repairs and estimate costs accurately. This assessment is crucial for budgeting purposes and evaluating the overall feasibility of the investment.

Property Taxes

Abandoned properties often come with a backlog of unpaid property taxes, which can accumulate to substantial amounts over time. Potential buyers must research any outstanding tax liabilities, as these will become their responsibility upon purchase. In some cases, negotiating with local tax authorities for a settlement or payment plan is possible, but buyers should factor these costs into their overall investment strategy.

Financing Challenges

Securing financing for the purchase and rehabilitation of an abandoned property can be more challenging than for a traditional real estate transaction. Lenders may view these projects as high-risk, requiring investors to seek alternative financing methods such as hard money loans, private investors, or personal resources.

It’s essential to explore various financing options and secure commitments before proceeding with the purchase to ensure that sufficient funds are available to complete the project successfully.

Navigating the acquisition and redevelopment of abandoned properties requires careful consideration of legal, financial, and practical factors. By understanding and addressing these complexities, investors and homebuyers can unlock the potential of these challenging but rewarding investments.

Abandoned Property Hunting 101

So, you’ve reviewed the risks, and you’re still interested in the massive potential gains of buying abandoned properties.

Sounds good!

There is certainly money to be made in this area, and we’ve prepared multiple tips to help you identify abandoned properties that may make good candidates for investment.

There are multiple listing websites for abandoned properties, giving you access to houses in your area that are up for auction. These sites often include filters that will help you narrow down listings to find properties that are in your desired area, fit your desired home type, and more.

After choosing these filters and identifying a few interesting properties, you can go even further to find off-market properties for sale. Many abandoned properties are listed off-market, not appearing online and only through auction companies. Do your research to find foreclosed homes in your area and call different companies to find off-market opportunities going up for auction soon. These can often be the best deals as not too many people know about them!

Pro Tip for Buying Abandoned Properties

Visit your tax authorities to find a list of properties that are currently abandoned. From there, you can track the addresses down and find out when the properties will be auctioned. That way, you can find some excellent deals that other investors aren’t aware of! Doing your research pays off when prospecting abandoned properties.

Another way to search for abandoned properties is to search on Facebook. Many “abandoned properties” groups are available where investors share upcoming auctions and prospective abandoned properties with each other. This can be a great source of information for those looking to buy abandoned properties.

One final way to find abandoned properties is to simply drive around! Look for overgrown grass, boarded-up windows, and other characteristic signs of abandonment.

From there, you can check in with your tax authority to make sure the property is abandoned. If it is, do some further research to find out when or if the property is scheduled to be auctioned. If you do more research than your competitors, you can go into the auction with a much better idea of the true value of the property!

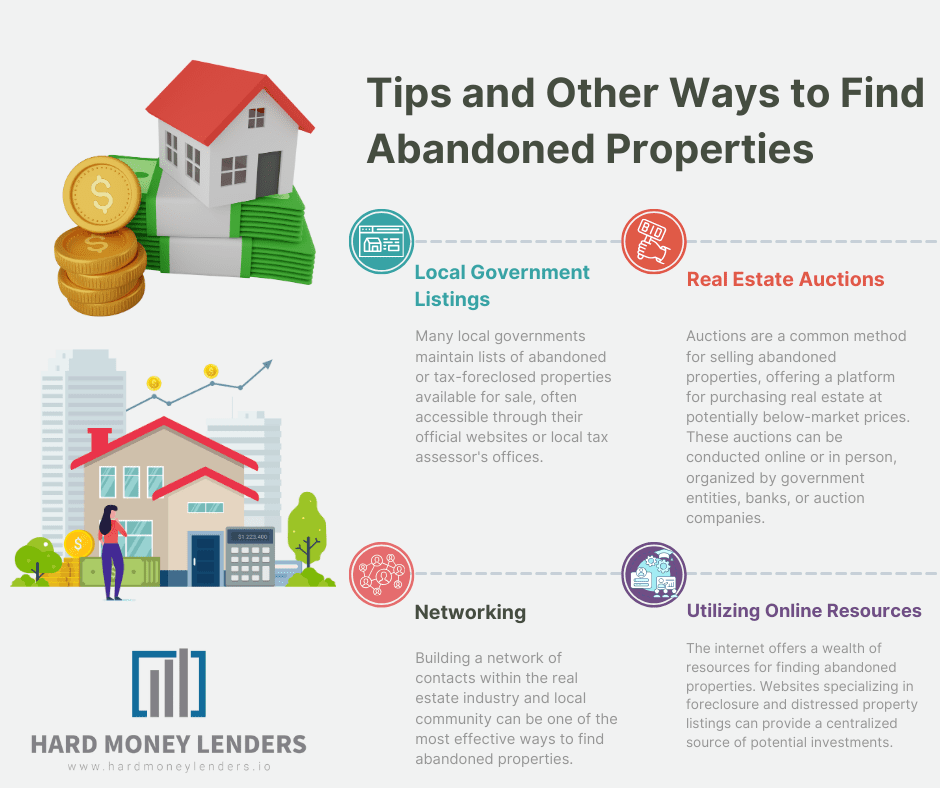

Tips and Other Ways to Find Abandoned Properties

Local Government Listings

Many local governments maintain lists of abandoned or tax-foreclosed properties available for sale, often accessible through their official websites or local tax assessor’s offices.

These properties have typically been seized due to unpaid property taxes and are sold to recover the owed amounts. Potential buyers can attend tax lien sales or tax deed sales, depending on the state’s specific process for handling delinquent taxes.

Additionally, some municipalities may have programs aimed at revitalizing distressed neighborhoods, offering abandoned properties at reduced prices to buyers committed to rehabilitation and adherence to certain conditions, such as completing renovations within a specified timeframe.

Real Estate Auctions

Auctions are a common method for selling abandoned properties, offering a platform for purchasing real estate at potentially below-market prices. These auctions can be conducted online or in person, organized by government entities, banks, or auction companies.

To participate, potential buyers should register in advance, familiarize themselves with the auction’s rules and requirements, and conduct as much due diligence as possible on the properties of interest. It’s important to have financing arranged beforehand, as auction purchases often require immediate or very prompt payment.

Attending these auctions provides not only the opportunity to bid on abandoned properties but also valuable insights into the local real estate market and networking opportunities with other investors.

Networking

Building a network of contacts within the real estate industry and local community can be one of the most effective ways to find abandoned properties. Real estate agents, particularly those specializing in foreclosures or distressed properties, can offer insider knowledge and access to listings that may not be widely advertised.

Likewise, connecting with other investors, property managers, and local business owners can lead to tips on properties that are abandoned or soon to be listed. Participating in real estate investment groups, online forums, and local community meetings can also provide leads on potential investments.

Additionally, simply exploring targeted neighborhoods and looking for signs of neglect, such as overgrown lawns, boarded windows, and accumulated mail, can uncover abandoned properties that haven’t yet been listed or marketed.

Utilizing Online Resources

The internet offers a wealth of resources for finding abandoned properties. Websites specializing in foreclosure and distressed property listings can provide a centralized source of potential investments.

Additionally, public records searches and online databases can reveal properties with delinquent taxes or those that have been vacant for extended periods. Social media platforms and real estate forums are also valuable for gathering insights and tips from a community of like-minded individuals and professionals.

Engaging with Legal and Financial Professionals

Attorneys and tax advisors familiar with the local real estate market can be invaluable in identifying abandoned properties. These professionals often have access to legal filings and tax records that can indicate properties in financial or legal distress, potentially leading to abandonment.

How to Get an Abandoned Property Deal

The best way to find an abandoned property deal is to get in contact with the previous owners. If they’ve moved away or defaulted on their mortgage, odds are they will want to get rid of the property quickly. If the previous owners passed away and the property has been in disrepair for a while, it may be worth contacting next of kin in a respectful manner to ask if the property is for sale.

Many first-time abandoned property owners get their first deal by simply driving around or connecting with family and friends. This way, you can also get a good deal while doing a favor to those closest to you. Either way, these are excellent ways to secure your first abandoned property deal rather than going to a public auction.

Oftentimes, contacting family, friends, or next of kin is not an easy or doable task. If you don’t have those sort of contacts, you may be able to secure a deal through public auction — after all, most investors go this route and find success! If this is the case, a full property inspection may not be available before the auction begins.

In this case, your best bet is to analyze other properties in that neighborhood, compare the condition of the auction home with those of the neighboorhood, and use one of hard money lenders hard-money calculators to estimate the home value and investment potential of the property.

There are still many great deals to be had at abandoned property auctions. You can also look for great value-add additions, such as: making use of a large lot size, finding areas to add a wall to create an additional bedroom, and much more. In the end, higher ROI potential will be associated with additional risk, so be sure that you can afford to take the risk on an abandoned property investment before you go ahead and buy a property at auction.

How to Locate Owners of Abandoned Properties

To avoid title disputes or other potential problems, you will want to track down the owners of the abandoned property if you can. Some contact will be available via your tax authorities, but it may not be up-to-date. Contacting previous owners is useful for many reasons, including:

- Finding out about back-taxes owed

- Discovering any irreparable damage to the property

- Learning about any expensive system or structural damage

- Hearing about any other problems with title, taxes, or damage

If you can’t get in contact with the owner, it may be worth knocking on the doors of neighbors to see if you can find the story on that house. Be sure to act respectful and responsibly when contacting neighbors, however! If they have a no solicitation sign on their property, it may be best to avoid that home. In the end, any research you can do to make yourself more knowledgeable on the property before investing will go a long way in making sure you don’t pick the wrong abandoned property!

Final Thoughts

The more you do your homework, the less likely you will be to run into problems with your abandoned property purchase. However, there’s no guarantee that your abandoned property will be free of issues, no matter how much you spend. Without a full inspection of the property, you can never be sure of the condition of a property before purchasing it at auction. Contacting previous owners, neighbors, or tax authorities can help you rule out some bad investments, but in the end there will always be extreme risk when buying an abandoned property. In the end, you must have some appetite for risk when investing in abandoned properties. That being said, the potential returns are excellent if you can do your research and find a home without major problems!

FAQs on Buying Abandoned Properties

Can I Get a Mortgage on an Abandoned Property?

Obtaining a mortgage for an abandoned property is possible, but it presents unique challenges compared to financing a conventional real estate purchase. Traditional lenders may be hesitant to provide mortgages for these properties due to perceived risks associated with their condition and the uncertainty of their market value post-rehabilitation.

However, some lenders specialize in loans for investment properties, including fix-and-flips or renovations, and may be more accommodating. Expect to provide a detailed renovation plan and budget, and be prepared for potentially higher interest rates, larger down payments, and additional insurance requirements.

Exploring options like a construction loan or a 203(k) loan, which allows borrowers to finance the purchase and rehabilitation of a property with a single mortgage, can also be viable alternatives.

Are There Grants Available for Renovating Abandoned Properties?

Yes, there are various grants and incentives available for the renovation of abandoned properties, aimed at encouraging urban renewal and community development. These programs are often sponsored by federal, state, or local governments, as well as private foundations.

Eligibility may depend on the property’s location, the intended use after renovation, and the applicant’s ability to meet specific program requirements, such as contributing to affordable housing or preserving historic features. Researching programs through the U.S. Department of Housing and Urban Development (HUD), state housing finance agencies, and local community development offices can uncover opportunities for financial assistance.

Additionally, tax incentives, such as deductions for historic preservation or credits for energy-efficient upgrades, can also provide financial relief to renovators.

How Do I Ensure I’m Not Liable for the Previous Owner’s Debts on the Property?

To protect yourself from inheriting the previous owner’s debts or legal encumbrances on an abandoned property, conducting a comprehensive title search is essential. This process will reveal any outstanding liens, mortgages, or judgments attached to the property.

Purchasing title insurance offers further protection by providing financial coverage against unforeseen claims on the property’s title post-purchase. It’s also advisable to work with a real estate attorney who can navigate these complexities and ensure that any outstanding debts are settled or dismissed before the sale is finalized.

What are the risks of investing in abandoned properties?

Investing in abandoned properties carries several risks, including unforeseen structural issues, higher renovation costs than anticipated, vandalism or theft during the renovation process, and potential difficulties in reselling or renting the property. Thorough due diligence, including property inspections and budgeting for contingencies, can help mitigate these risks.

Can I claim ownership of an abandoned property through adverse possession?

Adverse possession laws allow individuals to claim ownership of a property under certain conditions, such as openly occupying and improving the property without the legal owner’s permission for a period specified by state law. However, successfully claiming a property through adverse possession is complex and requires adherence to specific legal criteria. Consulting with a real estate attorney to understand the feasibility and process is crucial.

How do I find the owner of an abandoned property?

Locating the owner of an abandoned property can involve searching public records, including property tax records, deed records, and local court filings. These records can provide contact information or lead to the entity responsible for the property. In some cases, hiring a title company or private investigator may be necessary to trace the owner, especially if the property has changed hands through foreclosure or tax lien sales.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.