Is a Business License Required to Flip Houses?

If you’re looking to get into real estate investing, you may be wondering how much prep work you need to do before you can get started. Do you need to file an LLC to flip houses? Do you need to have your realtors’ license? Do you need a separate business bank account, and do you need a business license or DBA? Is a business license required to flip houses? The answer is: no! You don’t need these things to start flipping houses, although there are pros and cons to setting up a business before you begin your house-flipping business adventures.

Do I need a business license to flip houses?

You can start flipping houses under your own name without a business license, although it might not be advantageous to go this route. Instead, you may want to invest in separating your personal and business accounts with an LLC or DBA. A DBA is a “Doing business as,” and creates a business entity to run your house flipping business through. This can be useful to separate finances, although it doesn’t offer much legal protection if you get sued, a contractor gets injured, or some other calamitous event.

You can start flipping houses under your own name without a business license, although it might not be advantageous to go this route. Instead, you may want to invest in separating your personal and business accounts with an LLC or DBA. A DBA is a “Doing business as,” and creates a business entity to run your house flipping business through. This can be useful to separate finances, although it doesn’t offer much legal protection if you get sued, a contractor gets injured, or some other calamitous event.

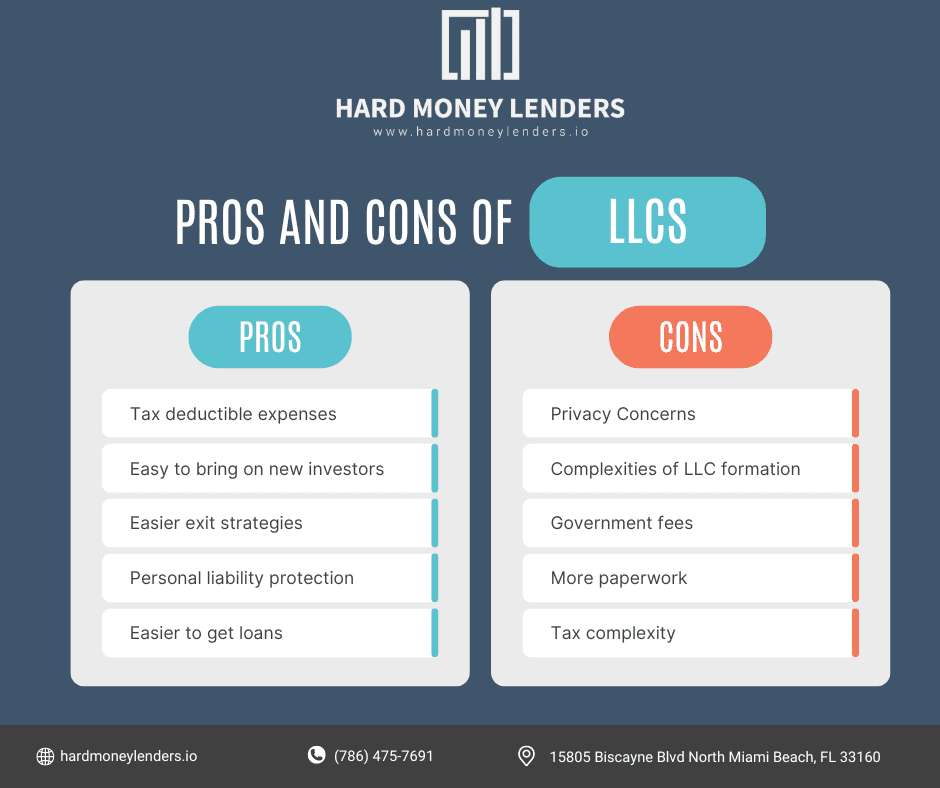

Instead, the most popular business structure to run a real estate house flipping business is an LLC. An LLC, or “Limited Liabilty Corporation” combines elements of a corporation and sole proprietorship, and is great for small businesses that need legal protection and tax advantages. LLCs are run much like corporations, where you are only taxed on the dividends you receive as an owner. This is advantageous compared to a sole proprietorship, where all income is taxed as earned income on your personal financial statements. Additionally, LLCs offer protection against seizure of personal assets in the case that your business debts surmount to unpayable levels. An LLC acts as a separate entity that cannot be tied to your personal assets, meaning you can only lose what is put into the LLC as an investment, and nothing more. This is a popular option for real estate investors looking to protect their personal assets and limit risk when investing in real estate.

Advantages of LLCs

Tax Advantage

The biggest advantage of an LLC is that there are many more tax advantages to purchasing a home when compared to a sole proprietorship or no business structure. There are many tax deductible expenses that can reduce your “on-paper” income and give you less profit to pay taxes on.

These tax deductible expenses include:

- Cost of property purchase

- Cost of renovations (labor and materials)

- Cost of prospecting (gas & vehicle depreciation)

- Office and employment expenses (rent, accountant, lawyer, etc)

- Loan interest

- Real estate commission

- And more

While an LLC can cost $0-1,000 to form in any given state, the tax advantages are well worth it, even if you plan on flipping only one property. Investing in an LLC can offer legal protection and save you hundreds or thousands of dollars on tax expenses on your first property flip alone.

Equity Partners

LLCs are also an excellent way to bring on new investors when your house flipping business can accommodate it. Adding people to a sole proprietorship or unstructured business can be daunting, but an LLC makes the process much simpler as part-owners can buy equity in the company.

Once your company gets off the ground and there are house flips under your belt, you may find that partners want to fund new projects to accelerate your company’s growth. In the case of an LLC, you can bring these new “silent investors” on with ease as they provide funding in exchange for equity. It’s also easy to bring on investors that want to take an active role in helping grow your business beyond equity contributions.

Exit Strategy

If you have an LLC for your home-flipping business and want to change career paths or retire down the road, it’ll be much easier to do so if you formed an LLC when you started. LLCs can be transferred in exchange for cash, leading to a big payout if you decide to exit your business. You can transfer any home inventory, equity, and deals to another party in the form of LLC equity. If you choose to forego an LLC and want to exit the real estate business, you’ll have to sell off all your inventory on the open market.

Cons of Forming an LLC

Cons of Forming an LLC

Despite the vast benefits of LLC formation, there are some cons that make some investors shy away from the business structure. First, the setup costs can range anywhere from $0-1000 depending on what state you form the LLC in. You must also have an address in the state you want to form the LLC in (not a PO box). Furthermore, you must be present to receive mail at this address year-round unless you choose to have a designated agent to handle your mail for you. Because there’s not an easy way around these initial set-up costs, some investors choose to jump in without forming a business structure.

Furthermore, the time it takes to form an LLC can vary. In busy periods, LLC formation can take as long as 3 months to go from filing to registration. This wait is often too long for investors, and they choose to jump in and risk their personal assets as a result.

“LLC formation can take as long as 3 months to go from filing to registration.”

Despite the complexities of LLC formation, businesses have formed to help you through the process. LegalZoom is an excellent source of information for LLC formation, and they also offer a service to help you form an LLC in your state for an additional fee on top of state registration. If you’re especially busy but want to protect your assets with an LLC, this is an option worth pursuing. If you do choose to form an LLC with the help of a company like Legalzoom, be sure to check and make sure you’re not agreeing to any additional services that you haven’t specifically requested!

Advantages of Foregoing an LLC

Despite the countless examples of an LLC being helpful to a home-flipping business, many people still choose to ignore any sort of legal structures. Are they simply ignorant to the advantages of an LLC? Not always! As it turns out, there are some situations where LLCs are not the best option, including:

- Living in the house you buy. If you choose to make your investment property your permanent residence, you can take advantage of tax benefits that you wouldn’t get as an investor. This can be a great way to dip your toes into real estate investing, especially if you house hack a multi-unit property.

- Without an LLC, you can save time and money on paperwork, expense filing, and other administrative tasks. If you’re blending your personal and business finances, you won’t need to spend as much time worrying about keeping these expenses separate.

- Save on expenses. LLC filing, a business bank account, and accounting software cost money, and many early-stage investors may want to scrounge and save where they can. Also, people may choose to be more risk tolerant and are fine risking their personal assets to save some time and money!

Filing an LLC will always be the safer option as it offers protection of your personal assets, but some find it to be an unnecessary risk. It’s best to do some further research and come to your own conclusion based on your personal risk tolerance and situation.

Why not a C-corp or S-corp?

You may know that there are more business structures than just sole proprietorships and LLCs. In fact, there are four main business types that one can create for their venture. If you’ve researched different business structures, you may have come across C-corps and S-corps. Many businesses you know and love are S-corps, such as Microsoft, Apple, and Tesla. S-corps can issue shares to raise money and invest into their business — what a great opportunity! Except, S-corps can be extremely complicated to set up, and you’ll need to have hundreds or thousands of investors ready to purchase equity in your business to make the venture worthwhile. Many LLCs convert into S-corps once they find great success — who knows, you may own the next publicly traded real estate firm with enough effort and smarts!

C-corps are similar to S-corps in their capabilities and setup procedures, but equity partners are limited to 100. This could be a good option for mid-sized companies who want to retain concentrated ownership of their business, but in most cases will not be applicable to real estate investing companies unless they’re very large.

S-corps or C-corps may be a good option to revisit if you’d like to raise capital once your real estate business becomes immensely successful, but for those just starting out, LLCs offer plenty of advantages with less costly and time-intensive setup than these other options.

Final Thoughts

LLCs are an attractive option for real estate investors to help save money on taxes and protect their assets. S-corps and C-corps offer some of these same benefits with additional equity raising options, but with a much costlier and time-sensitive setup. A sole proprietorship or no business structure will allow you to get started in real estate investing immediately, but with much more risk than setting up an LLC. Without a business structure, all your personal assets will be at risk in the case of default on a loan. Different options will be right for different situations, so be sure to do research pertaining to your own situation and make a choice from there!

FAQ

How can I secure the best deals when looking to flip properties?

To secure the best property deals for flipping, one should employ a multifaceted approach incorporating both traditional and innovative tactics.

- Monitor Listings: Regularly checking various real estate listing platforms is essential to keep up with new potential flips as they enter the market.

- Network with Agents: Building relationships with real estate agents, particularly those with knowledge of foreclosures and distressed properties, provides access to deals before they become widely available.

- Attend Auctions: Participating in real estate auctions, which can be in-person or online, may present opportunities to purchase properties at a reduced cost.

- Direct Outreach: Sending direct mailers to homeowners in targeted areas can prompt those considering selling to reach out, potentially leading to a deal without competition.

What home improvements add the most value in a house flip scenario?

For those flipping houses, certain renovations are known to boost property values more effectively.

- Kitchen and Bathrooms: Updating these areas is often the most lucrative, as modern and functional amenities are highly desired by homebuyers.

- Additional Space: Adding square footage to the property, like finishing a basement or constructing an additional room, can substantially improve a home’s value.

- Energy Efficiency: Upgrades to the HVAC system, roof, and windows not only improve aesthetics but enhance the home’s energy efficiency, making it more attractive to buyers.

- Aesthetic Improvements: Incorporating elements like hardwood floors, fresh paint, and appealing landscaping can impact the home’s overall appeal and functionality, further driving up value.

How should I market a house I have flipped to attract buyers?

Effective marketing is vital for flipped houses to draw attention from potential buyers.

- Staging and Photography: Invest in professional staging and photography to highlight the property’s features.

- Online Presence: Leverage platforms such as online real estate websites and social media to broaden your audience reach.

- Listing Details: Craft enticing listing descriptions focusing on the property’s location, unique attributes, and recently completed upgrades.

- Local Real Estate Agents: Working with agents who have extensive buyer networks can be a strategic move to expedite the sales process.

Are there educational resources available online to learn more about house flipping?

Several online resources offer educational material for those looking to learn about house flipping.

- Online Courses: Websites like Udemy, Coursera, and BiggerPockets host a variety of courses, from beginners to expert levels, taught by seasoned industry professionals.

- Community Engagement: Joining forums and discussion groups provides not only insight into the flipping process but also valuable networking prospects.

What permits or licenses are required for house flipping beyond a business license?

House flipping may require a range of permits and licenses, depending on the scope of work.

- Renovation Permits: Permits will likely be needed for any significant construction, electrical, or plumbing modifications.

- Local Regulations: Check with local authorities or a construction attorney to ensure all legal requirements are met.

- Contractor’s License: If you plan on performing some tasks yourself, a contractor’s license may be necessary, which generally involves an exam and specific experience levels.

What are the tax considerations for flipping houses?

House flippers must be aware of several tax implications associated with their investments.

- Short-Term Capital Gains: If a property is sold within a year of purchase, any profits are subject to regular income tax rates.

- Expense Records: Meticulously documenting all expenses can reduce taxable income by allowing for various deductions.

- Tax Planning: It’s advised to seek advice from a tax professional with real estate expertise to prepare for tax obligations.

What types of insurance are advisable for house flipping?

House flippers should consider multiple types of insurance to safeguard against potential risks.

- General Liability Insurance: Protects against accidents on the property.

- Property Insurance: Covers damage to the property during renovation.

- Worker’s Compensation Insurance: May be necessary if hiring workers, to cover job-related injuries or illnesses.

Each insurance policy should be specifically tailored to the unique risks involved in property flipping.

Do certain legal entities provide benefits for house flippers?

Choosing the appropriate legal entity for a house-flipping business can yield considerable benefits.

- LLC: Limited Liability Companies (LLCs) offer simplicity, flexibility, asset protection from business liabilities, and pass-through taxation.

- S-Corp: S-Corporations may be beneficial for those with higher earnings to save on self-employment taxes. Both types of entities can improve professional credibility and access to financing.

Under which business category does house flipping fall?

House flipping is a part of the real estate investment business, revolving around the concept of buying, improving, and selling properties for profit, often within a short timeframe for maximum margin gain.

Which business entity is optimal for house flipping?

An LLC is widely recommended for house flipping due to the liability protections it offers, potential tax advantages, and its operational flexibility, which helps in protecting personal assets and potentially avoiding double taxation.

Is it advisable to flip houses under an LLC?

While it’s not required to have an LLC to flip houses, creating an LLC for flipping houses provides personal asset protection, potential tax benefits through pass-through taxation, and enhances the professional image crucial for forging strong connections with lenders, investors, and buyers. That said, before you create an LLC, make sure to consult with a professional first.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.