Florida Housing Market Prediction 2024

In 2024, the Florida housing market is expected to experience positive growth and opportunities for both buyers and sellers. Chief Economist Dr. Brad O’Connor predicts a slowdown in inflation and stable mortgage rates, creating a favorable environment [1]. With more houses for sale, buyers may have the chance to purchase homes below their fair market value. This forecast offers optimism for those interested in the Florida real estate market. Here, we will explore some key factors likely to impact the Florida housing market in 2024 and offer our prediction as to what we can expect from the market in the coming year.

About The Florida Housing Market in 2024

The Florida housing market has been experiencing steady growth and shows no signs of slowing down in 2024. Buyers and sellers can expect positive opportunities with a favorable economic climate, low mortgage rates, and abundant inventory. According to our analysts, the market is forecasted to remain strong, attracting investors and ensuring stability in the real estate sector.

It’s also important to note that the state has seen a dramatic increase in population over the past decade. This influx of new residents has greatly impacted home prices across the state, making them climb steadily over the years.

There are also many different types of homes available to purchase in Florida (from condos on sandy beaches to luxurious mansions), so there’s something for everyone.

Miami real estate market predictions for 2024 have boomed because of its growing popularity among tourists and investors looking to capitalize on the city’s economy and vibrant cultural scene.

We’ve already seen many large companies make the move down to Florida, and in 2024 — Jeff Bezos made a strategic move to Miami, which could signal yet another economic boom for the city, and other cities in Florida.

Florida Housing Market Statistics & 2024 Predictions

| Metric | 2023 Data | 2024 Predictions |

| Closed Sales | 257,679 | Stabilization or slight increase (+1% to +3%) |

| Paid in Cash Sales | 76,242 | Potential moderate increase due to economic stability |

| Median Sale Price | $410,000 | Increase to approximately $418,200 to $426,400 (+2% to +4%) |

| Average Sale Price | $573,997 | Slight increase reflecting market adjustments |

| Dollar Volume | $147.9 Billion | Stabilization or modest growth (+1% to +5%) |

| Median Time to Contract | 32 Days | Potential normalization, reducing extreme changes |

| Median Time to Sale | 75 Days | Likely normalization with more balanced market conditions |

| New Listings | 328,775 | Could see an increase if market conditions encourage sellers |

| Inventory (Active Listings) | 77,513 | Increase (+5% to +10%) due to improved market conditions |

| Months Supply of Inventory | 3.6 | Slight increase as inventory grows and market balances |

Home Prices in Florida for 2024

The Florida housing market is predicted to see a marginal increase in home prices in 2024. According to Zillow, the average home value in Florida increased by 2.5% over the past year, reaching $388,454 as of December 31, 2023. [2]

This upward trend is expected to continue as demand remains strong and inventory levels improve. Buyers may need to be prepared for higher prices, but there may still be opportunities to find homes below their fair market value. Additionally, there may be opportunities to flip homes in Florida for a profit.

Rental Trends and Predictions for Different Types of Properties

In 2024, the rental market in Florida is expected to show strong demand for different types of properties. Single-family homes will continue to be popular among families and individuals looking for more space and privacy.

Additionally, rental apartments, condominiums, and condotels in urban areas are projected to experience high demand from young professionals and retirees seeking convenience and amenities.

Vacation rentals, especially in popular tourist destinations, are also anticipated to see steady occupancy rates and attractive rental income opportunities. Overall, the rental market in Florida is forecasted to offer various investment opportunities for property owners.

Moreover, we may see an influx of demand due to professionals and retirees using real estate leverage to purchase homes.

For example, those who already own homes may opt for second mortgages to purchase another home.

Expected mortgage rate trends and changes

Mortgage rates in Florida are expected to show a steady decline throughout 2024, according to our analysts. This is good news for potential homebuyers as lower mortgage rates make homeownership more affordable.

However, it is important to note that national and global economic conditions influence mortgage rates, so any significant changes in these conditions could impact the mortgage rates in Florida as well.

Buyers and investors are advised to closely monitor the economic landscape and consult with financial professionals to make informed decisions regarding their mortgage options.

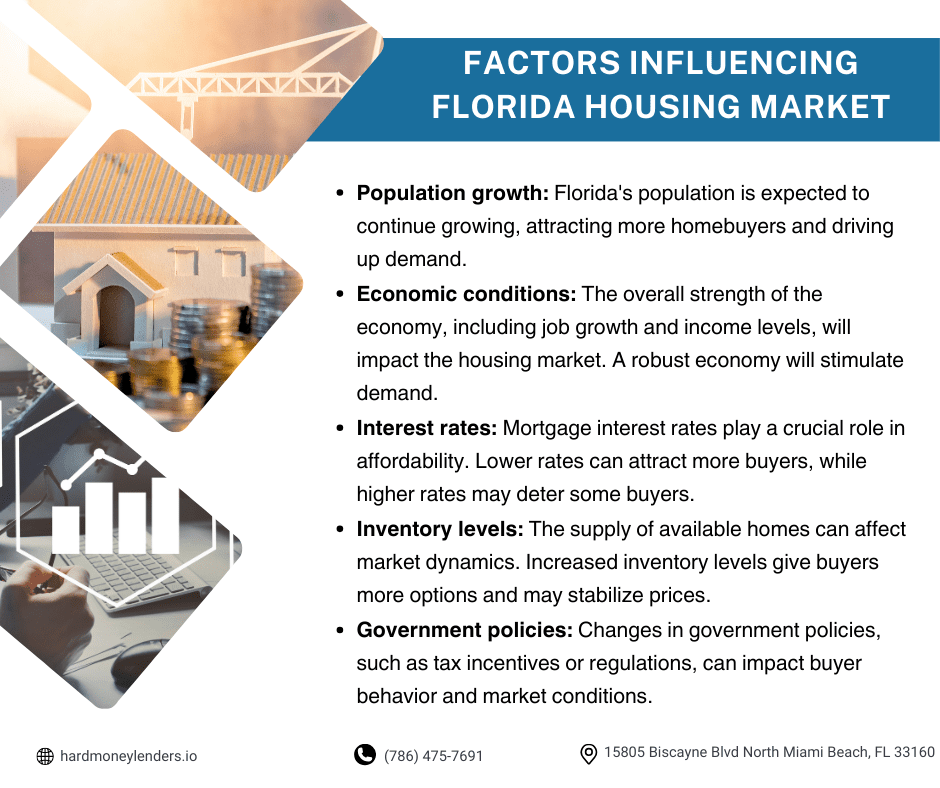

Factors Influencing the Florida Housing Market in 2024

In 2024, several factors will significantly influence the Florida housing market. These include:

- Population growth: Florida’s population is expected to continue growing, attracting more homebuyers and driving up demand.

- Economic conditions: The overall strength of the economy, including job growth and income levels, will impact the housing market. A robust economy will stimulate demand.

- Interest rates: Mortgage interest rates play a crucial role in affordability. Lower rates can attract more buyers, while higher rates may deter some buyers.

- Inventory levels: The supply of available homes can affect market dynamics. Increased inventory levels give buyers more options and may stabilize prices.

- Government policies: Changes in government policies, such as tax incentives or regulations, can impact buyer behavior and market conditions.

Keeping these factors in mind will help buyers, sellers, and investors navigate the Florida housing market in 2024.

Factors Affecting Price Movement in Florida’s Housing Market

Factors Affecting Price Movement in Florida’s Housing Market

The price movement of the Florida housing market can be affected by various factors, including supply and demand, interest rates, and the economy.

One of the factors that can most heavily affect the price movement of the Florida housing market is the balance of supply and demand. When there is a high demand for housing in the area but a low supply of homes available, prices rise.

In this situation, there are more people looking to buy homes than there are homes available, so buyers will be willing to pay more to secure a home.

On the other hand, prices will tend to decrease if there is a high supply of homes on the market but a low demand for them. In this scenario, more homes are available than people are looking to buy, so sellers need to lower their prices to attract buyers.

Another factor affecting the price movement of the Florida housing market is interest rates. When interest rates are low, it can make borrowing money to buy a home more affordable. This encourages more people to invest in the housing market, increasing demand and pushing prices up.

On the other hand, when interest rates are high, like the environment we’re currently in, it makes borrowing money to buy a home less affordable. This discourages people from entering the housing market, which decreases demand and causes prices to fall.

However, our team is predicting that interest rates are set to be cut this year. Consequently, this could spur an “easy money” environment and further drive Florida’s real estate growth.

The overall state of the economy can also affect the price movement of the Florida housing market. When the economy is strong and people are confident in their financial futures, they are more likely to purchase homes.

An Increase In The Number Of Foreclosures Or Short Sales Could Lead To A Saturation Of Homes On The Market

An increase in the number of foreclosures or short sales could have a negative impact on the Florida housing market in 2024. If more homes are available on the market, it can lead to an oversupply of housing, which decreases demand and causes prices to fall.

Foreclosures and short sales are both types of distressed sales in which a homeowner cannot make their mortgage payments and must sell their home. In a foreclosure, the lender takes possession of the property and sells it to recover the outstanding mortgage balance.

In a short sale, the homeowner can sell the home less than the outstanding mortgage balance, with the lender agreeing to accept the reduced amount as payment in full.

Foreclosures and short sales can add to, and potentially oversaturate, the supply of homes available on the market in 2024, which can decrease demand and cause prices to fall.

This increases demand and prices. On the other hand, when the economy is weak and people are uncertain about their financial futures, they are less likely to purchase homes. This decreases demand and prices.

That said, the price movement of the Florida housing market is impacted by various factors, including supply and demand, interest rates, and the overall state of the economy.

Investing in Florida Real Estate in 2024

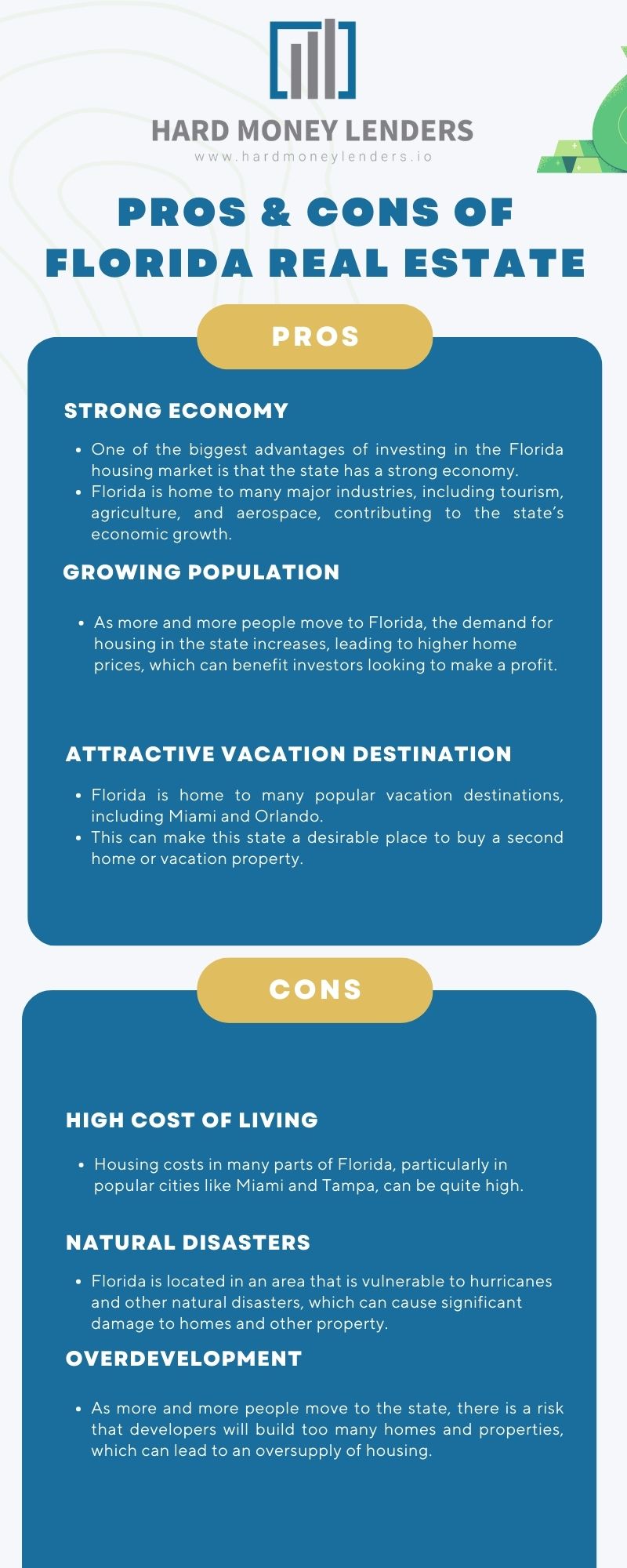

Pros

There are several benefits to investing in the Florida housing market. Some of these include a strong economy, a growing population, and attractive vacation destinations.

Strong Economy

One of the biggest advantages of investing in the Florida housing market is that the state has a strong economy. Florida is home to many major industries, including tourism, agriculture, and aerospace, contributing to the state’s economic growth. This booming economy provides a solid foundation for real estate investments, making Florida a great place to invest in the housing market.

Growing Population

Another benefit of investing in the Florida housing market is that the state has a growing population. As more and more people move to Florida, the demand for housing in the state increases, leading to higher home prices, which can benefit investors looking to make a profit.

Attractive Vacation Destination

Additionally, Florida is home to many popular vacation destinations, including Miami and Orlando. This can make this state a desirable place to buy a second home or vacation property. These are favorable investments, as they can generate rental income when not used by the owner.

Cons

While there are many benefits to investing in the Florida housing market, there are also some drawbacks to consider, including a high cost of living, natural disasters, and the potential for overdevelopment.

High Cost Of Living

One of the biggest disadvantages of investing in the Florida housing market is the state’s high cost of living. Housing costs in many parts of Florida, particularly in popular cities like Miami and Tampa, can be quite high. These prices can make it difficult for some people to afford a home in these parts of Florida, decreasing demand and the value of real estate investments.

Natural Disasters

Another drawback of investing in the Florida housing market is the risk of natural disasters. Florida is located in an area that is vulnerable to hurricanes and other natural disasters, which can cause significant damage to homes and other property. This risk of damage can be a major concern for investors, as damage can decrease the value of investments.

Overdevelopment

Additionally, some parts of Florida have the potential for overdevelopment. As more and more people move to the state, there is a risk that developers will build too many homes and properties, which can lead to an oversupply of housing. This would cause prices to drop, harming real estate investments.

Investment strategies and tips for navigating the Florida real estate market

Final Thoughts on the Florida Housing Market Predictions in 2024

The Florida housing market is expected to experience positive growth and stability in 2024. With increasing inventory, moderate price appreciation, and a steady rental market, it presents opportunities for both buyers and sellers. However, it is important for investors to carefully analyze the local market conditions and consider factors such as population growth, economic development, and affordability. By staying informed and working with experienced real estate professionals, individuals can navigate the market successfully and make wise investment decisions.

Questions People Also Ask About Florida’s Housing Market

What are the key predictions for the Florida housing market in 2024?

The Florida housing market is poised for continued growth in 2024, with an expectation of steady demand leading to price increases, though possibly at a slower pace if interest rates rise and inventory moderately increases.

How has the Florida real estate market changed in recent years?

The market has seen significant growth, driven by economic expansion, an influx of new residents, and a high demand for housing. This has resulted in increased home values and a competitive market environment.

What factors are driving the Florida housing market in 2024?

Economic growth, demographic shifts, and Florida’s lifestyle appeal remain key drivers. Additionally, remote work trends and technological advancements are enabling more people to relocate to Florida, boosting demand.

Are interest rates expected to impact the Florida housing market in 2024?

While interest rates are a key factor, the strong demand and solid economic fundamentals in Florida are expected to sustain market growth, even if rates increase moderately.

What are the most promising areas for real estate investment in Florida in 2024?

Urban centers like Tampa, Orlando, and Miami, along with emerging areas on the Gulf and Space Coasts, are expected to be hotspots for investment, driven by economic and demographic trends.

How does the supply of homes in Florida affect the market in 2024?

The supply of homes, though improving, is still not fully meeting demand, keeping the market competitive and prices strong. An increase in construction could help balance the market.

What challenges do first-time homebuyers face in the Florida market in 2024?

Competitive bidding, higher prices, and the need for significant down payments are challenges. Accessing financing options and government programs can help navigate these obstacles.

What are the predictions for rental markets in Florida in 2024?

The rental market is expected to stay robust, driven by both permanent residents and a burgeoning population of remote workers, with rental prices likely to rise in response to strong demand.

How can buyers best prepare for purchasing a home in Florida’s competitive market in 2024?

Preparation should include mortgage pre-approval, staying updated on market trends, and readiness to make swift decisions. Leveraging the expertise of real estate professionals can also be beneficial.

Are Housing Prices Going Down In Florida?

It depends on the area. In some areas, housing prices are decreasing due to the COVID-19 pandemic and economic downturn. However, in other areas of Florida, housing prices have remained relatively stable or even increased due to strong demand from buyers. Overall, it’s difficult to predict the Florida real estate forecast 2023 without more detailed information about specific markets.

Has Florida Real Estate Peaked?

It’s difficult to say whether Florida real estate has peaked. The market is constantly changing, and what may have been true in the past may not be true today. It’s important to look at current trends and factors such as housing affordability, population growth, job market, and economic indicators to better understand where the market is heading.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.