How To Calculate The Vacancy Rate On A Rental Property

You’ve got a bunch of empty units. You’re running the numbers in your head, trying to figure out if they’re worth renting again or what you could get for them if you sell them off. But how much exactly does this affect your bottom line? Understanding your rental property vacancy rate helps you better understand your business and make more informed decisions about managing your properties. This can lead to increased profitability for short-term and long-term goals such as retirement savings or buying another property.

What is the Vacancy Rate?

It’s the percentage of units that are vacant at any given time. For example, if you have 100 apartments and two are empty, your vacancy rate is 2%. That’s a pretty low number. If you’re seeing higher than that, it might be worth investigating.

The lower your vacancy rate, the more income-producing properties you have. If you’re interested in buying a rental property as an investment or part of your retirement plan, keeping this number low will help ensure that even if one unit is vacant for a while, tenants will still need to rent from you.

Why is the Vacancy Rate Important?

The vacancy rate is a key indicator of the health of the rental market. It can help you make decisions about your property, as well as your property management and marketing strategies, and even the tenant screening process.

- The vacancy rate is important when determining if a property has a good return on investment (ROI).

- A high vacancy rate indicates that there are many available units in the market, which may mean it’s time to sell your property.

- On the other hand, if there are few vacancies, it means there aren’t any available units for potential renters or buyers in your area.

How to Calculate Rental Property Vacancy Rate

To calculate the vacancy rate on a rental property, you need to know how many units are vacant and how many units are occupied. You can use a simple equation to figure out the vacancy rate:

- [Rental Property Vacancy Rate] = number of vacant units / total number of units

Or…

- [Rental Property Vacancy Rate] = number of vacant units / total number of occupied units x 100

So, if you have 10 units and 6 are vacant (vacancy rate = 60%), your rental property vacancy rate is

60% = 6 / 10 x 100

What Vacancy Rates are Good for Investors?

The higher the vacancy rate, the lower your income. The lower your income, the less likely you are to make money and keep your investment property as an asset on your balance sheet.

One good rule of thumb for what vacancy rates are good for investors is, if you can find something that’s under 5% in a market where tenants are looking for housing and there’s not much supply, then it’s probably a pretty good deal that will produce some decent cash flow on your return.

But if it’s over 10%, then maybe don’t bother investing there because there may not be enough demand or too much competition from other investors who are chasing similar yields.

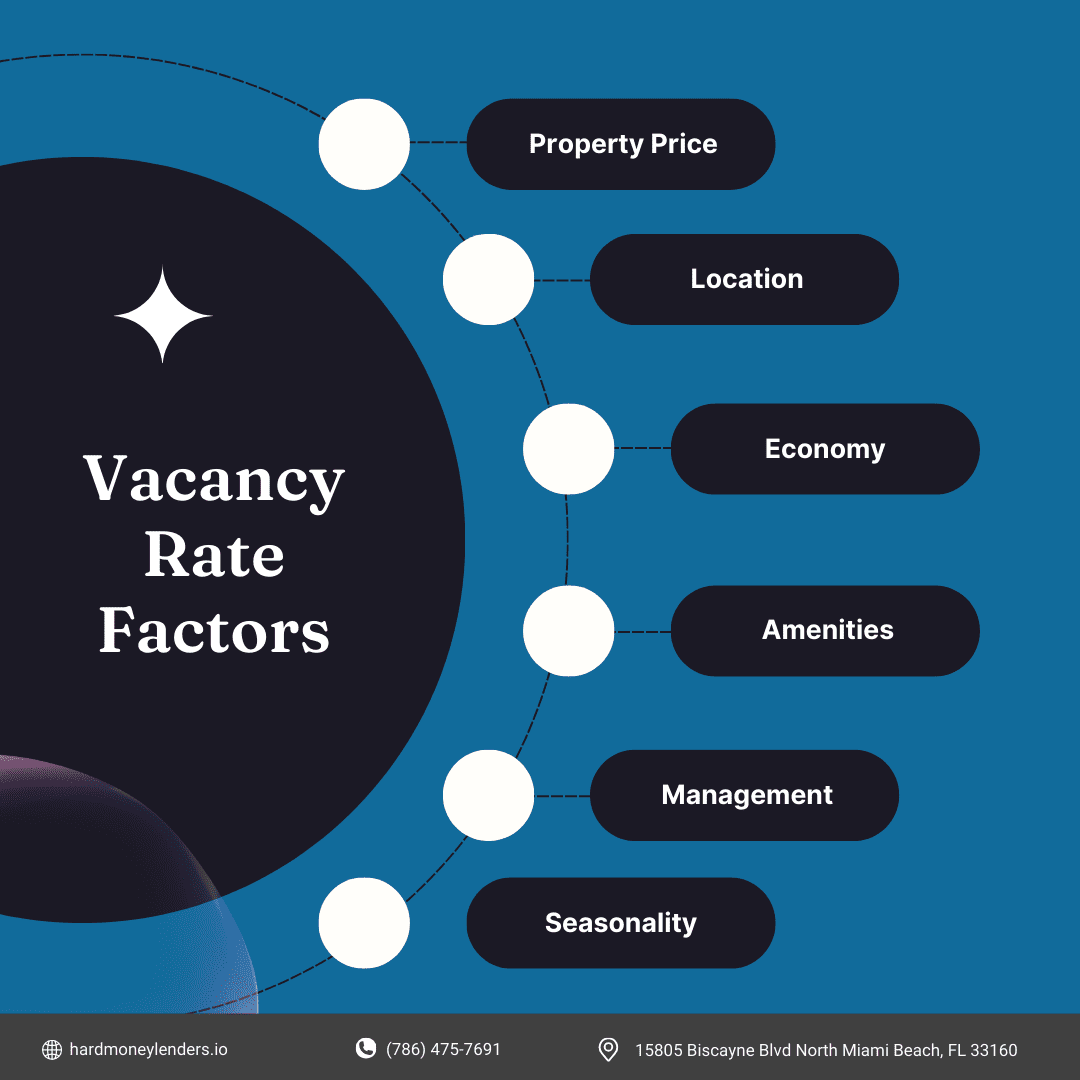

What Factors Influence the Vacancy Rate in a Rental Property?

Price of property

A higher price means fewer renters will be able to afford it, so you’ll have a higher vacancy rate. This is especially true for rentals that are new or have just been renovated. It will be easier to fill your property if you charge a fair price.

Location

Crime Rates

Areas with high crime rates tend to have higher vacancy rates than those without such problems. This is especially true in urban areas where there are many low-income families. The crime rate also affects property values, which can lead to higher vacancy rates and lower rents.

Few Jobs

Areas where there are few jobs available also tend to have fewer tenants than other areas that offer job opportunities for residents.

Neighborhoods

Neighborhoods where homes are older or not kept up well tend not only to attract poorer residents but also to reduce demand from potential renters who would prefer newer buildings with better amenities. A quiet, safe neighborhood with good schools tends to attract more renters than those with poor schools.

Community

The type of community also plays a role in the demand for rental homes. For example, college towns tend to have higher vacancy rates than those with no local university or only a small one.

Economic Conditions

When the economy is doing well, people have more money in their pockets and are more likely to move out of family homes into of their own places. This can lead to a lower vacancy rate for rental properties.

Property Conditions and Amenities

A property that is well-maintained and clean will attract more renters than a property that needs repairs or updating. Also consider that rentals with amenities like pools, gyms, playgrounds, and even things like washers and dryers are more popular than those without such features.

Management

If it’s a large corporation, then there may be less personal attention given to each unit, because their focus is on managing huge numbers instead of caring about each resident’s needs.

Type of property

Apartments tend to have higher vacancy rates than houses or duplexes. The same is true for older buildings, poorly kept up, or located in areas with undesirable school districts.

Seasonal Variations in Vacancy Rates

Vacancy rates in rental properties can exhibit significant seasonal fluctuations, particularly in markets heavily influenced by tourism or university schedules. For instance, tourist towns often see a surge in demand during peak travel seasons, leading to nearly full occupancy, followed by significant drops in the off-season when the tourists return home.

Similarly, rentals in college towns may fill up during the academic year but empty significantly over the summer unless they cater to summer school students or temporary faculty.

Investors in these areas must plan their financial strategies with these cycles in mind. Effective planning might include budgeting for lower income during off-peak times and capitalizing on peak seasons by adjusting rental prices to match increased demand.

Additionally, maintaining properties during low seasons, possibly with renovations or upgrades, can prepare them for peak profitability times. Investors can also explore opportunities to market their properties for short-term off-season rentals, such as holiday homes for winter renters in ski towns or summer spots in cooler areas to attract a different tenant demographic.

Long-term vs. Short-term Rentals

The choice between long-term and short-term rental strategies significantly impacts vacancy rates and overall profitability. Short-term rentals, such as vacation rentals, often command higher nightly rates but may suffer from greater seasonal fluctuations, leading to potentially high vacancy rates during off-peak periods. However, they allow landlords to adjust prices quickly in response to demand, potentially maximizing income during high-demand periods.

In contrast, long-term rentals provide more consistent income streams and typically lower vacancy rates, as tenants commit to longer periods. However, the returns on long-term rentals may be lower on a nightly basis compared to short-term rentals. Investors must consider their market, with factors such as location, tenant demand, and local regulations influencing the optimal rental strategy.

How Owners Can Reduce Vacancy Rate

Review Your Lease Agreement

Look at the terms of your lease agreement and see what you can do to make it more attractive.

- For example, if you have a no-pets rule then consider allowing pets under certain conditions (a small fee or deposit) so that people who want them don’t automatically pass over your property because they don’t have any other options.

Have a Good Screening Process

The screening process is the most important part of determining who gets to live in your rental property. You should have a written application that asks for basic information such as income, employment status, and credit history.

It may also be worthwhile to get references from previous landlords or employers if possible; this can help you weed out people who are likely to cause problems down the road.

Have a Good Maintenance Plan

You need to be prepared for any maintenance issue that may come up. It’s important not only to have an emergency fund but also to have a plan for how you’ll deal with things like plumbing or electrical problems.

You should also get renter’s insurance, which will cover damage from fire, windstorms, and other disasters. This is especially important if your property has more than one unit.

The Role of Advertising in Managing Vacancy Rates

Effective advertising is essential in reducing vacancy rates in rental properties. It not only fills vacancies faster but also maximizes rental income by reaching a broad audience. Below are strategies and case studies demonstrating successful advertising methods.

Advertising Channels

- Online Platforms: Online listings are the most dynamic way to reach prospective tenants. Utilizing platforms like Zillow, Apartments.com, and Rent.com allows landlords to reach a large audience. Features like detailed descriptions, high-quality photos, and virtual tours can enhance listings, making them more appealing to potential renters.

- Local Newspapers: Despite the rise of digital media, local newspapers remain a valuable resource, particularly in communities where digital penetration is lower or where older demographics prevail. Advertising in local newspapers can reach locals who prefer traditional methods of information consumption.

- Rental Listing Websites: Websites dedicated to rental properties, such as Craigslist or local classifieds, are essential for targeting specific geographical areas. These sites often offer free or low-cost advertising options and are frequently visited by those looking for rentals.

Case Studies

- Social Media Campaigns: An apartment complex in New York utilized Facebook and Instagram ads to target young professionals within a 30-mile radius. By showcasing amenities like a gym, pet-friendly policies, and proximity to public transport, the campaign led to a 25% decrease in vacancy within three months.

- SEO-Optimized Website: A property management company developed a website with search engine optimization (SEO) strategies focusing on keywords such as “rentals near me” and “affordable apartments in [City].” This approach improved their site’s visibility in search engine results, leading to a 40% increase in inquiries and faster filling of vacancies.

Effective Strategies

- Targeted Advertising: Understanding the demographic profile of potential tenants can tailor advertising efforts. For example, properties near universities can target ads towards students and faculty, while upscale properties might focus on professionals through LinkedIn.

- Incentives: Offering incentives such as a free month’s rent, reduced security deposit, or gift cards for signing a lease can attract more tenants. Highlighting these promotions in advertisements can make listings more attractive.

- Quality Content: Ensuring that the advertisement contains all necessary information in a clear, concise, and attractive manner is crucial. High-quality images, accurate property descriptions, and highlighting unique features can differentiate a property from others.

Flexible with Your Tenants

Be open to negotiation, as well as working with your tenant if they have issues that need to be resolved before they move in.

Property Manager

It’s best to ask around first and do some research. Make sure they have experience with the type of property you are looking to rent out, as well as the area. Also, make sure they have good references from other landlords and owners in your area.

Know your vacancy rate = Being better prepared financially

When you’re able to calculate your vacancy rate, you’ll be better prepared to manage your finances.

You can use the vacancy rate to compare properties and determine which ones are worth investing in. You’ll also be able to decide what repairs and improvements should be made first. The vacancy rate is a key indicator of the health of your rental property. It can help you decide what type of repairs to make and when it’s time to sell. The rate will also give you an idea of how much rent you should charge for each unit.

Expert Tips to Analyze Tenant Turnover

High tenant turnover can significantly impact the profitability of rental properties, leading to increased vacancy rates and associated costs such as advertising for new tenants and preparing the property for new occupants. To effectively manage and reduce tenant turnover, landlords must understand its causes and implement strategies to mitigate them.

Understanding Causes of Tenant Turnover

Several factors can lead to high tenant turnover:

- Poor Tenant-Landlord Relationships: Lack of effective communication and poor management practices can lead tenants to leave.

- Inadequate Property Maintenance: If tenants feel their living conditions are deteriorating or their requests are ignored, they may look elsewhere.

- Pricing Issues: If the rent is perceived as too high compared to similar properties in the area, or if increases are frequent and unjustified, tenants might opt to move.

- Neighborhood Changes: Changes in the neighborhood environment, such as increased crime or declining public services, can also drive turnover.

Strategies to Reduce Tenant Turnover

- Enhance Tenant Relations: Regular communication and prompt responses to maintenance requests can significantly improve tenant satisfaction. This might include monthly newsletters, community events, or satisfaction surveys.

- Competitive Pricing and Amenities: Keeping rent prices in line with similar properties in the area and providing desirable amenities can make tenants think twice about moving. Amenities could include access to a gym, parking facilities, or modern home appliances.

- Lease Renewal Incentives: Providing incentives for lease renewals can be an effective strategy. This might include a discount on the monthly rent if they renew early, or upgrades to their living space, such as new appliances or cosmetic improvements.

- Regular Property Upgrades: Incremental upgrades to the property can enhance its value and the quality of living for tenants, reducing the incentive for them to move. This can involve updating fixtures, repainting, and maintaining the exterior of the property to boost curb appeal.

- Feedback and Adjustments: Implementing regular surveys and feedback sessions with tenants can help landlords and property managers understand and respond to tenant needs, improving satisfaction and reducing the likelihood of them moving.

- Loyalty Programs: Implementing loyalty programs that reward long-term tenants with perks such as rent discounts, special parking spaces, or first choice on another property can foster a sense of loyalty and encourage lease renewals.

The Wrapup

Understanding the vacancy rate on your rental property is important for making informed decisions about how to improve your business. By maintaining a high occupancy rate, you’ll prevent yourself from losing money and keep your property in great condition for new tenants.

It allows you to see how effective your marketing efforts are and how many potential tenants there are in your area. Calculating the vacancy rate can be tricky, but once you know the basics, it will become easier every time!

New to real estate investing? Check out our article on the best business structures for real estate investors. And you can be on your way on becoming a real estate expert by reading about investing in multifamily properties.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.