The Beginner’s Guide to House Flipping and Taxes

You spend weeks, months, or possibly more than a year flipping your first property… you carefully completed the renovations, finally completing your first flip and making a profit! Now you’re left with one question – how much will you have to pay in taxes for flipping the house? Based on a variety of house flipping tax rules, your taxable amount owed for the house you flipped can change greatly based on several factors, such as the investor’s income and property type. It’s important to keep an eye on these factors because the taxes associated with fix-and-flips can become very high if you aren’t careful. Below, you’ll find Hard Money Lenders’ Beginner’s Guide to House Flipping and Taxes.

You’ll learn about:

- Flipping Houses Tax Basics

- The Impact of Holding Periods on Taxes

- How Much Taxes You’ll Pay on Your Fix and Flips

- How to Save on House Flipping Taxes and Capital Gains Tax

- FAQs on house flipping and taxes

Flipping Houses Tax Basics

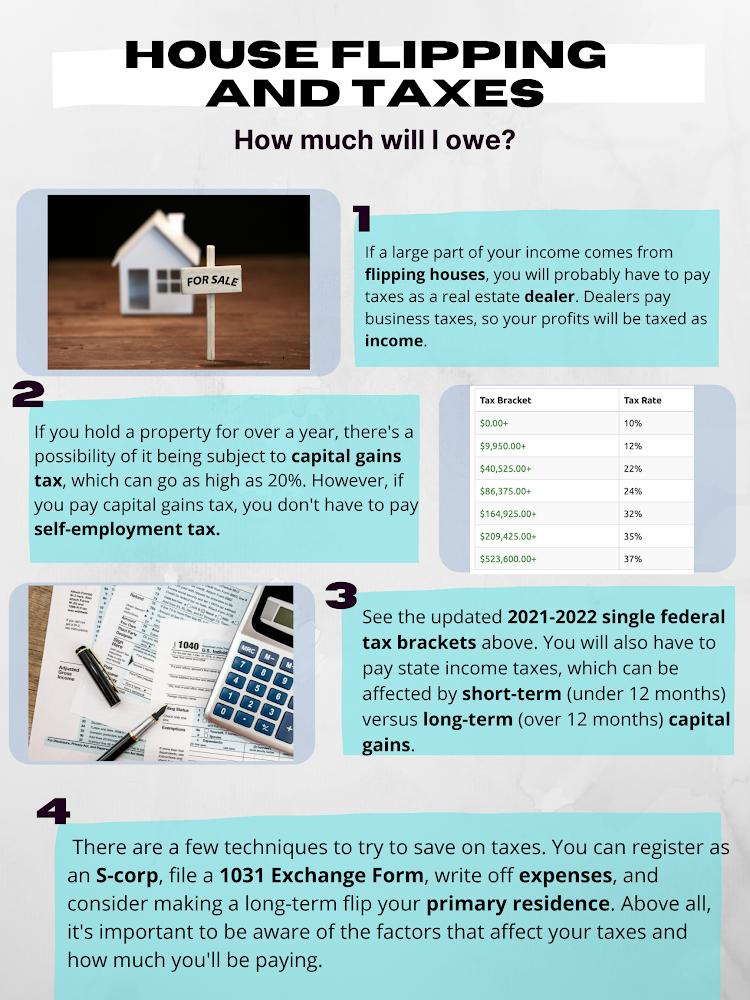

If you want to figure out how much you will have to pay in taxes, you first need to understand the basics of how house flipping taxes work. Although there are occasional exceptions, house flipping is generally considered to be active income, rather than passive investing. Therefore, within the financial year the investor has to pay typical income taxes on their net profits, including self-employment taxes as well as federal and state income taxes.

Understanding Your Tax Obligations When Flipping Houses

Navigating the tax landscape is a critical component of house flipping that can significantly affect your profitability. It’s essential to understand the different ways your profits might be taxed and how your business activities influence your tax status.

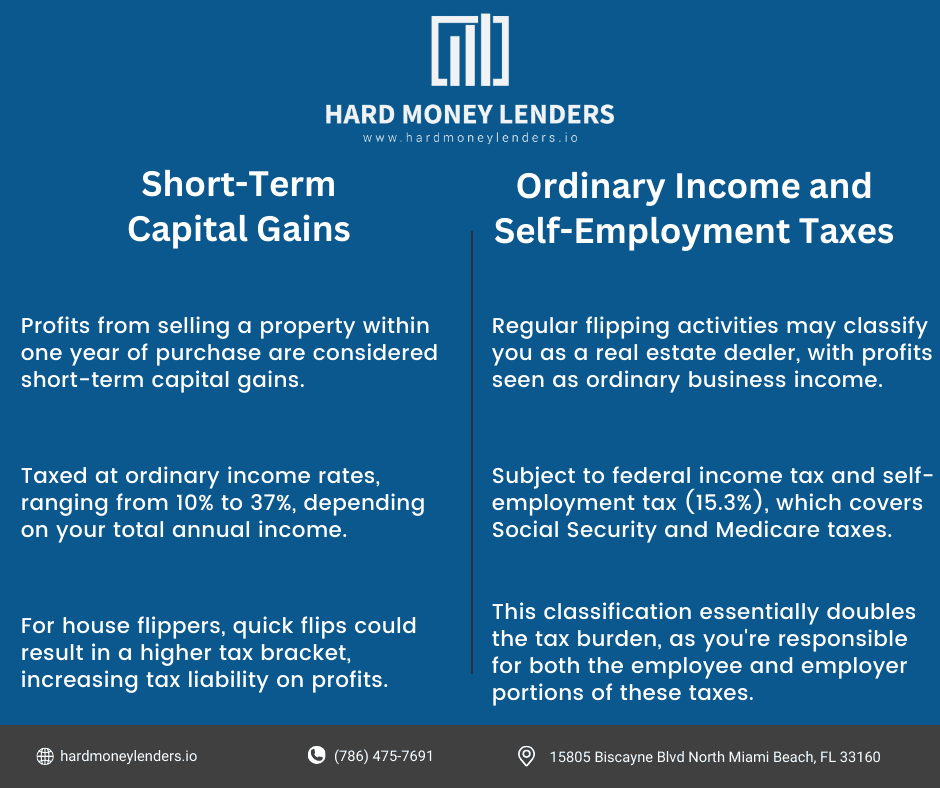

Short-term Capital Gains and Ordinary Income: A Closer Look

Short-term Capital Gains: If you sell a property within one year of purchase, the profit is treated as a short-term capital gain, taxed at the same rates as your ordinary income. The IRS categorizes income into several brackets, with rates ranging from 10% to 37% based on your total annual income. For house flippers, this means that quick flips could push you into a higher tax bracket, increasing your tax liability on the profits earned.

Ordinary Income and Self-Employment Taxes: House flippers who engage in flipping as a regular business activity may be classified as real estate dealers. This designation means that your flipping profits are considered ordinary business income.

Unlike capital gains, ordinary income is subject to both federal income tax and self-employment tax. The self-employment tax rate is 15.3%, covering Social Security and Medicare taxes, essentially doubling your tax burden as you’re responsible for both the employee and employer portions.

Distinction Between Investor and Dealer

If the majority of your income results from fixing and flipping properties, the IRS will usually classify you as a dealer.

A dealer is considered to be someone who buys real estate for a short amount of time and then sells it to others. Even investors that only rarely fix and flip houses are still often classified this way.

Real estate dealers pay business taxes rather than personal taxes, so your profits are taxed as income regardless of how long you hold the property. There are a few more discrepancies that can classify someone as a dealer versus a regular investor, and if you’d like to learn more you can explore this article here.

However, you should be careful with long-term properties because if you hold a property for over a year, it may be subject to the capital gains tax, which can go as high as 20%. These taxes are meant to apply mainly to long-term rentals or primary occupation situations but sometimes do apply to flipping houses and capital gains.

On the bright side, if you are paying capital gains taxes, the self-employment tax doesn’t apply anymore. There are also different kinds of capital gains taxes based on how long it takes you to sell the property when flipping houses, which are short-term capital gains taxes and long-term capital gains taxes.

Even if you only fix and flip houses on the side and don’t consider it to be a full-time business, the IRS says that any form of investment in real estate can be classified as a business, regardless of whether you do it under your name or as part of a different agreement.

The distinction between being an investor and a dealer is crucial here. Dealers have their profits treated as ordinary income due to the frequency and nature of their sales, suggesting that flipping is their regular business. This classification can lead to a higher tax obligation because of the combined impact of income tax and self-employment tax.

The Strategic Importance of Holding Periods

The length of time you hold onto a property has significant tax implications:

- Short-term Holdings: Properties sold within a year of acquisition are subject to short-term capital gains tax, aligning with your personal income tax rate. This can significantly affect your take-home profit, especially for those in higher income brackets.

- Long-term Holdings: By holding property for more than a year before selling, your profit qualifies for long-term capital gains tax, which is notably lower than short-term rates, maxing out at 20% for the highest-income individuals. For many investors, this rate is 15%, and for some, it could be as low as 0%. Planning your flips to align with long-term capital gains criteria can substantially reduce your tax bill and increase your net profits.

How Much Will I Pay in Taxes on My Fix and Flips?

There are several factors that can affect how much you will pay in taxes total, such as your federal tax bracket and your income tax rate. In 2024, self-employment taxes will come in at 15.3% up to $168,600.

Below, you’ll find the updated tax brackets for 2024.

| Tax Rate | Single Filers | Married Couples Filing Jointly | Married Couples Filing Separately | Head of Household |

| 10% | Up to $11,600 | Up to $23,200 | Up to $11,600 | Up to $16,550 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,150 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,151 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

| 37% | Over $609,351 | Over $731,201 | Over $365,601 | Over $609,351 |

Source: IRS

Now, keep in mind that if you live in a state with income taxes, you will also have to those taxes.

This is where long-term and short-term capital gains come into play, as selling a property in under 12 months counts as a short-term capital gain, whereas over 12 months works as a long-term capital gain. Short-term capital gains will be taxed at your usual income tax rate, whereas long-term capital gain tax rates can be anywhere from 0% and 20%.

If you’re concerned that your real estate investment may no longer be worthwhile after taxes are taken out, you can prepare a mock-up of your investment and potential payouts using our hard money loan calculator.

How to Save on House Flipping Taxes and Capital Gains Tax

With a few entirely legal tips and tricks, you can cut back on some of the taxes that usually come with flipping a house.

One strategy to reduce your self-employment tax is to register an S-corp. If you then pay yourself what is considered a “reasonable salary”, you’ll only have to pay taxes on a percentage of that salary.

Through owning your own S-Corp, you can also opt to receive dividends instead of a salary, which will be taxed less than your self-employment income. Finally, S-Corps even offer a 20% deduction for flow-through entities.

Another option is to file a 1031 Exchange form, which lets you avoid paying capital gains tax on a flipped house that’s been sold as long as you use the profits from that fix and flip to purchase another similar property. This can be a great option if you flip houses regularly. Some investors have been using 1031 exchanges for years without ever paying taxes on their fix and flips. More information on this strategy can be found here.

If you are only flipping one property at a time, and will possess said property for over a year, think about making that property your primary residence. While this isn’t an option for every investor, considering the timeline involved, doing so allows you pay less tax on your profits. The final sale will be classified as capital gains, rather than active income, and thus will be taxed at a lower rate.

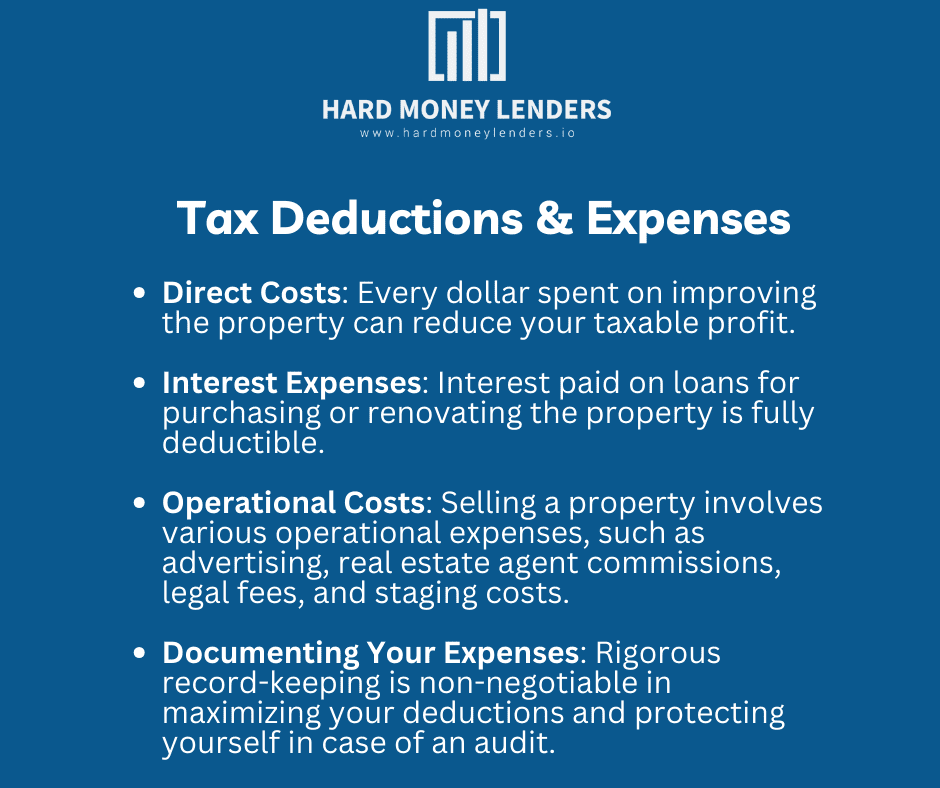

Deductions and Expenses: Maximizing Your Tax Benefits

Understanding what you can deduct and how to track these expenses can make a significant difference in your taxable income.

- Direct Costs: Every dollar spent on improving the property can potentially reduce your taxable profit. This includes material costs, labor, and any other expenses directly related to the renovation. However, distinguishing between capital improvements (which need to be depreciated over time) and repairs (which can be deducted in the year they occur) is essential for accurate tax reporting.

- Interest Expenses: Interest paid on loans for purchasing or renovating the property is fully deductible. This deduction is particularly valuable for flippers who leverage financing to maximize their investment potential.

- Operational Costs: Selling a property involves various operational expenses, such as advertising, real estate agent commissions, legal fees, and staging costs. These are fully deductible and can decrease your overall tax liability.

- Documenting Your Expenses: Rigorous record-keeping is non-negotiable in maximizing your deductions and protecting yourself in case of an audit. You should always keep detailed records of all transactions, including receipts, invoices, and bank statements, organized by your fix and flip projects. Utilizing accounting software designed for real estate investors or consulting with a tax professional can ensure you’re capturing every allowable deduction.

Grasping the complexities of taxes in house flipping allows investors to strategize effectively, ensuring that every flip is as profitable as possible. By understanding the nuances of short-term versus long-term capital gains, the implications of being classified as a real estate dealer, and the importance of meticulous record-keeping for maximizing deductions, you can navigate the tax landscape with confidence, making informed decisions that bolster your investment success.

Pro Tax Tips for House Flippers

To optimize tax outcomes for house flippers, detailed record-keeping is essential. Document all transactions related to purchasing, renovating, and selling properties to support deductions and ensure accurate income reporting.

Engaging a tax professional can offer invaluable insights into complex tax codes and regulations specific to real estate investments. They can advise on compliance, highlight potential tax-saving strategies, and assist in navigating the intricacies of real estate taxation, maximizing the profitability of your flipping endeavors through informed tax planning and strategy.

Final Thoughts on Taxes for House Flippers

With tax brackets and IRS requirements changing frequently, it can be hard to stay on top of all the possible tax deductions. Keep in mind that you should always be tracking your expenses and numbers to find places to save. Understanding how house flipping tax rules and capital gains work is the first step to making filing taxes less intimidating. With the use of our convenient legal strategies to reduce how much you’re paying, you won’t need to worry about tax season anymore.

FAQs on Taxes for House Flipping

How can I calculate my fix and flip taxes?

One rough method for calculating your flipping houses taxes is to multiply your normal income tax rate by the taxable profit you’ve made. While this may not be completely accurate, it will give you an estimate as to how much you’ll have to pay in taxes. Another option is to subtract your tax deductions from the final sales price of your fix and flip property, as well as subtracting your total expenses from the flip. This will show you your final profit after taxes have been accounted for.

When do I need to pay house flipping taxes?

According to the IRS, real estate property sales count as inventory, and so you don’t need to pay taxes until after that inventory has been completely sold. Therefore, you only need to pay taxes on your properties for the year in which you sell them. However, because real estate investors technically count as a business, if you make more than $1,000 in a year, you’ll need to prepay your taxes quarterly. File a 1040 Profit & Loss Form, also known as a Schedule C form, by the 15th of January, April, June, and September. If you haven’t successfully flipped any houses yet and haven’t made any income, you’ll need to file taxes at the end of the year.

How does the IRS view house flipping?

The IRS distinguishes house flipping based on intent and frequency, viewing it either as an investment or a dealer activity:

- As an investment: If you occasionally flip houses, the IRS may view you as an investor. This classification subjects your profits to capital gains tax and allows for certain deductions, but losses are treated as capital losses, which have limitations on how they can be deducted.

- As a dealer activity: If you flip houses regularly with the intent of making a profit from the sales, the IRS may classify you as a dealer. This means your profits are considered ordinary business income and taxed accordingly. Additionally, you’re required to pay self-employment taxes on your profits. However, business losses can offset other types of income without the limitations imposed on capital losses.

Are there any tax deductions I can take advantage of?

Yes, when flipping houses, you’re entitled to several deductions that can reduce your taxable income:

- Cost of goods sold: This includes the purchase price of the property, renovation costs, and any other direct costs associated with improving and selling the property.

- Operating expenses: General administrative and business expenses, such as office supplies, utilities, and insurance, are deductible.

- Interest and financing costs: Interest on loans used to purchase or renovate the property can be deducted.

- Marketing and selling expenses: Costs associated with marketing the property and closing the sale, including advertising and real estate agent commissions, are deductible.

What if I sell at a loss?

If you sell a flipped property at a loss, you can deduct this loss from your income, which can reduce your overall tax liability. How the loss is treated depends on your IRS classification:

- As an investor: Losses are considered capital losses. Now, as a house flipper, these can be used to offset capital gains. If your house flipping capital losses exceed your house flipping capital gains, you can use the loss to offset up to $3,000. You can offset $1,500 if married filing separately of other income per year, with the ability to carry over unused losses to future years.

- As a dealer: Losses are considered ordinary business losses and can fully offset other income, including wages, without the annual limit applicable to capital losses.

Do I need to pay taxes if I flip a house as a primary residence?

If you flip a house that you’ve used as your primary residence for at least two out of the five years before the sale, you may qualify for the Section 121 exclusion. This allows you to exclude up to $250,000 of profit from your income if filing singly, or $500,000 if married filing jointly. However, to prevent abuse of this rule by serial flippers, the IRS may not allow the exclusion if flipping appears to be your regular business activity.

How can I minimize taxes on house flipping?

To minimize taxes on house flipping, consider the following strategies:

- Hold properties longer: By holding properties for more than a year, you can take advantage of the lower long-term capital gains tax rates.

- Keep meticulous records: Document all expenses related to the purchase, renovation, and sale of the property to maximize your deductions.

- Choose the right business structure: Operating through an LLC or corporation can provide tax benefits and help protect personal assets.

- Utilize tax losses: If you sell at a loss, make sure to apply these losses to offset taxable income, following the rules based on your classification by the IRS.

Is there a limit to how many houses I can flip in a year?

There’s no hard limit on the number of houses you can flip in a year, but the frequency of your activities can influence how the IRS classifies you, impacting your tax treatment. Regular, frequent flipping may lead to classification as a dealer, which has different tax implications compared to flipping as an investment activity.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.