Pros and Cons of Investing in Multifamily Properties

What do all real estate investments have in common? There are both risks and rewards involved and intertwined. If you plan on investing in multifamily properties, it is necessary to take all the aspects of the endeavor into account and choose your route. That said, here’s a look at the pros and cons of investing in multifamily properties.

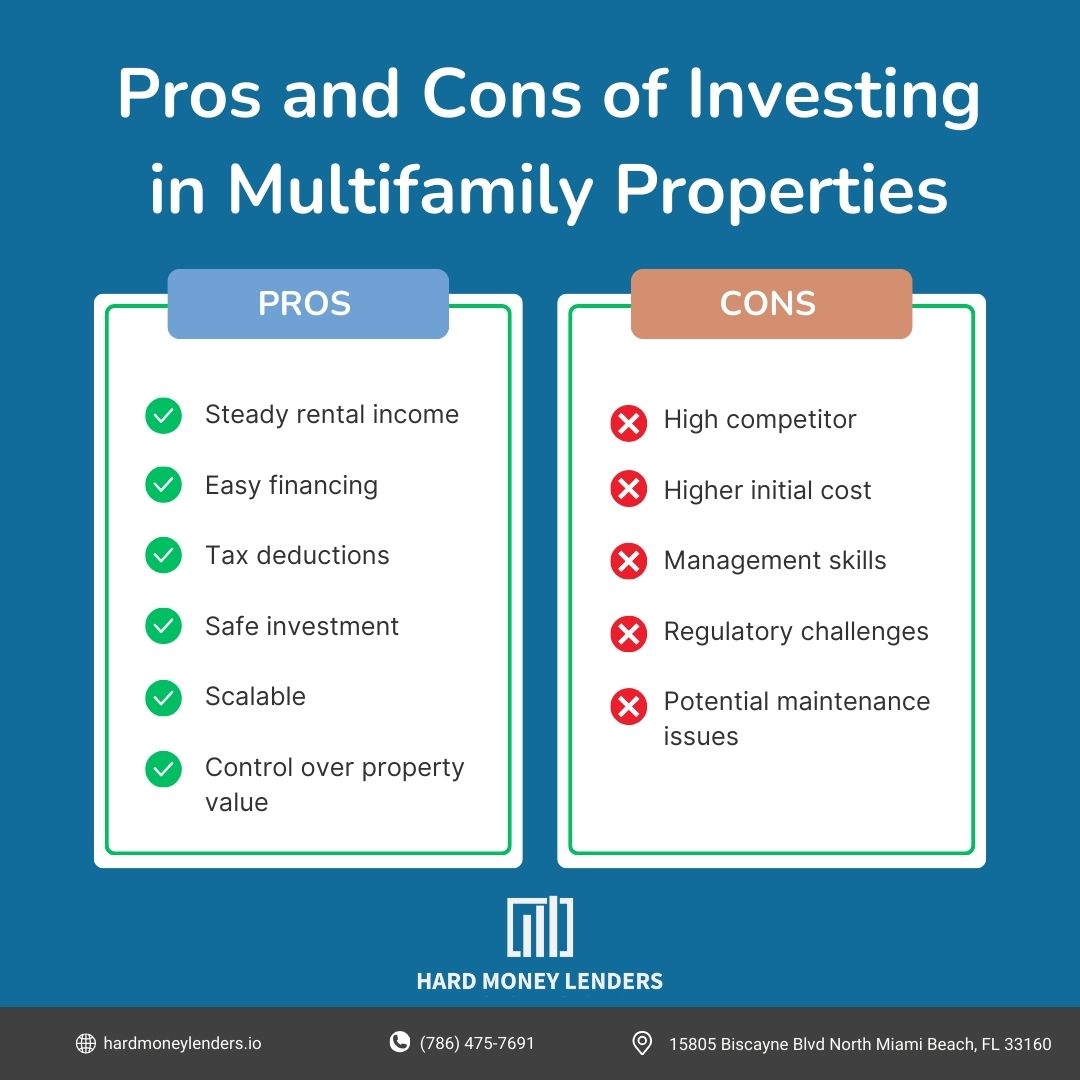

TL;DR on the Pros and Cons of Investing in Multifamily Properties

Every investment starts with a plan, and every plan with thorough research. It serves to enlist all the possible strengths and weaknesses and allows for precise budgeting. After all, it is ROI that investors look for, so determining the risks is a top priority in the planning phase.

What do investors in multifamily real estate primarily benefit from? The most significant advantages of this type of investment include:

- A reliable cash flow from monthly rents

- Financing is easy to secure

- Attractive tax benefits

- Generation of passive income

- It is one of the safest investments

- Insurance coverage is simple to arrange

- Scalability

- Increased Control Over Property Value

On the other hand, investment in multifamily real estate presents a couple of disadvantages:

- Competition among investors is tough

- Higher initial expenses are expected

- Requires multiple unit management skills

If you’ve set your mind on property investment, especially rental real estate, first weigh the pros and cons.

Pro #1 A Steady Rental Income

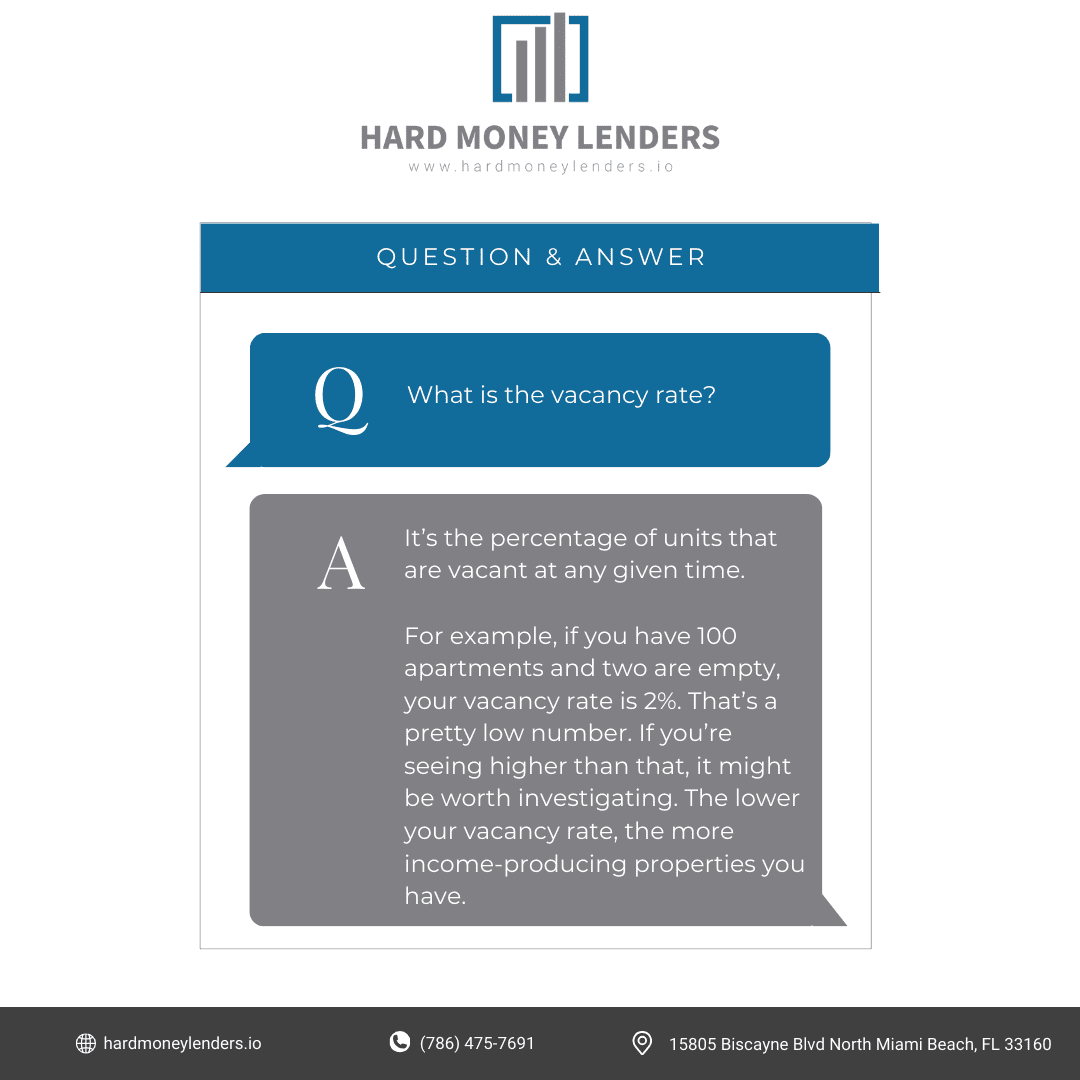

Multifamily properties are renowned for their ability to generate consistent rental income. This is because, unlike single-family homes, where a vacancy means no income, multifamily units can still bring in rent from other occupied units even if one or more are vacant. This mitigates financial risk and provides a more stable cash flow.

To capitalize on this advantage, investors should conduct a thorough analysis of the income to expense ratio. This involves evaluating all potential revenues and operational costs, including maintenance, management fees, and vacancy rates, to ensure the property generates net positive cash flow. Effective financial management and understanding market rent trends are key to maximizing returns from a multifamily investment.

To capitalize on this advantage, investors should conduct a thorough analysis of the income to expense ratio. This involves evaluating all potential revenues and operational costs, including maintenance, management fees, and vacancy rates, to ensure the property generates net positive cash flow. Effective financial management and understanding market rent trends are key to maximizing returns from a multifamily investment.

Pro #2 Easy Financing and Lower Interest Rates

Why are rental property loans so easy to obtain for multifamily real estate? Investing in multifamily properties doesn’t suggest a risky transaction to lenders due to the market predictability. If a tenant leaves your single-family rental property, you lose 100% rent. If a tenant leaves one unit in your multifamily rental, you lose just a percentage. For this reason, lenders might be inclined to suggest more convenient interest rates to prospective investors.

Pro #3 Attractive Tax Deductions

One of the most compelling benefits of investing in multifamily real estate is the significant tax advantages it offers. Investors can deduct a wide range of expenses associated with the operation and maintenance of the property. This includes routine maintenance, repairs, utility costs, property management fees, and marketing expenditures.

Additionally, investors can leverage cost segregation studies to accelerate depreciation on certain components of the property, further reducing taxable income. Understanding and utilizing these tax benefits can greatly enhance the financial performance of the investment. It’s advisable for investors to consult with a tax professional who specializes in real estate to ensure they are maximizing their tax deductions and aligning with current tax laws.

Pro #4 Generation of Passive Income

Investing in multifamily properties offers a notable advantage in terms of generating passive income. By hiring a professional property manager, investors can essentially automate the day-to-day management of their properties. This delegation not only alleviates the burden of regular operations such as tenant communications, maintenance requests, and rent collection but also frees up investor’s time to focus on strategic growth opportunities such as acquiring additional properties or enhancing current holdings.

Enhancements could include adding value-added services like storage units, which are particularly lucrative in properties with limited space, thereby increasing desirability and competitive edge in the market. This approach transforms active investment into passive income, allowing investors to potentially expand their portfolios or reinvest in their existing properties to boost profitability further.

Pro #5 It’s One of the Safest Investments

Multifamily real estate is often considered one of the safest investment strategies, particularly in times of economic uncertainty. Housing is a fundamental need, which means demand for rental properties remains stable, even during downturns when home purchases might decline. This stability provides a buffer against the volatility often seen in other investment arenas like the stock market or certain commercial real estate sectors.

Additionally, the ongoing trend towards remote work has increased the value of comfortable, functional living spaces, further solidifying multifamily real estate as a secure investment. The predictability of income from multifamily units provides investors with a reliable cash flow, making it a safer bet for long-term financial planning.

Pro #6 Insurance Coverage is Simple to Arrange

Securing insurance for multifamily properties is typically straightforward due to the well-understood nature of the risks involved. Insurance providers are well-versed in the needs of these properties and offer customized packages that cover a range of potential issues from structural damage to liability claims.

These comprehensive insurance policies are tailored to include all units and common areas under one plan, simplifying the process and often reducing the overall cost of insurance. This ease of managing risk through insurance not only protects the investment but also provides peace of mind to the property owner, ensuring that both physical assets and revenue streams are well-protected against a variety of risks.

Pro #7: Scalability

Investing in multifamily properties offers substantial scalability advantages. Unlike single-family homes, multifamily units allow investors to acquire and manage multiple rentable spaces under a single purchase. This scalability can accelerate the growth of an investor’s real estate portfolio by adding several units at once, potentially across various locations.

By managing a larger number of units, investors can diversify their income streams and reduce the impact of vacancy rates on their overall profitability. This multi-unit approach not only speeds up portfolio expansion but also maximizes efficiency in property management, marketing, and maintenance, leveraging economies of scale that aren’t typically available with single-unit properties.

Pro #8: Increased Control Over Property Value

Multifamily properties grant investors a higher degree of control over the investment’s appreciation. This control stems from the ability to make strategic improvements to the property that can significantly increase its value.

Upgrading the interiors of individual units with modern fixtures and finishes or enhancing communal areas such as lobbies, gyms, and outdoor spaces can attract a higher-paying tenant base and justify increased rental rates. Furthermore, these improvements can positively affect the property’s overall market value, offering the potential for a lucrative return on investment when it comes time to sell or refinance. This proactive approach to property management allows investors to directly influence their property’s financial performance in the short and long term.

What about the cons?

This might be the most critical part for the real estate investor on the rise.

Con #1: High Competition Among Investors

The multifamily real estate market often experiences high competition due to its perceived stability and potential for high returns. This dense competition can make it challenging for new investors to find worthwhile deals, as experienced investors and large investment groups often dominate the market.

These seasoned players typically have deeper pockets and can make cash offers that are more attractive to sellers, which can squeeze out smaller or newer investors. To succeed, newcomers must be diligent, resourceful, and ready to act quickly when opportunities arise. Networking with other real estate professionals and staying informed about market trends can also provide a competitive edge.

Con #2: Higher Initial Expenses Are Expected

Investing in multifamily properties generally involves higher initial expenses compared to single-family units. This includes not only the purchase price but also significant costs related to renovations, legal fees, and compliance with building codes and regulations.

The upfront capital requirement can be daunting, especially in markets where property values are high. However, strategic planning and careful financial management can mitigate these initial costs. Investors should prepare detailed financial projections to ensure they can handle upfront expenses without jeopardizing their liquidity. Securing financing options tailored for real estate investments, like commercial loans or partnerships, can also ease the burden of initial costs.

Con #3: Requires Multiple Unit Management Skills

Managing a multifamily property requires a diverse set of skills, from understanding real estate laws to handling day-to-day operations and tenant relations. The complexity increases with the number of units, as each tenant may have different needs and issues that need to be addressed promptly to maintain high occupancy and tenant satisfaction.

Effective property management demands strong organizational skills, a proactive approach to maintenance, and excellent communication skills. For many investors, hiring a competent property management company can be a worthwhile investment, freeing them to focus on financial oversight and further investment opportunities rather than the daily operational challenges of property management.

Con #4: Regulatory Challenges

Investors in multifamily properties often encounter a complex web of regulatory requirements that can add significant challenges to their operations. These regulations can include stringent building codes, strict adherence to rent control measures, and more elaborate zoning laws compared to single-family units.

For instance, multifamily buildings in urban areas may face strict compliance requirements regarding safety, accessibility, and environmental standards. Additionally, navigating rent control laws requires a keen understanding of local regulations, which can limit the amount investors can charge for rent and impact their return on investment. The need for legal expertise to manage these challenges can also introduce additional costs and extend the timeline for project completion, potentially affecting overall investment profitability.

Con #5: Larger Upfront Maintenance Issues

Multifamily properties, due to their size and complexity, are often more susceptible to extensive and costly maintenance issues at the outset. Unlike single-family homes, multifamily units can have aging infrastructure, such as outdated plumbing or electrical systems, which may require significant investment to modernize.

The complexity of these systems and the scale of potential repairs mean that investors must be prepared with a substantial reserve fund to address these issues promptly. Initial maintenance challenges can significantly impact the cash flow from the property, as funds that could be used for improvements or to stabilize income might need to be diverted to cover these urgent repairs. This situation underscores the importance of thorough inspections and budget planning to ensure the investment remains viable from the start.

A Couple of Last Notes

Compelling benefits to investing in multifamily properties make it an excellent source of passive income with little risk but a lot of (healthy) competition. It also doesn’t surprise that investors rely on tailored loans only to be the first to grab the promising property investment opportunity. Weigh the pros and cons before you rush into things, and you will be just fine.

FAQs

How can I finance a multifamily property investment?

Financing a multifamily property can involve several strategies:

- Conventional Mortgages: Available through banks and other financial institutions, these are commonly used due to their relatively low interest rates and the security they offer to lenders.

- Government-Sponsored Loans: Programs like those offered by the FHA, Freddie Mac, and Fannie Mae can provide investors with loans that have competitive interest rates and more flexible qualification criteria.

- Private Lenders and Hard Money Loans: These are useful for investors needing quick approvals and funding, although they typically carry higher interest rates.

- Syndications and Partnerships: Pooling resources with other investors can provide the necessary funds while spreading out the risk.

What should I consider before investing in multifamily real estate?

Before diving into a multifamily property investment, consider the following:

- Location: The property’s location will influence tenant demand, rental rates, and ultimately, the investment’s profitability.

- Physical Condition: Assessing the property’s condition will help estimate upcoming maintenance or renovation costs.

- Legal Due Diligence: Understanding zoning laws, property rights, and tenant laws in the area will help mitigate legal risks.

- Financial Analysis: Detailed financial projections should include potential rental income, operational costs, expected ROI, and cash flow scenarios.

What should I consider before investing in multifamily real estate?

Before committing to an investment in multifamily real estate, it’s critical to evaluate several factors that can influence both the immediate viability and long-term success of your investment:

- Location Analysis: The profitability of multifamily properties is highly dependent on their location. Consider factors such as proximity to major employment centers, educational institutions, public transportation, and local amenities like shops and restaurants. A desirable location can ensure high occupancy rates and justify premium rents.

- Property Condition: Thoroughly assess the physical condition of the property. Consider the age of the building, the state of repair, and any upcoming major maintenance requirements. This assessment will help you estimate the initial and ongoing investment required for maintenance and renovations, which directly impacts the cash flow and return on investment.

- Market Trends: Understanding current and projected market trends in the area, such as population growth, economic stability, and housing demand, is essential. These trends will affect rental rates, property values, and the ease of finding tenants.

- Financial Projections: Perform a detailed financial analysis, including cash flow projections, cap rate evaluation, and internal rate of return. This should account for potential rental income, operational costs (like maintenance, property management, and utilities), vacancy rates, and capital expenses.

- Management Requirements: Assess whether you will manage the property yourself or hire a property management company. Effective management is crucial for maintaining property condition, ensuring tenant satisfaction, and handling day-to-day operations. Consider your own experience and capacity to manage property, as poor management can erode profitability.

- Legal Compliance: Familiarize yourself with local landlord-tenant laws, building codes, and zoning regulations. Compliance with these laws is critical to avoid legal issues that could result in costly fines or disputes with tenants.

Are there strategies to increase profitability in multifamily properties?

To enhance the profitability of multifamily properties, investors can employ several strategies that not only boost income but also potentially increase the property’s value:

- Renovations and Upgrades: Updating kitchens, bathrooms, and living areas, or adding luxury finishes can allow you to increase rental rates. Similarly, improving the building’s exterior and landscaping can enhance curb appeal, attracting more prospective tenants and justifying higher rents.

- Adding Amenities: Introducing popular amenities such as in-unit laundry, fitness centers, pet services, or enhanced security features can make a property more attractive to potential tenants and reduce turnover rates. Amenities that cater to the lifestyle and convenience of residents can often translate into higher occupancy rates.

- Efficient Property Management: Implementing professional property management can improve tenant satisfaction and operational efficiency. Effective management practices can reduce costs through better vendor contracts, streamlined operations, and proactive maintenance, which extends the lifespan of property components.

- Technological Integration: Utilize technology to enhance tenant services and operational efficiency. This can include online rent payments, digital lease signing, automated maintenance requests, and energy-efficient upgrades. Technology not only reduces operational costs but also appeals to tech-savvy tenants.

- Utility Cost Management: Consider measures to reduce utility expenses, such as water-saving fixtures, energy-efficient lighting, and solar panels. These can lower operating costs and be marketed as eco-friendly features, attracting a growing segment of environmentally conscious renters.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.