SB 264 Florida: All About Foreign Ownership Restrictions

SB 264 (Chapter No. 2023-33 Laws of Florida) has brought about significant changes in foreign ownership restrictions in Florida. Enacted on May 8, 2023, this legislation restricts individuals and entities associated with China, Russia, Iran, North Korea, Cuba, Venezuela, and Syria from owning specific real property in Florida.

That said, let’s comprehensively understand SB 264 and its implications and how it may affect foreign nationals in Florida. We will delve into who is affected by these restrictions, the key provisions of the law, and the impact it has on the Florida real estate market. Additionally, we’ll explore the penalties for violating SB 264 and discuss the restrictions on agricultural land ownership and ownership near military installations and critical infrastructure.

Moreover, you’ll discover alternatives to buying property in Florida and learn how you can stay informed about any future changes to SB 264.

Before we dive in, here are some statistics about foreign national and international buyer purchases in Florida.

Florida International Property Purchase Statistics

| Statistic | Description | Data | Source |

| Overall Market | Decrease in international buyer purchases of Florida residential properties (Aug 2022 – July 2023) | 18% decline | Florida Realtors Profile of International Residential Real Estate Activity |

| Total Dollar Volume (2023) | Dollar volume of international buyer transactions in Florida | $12.6 billion | Florida Realtors |

| Top Buyer Country | Country contributing the most in dollar terms | Canada ($2.1 billion) | Florida Realtors |

| South Florida Market Share | Share of South Florida in the U.S. international home sales | 11% of U.S. total | MIAMI Realtors® International Report |

| Median Purchase Price | Average median purchase price of South Florida foreign buyers | Brazil $990,000 | MIAMI Realtors® International Report |

| Payment Method | Percentage of international transactions in South Florida made in all-cash | 69% | MIAMI Realtors® International Report |

| Pre-Purchase Visits | Percentage of international buyers visiting Florida before purchase | 93% in 2023 | Florida Realtors® 2023 Profile |

| Number of Homes Purchased | Number of existing homes purchased by international buyers in Florida | 19,500 (5% of sales) | Florida Realtors® 2023 Profile |

Now, let’s navigate the intricacies of SB 264 and uncover everything you need to know about foreign ownership restrictions in Florida.

Does SB 264 apply to me?

If you are a foreign individual or entity associated with China, Russia, Iran, North Korea, Cuba, Venezuela, or Syria, SB 264 may apply to you. This legislation restricts ownership of specific real property in Florida by individuals and entities from these countries.

It is important to note that SB 264 does not target all foreign investors, but specifically those associated with the mentioned countries. If you fall into this category, it is crucial to understand the restrictions imposed by the law and seek professional advice to ensure compliance.

On the other hand, if you are not associated with these countries, SB 264 does not apply to you. That said, you can freely explore real estate opportunities in Florida.

However, it’s important to stay informed about any changes or updates to the law that may affect foreign ownership restrictions in the future.

What is SB 264 Florida?

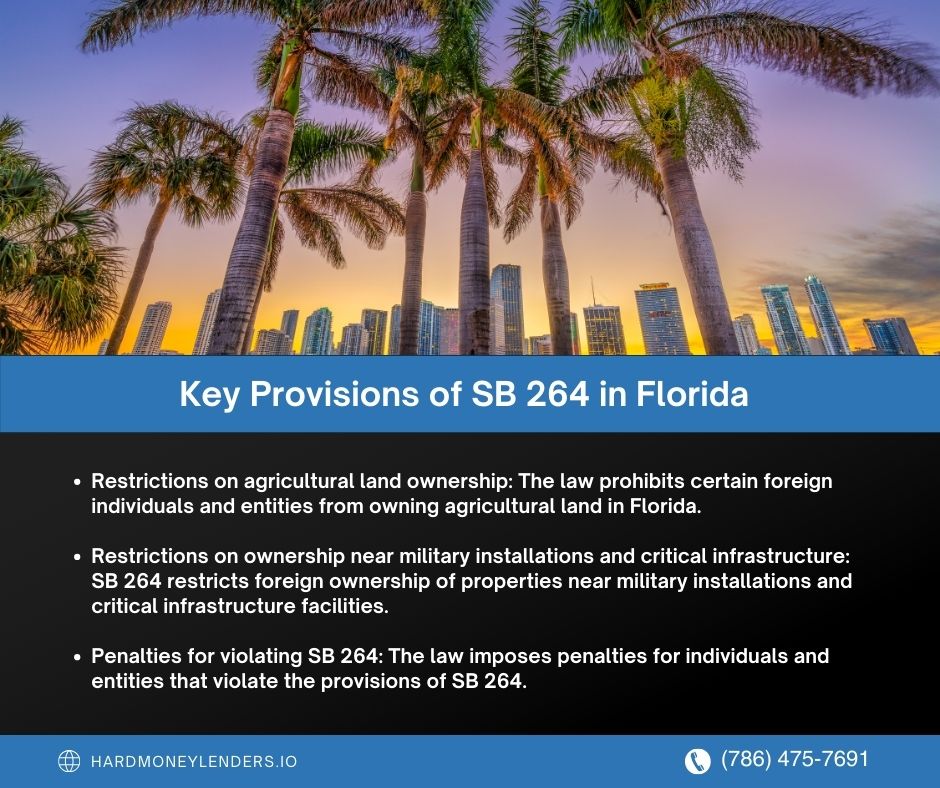

SB 264, the Foreign Influence Real Property Act, limits foreign ownership of real property in Florida. The law specifically targets individuals and entities associated with China, Russia, Iran, North Korea, Cuba, Venezuela, and Syria. Here are the key provisions of SB 264:

- Restrictions on agricultural land ownership: The law prohibits certain foreign individuals and entities from owning agricultural land in Florida. This provision protects the state’s agricultural industry and prevents foreign control over essential resources.

- Restrictions on ownership near military installations and critical infrastructure: SB 264 restricts foreign ownership of properties near military installations and critical infrastructure facilities. This provision is designed to safeguard national security interests and protect sensitive areas from potential threats.

- Penalties for violating SB 264: The law imposes penalties for individuals and entities that violate the provisions of SB 264. Violators may face fines, legal repercussions, and potential forfeiture of the property.

Individuals and entities associated with the mentioned countries must understand and comply with the provisions of SB 264. Seeking professional advice can help navigate the complexities of the law and ensure compliance with the regulations.

Understanding the Restrictions

Foreign individuals and entities associated with countries like China, Russia, Iran, North Korea, Cuba, Venezuela, and Syria need to be aware of the restrictions imposed by SB 264, also known as the Foreign Influence Real Property Act, on foreign ownership of real property in Florida.

One of the key provisions of SB 264 is the restriction on agricultural land ownership. Foreign principals are prohibited from owning agricultural land in Florida. This measure protects the state’s agricultural industry and prevents foreign control over essential resources.

Another important restriction is on ownership near military installations and critical infrastructure facilities. Foreign principals cannot own properties within 10 miles of these sensitive areas. This provision is in place to safeguard national security interests and prevent any potential threats.

Violating the provisions of SB 264 can result in penalties, including fines, legal repercussions, and potential forfeiture of the property in question. Individuals and entities associated with the mentioned countries need to understand and comply with these restrictions.

To navigate the complexities of the law and ensure compliance, seeking professional advice is highly recommended. By staying informed about any changes to SB 264 and understanding the restrictions, foreign investors can make informed decisions regarding property ownership in Florida.

Exceptions to the restrictions

While SB 264 imposes restrictions on foreign ownership of real property in Florida for individuals and entities associated with certain countries, these restrictions have a few exceptions. These exceptions allow for certain circumstances where foreign ownership may still be permissible.

One such exception is for properties owned by foreign governments or their political subdivisions. This means that if a property is owned by a foreign government or any of its political subdivisions, it may be exempt from the restrictions outlined in SB 264.

Another exception is for properties owned by foreign individuals or entities who have obtained a specific license or authorization from the federal government. In certain cases, foreign owners may be able to obtain the necessary permits or authorizations to own property in Florida despite being associated with one of the countries mentioned in SB 264.

It is important to note that these exceptions are subject to certain conditions and requirements. Foreign individuals and entities seeking to take advantage of these exceptions should carefully review the specific guidelines and consult legal professionals to ensure compliance.

People Also Ask Questions for SB 264 in Florida (for Foreign Nationals)

What are the alternatives to buying property in Florida?

Suppose you are restricted from purchasing property in Florida due to the foreign ownership restrictions outlined in SB 264. In that case, there are alternatives available to you.

One option is to enter a lease agreement instead of outright ownership.

This allows you to enjoy the benefits of the property without violating the ownership restrictions.

Another alternative is investing in real estate investment trusts (REITs) or other real estate investment funds that focus on Florida properties.

This allows you to invest in Florida real estate indirectly without individual ownership.

How can I stay informed about changes to SB 264?

To stay informed about any changes or updates to SB 264, it is advisable to regularly check the official websites of the Florida State Legislature and the Department of Business and Professional Regulation.

These websites often provide information on new laws and regulations. Additionally, you can consult with legal professionals or real estate agents who specialize in foreign ownership regulations in Florida. They can provide you with the most up-to-date information and guidance on any changes to the law.

Can I still buy property in Florida if I am a foreign national?

If you are a foreign national, you may be wondering if the recent restrictions imposed by Florida’s SB 264 will prevent you from purchasing property in the state. The answer is not a simple yes or no.

The law primarily targets foreign governments and individuals from specific countries who intend to acquire real property through purchase, grant, devise, or descent. However, it is crucial to understand that the law does not completely ban foreign ownership of property in Florida.

Foreign nationals can still buy property in Florida, but they need to navigate certain restrictions and comply with the legal requirements.

It is essential to seek professional advice from experienced real estate attorneys who specialize in foreign investment. They can guide you through the process, ensure compliance with the law, and help you make informed decisions regarding property ownership in Florida.

While SB 264 may introduce some challenges, it does not completely restrict foreign nationals from buying property in Florida. With the right guidance and understanding of the law, you can still fulfill your dream of owning property in the Sunshine State.

How does Florida’s SB 264 affect foreign property ownership?

Foreign property ownership is impacted by Florida’s SB 264, which introduces restrictions and requirements for foreign nationals. Under this legislation, foreign principals, as defined by SB 264, face specific limitations on property ownership. Agricultural land in Florida is off-limits for foreign principals, and similar prohibitions extend to real estate located within 10 miles of military installations or critical infrastructure facilities.

These restrictions aim to regulate foreign ownership and protect national security interests. It is important for foreign nationals interested in buying property in Florida to be aware of these regulations and comply with the necessary requirements.

Can foreign nationals still own property in Florida after SB 264? If so, under what conditions?

Foreign nationals can still own property in Florida after the implementation of SB 264, subject to certain conditions. Depending on what country you’re from, the law prohibits foreign principals from owning agricultural land and restricts the ownership of properties within 10 miles of military installations or critical infrastructure facilities for national security reasons.

However, foreign property owners must comply with the necessary regulations and complete registration procedures to validate ownership. It is recommended that foreign nationals consult relevant government agencies or seek legal advice to fully understand and adhere to the conditions imposed by SB 264.

Understanding the ability of foreigners to buy property in Florida post-SB 264

Foreign nationals still have the ability to buy property in Florida post-SB 264, but there are certain conditions to consider. The law prohibits foreign principals from owning agricultural land and restricts ownership within 10 miles of military installations or critical infrastructure facilities for national security reasons. To ensure compliance, foreign property owners must complete registration procedures and adhere to the necessary regulations. It is important for foreigners interested in buying property in Florida to consult relevant government agencies and seek legal advice to understand and navigate these conditions effectively.

Process and considerations for foreigners looking to purchase property in Florida

Foreign nationals looking to purchase property in Florida need to follow specific steps and consider certain factors. Here is a clear and concise overview of the process and considerations.

- Research and Identify Property. Begin by conducting thorough research to identify the type of property you want to purchase in Florida.

- Engage Real Estate Professionals. Seek the assistance of a reputable real estate agent and a qualified attorney who specializes in foreign property ownership in Florida.

- Financing Options. Explore financing options available for foreign nationals, such as foreign national loans or foreign national hard money loans, to secure the necessary funds for the purchase.

- Due Diligence. Complete a comprehensive due diligence process, including property inspections, title searches, and understanding any liens or restrictions on the property.

- Registration Procedures. Comply with the registration procedures outlined in SB 264 by submitting the necessary documentation and adhering to the regulations set forth.

- Hire a Property Management Company. If you plan to use the property for rental purposes, consider hiring a property management company to assist with tenant screening, property maintenance, and rental income management.

- Tax and Legal Considerations. Consult with a tax advisor and an attorney to fully understand the tax implications and legal obligations associated with foreign property ownership in Florida.

- Insurance. Obtain comprehensive insurance coverage for your property to protect against potential risks and liabilities.

- Ongoing Compliance. Stay updated with any changes or updates to regulations and comply with all requirements for maintaining foreign property ownership in Florida.

By following these steps and considering the necessary factors, foreigners can navigate the process of purchasing property in Florida in a legal and compliant manner.

What are the potential benefits and drawbacks of foreign property ownership in Florida?

Foreign property ownership in Florida comes with both potential benefits and drawbacks.

Benefits of foreign property ownership in Florida

- Investment Opportunity. Florida’s real estate market can offer attractive investment opportunities, especially in popular tourist areas.

- Rental Income. Foreign property owners can generate rental income by leasing their property to vacationers or long-term tenants.

- Vacation Home. Owning a property in Florida allows foreign nationals to have a vacation home in a desirable location.

- Potential Appreciation. Over time, the value of the property may appreciate, leading to potential financial gains.

Drawbacks of foreign property ownership in Florida

- Tax Obligations. Foreign property owners must understand and comply with the tax obligations imposed by the U.S. and their home country.

- Maintenance and Distant Ownership. Managing and maintaining the property from a distance may present logistical challenges.

- Exchange Rate Risks. The fluctuating exchange rates between currencies can impact the financial returns of foreign property owners.

- Legal and Regulatory Complexity. Foreign property owners need to navigate the legal and regulatory landscape, including compliance with any restrictions or requirements imposed by SB 264.

How does Florida’s SB 264 impact real estate investment opportunities in the state?

Florida’s SB 264 has the potential to impact real estate investment opportunities in the state. The new law introduces restrictions and requirements for foreign property ownership, which may deter some investors.

However, it also opens opportunities for alternative investment strategies, such as partnering with U.S. citizens or entities to navigate the regulations.

Foreign investors should carefully analyze the implications of SB 264 on their investment goals and consider working with experienced professionals who can provide guidance and expertise in navigating the changing landscape of real estate investment in Florida.

Emerging Alternatives for Foreign Investors in the Florida Real Estate Market

Foreign investors in the Florida real estate market are exploring alternative strategies in light of SB 264. Here are some emerging alternatives for foreign investors:

- Partnering with U.S. citizens or entities. Foreign investors can navigate the new regulations by partnering with U.S. citizens or entities who can hold ownership on their behalf.

- Exploring other investment opportunities. Foreign investors may consider other investment opportunities in sectors such as commercial real estate, vacation rentals, or real estate development projects that are not subject to the restrictions under SB 264.

- Leveraging foreign national loans. Foreign investors can explore foreign national loans or foreign national hard money loans specifically designed for non-U.S. citizens to facilitate real estate acquisition in Florida.

- Seeking professional advice. It is essential for foreign investors to consult with experienced real estate professionals and attorneys who can provide guidance on navigating the changing landscape of the Florida real estate market.

By considering these emerging alternatives, foreign investors in the Florida real estate market can adapt their investment strategies to comply with the new regulations. That being said, they can continue to explore opportunities in the state.

The Future of SB 264 and its Impact on Foreign Nationals in Florida

The future of SB 264 is uncertain, as with any legislation. As the global political and economic landscape evolves, there may be changes to the law or its enforcement. It is essential to pay attention to any proposed amendments or discussions surrounding SB 264 to understand how it may impact foreign ownership in Florida. Staying informed and seeking professional advice is critical to navigating potential changes or challenges.

The restrictions imposed by Florida’s SB 264 do not completely prohibit foreign nationals from buying property in the state. That said, the law primarily targets foreign governments and individuals seeking to acquire real property through various means. However, there are still opportunities for foreign ownership with certain restrictions and legal requirements.

To navigate through these complexities, foreign nationals should seek professional advice from experienced real estate attorneys specializing in foreign investment. These experts can provide guidance, ensure compliance with the law, and help make informed decisions regarding property ownership in Florida.

Now, SB 264 may present challenges, it does not entirely hinder foreign nationals from fulfilling their dream of owning property in the Sunshine State.

We’ve got you covered if you’re a foreign national looking for loans to invest in Florida’s real estate market. Check out Hard Money Lenders’ foreign national loans here.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.