Last Updated on March 18, 2024

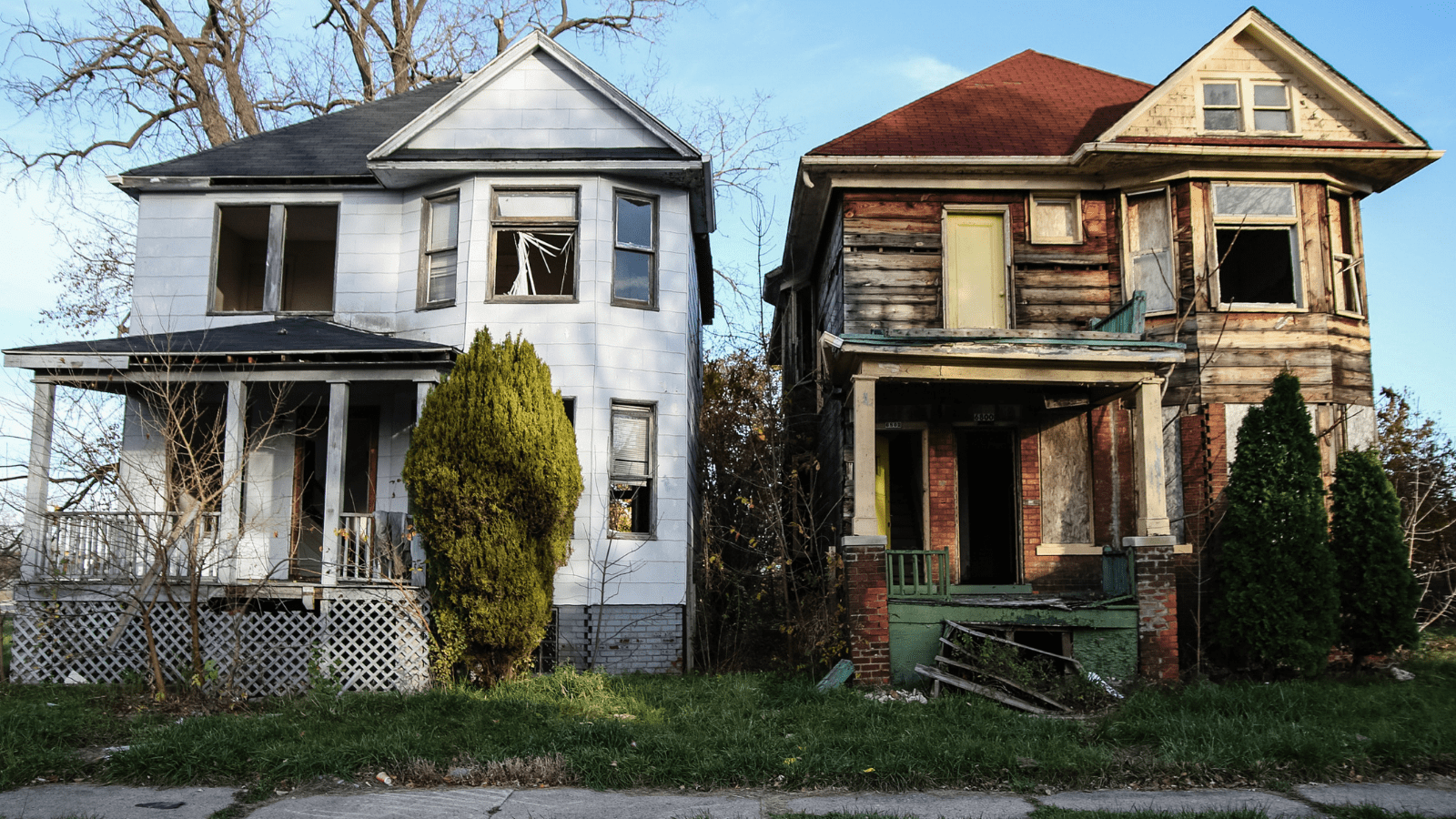

If you’ve ever wondered how you could become a house flipper, you’re in the right place. House flipping is the act of buying a house, fixing it up, and turning it into a revenue-generating asset, then quickly reselling the house for profit. In real estate, house flipping is also known as “fix-and-flips,” particularly for real estate investors. Not only is house flipping good for making a profit, but it also helps real estate investors add to their portfolios.

Now, for inexperienced investors, house flipping can be very risky and difficult. Even experienced real estate investors have trouble finding the best houses to flip, or just keeping renovation costs low. It is very difficult to keep renovation costs low if a real estate investors don’t have sufficient construction experience. Right now, finding the right house to flip is also a major challenge. Below you’ll find an expert’s guide on how to become a house flipper.

A Note for Beginners

If you’re just getting started with buying and flipping houses, then you’ve probably come to the realization that there’s a lot to learn. Contrary to popular belief, buying and flipping properties isn’t nearly as simple or straightforward as it appears.

While flipping houses can be an incredibly daunting task for many, it’s possible to be successful, but it must be done correctly.

One question that every beginner must address when they initially begin flipping houses is “How do I find the right house to buy and flip?” This is one of the most difficult steps in buying and flipping houses for several reasons.

There are a variety of factors to consider, such as the property’s location, the current condition of the property, and the property’s potential resale value. Are you buying the house from a resident or from a bank? Is the house below market value and can you add enough significant value to it to sell it for a profit?

While this can seem a bit overwhelming at first, with the right resources and tools, you can know exactly what to look for when searching for a prospective house.

First things first.

When it comes to house flipping and real estate, it’s important to understand key trends.

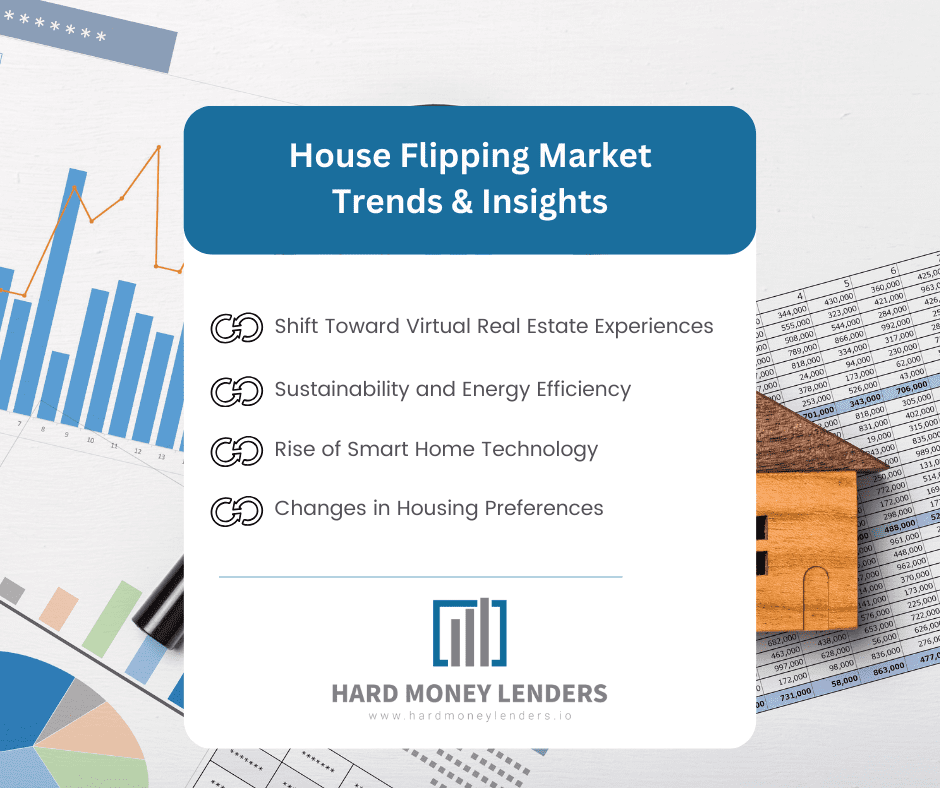

Understanding the House Flipping Market: Trends and Insights

Before venturing into the realm of house flipping, it’s crucial to have a thorough understanding of the current real estate market. Market trends can significantly impact the profitability of your flips, and what was effective in the past may no longer apply. To navigate this landscape successfully, let’s delve deeper into new trends and insights that are shaping the house flipping market today.

Shift Toward Virtual Real Estate Experiences

The rise of virtual home tours and digital closings has transformed how investors find and purchase properties. This trend, accelerated by the global pandemic, continues to influence the market, enabling investors to scout and buy properties without geographical constraints. Embrace these technologies to expand your search area and streamline the purchasing process.

The Impact of Remote Work on Housing Demand

Remote work has altered where people choose to live, shifting demand away from city centers to suburbs and rural areas. Homes with dedicated office spaces or potential for such conversions are becoming increasingly desirable. As a flipper, targeting properties that can cater to the needs of remote workers could tap into this growing trend.

Sustainability and Energy Efficiency

Eco-friendly renovations are not just good for the planet; they’re becoming a significant selling point for buyers. Investing in energy-efficient windows, insulation, and solar panels can increase a property’s appeal and value. As sustainability becomes more important to buyers, properties that offer green features or potential for such upgrades can offer a competitive edge.

The Rise of Smart Home Technology

Smart home technology, such as intelligent thermostats, security systems, and lighting, is becoming increasingly popular. Incorporating these technologies into your flips can attract tech-savvy buyers looking for modern and convenient living solutions.

Market Saturation and Competition

As more people get involved in house flipping, some markets are becoming saturated, driving up property prices and making it harder to find good deals. This trend underscores the importance of thorough market research and creative sourcing strategies to uncover under-the-radar opportunities.

Adapting to Changing Financing Landscapes

Interest rates and lending criteria are always in flux, influencing how easily you can secure financing for your projects. Keeping abreast of these changes and exploring alternative financing options, such as partnering with investors or using crowdfunding platforms, can provide the flexibility needed to continue flipping houses in varying economic climates.

Demographic Shifts Influencing Housing Preferences

Changing demographics, such as millennials entering the housing market and baby boomers downsizing, are influencing the types of properties in demand. Tailoring your flips to meet the preferences and needs of these groups, such as minimal maintenance homes for baby boomers or urban townhomes for millennials, can help tap into these significant buyer segments.

By staying informed about these trends and insights, you can make educated decisions and adapt your strategies to align with current market conditions. This knowledge will not only help you identify the most promising flipping opportunities but also anticipate shifts in buyer preferences, ensuring your renovations meet the demands of today’s homebuyers.

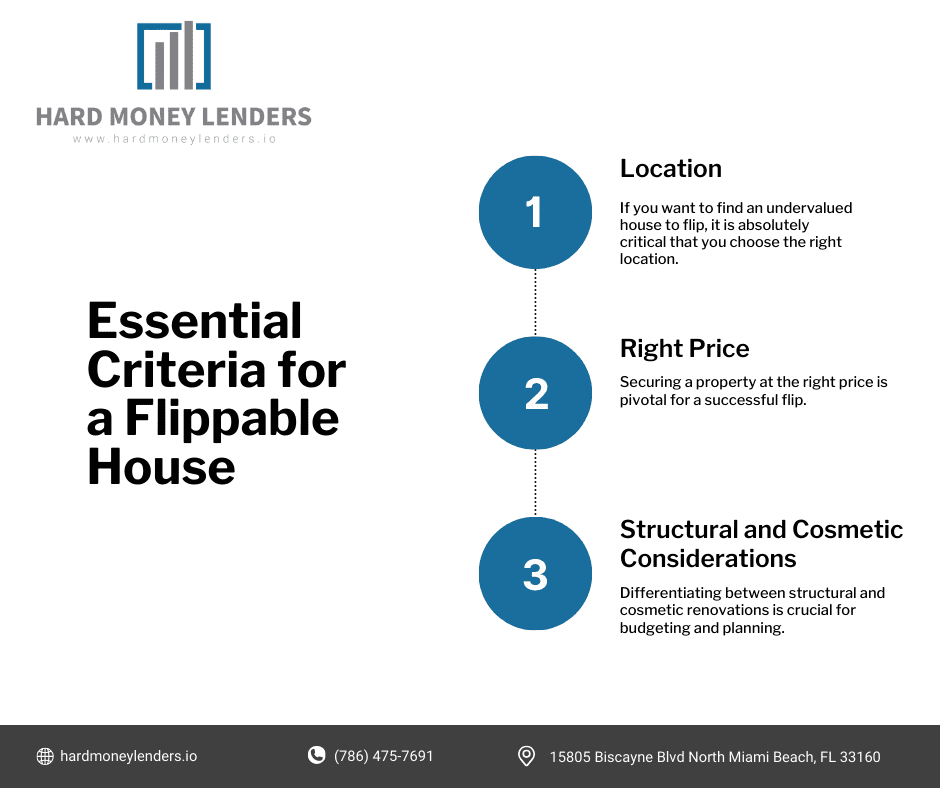

Essential Criteria for a Flippable House

When it comes to becoming a house flipper, you should know the criteria to search for a flippable house.

Location: The Cornerstone of Property Value

The significance of a property’s location in house flipping cannot be overstated. A superior location can compensate for many property deficiencies, potentially making a less-than-perfect house a lucrative investment.

If you want to find an undervalued house to flip, it is absolutely critical that you choose the right location. If you are looking to flip houses in the same state that you live in, it is important to be aware of the housing market in your surrounding area.

For example, California and Hawaii are notorious for being extremely expensive states for buying and flipping houses. Metropolitan cities like Los Angeles, San Francisco and New York are known for hosting some of the most expensive real estate in the U.S.

On a smaller scale, take into account key factors that buyers may consider when looking to purchase a house from you, such as the school district the house is located in, the surrounding neighborhood, and accessibility to frequently visited businesses nearby.

Close proximity to local business and public transportation can potentially increase value, while close proximity to airports and highways have the potential to decrease value. Doing the exact same research as your buyers is key.

With this being said, having an intimate knowledge of the area is irreplaceable, and this is why many property investors choose areas that they are already familiar with. If your current city or state is relatively affordable, this is often the most useful place to start your search.

Here’s What to Focus on to Find the Right Location for House Flipping

- Up-and-Coming Neighborhoods: Properties in areas on the brink of gentrification offer immense upside potential. Indicators include new business developments, improvements in local schools, and increasing home renovation activity. However, investing in these areas requires a nuanced understanding of local market trends to time your investment wisely.

- Established Areas: Established neighborhoods with a history of stable or increasing property values are safer bets. Look for areas with low crime rates, good schools, and ample amenities like parks, shops, and restaurants, as these factors significantly attract buyers. For example, Florida may offer some attractive house-flipping opportunities.

- Proximity to Key Locations: Proximity to employment centers, universities, and transportation hubs can enhance a property’s appeal. Homes near these conveniences often command higher resale values and appeal to a broader pool of buyers.

- Street-Level Characteristics: Even within a desirable neighborhood, the specific location of a property on its street can affect its value. Properties on quiet cul-de-sacs or with waterfront views, for example, are often more valuable than those on busy roads or next to commercial properties.

Right Price: The Art of the Deal

Securing a property at the right price is pivotal for a successful flip. Here’s how to master this element.

- Market Research: Diligent market research helps identify the typical property values in your target area. Use this as a benchmark to spot undervalued properties.

- Off-Market Deals: Sometimes, the best deals aren’t listed on the MLS. Networking with real estate agents, attorneys, and local investors can uncover off-market opportunities, often at better prices due to less competition.

- Foreclosures and Auctions: Properties in foreclosure or being sold at auction can be acquired below market value. However, this approach requires due diligence, as such properties often come with additional risks and complications.

- Negotiation Skills: Effective negotiation can significantly lower purchase prices. Understand the seller’s motivation, such as a quick sale or avoiding foreclosure, and tailor your offer accordingly.

Structural and Cosmetic Considerations: Maximizing Value with Minimum Spend

Differentiating between structural and cosmetic renovations is crucial for budgeting and planning.

- Cosmetic Improvements: Focus on renovations that offer the highest return on investment. Painting, updating light fixtures, landscaping, and refinishing floors can transform a property at a relatively low cost. Kitchens and bathrooms offer the highest potential for added value, so consider updates that modernize these spaces without complete overhauls.

- Structural Concerns: While some structural issues can be deal-breakers, others may offer negotiation leverage. A thorough inspection is essential to identify potential problems like foundation cracks, outdated electrical systems, or roofing issues. Factor the cost of these repairs into your budget, and avoid properties with extensive structural damage unless you’re equipped to handle them.

- Unexpected Issues: Always allocate a contingency budget for unforeseen expenses. Even primarily cosmetic flips can uncover hidden problems once work begins. Having a financial buffer ensures you can manage these surprises without compromising your profit margin.

By prioritizing properties in desirable locations, negotiating the right purchase price, and focusing on cost-effective renovations, you can maximize the profitability of your house flipping projects. This approach combines strategic acquisition with savvy improvements to appeal to buyers, ensuring a successful flip with a significant return on investment.

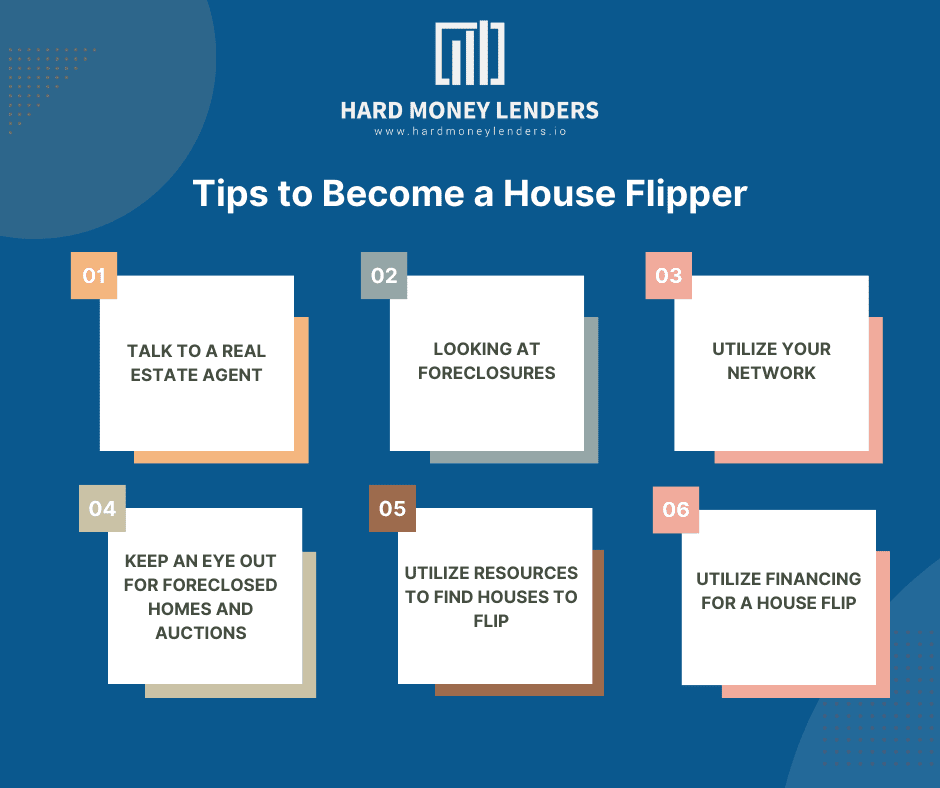

Tips to Become a House Flipper

Of course, here at Hard Money Lenders, we’re all about providing tips so you can further your real estate journey. That being said, here are some tips that can help your journey in becoming a house flipper.

Tip #1: Talk to a Real Estate Agent

For inexperienced investors, in particular, real estate agents can be particularly helpful in finding a house to flip. Really experienced real estate agents can help real estate investors find houses to flip, and know the best places for flipping homes. This helps investors know how to quickly filter options that apply and give the best possible real estate investment applied.

Experts often recommend acquiring an agent that specializes in REO (Real Estate Owned). REO is a property held by a lender due to a borrower defaulting on a loan. A lot of these properties qualify as REO due to a foreclosure, which makes them priced lower than many surrounding homes.

Repairing an REO home often makes a lucrative house flip. Another option that fix and flip experts recommend which is safer but less lucrative than talking to an agent, is talking to a wholesaler. A wholesaler is someone who buys rehab properties and puts them under contract. Wholesalers are not considered the most cost effective method, but they are very efficient and may save a lot of bandwidth for real estate investors.

Wholesalers have a full time job of finding the right houses to flip, and they can be found through real estate investment groups. They often have a lot of connections and experience. Real estate investment forums themselves are online forums that are helpful in finding houses to flip, and these groups often show listings and often have meetups to meet face-to-face with other investors.

Tip #2: Looking at Foreclosures

One way to find great houses to flip is to find foreclosures. Foreclosures give great deals to flip houses and are properties that banks have repossessed, and when buying a foreclosure, it is essential to factor in the cost of renovation.

Finding realtors who work specifically with foreclosed properties is essential . The Zillow site provides many of these resources, as do the Federal Housing Administration and Department of Housing and Urban Development websites. Actually visiting foreclosed properties is also a terrific way to find a good home to flip.

Another way to find foreclosed properties to flip is through auctions. Auctions can sometimes sell hundreds of foreclosed homes per day, so conventional real estate advice includes doing background research, setting bidding limits to yourself, and securing title insurances for properties with liens attached.

Sometimes, the homeowners may be willing to initiate a sale on the house. Real estate investors trying to find houses to flip can make offers to homeowners directly, whether through short sales or finding a real estate agent to assist.

Tip #3: Utilize Your Network

One good way to begin looking for properties is to network in your community. While it is not always a 100% guarantee that you will find a house to flip this way, there’s always a chance that you may find a lead or two. Believe it or not, word of mouth is still important, and if you know the right people, there’s a possibility you can find out about real estate deals as they are hitting the market.

Joining a community real estate group is an excellent way to connect with other real estate investors and realtors who have access to valuable information. The chance of locating a great property alone makes it worth joining, and it can also serve as a fun and informative way to network with others in the industry.

Now, there are a number of online websites and resources that you can use to do this.

FlipScout is essentially a free house flipping search engine that allows you to calculate flipping costs automatically, see ROI and rental income instantly, and aggregate results from various sources. FlipScout is specifically great for finding houses that are in the ‘pre-foreclosure‘ status, and also allows you to get construction estimates. FlipScout even gives you access to the current listing price, assessed value, predicted ROI and the potential profit.

Zillow’s Foreclosure Center is another valuable resource for those who are looking to buy and flip houses. This feature allows you to search Zillow’s entire database of pre-foreclosures, foreclosure auctions, and bank-owned properties in your community. These are the types of properties that generally sell below their market value, which presents a fantastic opportunity for house flipping specialists.

Foreclosure.com can also prove useful for those looking to flip houses. It’s a real estate database consisting almost exclusively of foreclosure properties.

Tip #4: Keep an Eye Out for Foreclosed Homes and Auctions

The general idea behind flipping real estate is to buy properties below market value and add significant value to achieve the highest return on investment. Sometimes, the best properties to go for are auctions or foreclosed homes.

Most of the time, houses are put on auction because it is one of the quickest ways to sell a house. It could be that the house has fallen into foreclosure, or simply that the current owner needs to achieve a quick sale. Ultimately, houses are put on auction in order to accelerate the change of ownership. There are many auctions where the owner is willing to accept a below market price just so they no longer have to assume responsibility.

However, there is one main risk that you will face if you decide to purchase a house this way. When you buy a property at auction, you aren’t able to inspect it prior to purchasing it.

If there is structural damage, electrical problems or general repairs that are needed, you will only discover the true condition of the house once the sale is finished. Most buyers are fine the majority of the time, but the possibility of an expensive repair job is something that you must be aware of.

For foreclosed homes, FlipScout, Zillow, and Foreclosures.com and other real estate websites make it a breeze to find a foreclosed home online. But, there are other ways to identify foreclosure properties offline as well, including newspaper listings, searching for a notice of default (NOD) at your County Recorder’s Office, scouting neighborhoods looking for properties boasting a ‘Foreclosure‘ sign, and chatting to real estate agents that are familiar with the area.

Tip #5: Utilize Resources to Find Houses to Flip

Real estate experts sometimes recommend not flipping houses in certain areas that are very expensive, including Hawaii and California. It is essentially to have an “intimate knowledge of the area” and invest in a place where you know the area very well and find an affordable place to start flipping houses. If the area you live in is a very expensive area, you may have to find houses to flip elsewhere.

There are multiple Internet resources that help investors find houses to flip, including Zillow’s Foreclosure Center. Most investors don’t know Zillow has a blog devoted to finding foreclosures, as well as a database for finding foreclosed homes. When finding a foreclosed home, the database allows you to find homes in the foreclosure stage, as well as the pre-foreclosure stage. It also allows you to see bank-owned properties and properties selling well below market value. With affordable renovations, there can be a high return on investment with these houses.

MLS, otherwise known as Multiple Listing Service, is also a resource to finding good houses to flip. MLS lists foreclosed properties and has the highest directory of listed properties, but you have to be a real estate agent to access MLS and there is a monthly fee involved. A real estate investor often has to pair with an agent to use MLS. MLS has a lot of information on listing,s and it is also a terrific tool for comparing and contrasting properties to flip.

There are also many other online resources that give real estate investors access to properties to flip, including Foreclosure.com, which provides sales in pre-foreclosures, sheriff sales, bankruptcies, and short sales. There’s FSBO.com, which allows a real estate investor to contact homeowners directly and not get involved in paying any real estate commission fees.

Tip #6: Utilize Financing for a House Flip

While there are a lot of opportunities in house flipping as well as significant funds. Amy Fotinelle at Investopedia says it often costs more money to flip a house than to buy one as your primary residence, so finding a source of financing is essential. Not only do real estate investors need to become property owners, but they have to deal with property taxes and renovation funds after purchasing the home.

Lenders see the risk of house flipping as well, and this is reflected in the interest rates and other terms of loans. In particular, inexperienced house flippers may have a lot of trouble getting a loan, and if a house flipper with no experience wants to get a loan, there are often higher fees and interest rates.

Utilizing Hard Money Loans to Finance Fix and Flips

Hard money loans are some of the most popular loans for house flipping. Hard money loans earned their name because they rely on a “hard” asset — the property. Hard money loans use the real estate itself as collateral for a loan, and because this is an added risk in comparison to traditional financing, hard money loans carry many advantages and risks.

The advantage of hard money loans is their very fast speed of approval. Hard money loans can be approved within a couple of days, which can instantly help real estate investors compete for competitive properties. This speed of approval, for a house that can be flipped and generate significant profit, is often seen as important as money.

However, the disadvantages of hard money loans are they have high interest rates, short repayment periods, and low LTV ratios. They require significant down payments and have interest rates anywhere from 9% to 16%.

Because of all the fees and interest rates of hard money loans, hard money loans can be very expensive and risky. Hard money lenders look at the strength of the deal and the reliability of the real estate investor. The more experienced real estate investors usually have the least amount of risk, and new investors need to rely on financial standing and credit history.

Hard money loans have a unique advantage of qualifying as cash for “cash only” properties as well. “Cash only” might seem like only cash can be used to pay for a home, but it also means a home is in such a state of disrepair it doesn’t qualify for traditional financing. Banks won’t even touch the property, and the house needs renovations and repairs hard money lenders are known for.

Hard Money Lenders IO

At Hard Money Lenders IO, we’re here to help. Not every house you find to flip is the right home for your financial situation, particularly now during a housing bubble that some real estate experts say is going to burst. We offer a free consultation for each real estate investor’s situation.

As our name suggests, we are also a hard money lender with a variety of resources. We have a loan calculator for hard money loans where you can project monthly payments. We also have a directory of private lenders where you can look at the best and most reputable hard money lenders in your area.

While we are a Florida-based private lending company, we help investors all across the country, even new investors to foreign nationals. We are a very versatile resource who can get you paired with a broker who will help you find the best hard money lender and get you a hard money loan ourselves.

Regardless of what you need, we are here to get you started on your house-flipping journey.

Closing Remarks

Finding the right house to flip involves a blend of market knowledge, research, and financial savvy. By focusing on location, price, and the potential for value addition through renovations, investors can increase their chances of a successful flip. Remember, thorough due diligence and a robust network are invaluable assets in your flipping endeavors. Now, if you’re new to house flipping, it’s also important to understand taxes for house flippers — you can learn more about that here.

FAQs on Becoming a House Flipper

How much money do I need to start flipping houses?

The initial investment varies significantly based on several factors including the property’s location and condition, and the financing method you choose. You should be prepared to cover the down payment, renovation costs, carrying costs, and any unexpected expenses. Exploring financing options like hard money loans or partnering with investors can also affect the amount of upfront capital required.

How do I find the best properties to flip?

Successful flipping often involves a mix of strategies such as networking with real estate professionals, searching through MLS listings, attending foreclosure auctions, and utilizing online real estate platforms. Properties in neighborhoods with growth potential and those requiring mainly cosmetic updates tend to offer profitable opportunities.

What are the most profitable renovations?

Renovations offering the best returns typically involve updating kitchens and bathrooms. Minor cosmetic improvements like painting, installing new fixtures, and improving the property’s curb appeal can also significantly increase a home’s market value. Incorporating energy-efficient upgrades and smart home technology can further enhance a property’s appeal and profitability.

How long does it take to flip a house?

The duration of a house flip can vary widely, but generally, a timeline of 6 to 9 months from purchase to sale is common. This includes time for acquiring the property, completing renovations, and selling it. The timeline can be influenced by the property’s condition, the scope of renovations, and market conditions.

What are the biggest risks of house flipping?

Risks include overestimating the after-repair value, underestimating renovation costs, encountering unexpected structural issues, and facing shifts in market conditions. Conducting thorough research, maintaining a contingency fund, and staying up-to-date with the real estate market can help mitigate these risks.

Can I flip houses as a side hustle?

Flipping houses part-time is possible and can be a way to get started in real estate investment. It does require a significant commitment in terms of time and effort, especially for overseeing renovations and managing the sales process. Starting with a less demanding project can help you gauge the commitment required.

Do I need a real estate license to flip houses?

A real estate license is not necessary for flipping houses, but having one can provide benefits such as access to MLS listings, potential savings on commissions, and a deeper understanding of real estate transactions and legalities.

How do I finance my first flip if I don’t have enough savings?

Several financing options are available for those without substantial savings, including hard money loans, home equity lines of credit, personal loans, or forming partnerships with investors. Each financing method has its pros and cons, so it’s important to research and choose the best option for your circumstances.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.