A Guide to Using Hard Money for Properties at Auction

Hard Money or private loans are a great way to get hard cash for properties at auction. These loans are different from traditional loans as the collateral is not the property but the individual’s equity in their residence. Lenders will give funds to borrowers without any credit or income documentation, just on their equity in their house. Private loans are a great option when you want a quick loan with no credit check and no hassle! That said, below, our team at Hard Money Lenders created A Guide to Using Hard Money for Properties at Auction.

Why Use Hard Money Loans for Auction Properties?

Purchasing properties at auction presents unique challenges and opportunities, especially when it comes to financing. Traditional real estate transactions allow buyers some leeway in securing financing, often with a closing period of 30 to 60 days. However, the dynamic changes drastically when the gavel falls in an auction setting. Let’s delve deeper into why hard money is particularly suited for auction property acquisitions.

Swift Financing Meets Auction Deadlines

Auctions operate on a much tighter timeline, requiring immediate or very rapid payment after a bid is won—typically within 24 to 48 hours. This immediacy can pose a significant hurdle for those relying on traditional financing methods, which are often bogged down by lengthy approval processes, credit checks, and paperwork.

Hard money loans, on the other hand, are designed for speed. With these loans, approval and disbursement can happen within days, thanks to the collateral-based lending approach that focuses more on the property’s value than on the borrower’s credit history. This rapid turnaround is vital for auction buyers who need to secure funds quickly to meet the stringent payment deadlines of auction houses.

Gaining a Competitive Edge in High-Stakes Auctions

The real estate market is fiercely competitive, especially at auctions where numerous investors are eyeing the same valuable properties. In this high-pressure environment, the ability to act swiftly and decisively can make all the difference. Here’s where hard money loans shine.

By securing a hard money loan in advance, investors can approach auctions with the confidence of having immediate access to funds.

This readiness allows them to bid more aggressively and decisively, giving them a significant advantage over competitors who may still be scrambling to arrange their finances.

Moreover, presenting proof of readily available funds can also influence the auction’s outcome in favor of the hard money-backed investor.

Sellers and auctioneers favor buyers who can guarantee a quick and hassle-free transaction. Knowing that the funds are already in place and accessible immediately after the auction ends can make a bidder backed by hard money financing more appealing, potentially tipping the scales in their favor.

In essence, the use of hard money loans in auction property purchases addresses the critical need for speed and reliability. By providing rapid access to financing, hard money loans not only enable investors to meet the stringent payment demands of auctions but also enhance their competitiveness in this aggressive market.

This dual advantage—meeting the immediate financial requirements and boosting the investor’s bidding power—makes hard money an invaluable tool for anyone looking to succeed in the fast-paced world of auction property investing.

Working with Foreclosure Properties

Working with foreclosures is something that many private lenders, private investors, and private buyers fund their private deals. You should know some unique characteristics of private foreclosure properties before looking for private lenders to work with. The first thing to know about private foreclosure properties is that the loans are typically set up with real estate as collateral.

The lender will have a lien on the property, and the borrower has an equity interest in the property. The private seller of the property could be a private individual or entity dealing in foreclosed properties.

Private sellers often use hard money financing on property purchases, and they may not always have a good credit history or lots of funds available for cash purchases. Private sellers also prefer to sell their assets quickly for a higher price, especially when the private lender is willing to offer private money for real estate assets.

Preparing to Use Hard Money for Auction Purchases

Entering the auction market with hard money financing requires careful preparation and strategic planning. Here’s how investors can set the stage for successful auction purchases with hard money loans.

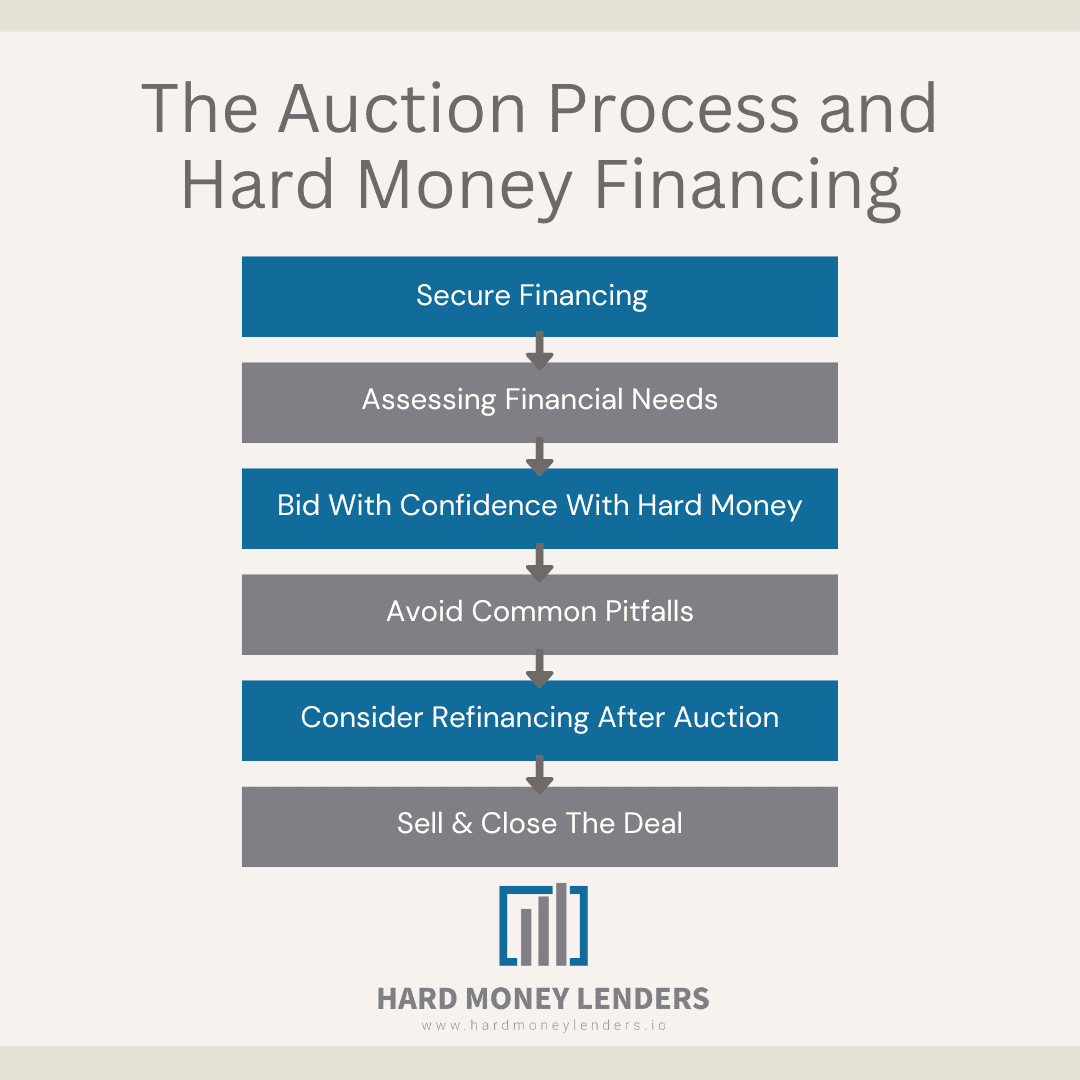

Securing Financing

Securing Financing

The first step in leveraging hard money for auction purchases is to ensure your financing is locked in well before the auction date. This process begins with identifying reputable hard money lenders who are experienced in financing auction purchases.

Investors should conduct due diligence on potential lenders, comparing terms, interest rates, and the speed of the funding process.

Securing a pre-approval or a proof of funds letter is crucial, as it not only confirms the amount you’re eligible to borrow but also strengthens your position as a serious bidder in the eyes of sellers and auctioneers. This letter should clearly state the maximum loan amount you can access, offering flexibility within your budget to make competitive bids.

Assessing Financial Needs

A critical aspect of preparing for auction purchases is accurately assessing the amount of hard money financing required. This calculation goes beyond the auction purchase price to include potential renovation costs, holding expenses, and any unexpected costs that might arise during the rehabilitation of the property.

An accurate assessment ensures that investors avoid the pitfalls of underfunding, which can stall project completion, or overborrowing, which may unnecessarily increase financial strain due to higher interest payments. To fine-tune this estimate, investors should perform detailed market research, including the analysis of comparable sales and repair costs, and consult with contractors to get realistic renovation quotes.

The Auction Process and Hard Money Financing

Armed with hard money financing, investors are well-equipped to navigate the nuances of the auction process. Here’s how preparation translates into action.

Bidding With Confidence

Knowing that the financing is already arranged allows investors to bid with confidence. This assurance enables them to make informed, strategic decisions during the auction, focusing on acquiring properties that align with their investment goals without the added stress of securing last-minute funding. A solid financial backing means investors can swiftly counter bids, maintain a strong presence in competitive situations, and ultimately secure desired properties at the right price.

Avoiding Common Pitfalls

While hard money provides a significant advantage, investors must remain cautious not to let the ease of access to funds lead to overbidding. Establishing a clear maximum bid based on comprehensive market research and the total project budget, including the cost of renovations and the hard money loan’s terms, is essential. Staying disciplined and adhering to this limit ensures that investments remain profitable and sustainable.

After the Auction: Managing Your Hard Money Loan

Securing a property at auction is just the beginning. Efficient management of the hard money loan is key to the success of the investment.

Refinancing

Given the higher interest rates associated with hard money loans, refinancing into a traditional loan with a lower interest rate is a common strategy once the property is stabilized or improved. This transition typically occurs after renovations are completed and the property’s value has increased, making it eligible for conventional financing. The goal is to reduce the cost of capital quickly, thereby increasing the investment’s overall profitability.

Selling

For investors focusing on flipping auction properties, the objective is to complete renovations swiftly and sell the property at a profit. A quick sale is crucial for minimizing holding costs, including interest payments on the hard money loan. Strategic improvements that enhance the property’s marketability and value, coupled with effective marketing strategies, can expedite the sale process, allowing investors to repay the hard money loan and realize profits in a timely manner.

Critical Considerations with Hard Money Loans for Foreclosures

Hard money loans can be used to buy a distressed property or a property at foreclosure auctions. Private loans are different from traditional loans as the collateral is not the property but the individual’s equity in their residence. The lenders will give funds to borrowers without any credit or income documentation, just on their equity in their house. Working with this type of loan is a great option when you want a quick loan with no credit check and no hassle!

Real Estate Investments Strategy With Foreclosure Properties

One of the great things about private loans is that they can be used as part of a strategy to acquire distressed or foreclosed properties that require improvements by using other means like private financing or real estate investors.

For example, the real estate investor may want to make a deal on a foreclosed property that doesn’t require much work. In this case, the investor would use hard money as a last resort because of the ample funds available for lending purposes.

However, suppose the real estate investor wants to do some renovations on the property. In that case, they might use a private money lender for these projects because they are just taking out a small loan, and there are no credit underwriting or debt ratio requirements. This would allow the lenders to give the investor a loan for whatever TLC he needs.

This is why many investors use hard money as a tool to be used if they need to invest more quickly or if they are looking at a property that needs some renovation work. Private loans can also be structured so that private investors can avoid paying all interest on the loan until they sell or rent out a property.

This makes private money more attractive to private lenders as well. When using a private money lender, both hard money and private money are used most effectively when the investor is looking to purchase real estate in need of minor repairs or renovations.

Private Money for Distressed Properties in Need of Renovation or Repair

Private money for distressed properties purchases can be a great way to acquire property that needs some renovation work. This private lender will also like to know what the property is worth now and what it is worth in the past. They will also want to know about how properties in the area have been selling and any parking or storage facilities.

Private loans can be a great way to buy distressed, damaged real estate properties that need renovation work.

They will also want to know about how these how properties in the area have been selling and any parking or storage facilities. If you are looking for private money loan lenders specializing in foreclosure auction personal loans, reach out today!

Our team of experts would love to partner with you on your next real estate project – whether you’re looking at buying a foreclosure property or refinancing an existing one. We’ll help uncover all potential financing options available, so you get just as much value from our service as we do from yours!

Final Thoughts on Using Hard Money Loans for Property Auctions

Hard money loans offer a strategic advantage for real estate investors looking to purchase properties at auction. Their speed, flexibility, and convenience provide the necessary financial backing to make swift decisions and secure deals in the competitive auction market.

By understanding how to effectively use hard money, preparing accordingly, and managing the loan post-purchase, investors can leverage these loans to expand their portfolios and achieve their investment goals.

FAQs About Using Hard Money Loans for Properties at Auction

What are the risks of a private money personal loan?

There is always a risk of the private lender or private investor backing out at the last minute. Private lenders may also charge higher interest rates than those offered by a traditional bank, increasing the total cost of the loan. You may have to pay more upfront. Since private lenders don’t provide much flexibility in repayment schedules, real estate deals are typically more complex.

What is the difference between conventional lenders and hard money lenders?

The difference between hard money and conventional lending is that hard money is more of an unsecured loan. In contrast, traditional banks do more background research before lending to you.

They are willing to provide personal loans to private individuals who need them for private purposes. Private lenders typically charge a higher interest rate than a traditional bank. They are usually only interested in lending to investors with significant loan history or high net worth.

Know what hard money lenders are looking For!

When lenders are looking at a property, they are interested in their equity and how much cash they will get for that equity. The hard money lender will also like to know what the property is worth now and what it is worth in the past.

They will also want to know about the way properties in the area have been selling and any parking or storage facilities. Knowing what the lenders are looking for when reviewing your property portfolio will help you get cash in your hand faster. These tips work for buying bank-owned properties at foreclosure auctions as well as wholesaling real estate.

What are the Typical Hard Money Loan Terms for Buying Auction Properties?

Hard money loan terms are typical around the following:

- Hard money lenders require a 20% down payment from a borrower to secure funding.

- Interest rates in private loans can be as low as 5%.

- Lenders negotiate the loan amount with a borrower but typically offer between $200,000 and $1 Million.

- Lenders have no credit underwriting or debt ratio requirements for borrowers.

- Private loans don’t have prepayment penalties because they are usually structured as interest-only loans.

- Private loans can be structured to allow the borrower to make only interest payments on the loan until he sells or rents out the property.

- The loan term on hard money is usually 12 months, but hard lenders will do 10-month periods if they are interested in your project for some reason.

The show terms should give you a good idea of what hard money can do for you if you are in the process of buying auction properties. If this is your first time getting a hard money loan for investment purposes, consider some unique things when looking at other types of private financing options like hard money.

Where do I find a foreclosure auction?

If you want to find a foreclosure auction in your area, the best place to research is online. You can search by city and state. Once you’ve found one that looks good, go ahead and call them for more information. Here are a few sources for finding foreclosure auctions:

- Auction Nation

- Auction.com

- Bid4Assets

- LendingTree Auction Properties

- Local real estate agent

How quickly do I need to repay a hard money loan?

The repayment period for hard money loans is generally shorter than that of traditional mortgages. Terms can range significantly, usually from 6 months to up to 5 years, depending on the lender’s policies and the specific agreement between the lender and borrower. The exact duration is often negotiable and should be tailored to the timeline of your investment project.

For example, if you’re purchasing a property to renovate and flip, you’ll want the repayment period to align with your projected timeline to sell the property after improvements. It’s essential to have a clear plan for how you’ll repay the loan, whether it’s through refinancing, selling the property, or another exit strategy. Engaging in detailed discussions with your hard money lender before finalizing the loan will ensure that the repayment terms align with your investment goals and timeline.

Are the interest rates for hard money loans significantly higher than traditional loans?

Yes, hard money loans typically carry higher interest rates compared to traditional bank loans. This is primarily due to the increased risk that hard money lenders assume by focusing on the collateral value rather than the borrower’s creditworthiness.

Additionally, the speed and flexibility that hard money loans offer come at a premium. Interest rates can vary widely based on the lender, the property, and the borrower’s situation, but they are generally higher than conventional mortgage rates.

Rates might range from slightly above traditional loan rates to much higher, making it crucial for investors to factor in the cost of borrowing when calculating the potential profitability of their real estate projects.

Can I use hard money loans for properties other than those bought at auctions?

Absolutely, hard money loans are incredibly versatile and can be employed for various real estate investment strategies beyond auction purchases. These include but are not limited to:

- Fix-and-Flips: Investors looking to purchase, renovate, and sell properties for a profit often use hard money loans due to the quick funding speed that allows them to capitalize on opportunities swiftly.

- Land Loans: When purchasing undeveloped land for investment purposes, hard money can provide the necessary funds when traditional lenders are hesitant due to the perceived higher risk.

- Construction Loans: Hard money can finance new construction projects, offering investors the flexibility to start building without the delays often associated with securing traditional construction financing.

- Quick Close Situations: In any real estate transaction where a fast close is essential to secure the deal—such as with off-market properties or short sales—hard money loans can provide the immediate capital required.

In each of these scenarios, the common thread is the need for rapid, flexible financing that is less encumbered by the stringent requirements of traditional lending institutions. Whether for auction purchases or other investment avenues, hard money loans offer a powerful tool for real estate investors to leverage in pursuit of their investment objectives.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.