Last Updated on November 1, 2023

Navigating the complexities of real estate often leads to one pressing question: what is a lender inspection? Delving into this topic unveils a world where property evaluations intersect with financial security, ensuring both buyers and lenders make informed decisions. Join us as we unravel the intricacies of lender inspections, debunking myths and highlighting their pivotal role in property transactions.

Key Takeaways

- Lender inspections prioritize the lender’s interests over property details.

- Home inspections dive deep; lender inspections assess work quality.

- During foreclosure, lender inspections protect a property’s market value.

- Lender inspections can sway loan approvals and property negotiations.

- Contrary to myths, lender inspections are vital in the lending process.

Basics of Lender Inspection

Purchasing or selling a home in the world of real estate requires many steps, all of which are intended to protect and educate the buyer and seller. The inspection is one of these important steps. However, not every examination is made equal.

As the name implies, a lender inspection is mostly related to the lender or the financial organization that provides the mortgage loan. This inspection aims to ensure that the loan payments are being used by the terms specified in the loan application.

If a borrower takes out a loan to build a house (for example ), the lender will want to know that the money is being used wisely and that the building site is proceeding as it should.

On the other hand, a home inspection is a more in-depth examination of a property’s overall condition. Conducted by a certified home inspector, this inspection covers various aspects of the home, from the electrical wiring, crawl space, plumbing to the HVAC system and water heater.

The primary objective here is to uncover potential issues or defects that might affect the property’s value or the buyer’s decision on whether to buy. After the inspection, the inspector prepares a detailed written report, highlighting any concerns or recommended repairs.

The Role of Lenders in Property Inspections

Lenders play a pivotal role in property inspections, particularly when the purchase or refinancing of real estate is tied to a loan or mortgage. Their involvement ensures that their financial interests and risks are adequately managed.

- Due Diligence: Before approving any substantial loan, lenders want to ensure that the property’s market value aligns with the borrowed amount. An inspection verifies the property’s condition, which can significantly impact its worth.

- Protecting Investments: For lenders, a property acts as collateral. Should a borrower default on a loan, the lender has the right to seize the property. Thus, they need assurance that the property is free from significant defects that might undermine its resale value.

- Setting Loan Terms: Based on inspection findings, lenders might adjust the loan terms. If a property is found to have issues, lenders might reduce the loan amount or alter interest rates to reflect the heightened risk.

- Facilitating Transparent Transactions: Lenders encourage transparency in property dealings by mandating inspections. Buyers become aware of potential issues before finalizing a purchase, ensuring an informed decision.

- Regulatory Compliance: In many jurisdictions, lenders are legally obliged to ensure that properties they finance meet specific standards. Through inspections, they can confirm compliance, avoiding potential legal entanglements.

Home Inspection vs. Lender Inspection: Key Differences

Purpose:

- Home Inspection: Mainly conducted for the potential buyer’s benefit, a home inspection provides a comprehensive overview of the property’s current condition. It identifies any potential issues or defects that might affect the property’s value or habitability.

- Lender Inspection: This inspection’s primary purpose is to satisfy the lender’s requirements and ensure that the property’s value aligns with the loan amount. It primarily focuses on the property as collateral and its market value.

Scope:

- Home Inspection: A home inspector looks at various elements of a home, including its structure, roof, foundation, electrical system, plumbing, HVAC system, and more. It’s a thorough assessment meant to uncover any hidden issues.

- Lender Inspection: Often less detailed than a home inspection, a lender inspection focuses more on the property’s overall value. While considering the condition, it might not delve deeply into specific systems or components.

Resultant Action:

- Home Inspection: Provides potential buyers with insights, allowing them to negotiate repairs, adjust the offering price, or even reconsider the purchase.

- Lender Inspection: Impacts the loan approval process. If the property’s value doesn’t align with the loan amount, the lender might adjust the terms or decline the loan.

Initiator:

- Home Inspection: Typically initiated by the buyer or sometimes the seller to showcase the home’s condition.

- Lender Inspection: Initiated by the financial institution or lender providing the mortgage or loan.

Frequency:

- Home Inspection: Usually done once, during the buying process.

- Lender Inspection: Can occur more than once, especially if the property undergoes significant changes or if refinancing is sought.

Report Use:

- Home Inspection: Used by buyers to make informed decisions and possibly for negotiation.

- Lender Inspection: Used by lenders to determine loan terms, interest rates, and overall risk associated with the property.

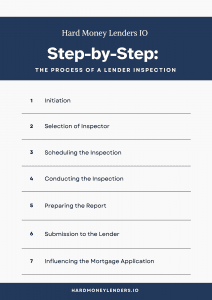

The Process of a Lender Inspection

The journey of a lender inspection typically begins when a borrower applies for a mortgage loan. The lender, keen on safeguarding their investment, initiates the inspection process to evaluate the property.

Here are the steps involved:

Step 1 Initiation

Once the loan application is submitted and preliminarily approved, the lender will require an inspection. This is especially common for construction or renovation loans, where the lender wants to ensure the loan funds are used appropriately.

Step 2 Selection of Inspector

The lender often collaborates with a trusted inspector or a team of inspectors. These professionals evaluate the property, ensuring it meets the lender’s criteria and standards.

Step 3 Scheduling the Inspection

The homeowner or borrower is informed about the inspection, and a date is set. It’s important to note that the homeowner plays a crucial role during this phase. They must ensure that the property is accessible and that necessary preparations are made.

Step 4 Conducting the Inspection

On the scheduled date, the inspector visits the property. Their focus is on assessing the progress and quality of work, especially in construction scenarios. They’ll evaluate structural components, check for potential issues, and ensure that the construction or renovation aligns with the plans submitted during the loan application.

Step 5 Preparing the Report

Post-inspection, the inspector prepares a detailed inspection report. This document highlights their findings, any potential concerns, and recommendations. The report provides a clear picture of the property’s current state and whether it aligns with the lender’s criteria.

Step 6 Submission to the Lender

The completed report is then submitted to the lender. They’ll review the findings, ensuring that the property meets their standards and that the loan funds are being used as intended.

Step 7 Influencing the Mortgage Application

The results of the inspection can significantly influence the mortgage application’s outcome. If the property fails to meet the lender’s standards or has significant concerns, the lender may require certain repairs or modifications. Sometimes, the loan amount might be adjusted or set additional conditions.

Property Inspections in the Face of Foreclosure

Foreclosure is a word that no homeowner wishes to encounter. It signifies a challenging period where the homeowner defaults on their mortgage payments, leading the lender to take steps to recover their investment. In such scenarios, property inspections become more crucial than ever, serving as a vital tool for lenders to determine the property’s condition and value.

When a homeowner defaults, the significance of property inspections intensifies. The lender, keen on understanding the property’s current state, often mandates these inspections.

This is especially true if the property becomes unoccupied. An empty property can deteriorate rapidly, with issues like vandalism, natural wear and tear, or neglect coming into play.

Regular inspections ensure the property maintains its market value and doesn’t suffer significant damages that could affect its resale value.

Servicers play a pivotal role in the face of foreclosure. Acting as intermediaries between the lender and the homeowner, servicers manage the loan and coordinate the necessary property inspections.

They ensure that the property is regularly inspected, promptly addressing any issues. They protect the lender’s interests, ensuring the property remains sellable.

The outcomes for the homeowner and the seller in foreclosure scenarios can vary. For the homeowner, foreclosure often means losing their home.

They can rectify the situation by catching up on their missed payments or negotiating new loan terms. However, if these efforts fail, the property is typically sold through a traditional sale or at an auction.

For the seller, or in this context, the lender, the primary goal is to recover as much of their investment as possible. The property’s sale proceeds are used to cover the outstanding loan amount. If the sale amount exceeds the loan balance, the excess funds may be returned to the homeowner.

However, if the sale doesn’t cover the entire loan amount, the homeowner might still owe the lender the difference, depending on the loan agreement and local laws.

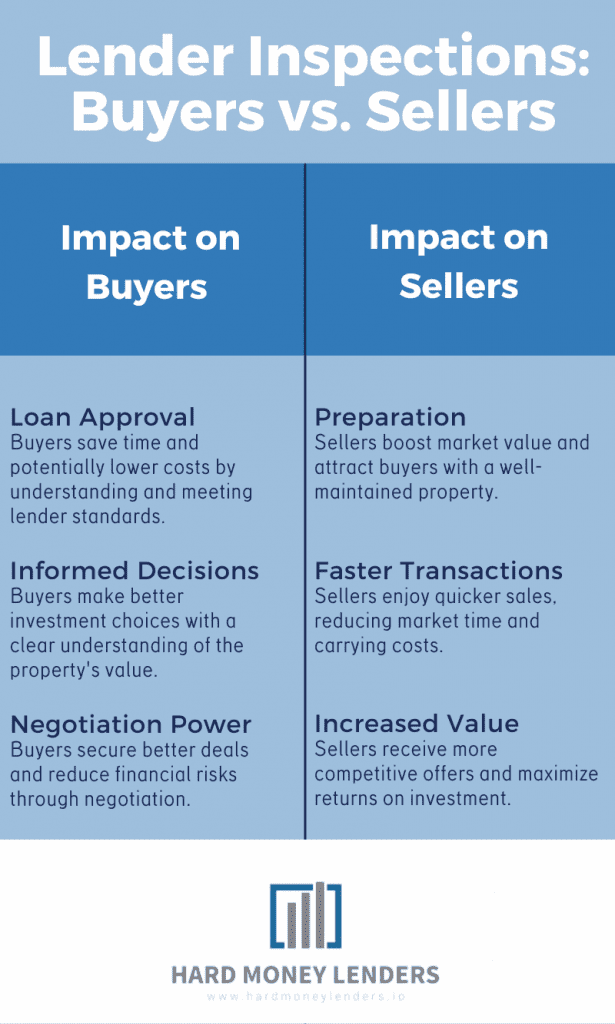

What Buyers and Sellers Need to Know

Here’s what buyers and sellers need to understand about these inspections:

For buyers, awareness of lender inspections is crucial for several reasons:

-

Loan Approval

A lender inspection can influence the outcome of a loan application. If the property doesn’t meet the lender’s criteria, it might affect the loan amount or the mortgage terms. Buyers should proactively understand the lender’s requirements and ensure the property aligns with them.

-

Informed Decisions

While a home inspection provides a detailed overview of the property’s condition, a lender inspection offers insights into how the lender views the property. This can help buyers gauge the property’s value and make informed decisions.

-

Negotiation Power

Suppose a lender inspection reveals issues that could affect the loan or property value. In that case, buyers can negotiate better terms with the seller, such as a reduced price or specific repairs.

For sellers, lender inspections present both challenges and opportunities:

-

Preparation

Sellers can proactively prepare for these inspections by addressing any known issues with the property. This increases the chances of a favorable inspection report and boosts the property’s market value.

-

Faster Transactions

A property that meets or exceeds a lender’s criteria can expedite the transaction process. With fewer hurdles, the sale can proceed smoothly, benefiting both the seller and the buyer.

-

Increased Value

A positive lender inspection can enhance a property’s appeal. Potential buyers might view the property as a sound investment, potentially leading to higher offers.

The impact of lender inspections on the real estate transaction process profound. They serve as a checkpoint, ensuring that properties meet specific standards. While they primarily protect the lender’s interests, they offer a layer of assurance to buyers and opportunities for sellers.

Common Misconceptions about Lender Inspections

Rumors and false information frequently surround lender inspections in real estate transactions. These misconceptions may cause confusion, lost opportunities, or even put buyers and sellers in danger.

Let’s remove a few of these rumors and clarify what lender inspections really entail.

Myth: Lender Inspections are the Same as Home Inspections

- Reality: While lender and home inspections aim to evaluate a property, their focus and depth differ. A comprehensive home inspection delves into the nitty-gritty details of a property’s condition, from its foundation to its roof. In contrast, a lender inspection is more concerned with the property’s value and ensuring it aligns with the loan amount. It might need to be more detailed but is crucial for the lender’s interests.

Myth: A Positive Home Inspection Means a Smooth Lender Inspection

- Reality: Even if a home inspection reveals a property in top-notch condition, the lender inspection might raise concerns. This could be related to the property’s market value, location, or other factors affecting the loan’s security.

Myth 3: Lender Inspections are Only for Foreclosed Properties

- Reality: While lender inspections become particularly vital in foreclosure cases, they’re not exclusive to such scenarios. Lenders often require inspections for new loans, especially for construction or renovation projects, to ensure the loan funds are used appropriately.

Myth 4: Lender Inspections are a Mere Formality

- Reality: Far from being a mere tick-box exercise, lender inspections play a pivotal role in lending. They help lenders gauge the risk associated with a loan, ensuring that the property is a sound investment.

Myth 5: Lender Inspections Only Benefit the Lender

- Reality: While designed to protect the lender’s interests, these inspections also benefit buyers and sellers. For buyers, they provide an added layer of assurance about the property’s value. For sellers, a positive lender inspection can enhance the property’s appeal to potential buyers.

Conclusion

Knowing the ins and outs of lender inspections can be the game-changer you’ve been looking for in the world of real estate. From protecting assets to guaranteeing seamless property sales, these inspections are the unsung heroes of many successful real estate transactions.

Thus, remember the critical significance that lender inspections play the next time you are on the verge of making a big real estate decision. Are you ready to purchase your next property? Reach out to one of our specialist at they are ready to help. If this is you first hard money loan, make sure you check out our article Tips On Getting A Loan For Your Real Estate Investment to better prepare you.

Jack Roberts has spent the last 5 years in the Private Money Lending world helping real estate investors secure financing for their non-owner occupied real estate investments. When he’s not thinking about real estate, Adam is an avid Jazz music fan and fisherman.