How Many Houses Can You Really Flip in One Year?

The primary goal of house flipping is to make as much profit as possible, but realistically, how many houses can you flip in a year?

There are technically no laws or regulations in the United States that limit the number of houses you can flip in one year. However, from a practical standpoint, there are factors that will put a cap on how many houses you can flip in one year. Some of these factors include how much time you have to work with, your financial situation, and the current status of the real estate market in your area.

On average, most full-time flippers can successfully flip two to seven houses per year. You might be thinking to yourself, “That’s a pretty large range for the average amount of houses that can be flipped in a year”. But truthfully, everyone’s experience with flipping houses is different, and each person has their own strategy and approach to house flipping.

In this article, we’ll take a deep dive at the determining variables that impact how many houses you can flip in a year.

What is House Flipping?

First, let’s examine some of the basics when it comes to house flipping.

First, let’s examine some of the basics when it comes to house flipping.

House flipping is the act of purchasing a property, holding onto it for a short amount of time, then selling it with the goal of making a profit. Oftentimes, flipping a house means the temporary owner has to commit to making repairs or renovations to increase the house’s value, and other times, it simply means holding on to the property until you can sell it for more than you initially bought it for. To be successful, you must be able to spend your money wisely and invest in properties that are below market value. The goal is to buy low, sell high, then earn a profit in a relatively short amount of time — usually within a few months.

There are many positive aspects associated with flipping houses. When executed correctly, flipping houses has the potential to net you an extremely large profit in a short period of time. You have the ability to put as much time and effort into it as you’d like. Some use it as a means of creating a secondary revenue stream, while others transition into house flipping full-time. It can also be a fantastic opportunity to build your network, through interactions with realtors, contractors, attorneys, and other investors, and it will undoubtedly increase your overall knowledge of the real estate industry.

With that being said, there are also negative characteristics tied to house flipping. The listings that you come across will likely have significant issues that need to be addressed before you can resell. There may even be underlying issues that you don’t notice until you begin renovations and repairs, such as mold, asbestos, or termites, so make sure to check thoroughly. There’s always the risk that you could suffer a financial loss if you end up investing more in a house than you originally expected, which is extremely important to be aware of.

So, now that you understand the fundamentals of house flipping, let’s look at the variables that determine how many houses you can flip in one year.

How much money/capital do you have to work with?

One of the most obvious factors that will impact the amount of houses you are able to flip in one year is the amount of money, or capital, that you have to work with. Even though you are able to fund up to 90% of the investment property with a hard money loan, you will still be required to invest some of your own personal money.

As you can probably imagine, capital plays a huge role in the amount of houses you’re able to flip consecutively and simultaneously. For example, if you have an abundance of capital at your disposal, it may be possible for you to flip multiple houses at one time. On the other hand, if you’re working with a limited amount of money, you may only be able to take on one house flipping project at a time, requiring you to work in a linear fashion, as opposed to simultaneously.

The amount of money, or capital, that you have to work with when flipping houses will vary from person to person, and it’s important to remember to strategize what will work best for you financially, and to not overextend yourself and take on more than you can handle.

You can check out our hard money loan calculator and our fix and flip calculator to help you determine the potential expenses and profit margins associated with flipping a house.

Locating properties

Your ability to locate undervalued properties can also affect the amount of houses you’re able to realistically flip in one year. This is one of the most difficult steps in the house flipping process, and if you can find a way to quickly and efficiently find homes that have the potential to be flipped, you can maximize the number of properties you can flip in one year.

There are a number of ways to locate houses for below-market price in your area. The first thing you should consider doing is using your network. While it is not always a 100% guarantee that you will find a house to flip this way, there’s always a chance that you may find a lead or two by communicating with others in your community. Believe it or not, word of mouth is still important, and if you know the right people, there’s a possibility you can find out about deals as they are hitting the market.

An excellent way to connect with other real estate investors and realtors who have access to valuable information is to join a community real estate group. The chance of locating a great property alone makes it worth joining, and it can also serve as a fun and informative way to network with others in the industry.

There are also a number of online resources that you can use to assist you in finding the right property to flip.

FlipScout is essentially a free house flipping search engine that allows you to calculate flipping costs automatically, see ROI and rental income instantly, and aggregate results from various sources. Zillow’s Foreclosure Center is another valuable resource for those who are looking to buy and flip houses. This feature allows you to search Zillow’s entire database of pre-foreclosures, foreclosure auctions, and bank-owned properties in your community. Foreclosure.com can also prove useful for those in the house-flipping industry. It is a real estate database consisting almost exclusively of foreclosure properties, with an extensive range of properties that can potentially be purchased below market value.

How much time do you have to work with?

Time can be an enormous constraint when it comes to determining how many houses you can flip in one year.

First off, you need time to find undervalued properties to purchase. Having a real estate agent assist you can speed up the process, but at the end of the day, finding the right property takes time.

Next, you’ll need time to renovate and repair the property. This can take anywhere from two to six months, depending on the condition of the house and the severity of the renovations needed.

Lastly, factor in your own availability. Are you a full-time house flipper, or do you use it as a side hustle? As a full-time flipper, you may be capable of committing almost all of your time into your business, enabling you to flip upwards of seven houses in a single year. If you only flip houses on the side, you may only be able to fix and flip one to three houses in a single year, depending on the time commitment required by each project.

Housing Market Conditions

Another important factor to consider when trying to determine how many houses you can flip in a year is the current conditions of the housing market. Unfortunately, this is something that you as a flipper will have little to no control over.

In a hot housing market, a house flipper may be capable of reselling a property within just a couple of days after putting it on the market for sale. However, they might struggle to find houses to flip because there is so much competition for houses in that market.

Alternatively, in a cold housing market, a house flipper might be able to find plenty of houses to purchase, but their flips have the potential to sit on the market for months while waiting for a buyer. In this case, if all of your capital is invested in one property, that means you can’t work towards flipping another house until you sell the one you’re currently working on, thus limiting the amount of houses you can flip in a year.

Conclusion

The amount of houses that you are able to flip in one year will ultimately differ from person to person. A multitude of factors will come into play, like the amount of capital and time you have to spend on each property, your ability to locate undervalued properties, and the current status of the housing market.

Start out with a realistic and manageable number of flips, like one to three houses a year if your lifestyle allows it, and slowly work your way up once you’re more comfortable with the process.

At the end of the day, it’s best to not rush and to go about it the right way. The more houses you flip, the more experience you will garner to use on future projects down the line.

Can you flip multiple houses at once?

Flipping multiple properties at the same time can be a big project, but it’s possible with the right experience, systems, and resources. Good flippers know how to build teams of reliable contractors, real estate agents, lawyers, and lenders. These professionals can handle different projects with ease. To manage simultaneous renovations, budgets, timelines, and sales processes, you need to plan carefully, have strong financial backing, and use technology wisely.

It’s important to track every project’s budget, schedule, and status in real-time. You can do this by using project management tools and workflow platforms. These tools ensure that renovation timelines stay on track, expenses don’t balloon, and profit margins remain healthy. Cloud-based software also allows remote monitoring and secure information sharing with team members, making it easier to stay on top of things.

Scaling to multiple flips requires having reserve funds and pre-approved lines of credit to handle unexpected costs, cover holding expenses, and purchase new properties without cash flow disruptions. It’s also valuable to have an established network of private and hard money lenders. These lenders provide you with the necessary financial resources to take on new projects with confidence.

How much can you realistically make flipping houses?

While there’s no definitive earnings figure, most experienced flippers aim for a 10-20% profit margin per property after factoring all expenses.

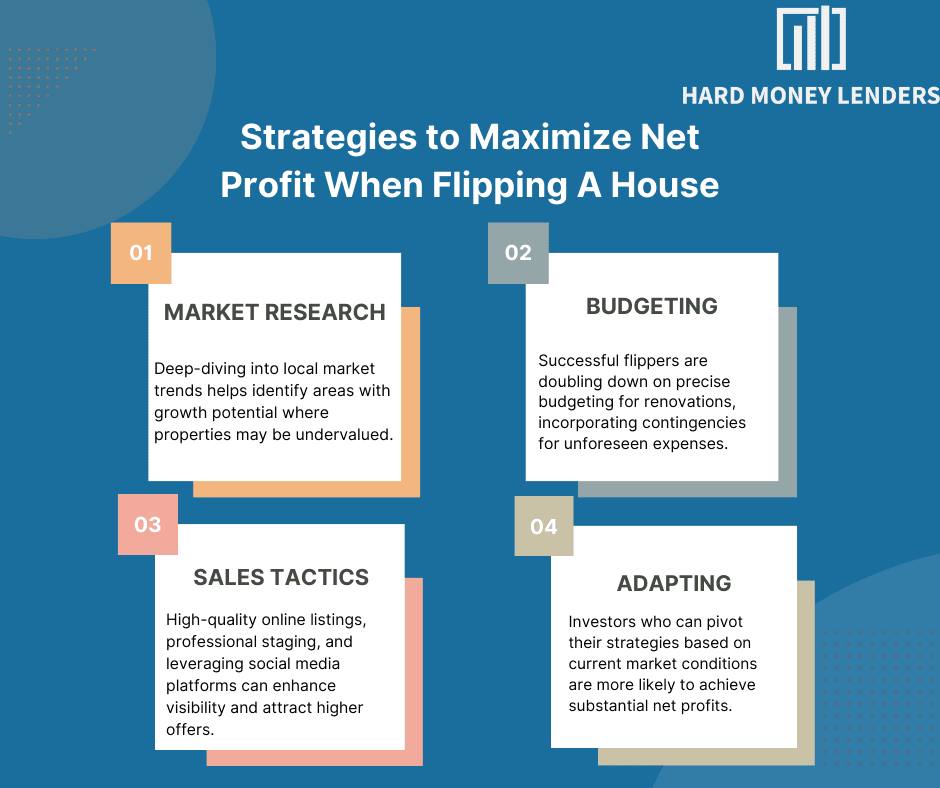

However, realized profits fluctuate based on acquisition costs, renovation outlays, market dynamics, selling strategies, and overall execution. Top flippers conduct extensive research on neighborhoods, pricing trends, comparable recent sales, and rental data to identify undervalued properties and maximize potential upsides.

On the renovation side, surprises like structural defects, code violations, and supply delays can quickly erode expected profits if not properly accounted for. Seasoned flippers build in ample financial contingencies, utilize cost-effective materials/labor, and implement stringent project management to control budgets.

Selling for maximum value requires strategic pricing, staging, marketing, and negotiating skills. Holding costs like mortgages, taxes, utilities, and homeowner association fees also cut into bottom lines when properties linger on the market.

How much do full-time house flippers make?

Full-time flippers’ annual incomes span a wide range depending on numerous factors like their experience level, market dynamics, number of concurrent projects, profit margins, and operational efficiencies. Those consistently completing 5-10 flips per year while netting 15%+ profits can easily earn six-figure incomes. Highly active flippers rehabbing 15-20 homes annually may cross into the mid-six-figures.

Top earners continually invest in professional development, market intelligence, negotiation training, and expanding their networks. They also implement robust systems for streamlining acquisitions, renovations, marketing, and sales to maximize productivity and profits on each project.

However, income variability is inherent due to property acquisition costs, unforeseen rehab expenses, holding periods, and sale prices fluctuating across individual deals. Managing cash flow and risk exposure is critical for full-timers.

What is the hardest part of flipping a house?

For most flippers, accurately estimating all-in renovation costs and timelines proves to be the greatest challenge. This requires deep knowledge of construction methods, materials pricing, local building codes and permits, and realistic timelines accounting for potential delays.

Even routine updates like kitchen remodels, bathroom overhauls, and unfinished basement buildouts involve countless cost variables spanning labor, materials, fixtures, appliances, lighting, and more. Unexpected structural issues, foundational problems, hazardous materials, and code violations can derail budgets and schedules.

Conducting thorough inspections, carefully reviewing inspectors’ reports, getting multiple contractor bids, and building ample financial reserves for contingencies is critical for protecting profit margins. Many flippers seek mentorship from seasoned pros when starting out.

How long should it take to flip a house?

Most experienced flippers aim to complete full renovations within 3-6 months from acquisition to sale. This general timeline allows adequate time for thorough remodeling while facilitating a timely resale that maximizes profits and minimizes excessive holding costs like mortgage payments, taxes, utilities, insurance and maintenance fees.

However, the actual timeframe can vary significantly based on the property’s condition, extent of renovations required, permitting turnarounds, contractor schedules and any unforeseen issues that arise. Larger projects with major structural work, additions or complete gutting can take 6 months or longer.

Aggressive flippers focused on cosmetic updates like painting, new flooring and light fixtures may turn properties in as little as 4-8 weeks in a hot seller’s market. Efficient project management, securing materials upfront, and having trusted contractors ready are essential for expediting timelines.

Profitability is also impacted by the duration – homes lingering over 6 months often become cash flow drains that negate expected gains. Experienced flippers diligently manage timelines while balancing quality renovations against holding costs.

What skills are essential for flipping houses?

Successful house flipping requires a multifaceted skill set spanning financial management, project oversight, real estate market analysis, contractor supervision, negotiation strategy and more. Key capabilities include:

- Real estate valuation and pricing expertise

- Renovation project planning, budgeting and management

- Understanding of construction best practices, permitting and building codes

- Ability to assess potential risks and estimate repair costs accurately

- Market analysis to identify neighborhoods and properties with upside potential

- Negotiation skills for securing favorable acquisition and contractor pricing

- Effective marketing, sales execution and contract management

- Money management including access to capital, cash flow forecasting and cost control

Top flippers are also exceptionally organized, manage timelines diligently, solve problems creatively, and adapt nimbly when issues inevitably arise. Continual learning about evolving market trends, construction methods and buyer preferences is crucial.

How do you finance multiple house flips simultaneously?

Funding multiple concurrent flip projects typically involves a diversified capital strategy leveraging:

- Personal cash reserves and equity

- Lines of credit from banks or personal asset loans

- Private money loans from investors at higher interest rates

- Hard money lending

- Profits from previous flips via BRRRR (buy, rehab, rent, refinance, repeat)

Many fix-and-flippers attempt to cherry-pick properties selling at deep discounts that only require mortgage financing for the initial acquisition. As renovations are completed, they refinance properties utilizing newly appraised values to pull out invested cash before relisting.

Careful cash flow forecasting and maintaining ample working capital are essential when juggling multiple projects with overlapping acquisition, renovation and holding cycles. Over-extending oneself is a major pitfall for flippers taking on too many projects simultaneously.

What are the common mistakes made by new house flippers?

Even seasoned property investors make costly mistakes when flipping houses, but novice flippers are especially prone to several preventable pitfalls:

- Underestimating renovation costs and timelines

- Overestimating the market value and potential profits

- Inadequate property inspections and due diligence

- Lack of project management processes and oversight

- Insufficient cash reserves for unexpected costs

- Over-improving properties beyond neighborhood comparable values

- Poor market timing for acquisitions and sales execution

- Cutting corners on quality of renovations to reduce costs

Many novices also get overzealous taking on too many projects before establishing reliable contractor crews, lender relationships and efficient renovation systems. This overextension spreads resources too thin.

Thoroughly evaluating potential deal financials,etting a proven team in place, and gaining hands-on experience through mentorship and education programs can prevent avoidable mistakes.

How can I minimize risk when flipping houses?

While some level of risk is inherent with real estate investing, diligent preparation can mitigate exposure:

- Market Mastery – Gain comprehensive command of your local markets through analyses of pricing trends, inventory levels, sale.rent ratios, neighborhood dynamics and more. Identify areas positioned for appreciation.

- Property Evaluation – Conduct exhaustive inspections, tour comparable properties, engage contractors for repair quotes, review historical permits/plans, check comparable sales, and evaluate potential exit strategies before purchasing.

- Conservative Analysis – Realistically forecast costs factoring contractor bids, material estimates, permit fees, labor, carrying costs and ample financial reserves for unknowns. Scrutinize potential profits against comps and estimated marketability.

- Build Expertise – Continually educate yourself on construction methods, design trends, negotiation tactics and legal/tax implications. Develop trusted professional networks.

- Limit Liabilities – Insure all properties fully, operate through LLCs or corporations to shield personal assets, comply with codes/regulations, document everything meticulously.

- Phased Approach – Start with modest, cosmetic rehabs before advancing to larger projects. Build up experience, systems and capital before scaling complexity.

What impact does the real estate market have on flipping houses?

Housing market cycles and economic conditions have a profound impact on the house flipping business model:

Seller’s Market Conditions:

- Low inventory of homes for sale

- High buyer demand driving bidding wars

- Rapid price appreciation

- Flippers can more aggressively price renovated properties

- Potential for higher returns if timed correctly

- Easier to find competitively priced acquisition opportunities early in the cycle

Buyer’s Market Conditions:

- Higher inventory of available homes

- Reduced buyer demand and longer marketing times

- Price stagnation or declines

- Flippers may need to price more aggressively and reduce profits

- Risk of listing at the wrong time and properties lingering

- More negotiating leverage on purchasing discounted properties

In seller’s markets, the reduced inventory means flippers face more competition for affordable acquisition properties from other investors and homebuyers. Securing reasonably priced deals becomes challenging without paying premiums.

Conversely, buyer’s markets provide more breathing room to selectively acquire properties at larger discounts from motivated sellers. However, marketing renovated homes for sale requires more strategic pricing, staging and promotion to attract scarce buyers.

Economic factors like employment rates, mortgage rates, consumer confidence and inflation also influence house flipping performance. Rising interest rates increase carrying costs but can also cool an overheated seller’s market. Monitoring these trends is crucial for strategic timing of acquisitions and sales.

Top flippers adeptly navigate market cycles by adjusting their buy boxes, investment criteria and profit margins accordingly while controlling project costs and aligning their pipelines with shifting conditions.

Is there an ideal time of year to flip houses?

While skilled flippers can achieve success year-round, seasonal cycles do impact ideal periods for purchasing properties versus listing homes for sale:

Spring Buying Season (February to May)

- One of the most active periods for buyers

- More inventory becomes available as sellers list

- Potential to secure discounted properties pre-spring listing bloom

- But also faces heightened competition from other buyers

Spring/Summer Selling Season (March to August)

- Peak period for residential real estate demand and transactions

- More buyers are actively searching to close before fall

- Flippers can capitalize on increased marketing exposure

- Renovated properties show better with warm weather and curb appeal

Fall Buying Period (September to November)

- Number of new listings tends to decline

- Potential opportunities as sellers become more motivated

- Less competition from other buyers

Fall/Winter Selling Period (November to February)

- Real estate market activity and demand slows

- Typically more of a buyer’s market for negotiating

- Renovated homes may require more marketing effort to attract buyers

- Poor weather impacts property showings and perceived curb appeal

While conventional advice leans toward buying in the fall and selling in spring/summer, flippers can find opportunities year-round by adjusting marketing strategies and negotiation tactics based on seasonality. Year-round investors simply modify their acquisition criteria and profit margins for countering the ebbs and flows.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.