How Do Real Estate Developers Make A Profit In 2024

Are you wondering how do real estate developers make a profit in 2024? If so, understanding how to start and successfully manage a real estate business is crucial. The landscape of real estate development is continually evolving, and staying abreast of the latest trends and strategies is essential to profit in this competitive industry.

In 2024, real estate developers need to be versed in more than just the basics of buying and selling properties. They must navigate a mixed economic outlook with expert precision and creativity.

As the market presents both challenges and opportunities, developers can take advantage of alternative financing methods, technological enhancements, and innovative construction approaches to streamline their processes and cut costs while adding value to their projects.

The real estate market in 2024 will reward those who adapt quickly to changes, embrace technology, and consistently seek ways to improve efficiencies in their development process. Understanding these nuances is essential for anyone looking to profit from real estate development in the modern era.

Here’s a look at some trends we’ve uncovered for real estate in 2024.

| Trend | Impact on Real Estate |

| Expense Mitigation | Top priority; focus on reducing talent and office space costs |

| Cost of Capital | 50% expect worsening; impacts borrowing and investment strategies |

| Capital Availability | 49% foresee a decrease; challenges in securing funding |

| ESG Compliance | 60% lack necessary processes; presents regulatory challenges |

| Outsourcing for Efficiency | Major strategy; focuses on technological advancements |

| Technology Modernization | Effort to move away from legacy systems; nearly half are updating |

Before we dive into how real estate developers make a profit in 2024, let’s start by answering the question, “What do real estate developers do?”

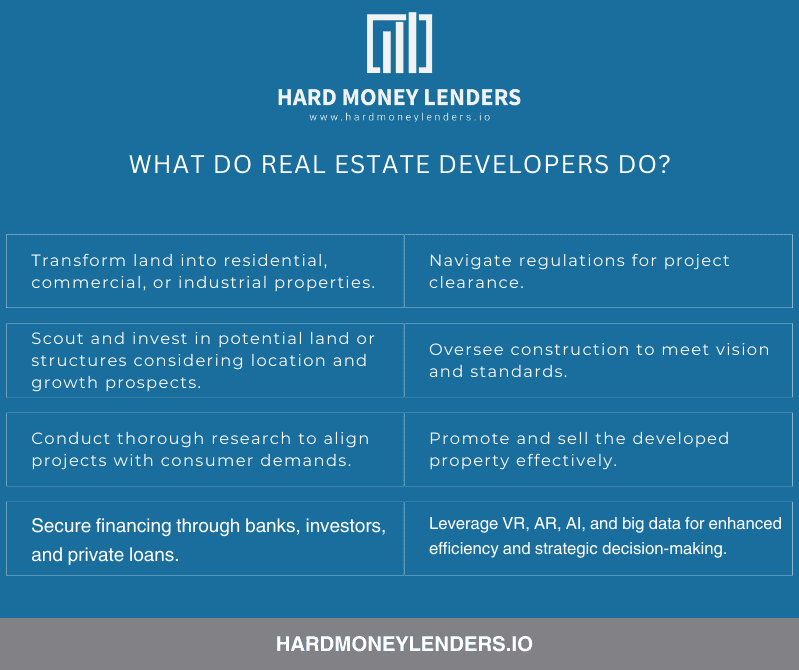

What Do Real Estate Developers Do?

Real estate developers are visionaries who transform land into valuable properties, whether residential, commercial, or industrial spaces. They play a multifaceted role in the real estate sector, starting with property acquisition. By identifying land or existing structures with potential, smart developers invest early, considering location, zoning restrictions, and growth prospects.

Identifying Potential Development Opportunities

This can involve anything from finding a piece of land to redeveloping an existing property. Real estate developers also might consider opportunities such as condotels, fix and flip homes, or assisted living facilities.

Conducting Market Research

Developers must understand the local market and determine whether a project is feasible and profitable.

Developers analyze if a project is viable by scrutinizing market trends, demographics, and economic conditions. This step ensures that their investments align with consumer needs and market demands, substantially reducing risks associated with development.

Securing Financing

Developers frequently collaborate with banks, investors, and other financial institutions to secure the necessary funds. Additionally, they may seek private investors to secure loans and raise capital.

In doing so and using leverage, they also generate income through financing fees, which are costs associated with arranging financial transactions.

Obtaining Necessary Permits and Approvals

This can involve navigating complex zoning and land use regulations and working with government agencies to obtain the necessary approvals for a project.

Managing Construction

Of course, the ultimate aim is to make a profit through development, sales, or rental income. Developers orchestrate the construction phase, manage contractors, and oversee the development to ensure it meets the planned vision and standards.

The culmination of their efforts materializes when they sell or lease the newly created spaces.

Marketing and Selling The Property

Once the project is completed, developers are responsible for promoting and selling the property to potential buyers.

Developers often engage in joint ventures and partnerships to enhance project viability and profitability. They create alliances to share expertise, risks, and rewards. Such collaborations can lead to more innovative and economically impactful projects, contributing to local communities by attracting businesses, creating job opportunities, and fostering economic growth.

This comprehensive approach to development allows real estate developers to serve as key contributors to market dynamics and urban landscapes.

These efforts help with marketing efforts, and it ultimately helps real estate developers make a profit when selling the property.

Real Estate Developers Might Integrate Technology in the Process

Technology’s role in real estate, from property management to sales processes, is expanding rapidly. Digital platforms and tools are streamlining property viewing, purchasing, and management processes, making transactions more efficient and accessible.

Virtual reality (VR) and augmented reality (AR) are allowing potential buyers to tour properties remotely, enhancing the buying experience and expanding the market reach for developers. In addition, big data and analytics are helping developers understand market trends and consumer preferences in real-time, enabling more strategic decision-making.

Artificial Intelligence (AI) and machine learning are also playing crucial roles in optimizing property management, from predictive maintenance to dynamic pricing strategies. These technologies are not only improving operational efficiency but also enhancing the tenant experience, leading to higher retention rates and increased revenue.

Consequently, real estate developers may look to hire consultants or other companies to integrate technology in their process to turn a profit.

How Do Real Estate Developers Make Profit

So, now that we have a better understanding of what real estate developers do, let’s dive into how they profit. In the dynamic world of real estate development, profitability is the beacon that guides every decision and strategic move made by developers.

To understand how these shrewd business professionals turn visions of brick and mortar into lucrative ventures, we must delve into their profit-making processes. The craft of profiting in real estate development lies in several key stages: acquisition, development, financing, and the final turnover, through sales or leases.

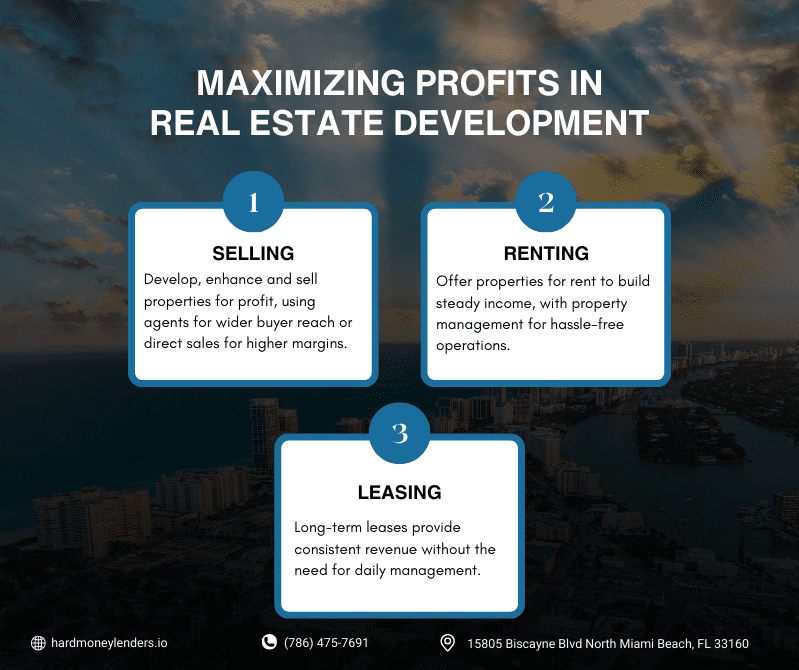

Selling The Property

One of the most common ways real estate developers profit is by selling their developed property. This can be a very lucrative method, especially if the developer has been able to add value to the property through renovations or other improvements. To sell the property, the developer typically works with a real estate agent to list the property on the market.

This can be a good option because the agent will have access to a wide network of potential buyers, and they’ll be able to handle all the details of the sale process, like setting the price, negotiating with buyers, and handling paperwork.

However, some developers may sell the property directly to a buyer without going through an agent. This option is available if the developer has a specific buyer in mind or wants to save on the commission paid to the agent. In this case, the developer will need to handle all the sale details themselves. This can be a bit more time-consuming but can lead to a higher profit margin.

Renting The Property

Another option is to hold onto the property and rent it out instead of selling it. This can be a good way to generate a steady income over time, especially if the property is in a desirable location or has other attractive features that make it appealing to renters.

As the property owner, the developer will be responsible for finding tenants, negotiating the lease terms, collecting rent, and handling any maintenance or repair issues. It’s important to remember that being a landlord can be a bit time-consuming, but it can also be a good way to build long-term wealth. And, of course, if the developer doesn’t want to deal with the day-to-day responsibilities of being a landlord, they can always hire a property management company to handle those tasks.

Leasing The Property

Real estate developers can also lease the property instead of selling it or renting it out long-term. Leasing a property is similar to renting, but the tenant is usually responsible for it long-term and may have more control over the property.

This can be a good option for developers who want to generate a steady income stream without the burden of managing a property long-term.

How Much Do Real Estate Developers Make?

Now that we’ve covered some ways developers can profit, you might wonder how much real estate developers make. Profit can vary widely, but developers can expect to make anywhere from 5-20% of the total cost of a project, though this can vary significantly.

One factor that can impact a developer’s earnings is the type of property they’re working on.

For example, developing luxury properties or properties in high-demand areas may be more lucrative than developing more modest properties in less desirable locations.

The developer’s experience and expertise can also affect their earnings. A developer with a record of successful projects can ask for higher prices for their properties or negotiate more favorable terms in a joint venture.

Of course, the overall state of the real estate market can also impact a developer’s earnings. In a strong market, selling properties for a higher price may be easier, while it may be more difficult to turn a profit in a weaker market.

How Much Do Top Real Estate Developers Make?

Of course, the rule always has exceptions, and some developers can consistently make large profits on their projects. These top developers often have a track record of success, strong financial backing, and access to the best opportunities.

How much top real estate developers make depends on market conditions, location, and time spent in the industry. Those who have been in the business for many years or have built up a reliable network can charge premium fees for their services. It is also possible that they will be offered larger projects with greater rewards due to their reputation within the industry. Experienced real estate developers can command salaries ranging from hundreds of thousands to millions of dollars per year, depending on their level of success and expertise.

Can You Become Rich From Real Estate Development?

Real estate development can be a very lucrative business, especially if the developer can identify and develop properties–particularly in high-demand areas–that have the potential to increase in value.

However, it’s important to remember that real estate development is not without risks. The market can be unpredictable, and there’s always the possibility that a developer might not be able to sell a property for as much as they had hoped. In addition, there are often significant upfront costs associated with real estate development, such as purchasing the property, renovating, and marketing the property for sale.

So, while it is possible to get rich from real estate development, it’s not a guarantee. It takes skill, experience, and a bit of luck to be successful in this business. But, it can be a rewarding career for those willing to put in the work and take risks.

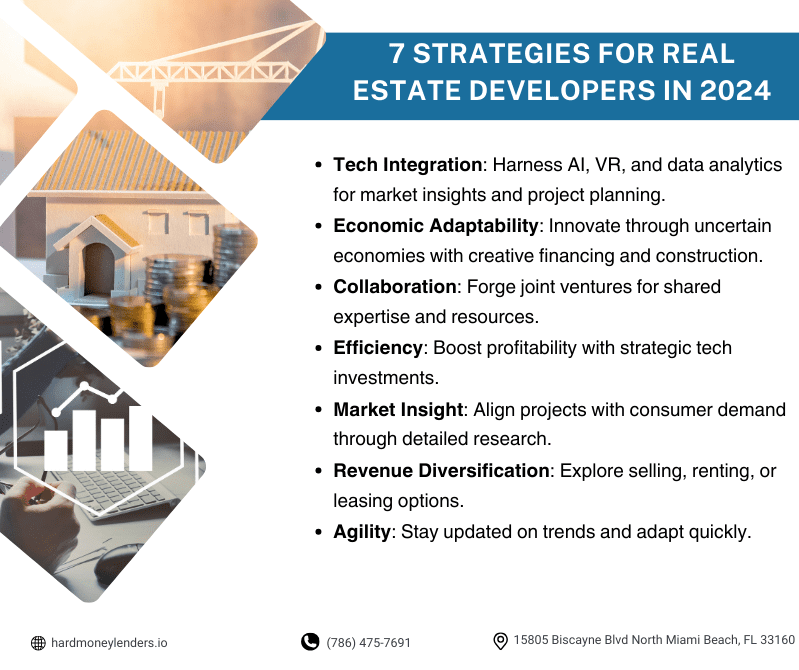

7 Key Takeaways for Real Estate Developers in 2024

- Embrace Technological Advancements: Utilize data analysis, AI, and virtual reality to assess market trends, plan projects, and showcase visions more effectively to clients and investors.

- Adapt to Mixed Economic Outlooks: Navigate the uncertain economic landscape creatively and precisely, focusing on alternative financing methods and innovative construction approaches to remain competitive.

- Leverage Joint Ventures and Partnerships: Collaborate to share expertise, risks, and rewards, leading to more innovative and economically impactful projects.

- Capitalize on Operational Efficiencies: Implement strategic decision-making and invest in technologies or processes that enhance long-term profitability, streamline project timelines and reduce costs.

- Understand Market and Consumer Needs: Conduct thorough market research to ensure investments align with consumer demands and trends, significantly reducing development risks.

- Explore Diverse Revenue Streams: Consider selling, renting, or leasing developed properties as strategies to generate income, choosing the method that aligns best with market conditions and investment goals.

- Stay Informed and Flexible: Keep abreast of the latest industry trends and quickly adapt to changes in technology, market demands, and economic conditions to ensure continued profitability.

FAQs about How Do Real Estate Developers Make A Profit In 2024

Understanding the nuances of real estate development is essential for anyone looking to navigate this complex industry. With 2024 shaping up to be a year full of unique challenges and opportunities, it’s important to address common questions concerning the profitability of real estate developers amid evolving economic landscapes.

How do interest rates affect real estate development profitability in 2024?

Despite potentially high interest rates, savvy developers can still thrive. While elevated rates can impact borrowing costs, well-managed development companies may not bear as much brunt. Operating firms often have the ability to sustain the required rental rates to cover the costs of building delivery and ensure an adequate rate of return.

What strategies can real estate developers employ to maximize profits in 2024?

As margins remain narrow, developers should prioritize strategic decision-making. This involves investing in operational efficiency improvements, such as advanced technologies or processes, to enhance long-term profitability. Forward-thinking developers will focus on creating value through smart acquisitions, developing in-demand projects, and timing the market effectively to sell or lease their properties at peak demand.

Can operational improvements make a significant impact on profitability?

Definitely. Refining operational practices can streamline project timelines, reduce costs, and increase efficiency, leading to better profit margins. In a year like 2024, where immediate profit may not be as accessible, leveraging tools to enhance operational capabilities can position real estate firms for greater success when market circumstances become more favorable.

Yuval Elkeslasi is a distinguished professional in the finance industry, celebrated for his pioneering strategies and significant contributions as the leader of Hard Money Lenders IO. Hailing from Queens, New York, Yuval has built an impressive career, transforming the lending landscape through his expertise and visionary approach. Yuval Elkeslasi

attended Florida State University, where he obtained a bachelor’s degree in Finance. This academic foundation provided him with the necessary skills and knowledge to thrive in the competitive financial arena. Yuval’s tenure at Hard Money Lenders IO is marked by numerous pioneering accomplishments. He has introduced a variety of loan programs designed to cater to specific client requirements, including fix and flip loans, new construction financing, cash-out refinancing, rental property loans, and specialized financing for luxury items like yachts. Among Yuval’s significant achievements is securing an $8 million construction loan for a spec home builder in Port Royal, Naples. He also orchestrated the financing for a prestigious 72’ 2024 Viking Convertible yacht valued at $7.2 million. These transactions demonstrate Yuval’s adeptness at navigating complex financial landscapes and delivering exceptional results.